Hot Chili Limited (ASX: HCH) (OTCQB: HHLKF): Largest Copper Company on the ASX Index, and Among North American Peers; Christian Easterday, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/16/2021

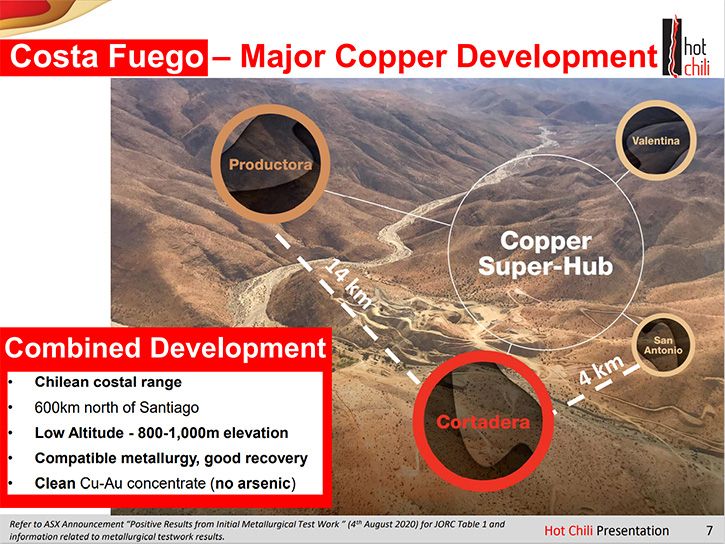

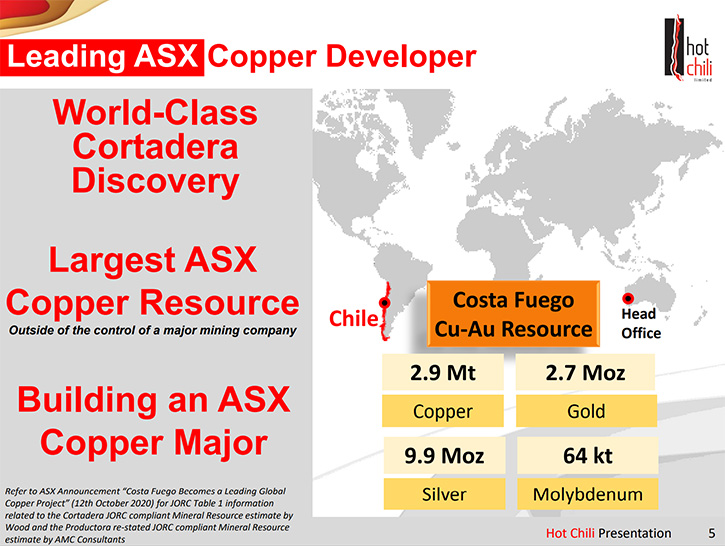

Hot Chili Limited (ASX: HCH) (OTCQB: HHLKF) is advancing three key copper projects: Cortadera, Productora, and El Fuego — all located in close proximity to one another, with a vision to develop a new mining hub, on the coastal range of Chile, called Costa Fuego. We learned from Christian Easterday, Managing Director of Hot Chili, that for the last two years, they have been focused on the Cortadera porphyry copper-gold discovery, which is one of only two major copper discoveries announced globally, since 2014. The maiden resource at Cortadera is 451 million tons, from surface, at about half a per cent copper equivalent. According to Mr. Easterday, by combining Cortadera and Productora into one development strategy, the Company is now holding some 724 million tons of resources on the coastline of Chile. This establishes Hot Chile as the largest copper company on the ASX index, and well placed among a crowd of North American peers, with similar resources, sporting much larger valuations.

Hot Chili Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Christian Easterday, who is the Managing Director of Hot Chili, Ltd. Christian, could you give our readers/investors an overview of your Company? What differentiates your Company and what are the exciting things that have happened this past year?

Christian Easterday:Hot Chili is Australia's largest copper developer in the junior space, we have a large copper hub of projects, on the coastline of Chile that we've been developing for some 10 years. Things have become very exciting for the Company in the past two years, with a deal that we were able to secure at the beginning of 2019 for the Cortadera Porphyry Copper Gold Discovery.

