Magna Terra Minerals Inc. (TSXV: MTT): Owns Three District-Scale, Advanced Gold Exploration Projects, World Class Mining Jurisdictions, New Brunswick, Newfoundland and Labrador; Lewis Lawrick, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/23/2021

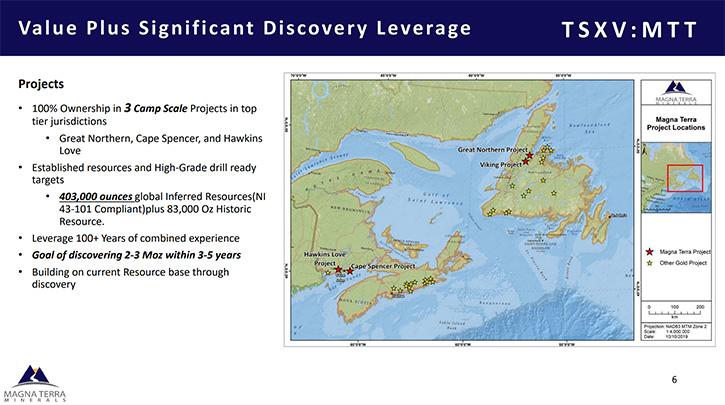

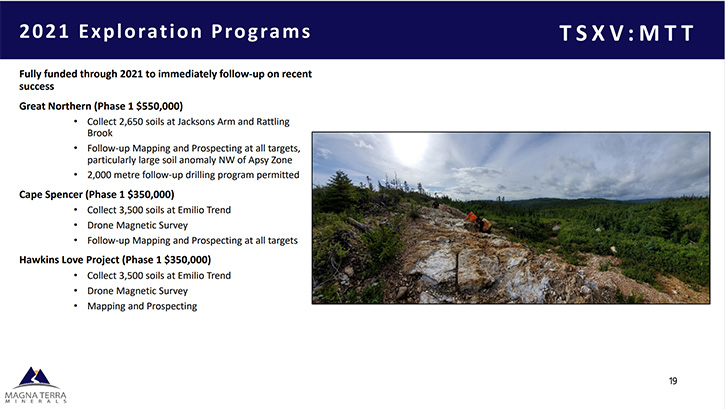

We spoke with Lewis Lawrick, President, CEO and Director of Magna Terra Minerals Inc. (TSXV: MTT). Magna Terra owns three district-scale, advanced gold exploration projects, in the world class mining jurisdictions of New Brunswick, Newfoundland and Labrador. In the summer of 2020, the Company acquired a portfolio including two district-scale gold exploration assets from their Sister Company, Anaconda Mining, and raised almost $5 million. They added a third district scale project, via an option agreement, to acquire 100% in the early fall. Two of the projects have established resources on large structural fault systems, within the Appalachian gold region. According to Mr. Lawrick, each-one, of the three potential Company-maker projects, can be a host to a standalone gold discovery. Anaconda Mining is a 27% shareholder of Magna Terra and Magna Terra utilizes Anaconda’s experienced Technical Team to help plan, execute and manage its exploration programs.

Magna Terra Minerals Inc.

Dr. Allen Alper: Hi, Lewis. This is Al Alper. I’m looking forward to talking with you about Magna Terra Minerals. Sounds like it's an excellent Company, in a great area for gold discovery. So, it sounds like you're going to do it once again. I'm looking forward to talking with you. We will post this interview on Metals News, Facebook, Twitter and LinkedIn.

