Joe David, CEO, Elementos Ltd (ASX: ELT) Discusses Moving Forward with a Definitive Feasibility Study for its High-Grade Oropesa Tin Project in Spain, Global Tin Supply Shortfall of 40,000 tpa Forecasted

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/22/2021

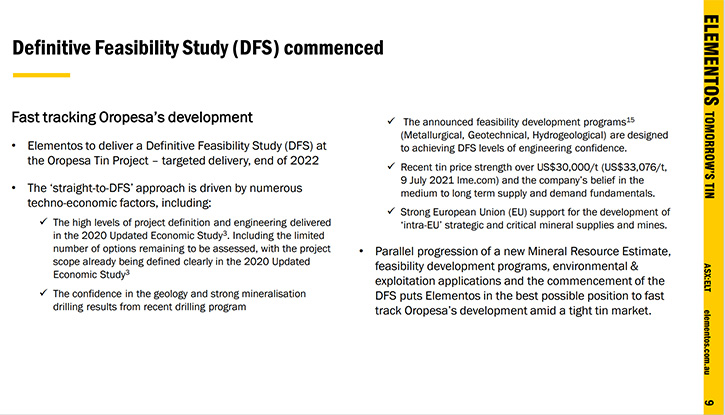

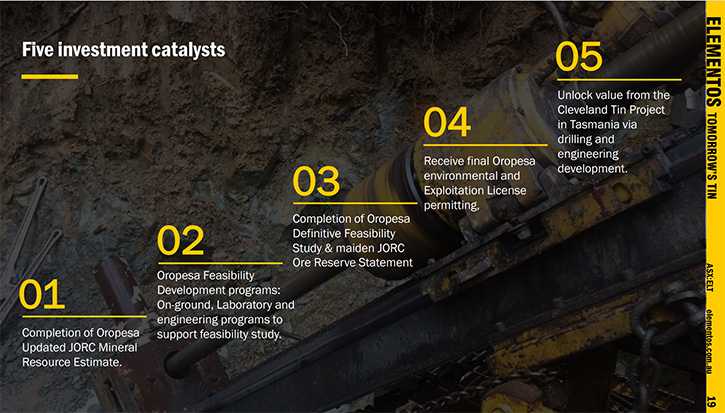

We learned from Joe David, who's CEO of Elementos Limited (ASX: ELT) that recently, they made an announcement, committing to move forward, with a definitive feasibility study (DFS), for the Oropesa Tin Project in Spain. The Company has completed a nine-month drill program, with the goal of releasing an updated mineral resource estimate for the deposit, in approximately October of this year. Other exploration work, to support the DFS, includes a; geotechnical program, geo-hydrological program, and metallurgical programs. They are looking to fill a gap in the tin supply market, and aim to commence tin production in 2024/2025, aiming to meet some of the forecast global tin supply shortfall, of 40,000 tpa.

Elementos Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Joe David, who's CEO of Elementos.

Joe, recently Elementos made a news announcement, committing to move forward to complete a definitive feasibility study, for the Oropesa Tin Project in Spain. I wonder if you could update our readers/investors on that project, what you know to date, and why you have determined to move forward, with a definitive feasibility study.

Joe David: Yes, certainly. Thanks, Allen.