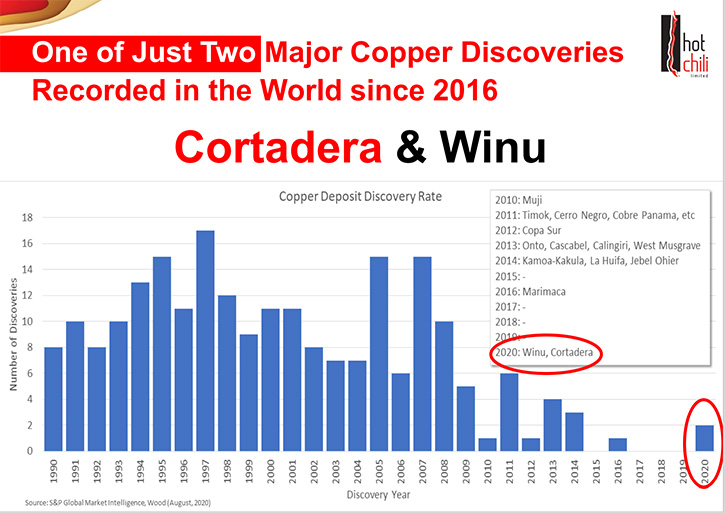

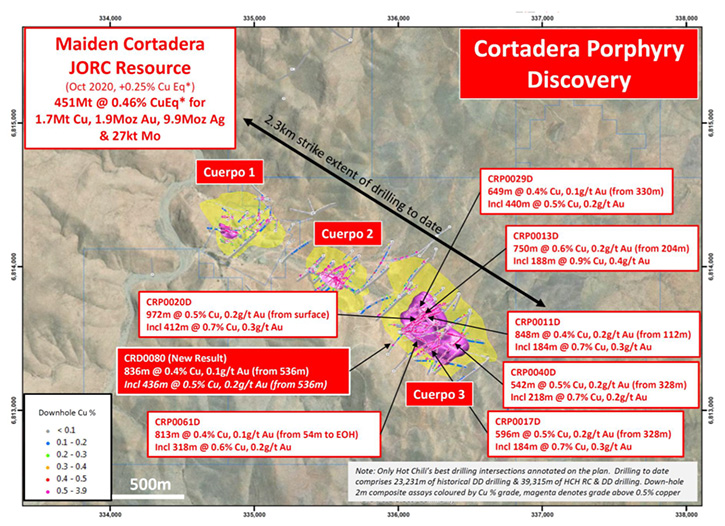

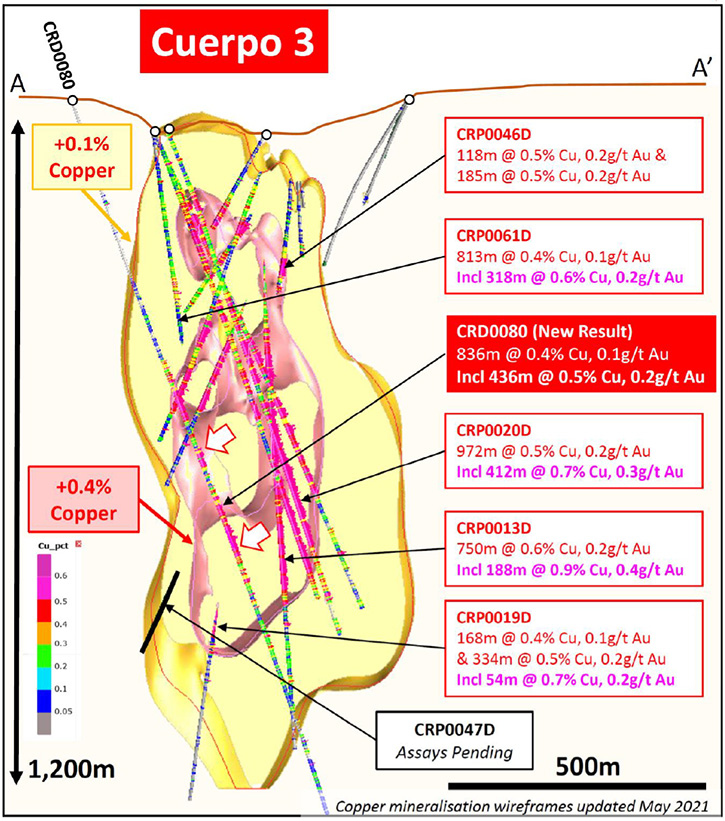

Cortadera is a large, privately held, discovery that was found 14 kilometers next to our original major copper asset in Productora. Since we took this deal out at the beginning of 2019, we've been able to complete quite a lot of drilling. This discovery is now one of only two major copper discoveries that have been brought to the world since 2014, since Robert Friedland found Kamoa. Cordera has been delivering a lot of world class results for the Company during that time and we now have seven of the world’s top 25 drill results, reported in the copper space, over the past two years. These results are headlined by a near 1,000m drill result (972m) from surface grading 0.5% copper and 0.2g/t gold, which included 412m grading 0.7% copper and 0.3g/t gold.

Just last week, we were able to put out another 836-meter drilling intercept, running about half a per cent copper equivalent. In October last year, we released our first resource on Cortadera, some 451 million tons from surface, at about half a per cent copper equivalent and right next to Productora. That allowed us to combine these two assets, take a centralized processing approach to our development strategy, and now be holding some 724 million tons of resources on the coastline of Chile. That establishes Hot Chile as the largest copper play on the ASX index, in a space which is almost exclusively controlled by North American large-scale copper developers.

Dr. Allen Alper:

That's excellent. You really have a great property and copper is extremely important in electrification of the world. Your timing is perfect.

