Kamoa Copper S.A.: Joint Venture Between Ivanhoe Mines, Zijin Mining Group, Crystal River, and the Government of the DRC; Olivier Binyingo, Board Member Interviewed.

|

By Allen Alper Jr., CEO and Senior Editor

on 6/24/2021

As the operating company of a joint venture between Ivanhoe Mines, Zijin Mining Group, Crystal River, and the Government of the Democratic Republic of Congo (DRC), Kamoa Copper S.A. is developing the Kamoa-Kakula Copper Mine. We learned from Olivier Binyingo, a member of the Kamoa Copper Board, that the Kamoa-Kakula Copper Mine is the most significant mining project, coming on stream, in the DRC. Production at this very large, high-grade deposit began on May 25, 2021, and the initial capacity of around 200 thousand tonnes of copper is expected to double next year. In the long term, the Company plans to produce up to 800 thousand tonnes per annum, making Kamoa-Kakula Copper Mine the second biggest copper mine in the world.

The Kamoa-Kakula Copper Mine, in the Democratic Republic of Congo (DRC)

Al Alper, Jr.:

This is Allen Alper, Jr., President of Metals News. I am interviewing Olivier Binyingo, who is a Board member at Kamoa Copper S.A.

Olivier, thank you for joining me. Could you tell us more about Kamoa Copper and what differentiates you from other mining companies?

Olivier Binyingo:Kamoa Copper is in a joint venture (JV), with the DRC government, which owns a direct 20% stake. This JV model differentiates us from historical mining projects in the DRC, in which the government would have typically held its stake indirectly, through a state-owned mining company, rather than as a direct partner. The remaining 80% of Kamoa Copper is held by Kamoa Holdings, itself, in essence, a 50/50 joint venture between Ivanhoe Mines and Zijin Mining.

This new mining operation is one of the most significant projects in the DRC. We will be mining copper exclusively, rather than copper and cobalt as is often the case with copper projects in the DRC.

Another differentiator is the sheer size of the deposit; equally, the extremely high-grades of the resource will set us apart. It's really a perfect combination, in terms of both size and grades, where often you find one without the other.

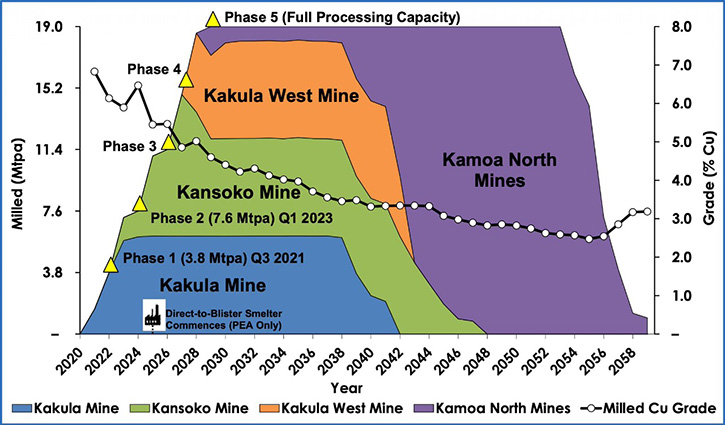

We are very close to finalizing phase one, which essentially means the start of commercial copper concentrate production. This will happen towards the end of May or early June. The concentrator plant has a capacity of 3.8 million tonnes of ore per year, producing around 200 thousand tonnes of contained copper. Phase two, which should be finalized next year, will double the capacity of the plant to 7.6 million tonnes per year, or approximately 400 thousand tonnes of contained copper.

Once the project is fully developed as conceived, we will have a processing capacity of some 19 million tonnes of ore per annum – enough to establish Kamoa Copper as not only the largest copper mine in the DRC, but also one of the largest in the world. Once this whole district of mines has been developed to its full potential, it will be second only to Escondida in Chile.

Al Alper, Jr.:

Could you tell us more about the deposit?

