Megado Gold Ltd. (ASX: MEG): High-Quality Gold Exploration Assets, Covering 511km2 in Ethiopia, Potential Gold Deposits of Significant Scale; Michael Gumbley, Managing Director and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/22/2021

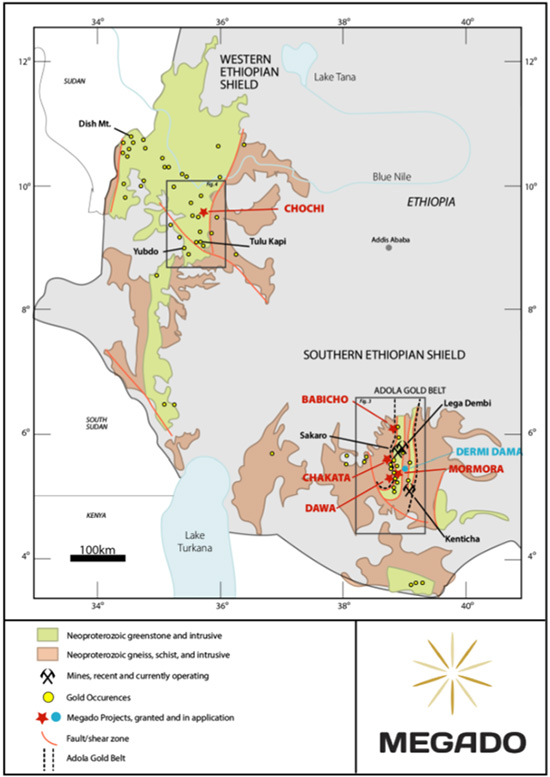

Michael Gumbley, who is Managing Director and CEO of Megado Gold Ltd. (ASX: MEG) gives us an update. Megado Gold has five high-quality gold exploration assets, covering 511km2 and one license application covering 227km2 in southern and western Ethiopia, with the geological potential to host gold deposits of significant scale. Megado’s flagship projects are Babicho and Chakata, where there was historical drilling and trenching work done. Megado has received the first series of extremely encouraging rock sample results, from its Chakata Gold Project. Megado recently completed its first drilling program at Chakata, peak rock results returned 15.55g/t Au, 5.10g/t Au, and3.73g/t Au.

Michael Gumbley commented “The initial high-grade gold in rock samples, bodes well for the ongoing drilling and trenching activities at the Chakata Gold Project. Significantly, the strong results have been returned from each of the three primary target areas, within Chakata, where Megado is active. Moreover, they reflect the value of the exploration program, designed by Megado’s Executive Director, Dr. Chris Bowden. This program mirrors the systematic approach Dr. Bowden previously employed, in western Ethiopia, to discover a gold deposit of over 1.5Moz. Over the next six months, the Company will continue to refine its Chakata targets. through continued application of Dr. Bowden’s program, with the goal of being able to define a JORC resource.”

Megado Gold Ltd

Dr. Allen Alper: This is Dr. Allen Alper. Editor-in-chief of Metals News, talking with Michael Gumbley, who is Managing Director and CEO of Megado Gold. Michael, could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

Michael Gumbley: Thank you, thanks so much for having me. A friend of mine and I established Megado Gold ourselves, just a couple of years ago, from scratch. He was asking me whether I knew anything about Ethiopia. For the last 20 odd years, I have been working in nonprofits across Africa and Asia. So, I had strong experience working in some of these countries. When he had this Ethiopian opportunity come across his desk, he asked me what I knew about Ethiopia. I love the place I go there a few times a year. At that point, we were spending about $20 million a year doing water projects there. So, we set up the Company and we found Dr. Chris Bowden, an Australian who lived and worked in Ethiopia for five years.

He had found a deposit and had made a discovery in Western Ethiopia of over one and a half million ounces. What differentiates us, is we have a Team, going into a Country that is relatively new to the junior mining space. There aren't a lot of international companies working there. We have a Team who has strong experience working in this Country and we've been able to reassemble his Team. His Team, with whom he worked in Western Ethiopia, has come and they like Chris, so they've come to work with us. We have a Team that's done it before in this country. We've basically been employing the same strategic playbook Chris used, to find that deposit in the west.

