Eira Thomas, President and CEO of Lucara Diamond (TSX: LUC, XSTO: LUC, BSE: LUC), Renowned for Their Production of Very Large, Gem Quality, Historic Diamonds, Discusses Their $530 Million-Dollar, Underground Expansion Program.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/31/2021

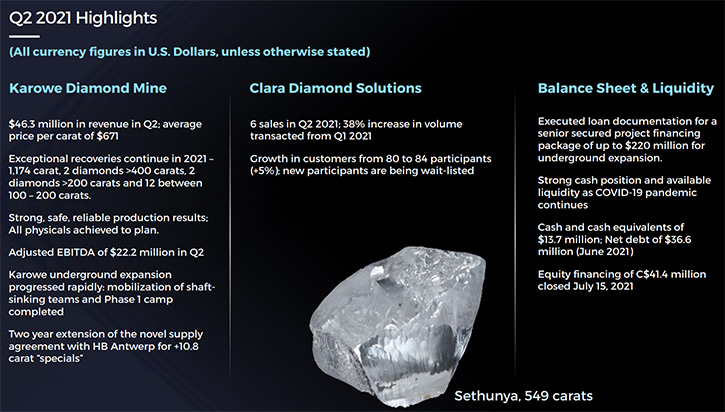

We spoke with Eira Thomas, who is President and CEO of Lucara Diamond (TSX: LUC, XSTO: LUC, BSE: LUC). Lucara is a leading independent producer, of large, exceptional quality, Type IIa diamonds, from its 100% owned Karowe Mine, in Botswana, and owns a 100% interest in Clara Diamond Solutions, a secure, digital sales platform, positioned to modernize the existing diamond supply chain and ensure diamond provenance from mine to finger. With the diamond prices rebounding up to $671 average price per carat, Lucara produced $46.3 million in revenue in Q2 2021. The Company is rapidly moving forward, with a $530 million-dollar, underground expansion program, at Karowe, which has already begun and will continue over the next four to five years.

Dr. Allen Alper: This is Dr. Allen Alper, Editor in Chief of Metals News, talking with Eira Thomas, who is President and CEO of Lucara Diamond. Eira, could you give our readers/investors an overview of your Company and what differentiates it from others, and then tell us the exciting news about your second quarter and your outlook for 2021. Also tell us a little bit about some of the fantastic colored diamonds you've been recovering.

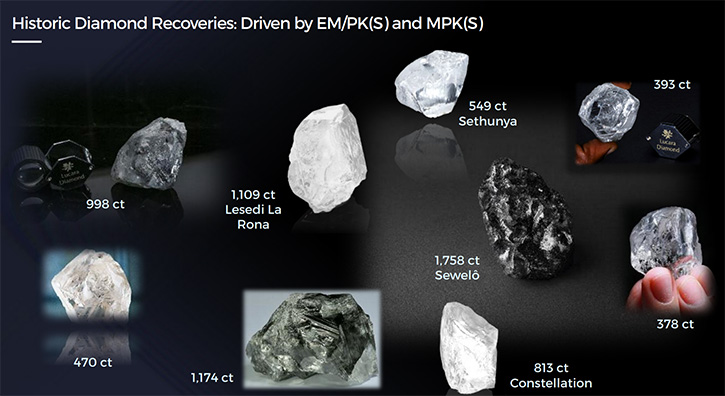

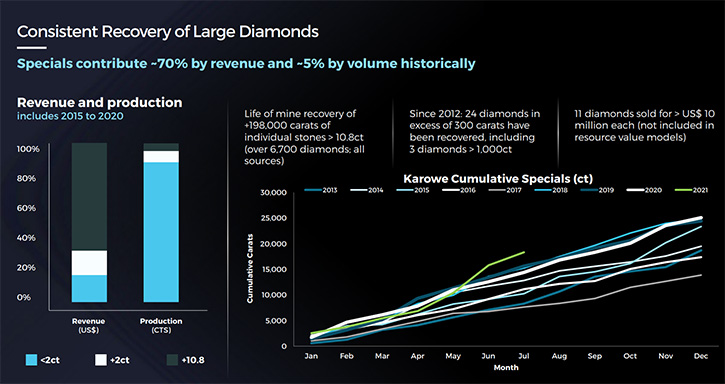

Eira Thomas: Sure, I'd be very happy to. Thank you very much for having me tell your readers/investors about Lucara today. Lucara is a mid-tier diamond producer, whose flagship asset is the 100% owned, Karowe Diamond Mine, situated in north central Botswana. We've been in production at Karowe since 2012. We have become renowned for our production of very large, gem quality, historic diamonds that have been recovered during this eight-year period. These historic recoveries include the 1,758 carat Sewelô, the largest diamond to be mined from Botswana, and the 1,109 carat Lesedi la Rona, the second largest gem quality diamond in recorded history. In addition, we recovered the 813 carat Constellation, which was sold for the world record price of $63.1 million dollars. So, it is an unusual mine, in that it contains a preponderance of large, rare, high value diamonds. Ensuring that we recover these high value diamonds, without damaging them, has been key, and in fact we were the first diamond mining

Company to incorporate state-of-the-art XRT technology for primary diamond recovery, which really has helped mitigate against diamond damage. We are also the only diamond mine in recorded history to have recovered three diamonds in excess of 1,000 carats in size.

