Vincent Mascolo, MD and CEO, IronRidge Resources Ltd (AIM: IRR), Discusses their Agreement, with Piedmont Lithium to Fully Fund and Fast Track the Ewoyaa Lithium Project to Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/25/2021

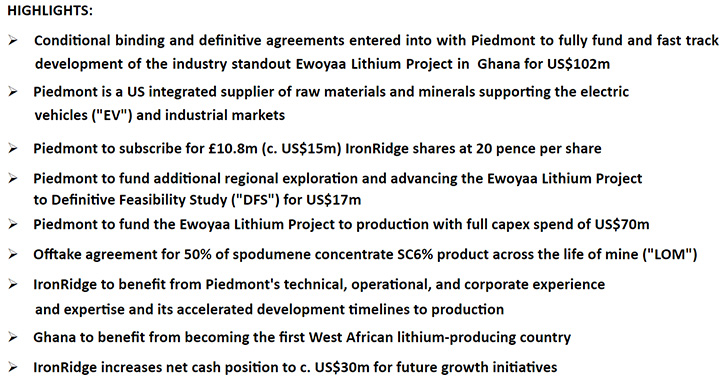

We learned from Vincent Mascolo, Managing Director and CEO of IronRidge Resources Limited (AIM: IRR), an African focused lithium exploration company, that they have entered into a conditional binding agreement, with Piedmont Lithium to fully fund and fast track the Ewoyaa Lithium Project, part of IronRidge's Ghanaian Cape Coast Lithium Portfolio, to production. Piedmont, a Nasdaq listed lithium exploration and development company, is a US integrated supplier of raw materials and minerals supporting the electric vehicles and industrial markets. Mr. Mascolo expect to see the Ewoyaa Lithium Project in full production by 2024.

IronRidge Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, editor-in-chief of Metals News, talking with Vincent Mascolo, who is CEO of IronRidge Resources. Vincent, could you tell our readers/investors about the exciting news of Piedmont lithium financing, your lithium project in Ghana?

Vincent Mascolo: Yes, certainly Allen, and once again, thanks for having me back. Recently, we just announced a landmark deal for IronRidge and all stakeholders. Piedmont Lithium, a NASDAQ listed Company, with a vision of becoming America's number one lithium hydroxide producer, has agreed to fully fund and develop our lithium project in Ghana.

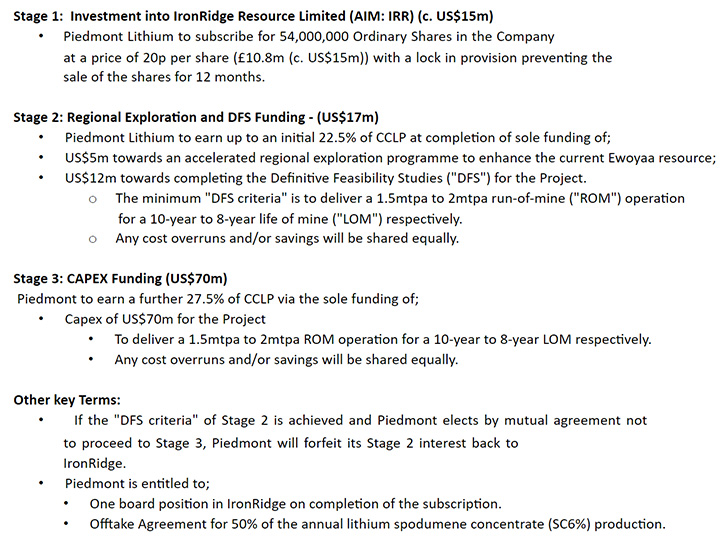

It's a three-stage investment. Stage one is a placement in Top Co. IronRidge for 15 million US dollars. Once that subscription is made, in the next four to six weeks, Piedmont has agreed to fully fund our project, to a definitive feasibility study, plus an additional 5 million US dollars for regional exploration to further bolster the current resource.

