David Williams, Executive Chairman, Thomson Resources (ASX: TMZ): Discusses Creating a Large Precious (silver – gold), Base and Technology Metals (Zinc, Lead, Copper, Tin) Resource Hub in New South Wales and Queensland Border Region

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/28/2021

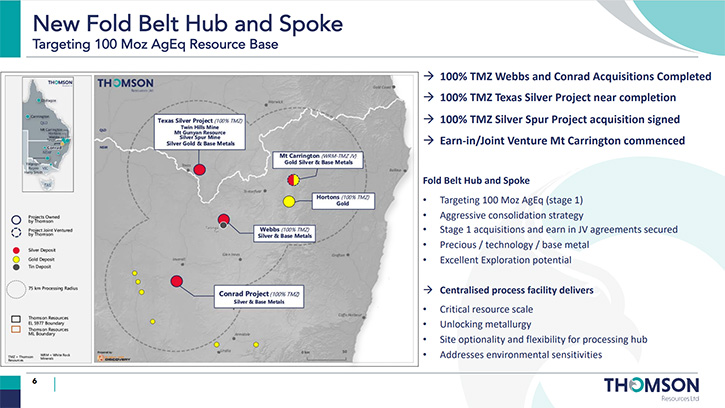

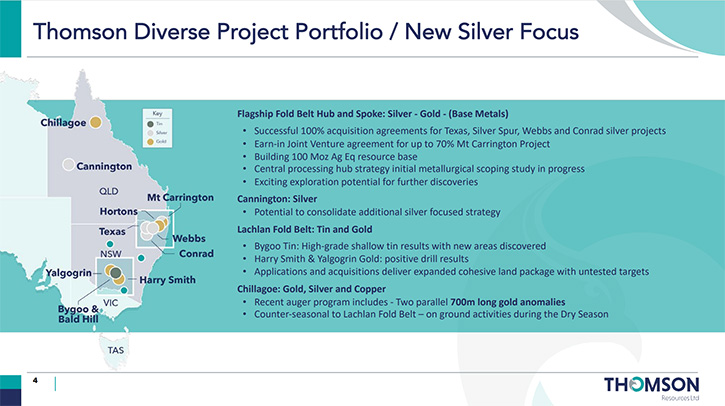

Thomson Resources (ASX: TMZ) is a diversified minerals explorer that holds a diverse portfolio of mineral tenements, across gold, silver and tin, in New South Wales and Queensland. We learned from David Williams, Executive Chairman of Thomson Resources, that their strategy is to create a large precious (silver – gold), base and technology metals (zinc, lead, copper, tin) resource hub in New South Wales and Queensland Border region. The Company's key projects include the Webbs and Conrad Silver Projects, Mt Carrington Silver-Gold Project, Texas Silver Project and Silver Spur Silver Mine. Thomson Resources is targeting a 100 Moz silver equivalent resource base.

Thomson Resources

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with David Williams, Executive Chairman of Thomson Resources Limited. David, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others.

David Williams:Thomson’s gone through a transformational change, over the last 12 months. It’s moved from being your typical little junior explorer in Australia, focusing on gold and tin in New South Wales to being a Company now that has moved to a developmental phase focused on silver. The particular focus has been on the New England Fold Belt, around the northern part of New South Wales and the southern part of Queensland.

What we targeted to have was an in-ground resource, available to a centralized processing facility, in the order of 100 million silver equivalent ounces. To get to that level of scale, that not only gives us mine life, but gives us a significant volume of throughput in a processing plant. This means that we can not only have a commercially sustainable project, but have longevity as well. But also, with that scale, we will be able to look at introducing circuits, which will enable us to extract value from the minerals associated with the silver, in the deposits such as gold, zinc, copper, lead and tin.

Dr. Allen Alper:

Well, that's excellent. The timing is great because everyone I talked to feels that silver is still highly undervalued and will greatly increase and it has a big role to play in electrification.

