King Island Scheelite Limited (ASX: KIS): Commencing Production and Shipping Their First Tungsten Concentrate in the Final Quarter of 2022 Johann Jacobs, Executive Chairman Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/27/2021

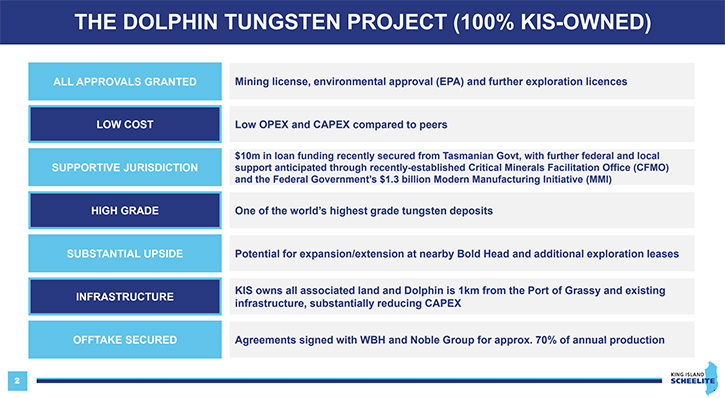

At PDAC 2021, we spoke with Johann Jacobs, Executive Chairman of King Island Scheelite Limited (ASX: KIS). King Island Scheelite is focused on redevelopment of its 100% owned, past producing Dolphin Tungsten Mine, located on King Island, Tasmania. Initially, the focus is on producing a high-grade tungsten concentrate, however plans are well advanced to value-add the product for supply into the upstream tungsten industry. We learned from Mr. Jacobs that once operational, the Dolphin Tungsten Mine will be producing 300,000 to 400,000 tons of ore per year for 14 years. The Company will be exporting about 3.5 thousand tons of concentrate per year to Europe and Asia. According to Mr. Jacobs, they will be commencing production, and shipping their first concentrate to their customers, in the final quarter of next year, 2022. King Island Scheelite already has two off-takers, who will buy approximately 70% of the Company's tungsten concentrate production. Tungsten is used in cutting tools, drill bits, drilling tunnels, mining, armaments, and now, increasingly, in the high-tech industry.

King Island Scheelite Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor in Chief of Metals News, interviewing Johann Jacobs, who is Executive Chairman of King Island Scheelite. Johann, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Johann Jacobs:

Thank you very much, Allen. King Island Scheelite Limited, is listed on the ASX. Its primary asset is 100% ownership of tenements on King Island. King Island is a small island, midway between Victoria, a State on the mainland of Australia, and in the Southern part of the island, called Tasmania, which is another State. The tenements on King Island are rich in tungsten, and it is certainly the highest-grade tungsten deposits in the Western World. The mine actually operated from 1917 to 1990 and was especially prolific during the wars because of the requirement of tungsten for military applications.

The mine closed in 1990, having mined out approximately 50% of the ore body. It closed because of very, very low tungsten prices prevailing at that time. Tungsten, prior to the benchmark, at that stage was $50 US per metric ton unit. Today, that price is around $275. The Company has, over the last eight years, been working very extensively on a redevelopment plan to mine out the remaining 50% plus of the reserves. At this stage, we have what we believe is an almost optimal plan for the redevelopment. It will be developed as an eight-year open cut mine, followed by a six-year underground mine, 14 years in all.