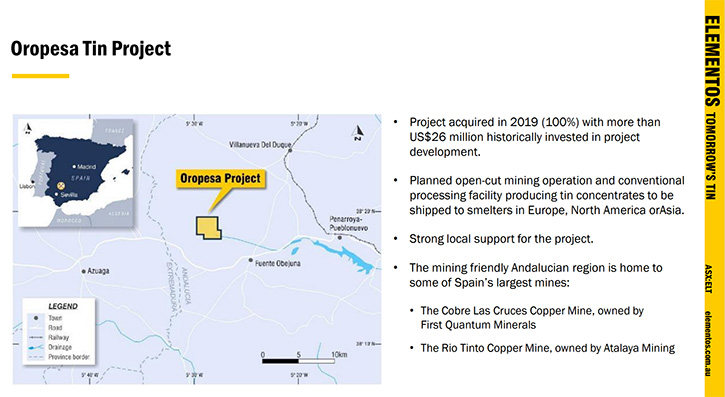

Elementos, as a Company, acquired Oropesa Tin Project, about two years ago, from a TSX listed Company, called Eurotin. Eurotin has spent approximately $25-$30 million on drilling and on other technical studies on the deposit, that they had previously released a preliminary economic assessment onto the TSX. We acquired that in 2019, for approximately $6 million Australian, so let's just say about $5 million US. The tin price was low, and it was an advantageous time to do a deal.

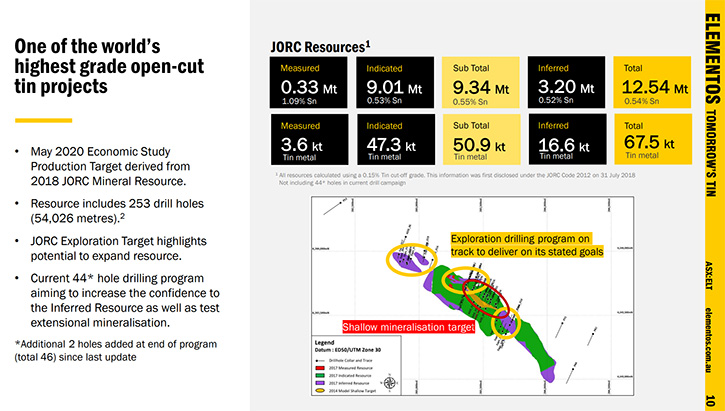

Elementos then proceeded to do an updated economic assessment, or a scoping study, on the deposit, which was utilizing the available historic data and the available mineral resource that Eurotin had done for the deposit. We released those results to the market in May 2020, and they had some positive economics, albeit at a much lower tin price than the current tin prices.

That was enough to build support into a capital rising. And we have just, as of mid-July, completed a nine-month infill and extension drill program on the deposit, with the goal of releasing an updated mineral resource estimate, for the deposit, in approximately October of this year.

About a month ago, we also announced the on-ground works, technical streams, to also support a feasibility study. These, being a geotechnical program, a geo-hydrological program, and a metallurgical program. We currently have metallurgical test work, happening at Wardell Armstrong in Cornwall, in the UK. And they will follow on from the pilot programs and do some variability test works, on the various ore streams to produce metallurgical regressions.

Those data sets, as you'd be aware, set the project up very nicely to go into a feasibility study. The Company, supported by a number of expert technical specialists, has decided the project is going to move directly from the updated economic assessment (scoping study) into a definitive feasibility study. We are confident we have the scope of the project well-defined, high maturity levels of all the technical data, which will support going past a PFS and directly into a DFS. Due to the all-time high tin prices and the support we're getting from off-takers and potential financing partners, we are certain it's time to get this project moving and get it as close to funding, construction, and operations as we can.

Dr. Allen Alper: Well, that sounds excellent. I wonder if you could tell our readers/investors the importance of tin and the uses of tin. I think they would appreciate learning more.

