Magna Mining Inc. (TSX.V: NICU): Exploring and Developing the Past Producing Ni-Cu-PGM Shakespeare Mine, Located near Sudbury, Ontario, Canada; Jason Jessup, President, CEO, and Founder Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/12/2021

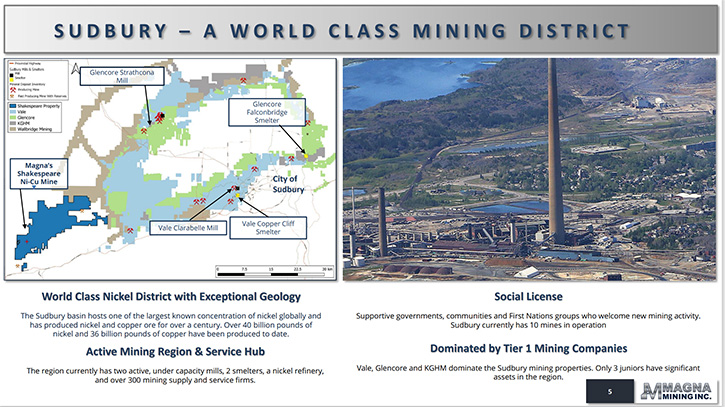

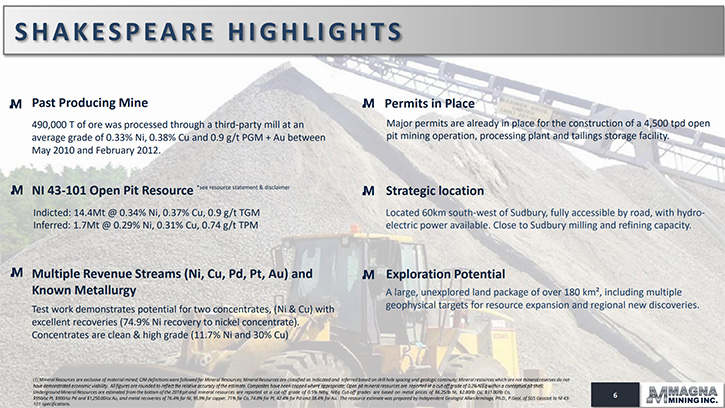

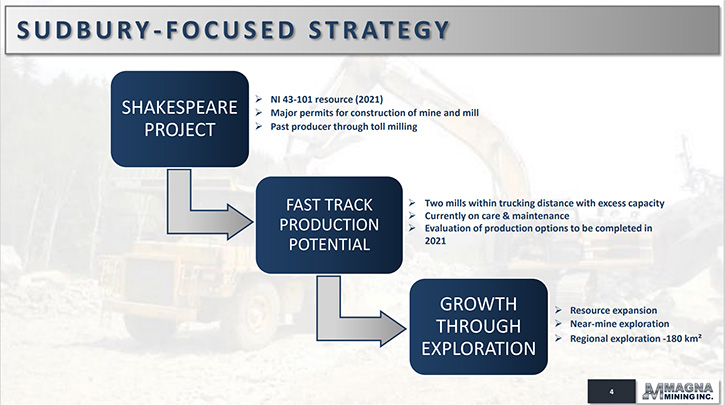

We spoke with Jason Jessup, President, CEO, and Founder of Magna Mining Inc. (TSX.V: NICU)Magna Mining is an exploration and development Company, focused on the past producing Ni-Cu-PGM Shakespeare Mine, located 70km southwest of Sudbury, in Ontario, Canada. Shakespeare is an advanced project, with 14.4 million tonnes of indicated open pit resource and an additional 1.7 million tonnes of inferred open-pit resource. The project has major permits for the construction of a 4500 tonnes per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Magna Mining started trading on the TSXV on May 11th and raised $7 million to fund the 9000-meter exploration program this year. The Company is looking to expand the resource, as well as to test some new regional targets.

Magna Mining Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jason Jessup, who is President, CEO, and Founder of Magna Mining. Jason, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others.

