Northern Dynasty Minerals’ Alaskan Pebble Project: Huge, US-based, Strategic Metals for Renewable Energy and Green Technologies, Provides Significant Benefits to Local Communities; Fisheries Protected; Ronald Thiessen, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/10/2021

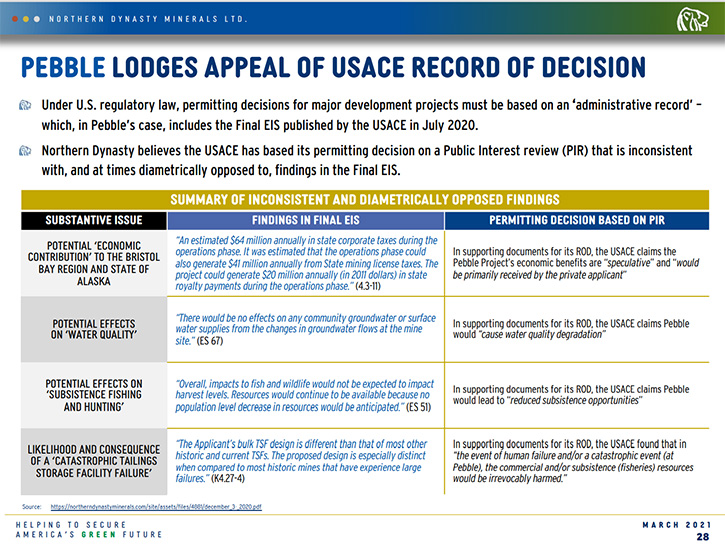

At PDAC2021, we spoke with Ronald Thiessen, who is the President & CEO of Northern Dynasty Minerals Ltd. (TSX: NDM; NYSE American: NAK), a mineral exploration and development Company based in Vancouver, Canada. Northern Dynasty's principal asset, owned through its wholly owned Alaska-based U.S. subsidiary, Pebble Limited Partnership, is a 100% interest in the Pebble world-class polymetallic copper-gold-silver-molybdenum-rhenium deposit, located 200 miles from Anchorage and 125 miles from Bristol Bay, Alaska. The Pebble project will be a huge, US-based, source of strategic metals for renewable energy and green technologies and will provide significant social and economic benefits to the local communities. The project's permit was denied in November 2020, based on the conclusions reached by the US Army Corps of Engineers (USACE). Northern Dynasty believes the USACE has based its permitting decision on a Public Interest review (PIR) that is inconsistent with, and at times diametrically opposed to, findings in the Final Environmental Impact Statement. The appeal process is underway.

Northern Dynasty Minerals Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ron W. Thiessen, President and CEO of Northern Dynasty Minerals Ltd. Ron, I wonder if you could give our readers/investors an overview of your Company, and tell us about the benefits of the project to Alaska and to society in general, and what steps your Company would be taking to protect the environment.

Ronald Thiessen: Sure. Love to do that. Thank you for the opportunity Dr. Alper. I think most people know about the Pebble Project and Northern Dynasty. It's a project that's located in Western Alaska, an area that doesn’t look like your quintessential Alaska. It was eroded by glaciers during the last ice age. So, it's flat to rolling hills in the area, and there is not a lot of vegetation. In fact, in the 20, 25 square mile valley that the Pebble deposit sits in, there is not a single tree. It's mainly tundra, undergrowth and the like. It is an ideal location for a mining project. It's not very close to any communities. The closest communities (Iliamna and others) are 20 miles away, so you're not dealing with having to move people away from the site. The infrastructure is not too bad, as there are two 5,000-foot paved runways near Iliamna and potential road access from Lake Iliamna is not expected to be challenging, as the terrain is mainly flat, and the distance is reasonably close. Access to the ocean is either by an 85-mile all land route to Cook Inlet or a road and ferry route across Lake Iliamna to Cook Inlet. All that terrain is relatively modest terrain.

