Vior Inc. (TSX-V: VIO, FRANKFURT: VL51): Proven Management Team Using Hybrid Strategy to Discover and Invest in Tier 1 North America Projects; Mark Fedosiewich, President and Laurent Eustache, VP Corp. Dev. Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/17/2021

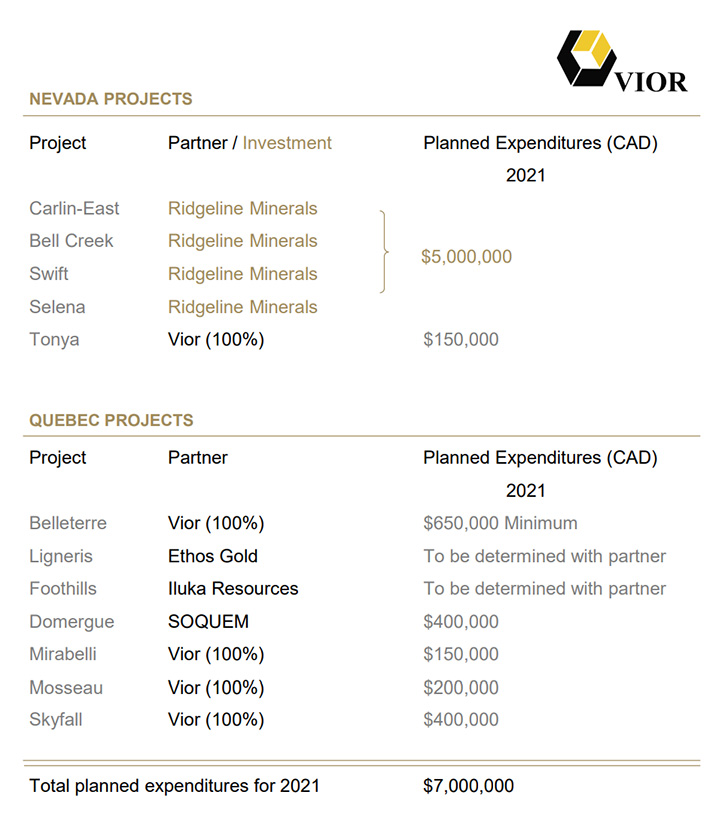

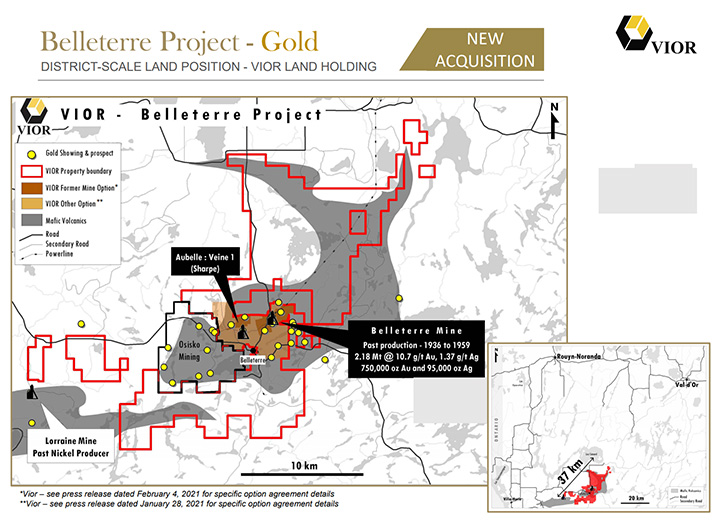

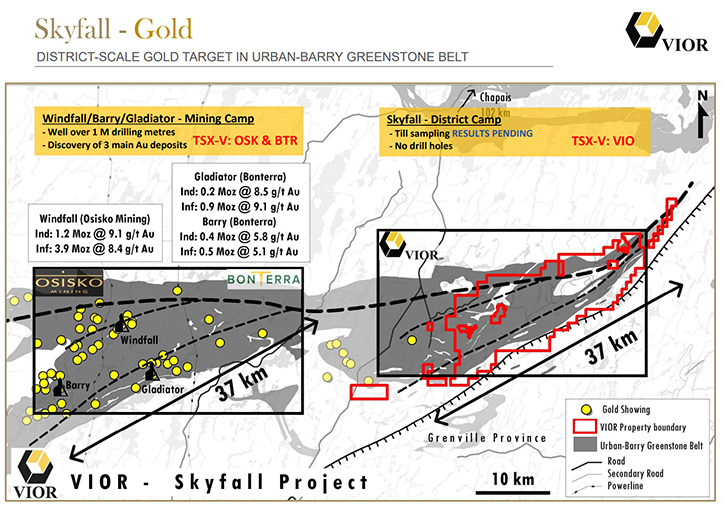

We spoke with Mark Fedosiewich, President of Vior Inc. (TSX-V: VIO, FRANKFURT: VL51), and with Laurent Eustache, the Vice-President of Corporate Development, about their Hybrid Strategy, combining exploration on their 100% owned projects and making strategic investments in some companies that have great projects and a proven Management Team. Vior has a significant equity or ownership interest in 11 mining projects that will be actively explored or drilled in 2021. Plans for 2021 include advancing their two District-Scale flagship projects in Quebec; the Belleterre gold project, located 95 kilometers south of Rouyn-Noranda, and the Skyfall gold property located strategically, East of Osisko Mining Inc.’s (6 M+ oz Au resource) Windfall deposit near Lebel-sur-Quévillon, Quebec.

Vior Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark Fedosiewich and Lauren Eustache of Vior Inc. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Mark Fedosiewich:Vior is a hybrid junior mining exploration company, based in Quebec. Our Corporate strategy is to generate, explore and develop high-quality projects in proven and favorable jurisdictions in North America. Vior has been around since 1984 and has survived many commodities cycles throughout the years. We have a strong Management and Technical Team that has demonstrated their ability to discover gold deposits and other high-quality mineral prospects.