Jason Jessup: Sure, pleased to do that. Magna Mining is a Sudbury-focused exploration development Company, primarily looking at nickel-copper-PGM deposits in the Sudbury region. We have been around since 2016, as a private company. In May of this year, May 11th, we started trading on the TSXV, and concurrently, with that, raised $7 million to fund our exploration program this year.

Our flagship asset is the Shakespeare project. Shakespeare is a nickel-copper-PGM past producing mine, which produced about a half-a-million tonnes, through toll milling, back in 2010 to 2012. So, it's a quite advanced asset. We do have the major permits for the construction of a 4,500 tonne per day open pit mine, mill and tailing storage facility. All that being said, we currently have 14.4 million tonnes of open pit indicated resource and an additional 1.7 million tonnes of inferred open-pit resource. So, quite an advanced asset!

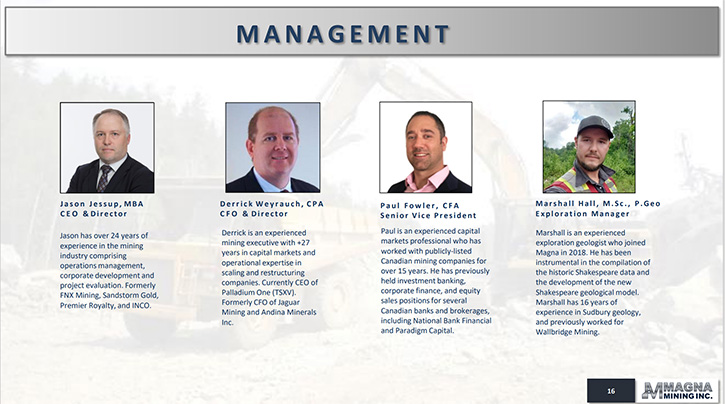

A lot of our Team members are Sudbury-based mining professionals, and many of us have worked together in the past at FNX Mining. So, we know the space really well. We know what it takes to make discoveries. We know what it takes to build and operate mines here in Sudbury. So, really, we feel that it's a highly de-risked project, with a lot of exploration upside, and I think tremendous leverage to the battery metals, in this current strong metal price environment.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors your primary goals for 2021 going into 2022?

