Phil Baker, President and CEO of Hecla Mining Company (NYSE: HL), Discusses its Outstanding Preliminary Silver and Gold Production Results, for the Second Quarter of 2021. Production, of all Metals.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/11/2021

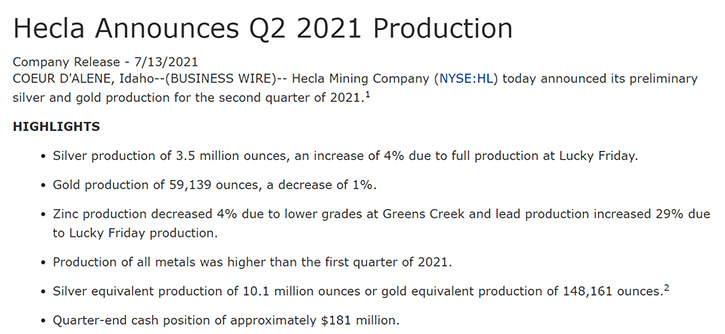

We spoke with Phil Baker, President and CEO of Hecla Mining Company (NYSE: HL) - the largest primary U.S. silver company, with operating silver mines in Alaska and Idaho and with a gold operating mine in Quebec, Canada. Hecla has just announced its outstanding preliminary silver and gold production results, for the second quarter of 2021. Production, of all metals, was higher than the first quarter of 2021, and the second highest quarterly silver production, since 2016. According to Mr. Baker, this strong performance, combined with steady prices, delivered an increase of approximately $41 million in cash, the fifth consecutive quarter of increasing cash reserves and one of the highest increases in Hecla’s history. Hecla's quarter-end cash position is approximately $181 million.

Hecla Mining Company

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Phil Baker, who's President and CEO of Hecla Mining. Well, it looks like Hecla had a great year. I wonder if you could talk about your year and what Hecla has accomplished, and what your plans are for the future.

Phil Baker: Sure! In 2020, despite the pandemic, we've been able to keep our workforce safe, in our operations. As a result of that, we had continuous operations. The only time we had any reduction in production, was when we were required to shut down, in Quebec and in Mexico for a period of weeks. Otherwise, we were able to continuously operate, without any disruptions, as a result of the pandemic. And of course, the pandemic continues as we speak, with the new Delta variant, and I'm happy to say, that for the Company, we're above the national average and our Greens Creek operation is right at 90% vaccinated. So, we feel very confident in our ability to continue to have great production in 2021.

In fact, we've just recently announced our mid-year production results for 2021. We had the first quarter of course, and now we've just announced the production part of the second quarter. A strong, strong quarter! We were higher in every metal, over the first quarter. 2021 looks to be a continuation of, and maybe even better than 2020. Certainly, we have better prices. As a result of that the outlook looks really positive.

Dr. Allen Alper: Could you tell our readers/investors a little bit about what's happening with silver and gold, and what the market looks like?

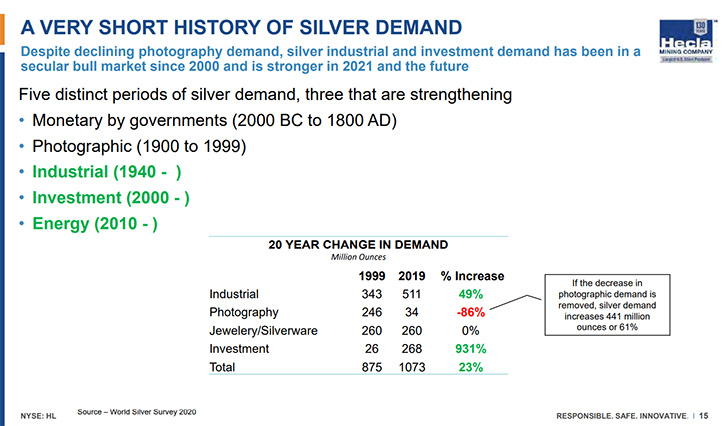

Phil Baker: Well, the silver market is really a fascinating one, and we're in a place that silver's not been in before. Silver has been a monetary metal for 5,000 years. It was in fact a metal, whose value was driven by governments and their use of it as money for probably 4,000 of the last 5,000 years. But that changed in the late 1800s, when by that time governments had moved away from silver as money and only really had gold or as we now have, fiat currency. The demand for silver fell off in the 1800s, and we saw it in the 1900s. What took its place was photographic demand for silver, and that had a run of a hundred years, from 1900 to 1999. The actual largest consumption of silver for photographic purposes was 1999, and it's been on a decline ever since.

