Dr. Stephen Grocott, MD and CEO of Queensland Pacific Metals Ltd (ASX: QPM) Discusses Becoming an Advanced and Sustainable Producer of Critical Chemicals, for the Lithium-Ion Battery and Electric Vehicle Sector

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/30/2021

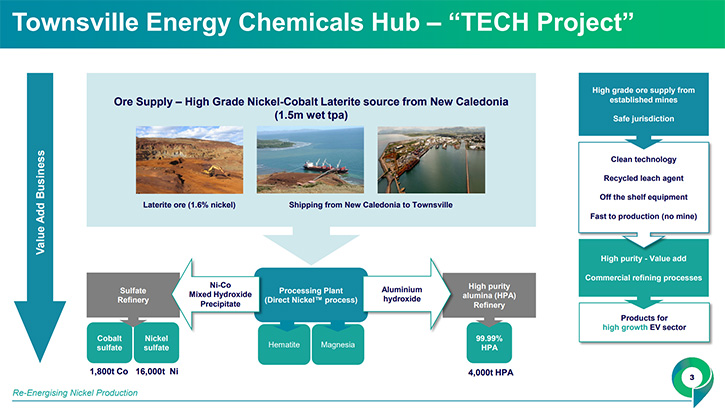

We spoke with Dr. Stephen Grocott, Managing Director and CEO of Queensland Pacific Metals Ltd (ASX: QPM), who is the 100% owner of the Townsville Energy Chemicals Hub (“TECH Project”), located in Townsville, in the newly established Lansdown Eco-Industrial Precinct, intended to be Northern Australia’s first environmentally sustainable, advanced manufacturing, processing and technology hub. The TECH Project will be an advanced and sustainable producer of critical chemicals, for the lithium-ion battery and electric vehicle sector. Processing high-grade ore, imported from New Caledonia, the TECH Project will produce nickel sulfate, cobalt sulfate, high-purity alumina and other by-products – leaving, for the first time ever, in the world, almost zero waste products.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Stephen Grocott, Managing Director and CEO of Queensland Pacific Metals. Stephen, could you tell our readers/investors about your Company and what differentiates your Company from others?

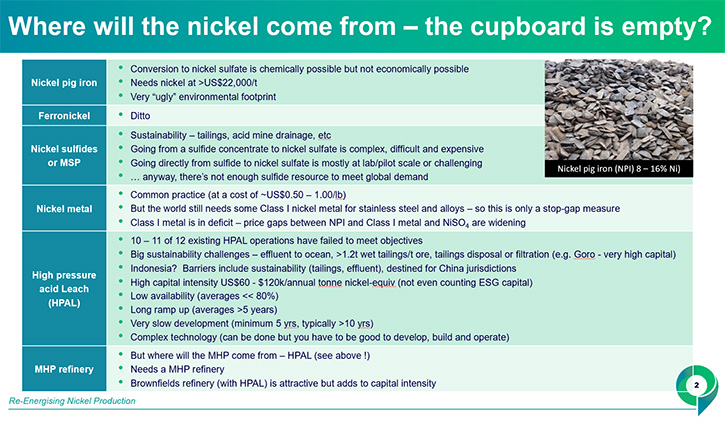

Dr. Stephen Grocott: I assume I don't need to talk about the battery metals market and projections. I'm assuming readers have a good understanding of that. But the bottom line is that the projected demand cannot even be satisfied by every single project, which is on the books. Material manufacturers, battery manufacturers and EV producers are quite concerned about their supply chain, for obvious reasons. Part of the problem has come about because people have simplistically looked at the nickel market, two and a half million tonnes a year and thought that most of that nickel can be diverted into the production of battery-grade nickel sulfate.

