Anaconda Mining Inc. (TSX: ANX) (OTCQX: ANXGF): On Track to Become a 150,000 Ounce Per Year Gold Producer in Three to Five Years, Kevin Bullock, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/6/2021

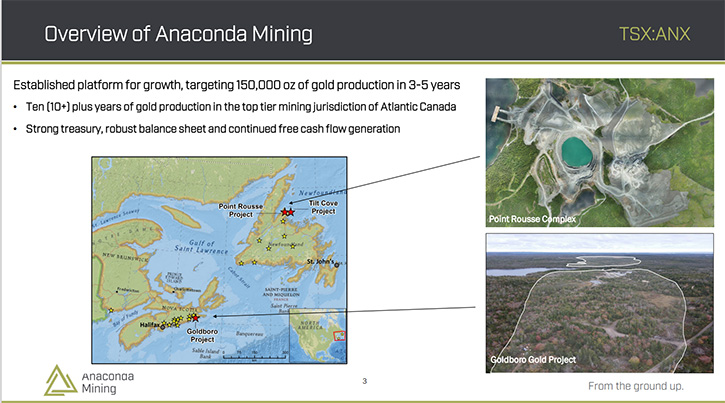

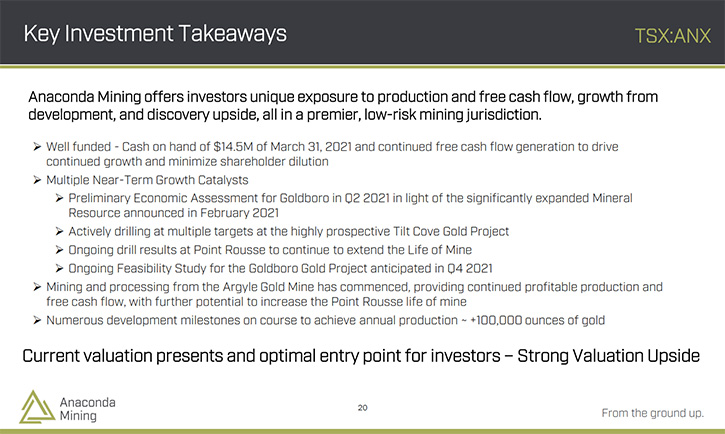

We learned from Kevin Bullock, President and CEO of Anaconda Mining Inc. (TSX: ANX) (OTCQX: ANXGF), that they are on track to become a 150,000 an ounce per year gold producer, within three to five years. Anaconda's Point Rousse Project, located in Newfoundland, continues to produce free cash flow, which funds exploration and development of the Company's Goldboro Gold Project in Nova Scotia, as well as its Tilt Cove Gold Project in Newfoundland. Last year, Anaconda put $14 million back into the ground to advance exploration and growth efforts. The updated resource, on the Goldboro Gold Project, increased 100% and it is now looking like a very significant and robust project. Near term plans include the Feasibility Study, due at the end of this year, as well as the PEA based on the new resource, due out in June.

Anaconda Mining Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Kevin Bullock, President and CEO of Anaconda Mining. Kevin, could you give our readers/investors an overview of your growing Atlantic Canada gold producing company and your extensive export exploration? Also tell us what differentiates your Company from others and then discuss the three main assets that you own and are developing and producing.

Kevin Bullock:

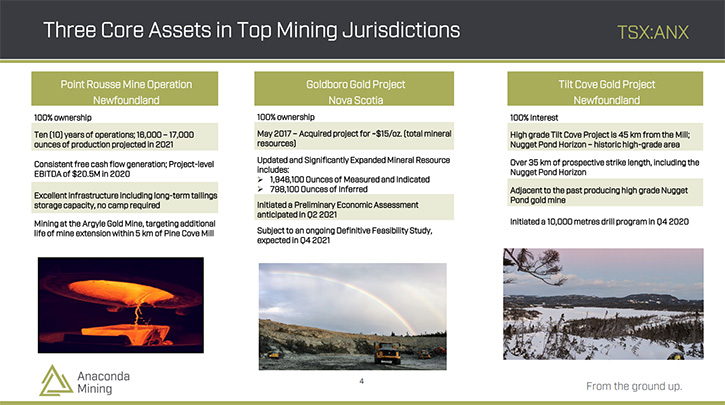

We set out on a course, about 18 months ago, to become a 150,000 ounce per year producer within three to five years. We set up a three-pronged approach to do that. One of them was to continue producing free cash flow, at the Point Rousse Project , to be the cash engine for our growth. Since we spoke to you and your readers last, we've certainly done that. Last year we had a $20 million EBITA at project level, which turned into $14 million being put back into the ground to advance exploration and growth efforts, including development of the Goldboro Project in Nova Scotia.

