Gold’n Futures Mineral Corp. (CSE: FUTR) (FSE: G6M) (OTC: GFTRF): Advancing Flagship Hercules High-Grade Gold Project, Northeast of Thunder Bay, Ont.; Stephen Wilkinson, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/23/2021

Stephen Wilkinson, President and CEO of Gold'n Futures Mineral Corp. catches us up and reviews steps needed to revitalize the Hercules Gold Project. Gold’n Futures Mineral Corp. (CSE: FUTR) (FSE: G6M) (OTC: GFTRF) is a Canadian based, exploration company, advancing its flagship Hercules Gold Project. The Hercules Gold Project is a well-known, high-grade gold project, located 120 kilometres northeast of Thunder Bay, Ont., in the townships of Elmhirst and Rickaby, within the Thunder Bay North Mining District, in the heart of the Beardmore – Geraldton gold mining camp. Their other advanced gold asset is the Brady Gold Property that consists of an advanced project, within a 950 ha claim group, in the highly prospective Gander Zone in the central region of Newfoundland.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Stephen Wilkinson, who is President and CEO of Gold'n Futures Mineral Corp. Hi, Steve. I know you've been doing some exciting things in the last few weeks. I wonder if you could give our readers/investors an overview of your Company, what differentiates you, your exciting projects and what you plan to work on?

Gold'n Futures Mineral Corp.

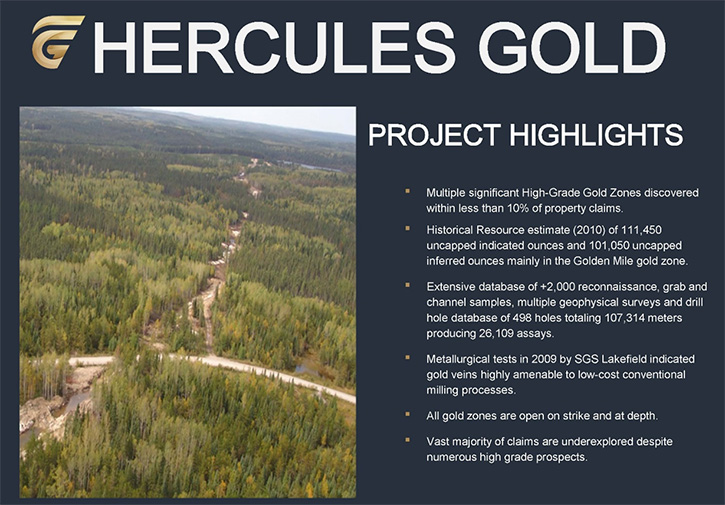

Stephen Wilkinson: Well, thank you, Allen. As always, it's a pleasure to be able to speak with you and your readers/investors. Gold'n Futures Mineral Corp. is a relatively new Company. I was asked to take the helm at the end of March of this year, and I thought, "Well, considering its fine assets, it would be great to be able to take the challenge on, despite this market. Gold'n Futures is new. It got down to starting business in October of 2020, when it signed its flagship option agreement for the Hercules Property in Northern Ontario. Hercules is pretty spectacular! It's a pretty well-known exploration property, having been denoted the Discovery of the Year in 2008, when the predecessor on the property, Kodiak, was actively exploring the very high-grade veins that they had discovered on the property.

What we've inherited with this property now, some 12 years later, is a modest mineral resource of about 220,000 ounces, grading above seven grams per tonne, and that's a global resource. There are about 500 or more drill holes that we have records for. There are about 2,000 channel samples on vein exposures. We're putting all of this, what was discontinuous information, into one large database, which will ultimately feed into a property-wide model. That's what our gang is working on right now, making a three-dimensional picture of the property, so we can study it and know where to look in the next rounds.

Dr. Allen Alper: That sounds very good. Sounds like a great plan in a great region for exploration.

Stephen Wilkinson: I'm glad you mentioned that because just 40 kilometers to the east of us, in the same Beardmore-Geraldton Greenstone belt, is the Greenstone Hardrock mining development, just south of the town of Geraldton, another old mining camp, where a mineable resource of about five and a half million ounces is being developed. Considering that that's being taken from developments around two or three old past-producers, it gives me a lot of encouragement that this belt holds the potential for a lot of large tonnage, a large number of ounces.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your plans for your newly acquired Newfoundland property?

Stephen Wilkinson: Well, very much so. We have two advanced properties in Newfoundland. The smaller of the two was first acquired in Newfoundland by the previous Management here at Gold'n Futures, it's called the Brady Gold Project. It was just a small hundred-hectare property, but it hosted about a 10 million tonne, 175,000 ounce resource in a low-grade, intrusion-hosted deposit and it was open on all sides. I've arranged to option the ground around that, that Brady Gold Project, and we've expanded the property now to 950 hectares. That gives us enough room to be looking for a very large-tonnage, low-grade bulk mining scenario deposit.

