Ucore Rare Metals Inc. (TSXV: UCU) (OTCQX: UURAF): Developing Rare and Critical Metals Resources, Extraction, Beneficiation and Separation Technologies, with Potential for Near-term Production; Pat Ryan, Chairman and CEO, and Mike Schrider, VP and COO Interviewed (Part 2)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/5/2021

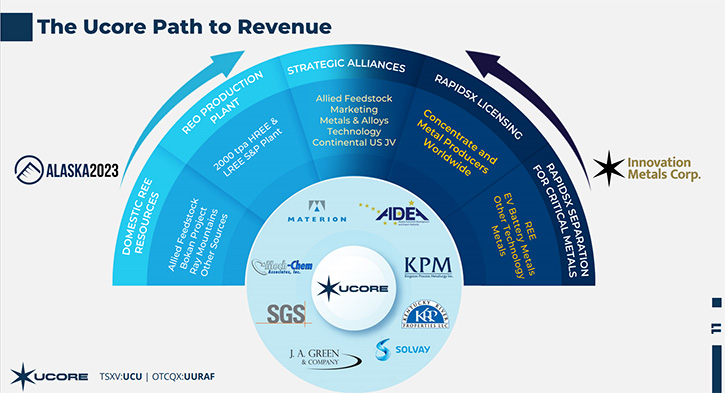

We spoke with Pat Ryan, Chairman and CEO, and also Mike Schrider, VP and COO of Ucore Rare Metals Inc. (TSXV: UCU) (OTCQX: UURAF). Ucore is focused on rare and critical metals resources, extraction, beneficiation and separation technologies, with potential for production, growth, and scalability. The Company's goal is disrupting the People’s Republic of China’s dominance of the US REE supply chain, through the development of a heavy rare earth processing facility – the Alaska Strategic Metals Complex (the “Alaska SMC”) in Southeast Alaska and the long-term development of Ucore’s heavy rare earth element mineral resource property, located at Bokan Mountain, on Prince of Wales Island, Alaska. In May of 2020, Ucore acquired Innovation Metals Corporation that has developed a patent-pending proprietary, environmentally sound, and 21st-century critical metal separation technology platform, called RapidSX, to be implemented at the Alaska SMC.

Ucore Rare Metals Inc

Dr. Allen Alper: Well, it sounds like 2021 will be an exciting time for Ucore, for your stakeholders and your shareholders. Maybe Mike could say a few more words on what's going on, his plans with Bokan.

Mike: Certainly. With Bokan, we're tracking rare earth prices very closely. We see the recent uptick in the overall market and want to ensure that we are prepared to move ahead with Bokan as soon as it makes sense. We have two primary projects right now. The first is a mill flowsheet development project underway at SGS Canada-Lakefield, where we are revisiting the flowsheet initially developed, during our 2013 Preliminary Economic Assessment. We are taking another look at the mill flowsheet, with the idea of recovering the co-products of beryllium, zirconium, niobium and hafnium in addition to optimizing, for the recovery of the primary rare earth metals, in an effort to lower the economic threshold required to initiate a feasibility study and permitting efforts for the Bokan-Dotson Ridge resource.

The second project is a planned field program to upgrade approximately 20% of the current ‘indicated’ and ‘inferred’ resource to ‘measured’ by conducting channel sampling of the exposed rare earth mineralization vein outcroppings. And to take some additional bulk sample material, so that we have additional mineralized material on hand, once we are ready to start, either a pre-feasibility study or a feasibility study as things unfold. So, everything that we're doing right now is to position ourselves to move rapidly when the timing is right.

Dr. Allen Alper: Oh, that sounds excellent. Maybe, Pat, you could tell our readers/investors a little bit about yourself, your Team, and your Board.

Pat Ryan: I'm a professional engineer, mechanical by training. Twenty-five years ago, I actually founded a tier-one automotive manufacturing and supply company, supplying the automotive players in North America and around the world. We supply proprietary parts to key companies, like Nissan, Honda, Toyota and Detroit’s big three of General Motors, Ford and Stellantis. We're also involved with other companies like Rivian, who is an upstart electric truck manufacturer that recently struck a deal to produce 100,000 electric delivery vans for Amazon.

My background has been in manufacturing, it's been in design and quite frankly, it's been in supply chains. When you build supply chains in an automotive world, you have to go right back to the molecules that actually make the materials, components and assemblies to ensure that they perform to exacting specifications. Then you have to have all sorts of QA/QC standards that you develop and build all the way through the production and sales networks.

I became involved with Ucore seven years ago, as a member of the Board of Directors. Since then, I've transitioned to Board Chairman and most recently a CEO role. As CEO I am particularly interested in the supply chain development, required to get this electrification job done for the auto industry, in North America. A steady and reliable supply chain is absolutely essential for automotive manufacturers and Ucore is well positioned to be an important part of this. My experience is manufacturing to support global supply chains and I've been very successful developing a Company, really a Team of professionals, to be a tier-one supplier to the auto industry. With Ucore, I'm looking to make sure that this Team gets all the pieces of the supply chain right, to get the job done. These critical metals Ucore is developing, from US-allied and domestic sources, will drive motors, batteries, and the electrification for the future. I'm certainly well-positioned, with industry contacts and with personal experience, to get the job done for Ucore this year.

Dr. Allen Alper: That's great to be in a position where you'll have firsthand contacts. Really great! That's key in the supply chain. Could you tell us a little bit about your share and capital structure?