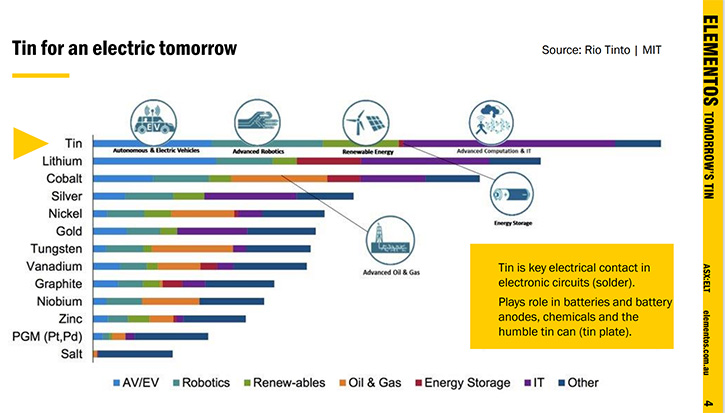

Joe David: Yes, certainly. Tin is the glue of all electrical circuits and smart infrastructure. It is also referred to as "the spice metal". It's referred to as "the spice metal" because if you're thinking about electrical components like a menu at a restaurant – tin would be the salt and pepper. Salt and pepper is likely a critical ingredient in every single dish, but is never listed by the chef as an ingredient – because it’s use is just expected. It is so integral, in the ‘cooking’ of electrical circuits that it often doesn’t even rank a mention when we talk about critical metals and components. Every electrical circuit and semi-conductor will have a portion of tin in it. Any place you have a computer, or you have solder connecting electrical components, tin is majority of that solder.

Traditionally, tin solder was made up of lead-tin composite. Obviously, lead, in every other part of our lives, is being removed where possible. That includes solder. Previously, it was about 60% lead, 40% tin solder. Now it moved to about 95% tin, 5% silver.

60% of the tin markets are still delivered into that. And that solder market is growing hugely, as is everything that was previously driven by combustion engines, or other forms of technology, is now moving to be driven by electricity and batteries. The green economy is driving strong demand for tin, mostly electrical, either contact, as we call it, or solder. Additionally, tin is used in some chemical stabilizers for PVC plastics. Tin is also still used to make the humble tin cans – or as we call it tin plate.

Predominantly, the future demand for tin is going to support the electrical future of tomorrow, as we move into green energy and green technology.

Dr. Allen Alper: Well, that sounds excellent. With the electrification of the world moving forward at a rapid place, tin plays a crucial part.

Joe David: Well, the simplest and bluntest message I can quote, is that Tesla doesn’t leave the garage without tin.

Dr. Allen Alper: Great. Could you tell our readers/investors a little bit more about the economics; your approximate projected costs, the market price, and what that looks like, what the supply/demand of tin is?

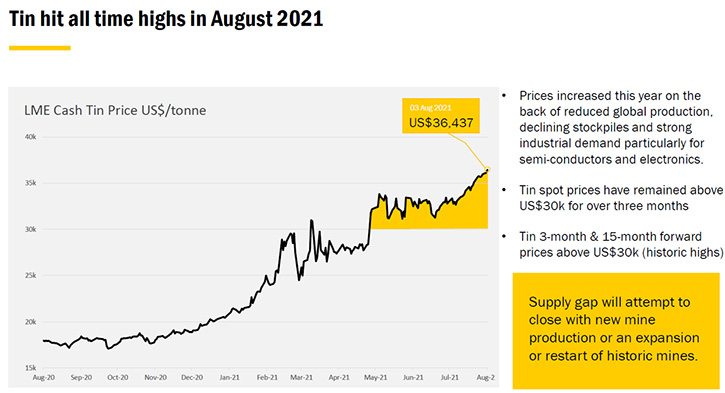

Joe David: The tin price in the last 12 months, has grown absolutely phenomenally – currently roughly 205%. Early-on, there were some COVID factors in supply reductions that didn't last that long, as the world moved out of the first wave. But as you've said, the demand, because of all the reasons we just mentioned, electrification of the world is starting to drive the interest in base, precious and industrial metals, and tin is included in that.

Tin has absolutely had, one of the largest rises, of all those metals. One of the reasons is, it's one of the least abundant and smallest volumes of metal supply in the market. So, with pure supply and demand fundamentals, tin is in great demand and there's not a lot of supply. Now, the tin price has gone from about $17,000 US dollars, a ton, at the end of last year. And where they are currently sitting, as of today, was just a tick over $36,000 US dollars, a ton. That price has been pretty stable above $33,000 for the last five months.

Tin traditionally is in backwardation, which is with the spot price being higher than the future's prices. Again, that often happens in these smaller markets, where the metal, when it's required, certain people are happy to pay a premium for short supply. But what we also see, in the last couple of months, in those future's prices, is the discount has really dropped away.