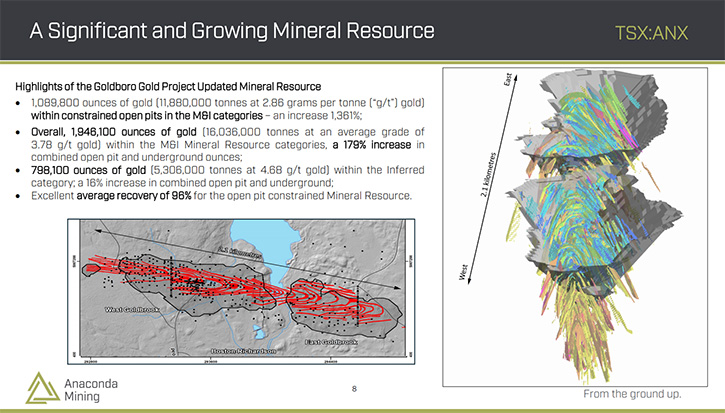

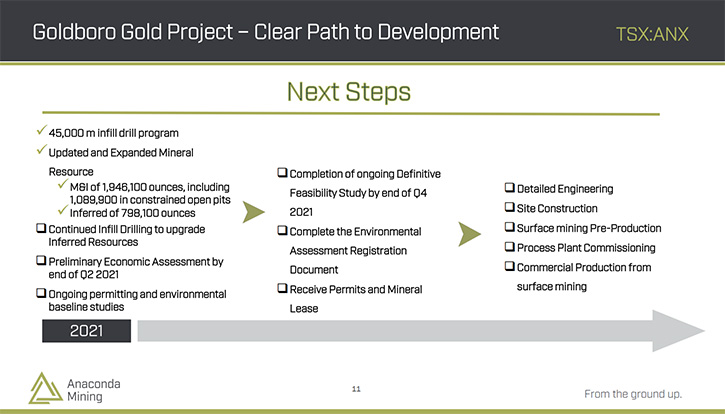

Not long ago, we announced an updated resource calculation, and it was 100% percent larger than the last one. More significantly, the open pit potential was over 1,000% higher than previous estimates. That's now looking like a very significant project that will show a robust cash flow. In line with putting out the new resource, we thought to ourselves, we’d better put out a Preliminary Economic Assessment (PEA), in parallel to our Feasibility Study (FS), that'll be out at the end of the year. We should do the PEA based on that new resource. The results of that will be issued in a news release in June, which will show the economics of a combined open-pit underground mine.

It will be quite robust, because of the size of the new resource, which is now the second largest gold resource in the Maritimes, the largest resource in Nova Scotia and the highest-grade, undeveloped, open pit resource, on the East Coast. This is now a world class deposit that we've advanced forward, with a little bit of production from Point Rousse. That, being step one of our three-pronged approach, has worked quite well and we've advanced Goldboro, to something that's making it a world class deposit.

Prong two, was to extend the mine-life at Point Rousse, so that can keep cash flow going forward. We've had a new discovery, an extension to an old open pit that we mined in the past, called Stog'er Tight in Newfoundland. This is about 3.5 kilometers, from the processing plant that we own, which is the only fully permitted, operating gold plant, on the island of Newfoundland, which gives us a distinct advantage of moving things forward quickly. The discovery that we have is showing some great intersections. We are still doing the extensive infill drilling at Stog'er Tight extension, and we believe strongly that that will be our next mine, after the current mine, Argyle, and we've already started the permitting process based on that.

We are excited to be putting out drill results, from that program soon, and ultimately a resource and a mine plan around it, to extend the mine life at Point Rousse. We think it'll add another year to two years of production at Point Rousse and we continue to explore other targets in this great trend. That's our second pronged approach.

