GoldSpot Discoveries Corp. (TSXV: SPOT) (OTCQX: SPOFF): Expert Scientists Merge Geoscience and TData Science Delivering Custom Solutions Transforming the Mineral Discovery Process; Denis Laviolette, Chairman Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/6/2021

We spoke with Denis Laviolette, Executive Chair and President of GoldSpot Discoveries Corp. (TSXV: SPOT) (OTCQX: SPOFF), a technology services company in mineral exploration. GoldSpot is a leading Team of expert scientists, who merge geoscience and data science to deliver custom solutions that transform the mineral discovery process. To aid in making discoveries, GoldSpot produces Smart Targets and advanced geological modelling that saves time, reduces costs, and provides accurate results. GoldSpot also has developed an impressive equity and royalty portfolio and a growing software service offering with over 40 mining software products in development

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Denis Laviolette, Chair of GoldSpot Discoveries Corp. Denis, could you give our readers/investors and our CEOs and Executives of mining companies, an overview of your Company and the services you have for mining and for mining companies? We have interviewed several hundred mining companies every year.

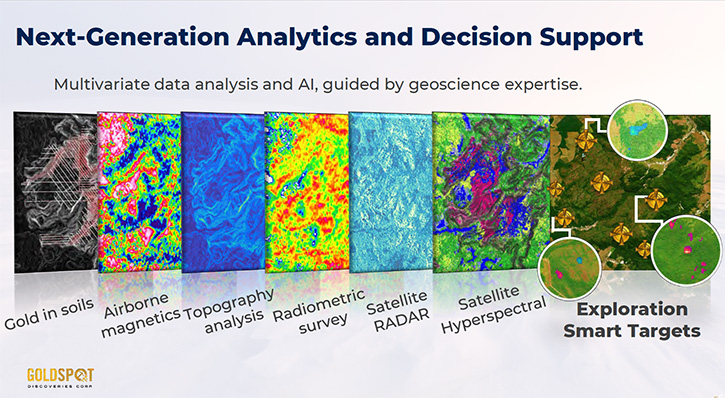

Denis Laviolette:GoldSpot Discoveries is the leading AI machine learning provider, for the exploration side of the mining business. We've been focused, as a technology company, on taking big data that's been collected over a very long time, whether it be geophysics data, geochemistry data, mapping information, just about everything under the sun that's been collected and paid for by companies. We basically take all that data, and we use new types of data science methods to analyze it and find patterns in it. That's really what the foundation of GoldSpot has been doing.

We offer this as a service to companies big and small. Over the course of the last five years, we've been building our brand, working for some of the largest companies in the mining space. We've also been bringing our technology to junior companies and oftentimes what we do on the junior side, is we pair up our service offering, with an investment. What GoldSpot ends up becoming is a consulting and technology company, having a pretty robust share exposure into the deals that it works on, as well as in some cases, royalty exposure.

Dr. Allen Alper:

Sounds excellent. Could you give our readers/investors some examples of what you're doing, some companies and some work discoveries, etc.

Denis Laviolette:

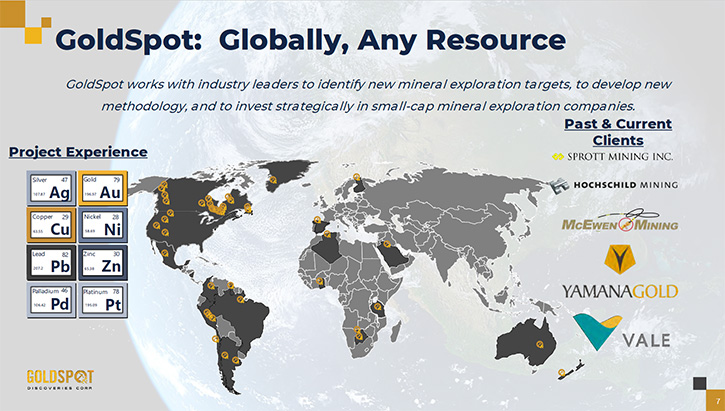

We got our start with Jerritt Canyon, which has since been purchased by First Majestic. It was a private company, Eric Sprott owned, where we put our Team and technology to work to come up with new exploration targets and ideas. Some of those targets were validated by the Company and that really helped us further secure investment from the very clients that we were providing our services for. We also moved into Hochschild Mining, where we had the pleasure of working on their entire fleet of assets in South America, predominantly in Peru.

We would get under the hood of these projects and into their data rooms and take all their information and clean it all up and stitch it all back together again and homogenize this data. Then bring it into a global model where we could then apply very sophisticated data science techniques to help find new targets. Validating some of their existing ideas, as well as providing them with some new ones that they hadn't even thought of yet to unlock value for them. Then those companies would go out and test those targets and test those concepts. What's been nice is that we start off with one project and that relationship matures into a multitude of additional contracts and referrals.