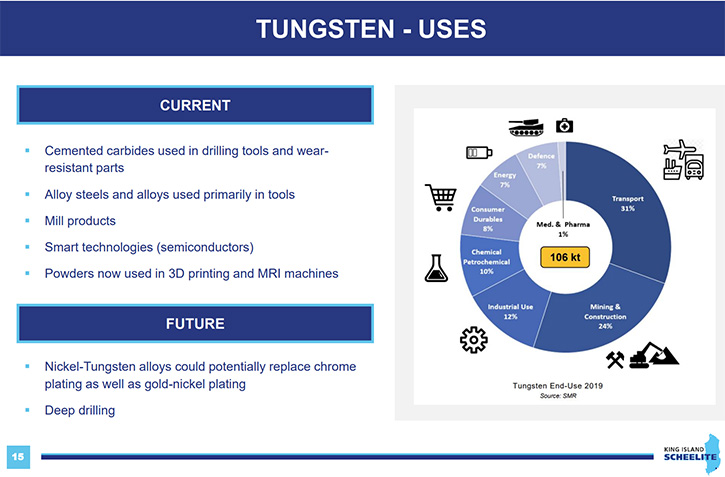

During that period, we will mine about 400,000 tons of ore per year. When we get to the underground, that will be about 300,000 tons of ore per year. Once it has been beneficiated and has gone through various circuits of concentrating the ore, we will be exporting about three and a half thousand tons of concentrate per year from the Island. That will be concentrate at 63% tungsten and will be shipped to Europe and Asia, where it will be used in the process of producing an intermediate product known as Ammonium Paratungstate (APT), before it is converted into tungsten. The primary use of tungsten today is in the manufacture of cutting tools, which is used in military applications, as well as for the construction of motor vehicle aircraft, et cetera. A very important use of tungsten is for drill bits for the oil and gas industry as well as for the construction industry in tunneling under major cities, throughout the world.

Dr. Allen Alper:

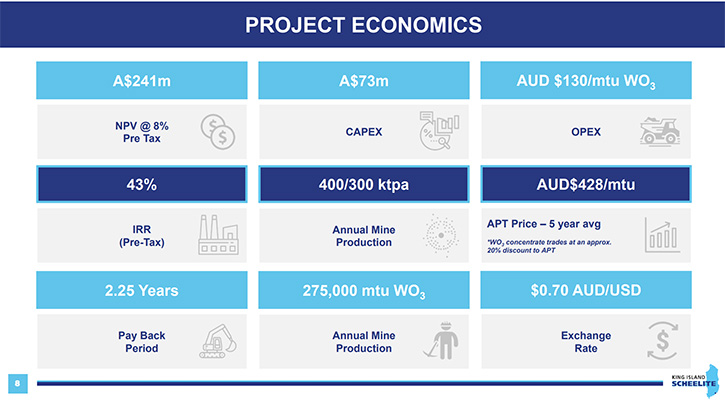

That sounds excellent. I know you have an economic study, and the numbers are quite attractive, could you summarize some of that data?

Johann Jacobs:

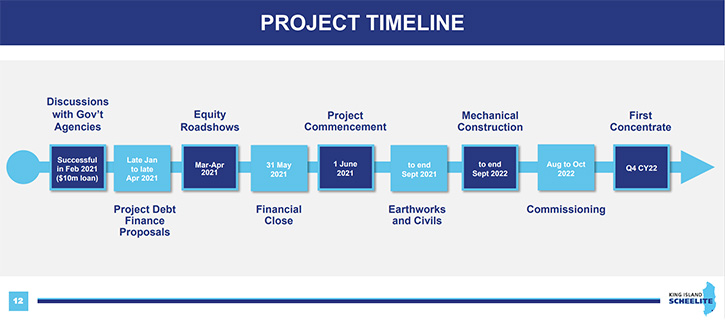

Certainly. The revised feasibility study, which we published in December of last year, uses relatively conservative estimates. We have a net present value (NPV) of some $240 million AUS. Our potential operating costs are around $100 U.S. dollars per metric ton and the value is $220 US dollars per metric ton unit, a significant margin for any price volatility. The timing of the redevelopment is that we are taking project finance at the moment; and are hoping to close that towards the end of May. We will then also have the equity component of that, and we are seeking to have a financial close by mid-June of this year.

Following that, we have a 15-month procurement and construction phase. Where we will acquire all the processing plant equipment, and heavy earth moving equipment. We will see the first concentrate being exported to our customers in the final quarter of next year, 2022. We have two customers that will take approximately 70% of our production and that will be exported to Rotterdam, the rest of Europe, potentially the US, and into Asia.

Dr. Allen Alper:

I see that you have two very important, substantial offtake agreements. Can you tell our readers/investors more about them?

Johann Jacobs:

Yes. The first offtake agreement is with an Austrian Company, called Wolfram, Bergbau and Hutten, they are a wholly owned subsidiary of a Company, called Sandvik. Sandvik is a multi-billion-dollar Scandinavian company, who is well known for the manufacture of cutting tools. They will take about 20% of our production. We have known them for a long time, and we signed them to this agreement two years ago.

The second contract, which we signed in September of 2020, is with the trading company called Kaylan Resources, they are based in Singapore. They are world leaders in trading of tungsten and tungsten concentrates. That is a three-year contract, and they will be taking approximately 50% of our production. The first offtake agreement, with Wolfram, is for four years, and for Kaylan is three years. They are both very substantial groups, so they have underpinned the project in terms of offtake of product.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about your background and your Team?

