Bruce Smith, President and CEO, Radius Gold (TSXV: RDU): Drilling Two Guatemalan Projects in JV with Volcanic Gold, and about to Drill Their Mexican JV with Pan American Silver

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/23/2021

Radius Gold Inc. (TSXV: RDU) is a gold and silver exploration Company, with a portfolio of compelling projects, located in Mexico, and Guatemala. Radius utilizes partnerships, where appropriate, to retain our Company’s strong treasury. We learned from Bruce Smith, President and CEO of Radius Gold, that they are currently drilling at two projects, Holly in Guatemala, in joint venture, with Volcanic Gold Mines, and at Amalia, their Mexican Joint Venture, with Pan American Silver. Radius expects to start drilling at Banderas, the project, with Volcanic Gold, in the next weeks. Radius also owns 100% of two drill-ready projects, in Mexico and expects to be drilling them, within the next 12 months.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Bruce Smith, who's President and CEO of Radius Gold Inc.

Bruce, could you give our readers/investors an overview of your Company, and also what differentiates your Company from others?

Bruce Smith: Okay, thanks Allen for inviting me to be interviewed. My name is Bruce Smith. I'm the CEO and President of Radius Gold. I'm an exploration geologist by profession, and I've been looking for metal deposits, predominantly gold and silver for 27 years, of that, 20 something years in Latin America. Radius Gold is a TSX.V listed Company. The symbol is RDU. Radius has been around a long time, almost 20 years. I've worked at various levels for Radius and in the last year, as CEO and President. Radius has been exploring, predominantly in Central America and North America. We have a number of attractive projects that we're working on. Right now, we have four key properties that we'll be drilling in the next 12 months.

Radius has not had any private placements or raised funds through issuing shares, for the last 10 years. We have made a number of discoveries, and we've been able to self-fund, by monetizing those discoveries. We just haven't hit the ball out of the park yet. We've discovered a number of small, 200,000 to half million-ounce deposits, and we've sold those and been able to fund exploration ourselves, without diluting our shareholders. In one way, Radius is unique amongst junior companies, that we haven't diluted our shareholders for more than 10 years. We also haven't hit it out of the park yet, but I plan on drilling four projects this year, and they're compelling projects. I think we have a very good chance of making that fantastic discovery this year.

Dr. Allen Alper: That's exciting. Could you tell us a little bit about the projects you're focusing on this year, going into 2022?

Bruce Smith: We have four key projects.

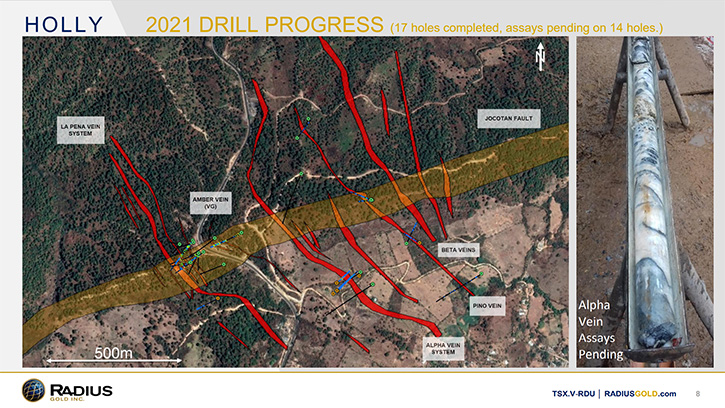

We have a Guatemalan joint venture, with Volcanic Gold. We have two drill ready projects in Guatemala, and we are drilling there now. We've had some great results so far, on the first project, called Holly. We have about 15 holes outstanding, waiting on our assays. We've published the first assays already, on the Holly project. I'll run through those in a minute. There are some spectacular results, and we hope to get more.

