Sixty North Gold Mining Ltd. (CSE: SXTY FKT: 2F4; OTC-Pink: SXNTF): Focused on Restarting the High-Grade Past Producing Mon Mine, in Prolific Yellowknife Gold Camp; David Webb, President & CEO Interviewed

|

By Allen M. Alper, Senior Editor and CEO, Metals News

on 5/19/2021

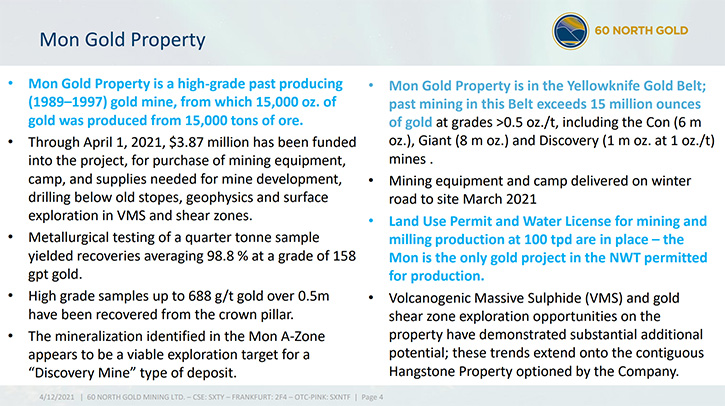

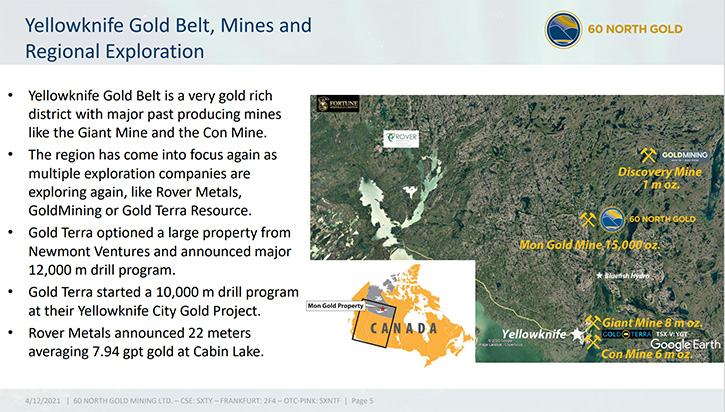

We spoke with Dr. David Webb, President & CEO of Sixty North Gold Mining Ltd. (CSE: SXTY; FKT: 2F4; OTC-Pink: SXNTF). Sixty North Gold Mining is focused on restarting the high-grade, past-producing, Mon Mine, which is 40 km north of Yellowknife, NWT. It is within the prolific Yellowknife Gold Camp. The Mon Mine produced 15,000 ounces of gold, from 15,000 tonnes of ore, between 1989-1997. Permits to explore the mine and mill, at 100 tons per day are in place. The Mon is the only gold project permitted for production in the NWT. Other targets on the property include recently discovered silver and gold-rich VMS targets, as well as the giant shear zone-hosted gold mineralization.

Sixty North Gold Mining

Allen Alper, Jr.:

This is Allen Alper, Jr., with Metals News, talking with Dave Webb, who is with 60 North Gold. They have a high-grade gold opportunity near Yellowknife in Canada. Dave, why don't you tell us a little bit about your property?

Dave Webb:

The Mon Gold property is the target for 60 North. It was acquired a number of years ago, but it has a history going back to the 1930s, when it was first staked by Cominco. It was a very high-grade vein, exposed on the side of the hill and it made Cominco pretty excited. I recall that the Yellowknife Gold Belt was discovered in the mid-1930s, in 1936 the first acquisitions were going on. This was part of that first pass to find all the gold you can in Yellowknife.

The Cominco explored the property because it was so high-grade it was on the order of 150 feet or 40 meters or so long, 1.5 meters high and averaged well over an ounce of gold per ton. They've cut everything to 5 ounces and still ended up with about a 2.5 ounces per ton width across that vein. Back in those days, drilling was in its infancy, so they sunk a shaft and they sub drifted underneath the vein and they couldn't find it. They shut things down and wondered what was going on until the 1940s, when another company found the Discovery Mine, about 45 kilometers to the north and that was very well received. It was developed very quickly and ended up producing a million ounces of gold at a one ounce per ton grade.

At the South end of the belt is the better-known Con Mine that produced 6 million ounces of gold and the Giant Mine that produced 8 million ounces of gold. Both of those averaged just shy of half an ounce of gold per ton.