I think our strategy sets us apart from some of the other juniors. Our Hybrid

model allows us to invest on our own in some of our 100% owned mining projects or to option and joint venture some of the projects, if we deem the risk is too high to go it on our own. In addition, we are also able to invest in private companies in the mining exploration space, of which we have a significant holding right now in a Nevada-based publicly traded Company, called Ridgeline Minerals Corp. We were able to enter into this particular investment at a very early stage in the Company's life cycle. Therefore, we benefited from the upside of some excellent Projects, in mineral rich Nevada, with a Management team that has a great track record.

Dr. Allen Alper: That sounds excellent. What are some of the recent developments?

Mark Fedosiewich:Vior confirmed several new prospective Gold areas at their Skyfall project, in the Urban-Barry belt, in Abitibi, Quebec. This was achieved by reporting high-gold grain counts, in 7 clusters of till samples, from its first reconnaissance till sampling program, conducted in Fall 2020. It demonstrates that the geology, in the Eastern extension of this belt, is just as prospective as the Western part, where Osisko Mining Inc’s Windfall gold is situated.

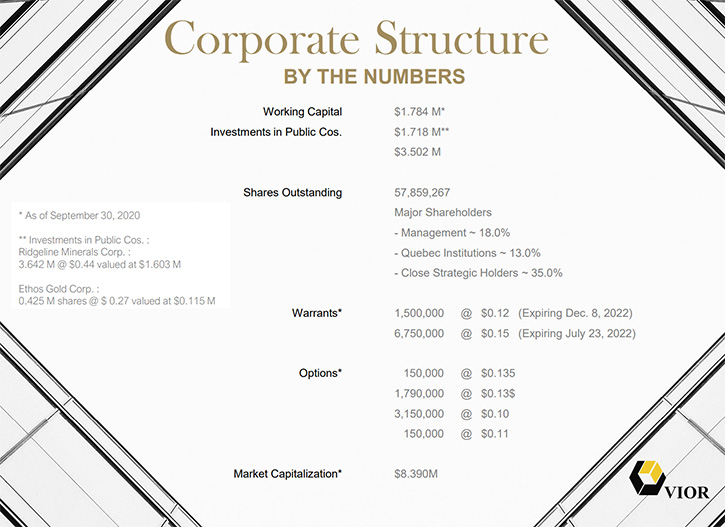

Vior closed an overall $2.4 Million Financing, which included a 9.9% partially diluted Strategic Investment, by Osisko Mining Inc. In connection with Osisko Mining’s investment in Vior Inc., the parties entered into an Investor Rights Agreement, paving the way for technical collaboration on several projects, as well as participation in future financings.