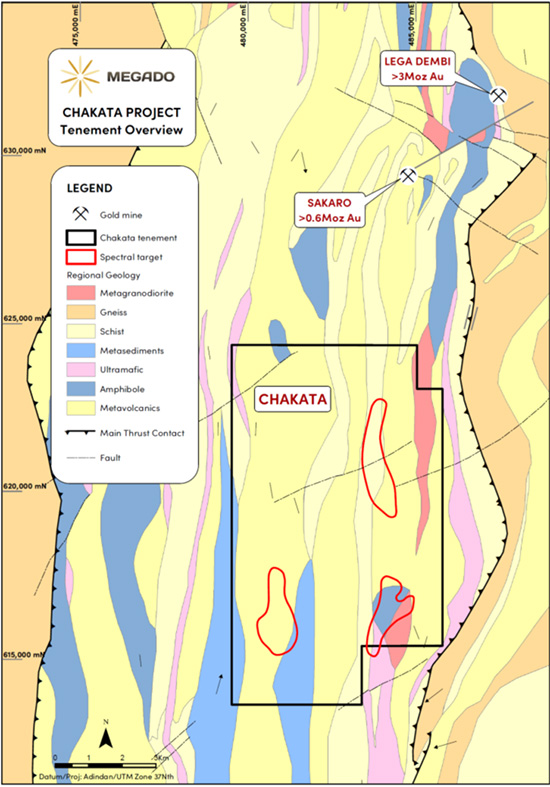

And what I mean by that is, he started with some satellite remote sensing technology to identify special targets. We used those to hand pick the land we have in the Adola Gold field, which is part of the Arabian Nubian shield. And once we were awarded that land, we had Chris's old Team go down there, to look at those targets. It just happened that 20 something years ago, an American Company was there, and that Company did substantial exploration work on a couple of our tenements. So, with all that information we listed, we were able to get that land, with those assets we listed on the Australian stock exchange in October last year, and we were able to start drilling, within a month. So again, what differentiates us is that we have a Team that's done this before in this Country, and we've been able to demonstrate that we're able to work there in pretty short shrift, since we listed on the stock exchange in October.

Dr. Allen Alper: Excellent!! Could you tell our readers/investors, your major plans for 2021 and 2022?

Michael Gumbley: We have two flagship projects, Babicho and Chakata. A lot of our focus has been there because those are the two where there was that historical drilling and trenching work. As an example, at Chakata there was a historical trench that returned 47 meters at one and a half grams gold. There was also some drilling there, highlighted by two meters at 11 grams. So, we have been focusing our attention on Chakata and Babicho. Over the next year to 18 months there will be a fairly continuous news flow on our exploration activities at Chakata. Chris's approach has been to start with remote sensing through the ground trenching.

At Chakata, right now, we have just finished our first drill program, it's a modest drill program, seven drill holes for just over 1200 meters. Visual mineralization has been intersected, copper, chalcopyrite and Bornite et cetera. Those first seven holes are now in various stages of the essay process, in the sense that Ethiopia doesn't have full scale laboratories, but they do have a laboratory, an ALS prep lab. So, the core is being prepped into pulp and then exported to ALS in Perth. We expect to get some of those early returns over the next couple of months. Then just a couple of hundred meters to the east, we have started a second drill program, and that is testing some of those historical results. We've been calling that the G2 prospect, because it's a granite diorite in this strong granite diorite area.

In the north of the tenement, we're halfway through a pretty extensive trenching program. We're excited about that because that area is just five kilometers south of the Sakuro Lega Dembi mines, the only two modern gold mines in Ethiopia, and they've produced more than 3 million ounces. We're right along strike from Lega Dembi and Sakuro. Geophysics has identified that that major structure runs straight through Chakata for about nine kilometers. Obviously, it's shown to be a structure that's capable of hosting significant gold deposits. That's Chakata! When asked, what are we doing over the next year? People will be hearing a lot about what we're doing at Chakata.