We have great starting ground there. We'll be doing work similar to what we're doing in the Hercules. We'll be upgrading all the resource information that we have that's been developed on that property over the years, and then of course looking for the next places to be drilling. And while we're doing that, we're going to be doing a lot of geological work and prospecting on strike from the Reid Gold Zone. I'm pretty certain that historically there have been occurrences. We'll do drill targets also along strike, so we're going to be very busy on that property, our most recent acquisition.

Dr. Allen Alper: That sounds very exciting. It sounds like 2021 will be a very interesting time for your stakeholders and shareholders.

Stephen Wilkinson: Well, there'll be a lot of news that will come out as we move forward here. There's no doubt about it, with basically a major project underway in Ontario, a developing project in Newfoundland, and of course the third property is the Handcamp Gold Silver Property, and that one is another huge property. It's more than 16,000 hectares, covers about 30 kilometers of volcanic belt strike length and within that belt, the Buchans Belt, where it's located is the historic Buchans Mine, which was one of the richest mines in North America for much of its life. And that mine actually being looked at to be revitalized, based on a low-grade zone, which is actually a very attractive development, within the Buchans Property. So I think we have pedigree in our Handcamp Property. We have defined zones that need to be followed up on, but with 32 kilometers of strike length, we have a great piece of geography to be tested, as we go forward. Probably we'll be active for, I would say at least three, four years on each of these properties that we're talking about.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like you'll be having an exciting time, an enjoyable time, exploring with great properties.

Stephen Wilkinson: Well, I think you and I have seen this before, Allen, where it's exactly right. You start with a very strong beginning and more than likely you'll end up with a very strong finish. And I have great expectations for each of our properties to be developing resource ounces. And of course, when a junior holds resource ounces, it gets the recognition in the marketplace for valuation at that point, too.

Dr. Allen Alper: Well, that sounds excellent. Steve, could you tell our readers/investors about your background, your Team and your Board?

Stephen Wilkinson: Absolutely. We are a fairly compact group. You and I, Al, go back many years. I started my career in 1972, working as basically a laborer with Bethlehem Copper Corporation. And I was so intrigued with mining that I went back to university, and got my first degree in 1976 in geology. I got my master's degree a few years later in 1981. And then in 1995, I obtained from Clarkson College in Potsdam, New York, my M.B.A. in Finance and Marketing.

In terms of work experience, I have literally worked as everything from a staker through sampler, geologist, mapper, government geologist to running a little gold mine in the Beardmore-Geraldton camp, called the Northern Empire, and that happened through 1985 to 1991. In addition to that, after I ran the mine in Beardmore, I became a gold analyst and ended my career as an analyst in 2000, having worked with Dominion Securities, as their small cap gold analyst. Subsequent to that, I took on the reins of a Company called Northern Orion. And Northern Orion was an Argentinian-focused exploration and development Company. Its primary asset was the Agua Rica deposit, in Catamarca Province. That Company we rebuilt, from basically ashes, to ultimately being sold for about US$800 million, at the end of the day.

After Northern Orion, I worked internationally for a few companies, gaining more experience working in Eastern Europe, throughout South America and throughout North America. And now, as I'm getting towards the twilight of my career, I'm concentrating on Canadian assets and that's what brought me to be so intrigued with Gold'n Futures and to accept the position as President here.

Dr. Allen Alper: You have a great background, great experience and a great career. So that's something to be very proud of, Steve.

Stephen Wilkinson: Well, thank you very much, Al. I am, and I've had the opportunity to meet some very great people in the mining industry. They've taught me very well, the proper way to do things in the industry, and to go out and do promotions, to raise money for the work. You want to be focused on aligning yourself entirely with your shareholders. And that's what I do, what I am doing and that's what I'm intending to do here on this, let's call it my twilight project.

Our lead geologist is Walter Hanych. He's a professional geologist. He has a similar lengthy career. He's worked on projects throughout the world for juniors and majors. He's very, very astutely handling all of the technical work and directing all the programs that we've had to date. He is responsible for designing much of our exploration programs. And of course, he and I do teamwork in writing our news releases, which is very important to make sure that we have good, accurate news going out. And my job is to make sure it is disseminated. So that's Walter.