David Williams:

That’s the interesting part to me about silver. I wasn't a strong silver person in the past, but I've certainly come to understand it a lot more. The interesting part of it is it being both a precious metal, as well as one of the technology metals. That's what is giving it its growth. The thing I like about the silver price, at the moment, is that unlike the past where it has skyrocketed quickly and then came down quickly, this time it has that steady buildup of the price. It seems to find a level and then goes up and down around there. Then it finds another new level, goes up and down around that and so on. I am just looking at the growth of the silver price this time, which is a far more long-term sustainable level than what we have seen in the past.

Dr. Allen Alper:

That’s excellent. Could you tell me more about your projects and a little bit more about the information you have on them?

David Williams:

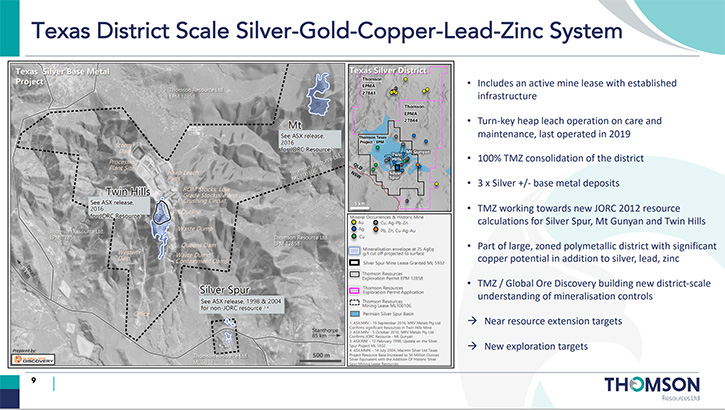

It’s an interesting group of projects that we have pulled together, with this hub and spoke strategy. What we were trying to do, was to aggregate a resource, contained in the ground, of around 100 million ounces of silver equivalent. Each of these projects, in their own right, has been operated as a mine in the past. In some cases, back in the late 1800s early 1900s and in a number of the cases re-mined in around the 50s or 60s. In the case of Texas, it was actually operated in 2019.

Each of the projects has an insufficient sized silver resource or silver equivalent resource to make them work as a project on their own. They were typically around that sort of 10 to 20 million ounces, which just is not enough to help you ride the troughs along with the peaks of the commodity prices. The companies that had had them before had done all right at the time, but then silver prices changed or the other key commodity prices changed, and they shut down and became forgotten.

For us, in each case, they have old mines here. They have been successfully mined in the past and that is a positive. They haven't been mined out because, in each case, they had a fairly short life of mining. They have been walked away from by previous operators so that has left the State Governments in New South Wales and Queensland, with legacy mine responsibilities, which is not great for them because it is costing the States to deal with them.

Thomson will come in, with modern mining methods and modern mining rehabilitation methods, and will sort out problems, created by old mining methods and old mining rehabilitation methods that the States have been having to deal with. It’s a win-win all around, both for the government and ourselves. For us, by bringing them together, we can get that scale that will achieve that mine life and that mine scale that enables us to be commercially sustainable.

