James Anderson, Chairman & CEO, Guanajuato Silver Co. Ltd. (TSXV: GSVR, OTCQX: GSVRF), Discusses Reactivating Past Producing Silver and Gold Mines and Producing Again in the Fourth Quarter

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/15/2021

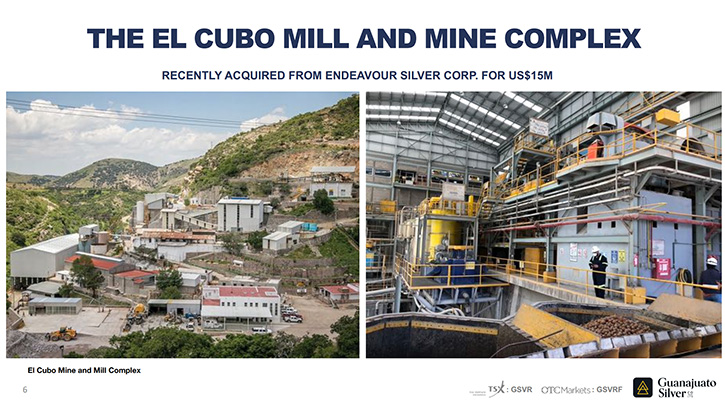

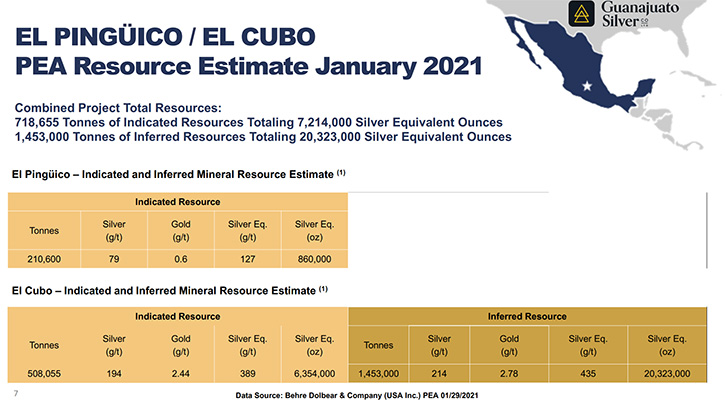

We spoke with James Anderson, Chairman and CEO of Guanajuato Silver Company Ltd. (TSXV: GSVR, OTCQX: GSVRF), a mining and development company, engaged in reactivating past producing silver and gold mines, near the city of Guanajuato, Mexico. Guanajuato Silver is a near-term producer, focused on the refurbishment of the El Cubo mine and mill, and swift re-commencement of production, from the El Cubo and El Pinguico Combined Operation. According to Mr. Anderson, they expect to be in production by the fourth quarter of this year. The PEA shows a 7-year mine life and a low-cost operation. The El Pinguico project is a significant past producer of both silver and gold. It has surface and underground stockpiles, left over from 110 years ago that were considered waste back then, but with modern metallurgy, produces good silver and gold recoveries. This will give Guanajuato Silver enough cash-flow to get the mine and mill back operating again.

Drone view of the El Cubo mill complex

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with James Anderson, Chairman and CEO of Guanajuato Silver. James, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

James Anderson:Guanajuato Silver is active in the Guanajuato Region, of central Mexico. Guanajuato is the name of a state and city and region, in central Mexico that has been the site of active silver and gold mining for 480 years. Just a few months ago, Guanajuato Silver purchased the El Cubo Mine and Mill operation from Endeavour Silver, for $15 million US.

The thing that differentiates us from other small Canadian mining companies, is that we will be in production - anticipated by the fourth quarter of this year. The mill is built, the permits are there, we have a resource estimate, just done by Engineering Consultancy Behre Dolbear, so we are just about ready to go.

Dr. Allen Alper:

That’s excellent. You have a very robust PEA. I wonder if you could tell our readers/investors about that.

James Anderson:

The PEA was done by the American engineering consultancy, Behre Dolbear and Company. The resource itself is modest. It encompasses mostly material from El Cubo, which Endeavor Silver closed down in November of 2019. Though all of the material ends up going into either the inferred or indicated category, because it's a PEA, I can tell you, boldly, that a lot of that material would, under normal circumstances, be in the measured or even in the reserve category. There is low hanging fruit material, that we know about, that was blasted and remains un-mucked at the bottom of open stopes.

There are two stopes that we will focus on, when we first start production again, in the next few months that you can easily drive to. It’s a big mine so when you get to the main portal, you get into a pickup truck and you drive for 25 minutes underground before you are at those two stopes. But there's readily available material that's staring us in the face.