The next project to start drilling, we expect to be notified any day now, is with Pan American Silver, our joint venture partner, in Mexico on the Amalia project, a gold/silver, high-grade epithermal style project, with some really great drill results early on. Then we have two undrilled projects, Maricela, an epithermal gold/silver deposit, right next door to Cananea mine. We have Plata Verde. Those two projects, Maricela and Plata Verde, are both a hundred percent ours. They're drill-ready, or almost permitted, and we expect to be drilling them, within the next 12 months, either ourselves or with partners, if we receive attractive offers.

Starting with the Guatemala projects, these are properties that Radius has had for a long time. The founder of our Company, Simon Ridgway, worked in Guatemala 25 years ago, where he and the Team discovered the Cerro Blanco deposit, that had an underground potential, of about a million ounces at 10 grams. So very high grade! Simon’s company at the time, called Mar-West Resources, sold in 1998 for $48 million and it was a great discovery that started Gold Group off. From there Gold Group formed Radius and formed Fortuna Silver Mines and Cordoba Metals, and a number of other Companies, with the profits from that sale.

Since that time, we've always maintained a presence in Guatemala. We accumulated a large land package, of applications and granted licenses. We have the biggest landholdings in Guatemala. We explored two key projects, Holly and Banderas in 2001, 2002 and had very interesting results, but at the time the dip in the markets and some other problems meant that we had to let those interesting discoveries sit. They hadn't been explored. Guatemala went through a period of where the government wasn't so favorable towards mining. But, in the last two years, Guatemala's had a new government that's really pro mining and a number of interesting companies have made big investments in Guatemala. So, we thought, it's the right time to go back there.

Pan-American Silver, one of the world's best and biggest, silver focused, mining Companies made a near billion-dollar investment to acquire a Company called Tahoe. The main objective of their acquisition was a project in Guatemala called Escobal. It's a world-class, large, very high-grade silver mine that had been stalled because of the political situation in Guatemala. Pan-American believed that that would change, and they spent a billion dollars to acquire Tahoe. The other key player that moved into Guatemala was a Company called Bluestone Resources, that's controlled by the Lundin family. And they've spent, around about $150 million on advancing the discovery that Simon made 25 years ago called Cerro Blanco.

So, with those two big companies moving into Guatemala, demonstrating confidence in the government, we decided it was the right time to reactivate our efforts there. Radius formed a joint venture, with Volcanic Gold Mines. Volcanic Gold Mines agreed to spend $7 million, in three years, exploring our properties to earn 60%. So they started straight away, with an aggressive drilling program on our Holly property, which is an epithermal gold/silver vein system, along a major continental break. We've just published the first four holes, in what we call the La Pena vein zone. The early 2001 drilling hit interesting stuff. The shallow drill holes hit 14 meters at 4.1 g/t gold and 151 g/t silver. And just below that 1.5 meters at 7 g/t gold and 123 g/t silver.”

They were shallow drill holes and they were left in 2002 and never followed up. So, we've just gone back and followed up, drilling in the same area. We're stepping down and along strike and we've published the first four holes there. We've had some great results. I'll just read a few of them to you, and you can find them on the website of course. 1.6 meters at 24 grams gold and 568 silver, and in the same hole, another cut, 6.9 meters at 4.9 g/t gold and 95 g/t silver. Then we stepped down, down dip, deeper into the system. We hit 11 meters, at 6.2 g/t gold and 282 g/t silver. We stepped down a bit farther. We hit 10 meters at, 5.29 g/t gold and 256 g/t silver. And we stepped down farther again and we hit 14.8 meters at 3.96 g/t gold and 1,097 g/t silver.