Olivier Binyingo:

With an average grade of close to 6% copper, we are looking at an exceptionally high-grade deposit over the first 10 years of production. While we are talking about the Kamoa-Kakula Project, I think it is important to understand that it is not just one mine; rather, it is almost a district of mines that will come on stream progressively as we expand, feeding an expanded centralised processing facility.

Kakula Mine is the first mine and is where most activity has been happening so far. This mine, which will mostly feed into phase one, has an exceptionally high grade – even more so than the other planned mines in the complex.

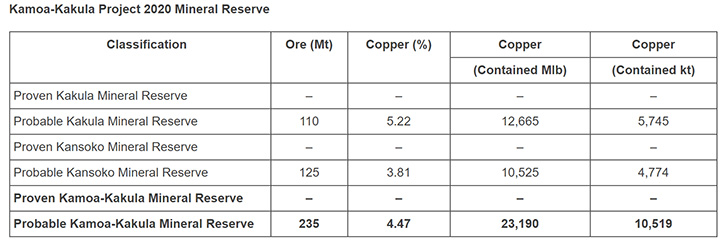

From a size perspective, we are looking at 38 million tonnes of copper in Indicated Resources, which makes it already the fourth largest copper deposit in the world. In terms of mixture between grades and size, it is much larger than other high-grade mines that you would find around the world.

Another key feature is that this is a greenfield project, based on a completely new discovery, made by Ivanhoe Mines in 2007, in an area that previously wasn’t considered very promising.

As we are geographically outside the historically well-known area of copper deposits around Kolwezi (also in the DRC), it was initially considered unlikely that viable copper deposits could be found here. However, geologists decided to challenge these preconceived ideas and despite the different rock formations, they followed their instincts and their assessment of what the geology of Kamoa-Kakula could look like - and that's how the discovery was made.

This shows that sometimes it is worth departing from preconceived ideas of what you can and cannot find.

In fact, this Team of geologists has taken this approach one step further – based on the hope of perhaps finding additional, similar deposits in the Kamoa-Kakula area, exploration activity is now happening at the Western Foreland, an area of approximately 2,500km2 adjacent to the Kamoa-Kakula Project.

Al Alper, Jr.:

Who are the key players on your Team?

Olivier Binyingo:

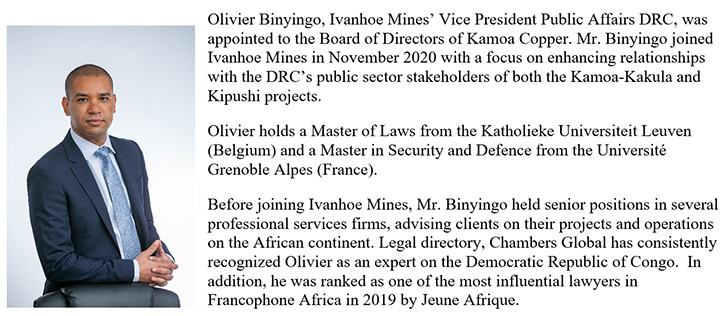

I am employed by Ivanhoe Mines, and I am one of its representatives on the Board of Directors of Kamoa Copper. The makeup of the Board reflects the shareholding that I described earlier, with one representative of the DRC Government and two representatives of Ivanhoe Mines (as one of the JV partners), namely Marna Cloete, the President of Ivanhoe Mines, and myself.

There are also two representatives of the local Management Team: the newly appointed Chairman, Ben Munanga, and Mark Farren, the CEO, who was previously with Anglo American Platinum. Then there are two representatives of Zijin, the other joint venture partner: Abraham Li (deputy CEO of Kamoa Copper) and Chen Yong.

There are two co-CFOs; Rochelle De Villiers, a South African national, and Minty Cai, a Chinese national, also coming from the Zijin side.