Our mine planners are currently designing the first 36 months of mining, in terms of sequencing. Also, in the PEA, our friends at Behre Dolbear discuss material that's readily available to us, at our other project, called El Pinguico, which is a fascinating project in its own right. It was a past producer and Guanajuato’s highest grade mine 110 years ago. It was mined by a Company that was listed on the New York Stock Exchange, called the Pinguico Mines Company.

There was material left over from that era of mining, which was waste 110 years ago. It is not waste today. It has a little over 100 grams of silver equivalent in it. Last year we sent 1,000 tons of that material, through another mill in the Guanajuato area, and got good silver and gold recoveries. It's of moderate grade, but it is right on surface. That will give us what our COO Hernan Dorado likes to call oxygen. It'll give us enough oxygen to get us on our feet and get the mine and mill back operating again.

Dr. Allen Alper:

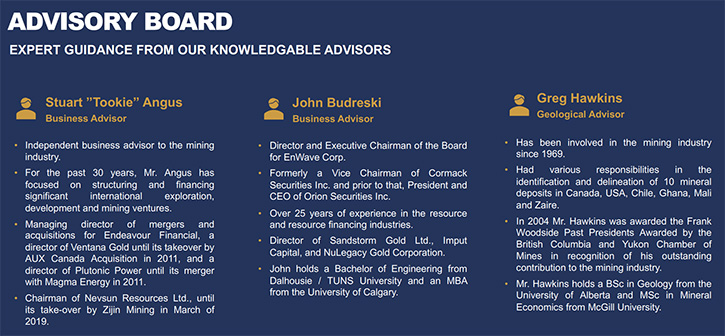

That sounds excellent. I know you, your Team, your Board and your Advisory Board are extremely experienced and successful. I wonder if you could tell our readers/investors about that.

James Anderson:

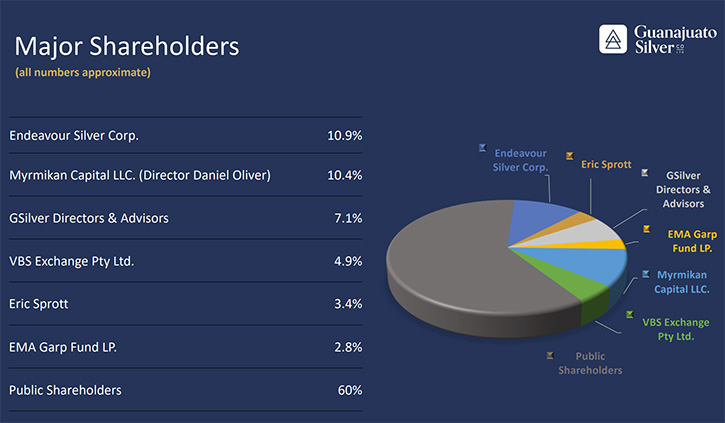

Let me just give your readers/investors a short synopsis of a couple of the people. Dan Oliver is a fund manager from Connecticut. Dan and I have been friends for about eight years. He was an early investor in the Company and his fund, Myrmikan, owns greater than 10% of GSilver. Dan is an expert, when it comes to credit bubbles and credit expansions, and he writes eloquently about that sort of thing. His belief is that we're on the precipice of a fairly unprecedented decline in the value of paper currencies. Therefore, all of his investments are in the junior precious metals category, of which obviously GSilver is one of his favorites. So that's Dan Oliver. He brings a certain flavor to our Board of Directors.

I also want to talk about Ramón Dávila, who is the latest addition to our Board. Ramón, in my estimation, has the best CV in Mexican mining. For 10 years he was on the Board of Directors and was the COO of First Majestic. First Majestic now has about a $5 billion market cap. But Ramón was the COO from when that Company had zero production to when it had 12 million ounces of silver production annually. He took over the operations, when it had four employees and left when it had 4,000 employees. When he left in 2016, he took a position as the Economy Minister for the State of Durango in Mexico. We have mining engineers and geologists, and now a little bit of political moxie because of Ramón's political connections. There are a whole bunch of different people who have come together to make this thing a success.

Dr. Allen Alper:

That’s fantastic. Could you say a few words about your background? I know we have a relationship, from when you were Chairman and CEO of NuLegacy.

James Anderson:

I was born in Timmins, Ontario, which is a great mining center in Canada. My father and my grandfather were both involved in the mining business, especially my grandfather, who was a mine Foreman in Kirkland Lake. I spent most of my adult life in the brokerage business, in Vancouver, financing junior mining exploration. About 10 years ago, I decided to get on the other side of that business, and became involved in the companies directly, that was more interesting for me.