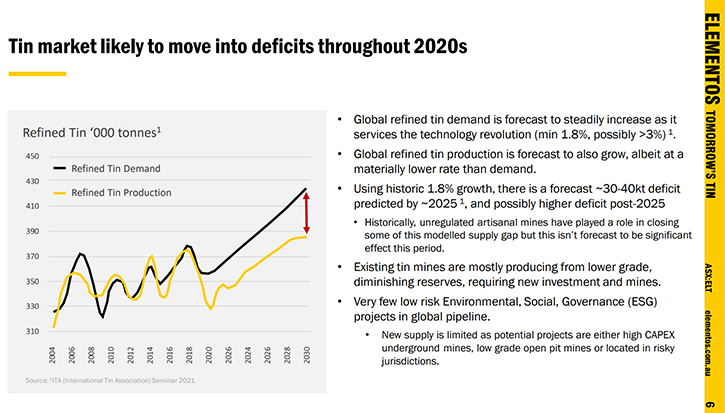

A supply and demand fundamental. we're a member of The International Tin Association, and they put out some great data on that. But they're pretty much predicting for the next eight to 10 years, there could be a 30-40,000 deficit in tin, from what the market wants to what the current supplies and the future supplies are, which doesn't include producers, such as ourselves. On the producing side and Companies like ours, who are looking to invest in the sector, there is a lot of confidence that demand will continue for the next foreseeable future.

Dr. Allen Alper: That sounds excellent. Sounds like your Company is so well positioned, to be in Spain, to be supported by the European Union. And also, the demand is increasing and now a deficit is predicted.

Joe David: Well, one extra point, and thank you for highlighting Spain and the European Union. Obviously, the globalization of the world has been rapid, in the last few decades. We're now moving into a point where major economies are trying to protected themselves from an adverse geopolitical event, by not getting all their supplies out of one country (ie. China) and their manufacturing sectors can work somewhat independently from global politics.

European Union and the US both right now are trying to find and secure sources of metals right through the supply chain to ensure minimal disruptions to high tech industries.

Dr. Allen Alper: Well, that sounds excellent! It sounds like you fill a critical position for the demand in Europe and a secure supply of tin. So, that's excellent.

Joe David: I was just going to say, The International Tin Association classified 90%-95% of tin suppliers, as being conflicted or having high ESG risks. They believe that there is great demand for suppliers, who have high ESG credentials, and are seen as supplying responsibly sourced metal. Our Spanish and Tasmanian projects both comply.

Dr. Allen Alper: It's great to become a supplier from a safe, responsible, and secure area, and one that's doing all the right things, and believing in and protecting the workers and the citizens of the state, in which you're operating.

Joe David: That's right.

Dr. Allen Alper: Could you tell our readers/investors a little bit about how it is operating in Spain? I don't think some of them realize that Spain is a long-term mining Country and supportive of mining, but maybe you could add to that.

Joe David: Yes, certainly. Being an Australian Company, with a Spanish project, we were somewhat restricted in our travel by COVID. We're very fortunate. We've already developed very strong relationships, with our employees and consultants in Spain, who make sure everything keeps moving forward. During COVID, we were relatively unaffected. We're lucky enough to have no infections onsite. None of our employees or consultants or contractors, are personally affected. In addition to that, the movement around the Country, despite some going into lockdown, was allowed, with some restrictions, due to the fact that mining is considered an essential service, like in most developed mining regions. So, I think that's another good indication that the government is supportive of mining.

Spain, like a lot of countries, is a series of provinces or states. We're fortunate to be in the Andalusia region of Spain. It has a very long history of mining, because it's in the south of Spain. The Province of Andalusia is mining friendly, in terms of comparing regions around Spain. The Rio Tinto copper mine has been operating since Roman times. It's currently being operated by a Company called Atalaya Mining, owned out of the UK. They have managed to build strong relationships, through operating responsibly, and with great support from the local government.

