Boab Metals Limited (ASX: BML): Australia’s Largest, Near Surface, Undeveloped Lead-Silver-Zinc Deposit; Simon Noon, Managing Director and CEO Interviewed.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/19/2021

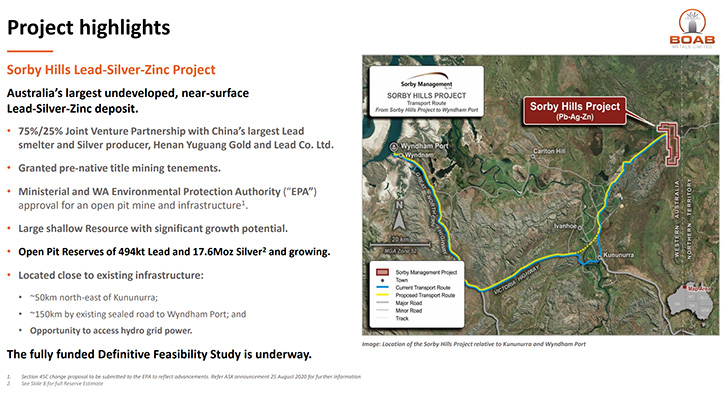

Boab Metals Limited (ASX: BML) is based in Western Australia and is a base and precious metals exploration and development company, fast tracking it's 75% owned, Sorby Hills Project towards production, following outstanding drilling success and a recent Resource update (44.9Mt at 4.3% Pb equivalent). The Sorby Hills Base Metals Project is located 50km northeast of Kununurra, in East Kimberley and just 150km from Wyndham Port, in an area with established infrastructure. We learned from Simon Noon, who is the Managing Director and CEO of Boab Metals, that the project has a robust pre-feasibility study, 10-year mine life, with 1.6 years payback. Sorby Hills will produce around 50,000 tons of lead and 1.5 million ounces of silver per annum. Near-term plans include DFS, during Q1, and making a final investment decision, in Q2 next year.

Boab Metals Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Simon Noon, who is the Managing Director and CEO of Boab Metals Ltd. Simon, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Simon Noon:Boab Metals is an exploration and development company and is making the transition through to operations, with its flagship project, which is Sorby Hills, a lead-silver-zinc deposit. We are currently in the middle of our final feasibility study. What makes this project very attractive is its location. First of all, it's just a 50-kilometer trip, out of a major town, Kununurra, which is home to around 7,000 people. The access is fantastic, it's a sealed road from the town to the project gate and also from the project gate to the port, which is just 150 k from the project and is Australia's closest port to China.

Dr. Allen Alper:

Well, that's excellent. Could you tell us a little bit more about your project? I understand it's very large, with lead zinc and silver in huge quantization and has a great preliminary feasibility study. Would you like to elaborate on that?

Simon Noon:

It's certainly getting reasonably large now. It's about 45 million tons, at around 4.3 lead equivalent. That's not factoring in the zinc. There's not quite enough zinc for us to sell just yet, although we can certainly extract it. There is a very attractive silver credit, with the project, an overall grade of around 37 grams a ton, that represents about 25% of the possible metal revenue.

Dr. Allen Alper:

Well, that's great. Could you tell us about the IRR, the payback, all of those are very attractive?

Simon Noon:

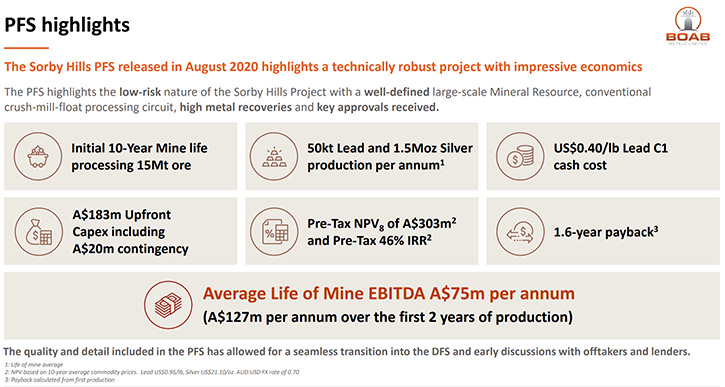

The pre-feasibility study outlined an initial 10-year mine life and I think we've proven over the last two or three years that there is excellent growth potential in that resource. Therefore, you'd expect that initial 10 year life to push out further. Over the 10 years, it will average around 50,000 tons of lead metal and 1.5 million ounces of silver per annum.