Allen Alper, Jr.:

Wow, that's really exciting. What are your plans?

Dave Webb:

We're a little bit different from most junior gold companies, in that our plan is to put it back into production. I skipped over the 1980s and 1990s when the mine was acquired by myself and we put it into production. That really worked out quite well for us, but the gold price went down to $256 an ounce when we were trying to produce it and sell it. That was a difficult stage, we couldn't really make any money mining it. I had partners in this and the financial partner said, "Shut it down, do the reclamation, I want to get my bond back from the government to guarantee that things are cleaned up. And at this gold price, we haven't a hope of making any money at all." It was shut down. What we plan on doing is not drilling off millions of ounces of gold because I can show how much it costs to do that. What we are going to do is run a ramp underneath the old stopes that averaged one ounce of gold per ton for the 15,000 tons that was extracted and start mining it again.

Allen Alper, Jr.:

That sounds really good. Tell me a little bit more about exploration potential.

Dave Webb:

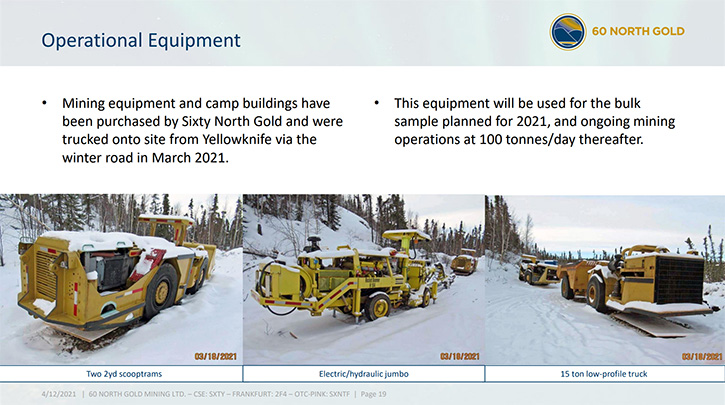

We have the A Zone which is a past producer and that's really our focus. We have purchased the mining equipment and it is sitting on the property. We've purchased the fuel, sitting in tanks on the property and the explosives are sitting on the property. We're all set to go on that. We are not unaware of the other potential in the area, and we've done a fair bit of work just figuring out if there are other targets. The big target is the Con Mine and Giant Mine, those shear zones, albeit a little bit lower grade than the Discovery Mine type of target. There are two different types of gold deposits, both have potential on the property. One is mined, the other we've done a fair bit of work on and we have a pretty good idea where there might be another one, but that will require diamond drilling into swampy areas, where we don't have much exposure.

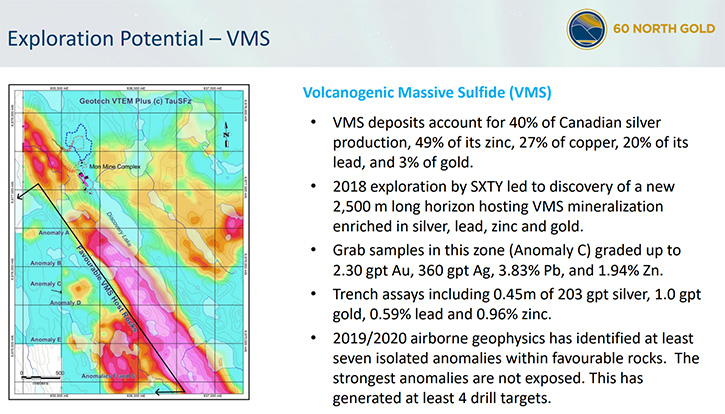

One of the side benefits of working in there, back in the 80s, Noranda was very busy in the belt, looking for volcanogenic massive sulfide deposits. These are similar to those of the Timmins, Noranda, Flin Flon camps, these kinds of massive sulfide deposits that are polymetallic. In our case, they tend to be pretty silver rich. We did a geochemical program, found some very encouraging outcrops, did a geophysical program and identified a number of trends and we trenched one of them and did confirm that we are dealing with grades in the order of 200 to 300 grams of silver per ton, a gram or so of gold plus, some lower lead and zinc values that go with it. With the work that we've done, we have outcropping VMS mineralization and, as is always the case, that big anomaly that's just sitting off there in the swamp or underneath the lake that has never been explored, never been drilled and is one of our targets that we'll follow up when it's appropriate.

Allen Alper, Jr.:

Tell us a little bit about where you are. I read your recent news release about opening up this winter road. Tell us, going forward, what you plan to do on the property.