In addition to his role as Chairman of the Board, Ben Munanga also serves on the Executive Committee (ExCo) of Kamoa Copper. He is also the Managing Director of the group’s energy company, Ivanhoe Mines Energy DRC. This reflects how crucial energy supply is to our plans, both in terms of the initial mining phase, and our plans to build a dedicated smelter and go beyond the production of concentrate. Ben’s dual role ensures that these vital synergies remain on track.

Al Alper, Jr.:

Let’s talk more about the operational aspects of the project…

Olivier Binyingo:

Since I joined Ivanhoe Mines in November 2020, our focus has been very much on finalizing the construction of phase one of the project and keeping to our plans on schedule and on budget. I’m happy to report that we are currently ahead of time, in terms of initial planning. Since I joined, we have basically brought forward the date for the first production of concentrate by approximately six weeks. That has been our focus in recent months: building the infrastructure and building up the stockpiles of ore that will feed into the concentrator plant.

At the end of April, we had more than three million tonnes of ore stockpiled, and the concentrator plant and necessary electricity infrastructure were nearing completion. We are in a partnership with SNEL, the national power utility in the DRC, for the refurbishment of hydroelectric power stations. The first of these is the Mwadingusha Power Station - once completely refurbished, it will produce some 78MW of power, more than enough for phase one. A large portion of that will come to us, with the balance being fed into the national grid to improve access to electricity for the general population and businesses.

We’ve almost accomplished our phase one targets in terms of construction, and now we’re accelerating implementation of phase two. This will see us add another unit of 3.8 million tonnes of concentrator capacity. We are about a year away from that – we anticipate that it should be finalized by Q3 of next year. That is our focus for the next year or so - to move as quickly as possible to phase two being ready. This will result in approximately 400,000 tonnes of contained copper being produced per year and establish Kamoa-Kakula as the biggest copper mine in the DRC.

Aerial view of the Kakula North stockpile

With copper prices as high as they are now, we want to try and leverage that as much as possible. There is serious talk about accelerating phase three of the project and adding the third unit of 3.8 million tonnes of ore per year capacity.

In terms of electricity, we achieved a major milestone in early April, when we signed up for the refurbishment of a second hydropower facility, this time with a capacity of around 162MW. Owned by the national utility, Ivanhoe Mines Energy DRC, a sister Company of Kamoa Copper, will come in with the financing and be involved in the refurbishment, with priority rights to access the generated power for the Kamoa-Kakula Project. As before, the excess being fed into the grid to the benefit of the Country.

Al Alper, Jr.:

What is the estimated life of the mine?

Olivier Binyingo:

It is a district of mines, of which the Kakula Mine is the first. The Kansoko Mine, which is being developed in parallel, will form part of both phase one and phase two. For the subsequent phases there will be the Kakula West Mine and a series of mines at Kakula North. We will reach a total capacity, once fully built, of about 19 million tonnes of ore per annum. If you are looking at that whole village of mines, some of them will be mined out over time, so in terms of projections, the Kakula Mine, the first one to come on stream, should have a mine life of around 20 years.

Because that is where we started, it will be mined out first. Then the Kansoko Mine will run to approximately 2050. The whole project, as it is currently mapped out, and given that there is still exploration potential (remembering that the total project areas is some 400km2, not all of which has been mapped), could see commercial production continuing until at least 2060, for a total project lifespan of 40 years or more.

Al Alper, Jr.:

Excellent. I am curious about how you see the DRC as an environment for copper producers like yourselves.

Olivier Binyingo:

I always want to be as truthful as possible about the DRC. It is not the Country with the best perception, in terms of its business climate; it is a Country that has scared people in the past and may still scare a few people. But if you look at a long-term horizon, you can see that a lot of things are moving in the right direction, including security, the political situation, and the economy. At the turn of the century, the DRC was divided between warring factions and much of it was outside of the control of the central government.

Now 20 years later, while there are still pockets of violence in some parts of the Country, the impact on business is minimal. In the area where our mine is located and where most of the mining activity takes place, the effects of these small-scale conflicts are not really a day-to-day concern.