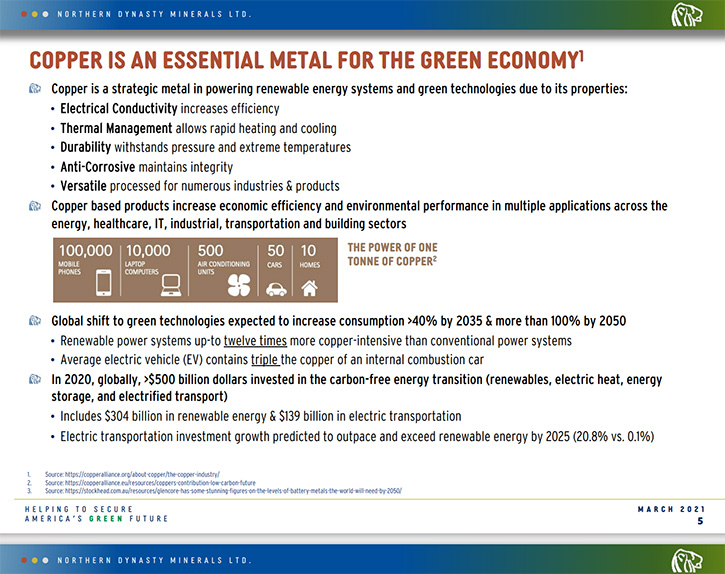

There is a presentation up on the Northern Dynasty website that people can look at. Basically, it covers four issues, and I am going to focus on a couple of them. It addresses copper as a critical metal. It addresses Pebble as a world-class resource. It addresses Pebble's significant social and economic benefits to the region in Alaska. And it addresses the road forward for Pebble. In terms of copper, the critical metal, I think most people realize that if modern society is going to convert our energy from fossil fuel generation to electricity, it's going to entail a great deal of copper metal because electrons only travel efficiently on copper.

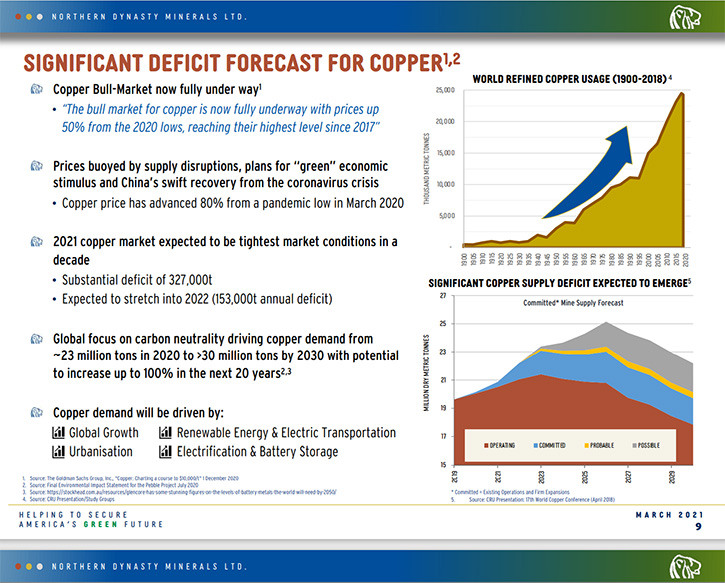

And so, with the phasing out of internal combustion engines, and the conversion to electric vehicles, which require, on average, 100-150 more pounds of copper in them, there is a huge increase in the need for copper. There are probably 80 to 100 million vehicles sold each year. It's just phenomenal, the amount of copper that'll have to be produced to meet this demand. The major mining companies are saying that there probably needs to be a 50% increase in the amount of copper that we produce between now and 2030, to 2035. We're currently producing about 22, 23 million tons. So, a 50% increase is an additional 10, 12 million tons per year, every year. And then we will have to double that by 2050 to 2060. So, it's a tremendous call on the industry and I'm not so positive that the industry is capable of delivering those kinds of numbers. This dynamic makes it a really great time to be in copper projects, because substantial increases in demand, without offsetting increases in supply, usually means materially higher prices. Even currently, the copper price is up, well over a dollar per pound, in the last 10 months or so and it hit a high of about US$4.50 last month.

Today, there are already tremendous shortages in copper concentrates in global markets. The contracts for treatment and refining charges, or TC/RC’s, are near historic lows. In fact, I think we're getting close to historic lows. I am seeing contracts at $20 and $2 ($20/tonne treatment charge and $0.02/pound of payable copper refining charge), and $15 and $5. Obviously, the pandemic has affected a lot of producing mines, in different areas of the country or the world, especially in Latin America. So even today, this shortage of copper is really starting to pinch. And the generation of clean energy requires wind turbines and solar cells. The average wind turbine has 5 to 10 tons of copper in the armature windings. Then you must aggregate all that power, those electrons. So, you have hundreds, if not thousands of kilometers of additional copper wire needed. And that all must be transported to the centers where the power is consumed, which are cities and re-electrifying stations. In the city of San Francisco, it is said that if 10% of the automobile market were electrified, then they would have rolling blackouts in the city due to a lack of generation capacity.

