Nicola Mining Inc. (TSX.V: NIM): Soon Generating Cash flow with Their Gold and Silver Mill and Tailings Facility, Exploring a High-Grade Silver Property, and New Craigmont Copper Project near Merritt, BC; Peter Espig, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/5/2021

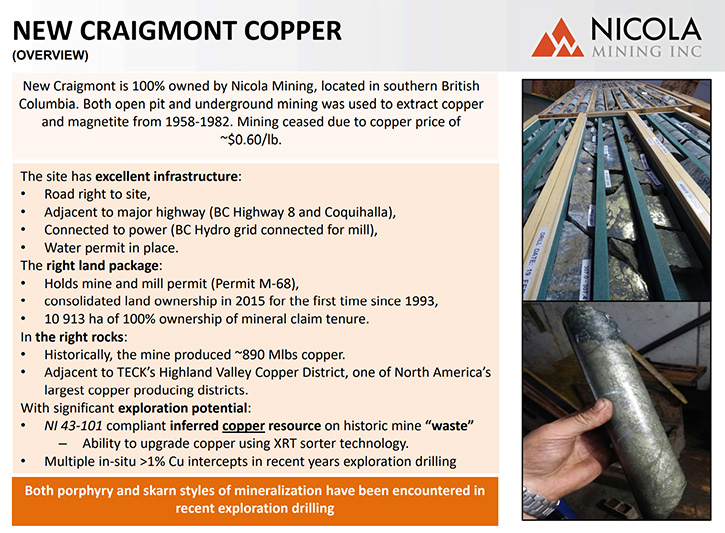

Nicola Mining Inc. (TSX.V: NIM) is a junior mining company in the process of recommencing mill feed processing operations at its 100% owned state-of-the-art mill and tailings facility, located near Merritt, British Columbia. The fully permitted mill can process both gold and silver mill feed, via gravity and flotation processes. The Company also owns 100% of Treasure Mountain, a high-grade silver property, and an active gravel pit that is located adjacent to its milling operations. In addition, Nicola Mining is planning to start a large five-year exploration program at its wholly owned, New Craigmont Copper Project, located near Merritt, BC, 33 km south of the world-class Highland Valley porphyry district. The 2021 program includes up to 21 drill holes (8520 meters), five new trenches and the reactivation of 6 historic trenches. We learned from Peter Espig, who is President, CEO and Director of Nicola Mining that the mill will be commences in June/July this year, in partnership with Blue Lagoon Resources. The proceeds from the mill operations will help the Company’s exploration projects.

The New Craigmont Copper Project

Dr. Allen Alper:

This is Dr. Allen Alper, Editor in Chief of Metals News interviewing Peter Espig, who is President, CEO and Director of Nicola Mining, Inc. Peter, could you give our readers/investors an overview of your Company, and what differentiates your Company from others.

Peter Espig:

I would say we are unique, in the Junior Mining Sector. You brought up a good point, which I would like to clarify. Where we are today is going to be very different from where we will be in the near future. Nicola is unique in that: we are a Company that has a fully permitted silver mine, we also have a fully permitted mill, which is the only mill in British Columbia that is permitted to accept third-party material, from anywhere in the Province. We also have a copper property, which is the Craigmont Mine.

I'll make it even simpler. The Craigmont Mine site has the highest copper in the history of North America. We will be doing an exploration program, looking for copper skarn and also for porphyry copper mineralization at the site. We are beside Highland Valley, which has the largest copper mine in North America. Historic grades at the 34Mt mine were 1.3%.

We have had, in recent drilling, several intercepts that are greater than include:

- DDH-THU-002: 85.6m @ 1.11% Cu

- NC-2018-03: 100.6m @ 1.3% Cu

I'd like to talk a little bit about the mill and what it means to us. The expectation is to commence milling operations, in the near future, the early part of June/July of 2021. It is public information. we have a milling and partnership agreement with Blue Lagoon Resources. The plan is to commence shipping to our site, and we will then process it. We have a profit share agreement between the two Companies, and we also have signed an LLI to acquire the 75% financial or economic ownership of a property called Dominion Property, which is a gold property in Northern British Columbia, and we will immediately commence our application for a bulk sample permit.

