Seabridge Gold (TSX: SEA, NYSE: SA): Exceptional Leverage to Rising Gold and Copper Prices, KSM in BC. Canada Reports 17 Billion Lbs Copper Resources, Measured and Indicated; Rudi Fronk, Chairman & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/20/2021

We spoke with Rudi Fronk, Chairman & CEO of Seabridge Gold (TSX: SEA, NYSE: SA), the mining exploration and development company, designed to provide its shareholders, with exceptional leverage to a rising gold price. Seabridge holds a 100% interest in several North American gold projects. In addition to gold, the Company has amassed a large quantity of copper, at their KSM project, located in British Columbia, Canada. KSM reports copper resources, in the measured and indicated category of 17 billion pounds, with an additional 33 billion pounds in the inferred category. As a result, in addition to Seabridge's industry-leading, gold-per-share metrics, the Company now has more copper reserves and resources per share than the major copper companies.

Seabridge Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rudi Fronk, who is Chairman and CEO of Seabridge Gold. Rudi, for 22 years, Seabridge has been known for its gold reserves and resources. However, it looks like you have also amassed a large quantity of copper, as well. Can you elaborate on this?

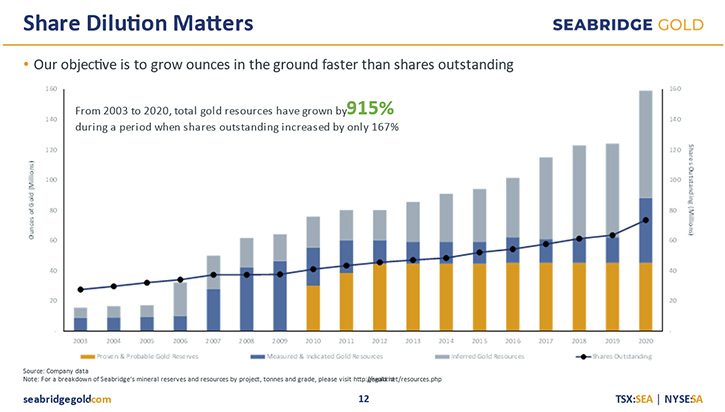

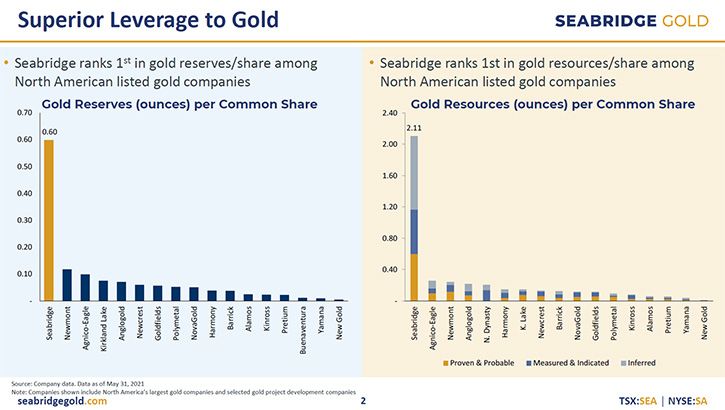

Rudi Fronk: Allen, great to connect with you again, and a timely question. You are absolutely right. When we formed the Company in 1999, our main objective was to create what we thought would be the best leverage play to the gold price by simply growing ounces of gold in the ground faster than our shares outstanding. On that front, we've been tremendously successful. If you look at our 21 plus year track record, our shareholder's exposure to gold continues to increase on a per share basis. At the end of 2020, we had about 75 million shares outstanding, but we had 88 million ounces of gold in the measured and indicated resource categories plus an additional 71 million ounces in the inferred category. This means that each one of our shares is backed by over two ounces of gold in the ground. Nobody in the industry comes close to us!