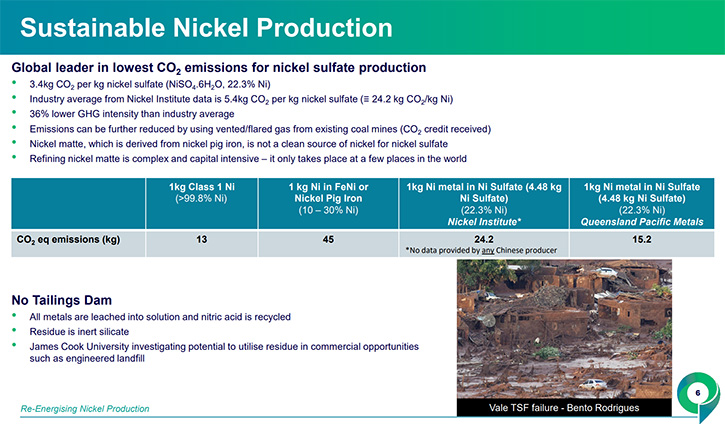

That is simply not the case, because most of the nickel produced in the world is in the form of liquid pig iron or ferronickel. So take nuclear pig iron, for example, that's 8% to 16% nickel and 84% to 92% iron (plus other impurities). Battery-grade nickel sulfate is 99.95% purity, it needs, for example, less than 5 parts per million of iron! The purification process, to go from nickel pig iron and ferronickel to battery-grade nickel sulfate is very complex, very expensive. It can be done, but it's expensive. And the nickel price that you need to incentivize that production pathway, is much higher than the current nickel price. The other problem, with that route, is that it's pretty dirty. It's very greenhouse gas intensive. Lots of tailings, lots of waste products. So, the world really needs alternative sources of supply of nickel in the battery supply chain, it needs primarily nickel sulfate.

Queensland Pacific Metals is deploying a relatively new technology, called the Direct Nickel Process™ (DNi Process™). The process leaches laterite ores, the dominant ore source in the world (they’re about 70% of global reserves of nickel). It dissolves virtually all of the ore in nitric acid. Virtually all of the metals in the ore, except for the silicon, dissolve and are recovered into saleable products. So, you end up with a very small, inert leach residue, quartz and silicates, and 80% of the ore ends up as a saleable product. Obviously, the nickel and cobalt as battery-grade feed stocks, but also the iron ends up as a high-purity hematite, which can go into steel making. The magnesium ends up as magnesium oxide or magnesite, which goes into chemicals, fertilizer and refractory production. The aluminum ends up as aluminum hydroxide, which is refined to high purity alumina.

So, what we end up with is a process, which has a very small environmental footprint - perhaps 0.2 tons of inert leach residue, for every ton of ore. That compares with 1.2 to 1.4 tons of active tailings for high pressure acid leach pathway. We also have a very small greenhouse gas footprint of about 15 kilograms of carbon dioxide per kilogram of nickel in the nickel sulfate. That is one third less than the global average, excluding China. China doesn't provide data. So, our GHG intensity is one third lower than the Western world global average. And additionally you have value added production from all of the resource. So that's an extremely attractive outcome for a process.

The DNi Process™ has been around for about 15 years. It's been extensively piloted. It uses nitric acid for leaching the ore. Nitric acid's a fantastic solvent for dissolving minerals. That's been known for well over a hundred years, but people mostly use sulfuric acid for ore leaching. The reason for that is sulfuric acid is cheap, nitric acid is expensive. But in the DNi Process™, the nitric acid is recycled. About 98% of it is recycled. That overcomes the cost problem. So, that was the IP development from about 20 years ago. And we've taken a license from Altilium Group to deploy that in the first commercial operation. All of the unit operations, in the process, are commercially proven steps in other industries. All that's happened is that they've been put together and deployed for nickel use. So, there's nothing especially novel in any of the flow sheets at all. The only novelty is that it's all put together in a single process for high purity battery nickel production.

Someone listening to this might say, "Well, this thing looks so good. How come it wasn't done years ago?" The previous owners of the technology, a company called Direct Nickel, acquired by Altilium Group, tried to commercialize this process about 10 years ago. But at the time, the only real market for nickel was stainless steel and alloys. And that time, 10 or 15 years ago, coincided with the boom in nickel pig iron production. Nickel pig iron was the cheapest way of getting nickel units into stainless steel. And it still is today. It has a horrible environmental footprint, but it's still the cheapest way of getting nickel metal into stainless steel.