In terms of politics, we have evolved from a Country that was ruled by the same individual for more than 30 years, Mobutu Sese Seko. In the last 12 years or so, three presidential elections have taken place. Most importantly, in early 2019, we witnessed a peaceful transition of power between the previous President, Joseph Kabila, and the current President, Félix Tshisekedi.

The last element is economics. Looking specifically at copper at the turn of the century, in the DRC, the mining industry was producing around 100,000 tonnes of copper per year. Last year, despite the challenge of the pandemic, total production was in excess of 1.5 million tonnes of copper. This represented the continuation of a trend that we have seen over several years, with copper production consistently exceeding one million tonnes per annum. The DRC also produces many other metals, including cobalt, which are critical to the electrification of the global economy.

Looking at the longer-term, there is movement in the right direction. We have the DRC as a partner, not only because they own 20% in the Company, but also, they are the host Country, so they set the rules of the game. We very frequently engage, with them, to find solutions that consider the complex realities of the Country, the investments that we have made and our operations – both existing and planned.

Al Alper, Jr.:

What are the main reasons our readers/investors will be interested in Kamoa Copper?

Olivier Binyingo:

I would sum it up in three key words: assets, people, and Country. This is an exceptional asset that combines size and grade. One of the additional benefits of the grade is that you are looking at an operation that has a very low cost per unit of production – and hence has a high degree of profitability, even at much lower copper prices. In that respect, the asset makes an extremely appealing, low risk investment opportunity.

People are another key factor: that is, the people on the ground who have been building this project, from Management to employees and surrounding communities that obviously need to come on board, for the project to be a success in the long term. Especially over the last year or so, with the COVID-19 pandemic and the challenges it has brought, the fact that completion of phase one has remained on track is a testament to the dedication of everyone involved. Not only has the project remained on schedule, but it has been fast tracked, and we are going to be producing concentrates more than a month earlier than we envisaged, say, six or seven months ago.

Meeting those targets has involved a lot of personal sacrifices. Especially from the Teams of expats having been stuck in the Country, sometimes for a lot longer than their usual rotations, because of various lockdown measures. COVID-19 meant that it was a tough year, particularly for the people on site. That we have not fallen behind really demonstrates the calibre of the project Team.

A flotation platform lift during construction of the initial Kakula Copper Mine

Then lastly, Country - I spoke earlier about how the DRC is perceived. It’s clear that there are many factors pointing to the strategic importance of a Country like the DRC increasing, especially in the context of the transition to clean energy and the mitigation of climate change.

The DRC has a lot to offer, not only because of its minerals, which with high-grades, allow for a lower footprint per ton, but also thanks to its vast forests which are a vital carbon sink.

The DRC also has immense hydropower potential - estimated at more than 100,000MW. This is a potential source of clean energy, not only for the DRC, but also for neighbouring countries.

With the political changes that have taken place, it is clear, from the reactions and statements of the international community, there is genuine support for the DRC to continue along the path, on which it has now embarked. The strategic importance of the DRC will only increase and therefore the number of parties, having a vested interest in its ongoing stability, continues to rise.

Al Alper, Jr.:

I'm in the US; what is the best way for our readers/investors in America to invest in Kamoa Copper?

Olivier Binyingo:

The Company in and of itself is not listed, but Ivanhoe Mines, one of the major shareholders and a Company that is also involved in other projects in the DRC, is listed on the Toronto Stock Exchange. Investing in Ivanhoe would be the quickest route to getting involved.

Al Alper, Jr.:

Anything else that you'd like to add?

Olivier Binyingo:

Nothing I can think of. We have covered most of the topics that keep me awake at night!

Al Alper, Jr.:

Olivier, thank you very much for your time. I know our readers/investors are going to be extremely interested in everything you have had to say here today. All the best for the future of this very exciting project.

Kamoa-Kakula Project | Ivanhoe Mines Ltd.

Investors:

Bill Trenaman

Phone: +1-604-688-6630

Email: billtr@ivancorp.net

|

|