Without confusing people, we have a silver mine. We have two sources of gold and then we have the copper. One of the questions people ask is, "What's your focus?" We believe the true value of the Company is the long-term value of the new Craigmont Copper Project. But, as we know, exploration is expensive, so having the benefit of having the mill operation—We have a $30 million mill of which we own 100%, which enables us to monetize other people's gold properties, as well as our own potential acquisition, which has not closed yet. But the opportunity to monetize operations to fund exploration, that is really what the core of the Company is about.

Dr. Allen Alper:

That sounds excellent! Sounds like you really have very important assets, short term assets and abilities that are unique, and also a long-term project that sounds like it has great potential for copper projects.

Peter Espig:

Several of the Junior Companies have an asset in Quebec and then an asset in let's say British Columbia or somewhere. It is difficult to understand the synergies between assets that are in completely separate jurisdictions. Ours is different. All our assets are within trucking distance and leveraging our $30 million, fully permitted mill. We own 900 acres freehold, so our entire site is an industrial site. We paid $9 million for the land and built a modern mill on top of that.

Distinguishing ourselves from our peers, there are companies in South America that have milling operations and they call themselves toll millers. In South America it is a lot easier to get permits. The barrier of entry in British Columbia is not just capital, but it is a decade of consultation, environmental impact studies, economic capability studies, so it is very, very complex. We are very comfortable, with our positioning, and we don't do toll milling, we typically enter into partnerships, where we receive most 50% of the profit from the gold operation. It gives us negotiating leverage.

But again, it is the copper asset, we're very, very excited about it because copper's a green metal. So, there's going to be a shortage of copper in the near future, and we have a historic permitted mine site. And, you know, Dr. Alper, getting to permit is not that easy either for a copper mine. We expect to have a successful drill program. If we're able to prove that the concept of the copper exists, we're able to expedite production much faster than a company that has a resource and a lot of drilling, but still does not hold in its hand a mine permit. We also pride ourselves on being an environmentally focused miner and good community citizen; the majority of our employees live in Merritt and are local.

Dr. Allen Alper:

Well, it sounds like you're in an excellent position, with the possibility of generating a cash flow in near term and a very exciting long-term position in copper. Which, with electrification and electric vehicles, I agree copper will be in short supply.

Peter Espig:

I worked for a Wall Street bank that certainly is one of the global eaters in commodity trading, but I don't profess to be a commodity trader, nor do I profess to be an expert. But, it is clear that people who projected the demands of copper supply three or four years ago, really couldn't foresee the rate of penetration that electric vehicles would have in the market. Nor could they accurately predict the growth of the middle class in both India and China and Africa. Remember that the average house requires 500 pounds of copper, which low and behold, so does an electric vehicle. So, the demand is really a grass roots demand in expansion of electric vehicles, which we all know is going to be part of the future. I don't think the experts foresaw the speed with which this would start.

Dr. Allen Alper:

Yes! It's really an exciting time for electric vehicles and for the people supplying the electric vehicles, and copper, of course, is one of the key ingredients. Peter, could you tell us a little bit more about your background and your experienced Team?

Peter Espig:

I feel like my life has now gone full circle, because when I was a teenager growing up in Canada at Alter University, I worked as a diamond driller. I worked on drill rigs, exploring for gold, copper and silver assets in Northern Canada and Northern British Columbia and Alberta and Yukon Northwest Territories. I did my undergraduate degree at the University of British Columbia. I then went to Japan and then I went to Columbia Business School as a Chase and International Scholar.

I graduated from Columbia and subsequently worked for Goldman Sachs and Olympus Capital. I certainly understand Wall Street, I was also one of the pioneers of SPACs, which have made a big come back in the US. I was part of the largest 10 stocks in history up until the date of 2008 and I retired and moved back to Vancouver and I slowly become involved in the mining sector and as a Distress Turnaround Specialist.