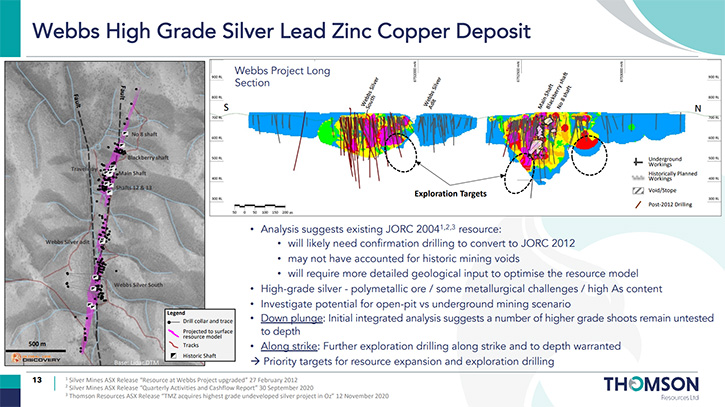

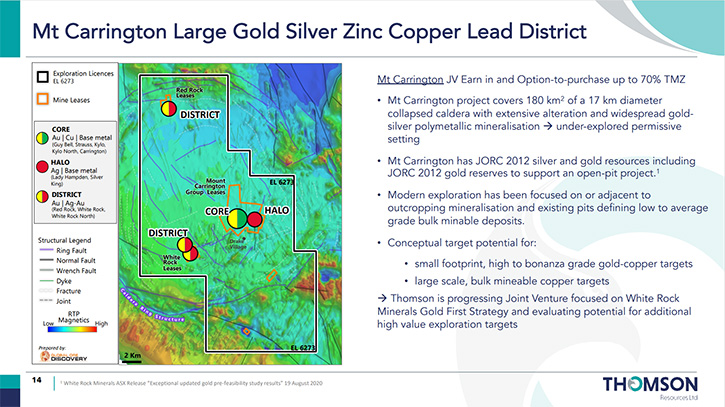

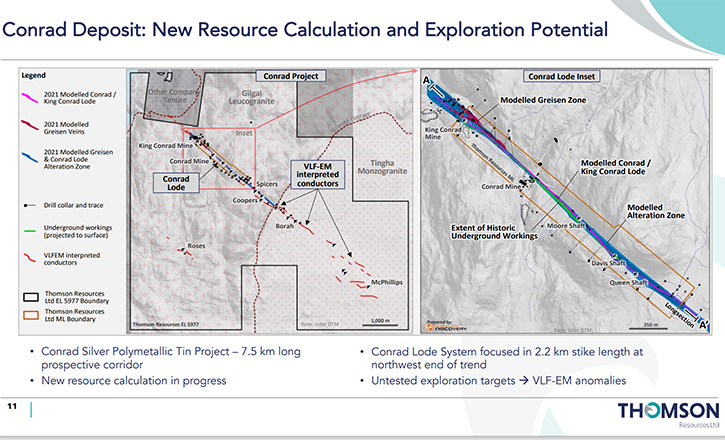

By adopting the hub and the spoke approach, we have flexibility and optionality, with the different deposits. Now each of the deposits are different compositions of minerals. You can go with Webbs, which is our high-grade, silver dominant resource. Then you have Conrad, which is also a high-grade, but more a polymetallic resource. Mt. Carrington has strong gold resources as well as silver resources, but equally has copper and nickel amongst it. Then to Texas, which is a low-grade and high-grade gold, but also areas of well-known high-grade zinc. There are also other areas, which you can see have been lightly explored, which have gold, zinc, copper and lead as well.

You have this mix, which ultimately, when you understand all of the metallurgy and how readily extractable they are, where you could actually get to a stage where you change your blend from the different deposits depending upon what the particular commodity prices are doing, or what your forecast for that particular commodity price is going to do.

You can actually maximize your returns on the higher price. Obviously, it is not as simple as that, but there is an opportunity for a bit of manipulation, around doing that, but you do get that flexibility and optionality. Importantly, if you had just one deposit, then it is all about that one deposit succeeding as expected. Here you have different deposits, so you have that ability to move around, if one is looking better than the other. It provides some risk mitigation.

Dr. Allen Alper:

That sounds great. It’s excellent to have that flexibility. Could you tell our readers/investors your plans for the remainder of the year and going into 2022?

David Williams:

Yeah, absolutely. There are a number of key things that we are focused on. One of the keys is to do our own resources definition, in accordance with the JORC code 2012, for each of the projects. The reason for that is twofold. One is, if we want to repeat the numbers, we are considered to be publishing them for the first time and therefore, we have to do the full JORC 2012 process. Whilst I can refer you to the ASX releases, where these were published by previous operators, I just cannot refer to the numbers. More importantly, because we are going forward as a development, we want to make sure that we have robust numbers. We really want to do definitions of the resource numbers in a consistent way, so we are having them all done by the one resource geology firm, and two, they are done in a way that we know that what we have is a sustainable number, as far as when we go through the feasibility study and bankable feasibility study stages.

We also want to make sure that we are picking up all of the valuable minerals, in the resource estimate that we are able to and this has not necessarily been done by the previous operators. So particularly to pick up the copper and the gold and zinc and the lead and tin. Then to be able to publish and demonstrate what we have. That is a work in progress that we will complete, during the balance of this calendar year. The first of those, which we have already given the heads up on, is Conrad and that should come out in the very near future. Then we will move onwards towards the Twin Hill, Silver Spur and Mount Gunyan resources at the Texas Silver Project and then onto the Webbs resource.

