Asante Gold Corporation (CSE: ASE, FRANKFURT:1A9, U.S.OTC: ASGOF): Exploring and Developing High-Quality Gold Projects in Ghana, Africa's Largest and Safest Gold Producer; Douglas MacQuarrie, President and CEO Interviewed.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/19/2021

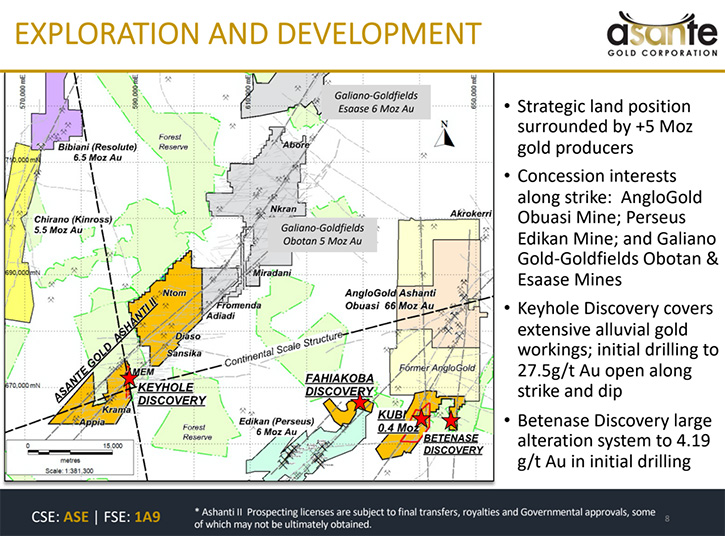

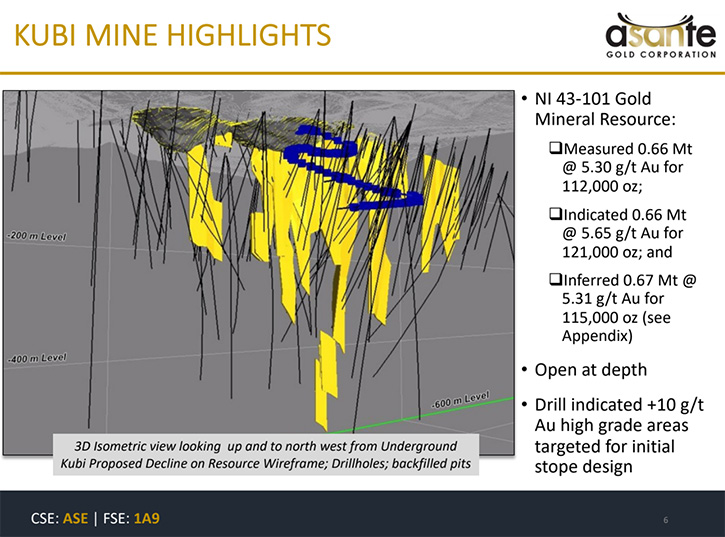

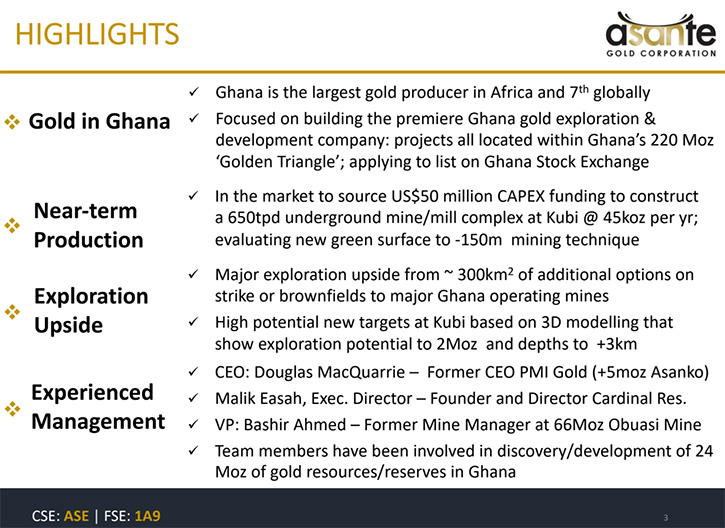

We spoke with Douglas MacQuarrie, President and CEO of Asante Gold Corporation (CSE:ASE, FRANKFURT:1A9, U.S.OTC:ASGOF), a junior gold exploration and development mining company, with a high-quality portfolio of projects in Ghana, Africa's largest and safest gold producer. Asante's flagship project is the Kubi Gold Mine, located next to and south of the 66 million-ounce (pre-mining resource) AngloGold Ashanti Obuasi mine. The project has a NI 43-101 Mineral Resource of measured 0.66 million tonnes @ 5.30 g/t Au for 112,000 oz, indicated 0.66 million tonnes @ 5.65 g/t Au for 121,000 oz, and inferred 0.67 million tonnes @ 5.31 g/t Au for 115,000 oz. Asante is sourcing funding to develop its Kubi Gold Mine project to production. In addition, Asante is exploring its Keyhole, Fahiakoba and Betanase concessions/options for new discoveries, all adjoining, or along strike of major gold mines near the center of Ghana’s Golden Triangle.