The other major Company, operating in the region, is First Quantum, with the Cobre Las Cruces mine. Again, another very large miner, with a large operation, well supported by the government. There are a number of much smaller mines in the region, which are also supported by the government.

The town we're close to, is a local town that has had a history of mining, mostly coal mining, to support power generation. Now, due to the greenification of the European energy network, those coal mines shut down. However, that means there's a knowledge of mining and a workforce, looking to get into new projects. Again, local government, state government, provincial government, and national government, are all very supportive of new mining projects in Spain.

Dr. Allen Alper: Oh, that sounds excellent. Joe, could you tell our readers/investors a little bit about your background, the Board and the Team?

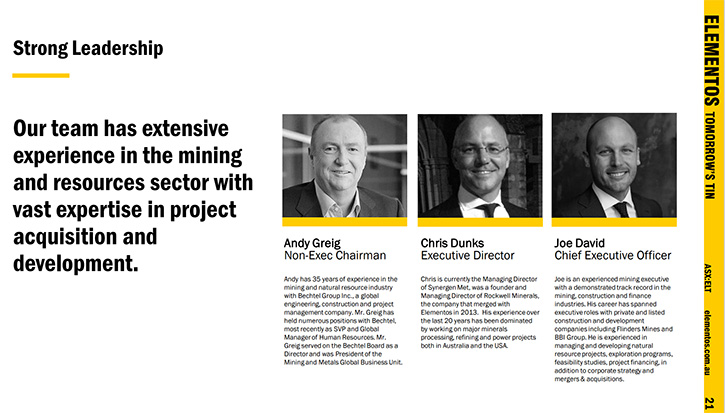

Joe David: Yeah, sure. I joined the Company about four months ago. My background is as a civil engineer, with a finance degree. I worked, technically, for mining consultancies, early in my career, moved into banking and mergers and acquisitions as well, doing a lot of cross-border, Chinese SOE transactions. I then moved back into the corporate side and worked for about 10 years, specifically in pre-feasibility and feasibility studies on large mining projects. In the last 10 years, I worked in Western Australia, with large metals and mining projects and mining infrastructure projects, in the iron ore and bulk space. So, that's my background.

I subsequently took this position with Elementos. I think they're a Company with some fantastic assets, moving into the critical stage, where they really needed to knuckle down and get this bankable feasibility, definitive feasibility study completed. And certainly, that's right in my wheelhouse, so I was very happy to take charge and drive the Company forward, from this point, through to finance, construction and operations.

Additionally, we have a very supportive Board. Two of my other Directors, both currently run other Australian listed mining companies. I mentioned Brett Smith. He's Managing Director of Metals X. Metals X is Australia's largest tin producer, and they mine ~95% of Australia's tin. They have tin assets in Tasmania, quite close to our second tin mining asset in Tasmania, called the Cleveland Project. He's very supportive and it's great to work closely, with a tin industry veteran like himself.

Corey Nolan is the other one. He runs a Company, called Platina Resources, in Australia. He have a portfolio of exploration and development projects. He's been in the industry for a long time. And provided practical operational day-to-day support when required.

Andy Greig, our non-Executive Chairman, ran Bechtel Metal and Mining Group for about 10 years. Probably the people in the US might be aware of Bechtel, more than in Australia, being a big private US firm. But Andy speaks for half a trillion dollars’ worth of engineering and development projects over his career. So, it’s fair to say he has a lot of development and delivery experience.

The other two Directors, Chris Dunks is the Executive Director I took over from. Chris continues to provide great support. Calvin Treacy, is the last non-Executive Director and between him and Chris are largely responsible for turning Elementos into a Tin focused Company a few years ago.

Dr. Allen Alper: Well, you certainly have a great background, and your Board has a variety of experience and a well-known record of accomplishment. So, that's excellent! Sounds like you're in a very strong position to move the Company forward. Could you tell our readers/investors a little bit about your share and capital structure?