Part of the reason that remote sensing works in Ethiopia, is because Ethiopia was never colonized. So, you haven't had a whole lot of work that's been executed in Ethiopia, the way you might have in former French and British colonies, with geologists walking all over the place. So there hasn't been that same type of disturbance, which bodes well for us, in terms of being first movers in this highly prospective region, of the Arabian Nubian shield.

Dr. Allen Alper: Well, that sounds excellent. Sounds like there's great potential for exploration and discovery. Could you tell our readers/ investors a little bit about how it is operating in Ethiopia?

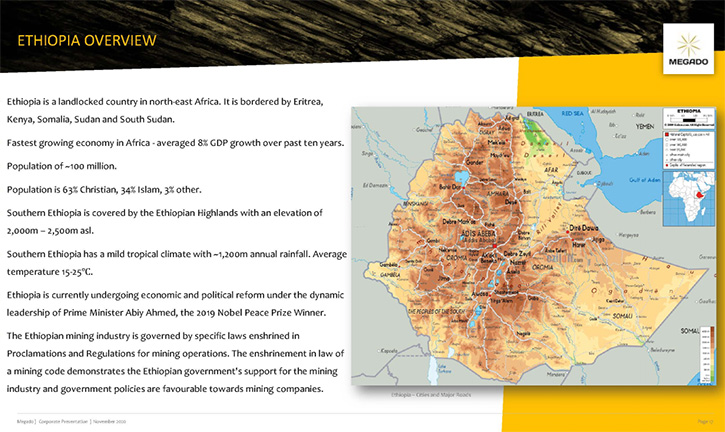

Michael Gumbley: I love the place, the status. Having worked all over Africa, Ethiopia is certainly a place where you can invest, with the confidence that you know your tenure is going to be respected and that your rights over that asset are going to be on it. I don't think that's the case across Africa, certainly that hasn't been my experience. So, I think working there, when Chris was there, it was called, Dish Mountain, that project in the west, and they spent more than $20 million. There was never a question of not honoring that tenure. I think Ethiopia is at a really important inflection point, in the sense that it's never been colonized. So, it doesn't really have a long history of European companies working there.

For most of the last 50, 60 years, it's really been a relatively closed economy, outside of a few national champions, like Ethiopian airlines and the coffee industry and the like, but it's been tightly held. And then since about 2018, that's all been turned on its head, by the current administration of Prime Minister Abbey, in the sense that they know that they have over a hundred million people to add that they need to get jobs and food for. So, they are aggressively following a pretty ambitious economic program of liberalizing finance, the finance sector just started, opening up telecoms, by awarding some of the spectral frequencies to, I think it's Vodafone just over the last couple of weeks. There's this massive dam, which is controversial, but it's more than a $4 billion investment.

Copper, granite, a $3 billion railroad going from ATIs to Djibouti and part of all that is that the government is actively investing in the country to improve infrastructure, to better those opportunities. Importantly, for us, mining is one of those strategic industries, because they know that they're standing on immense resources that have not been tapped. And so, they're extremely welcoming to companies like ours, because we are there, actively investing, actively working in these communities to get to identify some of these resources. Our success will likely breed more companies like us and that helps the economy overall to get more of those people to work, to get more activity from mining, which right now is found wanting.

Dr. Allen Alper: All right. Sounds excellent. Could you tell our readers/investors a little bit more about yourself, your Team and your Board?

Michael Gumbley: I've spent most of the last 20 years, living and working in Africa and Asia, on the operations side, building projects, nonprofit projects, mostly in water and agriculture and nutrition. In some of the tougher parts, I spent a lot of time in Congo and lived in Cote d'Ivoire, Nigeria, Pakistan, et cetera. So, my background has definitely included working and demonstrating the ability to operate in countries, such as that. Ethiopia is a dream compared to some of those countries. Dr. Chris Bowden, who's our technical lead, is the person, who devised the exploration strategy plan based on the work he has done in the past and where he's been extremely successful. The program, the deposit at dish mountain was a Virgin discovery.

