Gatling Exploration (TSXV: GTR, OTCQB: GATGF): Aggressively Drilling the Advanced, High-Grade Larder Gold Project, in Ontario, Canada, in the Heart of the Abitibi Greenstone Belt; Jason Billan, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/15/2021

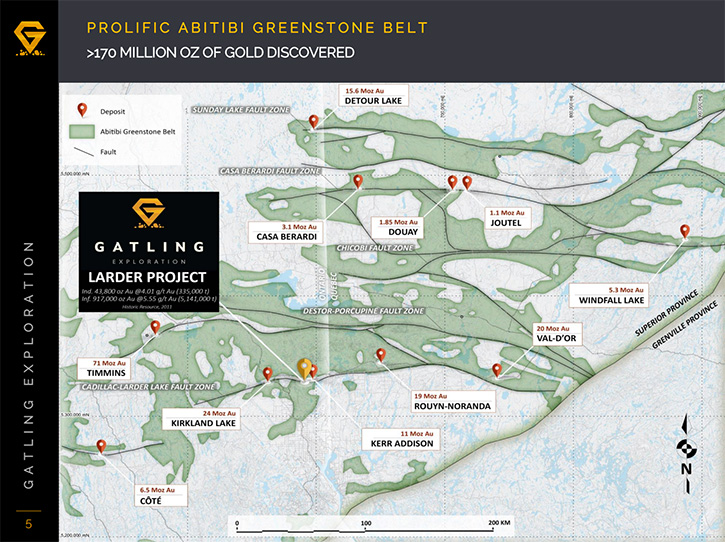

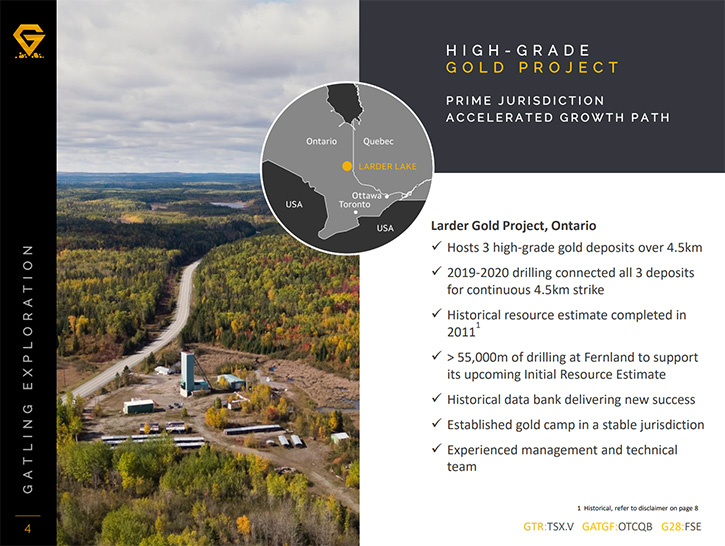

We spoke with Jason Billan, who is President, CEO and Director of Gatling Exploration (TSXV: GTR, OTCQB: GATGF). Gatling Exploration owns the advanced, high-grade Larder gold project in Ontario, Canada, in the heart of the Abitibi greenstone belt, just 35km east of Kirkland Lake. The project's historical resource contains 43,800 indicated Au oz at 4.1 g/t and 917,000 inferred Au oz at 5.6 g/t. Gatling has been expanding this resource in every direction, with 140km of successful drill results thus far. The Company is now rolling out a 25km drill program, during H1/21, with the goal to update the resource in the second half of the year.

Gatling Exploration

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jason Billan, who is President, CEO and Director of Gatling Exploration, Inc. Jason, I wonder if you could give our readers/investors an overview of your Company and also what differentiates Gatling Exploration from others.

Jason Billan:Gatling Exploration is a GTR: TSX-V: listed company, which also trades on the OTC bulletin board. We’re a Canadian-based project, specifically located in the Abitibi Greenstone Belt, which is near the border of the Ontario and Quebec Provinces and in a very prolific gold belt. Our Larder Project sits on the Ontario side and is situated on the Cadillac-Larder Lake fault zone, in between Kirkland Lake, which is just over 35 kilometers to the west and their prolific Macassa Mine. To the East, roughly five to 10 kilometers, is the old Kerr Addison Mine, which ran for 60 years, up until the mid-90s, and produced roughly 11 million ounces of gold at 10 grams per ton.