Johann Jacobs:

Yes. I've been in the mining industry since 1980. I'm a Chartered Accountant by profession, but have been in various commodities, since my first job out of Uni. The Team that we have is made up of my Co-Directors, Chris Ellis, a geologist by profession. He's been in the mining industry since about the same time as I have. We have worked together on various projects since 1990, so, for the last 30 years. The third Director that we have is Greg Hancock, who is Perth-based. Chris and I are both Sydney-based. Greg is a specialist in equity markets and contributes very significantly from that perspective.

Our Management Team is headed up by a General Manager, Charles Murcott, who is a Mining Engineer by profession. He's supported by a team of metallurgists, environmental engineers, geologists and mining engineers. That Team will be instrumental in formulating and building the mine and moving the mine forward. They have all been associated with the project for 8 to 12 years, so they have a very in-depth knowledge of the project and have mitigated risks as far as possible.

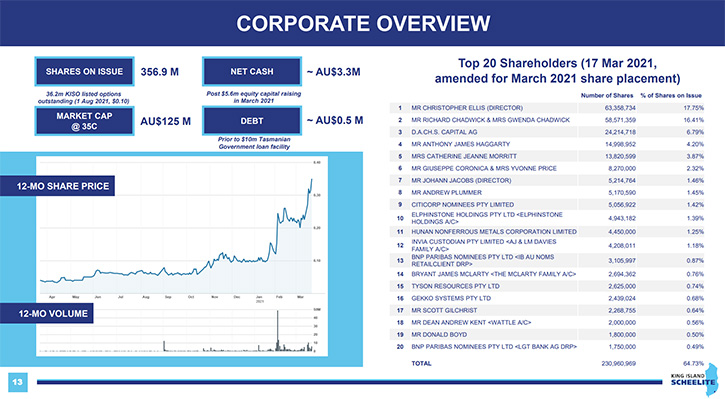

King Island Scheelite Limited, ASX listed as KIS, has some 3,000 shareholders on the register. The two principal shareholders own approximately 38% to 40% at this point in time. They have been very supportive of the Company and have loaned the Company money, when money was difficult to raise on the equity market. But I am happy to say now that the Company is debt free, the assets are totally unencumbered, so it leaves a clear path to raise project debt-funding and the equity component in the next two to three months.

The third largest shareholder that we have is a relatively new shareholder, based in Switzerland. He came onto the register originally in January and has expressed a desire to increase his exposure to the Company. Very recently, we undertook a placement of $5.6 million to new and existing shareholders, and that shareholder took up $4 million. They are now our third largest shareholder at just short of 7% of the Company and have been and continue to be very supportive of the Company.

That shareholder is a Company called D.A.C.H.S Capital. AG, indicating it is a Swiss registered company. The balance, of the top 20 shareholders, owns approximately 70% of the Company, so there is a very large free float, and the turnover of shares has been very, very significant and continues to support the share price where it is today. We have had a significant increase in the share price, over the last three months, from approximately 10 Australian cents per share, to yesterday closing at 31 Australian cents, so we are very happy with that situation.

Dr. Allen Alper:

Well, that's excellent. It is good to see all your hard work and your Team's work and perseverance being recognized and paying off. There are good times ahead, as you move towards production and start producing. You are in a great position and your Company is in a great position.

Johann, could you give our readers/investors the primary reasons they should consider investing in King Island Scheelite?

Johann Jacobs:

First and foremost, tungsten, which is the product that we will be producing, has been regarded and is regarded throughout the world, certainly the Western World, as a critical mineral, for two principal reasons; its economic importance in society, it is used in everyday life. The main purpose is the use of tungsten in cutting tools. Without tungsten, you would not have any drill bits to drill for oil, drilling tunnels, mining or armaments. It's now being used more and more in the high-tech industry. This gives tungsten great economic importance.

The second major reason why it is called a critical mineral is because of its supply chain. It's a relatively small industry, about 110,000 tons a year. But of that, 83% is mined and used in China. With the trade embargoes going on in the trade world, the supply of tungsten worldwide is under threat. That is one of the reasons why the Tasmanian Government has been very supportive of the project. Earlier this year, they provided us with a $10 million AUS loan for a 10-year period, to assist in the redevelopment of the project. The governments are serious about supporting critical minerals and that bodes well for us and other tungsten players.

Dr. Allen Alper:

Well, those are very compelling reasons, Johann for our readers/investors to consider investing in King Island Scheelite. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.kingislandscheelite.com.au/

Executive Chairman

Johann Jacobs

King Island

Scheelite Limited

E: kis@kisltd.com.au

T: +61 416 125 449

|

|