You will see a lot of this in the first 8 to 10 pages of our presentation material, but I know that we have only limited time. So, having established the coming increase in demand, what about supply? Where are we growing productively? Well, all mines are depleting assets. A lot of serious investment in some of the largest mines in the world has effectively only allowed those mines to stand still. If you take Escondida, for example, I think when it first started up, it was probably running copper grades of 2% or better. Today, it's probably one of the largest mines in the world. I think it has about a 360,000 tonne per day concentrating capacity, but the head grade is down at around between 0.6% and 0.8% and continuing to decline.

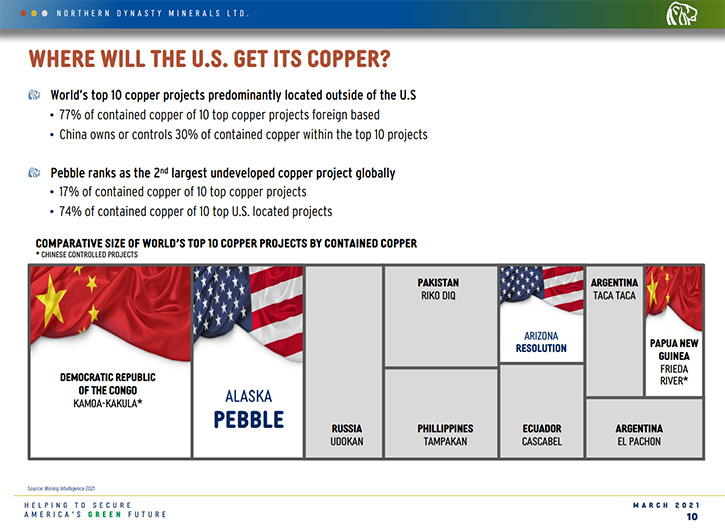

So, the amount of copper it produces, is no more than what it was producing in the 1990s. As head grades drop in projects around the world, you will start to see a reduction in production. The slide below depicts exactly that. We hit a structural deficit in about the middle of this decade that is being exacerbated by the pandemic, and now the accelerated shift to decarbonization and electrification. In terms of where mines are, the slide, entitled, “Where Will the US get its Copper?” shows 10 of the most significant copper deposits in the world today. Two of them happen to be located in the United States, Pebble and Resolution.