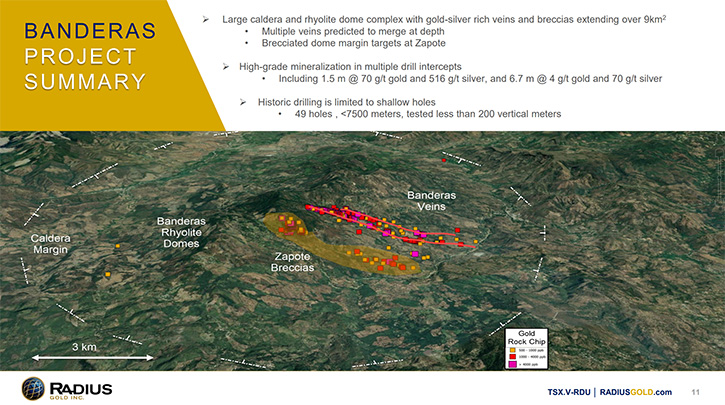

It was getting wider and better grade as we went down. We're drilling on a number of targets there. We hope to have success on more than one of those targets. It's a multi-vein system. That was hole four, we published hole eight, and now we're drilling hole 22. Assays are slow, but we're going to have more good news flow coming out of Guatemala. So, that's the Holly project. Five kilometers away, we have Banderas, and it’s the same sort of situation. There were a number of shallow drill holes in 2001 and 2002. At Banderas, a lot more drilling, around 30 shallow holes, all about a hundred meters deep, some good intersects, some wide, low-grade, 30 meters zones, at nearly a gram and some narrow high-grade zones, one to two meters at 35 grams gold and a kilo silver, that sort of thing.

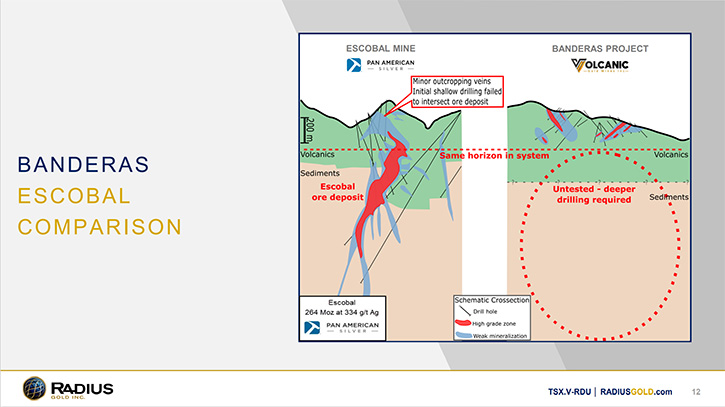

But it didn't hang together that well, and given the climate in 2001, 2002, they were not followed up. But in the intervening period, the Escobal deposit, 50 kilometers down the road, was discovered. And all the early drilling at Escobal were similar to Banderas, shallow drilling, narrow and discontinuous. They persisted drilling deeper and at the right stratigraphic level, hit 30 meters wide zones, grading a kilo silver. So, Banderas is a very good target. Two sets of veins dip together, that have never been drilled at the horizon, where they are predicted to merge at depth. And we have another big target, called the Zapote breccia, which has never been drilled. It's a couple of kilometers long, big breccia and vein system, at the margin of a dome complex. We're just discussing right now, when we take a break from Holly, to get all the assays, we'll move the rig five kilometers away and start drilling Banderas.

Volcanic Gold Mines had $12 million cash in the bank, at the start of this year. Their only focus is Guatemala. I think they're just going to drill and drill and drill, until they either hit the big one or they exhaust $10 million. And I think they're going to hit the big one. We have 240,000 hectares of regional applications, covering half a dozen, very interesting targets that we're going to develop and bring to drill-ready stage as well. It's not just these two properties, but a number of other ones, where we're going to advance to drilling. So that is Guatemala.

Dr. Allen Alper: Well, that sounds very exciting. Sounds like you have great projects and great potential there. With all that drilling going on, I think 2021 is going to being an exciting time for your shareholders and stakeholders.

Bruce Smith: Yes. The deal with Volcanic, is a 60, 40 joint venture. They spend the first $7 million on exploration, and then we convert to a 60, 40 joint venture. That's on Holly and Banderas only. If they decide to advance one of our other targets, we'll make another deal. Again, it'll be a 60, 40. So Radius is not looking at getting some million-dollar payments out of this thing. If we make a significant discovery, Radius' shareholders will benefit significantly as well. The Companies could either be merged, or they will have to buy out our 40%. So, Radius stands to make a great gain from the property, if there's a discovery, with little risk, because we're not paying anything for the exploration.