Dave Webb:

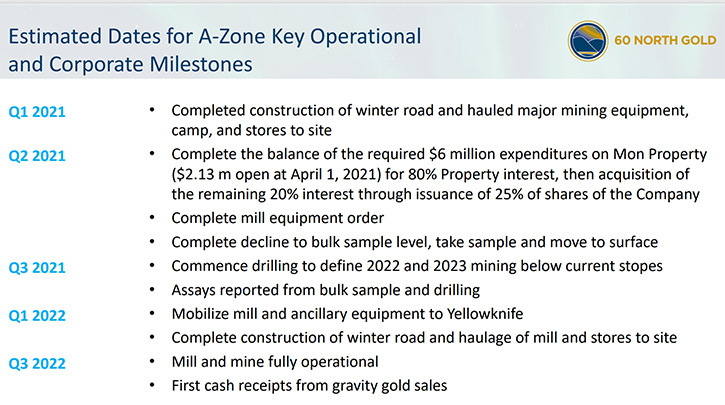

Because we are not planning on bringing the diamond drills in and trying to define half a million or a million ounces of gold, we've opted to prove that we have that by mining it and developing it. About seven years ago, we applied for permits to install a complete mine, a complete mill, tailing ponds here, camp over there, fuel stores, etc. and we received those permits. We are the only gold mine permitted, start to finish to produce gold in the NWT.

Heavy equipment haul on winter road March 2021

We purchased all the equipment; we got the team together that did this in the past. It's not just myself, it's a whole group of people behind me as well. We built the winter road a few months ago and brought all the equipment in on the property. Our plan is sometime in June, when we won't be fighting freezing conditions, we will start mining and driving ramps down to intercept the same vein that produced very profitably in the past.

Allen Alper, Jr.:

Excellent. Could you tell us a little bit about your background and your experience, as well as a little bit about your Management Team?

Dave Webb:

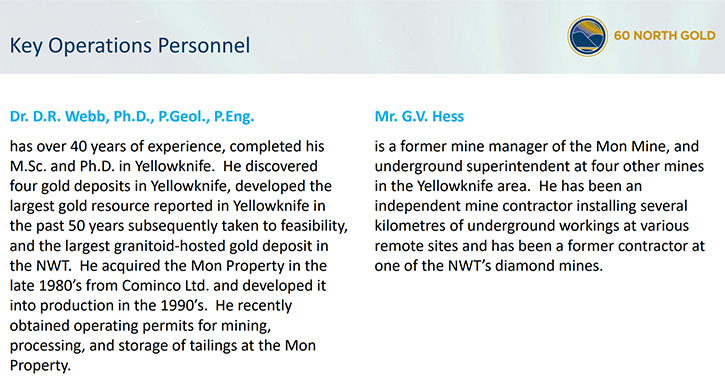

I've sometimes been called Dr. Yellowknife. I went up to Yellowknife in the early 1980s to do a master's thesis on the Con Mine. That was the large past producer that had operated from the 1930s and shut down in early 2000s. While doing that, I was just amazed at the potential in the area. I finished my master's, I rolled it into a PhD, finished in Structural Geology because these are structurally controlled gold deposits. I have an undergrad in Engineering, so I've activated my engineering certification as well as P. Geol certification and I'm focusing on starting these mines. These are deposits that don't do well under 43-101 because they're very difficult to drill off. It's like asking a diamond geologist, here's a bunch of drill hole results, what's the grade of the kimberlite pipe? They would turn to you and say, "Oh, kimberlite's diamond deposit is very nuggety, you have to bulk sample, it's the only way you can assess the grade."

This kind of gold deposit that we're dealing with is an incredibly nuggety gold and if you go to our website, you'll see trench samples over 600 grams of gold per ton across the width of the vein. You can imagine that another foot or two over we can get 20 grams of gold per ton, very nuggety. It doesn't lend itself well to diamond drilling. The bulk sample is what we're going to do and it's my 40th year of experience in the Yellowknife Gold Belt, finding these, developing these and with the Mon property, producing gold from these deposits.

Allen Alper, Jr.:

Can you tell me a little bit about your Management Team?

Dave Webb:

If you go onto the Sixty North website, you'll see a whole bunch of people with CPA after their names. We have quite a few accountants on board and they're excellent money managers. They've drifted into the junior mining business where they've brought some fiscal responsibility and made things work. We're quite impressed with that. We also have Ron Handford, who says he's a retired P-Eng., but he does review a lot of the work and he is very active in the business. We have people at Sixty North that do that.

