Rob McEwen, Chief Owner and Chairman, McEwen Mining Inc. (NYSE: MUX, TSX: MUX0) Discusses their Major Recovery from 2020; Gold, Silver, and Copper Bright Outlook and the Exciting Creation of McEwen Copper

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/19/2021

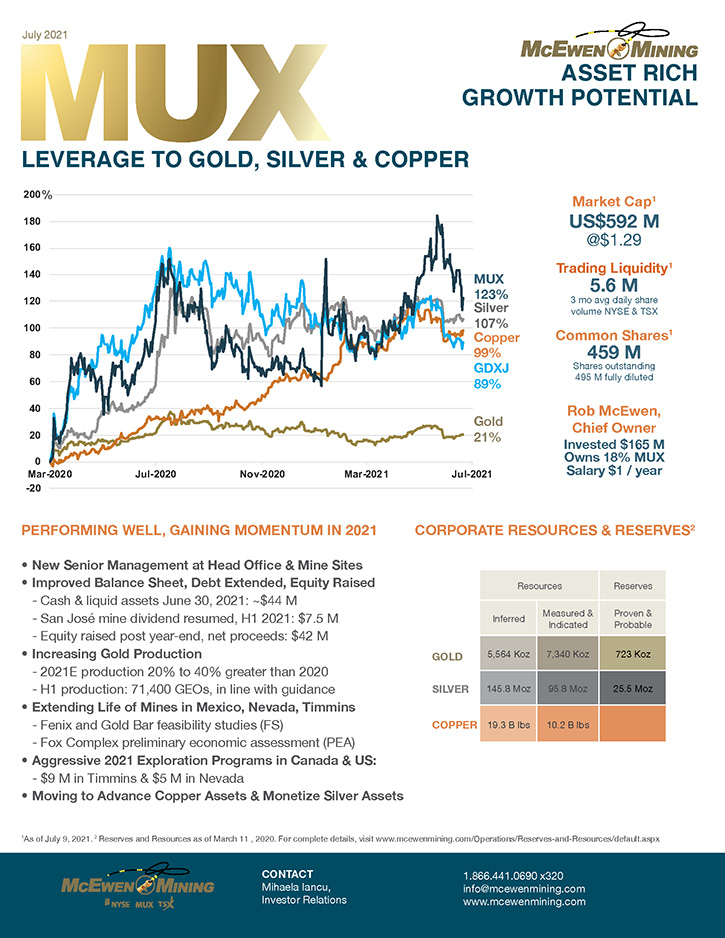

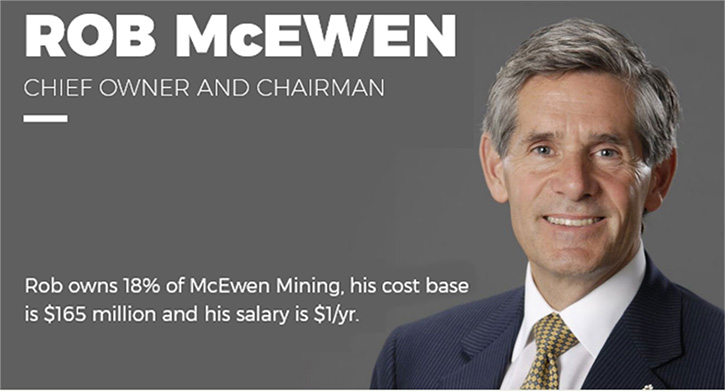

Rob McEwen talks about the market and the outlook for gold, silver, and copper. He is a recognized Leader in the mining industry and has greatly supported investment in mining. He founded Goldcorp Inc., which has merged with Newmont to become the world’s greatest gold mining Company. Rob is also a philanthropist, who is funding pioneering stem cell research, education developing entrepreneurs and leadership and architecture. McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a diversified gold and silver producer, with operating mines in Nevada, Canada, Mexico and Argentina. It also owns a large copper deposit in Argentina. Rob McEwen, Chief Owner and Chairman of McEwen Mining, owns 18% of the Company. He is very excited about the gold, silver, and copper outlook, as well as about the mining industry in general. With a diversified production base, in three of some of the best mining districts in the world, and with excellent potential for McEwen Copper, McEwen Mining is in the middle or a major recovery from 2020 lows.