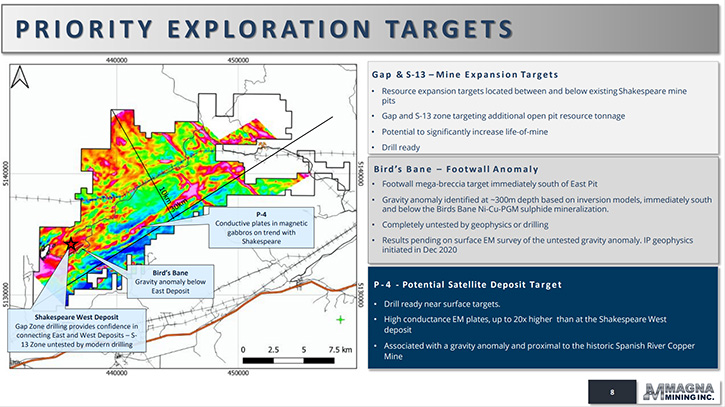

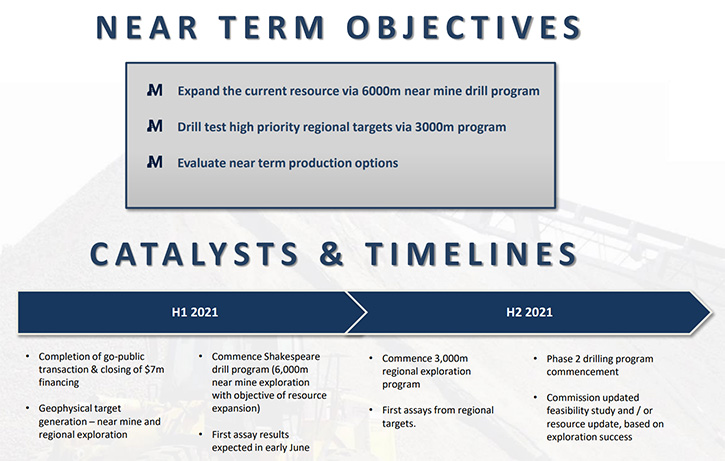

Jason Jessup: Sure. Right now, we are underway with a 9,000-meter drilling program, out at Shakespeare, and 6,000 meters of that will be to both grow the resource and make new discoveries, testing some exploration targets we have immediately around the existing deposit, and that'll be 6,000 meters of the drill program. An additional 3,000 meters, of our 9,000-meter program, will be to test some regional targets that we have.

Our land package is quite large. It's 180 square kilometers around the Shakespeare Mine. This land package has seen very little exploration over the past 20 years. We've identified a number of electromagnetic geophysical targets, located within 200 meters of surface, on this property that have never been drill tested. So, we'll be using the 3,000 meters to test some of these exploration targets and these EM plates, which we think have potential for new deposit discoveries.

So, that will be our focus over the next six months, to complete 9,000 meters of drilling, and hopefully that'll lead to a future resource update. While we're doing that, we will be looking at some near-term construction/production options, for the Company to leverage the existing permits we have, as well as looking to update some of the technical work we have done in the past, on the Shakespeare project and with the historic feasibility study that was done previously.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like 2021, going into '22, will be a very exciting time for your stakeholders and shareholders!

Jason Jessup: Yeah, we really think so. As I mentioned, we were a private company for four years. And we acquired Ursa Major Minerals, the Company that holds the Shakespeare property, back in 2017, at a time when nickel was around $4 a pound, and there really wasn't a lot of interest in nickel or even copper at that time. Since then, we've done a lot of good work to understand the deposit technically and understand the work that had been done on the project from the metallurgy point of view. We're quite encouraged by what we've learned. And it's great now to be in a position to have the cash, to execute on a strategy that's really been years in the making. We think the timing is perfect, and this will be a very exciting year for Magna shareholders.

Dr. Allen Alper: Oh, that's excellent. There's no doubt that nickel and copper are both crucial right now. There is an extremely growing market, with the electrification of the world, thus the need for nickel and copper.

Jason Jessup: Absolutely. It's a strong underlying theme. And to be honest with you, I've been in the nickel mining business, originally with Inco here in Sudbury, and then with FNX Mining. I still live in Sudbury. So, I would feel that I've had my finger on the pulse of the nickel business for the last 20-plus years. When we first acquired Shakespeare and we started looking at assets for Magna, we were always focused on Sudbury. We really wanted to recreate some of that success that we had during our years with FNX Mining.

And although back in 2016, I did not fully anticipate the impact that battery electric vehicles would have on the demand for nickel and copper, I did see that we were in a very low part of the cycle, and we were quite confident that we would see an improvement, due to the lack of investment in nickel and copper projects. We saw that, especially here in Sudbury, where only a very limited amount of exploration, very limited amount of capital development was invested to bring new mines into production.

We did see the supply/demand constraint, but now, with electric vehicles, it is amplified far beyond even our expectations, and it looks like there's no sign of it stopping. If anything, it's ramping up. With some of the comments that Biden has made, in looking to incentivize people to buy EVs and looking for friendly neighbors and allies to supply the metals that they will need to produce battery electric vehicles in the U.S. I think that's very positive for a Company like ours, here in Sudbury and in Ontario, to potentially help solve some of the world's problems, with batteries and the demand that will come from that.

Dr. Allen Alper: Oh, it sounds excellent! You're in a great position and the timing's excellent. It sounds like you have a great project, with a proven Team, to take it to production and operate it profitably.