Christian Easterday:

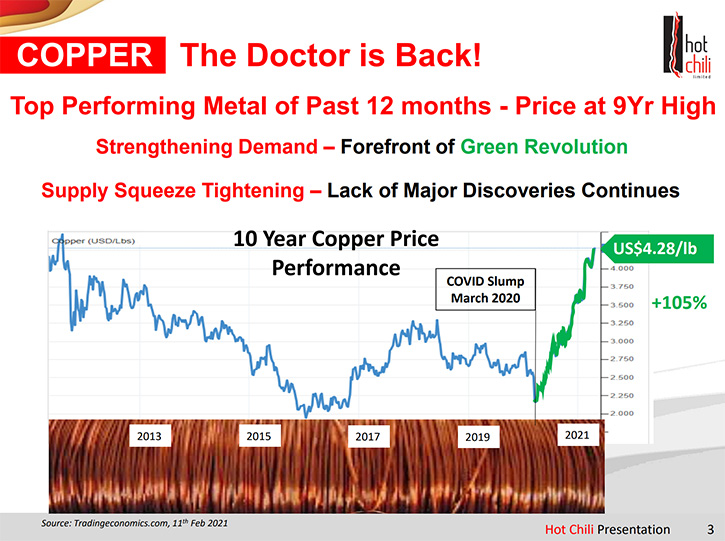

Yes, we have copper moving from $2 per pound, just over a year ago, at the beginning of this pandemic, to now sitting at $4.60 per pound as of June 2nd. It is one of the top performing metals in the market, at the moment. What's exciting for us, is the timing of all this, because we have a major resource upgrade, drilling program, going on this year, some 40,000 meters of drilling that is continuing to expand the Cortadera Discovery. We're aiming to establish ourselves with a Tier-1 copper asset (+5Mt Copper), outside of the control of the majors. We currently have 2.9Mt of contained copper and 2.7Moz of contained gold in our resource. Growing Costa Fuego to over 5Mt of contained copper, would effectively position us as a top five or six, global copper project.

Coming back to the copper price backdrop and timing, that is exciting and the North American market, over the past six to eight months, has had some stunning re-rates on some of our equivalent copper players. Based on the TSX-V and New York Stock Exchange, names such as Solaris, Filo Mining, Oroco Resource Corp, Josemaría and Marimaca Copper, these grouping of Companies have very similar scale assets to Hot Chili. Our Costa Fuego copper-gold resource compares very favorably to those assets in terms of size and grade. All those companies are now trading in the 400 million to one billion-market capitalization space. To have Hot Chili over on the other side of the world, not at that party and still sitting at around 120 million market cap, presents a pretty amazing opportunity that has yet to be discovered in North America.