The rest of our Board is made up of people, with many years of experience. They are actually longstanding Managers, within the industry and the person most associated with me, on the Management side, is Matt Fish. Matt is a lawyer. He has his own firm in Toronto, specializing in securities, and he also acts as our Treasurer. It's the three of us that are working on a day-to-day basis, to get this Company moving forward, at this point. As we grow, I'm actively looking for qualified people to join our Team. And we will be growing it and we will be able to actually expand our activities as we grow.

Dr. Allen Alper: Well, that sounds excellent. Steve, could you tell our readers/investors a little bit about your share and capital structure?

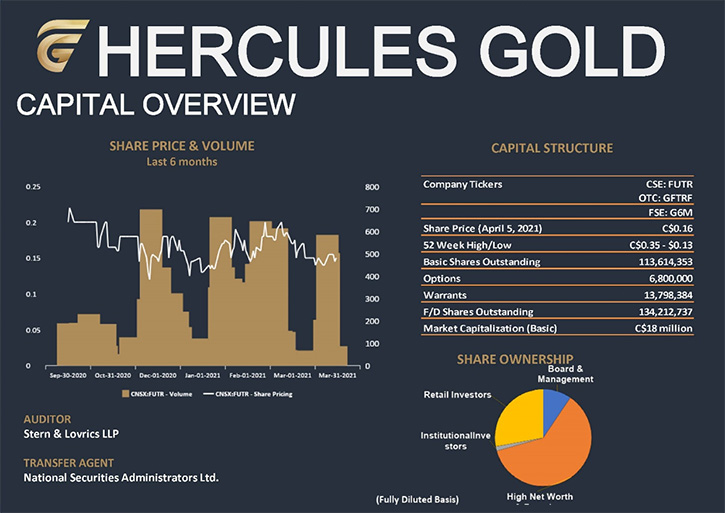

Stephen Wilkinson: Yes, I can. Certainly, one of the things that we do have here is a fairly compact structure, fully diluted. I believe we have about 134 million shares outstanding. Almost two-thirds of those shares are in the hands of Management, Board and the Founders of the Company. Around about a high 30%, maybe 40% of the Company is public float. And that of course, is traded fairly actively on the Canadian Securities Exchange, the CSE, on the Frankfurt Exchange and also over the counter in the States.

Dr. Allen Alper: Oh, it sounds excellent! Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Stephen Wilkinson: Oh, to me that's simple. First and foremost is the upside that I believe we're building on our Company here. It's not just based on blue sky. It's being based on the expansion of known resources. Right? If you consider that we have a global resource in the Company right now, almost 400,000 ounces of resources, if you compare us with other junior Canadian companies that do have in-the-ground resources, such as we do, you can be paid about, let's say somewhere between say $40 and $150 per ounce, based on the quality of those ounces. When I say quality of your ounces, are those ounces low-grade and deep? Or are they high-grade at surface? Well, ours are right there. They're high-grade for the most part and at surface. Even our Brady Zone is not a blind zone. It actually comes right to surface.

So, I anticipate we should be able to get at least the average of the valuation, which would give us somewhere in the range of about a $40 million market cap, not the $13 or $14 million that we have right now. The first step for looking at us is not only as an investment, but also a longer term investment.

Dr. Allen Alper: Well, that sounds like very good reasons to consider investing in your Company. Is there anything else you'd like to add, Steve?

Stephen Wilkinson: I am working to deliver to our shareholders a very good, top-tier grade mineralization and resources from the Hercules, in very short order. We have excellent support. We can work there year around. Once we finish our database, we'll have an absolutely perfect compilation that we can build on day in and day out. And that's what I'm going to be working to deliver on. I see the Hercules property as being initially a big zone of probably open-pittable mineralization. Our news we put out very recently, talks about our Area A, being a bulk mining tonnage scenario, but following along, as we mine the high-grade zones, and we have very high-grade zones, continuous strike length, in the order of greater than 20 grams per tonne, over about 1,200 feet or 400 meters long. These zones are spectacular! They'll add up to ounces very quickly, as we drill them and follow them below surface, and also discover new ones, because all of the mineralization on the Hercules, only occupies about 5% of the property area. Out of the 95%, there are lots of gold showings and I feel very confident we'll have brand new zones, so we'll be building up multiple zones for a very decent mining property.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like a great opportunity for your shareholders and I am glad to see that Management has skin in the game and is aligned with investors.

Stephen Wilkinson: Absolutely, Al, and we wouldn't have it any other way.

Dr. Allen Alper: I am very impressed with what you are doing! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

GOLD’N FUTURES MINERAL CORP

789 West Pender St., Suite 810

Vancouver, BC V6C 1H2

604-687-2038

Email: contact@goldnfutures.com

Twitter: @GoldnFutures

https://www.goldnfuturesmineralcorp.com/

|

|