Brazil Potash: Plans to Bring to Production One of the Largest, Lowest Cost Sources of Potash Fertilizer, Located in the Huge Brazilian Agricultural Market; Matt Simpson, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/11/2021

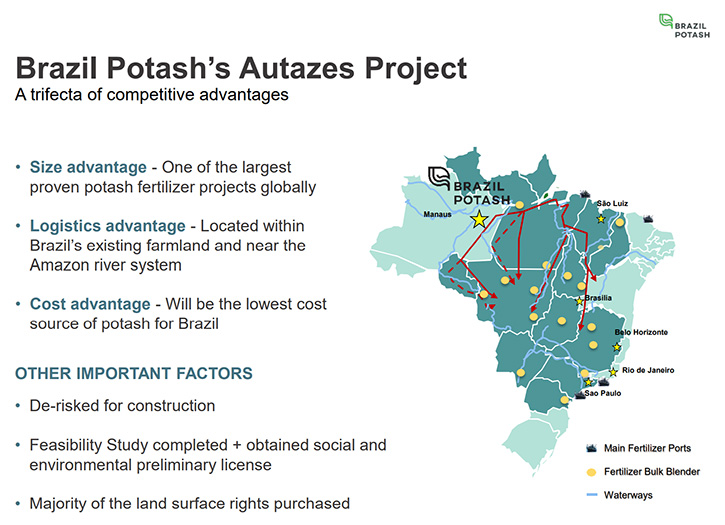

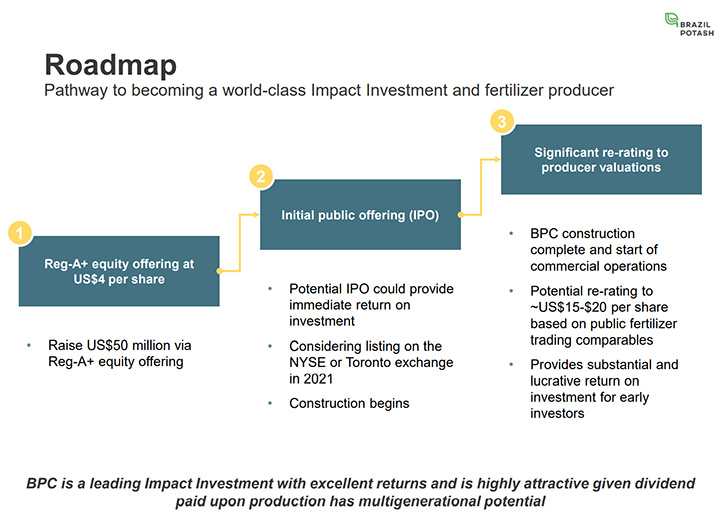

We learned from Matt Simpson, CEO of Brazil Potash that they are advancing its Autazes Potash project to the construction phase and are seeking to broaden its shareholder base, prior to conducting a future planned public listing. The Company has raised in excess of US$198 million since inception, permitted a 250 mile long, by 90-mile-wide ore basin, completed a Bankable Feasibility Study (BFS) and an Environmental Impact Assessment (EIA), obtained a Preliminary Social and Environmental License (LP), drilled 65 holes totaling 37 miles, and acquired most of the land required for the plant and port. The Company plans to bring the Autazes project to production, while also courting offers for sale of the Company, given how important this project is to global food security. Investors interested in participating, in the current fund raise, can find more details on the Company website www.brazilpotash.com

Brazil Potash

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Matt Simpson, who is CEO of Brazil Potash. I wonder Matt, if you could give our readers/investors an overview of your Company, what differentiates your Company, you; vision for your Company and what role is your Company going to be playing, in decreasing the greenhouse effect?

Matt Simpson:

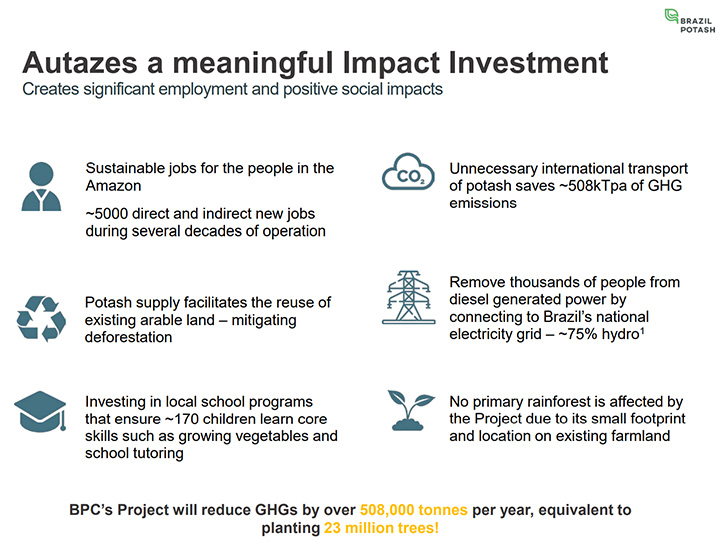

Brazil, today, is one of the world's largest net exporters of agricultural goods. It's the second largest consumer in the world of potash, which is an essential nutrient to grow food, with no substitute. Yet it imports 94% of its potash needs from mines, located primarily in Canada, Russia, Germany and Israel. Because we're located in Brazil, only five miles from a major river, our cost to extract, process and deliver this essential nutrient to farmers is less than the transportation cost alone for imported potash. Because we're not transporting that material unnecessarily, somewhere between around 9,000 and 12,000 miles, it reduces the greenhouse gas emissions by about 508,000 tons a year, which, to put it in perspective, is equivalent to planting 32 million new trees.