Asante Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Douglas R. MacQuarrie, President and CEO of Asante Gold Corporation. Douglas, I wonder if you could give our readers/investors an overview of your Company, what differentiates your Company, and talk about some of your exciting properties that you're exploring and going forward with.

Douglas R. MacQuarrie: Thanks, Allen. Asante Gold is involved in gold exploration and development in West Africa. We went public in 2012 and exclusively in Ghana, West Africa slowly building up our projects and our assets. Our lead project is Kubi, which has a NI 43-101 resource, and we're confident it can be a profitable producer. We're working towards raising the financing and doing the necessary studies to take it to production. That's our main focus. We also have many other high potential exploration concessions and recently raised CA$7 million in a private placement. We're fully funded to get aggressive on the exploration. Between Kubi, a development project and aggressive exploration, that's our story going forward here. We're looking for the next one or two-million-ounce discoveries. That's what we do.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit more about the Kubi Gold mine?

Douglas R. MacQuarrie: Kubi has been a known asset since the mid 1990’s. It's on the famous Ashanti Shear Zone that leads directly - 20 kilometers away – to the massive 66-million-ounce AngloGold Ashanti Obuasi Mine, which has been in production for more than 115 years. So, we're definitely in elephant country. We recently did a geophysical 3D inversion of the airborne magnetics, and it indicates that the mineralization at Kubi could extend down some three and a half kilometers deep. The resource has only really been drilled down to 400 meters, outlining a NI 43-101 resource of some 350,000 ounces, but we feel it has potential for a full two million ounces to 2,000 meters in depth. We have commenced a deep sounding EM survey and hope to soon outline some exciting drill targets at depth on Kubi and to transform it from a 350,000-ounce resource to something quite a bit bigger. That's our near-term focus at Kubi.

Dr. Allen Alper: Well, that's very exciting and sound. When do you think this will all take place, your exploration work?

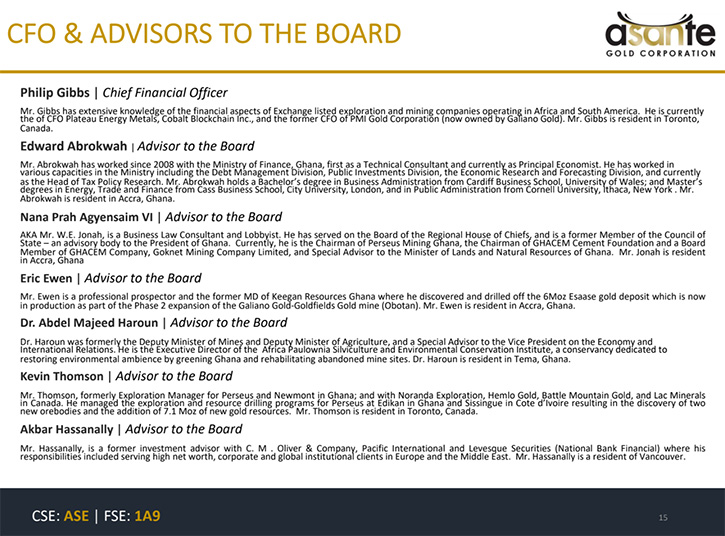

Douglas R. MacQuarrie: We're well-funded at the moment, Allen. We have our crews, our geophysicists and geologists hired. We have a couple of drills on site and we're just waiting for final transfer to us of some of the new land concessions, which we announced about a month ago. We intend to do quite a bit of ground and drone airborne geophysics to line up drill targets. So, I would hope by the third or fourth quarter of this year, we should be seriously into several drilling campaigns. My Team has found or drilled off some 24 million ounces of gold resources in Ghana, over the years. Our new Executive Director, Malik Easah, was a founder of Cardinal Resources – which was recently sold for $600milion. That's our focus – to develop Kubi to production and to find a couple of nice, big new ore bodies. That's our task and our goal.

