Bluestone Resources Inc. (TSXV: BSR, OTCQB: BBSRF): Interview with Jack Lundin, CEO; New PEA for Optimized Project, Doubles the Gold Resource Ounces and Production Profile, Triples the NPV5% of the Project to $907 Million

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/29/2021

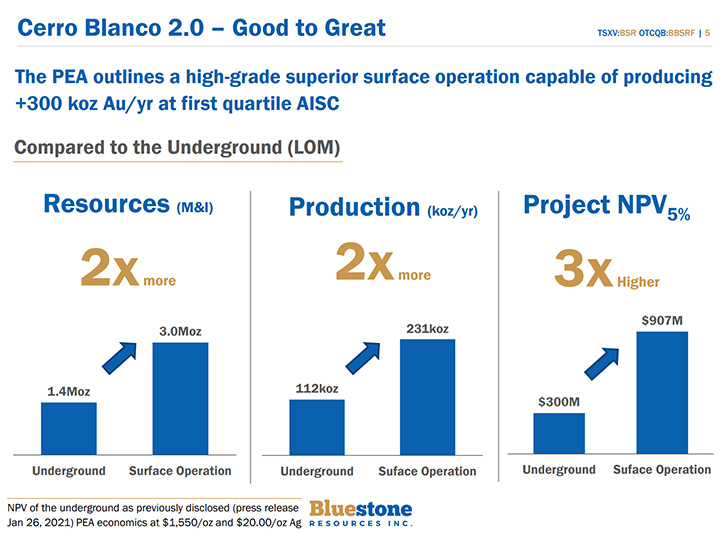

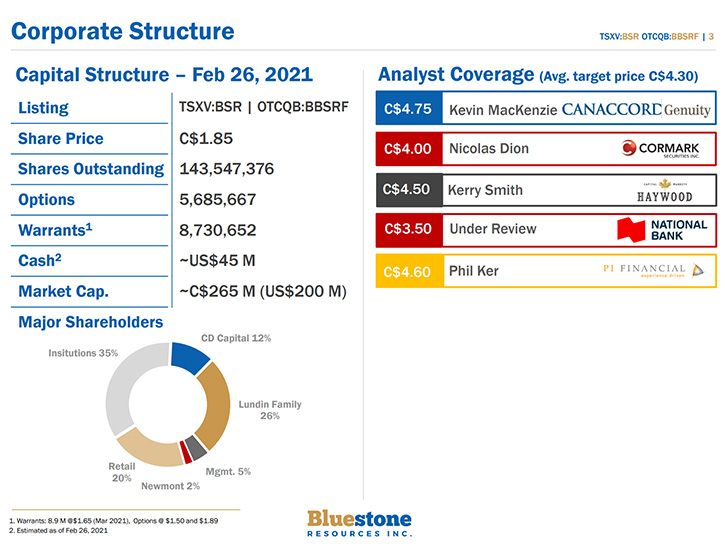

Bluestone Resources Inc. (TSXV: BSR, OTCQB: BBSRF) was created in 2017, with the purchase of the Cerro Blanco gold & Mita Geothermal projects in Southern Guatemala. The Cerro Blanco Gold Project is an advanced stage, high-grade, near surface development project. The company just announced the findings of a PEA that highlights an optimized project, which doubles the gold resource ounces and production profile and effectively triples the NPV5% of the project to $907 million. We learned from Jack Lundin, CEO and Director of Bluestone Resources that they have taken a strategic change and went from developing an underground mine to developing an open pit scenario at Cerro Blanco. The new project is capable of producing over 300,000 ounces of gold per year at an all-in sustaining cost of around $640 per ounce gold. This will allow Bluestone to generate a significant amount of free cash flow because of the great margins.

Bluestone Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Jack Lundin, who is President & CEO of Bluestone Resources Inc.

Jack, could you give us an overview of Bluestone Resources, and what your chief accomplishments were in 2020.

Jack Lundin: Hi, this is Jack Lundin. Thank you very much for having me. We are really excited here because Bluestone Resources is an emerging gold developer. We have a flagship project, located in Southern Guatemala, which is called the Cerro Blanco Gold Project. In 2020, we were able to put together a project execution team and really look at the technical aspects of the underground project. And as well, with our 2020 drilling campaign, where we drilled about 15,000 meters, we gained an enhanced understanding that gave us the opportunity to look at this project through a different lens. We're now making a strategic change and looking at developing it as an open pit scenario.

Dr. Allen Alper: Well, that's fantastic. You're going from good to great.