We've had this experience with the likes of Yamana as well where we were able to find new zones for them that they were able to go out and validate, as well as a multitude of junior clients. One of the most notable success cases that we've been able to participate in, is New Found Gold, they've been able to capture the imagination of the market recently, with some exceptional drill results. GoldSpot was pretty much part of that company from the start, taking a very district scale approach, looking at district scale data, refining it into target ideas, which ultimately culminated in a miraculous discovery over in Newfoundland, which has sparked a tremendous staking rush into the province. GoldSpot today owns a fairly handsome number of shares in New Found Gold, as well as a royalty on all the assets for our participation in that project. These are just a few examples of some of the projects and success cases GoldSpot had over the years.

Dr. Allen Alper:

That sounds excellent. I like your business model and I also like the expertise that you have that you could help companies train, develop and expose assets. That's a really fantastic technique. Could you tell our readers/investors about your background, some of your Management Team and your Board and also some of the key members of your Company?

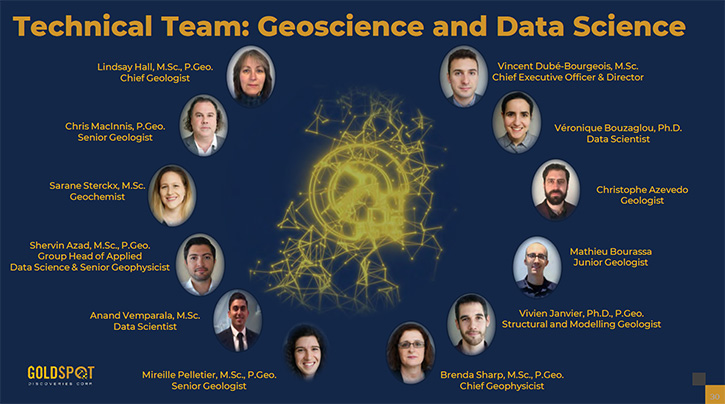

Denis Laviolette:GoldSpot is a bit of a ragtag bunch. I'm a geologist by background, I have worked with a lot of large companies and small companies in the space. I migrated into capital markets as a Mining Analyst, looking after the mining portfolio at Pinetree Capital, where we had over 400 names in the space. That's really where I cut my teeth on the capital market side. Cejay Kim, who was our Chief Business Officer, had a similar background. He's an MBA, CFA that also worked as an analyst for the KCR Fund.

We paired up with a team, out of the Institute of National Research, in Quebec City, which was led by Vincent Dubé-Bourgeois, who is our CEO right now. Vincent was developing machine learning and artificial intelligence tools to handle exploration data and problems, that was really the foundation of our business. Since then, we recognized that if we moved quickly and we got ahead of the pack, we should be able to get ahead of a lot of the larger companies in the space that would eventually come to the realization that they needed to go down this road.

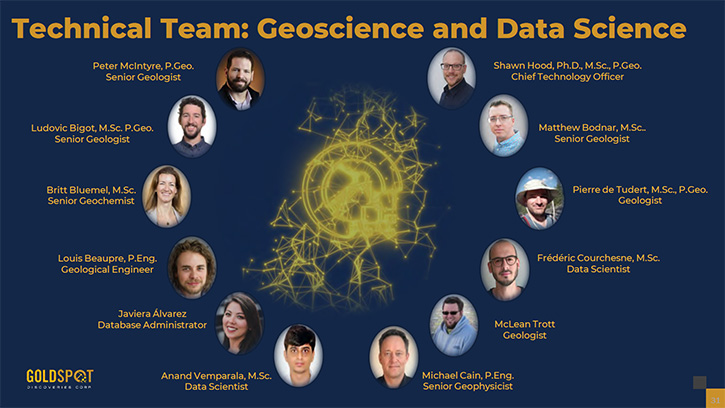

If we moved quickly without any red tape as a private entity, we could have most of the intellectual capital, which was very limited in this space. So, we have some really exceptional people on the team today. We have Dr. Pejman Shamsipour, who is based out of Montreal. Pejman used to be a lecturer in the field of geophysics and artificial intelligence, and he joined us to head up our R&D squad along with a couple of his proteges. We have Dr. Shawn Hood, who studied at the CODES program, which is a multinational cross institutional academic body, where Shawn specialized in machine learning and artificial intelligence and its processes and its application to machine learning. So, he was very well published in this field as well as Pejman.

We were able to go around and grab the people that were really functioning as the bridge between AI and machine learning and geology. In order to be proficient at what we do, you can't just have a bunch of computer scientists and computer people and machine learning type of mathematicians. We need to have a tacit understanding of the data which we're working with. So, a data scientist, in order to be effective and pick the right algorithms for the job, needs to understand what type of data they're working with and all the nuances and issues with that data. So, it's very important that we have domain experts. So, people that are geophysicists first and data scientists second, but they need to be both in order to be able to tackle the geophysical problem. The same applies to geochemistry, the same applies to structural geology.

It's about finding the very few people around the world that are thought leaders and experts in this and latching onto those people and bringing them in to be senior leadership within GoldSpot. That's what we've been acquiring, really, which has been intellectual capital over the last five years and trying to stay on top of that. We've assembled an incredible team that works very well together and is very, very well rounded.