Dr. Allen Alper: That sounds like an excellent arrangement with Volcanic. So that's great!

Bruce Smith: Yes. We have a similar situation in Mexico. We have a project called Amalia, again, a grassroots discovery of Radius. All of our projects are grassroots discoveries, and they're all made by us. We discovered Amalia in 2017. At that time, I had a friend in Pan American Silver, I'd worked with before in Argentina. He liked the property and they made us an offer, and they funded the drilling at Amalia. Amalia is located in the Northern Sierra Madre, Mexico and is a classic high-grade, gold/silver epithermal system.

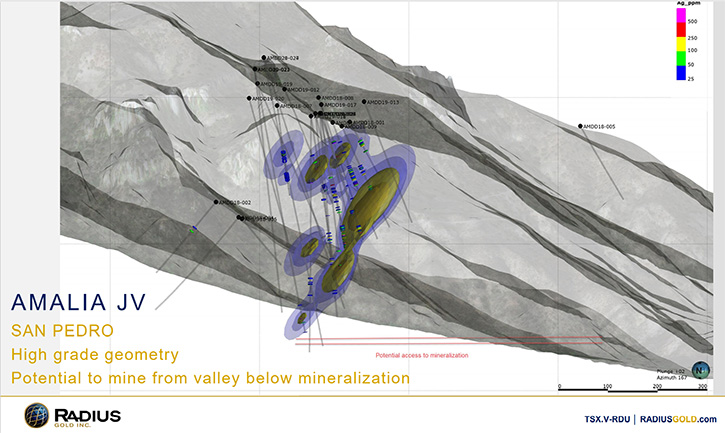

There are at least a dozen giant gold/silver deposits, within a hundred kms of us. San Julian, owned by Fresnillo, is about three and a half million ounces. It's 50 km’s down the road. With a partner like Pan-American, they didn't come in looking for a small deposit. Half a million ounces doesn't interest them. They're only interested in large multi-million-ounce deposits. So far at Amalia, we have drilled, together with Pan American, 31 drill holes and 10,588 meters. We had drilled nearly all of those holes on one particular target. We called it the San Pedro zone. We operated for the first two years and are now in the 5th round of drilling. We hit some good results on the first round of drilling, but on the second round of drilling, we hit spectacular, results. Hole ten, hit 44 meters at 12.38 gold and 309 silver. At that time, that was the best drill hole of 2019, drilled anywhere for gold in the world, in terms of grade meters.

When we hit that hole, Pan-American decided that they would like to operate, because of course they thought they were onto something big. We've continued to drill that off, what we call the San Pedro mineralized shoot. We have a number of great holes that define a mineralized shoot, from surface to 350m depth. We don't have a published 43, 101 resource, but I can tell you a little bit about the size. We can go through some of the holes. Hole nine, was the discovery hole, made in 2018. We hit 34 meters at 11 grams gold equivalent (gold and silver). I have the gold equivalent numbers in front of me. Then stepping down, hole 10, in terms of gold equivalency was equal to 44 meters at 16 grams gold. And in terms of true width, it's roughly 36 meters true width. We continued, the shoot got much larger in terms of width, the grades dropped as we went down. About 300 meters down the shoot, we got a 65 meter intersect at 2.7 grams gold equivalent.

We closed the shoot off at depth, about 400 meters down.