Jason Jessup: We like to think so. And it really does come back to Team. Again, when we founded Magna, I was one of the co-founders, we tried to surround ourselves with the right people. I think there are a limited number of company building team members in our industry. I've had the pleasure of working with some absolutely fantastic people in the past and had some great successes with them. So, we really are trying to surround ourselves with those people again, and it's been a lot of fun.

We have a great Team! And we know how it works here in Sudbury. We know how to build mines. We know how to work with the communities. We know how important that is. And that includes our First Nations communities. We have great relationships with them as well. So, it is a lot of fun when you work with the right people, and we're fortunate to have just a great project in one of the best jurisdictions I know of. So yeah, it's really coming together. We're very excited for this year.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a little bit more about your background and some of the Members of your Team and Board?

Jason Jessup: Sure. I've been in the mining industry for, well, it'll be almost 25 years now. I started out right out of school, out of the Haileybury School of Mines, working in technical services. I transitioned into mining operations and soon became Underground Supervisor, Mine General Foreman. And then in 2005, went over to FNX Mining. And FNX was a great experience.

I came from Inco, which was a very large nickel mining company, to a small startup at FNX. I think at the time we might've been a team of 80 or 90 people. But as being part of that team, I helped grow it to over 600 people by 2008, with two mines in production and a third underway to get into commercial production. Unfortunately, with the financial crisis, we needed to scale back and downsize, but we're in a strong position.

So, I took on the role of running operations at the Levack Mine, at that time, for FNX. Previously, I was at the McCreedy West Mine, running operations there. Then I led the Team to bring the Levack Footwall deposit, later named the Morrison deposit, into commercial production, and that was a huge success for us. It was our flagship asset, very high-grade copper-PGM-nickel footwall deposit. And after that, we merged with Quadra FNX. And in 2011, I left Quadra FNX to work with another junior Bridgeport Ventures in corporate development.

Bridgeport had cash in the treasury at the time. We were looking to do something exciting. And again, I was working with a former FNX colleague there. Looking at all our options and what to do with the Company, we came across a private royalty company and ended up doing an RTO to become Premier Royalty. So, I spent two years working in the royalty space, and it was great experience. It was an opportunity to look at a lot of projects. I was on the project evaluation and corporate development side. I spent a lot of time doing that. I got a really good lay of the land for projects that are out there.

In 2014, I left the royalty business to go out on my own. It was really then that I decided to recreate the energy we had previously with FNX in a new Company. It took until 2016 to get the pieces together to do that. But in the meantime, I did my MBA. And then that brought us to 2016 when I co-founded Magna Mining, and I've been focused on it ever since.

Dr. Allen Alper: Oh, that sounds excellent! That's a really great background for running the Company. Could you tell our readers/investors a little bit more about some of the other members of your Team?

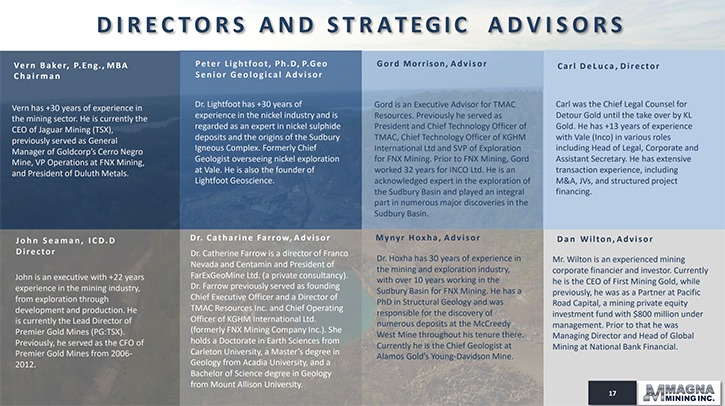

Jason Jessup: Sure. Our Chairman is Vern Baker. Vern is a mining engineer, with an MBA from Stanford. He was the Vice President of Operations at FNX, from about 2008 to 2010. I worked with them very closely there, and it was a great working experience. Vern was a mentor of mine. And currently, Vern is the CEO of Jaguar Mining, operating a couple of gold mines down in Brazil. But he's our Chairman and quite an active Board Member, which is great because he really gives us a lot of great support and credibility from the operation side of the business.