Rob McEwen holding a gold bar

Dr. Allen Alper: Looking forward to talking with you again and updating our readers/investors about McEwen Mining. I know it's an exciting time for McEwen Mining. Would you like to give us your thoughts on the gold and silver and copper markets, then possibly an overview of your Company? Then the new exciting formation of McEwen Copper, and why it's so important to your investors and also why it's such an extremely important asset that hasn't been really, truly understood or recognized by the market. Also, how you are leveraged to gold, silver, and copper? You could take that in any order you'd like, Rob.

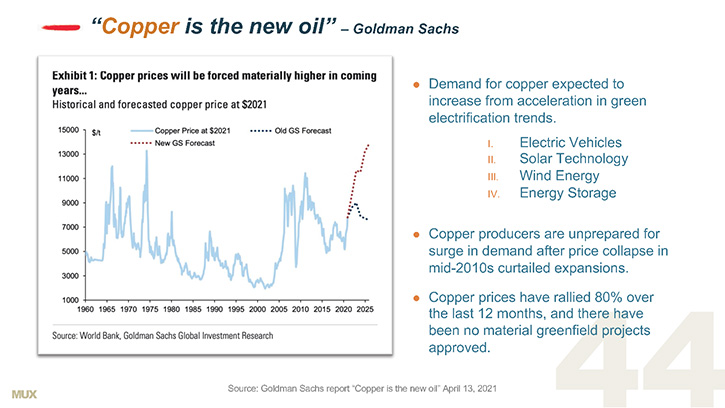

Rob McEwen: Let's start with the outlook for gold, silver, and copper. We've been through a very constructive period for all three of these metals. From the standpoint of gold and silver, the past 15 months of the monetary expansion globally is without precedence, and has laid the foundations for unleashing an inflation tsunami. When combined with the record level of government, corporate and personal debt, we are in an environment very conducive to propelling the price of gold and silver significantly higher.

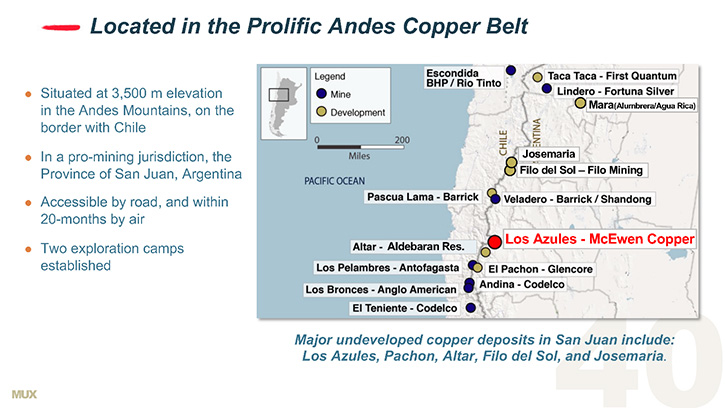

As for copper, it's a classic supply demand equation, where demand is increasing sharply and greater than supply. The price of copper appears to have only one way to go, and that's higher. We've all heard the news about the auto industry shifting significant production to electric vehicles. Copper is a key component in the electrification of transportation, the growth in adoption of renewable energy technologies and the urbanization of southeast Asia. What is likely not well understood by most investors, especially those who are embracing the new digital, low carbon world, is the need for many minerals, including copper, in order to create that better world. Building new mines is a long, slow, expensive process. Right now, the growth in annual production is viewed as insufficient to meet the growth in demand. So I expect that we will be seeing a copper price that continues to climb higher!

