Milan Jerkovic, Executive Chairman, Wiluna Mining Corporation Ltd. (ASX: WMC) Discusses Implementing a 3-year- Staged Growth Plan to Achieve Gold Production, up to ~250koz pa

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/12/2021

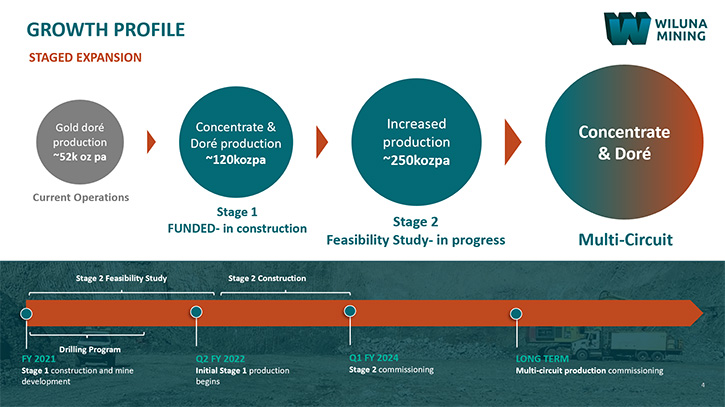

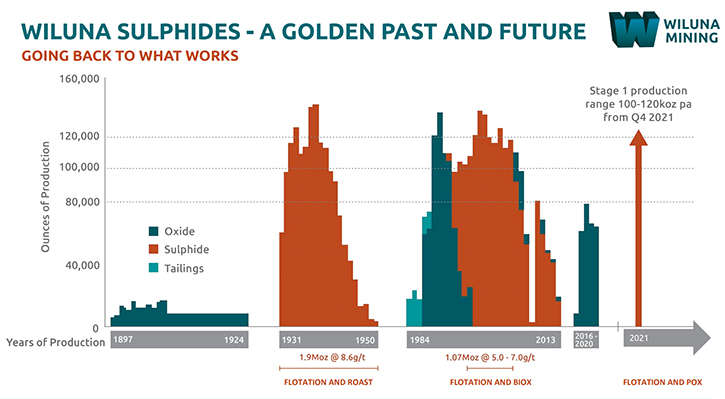

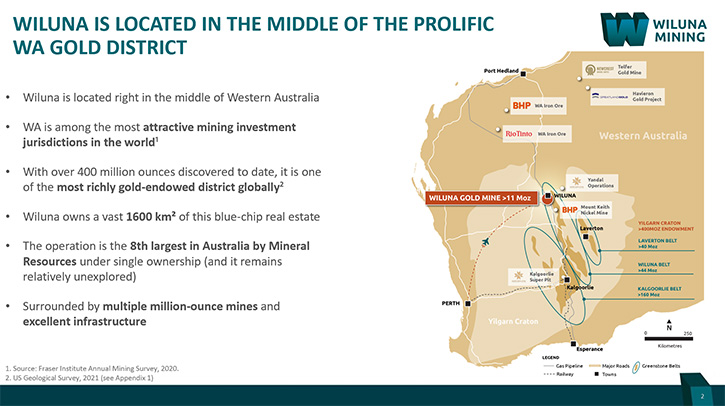

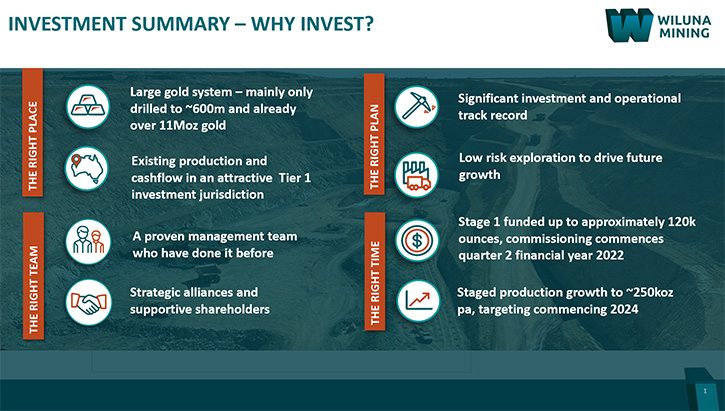

Wiluna Mining Corporation Limited (ASX: WMC) owns 100% of the Wiluna Gold Operation and controls over 1,600 square kilometers of the Yilgarn Region, in the Northern Goldfields of Western Australia. The Yilgarn Region has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. We learned from Milan Jerkovic, Executive Chairman of Wiluna, that they are currently implementing a 3-year- staged production growth plan to achieve production, up to ~250koz pa. In 2021, the Company is focused on completing the construction work and commissioning the mine to produce 120,000 ounces a year, as part of the growth plan.