The battery nickel sulfate market did not exist 10 - 15 years ago. So, Direct Nickel was attempting to commercialize a wonderful technology at a terrible time. In contrast, we're fortunate to be commercializing this technology at the perfect time. There is a market, a huge and growing market for battery grade nickel (especially nickel sulfate). It is projected, even by the pessimists, to be at least an additional one million tons of nickel by the end of the decade, for the lithium-ion battery industry. And the products from the DNi Process™ go straight into cathode active material manufacturing. So that's perfect timing.

The other thing that's important is, (I know it's not logical), but people don't care where the nickel comes from for their kitchen sink, but they do care where their nickel comes from for their electric vehicle. So, the sustainability credentials of this process are very, very important, particularly for North Asia, North America and the European Union, where people care about tailings, deforestation, ocean effluents, greenhouse gas intensity, child labour, etc. So, as I said in one forum, nobody wants to get into their electric VW in Frankfurt and know that the 50 kilograms or 100 kilograms of nickel, sitting in their battery pack, is responsible for 5 or 10 tons of tailings dumped in the ocean, which is what is practiced by one of the large nickel producers. Or they don't want to know that there's been a massive greenhouse gas footprint in the production of that material or deforestation, or damage to oceans, et cetera.

So the timing is right. There's a huge and growing market for battery-grade nickel. And the sustainability footprint of that production is very, very important. At Queensland Pacific Metals, we are bringing that all together at the right time.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about the partners you're working with?

Dr. Stephen Grocott: Yes. Firstly, the owners of the technology are a group called Altilium Group and we have a royalty-based license, from them, to produce nickel and cobalt sulfate. The other partner that we have is Hatch, for the Definitive Feasibility Study, which is well underway now. Hatch has a fantastic global reputation as an EPCM partner. We chose them, from a number of other companies, because they're high-quality and their reputation is important to them. They have very good experience in nickel and base metal hydrometallurgy. So those are our two key partners.

We're also partnering, with a local government. Our project is to be located just south of Townsville, in North Coast Queensland. The government there established a heavy industry-zoned precinct, called the Lansdown Eco-Industrial Precinct. It's a fantastic location. On the Eastern boundary of our construction site, there is a rail line, a highway, a gas pipeline, a few kilometers away there is a water pipeline and there is power, and that includes a solar PV power facility, being built nearby. So it has all of the infrastructure. As they say, “location, location, location”, and we couldn't ask for a better location.

We're also partnering, with some mining companies in New Caledonia, which is one of the two highest grade producers of lateritic nickel ores in the world. The other one being Indonesia, but Indonesia has an ore export ban. New Caledonia is just a few days sailing from Townsville and those mines have been in existence for many decades. They have hundreds of years of resource and we'll be partnering with them to import ore into Townsville, to process in our plant. They have exported to Townsville, for a number of decades, to a now shut down nickel facility. It was the Queensland Nickel Refinery. It used a very old, very greenhouse gas and tailings intensive process that shut down a few years ago. So we're partnering with the same mining companies to process the ore through the Direct Nickel Process™.