In each of these steps we find, as we revisit the geological model, we are also working out and being able to disclose the exploration upside. We have already started to see that, with Conrad in the areas of open shoots, which have not been taken into account. There will be positives, and in some cases, there will be negatives. That is the first main body of work that is going on at the moment.

The second main body of work is a whole lot of metallurgical work. What's key with each of these deposits, which has not necessarily been dealt with or understood by previous operators, is what is the composition of the various deposits or the various resources? What is the makeup of it? How can you extract the different minerals? Are they easily extracted? Are they difficult to extract? What is the optimal process to be able to do so? There is a lot of work and filling in the gaps, going on at the moment, so that through the balance of this calendar year, we will be able to develop that understanding. We will be able to decide on what the optimal centralized processing system is and how we would do that and effectively finish the scoping study. Then you are ready to turn to the more detailed feasibility studies in 2022.

At the same time, as we develop the geological models, as we develop our understanding of the different resources, as we look at each of these projects, on a district style basis, we are stepping back and looking at what is the potential there. Not just from the particular silver focus, but from the silver equivalent focus that is enabling us to develop what our exploration strategy will be, with a view that we can then implement and commence comprehensive exploration programs, at each of the projects, starting from around September/October.

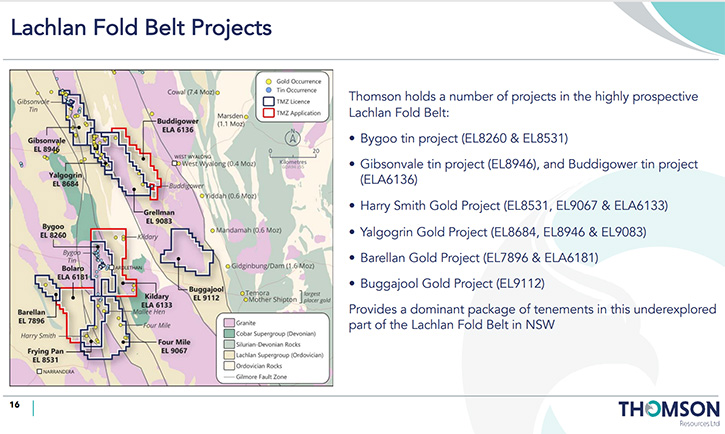

We are already doing a lot of geological mapping, logging of core and pulling together the databases so that we have a good understanding of the potential of the projects. So that for the last quarter of this calendar year, rolling into the next calendar year, we will have a pretty comprehensive exploration program, going along in this New England Fold Belt area. That is the main game. But we must not lose sight of the original projects, from 12 months ago, which are in the Lachlan Fold Belt in central New South Wales, as well as the early-stage projects of Chillagoe, in far north Queensland. We really had some outstanding results from recent drilling of the Bygoo Tin Project. That is really starting to shape up as a pretty interesting and a valuable project.

When coupled with the existing gold results at Harry Smith and Yalgogrin, all within that package of tenements, which from north to south, span about 100 kilometers, it lends itself to also being ideal for the hub and spoke strategy, which we will progress through. It is not as far advanced, in the developmental pathway, as the New England Fold Belt projects, but it has a lot of promise and a lot of potential in that hub and spoke approach. We will get back to it at the end of this calendar year and through to around May 2022, with further comprehensive drilling programs, at both Bygoo Tin Project, but also the Harry Smith Gold and the Yalgogrin Gold. I can see a lot of work on both the New England Fold Belt and the Lachlan Fold Belt projects that will see the exploration-side, kicking in from September, October, running through to at least the middle of 2022.

Dr. Allen Alper:

Well, it sounds like this will be extremely important and exciting times for shareholders and stakeholders of Thomson Resources.

David Williams:

That is correct. My short-term vision is to get us into a market cap in the order of $150 million, by the end of this year, early next year. Then ultimately to make us one of the leading silver plays in Australia with a focus on silver in Australia. There is still plenty more growth ahead, as far as Thomson is concerned. When you look at us, relative to the other silver players in Australia and you look at their current market capitalizations, compared to our current market capitalization, there is plenty of room for us to grow.