Dr. Allen Alper:

Could you tell our readers/investors a little bit about your deposits and what your plans are for developing them?

Matt Simpson:

We hold title to a basin that was discovered originally by Petrobras, the oil and gas Company in Brazil throughout the 70s and 80s. Where you find hydrocarbons, you sometimes find potash. Petrobras didn't care about that because they're an oil and gas company and at the time potash wasn't very economic. We went and staked a large portion of the basin Petrobras discovered, which, to put it in perspective, is about two thirds of the largest basin in the world located in Saskatchewan, Canada.

The Saskatchewan basin is jointly owned by several multi-billion-dollar companies, such as Nutrien and BHP and is almost twice the size of the Russian Ural Basin, which is the third largest basin in the world. Today we have proven and probable economic reserves, compliant with national instrument 43-101, supporting a 34-year mine life. But that's based on drilling only 10% of the land that's potentially mineralized. By further drilling, it likely has multigenerational potential.

Dr. Allen Alper:

Could you tell our readers/ investors about the process your Company will go through to extract the potassium chloride?

Matt Simpson:

We're using a fairly conventional process, where the ore is first mined underground, using a technique called Room and Pillar mining. You excavate a room out and you leave a pillar or a wall to provide support to the next room that you excavate out. You then take this material to surface, where you crush it. You grind it finer and then you add hot water that already has a lot of sodium chloride, better known as table salt. Because potash is potassium chloride salt, when you put it into hot water, it dissolves. Then you slowly cool it down using a crystallizer and because the crystallization temperature of potash is different from sodium chloride, you end up concentrating the potassium chloride from the mined 30% purity to a final product of 95% purity, for sale to customers.

Dr. Allen Alper:

Could you tell our readers/investors your primary goals for 2021?

Matt Simpson:

This is a very advanced, near shovel ready project, where we've already done the majority of our engineering and environmental permitting, including public consultations. We've also completed 76 of the 78 items required to obtain the Installation License. This allows you to start construction of the project. Our main plan for 2021 is to complete those two outstanding items, which are both related to the completion of indigenous consultations, which are currently on hold because of the COVID situation, but anticipated to resume mid/late summer.

Our Company is helping tremendously by providing medical personnel the use of our trucks and our boats to deliver COVID vaccines, in support of the local community. Mining companies should contribute back to local communities, where they can, where it is the right thing to do. In this case, it also happens to benefit us because it means that we will be able to start indigenous consultations this summer, with the aim of having them completed well before year end, ideally to start construction in 2022.

Dr. Allen Alper:

Could you tell our readers/investors, about some of the finances involved in getting your project into production and about the timeline.

Matt Simpson:

The initial capital cost to construct this project is $2.1 billion on an after-tax basis. We have expressions of interest from several export credit agencies globally, totaling around $1.4 billion for senior debt. We also signed a binding contract with CITIC Construction, where their consortium, of different investors, is looking to put in around $300 million of equity. We are currently a private Company doing a Regulation A+ offering, in which your investors could participate, by going to the Company website https://brazilpotash.com/. This is the last offering that we're going to do, before we do an initial public offering. This will occur on the back of the indigenous consultations being completed, upon which we expect to raise the balance of funds for construction.

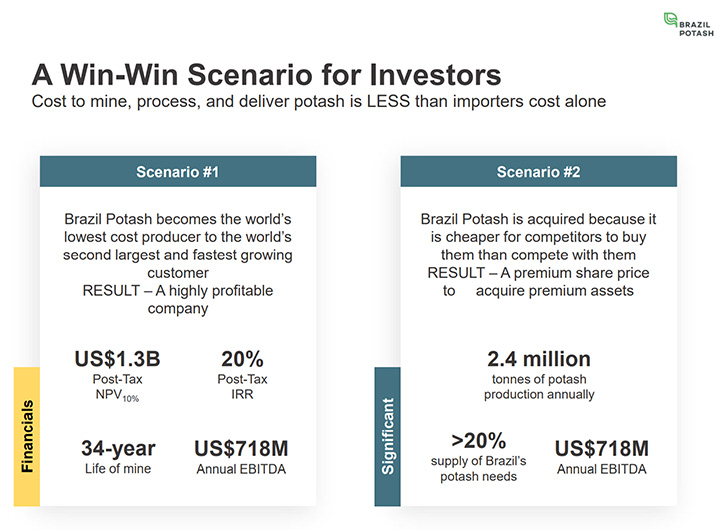

The construction period will take a little over four years to complete. Once the project is up and running, using today's potash prices, it will generate around $720 million a year EBITDA. So it's quite substantial. But what's really nice about this project is that even in a downside case, where we take the 10-year low potash price, it still generates about $450 million of EBITDA. The reason why the financials are so strong is just simply location. We're in Brazil, with this essential product to grow food right beside a river system, whereas everybody else is importing potash 9,000 to 12,000 miles.