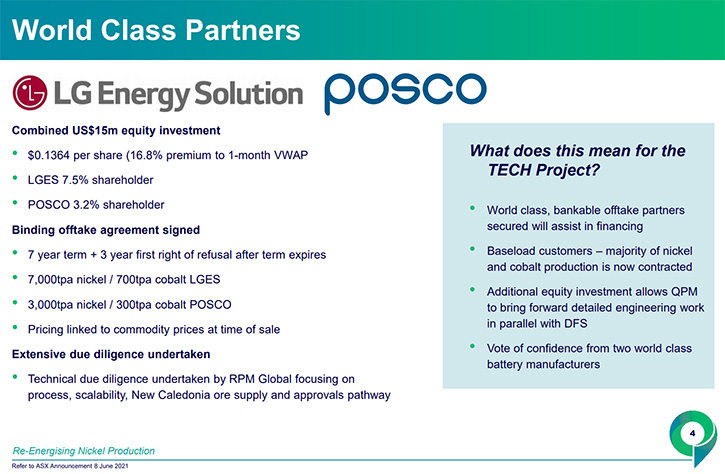

We're also working with the national government, the Commonwealth Government of Australia and investigating government funding opportunities. But I guess the biggest partners that we have are LG Energy Solution and POSCO. We have signed binding offtake agreements for about 65% of our production to supply POSCO and LG. We started discussions with them, nearly a year ago, and we went through a non-binding MOU, then lots of due diligence on their part. And they put us through the grill. They're very professional organizations, fantastic companies, as your readers probably know, LG Energy Solution is the world's largest manufacturer of lithium-ion batteries. So, they're the number one and it's a pleasure to work with companies like that.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors, a little bit more about the schedule of moving your project?

Dr. Stephen Grocott: Certainly. When we first started discussing, with LG and Posco and others (by the way, we also have a non-binding MOU with Samsung, a number four or five battery producer), they said to us, "Can you build this bigger? And can you build it faster?" And we said, "Yes, we can certainly build it bigger." Our previous planned nickel production capacity was 6,000 nickel tons a year. And we said, we've only made it that size because it's the smallest production unit we can build and still be economical. We were a small company and the funding was the challenge. So they said, "Can you do it bigger?" We said, "Absolutely. If you have skin in the game, we can." So now the production size will be about 16,000 nickel tons a year.

They also said, "Can you do it faster?" And we said, "Yes, we can do it faster, but it will cost more money, to do the feasibility study." When you accelerate feasibility studies, sometimes that means you have to circle back and re-optimize parts of the engineering. That sometimes adds to the costs. So, we said, "We can go faster, but again, you’d need to have skin in the game."

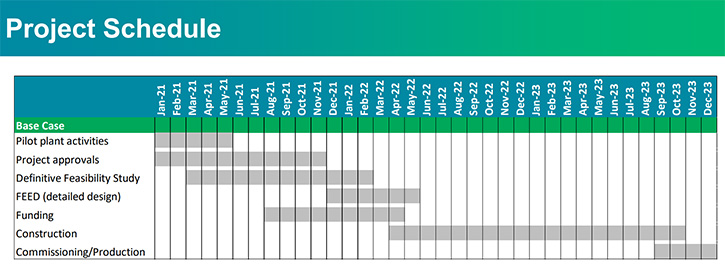

So, we raised 20 million Australian dollars. LG and POSCO injected 15 million US, converted, that's similar. And we now have an accelerated schedule for our feasibility study. The feasibility study, which is well underway, will be complete about February 2022 and that will deliver the capital estimate and operating cost estimate. In parallel with the feasibility study, we have approvals underway, which are relatively straightforward, because it's such a clean, green process, in a zoned-heavy industrial land, which is a former, cattle grazing research station. The approvals should be complete, by the end of this calendar year.

We're also paralleling the feasibility study, with some detailed engineering and early procurement activities, so that we have a fast construction schedule. Funding is underway in parallel. We aim for a final investment decision by the middle of next year. Before then, we will probably still be placing orders for long lead time items. Total construction time is about 18 months. And we'll be commissioning the plant for first production by the end of 2023.

So, that's quite a fast schedule, and people say, "Well, how on Earth can you do something like that so quickly?" Part of the reason is that the approvals are so straightforward, it's such a clean, green process, and we have no mine to develop. Often that is one of the slow parts, getting the approvals for the mine development, but we have no mine to develop. Our equipment is relatively simple. High pressure acid leaching, for nickel production, has very large, high temperature, high pressure autoclaves, very long lead time items. All of our leaching and nickel/cobalt production steps are at atmospheric pressure, simple vessels, relatively straightforward, steel alloys. So it's actually a relatively fast construction. First production, by the end of 2023.

Dr. Allen Alper: Well, that's fantastic! That's really great! Could you tell our readers/investors about your background and your Team?