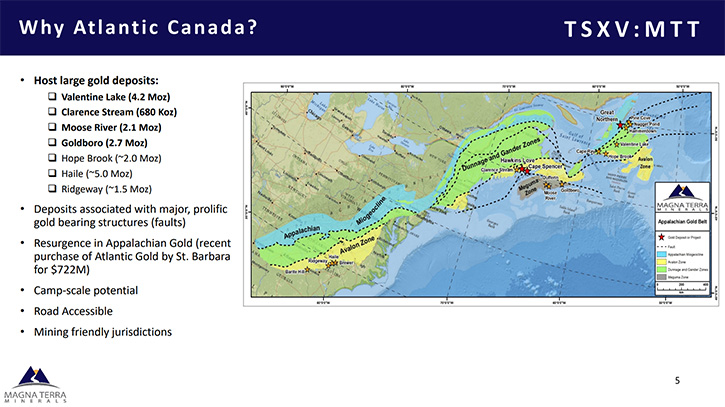

Lewis Lawrick: Okay, that sounds great, Allen. I'm looking forward to our chat, as well and giving you a more detailed view on our Company and our prospects. I think you hit the nail on the head. Where we have our projects, is a very exciting and hot region right now. Certainly, a lot of eyeballs, not only from the investment community, but also within the professional mining and exploration community, specifically precious metals as well, are focused on Atlantic Canada, not just in Newfoundland, but Nova Scotia and New Brunswick. There are a lot of companies doing exciting things and we hope to be one of them as well.

Dr. Allen Alper: That's great! You did a great job with Anaconda and now it looks like you have another opportunity to do it with Magna Terra Minerals.

Lewis Lawrick: Well, that's the idea, and I'm glad you referenced Anaconda, because it's an important component of the Magna Terra story. Effectively sister companies, as a result of my long affiliation with Anaconda, having been the founder of that Company back in 2007, and having been the CEO, the Chairman, and an ongoing Director now for almost 15 years.

Dr. Allen Alper: That's great, Lew. Could you tell our readers/investors what differentiates Magna Terra Minerals from others?

Lewis Lawrick: Absolutely. Magna Terra, by way of our foray into Atlantic Canada, we're a very young company in that region. But our Team, which is effectively the Anaconda Team, has been there for 15 years, so we know the lay of the land very, very well. We acquired a portfolio of assets from Anaconda, back in the summer of 2020, and did a concurrent financing raise, just shy of five million bucks to get us started.

About the projects we acquired from Anaconda, a lot of people ask me, "Well, why did Anaconda sell these projects?" The simple answer is that Anaconda acquired the Goldboro Gold Project in Nova Scotia in 2017, via the acquisition of a junior company (Orex Exploration), and effectively committed its available resources to the advancement of that Project, leaving very little opportunity for its other exploration assets to get moved forward materially. Obviously it was the right decision, as Goldboro has been a great acquisition success, as the Team has moved it from a mostly inferred 500k oz deposit then, to almost three million ounces today, in combined measured, indicated and inferred resource ounces. Further, Anaconda just announced a very economically robust PEA for the development of Goldboro that will be followed up by a full Feasibility, before the end of this year.

That's been Anaconda's main focus, for the last four years, outside of their production operations in the Point Rousse area of Newfoundland. So there just was not time and resources available to materially advance other projects in the exploration portfolio. So we thought it was a good idea to spin those out, independently finance them so they could be moved along as well, and that's what we did. We acquired the projects last summer from Anaconda and in so doing, made Anaconda a large shareholder. Anaconda is a 27% shareholder of Magna Terra. We share office space, both in Toronto and in St. John's, Newfoundland with them. We share a Finance Team, Administration Team, and we have an agreement with them; a Management Services agreement. where we share costs and utilize the entire Anaconda Technical Team to execute on our exploration program.