Derrick Weyrauch was the other co-founder of the Company, and he's currently our CFO. Derrick is also the CEO of a Company called Palladium One. So, he's an active executive. He's been in the mining space in an executive position for almost two decades now.

We have a team of advisors that is second to none! They include a lot of former FNX ex-colleagues. Gord Morrison, who led the discovery of the Levack Footwall deposit, which was renamed the Morrison deposit after Gord. Gord is one of our trusted advisors and is quite active in helping us review geological models and help develop exploration targets.

Catherine Farrow, a former FNX executive, who was part of the Team when we really grew the Company. She is a very active advisor, one of my most trusted advisors on a corporate level as well.

And Mynyr Hoxha, who is one of the most brilliant mine geologists I've ever had the pleasure to work with. He worked 10 years at FNX, and I worked quite closely with him, while he was the Chief Geologist at the McCreedy West Mine. He was responsible for a number of the in mine discoveries we made that kept McCreedy West Mine continually producing ore and extending the mine life year after year. He's been advising for us, since before we acquired Shakespeare and helped us on the original due diligence tour.

So, it's great to be working with people you trust, people that understand not just the geology, but also the culture and what we're trying to accomplish here. And aside from that, we have some other great new additions such as Paul Fowler, who is our Senior VP. He does a lot of the corporate development work. He has a background on the sales side of capital markets. He's been great to help us get the story out there and market to a lot of institutional investors.

So, we have a great Team, well-rounded. We have a Team of in-house geologists, led by Marshall Hall, who has been fantastic. He's a long time Sudbury geologist, with over 15 years of experience, primarily here in Sudbury, and he's running the day-to-day operations in the field. So, we have the makings of a really great Team that can grow and help us grow this Company.

Dr. Allen Alper: Well, it looks like you have an excellent team, with great backgrounds and very well balanced. That looks extremely terrific. Jason, could you tell our readers/ investors a little bit about your share and capital structure?

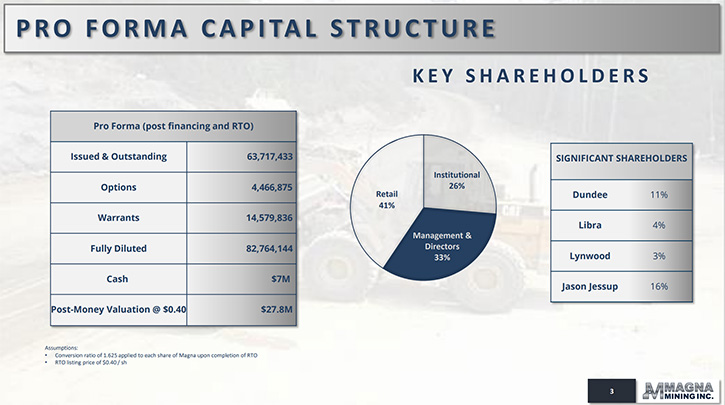

Jason Jessup: Sure. Currently we have just under 64 million shares outstanding. Fully diluted just under 83 million. We have approximately $7 million in the bank currently. We have just below $2 million of that budgeted for the 9,000-meter exploration program that's currently underway. So, it leaves us plenty of cash to either expand on that program or continue into 2022. So, we're in a very strong cash position. Being a private company for so long, we became very astute at conserving cash and being very frugal. Not cutting corners, but definitely not having a big G&A, and we continue to do that.

From an ownership perspective, I'm the largest shareholder in the Company. I currently hold about 16% of the outstanding shares. Management and Directors have almost approximately a third of the shares, about 33% of the outstanding shares. So, we have a lot of skin in the game and are aligned with existing shareholders. I'm really proud of that!