It's an extremely busy time for Lucara. Thankfully, the diamond market has almost fully recovered from the challenges of the pandemic and in 2021 we've seen a healthy rebound in diamond prices. This has allowed us to move forward with our plans for underground expansion, having full financed the project in the last few weeks with the completion of a $220 million debt financing with leading banks out of Europe and Africa and supplemented by a fully subscribed $41 million-dollar Canadian equity financing.

Dr. Allen Alper: Well, that sounds very exciting. It sounds like it's a great opportunity for your investors, shareholders and stakeholders, with the investment that you are putting in place.

Eira Thomas: Indeed. I should also mention the great progress we've made in respect of Clara, our secure, web-based digital marketplace for the transaction of rough diamonds up to 15 carats in size. Interest in Clara really took off during the pandemic, because it uses technology to facilitate diamond sales remotely and eliminates the need to travel to buy rough diamonds. We saw our customer base grow from our 20 participants pre-COVID to more than 84 participants today. We've also seen a 38% increase in the volume of diamonds transacted just since the beginning of 2021.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your very strong Team, yourself and your Board?

Eira Thomas: Sure, Lucara benefits from a mature leadership team, many of whom have been involved in our mining operations at Karowe for many years. It may be of interest to readers that 85% of our Executive team is actually female; myself as CEO, Zara Boldt as our Chief Financial Officer, Ayesha Hira our VP Corporate Development & Strategy, and Naseem Lahri, who is our Managing Director of the mine, in Botswana. Naseem is the first ever female Managing Director of a diamond mine in Botswana. Our Board of Directors is also comprised of 3 out of 7 female board members. We also have access to strong technical experience in diamond resources. Dr. John Armstrong our VP, Technical Services, is one of the world’s few leading experts in diamond resources and ore processing and led the effort to incorporate state of the art XRT technology into our recovery circuit. We also have a very strong operations team at the mine, ably led by our General Manager Joe Mchive, born, and educated in Botswana.

The Team is very excited about our plans for extending the mine-life at Karowe out to 2040 and accessing some of the richest portions of the orebody in the process. In fact, the orebody becomes more valuable the deeper we mine so our approach for the underground expansion is to sink a shaft to approximately 800 meters depth below surface and mine the ore body from the bottom up, using long-hole shrinkage mining methodology.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about the agreements you have with Antwerp and Vuitton?

Eira Thomas: One of the strategies that we pivoted to during the pandemic, was a novel approach to rough diamond sales. Traditionally, Lucara has only sold rough diamonds through quarterly public tenders or auctions. During the pandemic that became extremely difficult. Rough diamond prices were under tremendous pressure and instead of selling rough diamonds, we made a deliberate decision to put those diamonds into manufacturing instead, to use that time, through the pandemic, to actually transform those rough diamonds into polished diamonds and to sell polished diamonds instead.

As a result, we entered into a unique and novel supply agreement for all of our diamonds greater than 10.8 carats in size, with a company called HB Antwerp, a group based in Belgium. HB is a diamond manufacturing specialist and they have been receiving all of our large diamonds since July of 2020. At the end of 2020, we decided to extend that agreement for two years, so this is the way we're continuing to sell our +10.8 carat diamonds.

The way which this agreement works, is that HB receives those diamonds larger than 10.8 carats and they then use state-of-the-art scanning and planning technology to estimate the maximum polished outcome. We are then paid that maximum polished outcome, less a fee and the cost of manufacturing. So, for the first time ever, we're creating true alignment between the producer and the manufacturer. HB get paid a set fee, which is based on the polished outcome. In this way, they're motivated to maximize the value of the polished, which of course delivers the maximum value to Lucara as well.