He started that from scratch. He was walking into the wilderness to find these special targets, starting very much from ground zero. So, having him on our Team is instrumental to our success. He's done all this before, and it is extremely important that we've been able to mobilize his Team again. There were more than 15 Ethiopian geologists, who all worked with Chris in the past, and we have them in multiple teams, working in parallel, managing either the drilling section or the trenching section, or continuing ground-trenching, as we obviously still seek to identify genuine targets. So, having that experience next to TACE is critical to our success. We have a residential Exploration Manager, who will assume that position at the beginning of July and go to live in Ethiopia. So that's really the Team. Finally, our Chairman, Brad Drabsch, is also a gold expert. He had a project in Gabon, but mostly he's been in Western Australia.

Dr. Allen Alper: Well, it sounds very good. It's great to have an experienced Team that knows what they're doing in Ethiopia and has experience working in that environment.

Michael Gumbley: Yeah, yeah absolutely. I think, we would not have been able to progress as far as we have in a short amount of time. We're already onto our third drilling program. We're on our third trenching program. I think it's impossible to believe we would have been able to do that without having had this experienced Team ready to mobilize, as soon as we were re-listed, because especially, with coronavirus and travel being restricted, it's been absolutely critical to have this experienced team on site and ready to go from the outset.

Dr. Allen Alper: Sounds excellent! Michael, could you tell our readers/investors a little bit about your capital and share structure?

Michael Gumbley: Right now, we have about $4 million in the bank. We had an oversubscribed IPR at the end of October last year. We raised 6 million, current market cap is just over 11 million. We think that 4 million will get us through, into Q2 next year. It gives us the flexibility to continue executing the strategic plan, which would include what we expect to be some more drilling programs at Chakata, which will all be based on how these early results go. There are 71 and a half million shares on issue. Of those, the top 40 shareholders are pretty much almost 80% of the Company and that's Management and a couple of sophisticated institutional investors. It's almost all with management and friends and family as well.

Dr. Allen Alper: Oh, it's good to see Management have confidence in the company and is get into the game.

Michael Gumbley: Yeah. It's important. It's imperative!

Dr. Allen Alper: Michael, could you tell our readers/investors, the primary reasons they should consider investing in Megado Gold?

Michael Gumbley: I think the status we have, extremely prospective land, premium land holding of currently over 500 square kilometers, and we actually have the applications for more land.

We have premium land, in an extremely perspective area, in and around where a modern mine has produced more than 3 million ounces. And the land we have is directly along strike, from those mines and it hasn't been touched. So there is a lot of our seasonal activity there, but there's not really been the same kind of modern exploration that you've seen in the Burkina Faso and Cote d'Ivoire and Mali, or Western Australia, et cetera. Aside from those couple of small programs, in the late nineties, there hasn't really been anything, nobody's really explored it. We have a premium land packages that's been untouched in prospective areas. Second thing is we have a Team who's done it before. We have Chris leading it, who led this exact same team to find more than a million and a half ounces in the same Country, about 10 years ago. And because he likes the Country and because he likes the Team, he's come back to do it again for us. First thing is land. Second thing is our Team and third it's a Country that wants us there. They want us to be working in Ethiopia because again, they know that they have this, they know that they stand on the main slope that has been untouched. And the fourth thing is right now we have the cash to do it. We have the cash to be able to put this train in motion, to prove our thesis. And once that happens, we expect to be really well on the way to identifying a resource in 2022.

Dr. Allen Alper: That sounds excellent. That sounds like very strong reasons to consider investing in Megado Gold. Michael, is there anything else you'd like to add?

Michael Gumbley: We have the Team, we have the land, we have the cash, and we have the support. We have a detailed plan of how we're going to achieve this goal of identifying a resource. I think that rounds it out. We're really excited! We're very ambitious! We're also quietly confident that we're on track to really doing something special over there.

Dr. Allen Alper: Sounds excellent! Sounds like it's a great opportunity! It's in a region that has great goals and you'll have a great land position and great Team in place and you have the finances to move forward. So, that's a great position to be in. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Michael Gumbley

Managing Director and CEO

mgumbley@megadogold.com

+1 646 701 3034

Dr Chris Bowden

Executive Director

cbowden@megadogold.com

+61 439 109903

Mark Flynn

Investor Relations

mflynn@megadogold.com

+61 416 068733

|

|