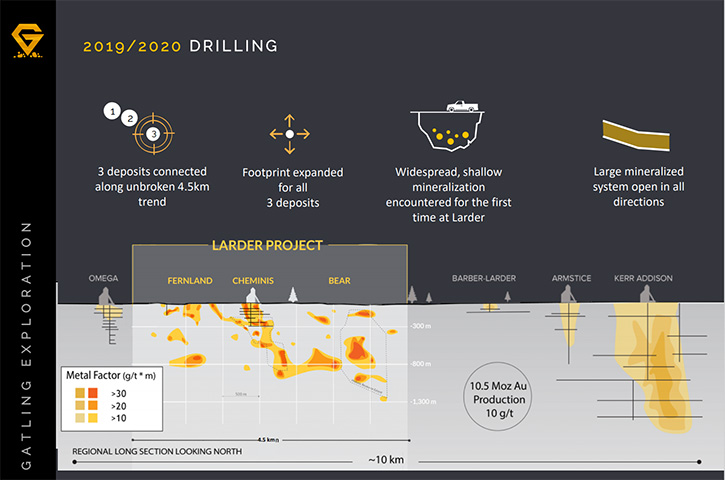

Gatling is an exceptional story, with what's transpired here in the past several months. We've had a very successful 25,000-meter drill program, which is still under way. Much of that was geared towards drilling our Fernland deposit, which has hit some pretty decent grades over long intersections, demonstrating that that deposit could deliver an open pit resource and ultimately become a starter phase for the project, when it moves towards production.

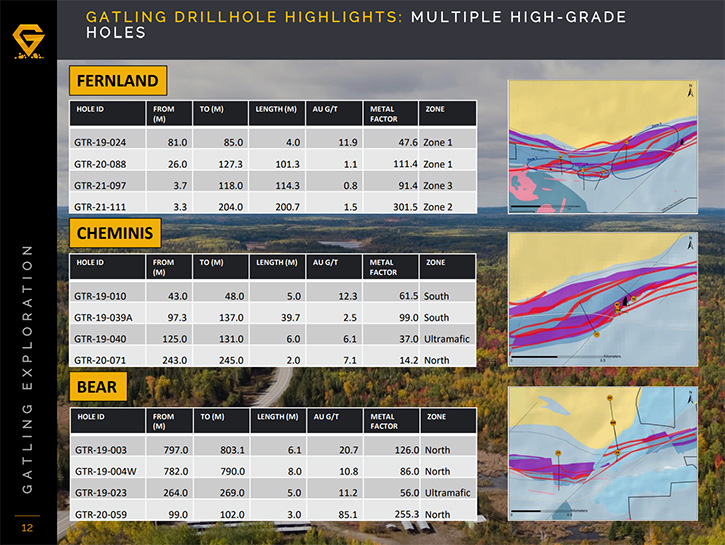

There are two other deposits, just east of Fernland, called Cheminis and Bear. We look at the three together as the overall project. Those three deposits will all be included in the upcoming resource estimate. Cheminis and Bear will be new 43-101 resource estimates, updated from the historical estimates completed roughly a decade ago, while Fernland will be a maiden resource estimate and include nearly 60km of drilling. The targeted timeline to release the resource estimate is the end of Q3, so a fairly significant near-term catalyst for Gatling.

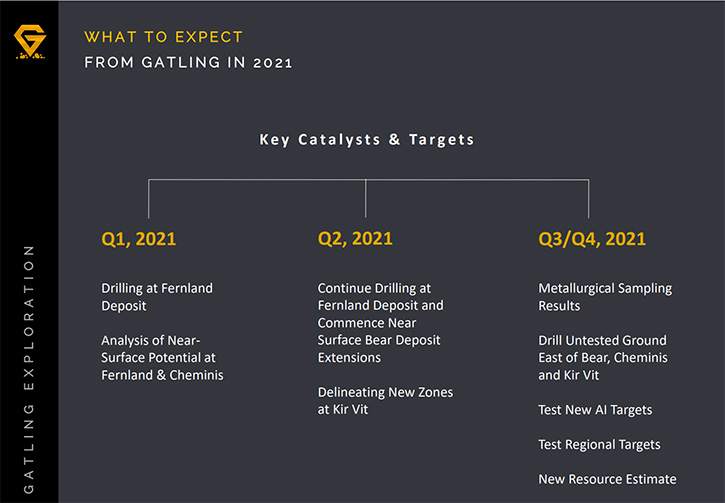

We have a significant amount of news flow, leading up into that resource update at the end of Q3, with the ongoing drill results at a couple of these deposits. Fernland is continuing to be drilled and likely until the end of Q2. In addition, we're drilling our highest grade of the three, the Bear deposit currently, which started at the beginning of May and will be drilled through the Summer. Then we'll move on to an exciting prospect for us, phase two drilling at our Kir Vit discovery, which is on trend with Agnico-Eagle's Upper Beaver deposit, which is roughly six kilometers or so to the west.