Dr. Allen Alper: Excellent!

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about yourself and your very strong Management Team? I know they are very renowned.

Mark Fedosiewich: I am the President and CEO and have been involved in junior mining exploration, predominantly from the investment and financing side, dealing with many CEOs of publicly traded junior resource Companies, for over 30 years. I have been running Vior for a little over three years now.

I was fortunate to come into this opportunity, with an excellent VP of Exploration, a gentleman by the name of Marc L'Heureux, who has over 30 years of experience in the mining industry, having worked for both large producers down to junior exploration companies in North America and Latin America. He also has a senior geologist on his team, Christian Blanchet, with upwards of 25 years' experience working for both large producers as well as junior exploration companies.

I was very fortunate, back in September of last year, to add Laurent Eustache to our team, who is also on the call with us today. He is our new Vice President of Corporate Development. He brings an excellent history in the junior mining exploration industry. He was an exploration geologist for Agnico-Eagle Mines and Aurizon Mines in Quebec. For the last six years, before he joined us, he was an analyst and Portfolio Manager at a small Quebec-based resource investment fund that invests in junior mining exploration companies in Quebec. From his last employment, he has acquired excellent firsthand knowledge of most of the resource players/companies and their projects in the province of Quebec.

Dr. Allen Alper: A very excellent team! Could you tell us a little bit about your Chairman, too?

Mark Fedosiewich: We've kept our Board of Directors manageable and nimble, to be able to maneuver and have the flexibility to make quick decisions. Our Chairman is the original founder of Vior and was also the CEO of Vior for many years. He was also the founder of several other successful mining companies, including the predecessor to Osisko Mining as well as Virginia Gold, which was a big success story in Quebec several years ago. He brings a wealth of business acumen and corporate strategy experience to the team.

Other members on our Board include a gentleman by the name of Eric Desaulniers. He is the Founder and current CEO of Nouveau Monde Graphite, a real success story in the electric battery vehicle and value-added graphite space. His Company has recently gone from a $50 million market cap to a recent $1 Billion market cap in the last 6 months. Along with him, on our Board, is his CFO at Nouveau Monde Graphite, a young gentleman by the name of Charles-Olivier Tartes. He is the Head of our audit committee. Charles has excellent financial skills and a keen business sense. Finally, Laurent and I are also on the Board.

Dr. Allen Alper: Well, that sounds like a very strong Team and an extremely strong and accomplished Board. Mark, could you tell us Vior’s primary goals for 2021?

Mark Fedosiewich: Our primary goals for 2021 are to advance two of our flagship projects rapidly towards a new gold discovery and by so doing, build shareholder value. We have been very fortunate lately to be able to build and acquire two District-scale land packages in Quebec, one Project by the name of Belleterre and the other Project by the name of Skyfall. Both of them have a strike length of approximately 37 kilometers long.

Our most recent District-scale Project is called Belleterre. Laurent and I have spent the last six months acquiring and consolidating this huge land package in the Belleterre Region of Quebec, about 95 kilometers south of Rouyn-Noranda and about 110 kilometers south of Val-d'Or. We're putting the final pieces together right now, and what we have assembled is something nobody else has been able to do. It is a vastly under-explored region for the last 50 years. It's been explored piecemeal. We plan to attack it in a very systematic manner. It is a combination of a brownfield play and several greenfield plays. As part of the package, there is a past-producing mine that produced over 750,000 ounces at just under 11 g/t Au in the 1940s and '50s, on which we were able to acquire a purchase option. We have also acquired a significant land package all around it.

Our other flagship Project is called Skyfall. We own a 37-kilometer strike length, on the Eastern boundary of the Urban-Barry mining camp, in Quebec, where Osisko Mining has a number of deposits, where they have proven up in excess of 6 million ounces of Gold resources thus far. These would be our two focal Corporate points for 2021, along with our investment in a publicly traded Nevada company called Ridgeline Minerals Ltd., that could also bring us some very pleasant surprises in 2021 and beyond.

Dr. Allen Alper: Well, that sounds like you have an excellent position, excellent properties, with great potential, in two of the best mining jurisdictions in the world.