The IRR is very impressive, 46% with payback, in just 1.6 years and delivering a very attractive NPV, of over 300 million. What makes this project particularly attractive, is the low CapEx. It's 183 million up front CapEx and that includes 20 million in contingency and a further 24 million in pre-production mining. It's a very straightforward project build. Therefore it attracts a nice low cash cost of 40 cents a pound for the lead.

The project will deliver EBITA of around 75 million per annum, as an average, over 10 years. But of interest, is the fact that the first two years will produce 127 million per annum. That's largely down to a nice portion of the high-grade ore, being very close to surface, in fact just 20 meters from surface, so certainly open pittable, and shallow open pits at that.

Dr. Allen Alper:

That sounds excellent. Those are great numbers and a huge deposit. Could you tell our readers/ investors a little bit about the Management and the Board?

Simon Noon:

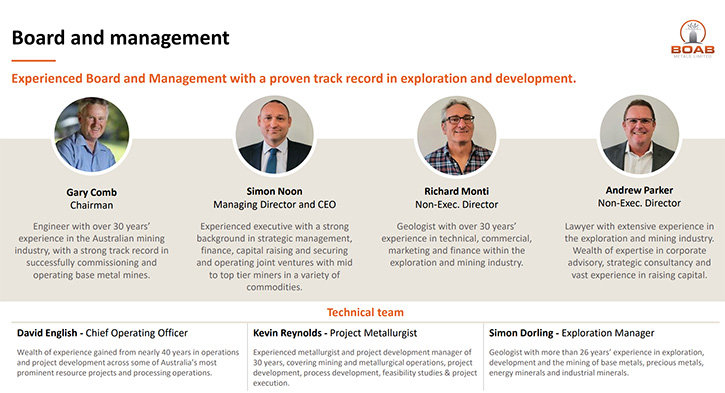

I've spent the last decade or so in senior management in several ASX listed companies. This is a Company that I've run since 2013, so I've been around for quite some time now and looking to drive the Company through this transition to a developer and producer. The Management Team is made up of some very experienced mining personnel. We have a Chairman, Gary Comb, who is well known in the industry for building and operating mining operations, here in Australia and overseas. He's a fantastic Chairman to have on board.

We also have recently appointed David English, as the COO. He has previously taken two very well-known projects into production. The first being the DeGrussa Copper project for Sandfire Resources. The second project was the Nova deposit for Sirius and ultimately IGO, after the takeover. We have some great people on the Board and the Management Team, highly experienced. We're halfway through the definitive feasibility study now, so the Team will grow significantly in the next six months.

Dr. Allen Alper:

Well, that's excellent. Could you give our readers/investors an idea of the schedule, moving this excellent project to production?

Simon Noon:

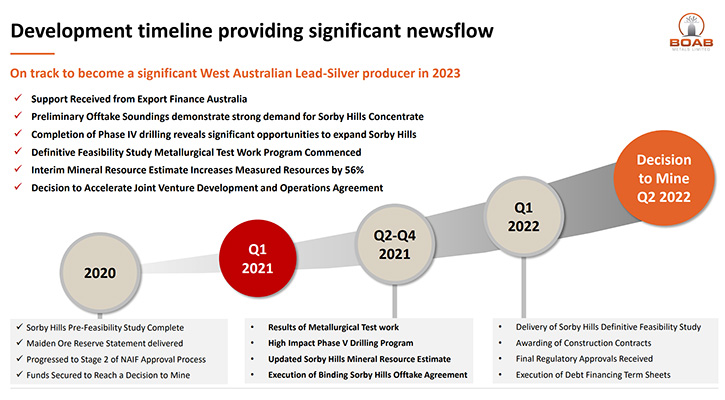

We are currently completing our Phase V drilling program, with the aim of increasing the mining inventory for the final definitive study. We were fortunate enough to have some excellent results in our last program. That made us think that we can go bigger with this project. The PFS was based on 1.5 million tons a year. We've opened up some opportunities that could potentially see us build a bigger mining operation.

The drill program will be completed over the next few weeks and then we will complete a further resource update to support the study. We will deliver both drill results and final DFS metallurgical results, over the next couple of months. We recently announced that we've just finished the first round of discussions, with a select group of off-takers and have received very attractive indicative terms.