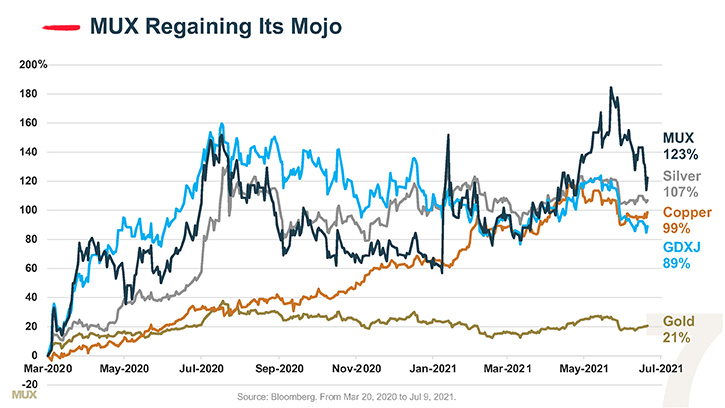

Regarding McEwen Mining, I'll start by saying it is a very big part of my net worth, which I am keenly focused on growing bigger and better. We have put a lot of effort into resolving the challenges that we faced in 2019 and 2020 and we are winning, regaining the ground that we lost.

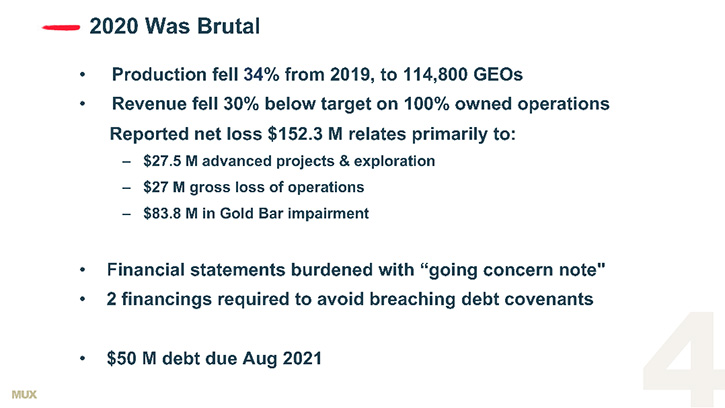

The challenges were multiple: Our operations failed to deliver on their guidance for ounces produced and cost/oz. As a result, our revenue fell far below budget. In order to prevent a breach of our debt covenants, we were compelled to do several equity financings. We improved our liquidity by refinancing and extending the maturity of our debt. Last year, at our Gold Bar mine, a surprising reinterpretation of our reserves and resources led to a large write-down. We spent much of 2020 working to get a clearer understanding of the geology and the implications for production and costs/oz. With this new knowledge we have been able to increase gold production and drive down the cost/oz.