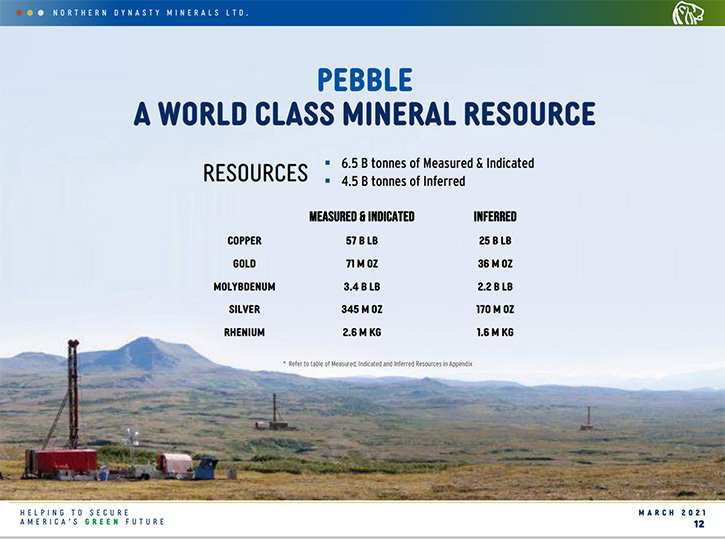

I am also thinking of Rosemont as one. In the US, they are all functionally behind, with permitting issues and legal challenges, and not advancing like they should be. Some of the largest ones in the world like Kamoa Kakula, Ivanhoe's project in the DRC, have gone ahead extremely well, with short timelines, but effectively that production is controlled by China. We are seeing China being extremely aggressive buying in both the current copper market, and in the long-term, tying up production capacity for future years. Many of the locations of these mines are not in the greatest jurisdictions from a risk perspective, as there are geopolitical problems in places like Russia, Ecuador, Argentina, Pakistan and Papua New Guinea. So, if the largest potential domestic supplies of copper in the US are not advancing through permitting, I just don't know where the West is going to get the copper that it needs. Pebble is a world-class resource. Although not 43-101 compliant, we are confident it has 10 billion tons of deposit in total and 107 million ounces of gold and 84 billion pounds of copper, plus about 6 billion pounds of molybdenum, 500 million ounces of silver plus rhenium.

It is truly a polymetallic deposit. Its mineralogical analog is Bingham Canyon in Utah. Measured and indicated resources are 6.5 billion tons, containing 57 billion pounds of copper, 71 million ounces of gold, 3.4 billion pounds of moly, 345 million ounces of silver, and 2.6 million kilograms of rhenium. Rhenium is a strategic mineral that is needed extensively by the US military or any military.

That is a great picture below that gives you an idea of what the terrain is like. Pebbleis located at between 750 and about 850 feet above sea level, so it's not like it's in the Andes at 4,000 to 6,000 meters, 12,000, 18,000 feet. We have a positive water balance in the area, so it is not a desert climate. And if we must discharge water, we run it through a water treatment plant first.

It has been well established that critical minerals will be desperately needed going forward. And Pebble represents probably the best solution to that, certainly for the United States of America and probably the Western Hemisphere. The US currently relies on imports for about 35% of its copper, 82% of its rhenium and 68% of its silver. Pebble has the capacity to reduce those numbers substantially. It can reduce copper imports by 8% to 10%, rhenium by 25% or more, and substantial amounts for all silver. And you might say, "Well, silver is a precious metal." Silver also has a tremendous amount of industrial electronic applications. So, Pebble is truly a required source for the country.” Pebble is the 12th largest copper resource ever discovered anywhere in the world and the second largest gold resource in the world.

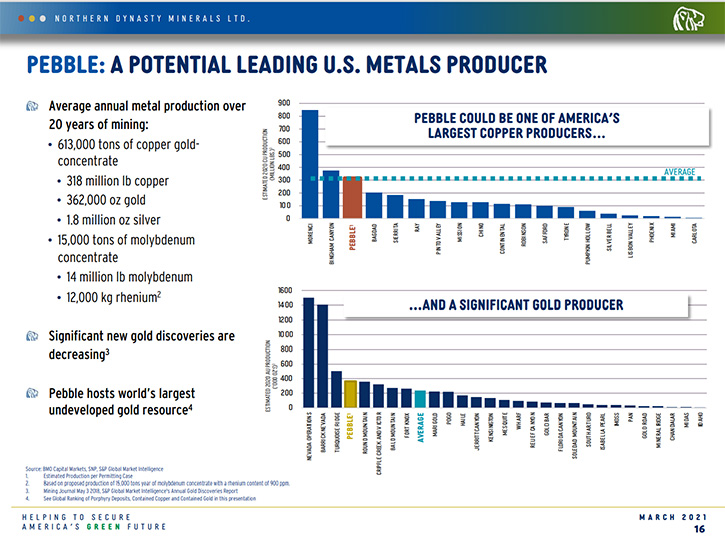

On a combined basis, in terms of its net metal value, it is likely in the top 3 or 5 metal deposits in the world. When in production; it'd be the third largest copper producer in the US and the fourth largest gold producer in the US. We would produce about 613,000 tons of copper concentrate containing 320 million ounces of copper and 362,000 ounces of gold, plus 1.8 million ounces of silver annually for the 20 years that we have in the permitting case. In addition, we will produce about 15,000 tons of molybdenum concentrate, containing 14 million pounds of molybdenum and 12,000 kilograms (or about 26,000 pounds) of rhenium.