We expect to secure offtake agreements before the DFS, probably before Christmas. They've all confirmed the high quality of the concentrate production. We're looking forward to doing that. The DFS is expected to be completed during Q1 2022, and then looking to make a final investment decision in Q2. Hopefully, we'll move straight into construction after that.

Dr. Allen Alper:

That sounds excellent, very promising! It sounds like you have a great Team that did it before and are ready to do it again. It's great to have a Team that has an excellent track record. Simon, could you tell us a little bit about your share and capital structure?

Simon Noon:

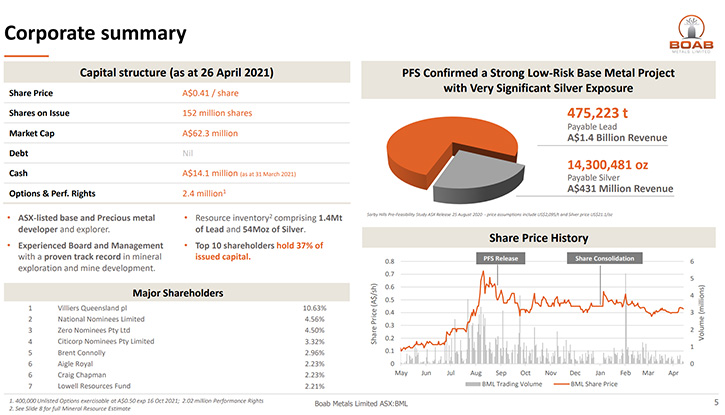

Absolutely. Very attractive capital structure! We have just 152 million shares on issue, with a market cap around the 62 million mark. Importantly, we have around 13 million in the bank, at the moment. That is sufficient funding to see us through our drilling, our DFS and reach that final investment decision. It's a great position to be in, at a very exciting time for base metals and silver. We have a good capital structure that is tightly held and we're starting to see more institutional investors joining the register.

Dr. Allen Alper:

That sounds excellent. Simon, could you summarize the primary reasons our readers/investors should consider investing in Boab Metals?

Simon Noon:

I think, the most attractive part about this Company is we have a project, in arguably the best jurisdiction in the world to be mining, Western Australia. We have a nice capital structure. We have a low market cap. And most of all, we have a project that's been de-risked significantly. It has advanced permitting; it has an Environmental Protection Authority and ministerial approval, for an open pit mine and infrastructure.

We already have granted pre-native title mining tenements. It's a low-risk project and yet we have a market cap, just in the low 60s and an MPV in the 300s. I think that's quite unique, particularly in a jurisdiction such as Western Australia, which through COVID has almost been unaffected and the mining industry has continued non-stop. We've been very, very fortunate here and I wouldn't want to build a mine anywhere else right now.

Dr. Allen Alper:

Well, those sound-like excellent reasons for our readers/investors to consider investing in your Company. It's great to have such properties and a great Team and in such a fantastic location and also close to customers. It sounds like you have everything going for you.

Simon Noon:

Yeah. I probably should mention, as well that the project is a joint venture project. Our joint venture partner, with the 25% interest, is Henan Yuguang. They are the world’s largest lead smelting group and China's largest silver producer. It's a contributing interest so they are responsible for 25% of all costs and of course are responsible for 25% of capital ahead of the project build. They have been a fantastic partner for us. They are an end-user for the project. I think that adds significant value.

Dr. Allen Alper:

That's excellent, Simon. Is there anything else you'd like to add?

Simon Noon:

We want to make investors aware of the progress we've made since acquisition. They can have a look at our recent corporate presentation for further details. The progress we've made, with this resource, over the last two and a half years, is absolutely sensational, for quite limited drilling. We've more than tripled the M&I category with over 90% of the 10-year mine life, now converted into reserves. These things matter, as I'm sure your readers/investors will appreciate. There's a big difference between generating low confidence resource and proving up a resource, with systematic drilling and converting to reserves, as we’ve managed to do This is another thing that sets this project apart from many others.

Dr. Allen Alper:

That's excellent, Simon. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://boabmetals.com/

Simon Noon

Managing Director & CEO

Phone: +61 (0)8 6268 0449

Email: info@BoabMetals.com

|

|