Dr. Allen Alper:

That sounds like an excellent opportunity for our readers/investors. David, could you tell our readers/investors a little bit about your background, your Board and your Team?

David Williams:

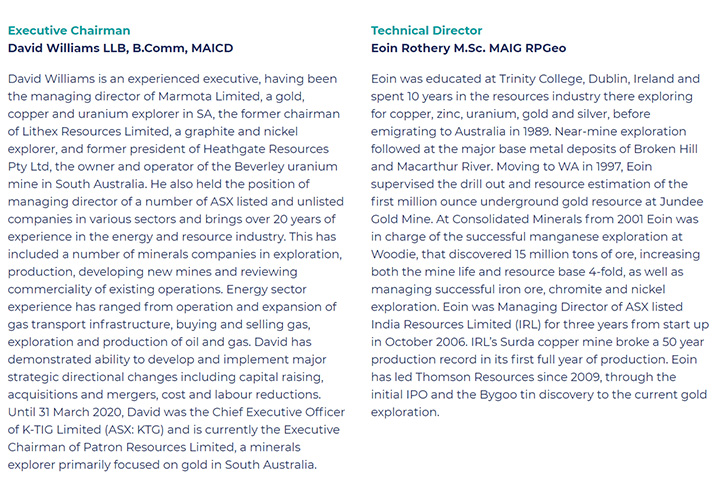

I have been leading ASX listed companies for just under 25 years now. My roles, over the years, have been very much about coming in and changing the strategy and the nature of the business and getting it onto another pathway that can help it to grow. I have been very much a person coming in and trying to fix it or trying to improve it. Sometimes you win, sometimes you don’t. With Thomson the results are there to be seen.

I am very much about strategy, corporate governance, ensuring that we can grow shareholder value. My more recent time has been in the hard rock area. I have spent a lot of time in oil and gas and also soft rock, uranium. I am very experienced in what I am dealing with here, in leading companies, particularly companies with the sort of change that Thomson is going through.

Eoin Rothery is one of the other Directors. Eoin is the Technical Executive Director. He started with the Company when it was first listed back in 2010 and has seen it through that period and has been very focused on our projects in the Lachlan Fold Belt. He is a geoscientist, with over 40 years of worldwide experience. He has very much been the one pushing and driving us in our Lachlan Fold Belt and Chillagoe projects.

The third and final Director, Richard Willson, is also our Company Secretary. Richard is a very well experienced and seasoned Director and Secretary and has been and is on the Boards of a number of companies. He brings that financial experience, as well as the corporate governance experience into the Company. Richard worked with me on a number of other Boards. We have a good blend of skills, within Thomson at the moment, and the three of us have taken Thomson from nothing to where it is today.

We recognize, because we were small and we have grown rapidly, that what has been the key to enable us to deliver on this growth strategy and this change strategy is to engage good consultants that are well regarded and that are also bought into our vision and strategy of where we are going. We have pulled together a number of consultants that tick all these boxes, primarily led by the Global Ore Discovery Team, led by Stephen Nano, who are driving the geoscience work for us and the development of the exploration strategy and the understanding of the geological models.

We have engaged AMC to do the resource definitions for us. We have also engaged Core Resources. out of Brisbane to do the metallurgy and they have access to a number of leading processing technologies as well. Then finally, we have engaged Spinifex and EMM, both out of Brisbane, to work with us on the environmental side and the community engagement. We have not tried to do it all ourselves, we have made sure that we have engaged like-minded, high reputation consultants as we build our Team and we are slowly building our Team internally. But we have tried to do this in a measured and considered way, as we have done with everything along the way.

Dr. Allen Alper:

That sounds excellent. You have an excellent background and a very balanced Board, and you’ve done an excellent job picking the right consultants and companies to help you move the projects forward.

David Williams:

Yes, and every step of the way, we have been considered in our approach, but the advantage that we have had also, is we have been able to move quickly. We have had the vision and the foresight of where we want to go, and we have just gone after it. Now, there is always a level of luck and timing with this. I never shy away from that, that is the resources sector for you. We identified in November/December that we wanted to pick up the Mount Carrington and Texas Projects and blow me down if they didn't come up for grabs, in that first week of December, that’s luck and timing.