So that's something that would need to be investigated and permitted during this 20-year lifetime. There's additional gold potential, in gold plant recovery, if we can find a lixiviant other than cyanide, which many in the gold world are working on today. So, at current long-term metal prices, on slide 17, you can see the relative value of the metals at Pebble. But I'm going to say this doesn’t really reflect current pricing I think right now we'd probably be about 70% copper and 30% gold or precious metals, given that copper has moved up so much. Pebble contains a tremendous amount of metal in terms of comparing it to other entire mining companies. We have just about as much copper metal as Teck does, 50% of what Anglo does, and a third of what Freeport has. Gold is similar. Lots of exploration potential as well! Let me talk just a little bit about the significant benefits expected to accrue to the region and the state when the mine is operating.

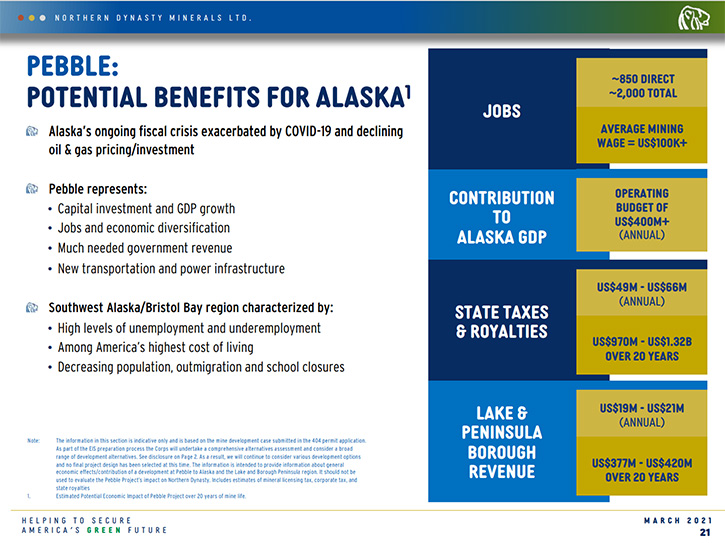

We are talking about something in the order of 3,000 to 4,000 total jobs during the construction phase of this project and 850 to 1,000 direct jobs in mining, and about 2,000 indirect jobs, once the project is in production. Mining is one of the highest paying industries in Alaska, with people currently making about $100,000 a year. So, imagine that the total payroll (direct and indirect) would be about $150 million a year. On an annual basis, Pebble will spend about $400 million on supplies and services, significantly benefitting the GDP of Alaska. That is another huge positive for the state of Alaska. Currently, Alaska has a structural deficit because of the reduction in the amount of oil it produces and the reduction in oil prices. On an annual basis, we'll pay at least $50 million in taxes to the state also.

In addition to that, we will pay $40 million in licensing fees and $20 million in royalties. So this could amount to more than $100 million a year to the state of Alaska, in the various forms of taxes, which is a big number. The state has a population base of about 730,000 people. In the borough that we are in, the county, the Lake and Pen Borough, there are about 1,800 people living in 17 villages spread over about 30,000 square miles. That is roughly the same size as Ohio, except there are only 1,800 people living there. The tax we will pay on an annual basis is about $20 million. The current budget for Lake and Pen Borough is between 4 and 5 million dollars. That's a four to five times increase in the revenue that they will see in that area, which would be huge for them because right now they're short of money. Schools are compromised, health services and other services in general. In addition, this region will benefit from the economic activity that results from the high paying jobs, which would be great for them as well.