Stage two is an aggregate, a 17 million US dollar investment, and there is a minimum DFS criteria, which, we believe has already been achieved. By virtue of our current exploration efforts, expanding the resource, the minimum DFS criteria will be achieved, and that triggers Piedmont to spend another 70 million US dollars to take our project into full production. Hopefully, that will be by late 2024.

Dr. Allen Alper: Oh, that's exciting! That's great news for your shareholders and Ghana, so that's excellent. Could you tell us a little bit more about the project update us on what's happening?

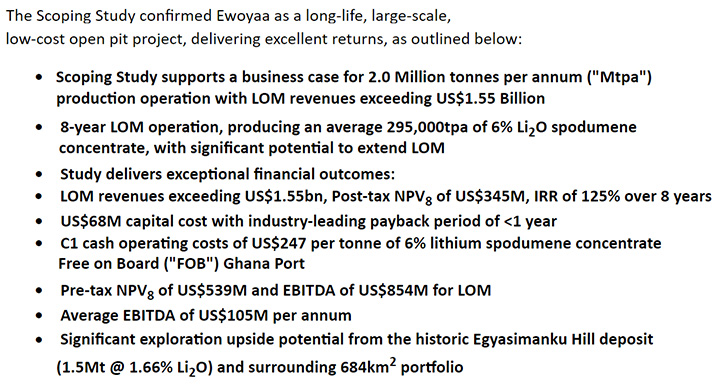

Vincent Mascolo: Of course. Our Cape Coast Lithium portfolio, and in particular, the Ewoyaa l Lithium Project Is rather unique. I think that's what Piedmont saw in the project. Operationally, its proximity to operational infrastructure is second to none, not only in Africa, but almost globally.

We are ideally located, less than a hundred kilometers from the capital of Ghana, Accra. We are one kilometer from the national highway. We are just 110 kilometers from the deep seaport of Takoradi. We have multiple high-voltage power lines, running adjacent to our site. Very few, projects can boast and leverage these exceptional operational infrastructure characteristics.

Apart from that, we also have exceptional geology and metallurgy, which suggests, we have a very simple processing flow sheet. That's why our Capex number is so low. It's because of our simple metallurgy and geology and our exceptional proximity to operational infrastructure.

Piedmont had the vision to take this project on. They were on site for six, seven days, and I had the foresight to see that if they didn't take this project, someone else would. We are very pleased and excited to be partnering with Piedmont Lithium, who because of their investment, will earn a right to own 50% of the Cape Coast Lithium portfolio and earn a right to 50% of the lithium concentrate that is produced.

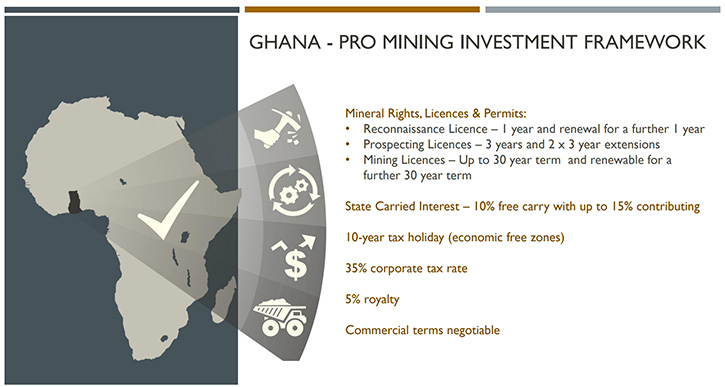

Dr. Allen Alper: Well. That's really excellent news! That's really fantastic! Now Ghana is well-known for its gold mining and being a very proactive mining jurisdiction. Maybe you could say a few words on how you find operating in Ghana.

Vincent Mascolo: Ghana's a great place to operate. They have a hundred-year mining history, so they know what mining is all about. And as you correctly stated, it's predominantly a gold focused country. That really works in our favor, as the mineral resource sector, in Ghana, is very much focused on diversifying the mineral resource sector above and beyond just gold.