I did spend seven and a half years, as the CEO of NuLegacy. We raised a lot of money, drilled a lot of holes and found a lot of gold in Nevada. Then this opportunity arose, a couple of years ago. I think that the marketplace has changed somewhat, over the last 15 or 20 years. I think that having a smaller operation, and being in production - being profitable - in the precious metals arena, right now, is really important. If you look at our stock price and the amount of money we've been able to attract to our Company over the last 12 months, I think that is a function of our desire and the reality of us being able to put El Cubo back into production and being able to take material both from El Cubo and from El Pinguico, and make this into a profitable operation quickly.

Dr. Allen Alper:

That sounds excellent. I noticed, you have great backing from your shareholders. I wonder if you could tell us a little bit more about your share and capital structure and your key supporters?

James Anderson:

Our largest shareholder is Endeavour Silver. They became our largest shareholder, with paying a portion of the El Cubo transaction, in a block of our shares. We have a very good relationship with that group. Their Team, in Guanajuato, understands that a success at El Cubo - a success for Guanajuato Silver - is a success for Endeavour Silver.

I've already mentioned Dan Oliver and Myrmikan Capital, they are our second largest shareholders. Guanajuato Silver Directors, other than Dan, also own a significant portion of the Company. Then there's a group out of Australia called VBS, which is a family office that has a Team that can do a deep dive and did some serious due diligence and evaluation of our business plans. They own 5% of our Company; very supportive.

Dr. Allen Alper:

That’s excellent. I've had a long-term relationship with Endeavour Silver. They’re a fantastic Company and I've known Brad Cook for years. It's great to see that kind of support and relationship that you have with Endeavour Silver.

James, could you summarize and highlight the primary reasons our readers/investors should consider investing in GSilver?

James Anderson:

The primary reason is because we plan to be Canada and Mexico's next silver and gold mining Company. We have a mill that is finished, it's built, and it was operating until 18 months ago. The work that we are doing is not a rebuild of the mill, it’s basically a big maintenance program. We continue to target the fourth quarter of this year, as a time when we can start to move material through that mill.

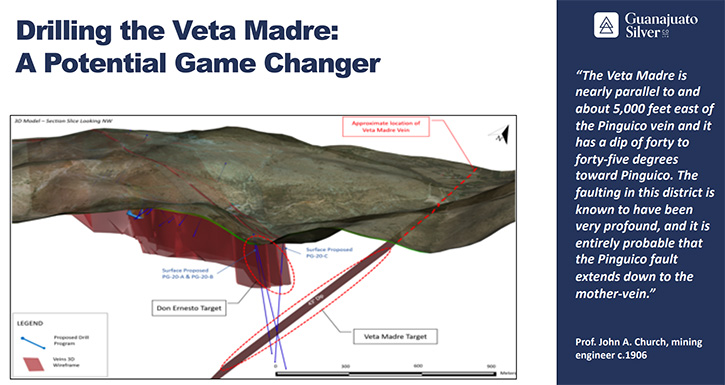

The other things that people will be interested in, if they choose to make an investment in Guanajuato Silver, is our El Cubo acquisition. We now have a 7,000-hectare land position, in one of the oldest, most established precious metal camps in North America. We have lots and lots of exploration upside ahead of us, including a deeper target at El Pinguico, which is called la Veta Madre, or the Mother Vein, which has been mined, in the Guanajuato area, for hundreds of years, and it's produced two billion ounces of silver.

That structure likely crosses onto our property at El Pinguico, a little bit deeper than people wanted to drill historically. But the intersection of the El Pinguico vein system and la Veta Madre system is a really cool, really exciting drill target and we'll be targeting that in the months ahead.

Dr. Allen Alper:

That sounds exciting, really great. It sounds like this year will be a fantastic time for GSilver investors, shareholders and stakeholders.

James Anderson:

Yeah, I think so. I think we have the warm winds of a bull market at our back. There are not a lot of quality silver producers out there and we hope to put GSilver into the annals of quality silver producers and really be able to stand out from a lot of our competitors.

Dr. Allen Alper:

That’s sounds excellent. James, is there anything else you’d like to add?

James Anderson:

I think that you'll see a steady stream of news from us. We are a Company and a Management Team and a Board of Directors that wants to do things as quickly as business will allow. You will see a steady stream of news as we continue to build the Company, into something special. We called it Guanajuato Silver for a reason. The whole region is ripe for consolidation, within the mining business. We also called it Guanajuato because it's a lovely city in its own right. It’s a UNESCO World Heritage City. It has a mining university that's quite famous in Mexican circles. Probably half of the people, who are working at Guanajuato Silver, are graduates of the University of Guanajuato School of Mines. For all of that, we think that we can really be leaders in the region.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://gsilver.com/

James Anderson, Director, +1 (778) 989-5346

Email: james.anderson@GSilver.com

|

|