So, you have these two uses of silver. First as money, and then for photography. Now both of those have declined. So what's taken its place? Well, number one, you've had investors that have come in and said, we want to have silver as a store of value. Not money, but as a store of value, and we want to have it as a way to combat the fiat currencies. And we've seen the growth in demand for silver over the last 20 years for investment purposes rise tenfold. But that's not the whole story, because silver is also used for industrial purposes, and those industrial purposes have grown and grown dramatically over the last 20 years. First you had the digital demand for silver. This would be in the products like our cell phone and computers and everything that allowed us to digitize our economy, and that continues on.

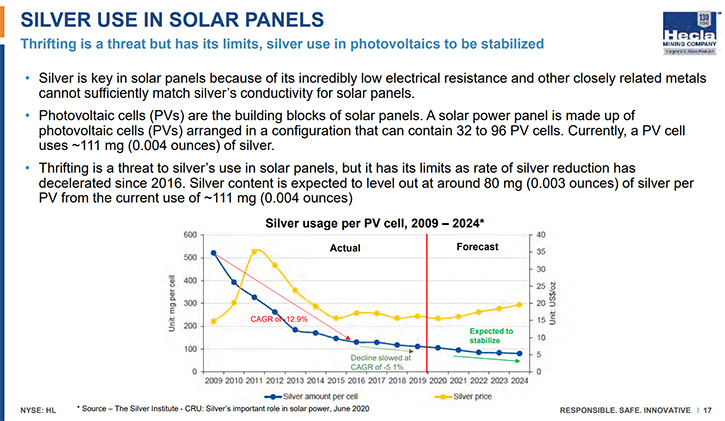

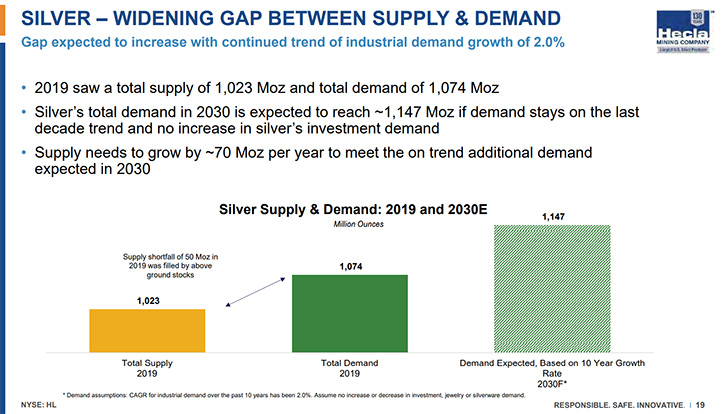

But it's been joined now by this energy demand for silver, this need for silver to be part of the decarbonization of our economy. And photovoltaic is the primary place that we see that demand for silver, and there's probably 10% of the total demand for silver, which is about a billion ounces, 10% is now this photovoltaic. But that's not the only thing. It's also used in wind energy, in the brushings. It's much more efficient than using copper. So, the outlook for silver is probably the best that it's ever been, because you continue to have this investment demand, but then on top of it, you have this industrial demand that is growing. So we would anticipate that over the course of the next 20 years or so, maybe 30 years, that silver demand will go from that billion ounces that we have today to more than a billion and a half, and probably close to two billion ounces. A lot of silver is required for our economy and Hecla, as the largest US silver producer, has a good future because of that.

Dr. Allen Alper: That sounds excellent. And my understanding is Hecla produces about a third of US silver. Is that correct?

Phil Baker: Yeah, that's right. We've been producing silver for over 100 years, in the United States and we've continued to grow that position relative to other producers. We produce a third of the total silver production from the United States.