The third would be to discover a higher-grade deposit, about 40 kilometers east of our current producing asset, all connected by quality roads and truckable distance for ore, in our Tilt Cove project. Tilt Cove is a 35 km strike length of Greenstone Belt that surrounds the past producing mine, called Nugget Pond, that produced in the '90s at just under 10 grams per tonne, diluted grade. We're looking for deposits that have similar characteristics to that, that we could truck back to Point Rousse when, after any further discoveries, including Stog'er Tight, are mined out.

To that extent, we've just announced another $8.5 million flow through raise to add to our $14 million in the bank to beef up the exploration at Tilt Cove, as well as further exploration at Goldboro, so that this three-pronged approach for growth will continue going forward. We're quite excited to be able to let everybody know that we are back, basically saying that we've done everything we said we would do, and we continue with our growth strategy.

Dr. Allen Alper:

Well, you've done outstanding accomplishments since last year. You really have done great work and have three great assets with such great potential. So that's excellent!

Kevin Bullock:

Yes, we're quite happy about it. I urge people to keep their eyes open for the PEA in June, which we truly do believe will have a valuation, much larger than the current market cap of our Company.

Dr. Allen Alper:

That's excellent!

Kevin Bullock:

We're quite excited about that, which will lead towards finally putting out a FS at the end of the year. Once we have a FS done, we will have all the information we require to submit our Environmental Assessment Registration Document (“EARD”) and that starts the process of getting final permits. That's about an 18-month process, which means we could be breaking ground in mid-2023.

Dr. Allen Alper:

That's excellent! It's great to be in a position where you're producing, expanding your resource and you have two other great projects that you're developing. You have a great goal of becoming a mid-term producer in the very near future.

Kevin Bullock:

Yes, we've put together a very detailed and aggressive growth strategy, that we are following and giving regular updates to our shareholders and potential shareholders.

Dr. Allen Alper:

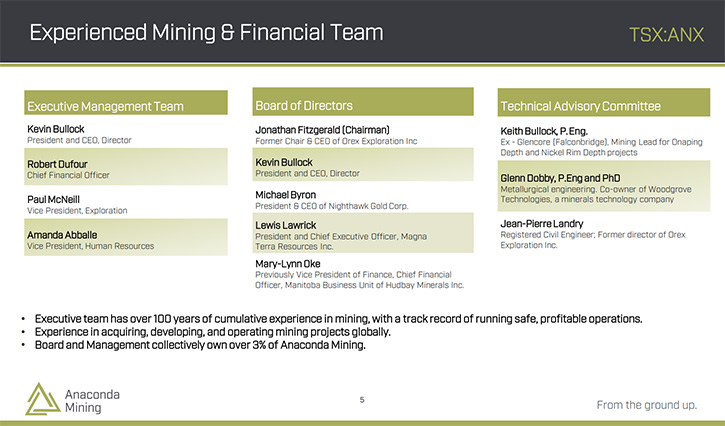

Well, that's excellent! Could you tell our readers/investors a little bit about your experienced Management Team, both technical and financial?

Kevin Bullock:

I've been in the business 35 years. I have been part of a few successful stories. In the early 90s, I moved to West Africa, with a private company called IAMGOLD. I stayed there for three years. The following year we took it public and now it's a multi-billion-dollar company. I came back and was asked to find an asset for a penny stock shell company, called Foxpoint Resources and ended up being part of the Team that negotiated the purchase of the Macassa Mine in Kirkland Lake. We changed the name of that company to Kirkland Lake Gold, and that's now a multi-billion-dollar company, I think it's over $10 billion in value at the moment.

I then started my own Company, called Volta Resources that drilled off the largest gold deposit in West Africa, at the time, called Kiaka in Burkina Faso. That Company was acquired by B2Gold and I'm still a Director, as a result of that transaction, and that's a multi-billion-dollar company. I saw a set of assets at Anaconda that I thought were fantastic. I thought, here's the next Company we could build. Over the first year, it was a matter of seeing who was involved and who needed to be changed. We made some significant changes, within the Company and outside of the Company, as far as consultants and contractors go. We cleaned it up quite well so that we now have a quality Operating Team and a quality Management Team. The Technical Team is the same as they've always been, and they've been finding gold for over 10 years in Newfoundland and Nova Scotia. So, quality people that have a lot of experience in the industry!