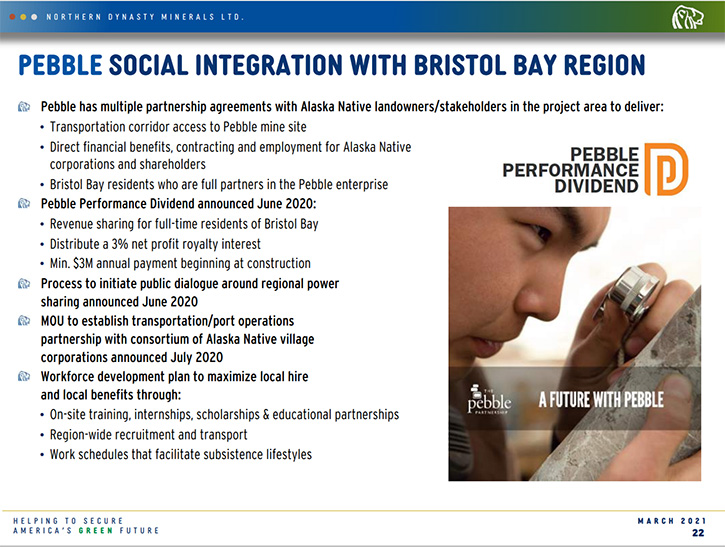

Our plan is to offer training to anybody in the region that is interested in working at Pebble. If you want a job and are prepared to be trained, you can have a job. We've initiated something called the Pebble Performance Dividend, designed with the Alaska Permanent Fund in mind. Basically, people can sign up. We have created a trust that will hold an NPI interest in the Pebble Project. We anticipate that that dividend, over time, will approximate the Permanent Fund Dividend, which in its most recent incarnation, I think will be about $1,000 a year to every man, woman and child in the region.

We have talked about providing power to the region and that is an initiative that we want to advance as well. We will work with the state and the local communities to bring natural gas power into the Pebble mine. This will enable us to provide natural gas or line energy to nearby villages and to the coast. Currently, most of the energy in the area is generated by diesel, brought in by air. Electrical prices are currently about 60 to 80 cents a kilowatt hour. There is very little industry as a result of the prohibitive cost of energy. If we can provide them with much cheaper power, then there is the opportunity for further economic development. We have established MOUs and right-of-way contracts, with several of the villages and Native corporations that are proximal to the Pebble Project.

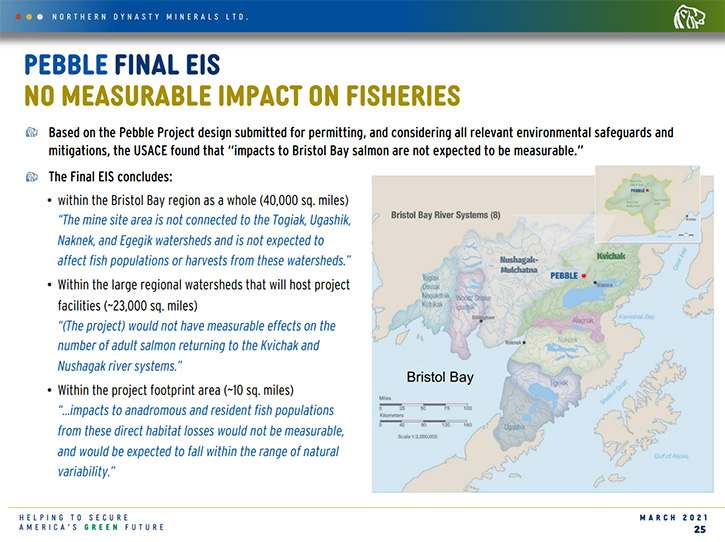

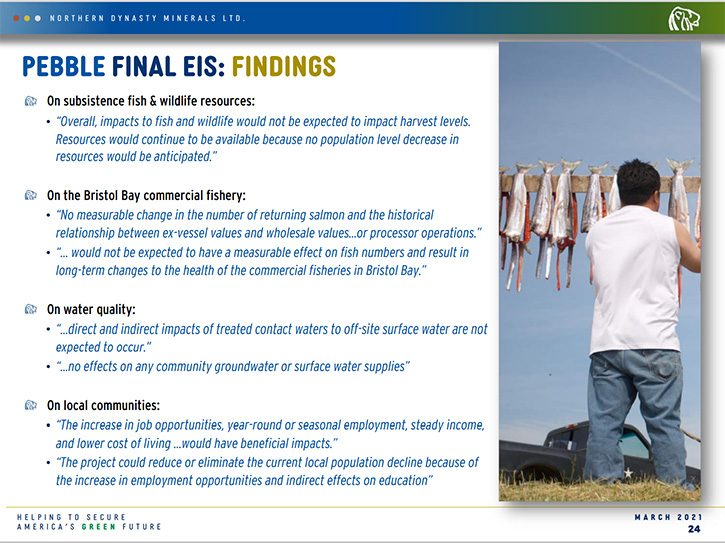

And so, they will be using their assets, their surface title, to generate revenue for the villages, based on mine-related transportation that goes across their lands - either as a toll or other compensation. We have signed NPIs with them. So, they also have, in effect, a royalty resource. We are trying to work, with all these villages and communities, to ensure that everybody gets their share of the benefits of the Pebble project. We completed the NEPA (National Environmental Policy Act), environmental impact statement (EIS) federal permitting process last summer. The Final EIS was filed on the federal registry in July 2020. That becomes the official document for all future decisions at the Pebble project. It was the first time that there's been a third-party assessment of a project that we, the proponent, put forward.