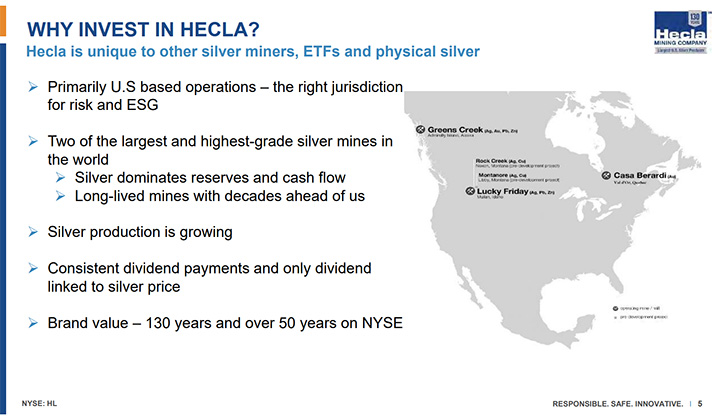

Dr. Allen Alper: That sounds great. It's great to be in great jurisdictions. I wonder if you could tell our readers/investors a little bit about your portfolio and update them on what's happening.

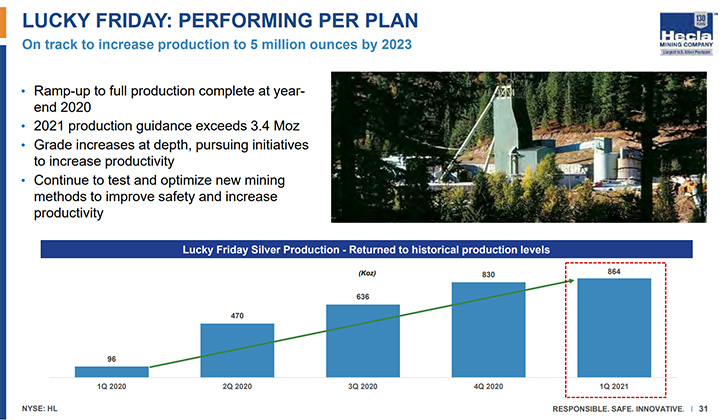

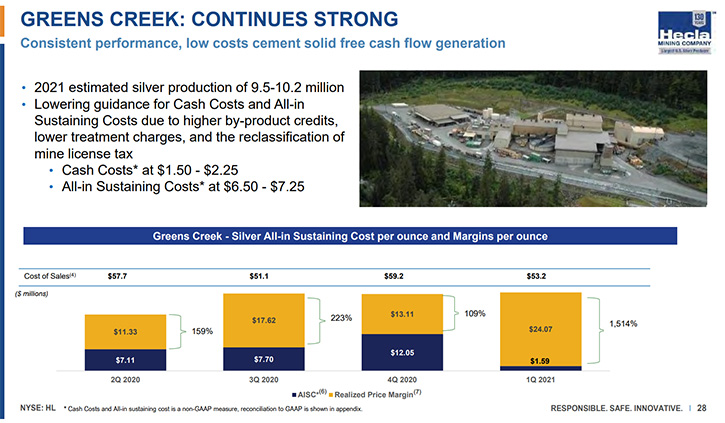

Phil Baker: We are located primarily in the United States, with a gold operation in Canada. We made that decision to really focus on the US, Canada, and a few places in Mexico about 20 years ago, and we have been following through on that strategy, with operations in Alaska and in Idaho, a large land position in Nevada, and then a number of other exploration properties and development properties, in other states in the United States. The Alaska operation, called Greens Creek, has been in production for over 30 years. The Lucky Friday operation, in Idaho, has been in operation for over 75 years. And both of those operations have very long futures in front of them. I'd be very surprised if they're both not operating 20, 30 plus years into the future.