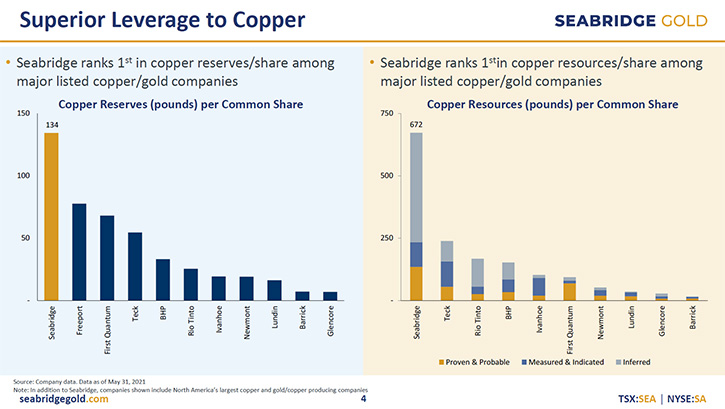

However, what I think what the market has not paid attention to is the amount of copper resources we also have. Along with our gold discoveries at KSM, we also found a lot of associated copper. In fact, at KSM, we now can report 17 billion pounds of copper in the measured and indicated resource categories, with an additional 33 billion pounds in the inferred category. As a result, in addition to our industry-leading gold-per-share metrics, we also now have more copper reserves and resources per share than the major copper companies. In addition to more than 2 ounces of gold per common share, we can report more than 600 pounds of copper for each share outstanding. Although our share price has performed well versus gold and other gold equities over the long-run, our share price has not yet participated in the recent run-up in copper prices, which have more than doubled over the past year.

Dr. Allen Alper: Well, that's a great position that Seabridge is in. Could you elaborate on how important is copper to KSM's economics?

Rudi Fronk: Sure. Extremely important. If you look at KSM as a project, we now have five distinct deposits that each have varying amounts of gold and copper. Based on current metal prices, along with the projected metallurgical recoveries, the copper and gold are about 50/50 in terms of revenue sources. So copper becomes just as important as gold in KSM’s economics. For a gold company that takes copper as a by-product credit against operating costs. operating costs are projected to be negative because the project will produce enough copper to offset all the operating costs and then some. Conversely, for a copper company that takes gold as a by-product credit against operating costs, operating costs are also projected to be negative for each pound of copper produced, because there's enough gold that'll be produced to offset all the operating costs and then some. Bottom line is that copper becomes extremely important, no matter whether a gold company or a copper company is our ultimate joint venture partner.

Dr. Allen Alper: Well, that's excellent. Seabridge Gold is in a fantastic position, having huge reserves of gold and also a vast amount of copper as well. Rudi, environmental and social concerns have derailed multiple mining projects in the past decade. How does Seabridge navigate these issues?

Rudi Fronk: Allen, as we are seeing in the world today, there's a lot more emphasis being put on ESG matters than ever before. At Seabridge, we have focused on the environmental and social aspects for many, many years. Not just because it is a box we need to check, but because it is the right thing to do. On the social side, we have maintained ongoing, open and transparent dialogue, with the indigenous peoples and other stakeholders that would be impacted by our projects. In fact, at KSM we have fully vetted Impact Benefit Agreements, in place with the Tahltan and Nisga'a Nations, both of which have been strong public supporters of KSM for the past decade. On the environmental side, we went through a comprehensive environmental assessment process at KSM that included not only the First Nations and the Canadian regulators, but the US regulators as well. As a result, we now have our environmental approvals in place, having demonstrated a safe and environmentally sound project.

In 2014, before it became standard practice, we formed an independent Technical Review Board that continuously assesses the design and operational plans of our key project structures, including our tailings and water management systems. In terms of environmental questions and concerns, that's where most of the focus is. Another hot topic, right now, is the carbon footprint. There's no doubt that large mines, around the world, tend to have large carbon footprints, due to their reliance on fossil fuels for power generation. At KSM however, we're blessed with an ample supply of hydro-sourced power, which will result in a very small carbon footprint, compared to other large operating mines. We will be able to buy that hydropower, right off the grid, from a transmission line that the government of Canada and British Columbia built, which is situated just east of KSM.

Dr. Allen Alper: Well, it's wonderful to see that Seabridge is just in such a great position, with gold, being able to mine huge amounts of gold and copper, and that the Company has done such a great job being an environmentally responsible Company, also that you'll have an extremely low carbon footprint, compared to other mining companies. So that's excellent. How prepared is the mining industry to meet the future demand for copper in a world full of green energy initiatives?