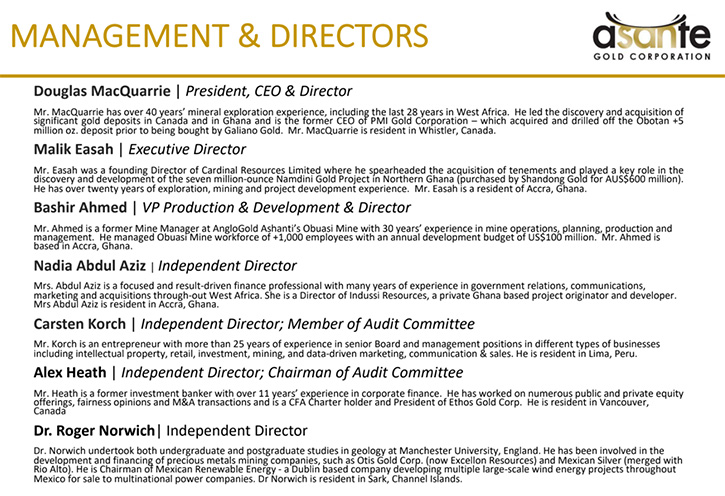

Dr. Allen Alper: Well, that sounds great. Douglas, could you tell our readers/investors a little bit about yourself, your Team and your Board?

Douglas R. MacQuarrie: I'm a geologist/geophysicist and have been working in West Africa for 28 years. And in that time, I was the former CEO of PMI Gold. There we put together 13 concessions on the Asankrangwa gold belt. It was bought out by Asanko Gold, which then changed its name to Galiano Gold. And Galiano Gold is now producing some 200,000 ounces a year. Asante currently have the southern part of the former PMI land, and we believe the exploration potential there is as good if not better than the northern part.

Re our TEAM - we've recently brought on Paul Abbott, an M.Sc. geologist. I've worked with Paul in Ghana for many years. He is credited with the discovery of the Cardinal Namdini ore body - a 7-million-ounce deposit in Northern Ghana. We have also recently welcomed Dave Anthony to join with us. He's a former COO of African Barrick and was responsible for development of three mines, in Tanzania. Our VP is Bashir Ahmed. He's the former Mine Manager of the Obuasi mine and an underground mining expert. His talents will come to play as we move Kubi to production.

Fred Akosah, is our Chief Geophysicist. Fred co-authored the book ‘Gold in Ghana’, the major reference book for all gold showings and mines in Ghana. A pretty talented team, for sure! We like finding gold, and Ghana is a great place to look. And now we have the money to finance it. And the strong backing of Ghanaian shareholders. It's the right combination. There are no guarantees, but we're going to give it our best to see if we can find the next big one.

Dr. Allen Alper: Well, it sounds like you and your team have excellent background, excellent record of discovery and you're well-positioned now to move the company forward and discover great big deposits.

Douglas R. MacQuarrie: That's the plan for sure. There's lots left to find. The easy stuff's all been found, Allen. Now we use a lot of geophysics and we look deeper. And so I think it gives us a bit of a leg up on a lot of the other competition.