Mark: Yes. We're getting a lot of direct calls, with a high interest in Ucore’s recent technical progress. I really appreciate you putting this call together, Al. Your audience will appreciate a detailed update, as it’s been a while since we have given you one.

Dr. Allen Alper: Great! Thank you.

Mark: Regarding Pat’s tenure as CEO, the key immediate accomplishment was the corporate restructuring, putting Ucore in a position to grow. We were humbled by our shareholder’s support of the Alaska 2023 plan and our tightened ownership structure has already demonstrated Ucore’s ability to drive explosive share appreciation. We now have only 49 million shares outstanding and continue to have long term, institutional interest from Concept Capital and Orca Holdings that have been involved on our Boards for over 5 years. Our trading is very stable, and we feel that we're in a position to move forward and to grow quickly, as per the technical update, from Pat and Mike in this article. Ucore has recently begun to educate the public, on our complete business plan, like this article, and this will create awareness of the remarkable potential available to Ucore investors. Ucore shareholders enjoy ownership of a piece of Ucore that includes, what can be described, as a warrant on the unlimited potential of our wholly owned subsidiary, Innovations Metals Corp. and their transformative technology, RapidSX.

Dr. Allen Alper: Oh, that's excellent!

Pat Ryan: Certainly, that tight share structure is very important. And we wanted to make sure we accomplished that in 2020. Heading into 2021, we wanted to be perfectly positioned to attract capital as needed. All our long-term shareholders are still long-term shareholders. They remain very faithful to the Company and we thank them for that. We've reorganized our technologies, through the acquisition, last year, of IMC and are now positioned to make a strong contribution to the electrification supply chain restructuring, for North America.

Dr. Allen Alper: Oh, that sounds excellent! Pat, could you highlight the primary reasons our readers/investors should consider investing in Ucore?

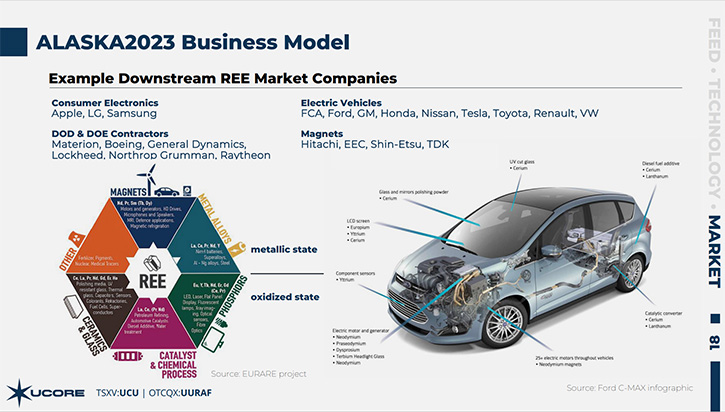

Pat Ryan: It's an interesting time, right? It's the 21st century, and decarbonization is the biggest challenge of the 21st century. In fact, that's where the electrification initiatives come from. It's where all the wind turbines that are being developed come from. It's where all the climate change initiatives come from. So certainly, starting with rare earths, as a critical metal and being able to get to the rare earth oxides, where there's a real growing demand. You have a growing demand from consumer electronics, and we've seen that through the COVID period, where microchips are in short supply. Well, all sorts of things are in short supply.

Companies like Apple and Samsung are trying to keep pace with what they need to do - driven by the consumer market. There's also a growing demand, on the DOD [Department of Defense] and DOE [Department of Energy] contractor side, as the US government finally gets serious about the origins of our critical metals. People like Lockheed or Boeing or General Dynamics, they're in need of secure sources of critical metals. Electric vehicles that we've talked about here in this interview; all companies now have very aggressive electrification plans, General Motors just announced a $35 billion investment by 2025, and they're looking to have 25 new electric vehicles by 2023. That's not that far off and there is a supply threat.

So, with a supply threat, due to China's dominance and all these growing demands, you have to fix it. So, the big opportunity, with Ucore, is back to the technology. We're putting our money where our mouth is. We've invested in buying a Company that can get the job done, Innovation Metals Corp, with a fantastic Science Team, evolving very quickly every day, with the technology to get to commercialization. We have a definitive competitive advantage through our RapidSX technology, and through our Team at Ucore and IMC, that will get that middle market secured and brought back home. There's political support that continues to evolve, and part of that is with the State of Alaska and AIDEA. We have enhanced government mining and critical metal policies that are continuing to come in place, with a heck of an upside potential.

It's not just to build SMCs for supplying the supply chain. But it's also for the licensing side of it, which will be accomplished, with IMC’s business model, beginning with the licensing side of rare earths, and then moving to other critical metals, such as the battery metals with cobalt, nickel, and lithium. So, it's a growing market that’s perfectly positioned for Ucore. Technology has to be the key, the centerpiece, and we've done that. We're also working with self-use, strategic partners and longer-term Bokan Mountain initiatives that make all of it come together. It's quite exciting! It's the right place, at the right time, we’re investing in ourselves, and we're going to get the job done, with the Team that we've assembled.

Dr. Allen Alper: Sounds like very strong reasons for readers/investors to consider investing in Ucore. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://ucore.com/

Patrick Ryan, P.Eng.

Chief Executive Officer

Chairman of the Board of Directors

Ucore Rare Metals Inc.

Mark MacDonald

Vice President, Investor Relations

Ucore Rare Metals Inc

902.482.5214

mark@ucore.com

|

|