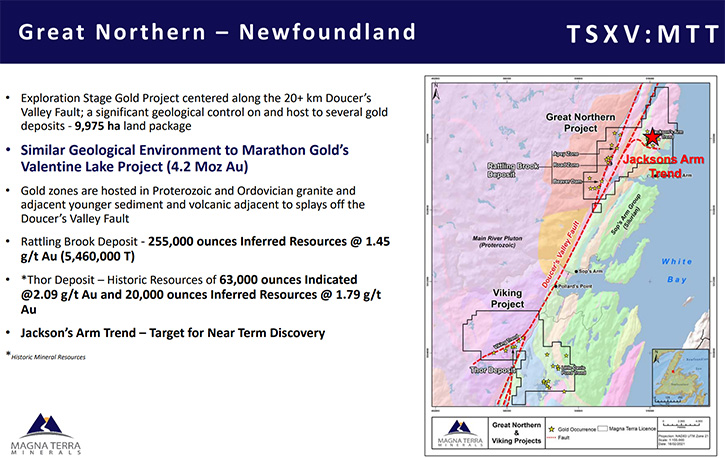

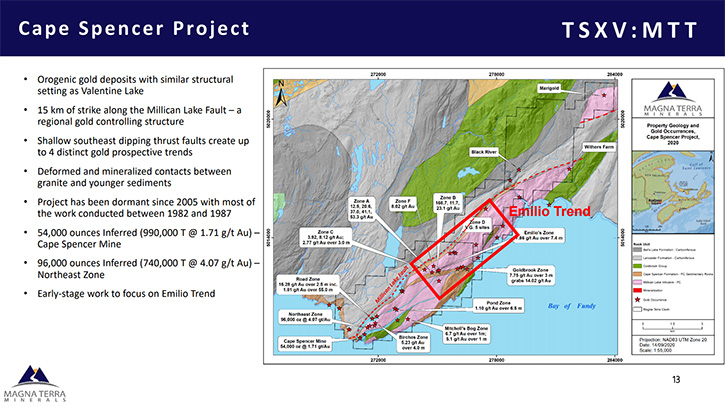

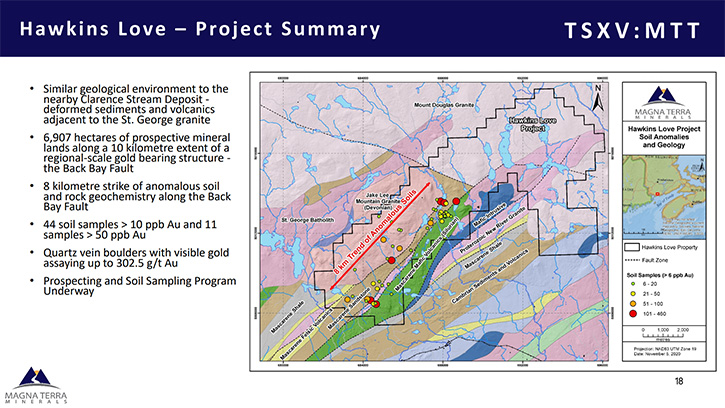

It is a great working relationship; Kevin Bullock (ANX CEO) and I have known and worked together for many years, and had a previous success, with a Company called Volta Resources, which was acquired by B2Gold. What do I feel is the highlight of Magna Terra? We have three, what I would call, regional scale projects. Two of which have established resources on large structural fault systems, within the Appalachian gold region. It's these large fault systems that basically are the geological controls for large orogenic deposits. So, we own three projects on these large fault systems, two in New Brunswick and one in central Newfoundland.

We have almost 500,000 ounces in both 43-101 compliant resources and historic resources, that live between two of those projects. We're anchored by existing gold deposition, which I think is very important. It gives your readers/investors and our shareholders confidence that we already have projects that have established discoveries and gold deposition. We know we're in a region and along gold-bearing structures, that have significant gold in the system, and I think that's a real highlight. Effectively, three potential company-maker projects, Each one of which can effectively be host to a standalone gold discovery. I think that's the highlight. You get three kicks at the can here, not one.