Dr. Allen Alper:

Well, you're in an amazing region, known for gold exploration and gold production. That's very enviable. I was wondering if you could tell us more about your drill results to date.

Jason Billan:

Sure. The focus of this 25,000-meter program, up to this point in time, has been solely on the Fernland deposit. At Fernland we've been drilling essentially what we describe as three different zones. They run west to east, and are labelled Zones 1, 2 and 3. Some of the most exciting drill results have actually come out of Zone 2, where we drilled 1.5 grams of gold over 170 meters, which started just 31 meters below surface. We had a follow-up hole in Zone 2, which hit 1.5 grams of gold once again, this time over 201 meters, and that started just 3 meters below surface. There's some fairly continuous, near-surface mineralization at the Fernland Deposit. I would say roughly 70% of the composites, in each of those two holes was above regional cutoff grade of 0.3 g/t. It was significantly continuous, and it didn't just have little spurts of ultra-high-grade mineralization.

What we're ultimately seeing at Fernland, from these drill results, are Zones 1 and 2 beginning to demonstrate that they could ultimately be a starter pit of decent scale. They both measure roughly 275 meters of strike length each. The two of them combined, over half a kilometer of strike length, have a series of lenses within them, up to roughly 30 meters at Zone 2 and up to 35 meters in length thickness in Zone 1. I'm pretty excited about ultimately moving towards the resource update phase at Fernland and showcasing the maiden resource here, later this year.

Dr. Allen Alper:

That's excellent and it looks like 2021 will be an extremely exciting time for Gatling and their stakeholders and investors.

Jason Billan:

Yes. The market's been an interesting one in the junior exploration space, thus far in 2021. From a macro perspective, gold was roughly on a nine-month downtrend from the peak of nearly $2,100 an ounce last August until a double bottom was reached, in late March of this year. Now it appears that gold has found its footing again and I think it's an excellent time to be looking at higher quality, undervalued exploration stories, in the sector right now, which could catch that next leg higher.

I believe that Gatling does fit that bill with a significant number of catalysts and news flow on the horizon, which we expect here over the next few months. In the very near-term, Fernland and Bear continue to be drilled, followed by a second phase of drilling at the Kir Vit prospect, which I can get into a little bit later. We will subsequently receive metallurgical testing results from SGS, due out sometime in Q3 before the resource update at the end of the quarter. So, a significant amount of news flow!

Dr. Allen Alper:

Excellent. That sounds like Gatling has excellent potential for investors and that 2021 will be a great time for discovery and for news that should spur the market. Jason, could you tell us a little bit more about yourself, your Team and your Directors?

Jason Billan:

Sure. I joined Gatling as CEO in November of last year. I was sitting on the Board for roughly a year and a half before being appointed as CEO. I became familiar with the Company, the Management Team and Board, and made the decision to move over to the CEO just over six months ago. My background really started in the mining sector, following the completion of my MBA at Richard Ivey School of Business, at the University of Western Ontario, in 2009. I then got into equity research, covering precious metals, for a smaller, resource-focused investment firm, called Salman Partners, based out of Vancouver.

I spent about a year there and then moved over to RBC Capital Markets, covered similar companies, small caps all the way up to large caps and in the gold and silver space. Then in mid-2012, I moved over to Nevsun Resources in Corporate Development, and I was the sole corporate development professional, reporting into the C-Suite and tasked with growing our Company. We had a world class operating mine in Africa, called Bisha and it was generating a significant amount of cash flow. We were in an enviable position to grow the Company at a time when the mining sector started to enter a downturn that lasted several years. During that time, I spent a significant amount of time evaluating gold assets, in the first few years, looked at well over a couple hundred gold projects and operating mines globally.

We got close on a number of opportunities and transactions, but ultimately passed, as we were very disciplined and didn't find the right fit for us. At that time, in 2015, the Bisha Mine transitioned to a base metal mine. Then we started looking at copper assets a little bit more than gold. We came across Reservoir Minerals and their Timok project in Serbia, and were quite aggressive in acquiring it, recognizing the world-class potential of the underlying assets as well as the substantial exploration upside.