Wiluna Mining Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Milan Jerkovic, Executive Chairman of Wiluna Mining. Milan, could you update our readers/investors? I know 2021 has been an exciting time for Wiluna Mining and many things have been accomplished. Could you tell us what has been done this year? Our last interview was in September.

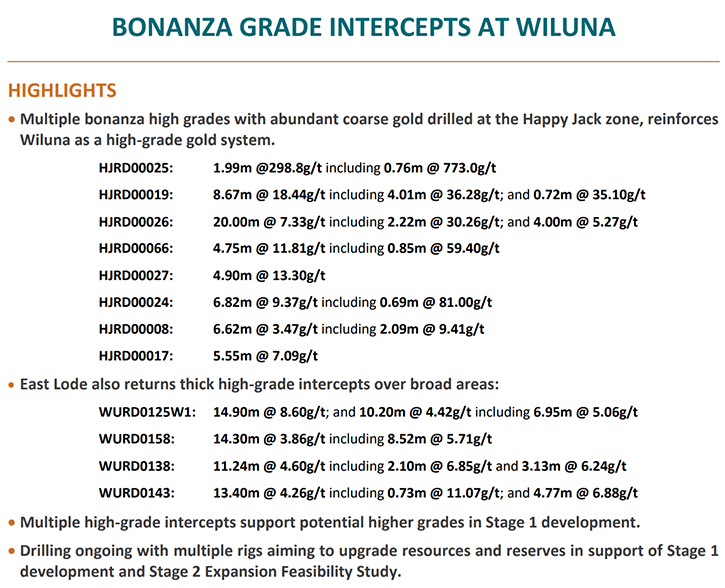

Milan Jerkovic: When we last spoke, Allen, we were in full swing, of a fairly transformational program of drilling. We're still drilling at a slightly slower rate, but we've done 112,000 meters, which is quite significant, of diamond and surface drilling and previously produced some stunning results. That drilling is now going to lead to a new resource update, sometime in October, maybe November, this year, with a view to use that to update a full feasibility study for a larger stage 2, which we call our stage two expansion, targeting around 250,000 ounces of annualized production, about three years from today.

In the meantime, we are transforming the asset from a current production rate of 50,000 to 60,000 ounces a year to 120,000 ounces, or a more modest 750,000 ton per annum underground mine development, at our main mine at Wiluna. That work is in progress. We have three jumbos working on that mine development, decline development, refurbishment of access, and we have access to three parts of the ore body now. We have de-watering actually in place, down to 800 meters, in the north part of the mine. We started to de-water the southern part of the mine, and we have, in the meantime, repaired our balance sheet, adding some more debt to clean up the equity structure, to position the balance sheet to a place where we can actually support the rate of activity.

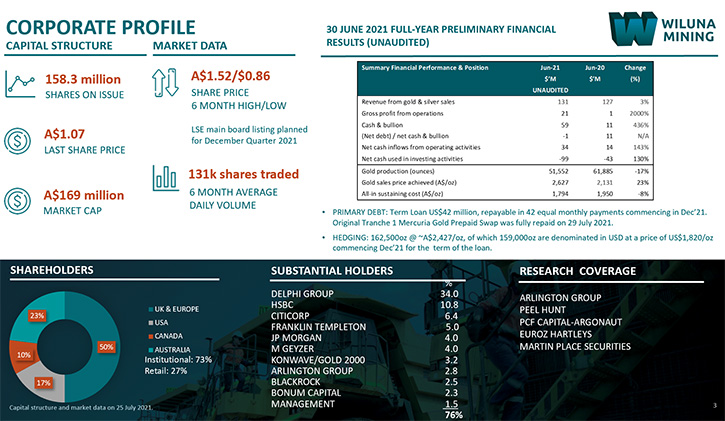

But having said all that, the underlying operations, in the last 12 months, pleasingly, also made a profit. It's a modest production, but it's profitable. Our all-in costs were actually quite good, AUD $1,790 Aussie, an ounce, still generating a good margin. Our sales cost for our gold was 2,650 Australian Aussie, so the margin was just under AUD $1,000 an ounce Australian. The exchange rate, of course, in Australia helps us with that.

We put in another $42 million U.S. dollars of debt. We are currently about 70% physically complete on Stage 1, on our new concentrator construction, which will take the sulfide ore, from the underground, towards the end of this year. When Stage 1 is fully commissioned, we'll be producing at about 120,000 ounces a year, run rate, by June 2022. And that'll reduce the costs again and set us up, with some underlying cash flow, to continue expansion.

Our plan, subject to successful feasibility and funding next year, is to go to 1.5 million tons underground mining. We are doubling the size of the concentrate that we're currently building.