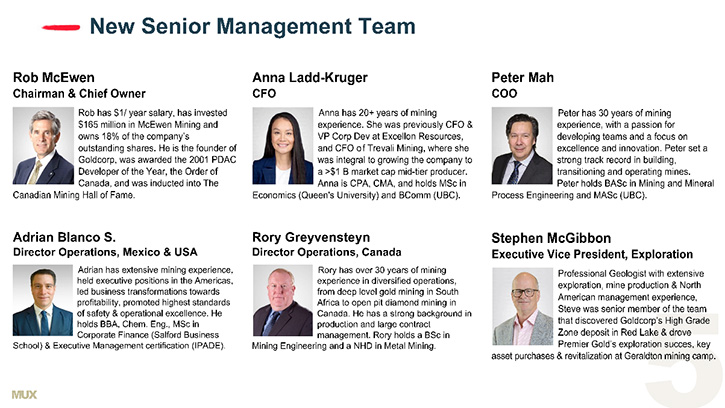

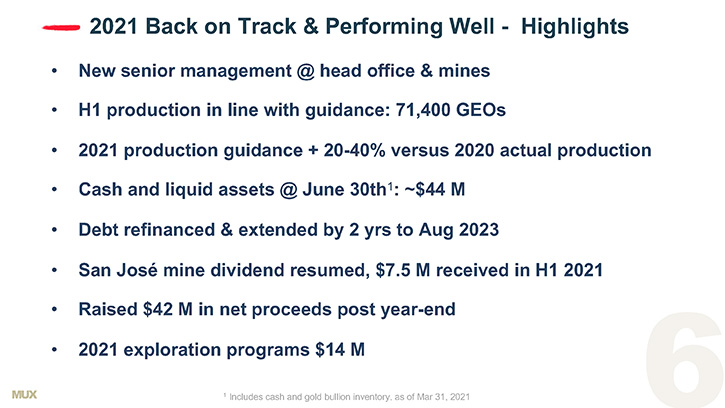

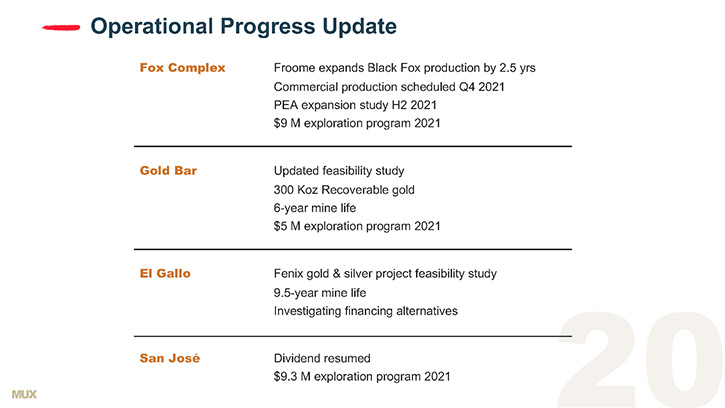

A key factor driving our turnaround is our new Management Team, in both our Head Office and at our mine sites. These individuals possess the right attitude, work ethic, experience, talent and ambition to make McEwen Mining profitable and fly. I've had the pleasure of working with Peter and Steve before, when we were building Goldcorp. In the first half of this year, production is hitting guidance and our Black Fox, Gold Bar and San Jose mines are generating operating profits.

In addition, we are once again receiving dividends from our San Lose mine JV, located in Argentina. By June 30th we had received $7.5 million in dividends and our treasury had grown to $44 million in cash and liquid assets. So, I have good reason to smile this year.

Beyond our gold production, I believe the size and value of our copper and silver assets were obscured by the challenges we faced. As our turnaround progresses, these assets should attract greater market attention. Our Los Azules Copper Project is one of the world’s largest undeveloped copper projects, not owned by a major mining company. Our silver assets currently have annual production of 5.6 million silver equivalent ozs which could increase to over 10 million silver equivalent ozs with the construction of our Fenix project in Mexico.

Los Azules will require a large amount of capital to advance to the development stage and then very large capital to build. Since McEwen Mining’s treasury lacks the strength to advance the project, we looked at several funding alternatives. One was to seek a joint venture, with a major mining company, a second alternative was to sell the property, while retaining a royalty and the third was to create a new Company and fund its advancement separately, while retaining a large equity interest and royalty. None of the several major mining companies wanted to do a joint venture. They all wanted to buy 100% and not provide us with a royalty. We elected to go with the third alternative, with the greatest potential to create significant value for MUX, in both the short term and long term.

In June, we announced that we were seeking to raise $60-80 million privately, to fund the advancement of Los Azules, in a new Company, McEwen Copper. These funds will be used to advance the project to a pre-feasibility stage. We plan to take McEwen Copper public, in Q3, 2022. To get the ball rolling, I have personally committed to put up $40 million.

Because it's a related party transaction, the Board of Directors formed a disinterested group of Directors, which is seven of the eight directors. They engaged an independent company to look at the fairness of the deal. This company came back and said that what was being offered was fair.

McEwen Mining will retain a majority interest in the new company, along with a 1.25% net smelter royalty, on the copper properties. The pre-money valuation is $175 million. Shares are priced at $10, with a minimum subscription of $1 million. The final closing is scheduled for the end of September.

Our goal is to design a copper mine that is model for the 21st century. Sustainable, green, net zero, community focused and profitable. This financing will fund the completion of a prefeasibility study.