We were successful in acquiring it for roughly US$500 million in 2016 and that ultimately set up the Company for what translated, two years later, into a potential hostile takeover and then full sales process, with Nevsun ultimately selling to Zijin Mining, a Chinese-based miner for nearly C$2 billion at the end of 2018. After that I ended up taking a little bit of time off. Then I joined Wheaton Precious Metals, in metal sales and streaming operations, for about a year before moving over to Gatling as CEO in late 2019.

Dr. Allen Alper:

That's a very accomplished career. You have an excellent background.

Jason Billan:

Thank you. Yeah, it was very diverse. It covered a lot of aspects of the business, and I really learned the fundamentals of the mining sector, in equity research, covering precious metals. This provided the platform for further learning and growth after moving to Nevsun and diving into corporate development and strategy. We spent a lot of work on our assets. I was a Valuation Expert at the Company, but also did a fair amount of work on life of mine planning and even the study phases at our Timok project, before we ultimately sold the Company.

I'll just touch on a couple others on our Team. Nathan Tribble is our VP of Exploration. He spent roughly 14 years in exploration and mining. He worked on this project, many years ago, for another Company called Kerr Mines and liked it so much, as well as identifying the significant amount of exploration upside at Larder. So, he was quite excited to come back and join the project, once again under Gatling. But he's worked for several different companies in and around the Abitibi region and even a couple of years ago worked directly for Eric Sprott, evaluating opportunities and looking at projects around the world.

A couple other notable additions to our Team were appointed following the creation of a Technical Advisory Board, which I decided to put together after joining. I thought that we should beef up our technical expertise and we're excited to have two individuals join our Board: Darin Wagner and Gil Lawson. Darin is a Geologist by trade. He's a seasoned corporate executive, who has run a couple high-quality juniors, which have been sold to mid-tier mining companies in the last decade.

Gill Lawson is a Mining Engineer by trade and has a pretty good background in his own right. He was ex-Goldcorp and Placer. At Goldcorp, he ran the Musselwhite mine in Ontario and more recently, was COO of TMAC Resources, which sold their Hope Bay Project to Agnico Eagle earlier this year. Gill Lawson recently joined the Board of Great Bear Resources, which is a high-quality exploration company. Their market cap is approximately in the range of $800 million and their flagship Dixie project is based in the Red Lake Region. I'm happy to have those two individuals on board and leveraging their expertise as we move forward, advance and de-risk this project.

Dr. Allen Alper:

Those are great exploration geologists and technical people, so that's great. You've really strengthened your Company.

Jason Billan:

Yeah, I believe so. That's been the focus, after coming on board here, to build out the Team and advance this project at a more accelerated rate and put the people in place that will be able to do so. I'm happy with what we've accomplished so far in 2021 and think that the second half of 2021 will be that much stronger for Gatling.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your share and capital structure?

Jason Billan:

We have a tight capital structure and share structure. Just prior to our last raise, which was completed in December of last year, we did a two for one share consolidation. We now are sitting at just under 40 million shares outstanding. We have roughly 3.9 million options and roughly two million warrants, so fully diluted. We're just under 46 million in shares. We believe that it's tightly held with top shareholders aligned with Management and Board’s view of a significantly undervalued story and we're well positioned to be able to raise further capital as needed, but also reward shareholders, as we deliver positive news to the market, within a tightly held capital structure.

Dr. Allen Alper:

That sounds excellent. Jason, could you tell our readers/investors the primary reasons they should consider investing in Gatling Exploration.

Jason Billan:

I would highlight that we are in a top tier jurisdiction in the heart of the Abitibi. There are a number of high-quality operating mines, and mid-tier and major mining companies in the region, which are looking for additional growth opportunities in and around this region. They are looking to fill mill capacity, expand mill throughput or secure new growth opportunities, in low risk, geopolitically safe jurisdictions, such as Canada and pro-mining friendly jurisdictions such as Ontario. That's checked a number of key boxes for strategic investors.

Right next door to our project is Agnico Eagle, with three deposits in close proximity to ours, led by their most advanced deposit, Upper Beaver. They actually have named their Upper Beaver Project, a top priority growth project, in their portfolio, as of February this year. They're doing a significant amount of work on the ground at Upper Beaver, through exploration drilling, as well as doing an updated technical study of the three deposits. They're looking at a centralized milling scenario, via that study, and that's due out at the end of this year. The project is targeted to reach initial production in 2027.

