Spencer Cole, Chief Investment Officer of Vox Royalty Corp. (TSXV: VOX, OTC: VOXCF) Discusses Their Record Royalty Revenues and Strong Growth

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/31/2021

We spoke with Spencer Cole, Chief Investment Officer of Vox Royalty Corp. (TSXV: VOX, OTC: VOXCF). On July 27th Vox announced that it now expects 2021 royalty revenues to double to C$4,000,000 – C$5,000,000 on the back of extremely strong operating performance. The increase in 2021 revenue guidance is mainly attributable to: (1) higher royalty-linked production volumes at the Koolyanobbing iron ore operations, across the Deception open pit and recently commissioned Altair open pit; (2) first production from the Segilola gold mine, and (3) continued quarter-on-quarter record royalty-linked production, from the Hidden Secret deposit, at Higginsville, covered by the Dry Creek royalty.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Spencer Cole, Chief Investment Officer of Vox Royalty. Spencer, could you give our readers/investors an overview of your Company? What differentiates your Company from others, and update our readers/investors?

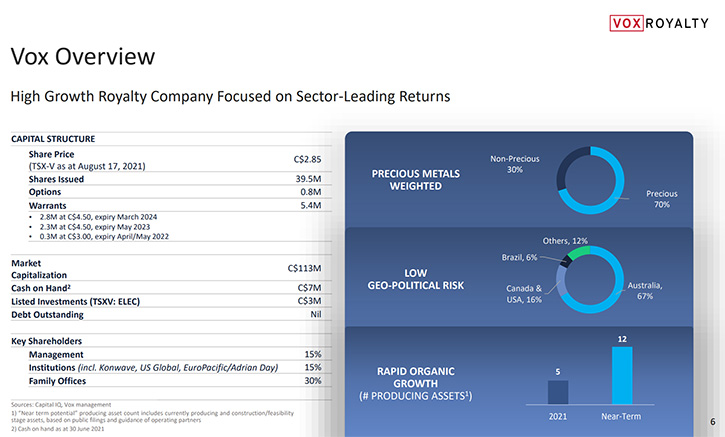

Spencer Cole: Absolutely, Allen. Thanks for interviewing me here today. It's a pleasure to talk with your readers/investors. In terms of an overview on Vox Royalty Corp, Vox is a precious metals focused mining royalty investment Company, listed on the TSX Venture Exchange. It is also trading on the OTCQX Best Markets as well. Vox was established eight years ago, but we've only been publicly traded for just over one year. Over the past eight years, with a global portfolio of over 50 mining royalties and streaming contracts that are diversified around the globe. Our portfolio is predominantly weighted towards gold and then predominantly weighted towards Australia as well. In terms of what makes us different from a number of the other mining royalty investment companies, Vox uses a proprietary database of 8,000 mining royalties to source, evaluate, and acquire royalties at deep value, in most cases, where our competitors aren't even aware of those royalties.

Also, our Management Team is heavily technical, made up of mining engineers and geologists. When we're doing due diligence on royalty investments, we ensure that we truly understand what the cash flow profile looks like and what the risks embedded in that investment look like. Also, a brief update on what we've been up to since Kyle spoke with you back in April. We've had an extremely busy last four months. I'd say one of the most exciting announcements we've shared with the market, was on the 27th of July, where we announced that we were doubling our 2021 revenue guidance. We increased it by over 100% on the back of extremely strong record revenues for our second quarter. In addition to that, since you last spoke with Management, we've also added an extra seven new royalties to our portfolio. So, we have 54 royalties in our portfolio today, and we continue to unearth really exciting and interesting royalty opportunities.

Dr. Allen Alper: Could you tell us some of the highlights of your key royalties?

Spencer Cole: Sure. Of our 54 royalties, five of them are currently production stage royalty assets. We were excited to share with the market, that our fifth royalty to come into production just poured first gold at the end of July, the Segilola gold mine in Nigeria. That should add to our revenue over the coming quarters. In addition to that gold royalty that's just come online, in April, we acquired a new gold royalty in Western Australia called Janet Ivy. This is operated by one of the largest gold mining companies globally, Hong Kong-listed Zijin Mining. Zijin are working on quite a major expansion of that gold mine in Western Australia at the moment. It's currently producing and it's going to be a key growth asset for us as it expands over the coming years.

In addition to those two producing royalties, we have a producing iron ore royalty, called Koolyanobbing, which is producing strong revenue for us at the moment. That operation is located in Western Australia and operated by an $11 billion ASX-listed company, called Mineral Resources Limited. Your readers/investors may be aware, but we actually acquired that royalty from a telecommunications company. In addition to those three producing royalties, we also have another gold producing gold royalty, in Western Australia, covering part of the Higginsville goldmine, that Karora Resources operates. And then we have a royalty over the largest diamond mine in all of South America called Brauna, which is also producing for us at the moment. Those are our five production stage royalty assets, but beyond that, we have a number of royalties that we expect to start producing and generating cashflow for our shareholders, within the next 12 to 18 months. We expect that, organically, our portfolio will go from five producing assets to north of 10 producing assets, in the near term.