Dr. Allen Alper:

Well, that's an excellent opportunity for stakeholders and shareholders.

Christian Easterday:

Yes. That is behind our strategy this year to move the Company onto the TSX or TSX-V. We've officially commenced that process, and just a couple of weeks ago, we confirmed that we are now trading OTCQB: HHLKF in the US. We are very excited to be migrating the Company into the large copper investment space in North America. A key catalyst for the Company, over the coming three to six months, is the dual listing over in North America. Followed very closely by a major resource upgrade that looks to position us in a really rare space, in the copper sector, with a rising copper price behind us. We have one final catalyst in front of us, which will be to take out the final payment, of the acquisition of Cortadera, before July of next year. I imagine that all of those three events are likely to drive Hot Chili's growth in its share price and market capitalization.

Dr. Allen Alper:

That sounds excellent. You and your Team have done a remarkable job in the last couple of years, in expanding the resource center and moving the projects forward. That's outstanding!

Christian Easterday:

Yes! It has been a long journey and one of persistence. I started this Company with our Chairman Murray Black, back in 2010, when we listed on the Australian Stock Exchange. It's no small feat to build something from scratch in the large copper space, where you're talking about 100,000 ton per annum copper projects and 100,000 ounce per annum gold projects, with over 20-to-30-year mine lives. They take a lot of dedication, a lot of investment and never losing sight of the vision. These assets are in the bulk space and the last time the copper price moved to these price levels, large scale copper developments were behind some of the largest M&A transactions in the last commodity cycle.

We have now seen M&A activity starting to pick up, with Newmont's $460 million cash bid for GT Gold about six or seven weeks ago now. So that really kicked things off. Then last week, Rio Tinto made an 8% purchase of Western Copper, for their casino copper asset, for around C$26 million. So certainly, things are starting to heat up! I think Hot Chili is very well positioned to be one of the leading new large-scale copper developers for this new copper cycle.

Dr. Allen Alper:

That sounds excellent! The future of copper looks extremely bright, as the world moves to decarbonization and electrification, with electric vehicles. Copper is one of the key ingredients for that to take place.

Christian Easterday:

We see a really strong demand thematic for copper. Now people are also starting to focus on the supply side of the equation, just where will new copper supply come from and how will the supply response look like. In the last copper cycle, it took five years for the copper sector to be able to react to copper prices and deliver new supply. A lot of that came from lowering cutoff grades on existing mines. This will be difficult to achieve again, given that most cut-off grades for ore reserves sit around 0.2% copper grade.

There have been very few new major discoveries globally and that's really setting ourselves up for a prolonged period, in which the copper sector will try to expand existing mines that are very old. I imagine that these copper prices are not going to fall back to Earth any time soon. I think the industry is going to struggle to keep up with depletion, without any new major discoveries. So, it makes discoveries such as Cortadera that much more attractive.

Dr. Allen Alper:

That sounds excellent! Christian, could you tell our readers/investors about your background, your Management Team and your Board?

Christian Easterday:

I'm a Geologist and a Mineral Economist. I've been working in the mining sector for 23 years. Originally, I started my career in gold exploration in Western Australia and then quickly moved to working for international companies, such as the Placer Dome. I had an entrepreneurial drive to build a mining company and did that with my Chairman, Murray Black, who has many, many years’ experience in the industry.

We have some fantastic Directors sitting on our Board; Randall Nickson, a former Chief Geologist for BHP in South America, Dr. Alan Trench, a Professors of Mineral Economics, who sits on a lot of Boards, here in Australia, Roberto de Andraca Adriasola, who is a Director of CAP S.A, one of Chile’s big three miners.

The Board has a lot of experience, both technically and commercially. That's complimented by a very talented Management group that we have assembled and are now expanding. That includes people such as our Lead Technical Consultant Dr. Steve Garwin.

Steve is quite famed in the porphyry copper space, because of his ongoing involvement and direction to the growth and expansion of SolGold's Alpala's porphyry discovery in Ecuador. We have a lot of great people and a dedicated Team that has been the driving force behind Hot Chili for a number of years. You're only as good as the people around you and we're very, very happy to have such a talented Team put together.