So, it's been a busy year. The underlying work we've done has been all on track. The investment we made, generally, in geology resources has, in my view, overachieved. We do not quite have the market recognition yet, for the deep value and the long-term reserves, we're going to generate here in cashflow, but that'll come as we keep transforming the asset and delivering a low risk, 10 year, cashflow top asset.

Dr. Allen Alper: It sounds excellent. Could you tell our readers/investors a little bit more? You have a huge reserve and a huge resource. Could you give them some of the numbers?

Milan Jerkovic: Sure. Our current global resource at Wiluna is quite substantial. It's about 106 million tons, at 6.8 million ounces, at two grams. But then, when you go up to a higher-grade envelope that we're currently working on, in the underground mine planning, we have 27 million tons of 4.9-gram material, for 4.2 million ounces, which is very substantial already. Half of that is indicated. Our current work is to infill gaps in that, up in the top 600 meters, in the immediate mining areas and try and lift the grade.

We've announced some drilling results this week, on extensions we're drilling, where there's ever been previous mining, we're seeing some superb grades, continuity. So, we're really quite confident, but I guess the numbers will speak for themselves, when they do the resources, that in fact, this high-grade envelope will actually lift in grade. What that means is every gram of additional high-grade ounce that we can put through the mill gives us 25,000 ounces more production, through the same infrastructure and mining. It reduces our development costs per ounce and speaks to better economics for the mine.

Dr. Allen Alper: It sounds excellent. Could you tell our readers/investors your primary goals, going into 2021 and going into 2022?

Milan Jerkovic: All of the Company's focus now is to get this construction work completed and the mine commissioned and ramped up, from December to that 120,000-ounce run rate. At which point we should be declaring commercial production, from this round of capital investment. So that's the number one focus, while we continue to produce some underlying cashflow from some stockpiles and some free-milling ore we're still processing in parallel.

The second big job is to get this drilling data cutoff, somewhere around August, September of this year, get our resource numbers updated, and produce a fully bankable, feasibility study for our expansion stage two.

In parallel with all that, Allen, we're looking at a Main Board listing, on the London Stock Exchange, sometime in October. We don't, at this stage, plan to raise any capital, but that's because most of our shareholders, at the moment, are over in Europe and London, and a large part in North America. We're very much a northern hemisphere held Company, from an equity perspective. And then that'll give us some visibility next year, when we, hopefully, get the feasibility study finished. When the Board approves the second stage, we will have an indicative debt component, on the table. We will then look at what the market is like, whether the shareholders are supportive of looking at some further equity market work, in the first half of next year, to support the stage two development.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors about the importance of Western Australia and the region you're in, for discovering mining and producing gold?

Milan Jerkovic: Absolutely! That's a good question. We sit at the northern end of the biggest gold field in the world, which is the Norseman-Kalgoorlie-Wiluna belt. Wiluna is the northern end of it. We have 1,600 square kilometers of ground. We're in a tier one jurisdiction, and that's starting to matter a lot. We have a government that's very supportive of keeping the mining industry functional and operating, even throughout this whole COVID situation.

The other thing is the scale of this, as it lends itself to eventually being a tier one asset, (300,000 ounces for 10 years) which we hope to attain, within the next five years. That would put us in the top 10 Australian single location gold mines.

Given what's happening around the world these days and the ability to have stability, to have sovereign risk minimized, to have support, to continue with expansion, we are in a very, very good location. We are very thankful for that. And the fact that we can deliver this type of product to a generalist market, even in the UK and North America, clearly in London, there is a lack of product in the general institutional space of growth gold stocks, because there have been a few mergers and there are not many left on that exchange over there.