The findings in that EIS were nothing short of spectacular, relative to other resource projects I have seen. The report predicts no impact on harvest levels for subsistence fish and wildlife resources. We expect that everything would continue as is, and we would have no negative impact on the commercial fishery and again no measurable change in ex-vessel values. Some people seem to think that having a mine in the borough, in a state or an area the size of the state of Ohio, would have a negative effect on the commercial fishery. But for perspective, one of the most valuable fish in all of America and Alaska, is the Copper River salmon, and the headwaters of the Copper River was where Kennecott's first copper mine was located in the 1930s.

So, again, no impact on harvest levels, no impact on fishery values. In addition, because of the way we handle the water in the water treatment plants at Pebble, there is not expected to be any effects on community groundwater or surface water supplies. And then with respect to local communities, because of the increase in jobs and year-round seasonal employment, steady income and lower cost of living, it would have huge beneficial impacts for the region overall and could help eliminate or reduce the out migration that's underway in this region currently. And, again, no impact on fisheries.

So, where do we go from here? The actual outcome of the federal permitting process was that a negative Record of Decision (ROD) was delivered to us in November of last year. This was stunning to us because of all the positive conclusions outlined in the Final EIS. And this ROD decision was basically contrary to that. It was delivered before the federal permitting process had been finished, which also was a surprise.

The two reasons given, without a lot of background or detail, is that the USACE said in their analysis, it was not in the public's interest to develop Pebble and that was because of potential impacts on the fishery and that our compensatory mitigation plan was noncompliant. Yet we detailed the economic benefits expected, which we have already summarized for you. And yet despite what the Final EIS says about the economic benefits, the denial claims that the Pebble Project's economic benefits are speculative and would be primarily received by the private applicant. Over $100 million to the state a year, $20 million to the region and over 500 million to the GDP doesn't sound too speculative to me, and clearly not all the benefits are accruing to the Pebble Project.

In the negative ROD decision, the USACE said that we would cause water quality degradation, but the Final EIS said the exact opposite, we would have no impact. On the effects on subsistence fishing and hunting, the ROD said Pebble would reduce subsistence opportunities, when in fact the Final EIS said the exact opposite. Probably, the most egregious claim is the ROD found that in the event of a catastrophic tailings failure at Pebble, due to some event or a human error, that it would cause irrevocable harm to the fishery. Well, the Final EIS stated that the US Army Corps of Engineers and their independent contractor, AECOM, could not envision an event or series of events including human error that would result in a catastrophic tailings failure due to the design of the particular tailings facility.

Fundamentally, we are going to manage water so that it doesn’t accumulate in the tailing storage facility. Almost all tailings storage facility failures elsewhere have been a result of the accumulation of excess amounts of water.

We are in the appeal process right now. We have appealed the USACE’s ROD and permitting decision. And so, that process starts, with what's called an administrative appeal to the Army Corps of Engineers. Our appeal has been accepted and is now moving forward. The USACE’s guidelines for administrative appeal is that they should be complete within 90 days.

However, we believe that the Corps is going to take longer than 90 days. And in fact, the spokesperson for the USACE said, they thought this was a relatively complex case and therefore the decision could take till later in the year. When I read the USACE’s ROD and Final EIS, which is fundamentally the Army Corps' document as well, it does not seem that complex to me. But I would not expect a decision before late summer, or early fall. There are three possible outcomes, I believe. One is a confirmation of the denial, in which case we and the state and the village corporations will most likely seek a completely independent, judicial review.

In some cases, they could overturn the denial and issue a positive ROD. I do not see that happening in this case because I understand the permitting was not completed, as well as the fact that the state of Alaska's 401 certification under the Clean Water Act) has not yet been submitted. The third possible outcome is a remand, where the commander of the Pacific Region directs the Alaska district to complete the permitting and redo the ROD decision to ensure that it is in compliance with the administrative record, which is fundamentally the Final EIS.