But we did go forward and make sure we got the projects at a reasonable value to shareholders. We have done the same with the capital raisings. We have raised a level of money at a particular price, so that it is not overly dilutionary. Then wait for the price to increase before we raise the next tranche and so on and so forth and we continue to do that. Whilst the company may need money, we do not have debt and I do not want to have debt at this stage. We are responsibly timing our capital raisings and quantums, so that we are getting in at the best price that we can at that level. It enables us to continue to add value to the Company as opposed to just raising money for the sake of raising money, which would not be a good outcome for shareholders.

Dr. Allen Alper:

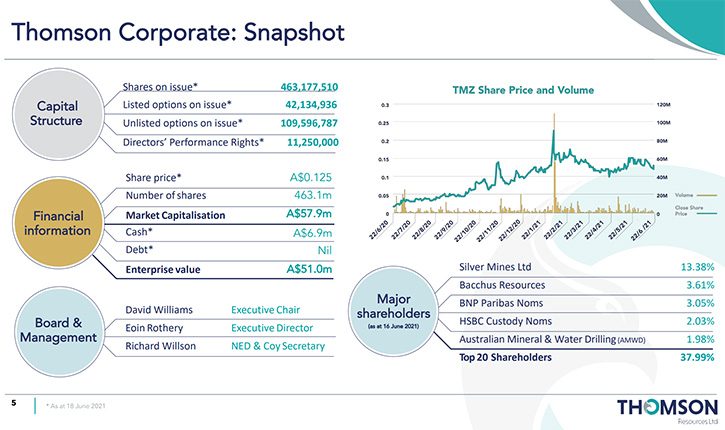

That sounds like a very wise business approach. David, could you tell us a little bit more about your share and capital structure?

David Williams:

We have a bit over 450 million shares on issue, and we have on the order of about 160 million options or warrants that are also out there. It has been fairly tight in the past, if we look back 12 months ago, the shares on issue were much lower, but we have had to raise capital since. Also when you go back 12 months ago, the share register was very tight and essentially the top 20 own over 70% of the shares on issue. The top five effectively owned about 65% of the share register. Consequently, the Company did not have any liquidity in its trading.

Since that time, and getting the liquidity into the stock, and with the growth, we have changed those numbers quite a bit. The top 20 now holds a little under 38% and the top five effectively only hold about 20%. We have changed that a lot and have seen a change in the liquidity of the stock so that we are moving from 12 months ago, when we might have been trading a few thousand shares in a week, to now where we would typically trade around two to three million shares in a day. That means we have a far more active share register and that is a positive.

Yes, you can go up and down, as you are more in people’s focus, but the important thing is that it means that investors coming in know that they will have the ability, when they want to, to be able to exit or to sell down, as the case may be, and equally to be able to trade in the market to increase their stake. To me liquidity is very important as far as investors are concerned.

Dr. Allen Alper:

That sounds excellent.

David Williams:

Finishing up on that note. There is no debt and we have about $6.5 million in cash at the moment.

Dr. Allen Alper:

That’s great. David, could you tell our readers/ investors the primary reasons they should consider investing in Thomson Resources?

David Williams:

The primary reasons are that we are silver focused and we are well down the development pathway. We have the scale, with the resources at around that 100 million silver equivalent ounces, contained in ground. We are doing things in a considered way, ensuring that we are well-funded, so that we can progress properly down that development pathway. We are ensuring that we are going to get value for the other minerals that are associated with the silver. There is plenty of growth still to happen, and that is demonstrable, when you compare us with the other silver plays in Australia. That coupled with the fact that you can also get exposure to gold and to tin, with our Lachlan Fold Belt projects. I think the final and important points for your readers/investors, are that we have actually demonstrated that we have a vision, we have delivered on that vision, and we continue to deliver on shareholder value as we have done that. We will continue to, because we are only a short way into where we want to have this company. As we have moved quickly in the past, we will continue to move quickly in the future.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors to invest in Thomson Resources. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.thomsonresources.com.au/

David Williams

Executive Chairman

Thomson Resources Limited

Level 1

80 Chandos Street

St Leonards NSW 2065

Phone: 0419 779 250

Email: david@thomsonresources.com.au

|

|