Jack Lundin: That's exactly right. We're focused on maximizing the benefits of this mineral resources for all stakeholders involved, which includes the local communities in which we operate, the national authorities, the national government here in Guatemala and of course our shareholders that have been very, very loyal to us over the years. We want to show our appreciation by maximizing the value of the asset that we control.

Dr. Allen Alper: Well, that sounds excellent. Could you highlight the PEA results?

Jack Lundin: We are now looking at a new project, capable of producing over 300,000 ounces of gold per year at an all-in sustaining cost of around $640 per ounce gold. That means we're able to generate a significant amount of free cash flow at these margins. The NPV5% of this new project is $900 million US after tax, as compared to $300 million after tax that we were contemplating, with the previous project. That is due to the understanding of the geology. The fact that we know that this deposit flares out and mineralization goes to surface, meaning that we can show a project amenable to surface mining methods, which reduce a lot of the technical challenges, when considering mineral extraction.

Dr. Allen Alper: Excellent! That's really great news! What are your key objectives for 2021?

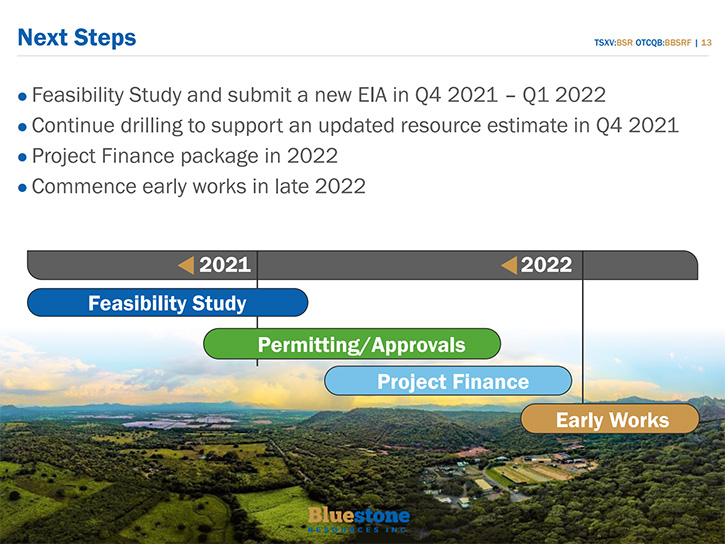

Jack Lundin: We're looking to build on the momentum that we've been gathering here in 2021. We just released the results of a preliminary economic assessment. We'll be looking at advancing that into a bankable feasibility study by the end of this year, to release those results in early 2022. In parallel, because of this new project, we are going to have to go out and get a new environmental impact assessment, approved by the authorities. So, we are currently collecting social and environmental baseline data, in order for us to submit a new EIA application to the authorities by the end of this year.

Dr. Allen Alper: Oh, that's excellent! Sounds like you're moving the project forward very rapidly and with great results.

Jack Lundin: Our goal is to move this project as fast and as efficiently, as responsibly possible. We do know that because this does require a new permit, we have to do that permit in the right way. We have to make sure that we have the best information available at that time before we submit it. And we have to continue to engage with our local stakeholders and our national stakeholders, here in Guatemala, to continue to build a strong relationship, so that collectively we can move the project forward together.

Dr. Allen Alper: Well, that's excellent! Could you also tell our readers/investors about Mita Geothermal project?

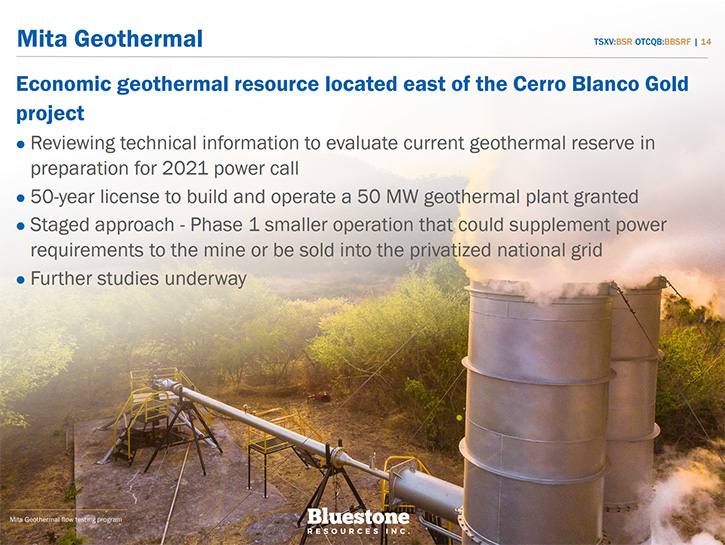

Jack Lundin: With the Mita Geothermal project, in the concession adjacent to the Cerro Blanco deposit, we are licensed to generate up to 50 megawatts of renewable energy. That could be very good for us. Potentially we could offset some of the energy needed, to take from the grid, for powering our Cerro Blanco facility, by using the Mita Geothermal project. Additionally, there's an opportunity to generate renewable energy to sell into the grid, which is something that we're assessing at this time.