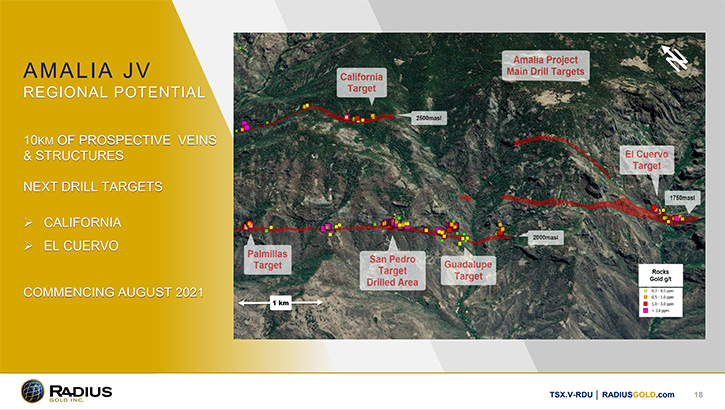

So, what is Pan-American going to do now? They are looking for the next shoot. We have 10 kilometers of structures and veins, and we've only drilled one section. They are due to start work on our fifth drill project, in the next month. I expect to get the news, within days, that they have started. And they're going to be drilling to new targets, El Cuervo target and the California vein target. Both of those targets have good high-grade rock chips at surface, interesting widths.

And if we can find another San Pedro, we've got ourselves a truly great discovery, that'll make Pan-American happy. If Pan-American does not find another one of these shoots, I believe they're going to give the project back to us. They still need to pay us a million dollars next year, and I don't think, unless they make that discovery, that they're going to make that payment. If they don't make that payment, I would be very happy to have the project back. Because Pan-American Silver is one of the bigger silver/gold mining companies in the world, they are only after giant deposits. I think that I could turn the San Pedro shoot into more than half million ounces at five or six grams. And given it's all on one big ore shoot with nearby expansion potential, it will be a very attractive target for a mid-tier mining company. Drilling will commence soon at Amalia.

We're always looking for new targets. There's a Team in the field seven days a week, almost 350 days a year, looking at projects. And we've found two new ones. Maricela, which is a classic epithermal vein system, just on the margins of the Cananea porphyry in Sonora. Never been drilled. The Cananea porphyry in Sonora is the third biggest porphyry copper deposit in the world. It's been mined on and off since the late 1700's. And it still has a couple of billion tons of resources today.

About five kilometers from the edge of the Cananea porphyry, we found a gold silver stock work vein system. And it had never been drilled. I think that it has never been drilled because it's been held by one of the large Mexican copper mining companies that didn't have interest in gold and silver. And we have hold of the core group of half a dozen claims, covering these gold silver veins, that were actually mined between 1900 and 1960. They were mined and shipped to the Cananea smelter.

We have two targets, an open pit, low-grade, balk tonnage deposit and high-grade underground veins. We are seeing widths in excess of 25 meters in some cases, with average grades around 0.3 to 0.5 gold and a hundred silver, average grades. And average width of 10m, with multiple intersecting veins.

That would make an ideal open pit target. That's the first target I would like to drill. But we are in a district, where some of these epithermal vein systems extend to great depth and they're high-grade and underground mining targets.

There is Las Chispas, Silvercrest’s deposit, 50 kilometers to the south, with an average grade of 778 grams per ton of silver, and in excess of a hundred million ounces of silver. Then there's Santa Elena's First Majestic underground mine, and Equinox Gold’s Mercedes mine are all within the same district. They're all high-grade, underground mines. We have high grades at Maricela as well. We have samples up to 12 grams of gold and three kilos of silver, in some cases. We have spotty high-grade through it, so we will be drilling for the open pit style, disseminated, stock work, vein system deposit that we can see right in front of us. And we'll be drilling to find high- grade shoots for underground mining. We acquired Maricela less than a year ago. We've done all the trenching and sampling and some geophysics that we need to do. I'm just in the permitting stage. That shouldn't take too long, a month or two more and I'll have a drill permit. So that's Maricela.

And then we have Plata Verde, which is in Chihuahua, Mexico. It's a discovery we made two years ago. It's a historic mining district that was left unexplored. We think that it was mined in the late 1800's and stopped at the Mexican revolution. It is a silver only target. And we found extensive underground mines, on flat lying silver mantos, hosted in basalt. It's a bit unusual because it's calcite, barite, silver chloride, hosted in basalt. The mines that we found were extensive. I think that they extracted more than a million tons, by hand, in the late 1800s. Some of the mined cavities are 50 meters diameter, with roof heights of 30 meters and all up the mining area covers roughly 600 meters by 300 meters, targeting high-grade silver. Never been drilled!