Dr. Allen Alper: Well, I appreciate you sharing the situation with our readers/investors, the reasons for Pebble to go forward with its project and also what your Company has been doing to protect the environment and how this project would help Alaska and society in general, as they go through the electrification process of the world.

Ronald Thiessen: I believe that the US cannot achieve its clean energy targets unless, not just Pebble, but Resolution, Rosemont and other projects are allowed to advance in the United States. They are currently operating at a deficit in copper. The rest of the world is going to be operating at a deficit, and China's tying up most of the foreign sources. So, does the United States want to achieve its electrification objectives and its climate initiatives? If it does, then it is imperative that they find more copper production.

Dr. Allen Alper: And you feel confident that the procedures that your engineers and scientists are putting in place will protect the environment and protect the fishing industry?

Ronald Thiessen: I absolutely do. I am familiar with this fishing industry. I have history on this back to the 1970s. I have a great deal of respect for it. And I know that if the fishery were at risk, we could not go forward with Pebble. We would not want to. That is the nature of what permitting means. I believe that we must protect the fishery in order to receive our permits. I think that bringing Pebble on stream can actually enhance the value of the fishery, simply because we can bring much lower cost energy to the coast, and they can produce many more, higher value products with that commercial fishery.

And yes, I am positive that our engineers have done great work. We have put a tremendous amount of work into those water quality issues. The risks that people generally associate with mining, in relationship to water quality issues, occur where the water is discharged without treatment. But we have undertaken to build two large scale water treatment plants, so that any excess water that needs discharging will be properly treated to meet, or exceed, the standards of the state of Alaska.

Dr. Allen Alper: Well, that sounds like your scientists and engineers have studied the situation and realized how important the environment is and planned accordingly, having methods in place to protect the environment and protect the fisheries that you and your Company feel are so important, and rightly so.

Ronald Thiessen: One of the reasons for a 20-year mine life to start with is so that people can have a decent period of time to get stakeholders comfortable with the Pebble Project, and the fact that the fish will return every year and water quality issues won't manifest themselves. And it will allow us additional time to look at other opportunities, other methods that Pebble could potentially use to extend mine life or alter the method of mining, underground versus open pit or a hybrid, a combination of the two. It is not unusual. There are many features in common, between Pebble and let us say, Oyu Tolgoi. There is a portion of the deposit that is very amenable to open pit mining, which is why we chose that in the first place, because it outcrops, and it does not generate a tremendous amount of waste, meaning most of the material extracted from the ground goes into the mill.

It keeps our footprint extremely small for the first 20 years. Then after that, we will look at plans such as larger scale bulk mining from underground, which does not generate any waste rock. It generates tailings and Pebble tailings are very clean. Another idea that we have implemented, at the end of mine life, is drying out tailing storage facilities, so you will not have water in perpetuity to manage. It will be dried out. It will be resurfaced and vegetated. And any potentially reactive tailings or waste rock will be separately stored to be returned to the bottom of the pit at the end of the mine life, and then covered. That will all be contained and well-managed. Any plans after the initial 20 years would require additional permit approvals before they could be put into action.

Dr. Allen Alper: Sounds very good. Ron, is there anything else you'd like to add?

Ronald Thiessen: I would just like to thank all our shareholders for their ongoing support. Developing natural resources is not for the faint of heart. We all need these resources. 95% of what is above the ground today came from below the ground. We cannot live in urban society, without a tremendous amount of mining. And this change from fossil fuel energy to electrical energy is going to entail a shift that is akin to the industrial revolution. So, it's massive, and we have to undertake the things that are on the table today to come even close to hoping to be there by 2050. It is not like we can put this off for 10, 20 years. On a project like Pebble, if we were to get the green light today, it is still six years to production.

Dr. Allen Alper: Well, it sounds like extremely compelling reasons to go forward with Pebble. I must say, the Company must be complimented on your perseverance and your willingness to fight for what you think is right.

Ronald Thiessen: I agree. It is a tremendous deposit, which is what gives me my perseverance, staying power, stamina. It is a unique deposit in the world, and it is located 100% inside the boundaries of the United States. That is why it should be developed.

Dr. Allen Alper: It sounds excellent! You can be proud of what you are doing! We will publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.northerndynastyminerals.com/

Ronald W. Thiessen

President & CEO

|

|