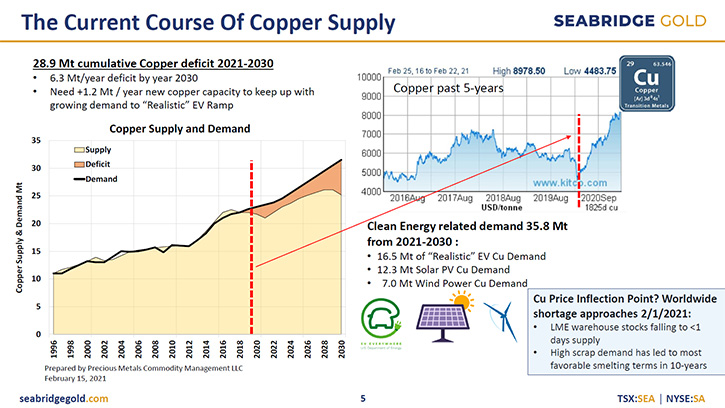

Rudi Fronk: Not at all. The demand for copper is increasing significantly and that’s forecast to continue to increase as a result of the new green, global energy initiatives that are being initiated. The fact is electric-powered vehicles, wind turbines, solar panels, and other green energy initiatives require a lot more copper than is traditionally used in other sources of power generation. The elephant in the room is that we're already experiencing deficits in the copper market, which are projected to grow over the next decade. Even after taking into account planned expansions, at existing mines and new mines that may come on-line, it's estimated that the cumulative deficit, through the year 2030, will approach 30 million metric tons of copper, and in the year 2030 alone, that annual deficit will exceed 6 million tons. The bottom line is that unless a lot of new mines are built, beyond what is already factored into the supply equation, the copper price will continue to move much higher.

Dr. Allen Alper: Well, that shows that it's very important to increase copper mining, throughout the world. It's great that Seabridge Gold is in such an excellent position to do that. Rudi, could you summarize the primary reasons our readers/investors should consider investing in Seabridge Gold?

Rudi Fronk: First, if you believe the price of gold is going higher, we have a 22-year track record of our share price outperforming gold and other gold equities. Second, is our exposure to copper. Up to this point, we have not been recognized in the market for our copper, but when you look at us today, we provide more copper ownership per share than even the largest copper miners on the planet.

Third, is our ability to find gold. Over the past 15 plus years, our exploration team has found more gold than any other mining company, and that includes the majors. We now have three new exploration projects that we acquired recently, when the market conditions were not as favorable as they are today, and we have exploration programs planned, at all three this year. Finally, at KSM, we own 100% the world’s largest undeveloped gold and copper projects that are shovel ready, located in a safe political jurisdiction and showing tremendous capital efficiency

We have talked for a number of years about bringing in a joint venture partner at KSM to co-develop the project. We believe the stars are finally lining up for us, with high metal prices, both in terms of gold and copper, the need for more copper going forward because of the increasing demand that is in front of us; and, last but not least, the need of the big mining companies to find new projects because most of them are running out of reserves. I think that the window for getting a deal done, on terms that we can say yes to, is finally upon us. We believe that getting a joint venture deal done on KSM will drive significant value to our shareholders.

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Seabridge Gold. You have great gold reserves and copper, a huge copper resources, you are in a great location in Canada and you'll have hydropower. So it sounds like Seabridge has everything going for it.

Rudi Fronk: Well, as they say, Rome was not built in a day! I believe that the patience and perseverance of our long-standing shareholders will be rewarded.

Dr. Allen Alper: Well, it's great that you've had the perseverance and the patience and the vision to grow your reserves and to buy properties at the right time, at the right prices that have increased in value. It seems like you have put together great packages to move forward. I think what you have to offer will be extremely attractive to the right partner for the right price.

Rudi Fronk: Well, thanks, Al. I agree with your assessment and look forward to our next interview.

Dr. Allen Alper: Okay, great. I enjoyed talking with you again, Rudi. Have a great day.

We’ll publish your press releases as they come out, so our readers/investors can

follow your progress.

https://www.seabridgegold.com/

Rudi P. Fronk

Chairman and C.E.O.

Tel: (416) 367-9292

Fax: (416) 367-2711

Email: info@seabridgegold.com

|

|