There are two targets. One is to follow the mantos down. We've sampled extensively throughout these mantos systems. We find the average grade of all sampling is about 150 grams silver. If we look at just the breccias, the average grade is 250 grams. You can see all the information on our website. The whole system is covered by host mineral, volcaniclastic rocks. But the other very attractive target, is to find the feeders. Where are the feeders that are driving these mantos? And because it's all covered, there are not a lot of outcrops, we’ve run some geophysics. We can see some strong breaks, geological faults, directly under those historic mines. With the same drill hole, we can drill through the manto extensions and through the predicted feeders.

We have the funds available to drill Maricela and Plata Verde ourselves, but I'm always interested to hear from good, well operated, well-funded companies that may wish to help us in those. I've had a few talks lately, about who might like to drill there, and I'm sure I'm going to get an offer. If I don't get one, we'll drill it ourselves. So, I think Radius is in a strong position. We haven't diluted our shareholders for 10 years and we have no intention of doing so, in the near future. We have four projects. One drilling now, one due to start in a few weeks, one due to start in a couple of months, and one due to start within 12 months. So, we'll have constant news flow. Also, Radius owns 4 million shares in a company, called Rackla metals.

Rackla, right now, is going through a transformative change. It's going to acquire a 3.2-million-ounce gold deposit, at 2.16 grams per ton, in the Democratic Republic of the Congo. It's a large resource, already defined, we just put out the 43-101. It is currently in the exchange waiting for approval. I believe that project has world-class potential. When we were first offered Misisi, I said to Simon, I've worked in Africa before, on similar projects, and I'm not going back there unless it's world-class. When I looked at the project, I thought that has potential for more than 5 million ounces. It could be a tier one asset.

Radius is the main shareholder, at this stage, of Rackla Metals. As soon as we get the exchange approval of the deal, in the next weeks, the trading halt will come off, we'll be raising somewhere around $15 to $20 million and we'll have a potential world-class asset, and Radius will be one of the main shareholders. So, that's one of the ways Radius is able to fund its exploration, without diluting its shareholders.

Dr. Allen Alper: Well, that sounds exciting. You'll have great projects, with great potential. You'll have interesting partners and a huge amount of opportunity. You have a great Team, very experienced, very successful in the past, and it looks like you are doing very well now. Your Company seems like its market cap is very low, compared to what you own and what you're working on. So, it seems like it will be very exciting soon. You're drilling so much and generating so much news. Seems like it will be a very exciting time for your investors, your shareholders, and your stakeholders.

Bruce Smith: Yeah, I think you're right. I think we are highly undervalued, and I've only been the CEO, President for less than a year. Formerly, I was Exploration Manager, VPEx. I have looked around at other companies and at their share prices and I think we have so much more to offer, and yet our market capitalization is lower. We don't dilute our shareholders. I guess our market cap is lower, because Radius has been around a long time. People have been waiting a long time for something to happen. It's not a new story, but three of the four projects we have now, Maricela, Plata Verde, Amalia, are new discoveries. I believe it's a great opportunity and we have several chances to find that fantastic deposit. And that's a good buy!

Dr. Allen Alper: Well, it looks like you'll have the opportunity and the potential to find some district scale deposits. So, I think this will be a very interesting time for your shareholders and stakeholders. Bruce, anything else you'd like to add?

Bruce Smith: I think I've covered all of our projects. Anybody is welcome to look up our website. My number is there and I'm always happy to answer any questions about any of our projects. We have a lot of projects, but we only take things on that we believe are going to be mined or have the potential to be.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://radiusgold.com/

Bruce Smith

President and CEO

Office: +1604-801-5432

Toll free 1-888-627-9378

Mobile: +64221883763

Email: info@goldgroup.com

|

|