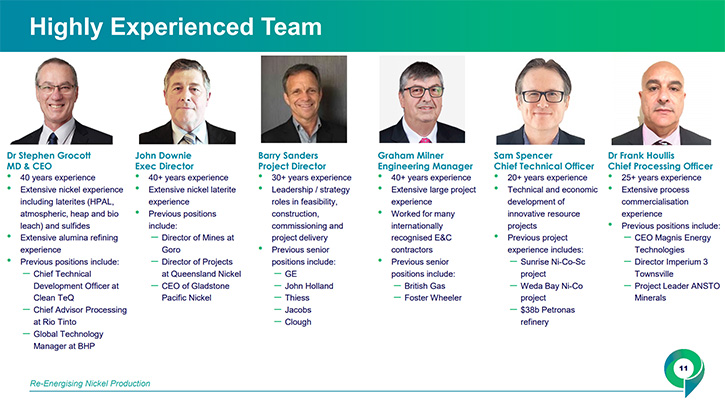

Dr. Stephen Grocott: Certainly. Prior to joining Queensland Pacific Metals, I was Chief Technical Development Officer with Clean TeQ, who have recently been renamed, Sunrise Energy. They are developing a high-pressure, acid leach project, in Australia. I was with them for about two and a half years. Prior to that, I was the General Manager of Processing for Rio Tinto, for many years. I had global responsibility for supporting their processing operations, troubleshooting, assisting capital allocation, and process development. Prior to that, I had similar roles in BHP, where again, I had a global Team, supporting operations and new projects. And prior to that, most of my time was working, with Alcoa, in the alumina refining industry. So, I have a long history in base metals, process development, project development, M&A, DD, troubleshooting, et cetera, et cetera.

The Team we have comprises a General Manager of Corporate Development, a gentleman by the name of John Khoo. John Khoo has a long history in banking, investment and finance. Our Chief Financial Officer, also has a lot of experience in corporate fundraising, capital raising. Our Project Director, for the Feasibility Study, is a gentleman called Barry Sanders. Barry has a long history in major feasibility studies and project development. Multi-billion dollar projects all around the world, working both on the owner's side and the engineering side. Our Executive Director and Founding Managing Director is a gentleman called John Downie. John has worked in the mining and nickel industries for many years, including in New Caledonia. And John has a very close relationship, with the ore suppliers in New Caledonia. So that is our Executive Team. We also have a Team of very senior people, sitting underneath them.

In all my time, in very large and successful Companies, like BHP, Rio Tinto and Alcoa, all three fantastic companies, but in those companies, I could never dream of pulling together a Team, the caliber that I've been lucky enough to assemble. The reason for that is that really good people like to work on something new that's exciting, attractive, and is making a difference, that has some risk, but not too much risk. And they have the freedom to actually make a difference in this industry because if we're successful - and it looks like we are certainly going to be successful, because we keep ticking all the boxes - if we're successful, I find it hard to believe that in 10 years’ time, anybody will be producing hydrometallurgical nickel through any process other than this direct nickel process. It has so many advantages.

The only concern that people have is, is it going to work? And I say, doing something new there is always technical risk. I don't want to shy away from that. However, the risk here is not a technology risk, where it's a one or a zero, does it work or doesn't it work. This is the technology risk where all of the unit operations already work. It's been piloted to death. So, this is project with a risk where it's a 1 or it's a 0.8 or it's a 1.2, but it's going to work. And the only question is how well will it work and how fast will we ramp it up. That's one reason why we're spending a lot of money in the feasibility study, much more than people would normally spend, so that we can eliminate all of those risks, rather than encountering them when we start up the plant and then end up with a slow ramp up.

Dr. Allen Alper: That sounds excellent. You and your Team have an outstanding background. And it sounds like your group is very well-prepared to take it through project, through to production. So that's excellent! I can see why you are getting such great support.