What that means for IronRidge is that we are going to get the full support of the Government to bring this project into development. This is an opportunity for Ghana to become the first West African lithium producer. Being a very proud nation, with a hundred-year mining history, I'm positive that they are going to be supporting us, to the fullest extent, to get this project into development as quickly as possible.

Dr. Allen Alper: Oh, that sounds excellent. Would you like to discuss any of your other projects?

Vincent Mascolo: Our business model was to hedge our downside risk, against jurisdiction, and commodity. We deployed a strategy to become a multi commodity, multi-jurisdictional explorer. We've now delivered on our lithium project, so it's fully funded. We retain 50% of the opportunity, which means we get 50% of the product, 50% of the revenues that come from that, which is significant.

The forecast of revenues, at our current resource level, is around 1.55 billion US dollars. So, we're capturing at least half of that on the current resource and revenues are growing faster than expected. We have commercialized our first green field discovery project, which we started four or five years ago. It is now fully funded to production.

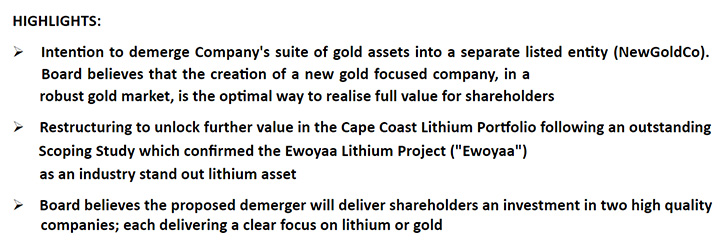

On the back of that, we've announced, just over a month ago, our intention to de-merge our gold assets. So now that we have the lithium project fully funded, we're fully focused on delivering an independent Gold Company. And I believe, with our current suite of assets, we will be able to deliver again, in Cote d'Ivoire and Chad in the next 6 to 12 months.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell us a little bit about those gold projects?

Vincent Mascolo: We have a flagship gold project in Cote d'Ivoire, it's called Zaranou. This is effectively how we'll deliver the right valuation for our gold portfolio demerger. It has the potential to be a very significant gold project in Cote d'Ivoire. We also have two other regional gold portfolios, the Kineta portfolio in the Northeast, and then our Vavoua portfolio in the Central west, which encompasses the Abujar three-million-plus-ounce resource.

And then in Chad, which is our longer-term strategy, with first mover advantage, we have a spectacular project, called Dorothe. Which will be getting back into country, after the wet season. We have a very extensive gold portfolio, through Cote d'Ivoire and Chad, two flagship projects. Zaranou in Cote d’Ivoire will underpin the valuation of our IPO with additional exploration activities, across the broader portfolios. And in Chad, our Dorothe Project, we also have a very significant walkout target, as part of our longer-term-lead project.

Dr. Allen Alper: That sounds excellent, Vincent! Could you highlight the primary reasons our readers/investors should consider investing in the IronRidge Resources?

Vincent Mascolo: Certainly. IronRidge has delivered what it promised to deliver four or five years ago, a project that would ultimately be fully funded to production. So, we've done that in the lithium space. We've managed to secure an ideal partner, Piedmont lithium, with strong initiatives and vision to become America's number one lithium hydroxide producer. They already have significant inroads in all American auto industries. They have secured a strong relationship with Tesla, and we think our project is going to be key to delivering on their objectives in North Carolina.

I strongly believe that with our lithium project alone, at the moment, we are significantly undervalued. And as part of the de-merger, there will be incentives for existing shareholders, in IronRidge's lithium, to carry forward into Cote d'Ivoire and Chad. So, we're delivering a project, fully funded to Production. We expect we're going to do exactly the same, with our suite of gold assets across Cote d'Ivoire and Chad, in the next 6 to 12 months.

Dr. Allen Alper: That sounds excellent. Those are great reasons for our readers/investors to consider investing in IronRidge, a Company that is making good on their promises, has a great lithium project, and also outstanding gold projects, so that's excellent. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.ironridgeresources.com.au/

Vincent Mascolo (Chief Executive Officer)

Tel: +61 2 8072 0640

|

|