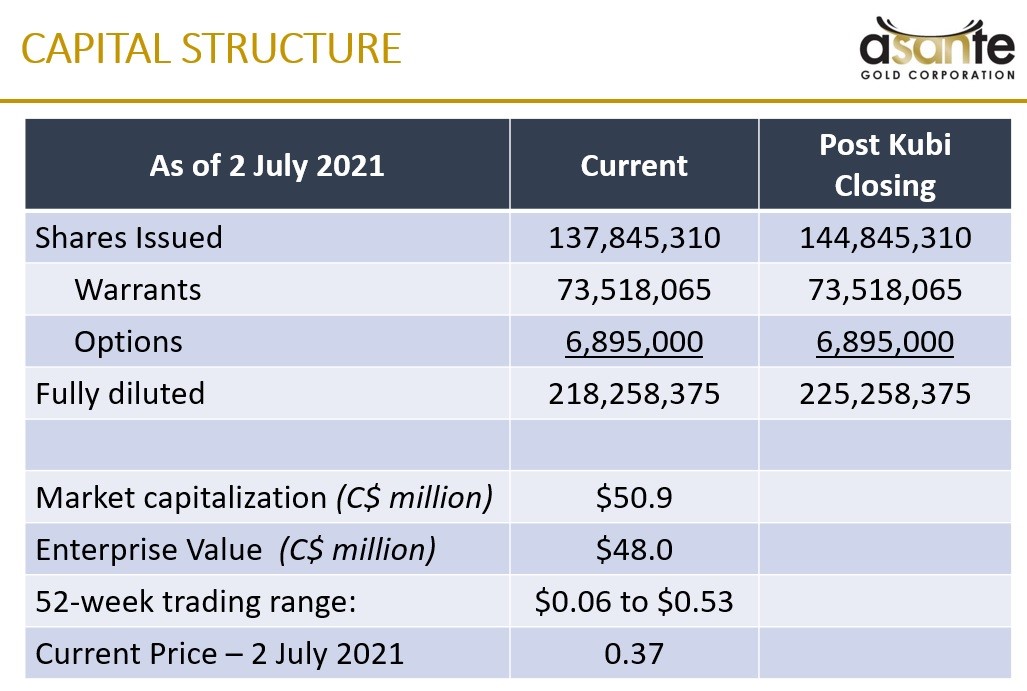

Dr. Allen Alper: Oh, that sounds great. Doug, could you tell our readers and investors a little bit about your share and capital structure?

Douglas R. MacQuarrie: We have 137.8 million shares issued, 73 million warrants and 7 million options, all of which are in the money. The majority of the warrants are related to the recent CA$7 million private placement. Our 52-week low was $0.06 about a year ago and we're currently $0.37. That's a pretty nice increase in market cap for our shareholders. We're very excited.

Dr. Allen Alper: That's fantastic.

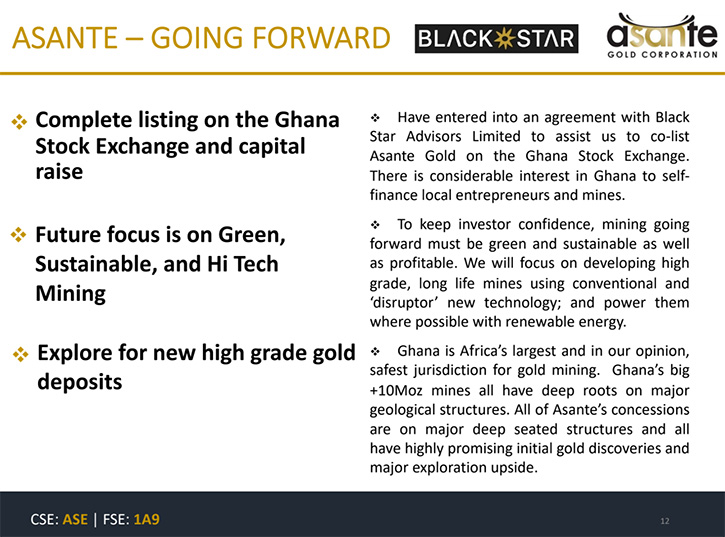

Douglas R. MacQuarrie: We're also really excited about the next up phase in our current bull gold market. We think gold and hard assets are the place to be at the moment. A lot of inflation coming into the system and it's only a matter of time until gold revalues up. With our current assets and a country like Ghana where there's lots of gold yet to find, I think there's just huge upside. I am one of the largest shareholders in the company, and I'm really happy to be in that position. So yes, let's just keep working to bring new assets into the company, to drill them off, and then develop production if and when warranted.

Dr. Allen Alper: Oh, that sounds great. Could you highlight the primary reasons why our readers and investors should consider investing in Asante Gold Corporation?

Douglas R. MacQuarrie: Yes Allen, the simple answer is you've got to follow people who have had success in the business, ones who are clearly committed with their funds and are doing what they like to do. We started Asante in 2012, here it is 2021. During a lot of that time, we were just building assets. We didn't have much cash and so the shares were largely ignored by the market place, and just a $3 million market cap, but that didn't stop us from developing the business. We just kept trucking, adding good people, and more assets. Sooner or later a team that is committed, in a country that permits outside investment and is rich in gold deposits like Ghana, it's just a matter of time until they succeed.

And what is to succeed? Well, there are companies with, what I would call, not that fantastic assets that are trading at $100 million market cap. We have a long way to go before we hit $100 million, and a lot of good exploration land that already has discovery holes on it. It's not like we were sitting around doing nothing for the last eight years. Over those years, we raised a little bit of money and drilled a few holes.

Now, we have three properties, with new discoveries already - that we can't wait to get back onto to and get aggressive with the drill. So, yes, it's a two or three year play here to see if our ideas work out and we can get production and that new discovery.

Dr. Allen Alper: Well, those sound like excellent reasons for our readers/investors to consider an investment in Asante Gold Corporation. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.asantegold.com/

Douglas MacQuarrie

President and CEO

tel: +1 604-558-1134

E-mail: douglas@asantegold.com

|

|