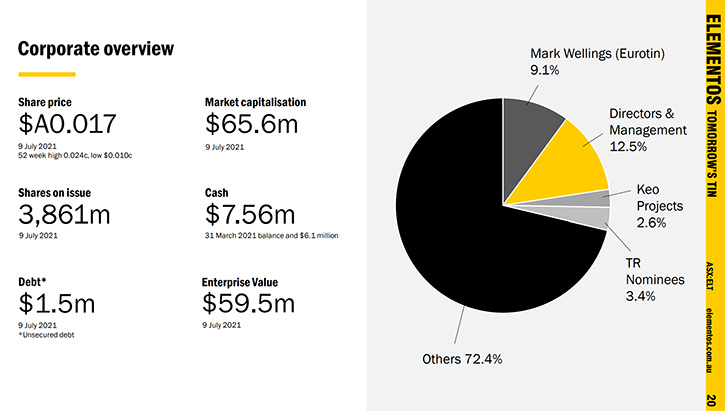

Joe David: Yes, certainly. Our share and capital structure. Our current market cap is just under $67 million. We are a Company that's had a relatively long history to get to where we are today. But where we are today is exactly where we want to be, as an emerging tin producer.

Cash position, we just got $5.5 million worth of cash in the bank. That's mostly from a recent raise we did, in May this year. We raised $6.1 million. And that was highly supported. Totally, I've subscribed, and certainly could have raised more. But on behalf of the shareholders, who want to progress the projects, before raising extra capital.

Debt position is in about $1.5 million worth of debt. And overall, we've gone up a little bit since I did my last slide, but we made about $65 million in enterprise value. So yeah, If you have a fundamental, if we think there's a lot of upside between what we're currently trading at in our market cap and our EV compared to what the net assets of our projects are and all the blue sky we have ahead of that. But I'll let the investors make their own decision on that one.

Moving to our shareholder base, we're very well supported from Director's Management. They hold about 15% of the Company. In addition, the CEO who ran Eurotin, from whom we bought the Oropesa project, holds just under 10%. A lot of continued support from those guys. They definitely are supportive, when we do our capital raising.

Dr. Allen Alper: Well, it's nice to see that Management and the Board is aligned with Shareholders, so that's excellent!

Joe David: Certainly!

Dr. Allen Alper: Could you tell our readers/ investors, the primary reasons they should consider investing in Elementos?

Joe David: Sure. I think the pitch for investing in Elementos is twofold. We get investors, who are coming in, primarily due to their recent interest in the tin space. For a long while, tin was a metal people didn't talk about, but the recent price growth and the potential for that price to go higher, in a very tight tin market, is high in some people's minds. And there's certainly a lot of potential upsides remaining, moving forward. So, you can invest in the Company, just based on the tin story and tin fundamentals, or you could also invest in us, based on the stage of our projects.

We are unlike a lot of junior companies. We have two projects, with large tin resources, ready for development into modern tin mines.

My belief, as the CEO of this Company, is that feasibility studies add the most fundamental value to a project like ours. It’s when you not only solidify all the opportunities you've identified to the market, but it’s when you significantly de-risk the project and move it close to production and cashflow. By the end of that feasibility study, we'll have all the key data at a sophisticated level, enough to get a JORC ore reserve, enter sophisticated finance and offtake discussions and take this project into production. I personally believe there is a lot of growth in this Company, from a fundamental basis. It’s a compelling project development story, for our shareholders to come along on, with the tin price growth, just the icing on the cake.

Dr. Allen Alper: Well, that does sound like very, very compelling reasons for our readers/investors to consider investing in Elementos.

Joe, is there anything else you'd like to add?

Joe David: Thanks, Allen, but I think we covered most of the key items. I appreciate your interest

Dr. Allen Alper: I enjoyed learning about your Company. I’m very impressed. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.elementos.com.au/

Joe David

Chief Executive Officer

Phone: 0419 187 430

jd@elementos.com.au

|

|