Dr. Allen Alper: Well, that sounds exciting. I know looking at your website that you're very excited for your revenue growth and your organic growth. Could you tell us a little bit about how you compare to your peers?

Spencer Cole: Absolutely Al. From a valuation perspective, we compare favorably to our peers. When you look at Vox on a price to net asset value ratio, P/NAV ratio, which is one of the most commonly accepted valuation metrics in our industry, we trade about half to a third of where our peers trade. Some of our peers include groups like Metalla, EMX, Gold Royalty Corp, and they trade between 1.5 to 2.5 times their net asset value. We're currently trading, based on broker consensus estimates, around 0.7 to 0.8 times our net asset value. So, I think we compare extremely favorably on a relative valuation basis. On some of the other comparisons, with our peer group, I think generally speaking, we have a much more technical management team than a lot of the emerging royalty companies. We have more mining engineers and geologists on our management team than a lot of our emerging royalty peers.

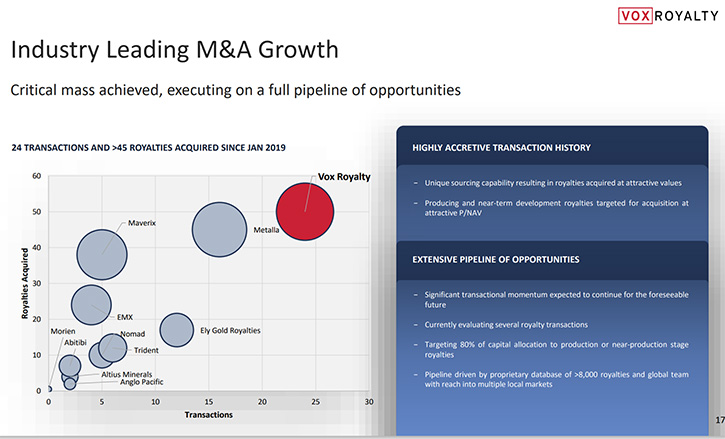

One other key differentiator, where we stack up favorably compared to competitors, is that the overwhelming majority of our deals are what we call “bilateral” deals, just us and the royalty holder negotiating together to transact on their royalty in good faith. Whereas a lot of the royalty industry has grown through competitive sale processes run by investment bankers. As you're well aware, we don't see that as a path to creating long-term shareholder value, by just simply winning auctions run by investment bankers. That's why we do more deals than any of our competitors full stop, working proactively with royalty holders outside of sale processes. We've been the fastest growing royalty company in the last two years, but also importantly, from a value perspective, we do more bilateral deals than any of our competitors.

Dr. Allen Alper: Right. Sounds excellent! I sense that you have a very strong Management Team. Could you tell our readers/investors a little bit about your CEO, yourself, and your Chair?

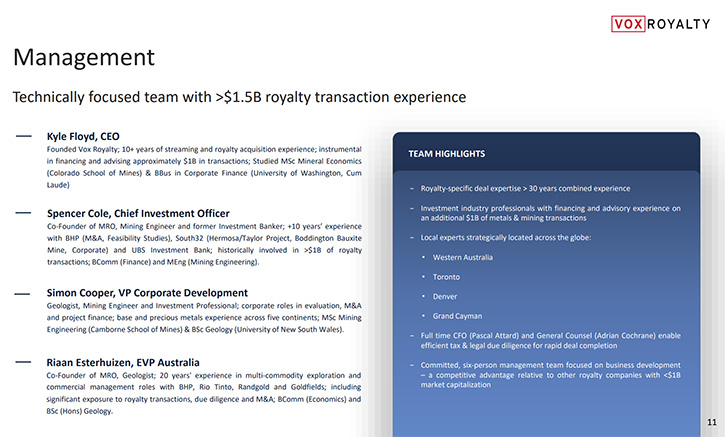

Spencer Cole: Absolutely Al. Our Management Team has been really handpicked, to build a business that has a truly differentiated business model and true competitive advantages that are sustainable, in the medium term. I am a mining engineer by background and I spent quite a bit of time in finance as well, having worked for some of the largest mining companies globally, such as BHP and South32. My colleague, Simon Cooper, who's our VP of Corporate Development, is both a mining engineer and a geologist. He's worked at some of the most interesting mining operations around the world, from Glencore's operations in the Congo, to Kyrgyzstan, to Australia and numerous other countries. Riaan Esterhuizen is our colleague, and Executive Vice President for Australia. He is based in Western Australia. He's a renowned exploration geologist, having led some of the Greenfield exploration campaigns, for some of the largest mining companies globally, such as BHP, Rio Tinto, Randgold and Gold Fields.