Dr. Stephen Grocott: And we've had a Board, who understood the vision. When I joined, I said to the Board, one of the conditions is that we are going to spend a lot more money on this feasibility study and associated test work and vendor engagement, a lot more money than a junior company like us would normally spend. And the Board said absolutely. So, the Board has totally bought into that philosophy.

One of the things we're doing, which is a bit unusual at the moment, is we're already talking with vendors, even though we're only part of the way through our feasibility study. And saying to some vendors, we're not going out to tender, you have the deal with us. We're going to be purchasing the equipment with you. Let's start on the detailed engineering design right now. When you go out to tender, that adds months into your schedule, and you don't necessarily get the commitment from those vendors anyway, because they think, well, am I going to get the job or not? But we've identified, in some areas of critical equipment, the best manufacturers and technologies in the world. And we said, we want to work with you and we're not going to work with anyone else.

And that is already paying dividends. So, we have some of the biggest and best companies in the space. I can't mention their names yet, but again, for a junior to be able to secure access to some of the biggest and best companies is a real positive. They like, of course, the green fundamentals, because a lot of them now will not work with companies that do not have the right sustainability credentials. And they like the fact that they can be at the start of something, which in plain simple terms is going to be very profitable for them going forward, because this will be the first of many plants.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your capital and share structure?

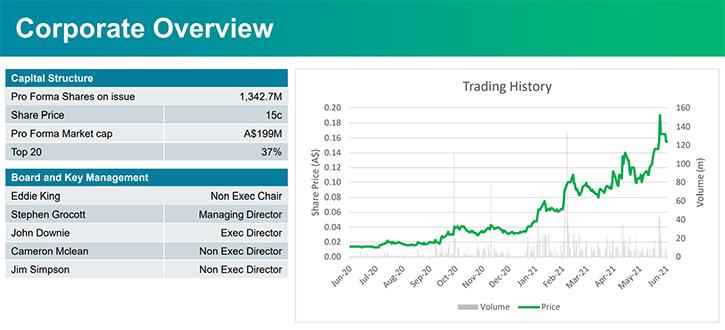

Dr. Stephen Grocott: We're publicly listed on the Australian stock exchange. I neglected to mention that POSCO and LG, after our extraordinary general meeting, shareholder approval on Tuesday, July 13th, will become 10% owners, via their $15 million equity investment. So we're publicly listed. We have very sticky shareholders, who have been there a long time. We have quite a few large institutions, who are now shareholders in the Company. We've progressed from a year ago, having a market capitalization of about 10 million Australian dollars to about 200 million Australian dollars. So we have sticky and solid shareholders.

In terms of funding the project, the capital will be around about a billion Australian dollars to build the project. The project valuation uses quite conservative numbers. We used nickel prices, much lower than today even. We think we can support, reasonably comfortably 60 plus percent debt. Some of that will be coming from government funding, we hope. We're working with a group called the Northern Australia Infrastructure Facility – a government investment fund. They're a government body that provides funding for projects in the north of Australia. We'll also be working with the conventional debt and banking sources.

We're obviously also looking for project equity. Everyone always asks us, "Will LG and POSCO be equity partners in the project?" And you know, the answer to that is, well, we're still in the feasibility study. Of course, we'll have discussions about that between now and the end of the feasibility study. But, obviously, at the moment we don't expect anyone to write us a check for 100 or 200 million dollars today, while we still have a few months to go on the feasibility study. So does that answer that question, Allen?

Dr. Allen Alper: Yes. Well, that's fantastic! Very impressive! That's really amazing what you and your Team have done, in a very short time, and have gotten such great support and moved the technology along and moved the business model forward so rapidly. So that's all really excellent work! That's great! Is there anything else you'd like to add?

Dr. Stephen Grocott: Thank you. No, the only thing I'd say, Allen, is that we don’t make a great fuss about things. I describe us as a collection of, almost, of box tickers. We tell the market, here's what we're going to do, and then we go and tick that box. And here's what we're going to do, then we tick that box. And so on.