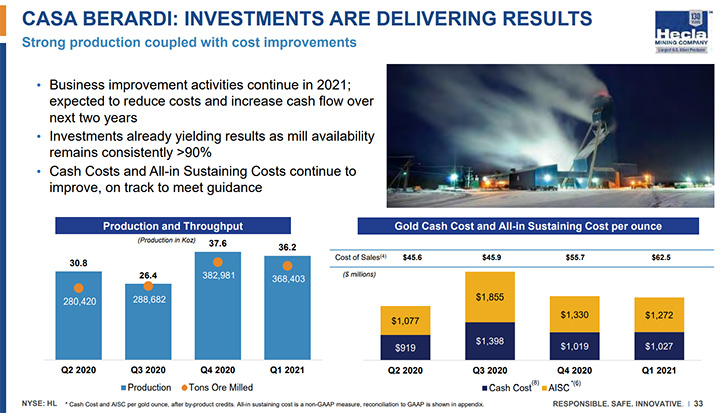

Our Nevada operations are in the heart of the gold district of Nevada. We're at the crossroads of a number of major geologic trends. So, we think the opportunity to find more high-grade mineralization there is very high. We've made an announcement on what we've discovered at our Midas property that's very, very exciting given the grade of it, and the fact that we're continuing to find more mineralization. So those are the three primary things in the United States. And then in Canada, with our Casa Berardi operation in Quebec, it makes us probably the sixth largest producer in Quebec, and it's an operation that too, has a long future in front of it. We would anticipate 20 plus years for Casa Berardi as well. And the exploration is not done there. We think we'll find even more to extend the life beyond that.

And at the same time, we're in a program to lower the cost there, and we're starting to see more production come from the operation, which we think will end up resulting in lower costs. And then finally in Mexico at San Sebastian, a property located, in what one person has described as a silver belt, a silver lane in Mexico, the Mexican silver belt, and we're right in the middle of that silver belt. So the outlook for this property is extraordinary. It's just continuous exploration. We've been there for just a little over 20 years, which maybe sounds like a long time, but these silver districts sometimes take hundreds of years to find the strongest ore bodies, and we've had great success, but we think there's even better to come in the future.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about yourself and your Team?

Phil Baker: I've been with Hecla for 20 years now. I have been in the mining industry, since 1986. In the mining industry, I'm struck by, number one, having large land packages, in highly prospective geologic environments, a critical feature of a successful mining company. It all comes down to the geology of the districts that you're in. Then everything else follows, but almost equally important as the geology is the jurisdiction. When I joined the Company 20 years ago, our most important asset was in Venezuela, and we made the determination that we needed to reduce the risk profile and increase our exposure in the United States. So that's when we sold the Venezuelan asset and bought the portion of Greens Creek that we didn't already own.

Dr. Allen Alper: Well that was a fantastic decision.

Phil Baker: It was. And as a result of having these assets and having them in the jurisdictions we have, we have a great Team of people that are able to focus on productivity, able to focus on costs. We don't have lots of the extraneous issues that you have to deal with, when you're in these other jurisdictions.

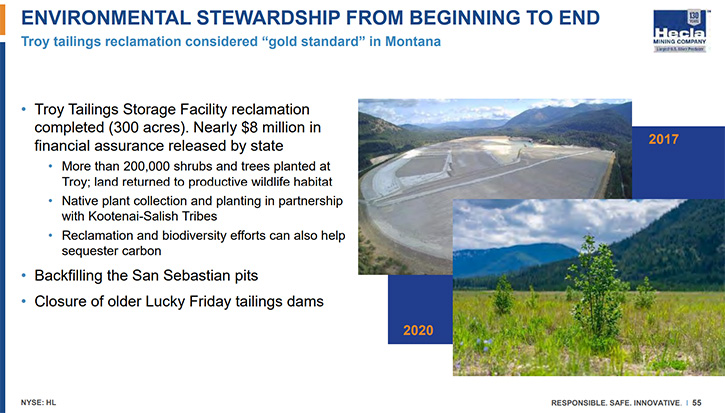

Dr. Allen Alper: Well, that's excellent. That was a great philosophy. I know Hecla Mining has done a lot as far as the environment, the community, safety. Could you say a few words about that?

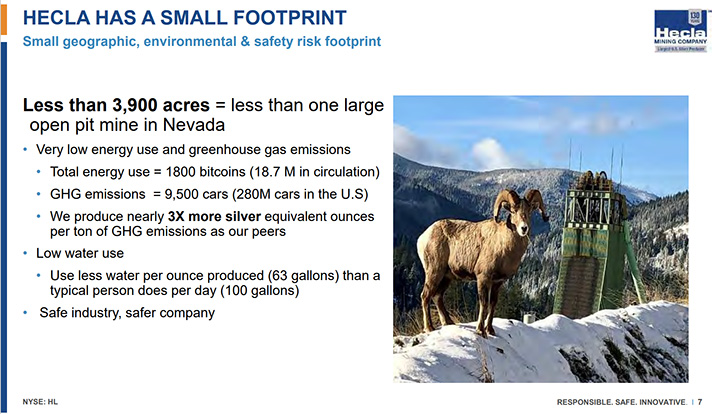

Phil Baker: Yes, it's interesting. The thing that distinguishes Hecla, from other mining companies, is the fact that we have such a small footprint, Allen. You realize that our operations are primarily underground operations, so the number of tons of material that we move is quite small. As a result of that, our impact on the environment is extraordinarily small, relative to others. And the benefit that we provide our communities is very, very large. We are the largest private employer, everywhere we operate. When I say it's small, we probably impact the environment at somewhere between a tenth and a third of the impact that other mining companies have. It's really the nature of the assets that we have.