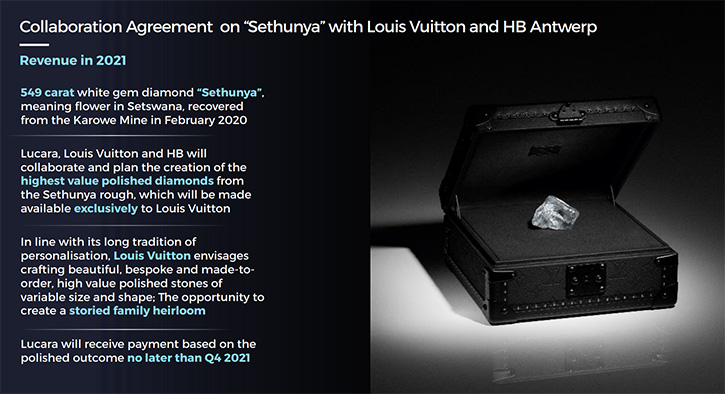

In addition, we entered into two unique collaboration agreements, with HB Antwerp and Louis Vuitton, the world's leading luxury brand, for two of our largest exceptional diamonds, the 1,749ct Sewelô and the 549ct Sethunya.

Dr. Allen Alper: It sounds excellent. Could you tell us more about the agreements?

Eira Thomas: The opportunity there, was to, once again, create full alignment along the value chain, this time between the producer, the manufacturer, and the retail brand. Louis Vuitton (LV), as the world's leading luxury brand, has been working to increase its exposure to diamonds and diamond jewelry, because they believe that this is an undervalued segment of the luxury goods market. They have recently taken over Tiffany out of New York and have been posting record earnings ever since. LV saw a very interesting opportunity to partner with Lucara and HB, creating a three-way collaboration, on the sale of our 1,758 carat Sewelô, the largest diamond to come out of Botswana, and the 549 carat Sethunya, which is quite frankly one of the purest diamonds ever recovered at Karowe.

We're working with Louis Vuitton to identify customers, within their global customer base, who would be interested in working with us to create and craft a bespoke diamond jewelry collection, based on their specific needs, and wants.

Dr. Allen Alper: That sounds excellent. That sounds like you have a great mine, a great potential, and you're making investments to go deeper and get more, even more valuable diamonds and you have a great marketing and business plan. So that all sounds excellent. Eira, could you tell our readers/investors a little bit more about your share and capital structure?

Eira Thomas: I think it's a great time to be looking at the diamond space and Lucara in particular. We are a Company that benefits from a rare, high margin asset that’s been in production for eight years now and will continue to deliver, large, high value gem diamonds until at least 2040. Not only were we able to weather the challenges of COVID and remain fully operational, but we were also able to maintain good liquidity and make significant progress on our plans for underground expansion. Throughout much of Lucara’s history, we've enjoyed a market capitalization significantly higher than we sit at today. In large part this is attributable to the uncertainty introduced by the pandemic and the volatility experienced in the sector over the last several years. Not only have the fundamentals of the market significantly improved over the last year leading to a dramatic recovery in diamond prices, Lucara has been able to significantly de-risk its business strategy, having fully financed the underground expansion project and progressed its growth plans for Clara. Because of declining global diamond supply, our outlook for diamond prices and the diamond market remains positive.

Our current market cap is about $312 million dollars. Our largest shareholders include the Lundin family and Letko, Brosseau out of Montreal.

Dr. Allen Alper: Sounds very good! Eira, could you tell our readers/investors, the primary reasons they should consider investing in Lucara Diamond?

Eira Thomas: I think the primary reason to be investing in Lucara Diamond is the fact that we finally have a diamond market upon us. The diamond market has performed very well over the last two quarters. We haven't seen the fundamentals look this good in several years. Lucara has used the challenges of COVID to our advantage. We've made significant progress on our underground which is now fully financed and we're moving forward with that. The company is significantly de-risked, going into a much stronger diamond market. There are very few diamond companies in the space and Lucara is, in my humble opinion, the story to watch as we continue to move forward, with our progress on the underground and Clara, and start to see stronger revenues, as a result of a much-improved diamond market outlook.

Dr. Allen Alper: That sounds excellent! Could you say a few words about how it is operating in Botswana and seeing the mining environment?

Eira Thomas: We often refer to Botswana, as the “Switzerland of Africa,” a strong democracy for more than 50 years, Botswana has used the proceeds from natural resource development to build local infrastructure such as roads, power, hospitals and schools. This has resulted in a high proportion of the Botswana population being highly educated. 98% of the people employed in our mine are Botswana nationals. That's something we're very proud of. It is a country with a reputation for being very business friendly and we've really enjoyed our time in Botswana, and we look forward to investing more. The one challenge for us has really been the COVID crisis. Vaccines are unfortunately not yet widely available in Botswana, however we are working very closely with the government, to try and get the vaccine rollout accelerated. That is something we're watching very closely and is a top priority for Lucara in the short term. We are doing everything we can to protect the health and wellbeing of our workforce and to keep everybody safe.

Dr. Allen Alper: Very good, Eira. Is there anything else you'd like to add?

Eira Thomas: I don't think so. I really appreciate your time today and I think we've covered it all.

Dr. Allen Alper: Sounds great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://lucaradiamond.com/

Investor Relations & Communications

+1 604 674 0272

info@lucaradiamond.com

|

|