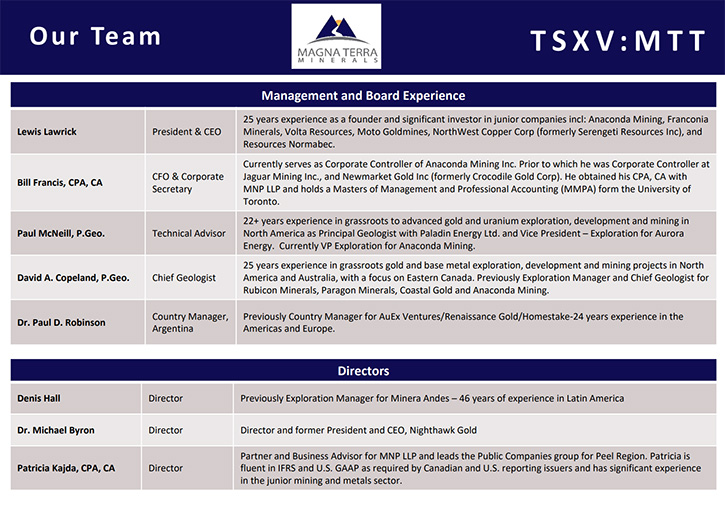

Dr. Allen Alper: Well, that's fantastic. That's really exciting. That's great news for your stakeholders and shareholders, so that's excellent. The experience you and your Team had, bringing Anaconda along, will be extremely valuable in bringing the new company along, Magna Terra Minerals. Could you tell our readers/investors, a little bit more about your Team?

Lewis Lawrick: Yes. The key focus, I can go on and on about everybody on our Team. Myself, my background purely, I started in this business, and continue in this business as a serial investor. I manage a private merchant bank that is effectively my investment capital, along with my longtime business partners' capital, and we've been investing in the junior mining space since the late '90s. We've had a number of successes. We've been involved in a number of successful companies, not only as founders, putting together Management Teams, putting together projects, financing, and we've had, I think now, six or seven successful exits, either by way of a corporate transaction or an asset transaction. So we have a pretty good track record.

Our Technical Team is headed by Dave Copeland and Paul McNeill, who basically have the same roles at Anaconda. They are true mine finders. They've been involved with a number of successful discoveries in Eastern Canada and the Atlantic region, obviously highlighted by the work that they've done to take Goldboro in Nova Scotia from a half a million ounce inferred resource to now almost three million ounces in MI&I categories. We believe that that number is going to grow. It's open. Goldboro remains open and it really is a world-class deposit. We have a very, very good Technical Team, with significant experience in the Atlantic Canada region.

Dr. Allen Alper: That's fantastic, and the Atlantic Canada region is a booming region. That's really a new gold rush.

Lewis Lawrick: I definitely agree with you, Al, and it's funny you say that. I've been there since 2006, 2007, when we established Anaconda, and we joke about this all the time. It's the overnight-success story that took 15 years. We've always believed in the geology. I think it's been, with the success that Atlantic Gold had and the subsequent sale to St. Barbara of Australia, for almost 800 million Canadian dollars; with the success that Marathon has had in the Valentine Lake gold camp, now up over 4 million ounces. The high grade discovery that NewFound Gold is advancing in central Newfoundland has certainly caught people’s attention. Galway Metals and their Clarence Stream project in New Brunswick. They're going to have a resource update on that project here, sometime in the third quarter, and that's going to be well over 2 million ounces in our estimation. That’s turned that part of southern New Brunswick into a new gold district as well.

Two of our projects are centered right in the heart of that region. Then, Anaconda's success is not only in Newfoundland, but in Nova Scotia with Goldboro. We've always thought the region was underexplored and misunderstood, and now people are starting to appreciate why we've been champions of the geology as long as we have.

Dr. Allen Alper: It's great that you and your Team had the vision you had and the courage to do all this investing and work in the early stages.

Lewis Lawrick: It certainly wasn't always easy, in this industry, as you well know, where we operate down in the deep end of the risk spectrum and the micro caps and so forth, the juniors, it is fraught with risk. But, when you have good people and you put them together, with good projects, and people, who know their way around the capital markets for financing, it's usually a recipe for success. You can do well with it. We have been successful and we believe with Magna Terra, we're going to be successful again.

Dr. Allen Alper: It sounds excellent. Lew, could you tell our readers/investors about your share and capital structure?