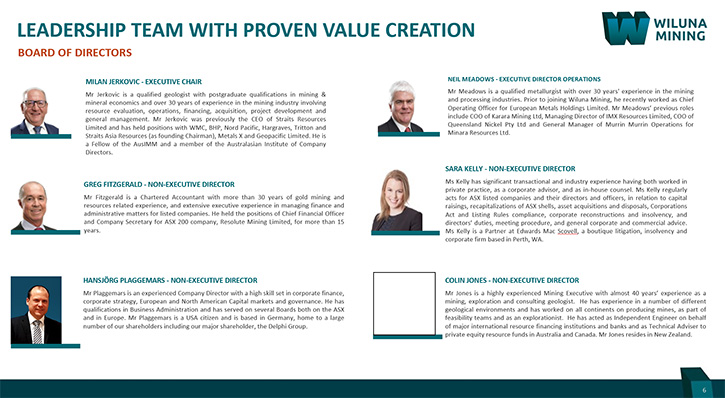

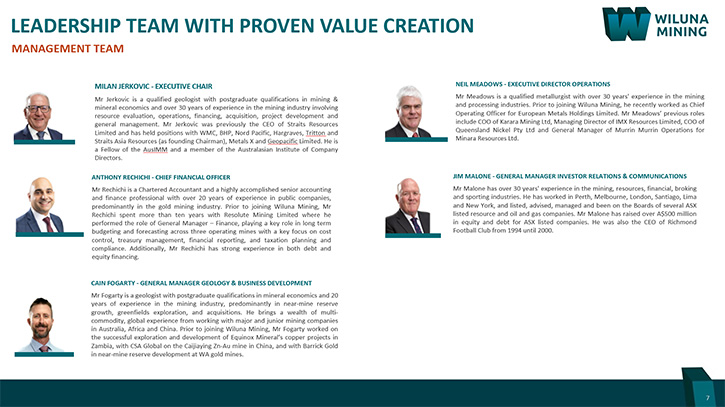

Dr. Allen Alper: Oh, that sounds excellent, Milan! I know you and your Team, and your Board have great experience and a successful track record. Could you tell us a little bit about that?

Milan Jerkovic: My background is in building and renovating both companies and assets. I've built close to six, seven mines in my lifetime and bought and sold a few Companies along the way. My biggest success was a Company called Straits Asia Resources, which was listed in Singapore. Straits Resources is the parent company where we returned a bit of cash to shareholders after years of investment.

My Operations Director, Neil Meadows, is an expert in pressure leaching, processing, and business improvement. He's been an MD, he's been a CIO. With him, he has a technical Team that both has very good mining skills and processing and business improvement skills. So, for a small company, we've not compromised on the level of skills, that we need, to make sure that this asset is properly understood, planned, and then methodically executed. So execution risk is not there, because you have the right brains and the people with experience to do it.

In the meantime, we've just recently strengthened our Board. We had a gentlemen named Tony James, who's a mining engineer. He retired from WMC and joined a Company called Galena, as a full-time Managing Director. We've appointed a gentleman named Colin Jones, who's well-known in the North American market, an economic geologist, with a lot of global experience. He adds that technical skill to the Board. Also, a gentleman called Hansjorg, who has significant commercial experience with business improvement and turnaround experience, who's a U.S. and German citizen. He currently lives in Heidelberg, Germany. That's given us a deeper, broader Board. Our markets are more international, in terms of our shareholders.

Dr. Allen Alper: Oh, that sounds excellent! Outstanding Team and Board! Could you tell us a little bit about your share and capital structure, Milan?

Milan Jerkovic: We have quite a tight capital structure. We only have, at this stage, about 158 million shares on issue. If I'm not mistaken, I'd say our market cap is about 160 million or so today. It's quite modest. When you look at us as a very large explorer that's going to add quite a lot of ounces to our register, as well as an operator that's growing, our market cap is very modest, given the earnings profile we're going to develop, deliver, in the next three years.

If you compare us to other developers, they might have very good ore bodies and there are some recently that have been discovered. Our path to production and our risk is much shorter and smaller. We're already in execution. We're not doing feasibility studies to put a reserve together. And our ounces, on the excavation side, continue to grow quite significantly.

We have quite a unique position, where our ounces are undervalued, compared to some of the pure developers that don't even have a plan yet to develop. That's where the opportunity lies for us, to show people the value of these ounces and how they're going to be turned to account. I think, we should see some support coming in for that.

Dr. Allen Alper: Oh, that sounds excellent. Is there anything else you would like to add as to why our readers /investors should invest in Wiluna Mining?

Milan Jerkovic: I think if you look at us, given the way we've clearly shown that the investment we made and continue to make is the asset, and you are looking to invest in gold, if you're looking for some safety, in a potentially volatile world, we're probably the most leveraged gold stock in my view, generally, anywhere. If you compare us, given that we have underlying cashflow, we're about to double the production, and then double that again and continue to increase the scale of this asset and resources, in a safe jurisdiction, with a very good Team that's demonstrated now in the 18 months, that we're all about methodically executing, on what is actually in front of us, our risk from here seems quite low.

It's all about execution risk, and the support that we need next year to continue to fund what we need to do. But our geological risk is very low. Our value in the ground, leveraged to people getting interested in gold again, is actually very, very high. "Have a look at the fundamentals if you're interested in gold, and I think you'll find the real value here."

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Wiluna Mining. You have a huge resource and reserve right now! You have the opportunity to increase that, and you're also moving rapidly into increasing your production. And that is all exciting news for stakeholders and shareholders.

Milan Jerkovic: That's right, Allen.

Dr. Allen Alper: Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://wilunamining.com.au/

Milan Jerkovic

Executive Chair

+61 8 9322 6418

mjerkovic@wilunamining.com.au

|

|