Other big shareholders are Dundee Corp, led by Jonathan Goodman. They hold about 11% of the outstanding shares currently. So, I think we have a strong shareholder base. And again, Management and our Board are very much aligned with all our other shareholders.

Dr. Allen Alper: Oh, that's great. It's great to see Management having skin in the game and the same objectives as individual investors. So that's excellent! Jason, could you tell our readers/investors the primary reasons they should consider investing in Magna Mining?

Jason Jessup:Magna offers investors, who are interested in exposure to the upside of copper and nickel, an advanced asset that's in one of the best mining jurisdictions. When I say advanced, we have not only an existing resource, but we also have permits in place, including an IBA with the Sagamok First Nations. It's largely technically de-risked because we've not only done laboratory metallurgical work, but by mining nearly half-a-million tonnes and toll milling it, we have actual recoveries and know what concentrates we can produce, which is huge when you're looking at nickel and copper deposits.

All that combined, we have a lot of exploration upside. And I think there's tremendous potential for a new discovery that builds right into potential future mine plans. So, we're very much a unique Company that is well positioned, in a great jurisdiction, with an experienced Team and in an asset that is de-risked, technically. So, I think that really sets us apart.

Dr. Allen Alper: They sounds like very compelling reasons for our readers/investors to consider investing in Magna Mining. You have a great property, production experience, and the timing for nickel, copper, and the platinum metals is great right now, and it looks like it'll continue to be in the future.

Jason Jessup: I couldn't agree more. I'm glad you're seeing the same things we are. We're quite excited. Being a new Company, who just started trading and being private for four years, with essentially a zero-marketing budget, we have it cut out for us right now to get our story out there. I'm really pleased to speak to you and for you to help tell some of your readers/investors about what we're doing, because we are focused quite hard now on getting out there and speaking to people, telling our story. Because we think that by doing that, we'll be trading more in line, with a lot of our peers, which are trading at much higher valuations than we are right now and don't have as advanced an asset or are in such a good jurisdiction. So, yeah, we're really excited to tell the story. I think there's lots of upside for Magna Mining.

Dr. Allen Alper: Oh, that sounds excellent, is there anything else you'd like to add, Jason?

Jason Jessup: We are all about doing things right. And have been from day one. We said, "Let's build a mining company that just does things right." That could be interpreted in a lot of ways. But at the end of the day, you're making the right decisions for all stakeholders, not just, short term views.

This is part of why we hired a consultant to give us a measurement of what our current carbon footprint is. During a marketing meeting I was asked, “What's your current carbon footprint and what do you think it'll be when you're a producer someday?” Those were questions I couldn't answer at that time. So, we went out and hired a consultant to look at what our plan is for 2021, and what fossil fuels we've burned so far to date, and what the carbon impact of that was. And they calculated our estimated CO2 emissions for 2021.

And when we had that number, we thought that was great that now we have something to measure against and help us make decisions going forward. And where does most it come from? Most of it comes from running diesel generators and diesel diamond drills right now. So, that helps us make decisions. Now, we're not able to stop diamond drilling, but at least we know.

Then we made the next step of the decision saying, "Okay, well, what can we do to start offsetting the impacts now?” It's not enough to just do that once we're a producer. Why not start doing it now and building the culture of doing things right from the start? And so, that's what we've done. And we're really proud to say that we are now a carbon neutral, nickel copper exploration company. And I believe we are one of the only carbon neutral nickel copper exploration companies in the world, if not the only one.

Magna Mining Inc.

And I hope that many other exploration companies follow suit. I think it makes a lot of sense. But this, again, reinforces our belief that we want to do things right. I think that's important because when you invest in a junior mining company, I think you should be investing in the Team as much as the asset. We want to be a transparent Team, who does things right, and right for all stakeholders. We believe that will give us long-term growth and long-term success.

Dr. Allen Alper: Oh, that's excellent! It's great to see a Company that's socially responsible, so that's excellent.

https://magnamining.com/

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Senior Vice President

Email: info@magnamining.com

|

|