Dr. Allen Alper:

Could you tell our readers/investors a little bit about your background, your Team and your Board?

Matt Simpson:

Educationally, I'm a Chemical Engineer with a Master of Business Administration degree. I started my career with a global engineering consulting and construction firm, called Hatch, where I used to design metallurgical refineries. I then constructed them for a number of years, before joining Rio Tinto. I held several roles at Rio Tinto, with my last role being the GM of a large mine that safely moved about 85 million tons a year of material, with roughly 650 people that reported to me. Hence, I've designed, constructed and run large mining operations globally.

The bulk of our Team is based in Brazil. Probably one of our most critical people is our Project Director, Guilherme Jacome, who joined us from Vale, which is the biggest mining company in Brazil, where he used to be their GM of major projects. He has a tremendous amount of experience in the design and construction of large mines. During his time at Vale, he also worked on the only producing potash mine in Brazil, called Taquari-Vassouras, which is now owned by Mosaic. In addition to him, we have some key people like Marcos Pedrini, who spent about 30 years, selling potash in Brazil, so he's very knowledgeable, regarding the customers and their needs.

Dr. Allen Alper:

Could you tell our readers/investors the primary reasons they should consider investing in Brazil Potash?

Matt Simpson:

I think what's really interesting about Brazil Potash is that the world population continues to grow and there's also a growing middle class that wants more protein in their diet. You

to ask yourself, where is all the food to feed the world going to come from? When we look at Brazil, Brazil has the highest amount of arable land in the world. This is land that can be used to grow food, but today is only using about one fifth of its potential. Some of the most populous countries in the world, like China, have very little land still available to grow food and that land is quickly becoming urbanized. In places like India, there is no more land available.

Brazil also has the highest amount of fresh water available in the world. Even today, things that your readers probably eat and drink every day of their lives, like coffee, orange juice, chickens, cows, Brazil is either number one or number two in the world in terms of both production and export. Keeping in mind that potash is not just used to increase crop yields in Brazil, it's essential to put potash on the farm fields because the soils are very clay like. The problem clay soils is after one or two crop seasons, they become so nutrient deficient you can't grow food anymore.

Brazil Potash will be the lowest cost supplier of potash to Brazil in the world, simply because of our logistics cost advantage, which gives us a substantial and sustainable cost advantage to supply this essential nutrient to grow food. Not only to feed the people of Brazil, but also to secure food for a large portion of the rest of our world! It's not a matter of do we want to eat, we have to eat, and therefore we have to use potash.

Dr. Allen Alper:

Is there anything else you'd like to add?

Matt Simpson:

Would you like a little bit more information on the projects ESG benefits?

Dr. Allen Alper:

Why don't you give us a synopsis on that?

Matt Simpson:

In addition to the estimated 508,000 tons per year of greenhouse gas emission reductions, from avoiding the unnecessarily transport of potash several thousands of miles, it might be interesting for your readers to know roughly 80% of Brazil's electricity is hydro-electrically generated. Our project is located about 120 miles away from a city of 1.7 million people, called Manaus. But in between that city on our project, which is connected to the national electricity grid and accesses that clean hydroelectric energy, there are several communities, ranging from a few thousand people to well over 100,000 people, who use diesel generators to produce electricity.

Those diesel generators are extremely emission intensive and costly to run. By our project coming on stream, we will be constructing a high voltage power line that connects to that national grid and we're going to take all of these people off diesel generated power and put them onto much cleaner hydroelectric generated power.

We're also very involved locally in the community. One of the things we did several years ago was to set up a program, where underprivileged children can get a hot breakfast and a lunch. We also provide them tutoring on their schoolwork and teach them some practical skills, like how to grow food and how potash is used to increase their crop yield. It's one of those investments, where you have a great return on your investment, but you're also doing quite a bit for the environment and the local community.

Dr. Allen Alper:

Thank you, Matt. Is there anything else you'd like to add?

Matt Simpson:

No, Your questions did a really nice job of covering the Brazil Potash story. I would encourage people, who are interested, to go to our website, which is www.brazilpotash.com to learn more about this Company for investment consideration.

Dr. Allen Alper:

Thank you, Matt. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

www.brazilpotash.com

invest@brazilpotash.com

+1 (647) 697-3937

|

|