The key elements of our work plan are:

Drilling, 53,000 meters to upgrade the resource from indicated and inferred to measured, indicated and inferred.

Improving Access: At present, we can only access the site by road, five months of the year, due to heavy snow in the mountain passes. But this will all change soon because we have just started construction of a new, lower elevation road that will give us 12 months access. One other important advantage of that route is that it will be an ideal corridor for bringing power into the process plants, when the mine is built.

Other advantages are: Studies- Environmental, Metallurgical, Economic and Permitting.

We expect the prefeasibility will take 24 months to complete.

When we take McEwen Copper public, we expect it to compare very favorably, with the popular single asset copper developers currently listed.

I chose to step in, because I truly believe this will be one of the biggest value generators, for McEwen Mining. Assuming we raise $80 million McEwen Mining, post the financing, will own roughly 69% of the new McEwen Copper alongwith a 1.25 % royalty and the new investors, which includes myself, would own 31% of McEwen Copper.

Dr. Allen Alper: Well, this year has been a great turnaround year, and with what's happening with gold, silver, and copper and inflationary increase, McEwen Mining seems to be very well positioned. This new development, of developing McEwen Copper, is excellent for the McEwen Mining, investors, stakeholders, and shareholders?

Rob McEwen: In the past 15 months, our share price has come off the low that resulted from our challenges and today we're trading at around $1.20. As a result, our share price has outperformed silver, copper, the GDXJ index and gold. Despite having doubled during this period, there remains significant price appreciation, as we regain our historic trading premium, to the GDXJ index. I think it makes McEwen Mining an attractively price investment.

Dr. Allen Alper: Oh, that's excellent. And you have, from what I understand, the opportunity to do a great deal of exploration, and growing your resources and reserves?

Rob McEwen: Yes, we have a $23 million exploration program. Most of it focused on outlining near mine mineralization, in order to extend the mine life. In Timmins, $9 million this year, at gold bar, $5 million and at our San Jose joint venture $9 million. One sucess of our exploration efforts, is the Froome deposit, a near satellite deposit at the Black Fox mine. We were able to expand the resource sufficiently, to have an economic deposit that today is being developed, with commercial production to be declared later this year. Froome has many advantages over our Black Fox Mine: shallower deposit, shorter haul distances, wider mining widths, more consistent grade distribution, and more stable ground conditions. This all translates into higher productivity and lower cost/ ton and cost/oz gold.

Dr. Allen Alper: That's excellent. I think that's great that you're developing a new deposit and anticipating that it'll be in production by the fourth quarter. That's excellent, that's rather rapid!

Rob McEwen: Also in the 4th quarter, we will be releasing our plans for expanding our production in Timmins. We have a measured and indicated resource base, in and around Timmins, of 3 million ozs. Our objective is to define a economic justification for expanding our annual production from the Fox Complex to over 100,000 ozs and have a mine life in excess of 9 years.

Dr. Allen Alper: That's excellent! Could you highlight, for our readers/investors, the primary reasons they should consider investing in McEwen Mining?

Rob McEwen: There are 4 reasons:

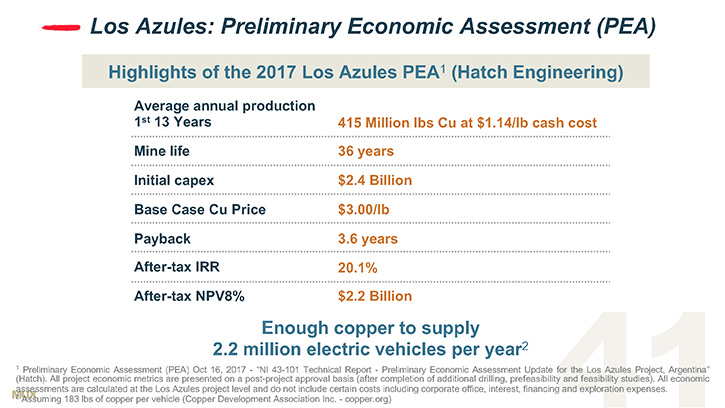

One, McEwen Copper – It is a well-documented fact that as the stage of a copper project advances from a resource to PEA (preliminary economic assessment) on to a PFS (prefeasibility study) and on to a FS (feasibility study) the value of the deposit increases. Between 2010 and 2018, 12 large copper projects were purchased. The price paid per lb. of copper increased with the advanced stage of development. were at various stages of advancement and the price paid per lb. of copper. Los Azules is currently in the PEA stage, valued at 0.6 cents/lb. and based on past trading once we complete the PFS, in two years time, it could be valued at 3 to 5 cents/lb. Los Azules has an indicated and inferred resource base of 29.5 billion lbs. of copper, 5.5 million ozs. gold and 191 million ozs. silver.

Two – our gold operations are performing much better than last year, and the market is sensing the improved performance. On a relative basis the upside potential appears greater for MUX than the shares of companies that didn’t experience a sharp drop last year.

Three – our silver assets, compared to many of the silver producers, are surprisingly large. Currently, we are looking to finance the growth of these assets, through a joint venture or sale, invite a joint venture or sale of these assets. Either alternative would strengthen our balance sheet, rationalize our corporate structure and allow us to focus on building our asset base, in two of the best areas of the world for gold.

Four – Exploration, we have large land positions in some of the best areas of the world for gold, Timmins and Nevada and our properties are unexplored.

The other way of looking at Los Azules’ impressive size is to convert the copper to a gold equivalent. So, let’s do the math. On August 13th the approximate prices of gold and copper were $1,780 and $4.31, respectively. Therefore approximately 413 lbs. of copper is equivalent in value to 1 oz. of gold. So, Los Azules with its 29.5 billion lbs. of copper is equivalent a 70 million gold deposit (29,500,000,000/413). If we use the numbers from the Los Azules PEA, it has a 36-year mine life, capex of $2.4 Billion and a payback of under 4 years at $3/lb. copper. At the current price of copper, Los Azules, posts a production decision, has a NPV discounted at 8% of over $5 Billion.

Dr. Allen Alper: Well, that sounds excellent, it sounds like, some months ahead will be an exciting time for McEwen and shareholders and stakeholders. Your strategy, business plan sounds excellent.

Rob McEwen: Glad you like it.

Dr. Allen Alper: Is there anything else you'd like to add, Rob?

Rob McEwen: Yes, with respect to CEO compensation and financial commitment, a topic that you have covered frequently, McEwen Mining is rather unique. As the Chairman, Chief Owner & CEO my salary is $1/year, I own 18% of the Company and currently I have $165 million invested in MUX and that amount is increasing to over $200 million with my investment in McEwen Copper.

Dr. Allen Alper: It's good to see that you have faith in your Company, you're willing to back it, and you are totally aligned with shareholders, in the success of the Company. I should say that I've had faith too, and I've come with you since I invested years ago. I believe in you, and I believe in what you're doing, and I think you have outstanding properties that will yield outstanding success in the long-term.

Rob McEwen: Thank you, Allen. I appreciate your support. I believe the best is yet to come!

Dr. Allen Alper: I'm glad to see the turnaround that's taking place this year and the plans for the future. Rob, is there anything else you'd like to add?

Rob McEwen: I think we've covered it all out. Thank you.

Dr. Allen Alper: Thank you. I enjoyed talking with you and I'm very impressed with what you're doing now and the plans you have in progress. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

Contact Information

For additional information:

Rob McEwen

Chairman and Chief Owner

McEwen Mining & McEwen Copper

rob@mcewenmining.com

Tara Saratsiotis

Executive Assistant to Rob McEwen

tsaratsiotis@mcewenmining.com

(647) 258-0395 x230

Anna Ladd-Kruger

Chief Financial Officer

McEwen Mining & McEwen Copper

akruger@mcewenmining.com

Stefan Spears

Vice President, Corporate Development

stefan@mcewenmining.com

(647) 408-1849

|

|