Dr. Allen Alper:

Well, you and your Team and your Board are extremely accomplished and are very capable to move this project forward, through to production.

Christian Easterday:

Thank you! They are the future of the Company. We've been pushing hard, building scale, which is necessary when you're dealing with half a per cent copper deposits, which is now the average grade of production globally. These projects are becoming quite rare.

Next, we are planning to complete an update and combined pre-feasibility for Costa Fuego, before moving towards a definitive feasibility, which will take us to a major financing decision. Our road ahead is not just about continuing to deliver world class drill results and expanding our resource base, but also about the de-risking and study phase, which will be run in parallel.

Dr. Allen Alper:

That sounds excellent, Christian. Could you tell our readers/investors the primary reasons they should consider investing in Hot Chili?

Christian Easterday:

I think Hot Chili is one of those anomalies for people, who are looking for exposure to copper and copper equities. In Australia there are very, very limited opportunities for copper exposure outside of major mining Companies. In the junior space, we have two producers of note, Oz Minerals and Sandfire on the Australian Stock Exchange. We have three copper developers of note and Hot Chili is clearly the largest, by resource base, and then we have a handful of junior explorers. The last downturn in the copper cycle, really cleaned out a lot of our peers in this space.

In terms of what we represent, exposure to a large copper resource base, of nearly three million tons of contained copper and close to three million ounces of gold, Hot Chili is sitting there, with no peers on the ASX. Our peers are all sitting on the other side of the world. The fact that those Companies now are enjoying valuations at three, four, five, six-time multiples of what Hot Chili is, is quite an anomaly. I imagine that Hot Chili is probably going to be discovered by the broader market and that market for copper broadly resides in the northern hemisphere.

Our strategy to get over to the North American market is really about exposing a fantastic opportunity for North American investors. It's very, very rare in the large-scale copper space to find an asset like this, in a top three mining country, below a thousand meters altitude, with no arsenic in any of our ore sources and with all the infrastructure access secured. I think that when investors review our corporate presentations and go through those additional “do-ability” factors, that certainly the opportunity will become clear.

Dr. Allen Alper:

Those are extremely compelling reasons for our readers/investors to consider investing in Hot Chili. Could you tell our readers/investors a little bit about how it is operating in Chile?

Christian Easterday:

Operating in Chile is very similar to operating in Australia or Canada. Obviously, it's where all of the major mining companies are. Chile has three of the world's five largest undergrounds and five of the world's seven largest open-pit mines. They do things big in Chile. Their mining sector is not too dissimilar to the breakup of the economy over here in Western Australia. Mining is a big part of the economy over there. The pandemic has obviously changed the world in the last year. We've been very pleased to be operating three drill rigs and five shifts during this time. It's a real credit to our Management and to our procedures to keep our people safe.

Like everywhere in the world, things are changing. In the last boom, the left attempted to introduce a Super Profit tax here in Australia. Fortunately, that never eventuated, but it has led the way for a lot of countries to start talking about that again. We fast forward six or seven years and now we see in 2021 the same conversations have reared their heads again, although this time that started in Chile.

Our view, along with the view of most in Chile, is that radical proposals for tax rates up to 80% on $4 plus copper pricing, is something that logically is very unlikely to take place, unless you want to kill 30% of the world's copper production, in an instant, and stall major investment decisions in new large copper projects. We do believe that the social situation in Chile will lead to a compromise but that compromise will align Chile’s taxation, with those of Australia and Canada. But certainly, Chile has always been a top three destination for investment in mining, and we don't see that changing any time soon.

Dr. Allen Alper:

Is there anything else you'd like to add?

Christian Easterday:

No, I think that's it. Thank you very much for giving me a soapbox to speak to your readers/investors. I really appreciate that.

Dr. Allen Alper:

Well, I'm very impressed with what you've done in the last few years and the potential of your Company in the copper space, and the timing, during a deficit in meeting the demand for electrification, a deficit of copper. The timing is great! I think you and your Team are doing a great job and you have outstanding, exceptional resources to work with. So that's excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.hotchili.net.au/

Christian Easterday

Managing Director

Tel: +618 9315 9009

Email: christian@hotchili.net.au

|

|