This project, right next door to us, held by a major mining company like Agnico, does put Gatling on the radar screen. It's exciting to see that they are keen to move this project forward, at a more accelerated rate. In addition to that, in terms of reasons to buy Gatling, we have a significant amount of drilling still ongoing, with the second rig on site where we'll be drilling. Currently, we're drilling Fernland, which has been quite active since the beginning of this year, as well as the Bear Deposit, since early May. Once Fernland finishes up its program, that rig will be moved over to the Kir Vit Discovery, which is on trend with Agnico Eagle’s Upper Beaver Deposit, and we will be doing phase two drilling testing NE-SW trending shear structures.

We're hopeful that the second phase of drilling will follow up on some pretty exciting, channel sampling results we released to the market last November, where we were hitting upwards of 16 g/t, over a meter of channel sampling results at surface. We believe the resource update will be a key catalyst for our Company. The historic resource is heavily discounted by the market, because it was dated and non-43-101 compliant. It was done by a prior operator and we feel that the market is in need of a highly robust 43-101 compliant estimate, on our three deposits, to give us the credit we deserve and have demonstrated through the drill bit, but not yet received in the marketplace.

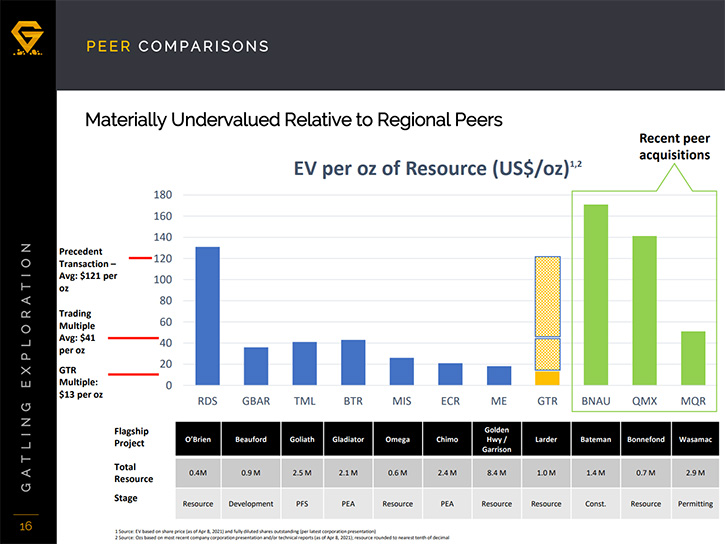

There's a large value disconnect, which is currently in place with Gatling, and I would recommend your readers/ investors look at our corporate presentation. One of our slides does show an EV per ounce of our Company, versus several others in the region, which are commanding much higher valuations on a per ounce basis. We believe that we'll be able to unlock our value over the course of this year.

Dr. Allen Alper:

Oh, those sound like very compelling reasons for our readers/investors to consider investing in Gatling Exploration. Jason, is there anything else you'd like to add?

Jason Billan:

One final item, with respect to the valuation disconnect I was just discussing. The number of M&A activities and deals in the region has also been quite substantial, both on the Ontario and Quebec side of the border. This is once again highlighting that mid-tier and major miners are looking to acquire high-quality assets, in this part of the world right now. They're looking to do deals, in and around existing operating mines, where they're comfortable investing capital and have a proven track record of success. We've highlighted the valuation gap in one slide of our corporate deck. In terms of precedent transactions, Yamana bought Monarch Gold and its Wasamac Project late last year. Early this year, Eldorado bought QMX and its Bonnefond Project. Also, O3 Mining, Osisko's spin out, merged with Moneta Porcupine. All these projects are in and around our vicinity. In addition to that, Kirkland Lake Gold recently did a deal, earlier this month, with two juniors, one to the east and one to the south of us. They are Mistango River Resources and Orefinders, run by the group led by Stephen Stewart. Kirkland Lake is doing a 75% earn-in to both of those Company’s projects, which is crystallized upon spending $60 million apiece.

There's a significant amount of activity in the region and we believe Gatling has been under the radar for several reasons. So, we're marketing the Company more aggressively and being a part of 121 is part of that marketing activity. We aim to continue to get out there and get this story in front of the right type of investors, who will see the long-term value potential in Gatling.

https://www.gatlingexploration.com/

Jason Billan, President and CEO

Gatling Exploration Inc.

For further information on Gatling, contact Investor Relations

Telephone: 1-888-316-1050

Email: ir@gatlingexploration.com

|

|