Dr. Allen Alper:

Oh, that sounds excellent. It sounds like you've done a great job finding the people and putting them together and having a staff that could solve problems, and that both a geological understanding and a computer science background. That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Denis Laviolette:

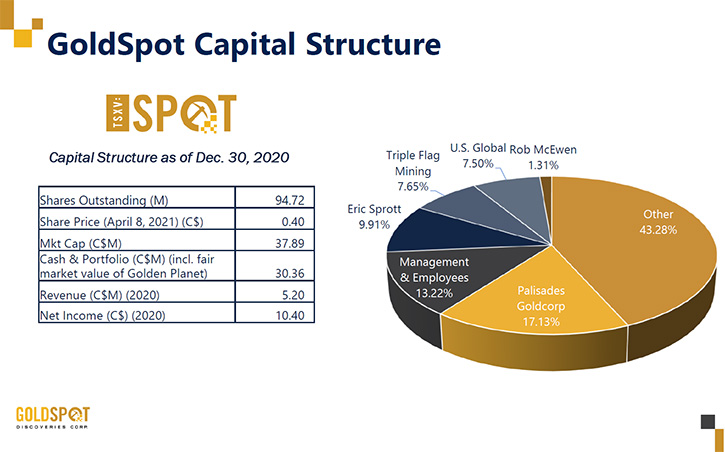

Sure, ahead of this financing that we've just announced, which is the Bought Deal by Canaccord Genuity, for CAD$10 million at 80 cents a share. We had approximately 94 million shares outstanding and predominantly our largest shareholders were, Palisades Gold Corp. and Management, as well as Eric Sprott and a few others, Rob McEwen, to name a few and some other institutions out there. Triple Flag, which has recently gone public itself, is a very large royalty streaming company, they own a handsome chunk of GoldSpot as well, and they've been there since our RTO.

We've never had any warrants outstanding; we've never issued a warrant on any of our financings, and we plan to keep it that way. We're currently sitting north of $40 million in assets under management, a combination of cash and securities. Our revenue last year, we had net proceeds of $10 million in net gains with a cash revenue of $5.2 million. It's a growing business, we've been growing over 100% year over year for the last four years and we plan to continue that trajectory into 2021.

Dr. Allen Alper:

That's excellent. That's very impressive what you and your Team have done. So that's great. Could you tell our readers/investors a couple of things? First, what are the primary reasons they should consider investing in your Company?

Denis Laviolette:

Well, we're commodity agnostic. Our solution and our Company can take advantage of precious metals, price performances and booms, base metals, rare earth metals and really anything. So GoldSpot is commodity agnostic in terms of its value that it brings to various different types of exploration and various different commodity types. We're quite resilient that way.

Secondly, with GoldSpot, you have direct drive in a Company that is actively developing our technology and driving our successes with our clients. If you're a shareholder of GoldSpot, you get a beautifully diversified portfolio of exposure into deals that are using the cutting-edge technology that GoldSpot brings to the table. We're giving you a short list of companies that have an edge over the rest of the pack. Through owning us, if we do make a discovery, with one of those companies, hopefully its share price will perform quite well, and we will capture a lot of that value for our shareholders and GoldSpot. It gives them a fairly less risky exposure to junior exploration and all of the asymmetrical upside that a junior can present. By owning shares of GoldSpot, you're diversified to that upside, but you are basically shielded from a lot of the downside risk that comes with that as well.

Another reason to own GoldSpot is that a lot of the discussions surrounding mining innovation and how mining is behind the curve and slow to adapting new technologies isn’t true. There is a beautiful sea of new technologies in mining, they just happen to be in undercapitalized private companies. It's very hard for mining technology companies to secure investments. It's very hard for them to grow and so we're currently sitting as a publicly traded technology company with a strong balance sheet and a strong track record and a growing brand. We're basically the public nucleus that can snap up and grow through acquisition, acquiring a lot of the other disruptive mining 2.0 technologies right now that exist, but just need a little bit of help.

They need help getting access to clientele, they need help with R&D and growth capital. There's a tremendous number of opportunities out there and GoldSpot is in a very enviable position to start consolidating the mining technology space. That's another great reason to own GoldSpot, there used to be an old saying, in the Yukon gold rush, you want to be the guy selling the shovels. Because it doesn't matter if the price of gold is high or the price of gold is low, the shovel seller is always selling shovels.

In our case, we don't really care what the commodity is, we don't care what cycle it's in, we were built in a bear market. We built a business model that thrives in a bear market, and it thrives more in the bull market. We're happy to be in the times we're in and we know how to take full advantage of it. But should things turn, we know exactly how to take advantage of that situation and thrive.

Dr. Allen Alper:

Sound like excellent reasons for our readers/investors to consider investing in GoldSpot.

https://goldspot.ca/

CORPORATE OFFICE

Toronto, Ontario

69 Yonge Street, Suite 1010

M5E 1K3

TECHNICAL OFFICE

Montreal, Quebec

980 Rue Cherrier, Suite 201

H2L 1H7

|

|