With our operations being in these small communities and being the largest private employer, we provide the jobs that allow these communities to thrive. You think about how many small communities are really in trouble because they don't have this driver of their economy. And then I guess the final thing, that no one really ever talks about is that we provide a full set of benefits to employees, which includes retirement benefits. And it goes beyond the traditional 401k. We still have the pension plan that allows people to be assured of income, well past their retirement date. When I look at environmental social issues and I look at Hecla, I think we've been a leader in this area, not just when it's become popular to talk about it. We've been a leader for even before I joined the Company, it's been a fundamental value that the Company has had.

Dr. Allen Alper: Well, that's excellent! It's great to have responsible stewardship for the environment, for the community, and for the employees. That's so important.

Phil Baker: It certainly is. Without the support of the community, you're just never going to be able to have these longstanding operations that we have. If you're creating environmental damage, you're not going to get that support from the community, so it all works together for a successful Company.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your finances?

Phil Baker: Sure. We are in probably the strongest financial position that Hecla has been in, during the time I've been with the Company, when you combine it with the outlook for the operations. The reason I say that, is just this past quarter, we generated 40 plus million dollars of free cash flow. It's probably the fourth best free cash flow quarter, in our history. It's a reflection of how strong our assets are. As a result, our cash position is roughly $181 million. The debt that we have is debt that's due in 2028, so we have lots of flexibility to utilize the cash that we have, plus an undrawn line of credit, so a great financial position.

And then what that financial position does is it allows us to pay really the most innovative dividend in the mining industry. We pay a dividend that's tied to the price of silver, and as a result of that, as the silver price goes up, the returns to shareholders go up. Not just because the share price goes up, but they're actually seeing more cash being returned to them. It puts us into a unique position for investors.

Dr. Allen Alper: Well, that's excellent. Could you say a little bit more about your capital structure?

Phil Baker: Sure. So when you look at our balance sheet, what you see is that we have this large amount of cash on the balance sheet, and then we have long-term debt. We sourced this long-term debt in the high yield market, and we did that because rather than going and issuing equity, we can issue this debt and we pay an interest on it, and it allows us to avoid the dilution that equity issuance would require. Because of our operations, we're able to carry that debt. Much like you see other companies that are base metals companies that have indebtedness, we have a similar capital structure to them because we also produce base metals. About 20% of our production, our revenue, comes from the sale of lead and zinc, and to reduce the risk associated with that, we hedge our position so that we're assured of a certain amount of cashflow. Basically we know that we're going to have enough cash to be able to make interest payments in any quarter. It's a conservative capital structure, but it is a capital structure that allows us to provide some leverage for our equity investors.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors the primary reasons they should consider investing in Hecla Mining?

Phil Baker: Well, I think the reason to invest in Hecla is the fact that it gives you exposure to silver, the metal, plus the increase in price, which would result in more dividends, as well as the exploration potential that our properties have. These are properties you can expect to grow in terms of reserves and resources, but also in terms of production. At each of our properties, we're looking at how to increase the production. So you have growth, and at the same time you're getting a dividend flow, and you're getting exposure to silver, and you're doing it all in the best jurisdictions in the world.

Dr. Allen Alper: That sounds excellent. That sounds like very compelling reasons for our readers/investors to consider investing in Hecla Mining. Phil, is there anything else you'd like to add?

Phil Baker: Just that we're willing to take questions should readers/investors have any questions. Please reach out to us through our website.

Dr Allen Alper

Well, that's great! Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.hecla-mining.com/

Russell Lawlar

Sr. Vice President – CFO and Treasurer

Jeanne DuPont

Senior Communications Coordinator

800-HECLA91 (800-432-5291)

Investor Relations

Email: hmc-info@hecla-mining.com

|

|