Dr. Allen Alper:

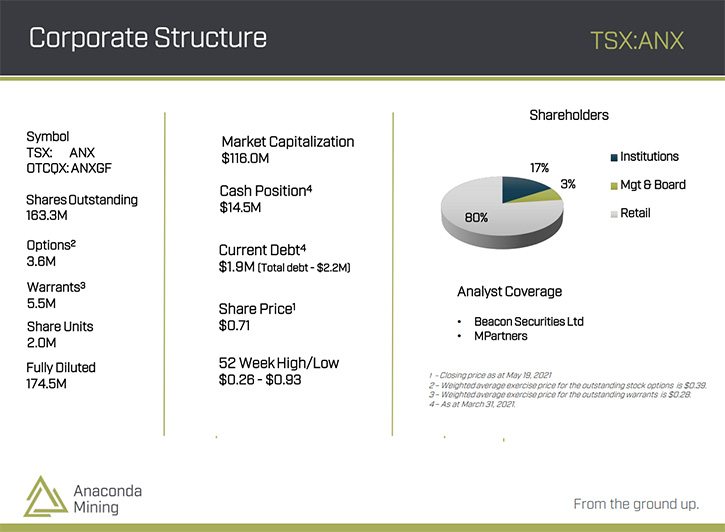

Well, you definitely have an outstanding record of accomplishment. It's great that you are doing so well with Anaconda Mining, so that's excellent. Could you tell our readers/investors a little bit about your capital structure?

Kevin Bullock:

We have 164 million shares issued and outstanding. We haven't done many financings, over the last 10 years, as far as hard dollar financings, because of the cash flow that we've been generating. We've been less dilutive than most junior companies, with moving our Company ahead because of the cash flow from the operations. We have $14 million in the bank, we have $8.5 million dollars coming a week from today, so we'll have over $20 million in the bank, 160 million shares outstanding, and 3 million ounces of gold, within the Company. A lot of news flow, with economics around the Goldboro Project, four Quarters of production at Point Rousse and further discoveries, both around Point Rousse and at Tilt Cove. We're quite excited about the future we have, and we have mainly been a retail story, however, over the last two years, we've been building up the institutional side. With this latest financing, we should be approaching a 25% ownership by institutions, long-hold gold institutions.

Dr. Allen Alper:

Well, that's excellent! It's really a great record of accomplishment and great potential for growth! That's truly excellent! You're in a unique position, having production and also all these great assets that are being developed, with great potential. So, you're in a great position! Kevin, could you tell our readers/investors the primary reasons they should consider investing in your Company?

Kevin Bullock:

Because of its uniqueness. We've been able to build a Management Team and Technical Team that would otherwise be with a larger company, but because of the excitement of this story and the difference between us being a junior that has production, cashflow, development and exploration creates a lot of excitement for people. It's a time now where people are scarce, because of the boom in the gold price, and we're happy to be able to retain a great quality in moving forward. That's one.

Number two is a development project that is near term. In other words, we could be breaking ground at Goldboro in 2023. Until then, we're moving towards that, putting out a PEA and then a FS, showing the value of the project, which will be robust. That, for a market cap of currently around $100 million is a very good entry point. One of the important things that readers and potential investors should look at is what is Management doing about it? Is Management investing in their own work? A couple of us are, myself and the CFO, Rob Dufour. In the last two years, we've put more than our own salaries back into the Company, buying alongside shareholders to build our position, as we are not Founders of the Company. We buy when we're not blacked out and we purchase on the market alongside our shareholders because we feel that this is a great entry point.

Dr. Allen Alper:

It's great to see that Management has confidence in the Company and is investing in the Company and taking a position just like other shareholders. It's excellent that you have skin in the game. It's great to see.

Kevin Bullock:

Very important!

Dr. Allen Alper:

Kevin, is there anything else you'd like to add?

Kevin Bullock:

Just that the news flow will keep coming, there will be momentum built and we have some major, major news events coming out, starting with the PEA next month. It should change the way people look at Anaconda as we've changed from being a small producer to a cash engine that supplies growth money to build a large project.

Dr. Allen Alper:

That's excellent. Those are compelling reasons for our readers/investors to consider investing and coming into mining. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.anacondamining.com/

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

|

|