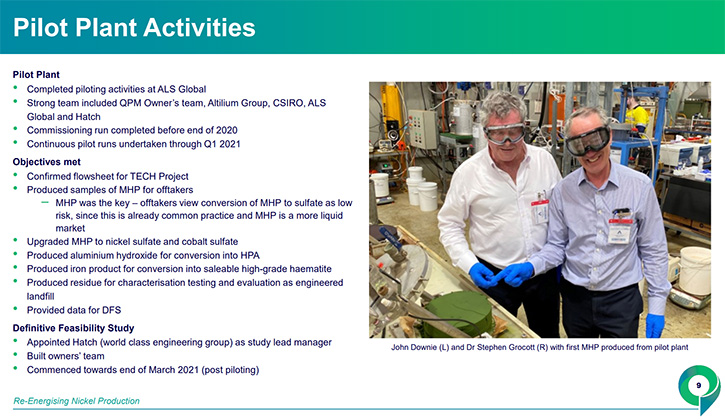

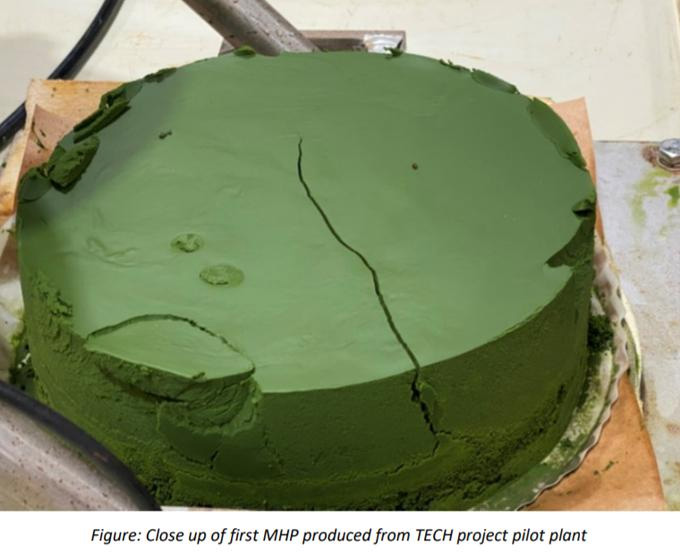

So we said, shortly after I joined, we were going to be doing some piloting, just a final verification, using what we will be processing. So we did that piloting. It was successful. Tick that box. We said we would negotiate, with a number of companies, to secure non-binding agreements. And we did that, secured those with LG and with Samsung. Heck, we had others that wanted to sign those MOUs, and we said, no, no, that's enough. We ticked that box. We then said we would prove that the intermediate product we produced, the mixed hydroxide precipitate, was acceptable. And we did that. We ticked that box. We said we'll review the size of the plant in relation to the MOUs. And we did that and increased the size two and a half fold. We ticked that box. We said we would raise capital to fund the feasibility study. We raised 20 million Australian and we ticked that box. And we said we would be looking for binding offtake agreements. And we've done that and ticked that box. We said we'd start a feasibility study, with a globally recognized engineering partner. We ticked that box.

We've seen shareholders developing confidence, in the project and the Management Team, so that, when we say something, so far, we've under promised and over delivered and that's the philosophy that we want to adopt, going forward. We don't want to get ahead of ourselves. I don't want to lead readers/investors to think that this is easy. It isn't, it's hard work and you need a good Team and you need good supporters. And we're fortunate to have all of that in place.

Dr. Allen Alper: Well, that's outstanding performance by you and your Team. That's really great performance!

Dr. Stephen Grocott: Thank you.

Dr. Allen Alper: You laid out a plan, you committed to it and you'll accomplish it on time, which actually is very difficult to do. I really admire what you and your Team have accomplished. That's really excellent! Stephen, is there anything else you'd like to say?

Dr. Stephen Grocott: No, that's all. If you need any information from us, or pics, or presentations, we'd be happy to provide that.

Dr. Allen Alper: Well, that's great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.qpmetals.com.au/

Dr Stephen Grocott

Managing Director

info@qpmetals.com.au

+61 7 3517 5900

|

|