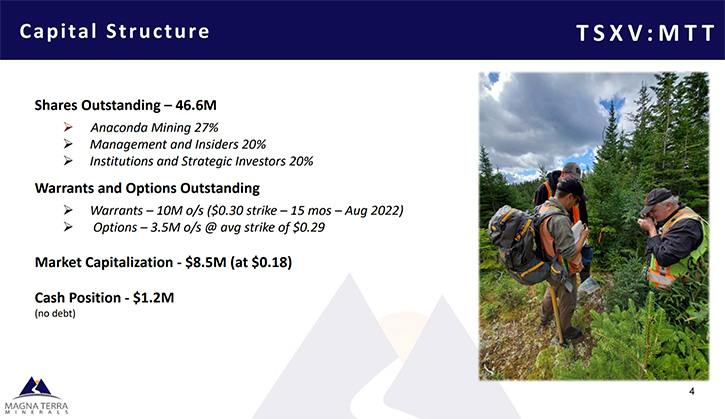

Lewis Lawrick: Absolutely. As part of our reboot of the Company last summer, we rolled it back on a seven for one basis issued, then issued the 12 million shares to Anaconda to give them 27% of the Company,+ in return for the project assets, and we completed the concurrent financing. Currently, we have about 47 million shares outstanding. From a junior's perspective, that's a pretty low cap number/tight structure, of which Anaconda has 27%. The Management/Insiders and the Board own about 20%, of which I have the largest percentage. I own, on a fully diluted basis, 15% of the Company. I might add, at a much higher cost than where we're trading now! So, I have plenty of skin in the game and I want it to be successful.

We have very good strategic/institutional shareholding components, some really key people that have invested in our companies and done well with us over the years and that represents about 20% of the outstanding as well. It's a very tight share structure with about 30% to 35% in an actual free trading float. In terms of warrants, we have 10 million warrants outstanding, at a price of 30 cents per share that were issued, with the financing we did last summer. They have a little over a year left to run and that's really it. Our option position is only at about 4% or 5% of what's on issue, so very manageable and for the most part at higher stock prices than where we're trading.

Dr. Allen Alper: That's great. It's great to see that the Board and Management and you have skin in the game, and you're aligned with shareholders for the success of the Company and you have confidence in what you're doing.

Lewis Lawrick: Well, I think that's the recipe. From my own perspective, Al, when I invest in companies, I don't invest in companies unless Management has a significant shareholding, because it's very difficult, if you're just working for a salary, to align yourself with your shareholders. You need to be an equity holder and you need to have written, real dollar checks to know what that's like. I think it's a really important component and one of the reasons we build our companies that way.

Dr. Allen Alper: That's fantastic. Could you tell our readers/investors, the primary reasons they should consider investing in Magna Terra Minerals?

Lewis Lawrick: There are three or four, what I think, are the most significant points. I think the people are very important. We have a great Team from top to bottom, with experience in the region, success in the region. We have a history of successful exits and creating value for shareholders. I think that's number one. Number two, the projects themselves. We have three projects, as I mentioned, that are all independently capable of hosting a standalone plus, million-ounce deposit. Two of those projects already have ounces in the ground, which I think is unusual for a junior. Having a half million ounces in metal inventory, in the ground, in compliant resources, with an $8 million market cap, that's probably reason number three. I think we're highly undervalued at this point. based on not only the metal inventory, the ounces in the ground, but the potential discovery catalyst upside, I guess you'd say, that is evident on all three projects.

Lastly, I'll point to the ownership structure. I think, because we have a tight float and a motivated group of shareholders and insiders, any discovery, there's a lot of upside price movement leverage.

Dr. Allen Alper: All those are great reasons for our readers/investors to consider investing in Magna Terra Minerals. Is there anything else Lew, that you'd like to add?

Lewis Lawrick: No, I think that's it. I think we've done a good job of covering the key points. I'll close by saying we focus on putting money in the ground. We run a very lean Company on a corporate basis. I'm a large shareholder, so I'm not taking out a big salary. I want to see my return in the shares I own, not necessarily in the salary I earn. We're excited about what we're doing and it's early days. We're not yet a year into this, with these projects. We think we're probably two years behind where Marathon was, Galway at Clarence Stream was, and Goldboro at Anaconda. Give us a couple of years, and I think you're going to see this Company, with a major deposit on one of these projects.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.magnaterraminerals.com/

Magna Terra Minerals Inc.

Lewis Lawrick

President and CEO, Director

647-478-5307

info@magnaterraminerals.com

|

|