You know, we're very fortunate to have Riaan on the Team and Kyle as CEO, with whom I think you've spoken before. Kyle previously ran the mining investment banking team for a firm called Roth Capital. And he also spent time studying at Colorado School of Mines. While Kyle doesn't consider himself completely technical, I'll tell you, there are not many technical risks that get past Kyle. He's one of the most experienced mining royalty and streaming deal makers in the industry, having spent over 10 years doing royalty-specific deals. Those four key individuals are at the core of our business development team.

In terms of the rest of our Team, we also had a dedicated legal counsel, Adrian Cochrane, and a dedicated CFO, Pascal Attard, who source deals and support a lot of the transaction execution, best practice and, ensure that we're all focused on the right strategic objectives.

Dr. Allen Alper: Oh, you and your Team have extremely extensive experience and knowledge and a track record of success. So that's excellent. Could you tell us a bit about your share and capital structure?

Spencer Cole: Absolutely Al. We have a relatively tight capital structure. We are just shy of 40 million shares on issue and relatively very few warrants out. We went public, in May of last year and we raised approximately $14 million, as part of that RTO transaction. In March of this year, we completed a second financing, where we raised approximately $16 million. So, in total, in the last 16 months, we've raised nearly $30 million. As a Company, we've deployed a total of about $32 million to create our royalty portfolio that has a market valuation of about $110 million. We have net cash on the balance sheet, of about US$5 million, but our royalty revenues, continue to grow. We're extremely well capitalized and no debt on the balance sheet. We're in a great position to continue organically growing, without needing to raise any further financing at this stage.

Dr. Allen Alper: Sounds excellent, Spencer! Could you give our readers/investors the primary reasons they should consider investing in Vox royalty?

Spencer Cole: One key reason is, we are deeply discounted compared to our peers on a relative valuation basis, we're trading at between half to a third of the relative P/NAV valuations that our peers trade on. And that's despite being the fastest growing royalty company in the entire royalty industry. Since January of 2019, we've done more deals than anyone else in the global mining royalty industry. But it's not just that we're doing more deals, it's that we're consistently pricing royalties at a far deeper value than any of our competitors. The second reason is, when shareholders buy into Vox, they're buying a deal-sourcing engine that's able to identify and transact on mining royalties at better prices than anyone else in the industry.

Now, how do we do that? I think part of it is, having developed the world's largest proprietary database of mining royalties. We're able to look at thousands of royalty opportunities in a matter of minutes. And then part of that strategy is, using our proprietary royalty database, we're able to identify royalties that are sitting in the hands of completely forgotten royalty holders, such as a telecommunications company, with an iron ore royalty or a hearing aid company, from which we acquired a gold royalty, or an automotive parts company that we bought another gold royalty from. We're consistently able to find these forgotten, very attractive royalties that are on the cusp of coming into production and generating revenue, and we're able to transact on them extremely efficiently, to capture that revenue for our shareholders at great value. The third reason to buy Vox now is, we are at the start of significant forecast organic growth in producing assets.

When we went public in May 2020, one of the criticisms was, we only had one producing royalty asset. We now have five production stage royalty assets. That's expected to organically grow to over 10, within the next two years. Investors that buy in today, get the benefit of all that huge amount of potential organic growth in revenue, cash flow, and production growth. Investors are getting in basically on the ground floor today, when we're only a $100 million company, right before we are expected to experience this significant forecast organic growth.

Dr. Allen Alper: Well, those sound like very compelling reasons for our readers\investors to consider investing in Vox Royalty. Spencer is there anything else you'd like to add?

Spencer Cole: Not really Al. The only other thing I would add is the wave of industry consolidation in the mining royalty industry has started. One of our competitors, Ely Gold, was recently taken over by another competitor, Gold Royalty Corp. So, a lot of sophisticated market analysts have started speculating that this might be the start of a broader wave of consolidation within our industry. If that does come to pass, obviously a company, with a really attractive portfolio of royalties, such as ours, being the second largest holder of mining royalties in Australia, second only to Franco-Nevada the $30 billion company, we see ourselves as being a potential takeover target. If that industry consolidation does continue to play out.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like an excellent potential for our readers/investors.

https://www.voxroyalty.com/

Kyle Floyd

Vox Royalty Corp., Chief Executive Officer

info@voxroyalty.com

Spencer Cole

Vox Royalty Corp., Chief Investment Officer

spencer@voxroyalty.com

|

|