The vending property owner company is New Discovery Mines Ltd. I happen to be a Director of that and the previous Mine Manager that operated the mine, when we did that in the 90s, is Gerry Hess and he's President of New Discovery Mines Ltd. We brought the past operators on this property, with the many decades of mining, engineering, geology and financial experience all together in one package. It's not easy to convince a bunch of accountants that they should get involved in mining.

Allen Alper, Jr.:

Yeah, that's a tough one. Tell me a little bit about the Yellowknife region, as an area for mining.

Dave Webb:

In working in Yellowknife, you're dealing with a historic mining camp, so it's similar in geology to Red Lake, Ontario or Kirkland Lake. It's Archean-aged, vein-hosted gold deposits, going to great depths, in excess of a kilometer deep, some of the past operating mines go for thousands of meters along strike, but they're controlled by structures. There are other people working in the belt. The Con Mine had produced 6 million ounces of gold, largely from two structures. The Giant Mine is a similar structure. We technical people love splitting hairs and arguing that it's different. It has 8 million ounces of gold at a half ounce grade, spanning thousands of meters along strike and almost a kilometer deep.

There is the Discovery Mine, which is 100 kilometers north of the city of Yellowknife. We're in the middle, we're 45 kilometers north of Yellowknife, splitting the difference between the north and south ends. It is a very gold enriched strip and I heard one of our competitors in the area describing, "Finding gold in Yellowknife is like looking for water in the ocean, it's everywhere. There's lots of it to be found, you just can't drink it." In the case of Yellowknife, I think the analogy he was making was, "It's not hard finding gold, you have to find it in economic quantities in a concentration right area." That's what we've done.

Allen Alper, Jr.:

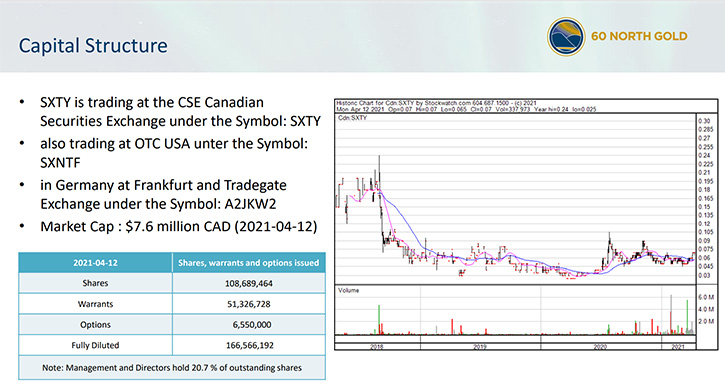

Could you tell us about your capital structure?

Dave Webb:

We are looking at just under 110 million shares issued. We have 51 million warrants outstanding, almost half of them are between 7 cents and 10 cents and we have 6.5 million options outstanding. The Management and Directors own 20% of this, so there is strong insider support for this project.

Allen Alper, Jr.:

You have a lot of skin in the game?

Dave Webb:

Absolutely. The payments that New Discovery Mines received, vending this property to Sixty North, not a dollar went out in option payments. It was all, you make these expenditures, and you own 80% of the property. We take our payment in the end. If everything works, we do okay. If it doesn't work, we don't take any money from the shareholders.

Allen Alper, Jr.:

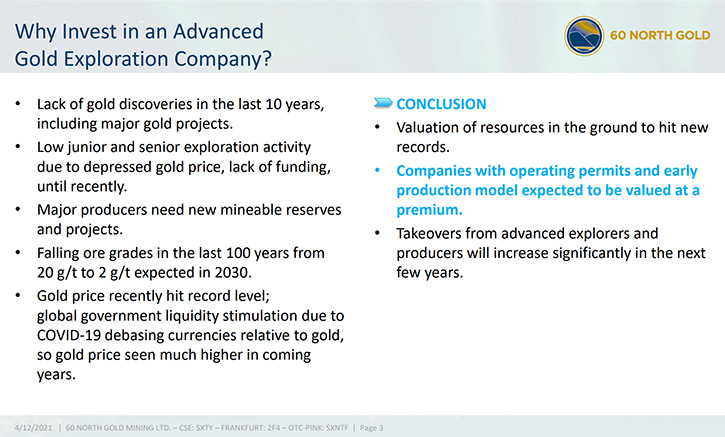

Could you tell our readers/investors why they would want to invest in an advanced gold exploration company like Sixty North Gold?

Dave Webb:

Absolutely. The following slide sums it up very well.

Allen Alper, Jr.:

Those are good reasons to consider investing in Sixty North Gold. We’ll also publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.sixtynorthgold.com/

David Webb,

President & Chief Executive Officer

604-818-1400

|

|