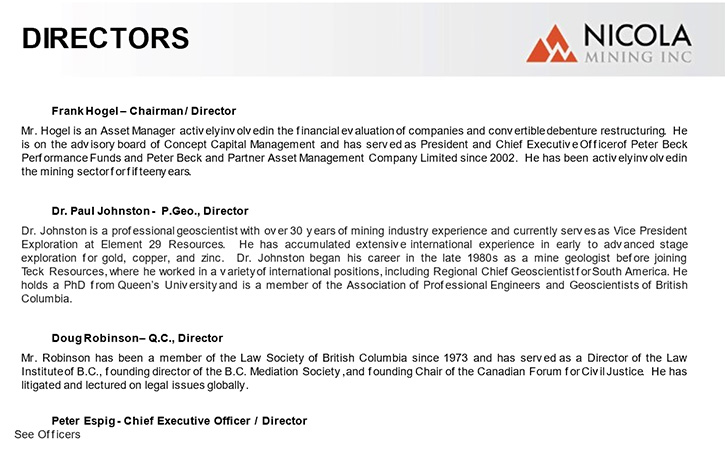

We have an incredible team as well. One of our Board members is a former Principal Geologist and Copper Specialist and is now the VP of Exploration for Element 29, which is also a listed copper resource company focused on Peru. And we have Frank Hogel, who is a financier and Doug Robinson, who is a prominent lawyer in Canadian Queen's Counsel.

We are putting together a very strong Team for our milling operation and we are increasing the strength of our geological team as well. We are increasing the geological team and the milling team because we have not had milling operations since 2017 and 2016 for a short period. Now we are going into a full, long-term, eight-year plan of milling operations.

Dr. Allen Alper:

That sounds excellent. It sounds like you have a very balanced and a very experienced team and you have a fantastic background, so that is really great. By the way, I got my PhD at Columbia University.

It is a great school. Their business school is outstanding. I could see from your career; you have done very well. Could you tell or readers/investors a little bit about your capital structure and your share structure?

Peter Espig:

Currently we have approximately 250 million shares outstanding. We have a $7 million debenture which is basically held by insiders. We structured it that way so that it would not be as dilutive because at this level we don't want to dilute shareholders, but it's friendly debt. With the milling operations, we expect to be able to pay down the debenture.

Another unique aspect of the Company is that between me and the Chairman and his family, we have approximately 40% of all outstanding shares. There are five shareholders that make up the group, with an additional three other shareholders that make up about 60% of the outstanding equity. We are liquid, but it is fairly tightly held.

Another unique characteristic is since 2013, when I took over the role as CEO, the Management has been associated with between 60% and 70% of all funds raised that are non-flowthrough. Several of the Junior Companies, have Management who, through the initial structure, benefited by getting very cheap equity or very cheap stock. This certainly is not the case, with us.

I participated in every round of every financing that we've done, so has the Chairman, so we were really committed to getting this going forward. Since 2013, 60% to 70% of all hard capital raised in the Company has been from Management, Board Members and family and friends.

Dr. Allen Alper:

It's excellent to see that Management has skin in the game, believes in the project and is willing to invest and continue that investment and grow the Company.

Peter Espig:

Yeah. As a debt person, again, I am not a promoter so the goal here is to focus on building a Company and not get overly focused on the share price. I understand that is important. We will start a marketing campaign as we get our operations running. There's a Japanese saying, "The wise eagle hides its claws." There's no point in talking about what you plan to do in the future. The future is now, so we're going to start talking about it. It's going to be the first time that we're really going to be focused, not just on the operations, but on the equity valuation as well.

Dr. Allen Alper:

That sounds very good. Peter, could you tell our readers/investors the primary reasons they should consider investing in Nicola Mining?

Peter Espig:

Looking at mining exploration companies on the TSX.V, and on the TSX, about 1.8% have positive cash flow. We are in the process of moving to the 1.8% bracket which is very significant.

Our cash flow from our milling operation is rare for a junior mining company. As far as the copper asset is concerned, we're confident and excited about the potential of our drill program in 2021. We expect a new market valuation. We are going from not having a lot of news to production, to positive cash flow, to showing positive exploration results. Our cashflow should start in the near future and is expected to be long-term.

Looking at High Range Exploration Ltd., with which we signed our Letter of Intent, they have representative chip samples across the vein of one ounce gold at surface. Having one ounce gold at surface, only helps if you are able to monetize it. We are right at the point, where we have a combination of exploration and monetization, which makes Nicola unique.

Dr. Allen Alper:

That sounds excellent! You're in the unique position of developing a long term positive cash flow. You have a great project that can supply the growing global copper demand. You have a great Team, and the Team is excited to back the project and take it forward.

https://nicolamining.com/

Peter Espig

CEO & Director

Phone: (778) 385-1213

Email: info@nicolamining.com

|

|