Dr. Allen Alper: Well, that sounds like an excellent and a unique opportunity for Bluestone Resources. Jack, could you tell our readers/investors about your background, your Team and your Board?

Jack LundinPresident, Chief Executive Officer, and DirectorMr. Jack Lundin has been involved in the natural resource industry his entire life through exposure to several Lundin Group companies. Prior to joining Bluestone Resources, Mr. Lundin was involved in the successful development of Lundin Gold Inc.’s Fruta del Norte Gold Mine in southern Ecuador where he served as the Project Superintendent. He began his career in the sector working prospecting jobs on various early-stage projects in Canada, Russia, Ireland, and Portugal. Mr. Lundin holds a Bachelor of Science degree in Business Administration from Chapman University and a Master of Engineering degree in Mineral Resource Engineering from the University of Arizona. Mr. Lundin currently sits on the board of directors of Lundin Mining Corporation, Lundin Foundation and The University of Arizona’s Lowell Institute for Mineral Resources.

Jack Lundin: I would be pleased to do that. I am President & CEO of Bluestone Resources. I joined in January 0f 2020. Prior to working with Bluestone Resources, I was working as the project superintendent at Lundin Gold, on the development of the Fruta del Norte Gold Project, located in Southern Ecuador. At Bluestone Resources, I have on the team with me, an experienced group of executives that have a very strong understanding of the Cerro Blanco project and know what it takes to advance this project into the next phase. Our Board of Directors is a very experienced and successful group of Directors, from both the Lundin group and Discovery group to help us maximize and leverage the expertise of both groups. Therefore, we have a great combination of a dedicated team that's ready to move this project forward. And I believe that this is the group that will get the job done.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Bluestone Resources?

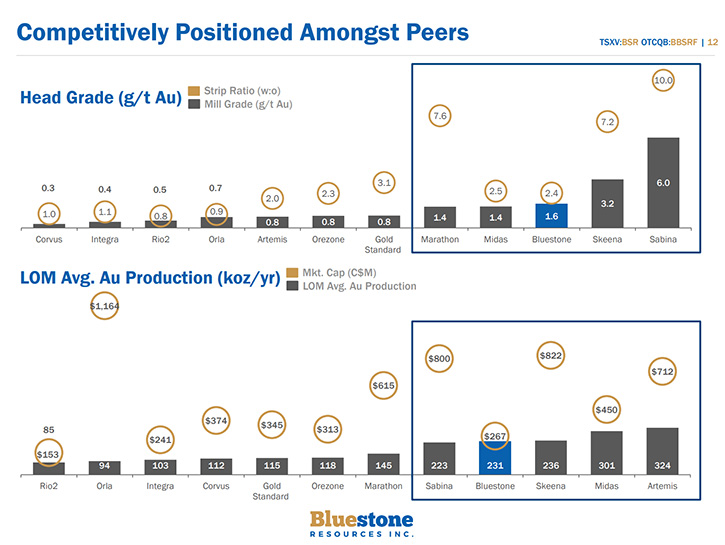

Jack Lundin: From a valuation standpoint, we're currently trading at around 0.3x net asset value. But that net asset value is of our underground or previous project. So, when you consider that, we've essentially just tripled the value of this project and you consider that our peers are trading on average around 0.45x net asset value. There are some significant opportunities for this Company to grow in terms of value.

Dr. Allen Alper: Well, that sounds like very compelling reasons to invest in Bluestone Resources. Jack, is there anything else you'd like to add?

Jack Lundin: No, I just want to thank you for the opportunity of allowing me to promote this exciting Company. I think that once the market understands the amount of value that we've just created, by this new development concept, we will start to see our share price go up. I hope that current and prospective investors in Bluestone Resources are going to be as excited as we are in bringing this project forward.

Dr. Allen Alper: Well, it sounds like 2021 will be an extremely exciting time for Bluestone. And when you have your feasibility study finished, that will really be great.

Jack Lundin: Yes, sir. Thank you very much.

Dr. Allen Alper: I enjoyed talking with you and updating our readers/investors on Bluestone Resources. Sounds like it's a great opportunity for our readers/investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://bluestoneresources.ca/

Bluestone Resources Inc.

Stephen Williams | VP Corporate Development & Investor Relations

Phone: +1 604-757-5559

info@bluestoneresources.ca

|

|