Mark Fedosiewich: Absolutely! With the latest Fraser Institute Mining jurisdiction rankings, Nevada is ranked number one and Quebec is ranked number six globally in their just-released 2020 standings.

Dr. Allen Alper: That's excellent. Could you tell our readers/ investors about your share and capital structure?

Mark Fedosiewich: Our shares, outstanding right now, sit at about 59 and a half million. Insiders own about 20% of the Company. Quebec institutions own about 13% of the Company. Other close associates and friends own approximately 35% of the Company. So, the public float would be somewhere in the vicinity of 30% plus or minus. We trade on the TSX Venture Exchange, under the symbol VIO. We also have a listing in Frankfurt under the symbol VL51. We also have an over-the-counter NASDAQ listing, where there's very little activity at the moment, but hopefully, with some success, we will be able to garner some significant shareholder interest in the United States.

Dr. Allen Alper: Well, that sounds like you are well-positioned in three excellent capital-raising areas. It is nice to see that Management and Quebec have skin in the game and will support the project until you discover some interesting gold resources.

Mark Fedosiewich: Yes, absolutely.

Dr. Allen Alper: Mark, could you tell our readers/investors, the primary reasons they should consider investing in Vior?

Laurent Eustache: We have tried to structure Vior to provide its shareholders with some excellent exposure to potential discoveries. This is really what drives the value proposition behind Vior's shares, because we think that the key driver for value creation in the industry will be new discoveries in good locations. And, at the right time and in the right market, many producers and larger exploration Companies will look to acquire new resources and promising Projects. So that's what we try to do. As Mark said previously, we try to differentiate ourselves from the herd, with our Hybrid strategy, which diversifies the Corporate risk of Vior, and giving more exposure to our shareholders to new potential discoveries from our projects and investments.

Dr. Allen Alper: Well, that sounds excellent! You have a great team, great properties in great locations and it sounds like you also have financial support to move forward. Is that correct, Laurent?

Laurent Eustache: Yes, I believe that we do.

Dr. Allen Alper: Laurent, could you explain a little bit more your hybrid business strategy?

Laurent Eustache: The hybrid strategy is a way for us to provide increased exposure to multiple potential discoveries for our shareholders, compared to other conventional junior exploration companies. This will be achieved through the execution of our strategy, and by taking advantage of the investment opportunities and the financial and technical capabilities of our Management Team at Vior. Mark was a Portfolio Manager for the last 30 years, before joining Vior. I also worked as a Portfolio Manager for the last six years, before joining Vior. We believe that we understand what investors are looking for, as well as what is a really good value proposition to invest in our specific market.

Dr. Allen Alper: Well, your properties and your portfolio strategy sound like a great opportunity and compelling reasons for our readers/investors to consider investing in Vior. Lauren or Mark, do you have anything else to add?

Mark Fedosiewich: From day one, our Strategy was to diversify our risk profile into a number of different projects and properties. As you no doubt know, exploration is a very high-risk game, and I do not want to bet the farm on one project and have to start from zero again. So, I think that we have identified and acquired some really promising gold projects, several of which we will advance on our own this year. Some of the others, we will find partners to option or joint venture them in order to spread the risk.

Dr. Allen Alper: Well, that sounds like an excellent strategy. It does lower the risk for investors and increases your chances for discovering gold and creating wealth for your investors.

Lauren Eustache: Thank you.

Mark Fedosiewich: We are going to have upwards of $7 million, at least, going into exploration work in the coming year, of which a large percentage, approximately $5.4 million, will be partners' money. We are going to have exposure to exploration upside at various stages, including several drill programs, and on no less than 10 Projects, within our overall portfolio.

Dr. Allen Alper: Well, that is excellent! It sounds like 2021 is going to be an extremely exciting time for Vior and your stakeholders and shareholders.

Lauren Eustache: Yes, we believe that it will be!

Mark Fedosiewich: We believe so, absolutely. This year and next year, a lot of money is going into the ground, both our money and our partners' money. We have exposure to some very promising projects, where we could see some excellent potential surprises. It could very well be more than one success!

Dr. Allen Alper: Well, that sounds excellent! We will publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.vior.ca/

Mark Fedosiewich

President

Phone: 613 898-5052

mfedosiewich@vior.ca

|

|