Renascor Resources Ltd (ASX: RNU): Extensive Portfolio of Battery Anode Material in South Australia, to Produce Purified Spherical Graphite (PSG) for Electric Vehicles ; Interview with David Christensen, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/25/2021

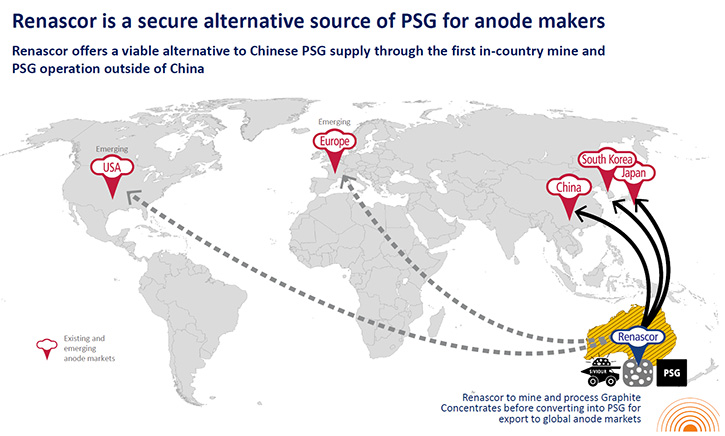

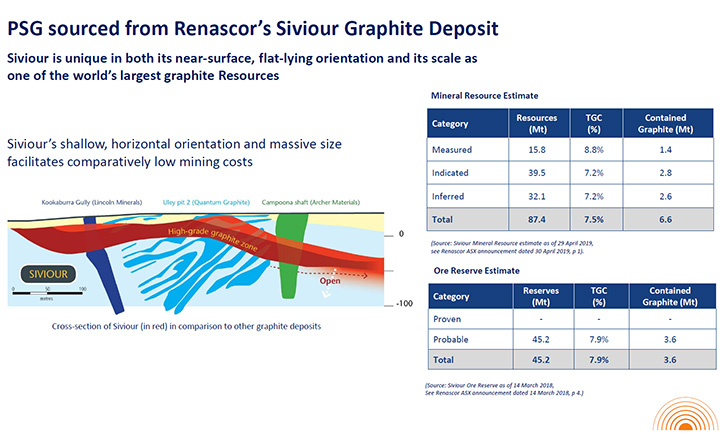

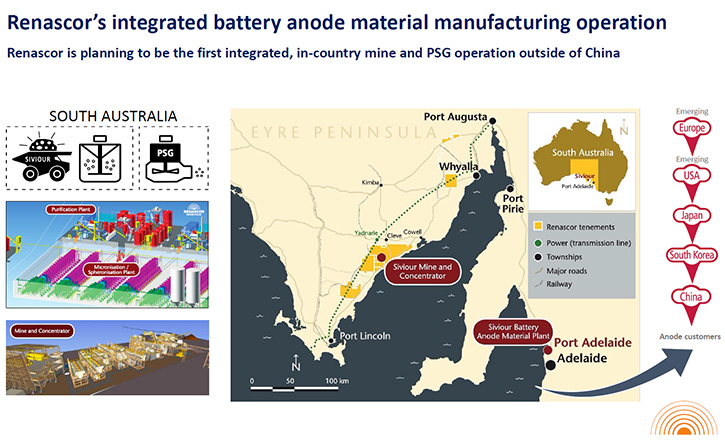

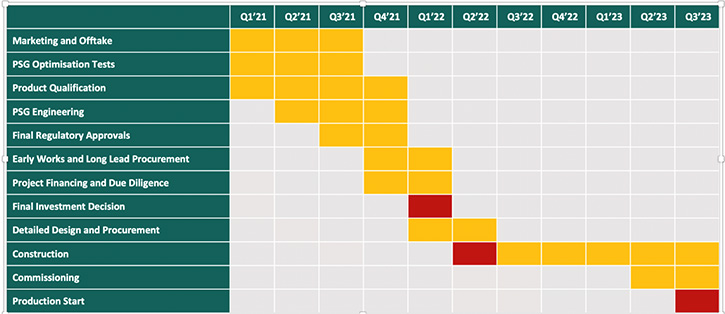

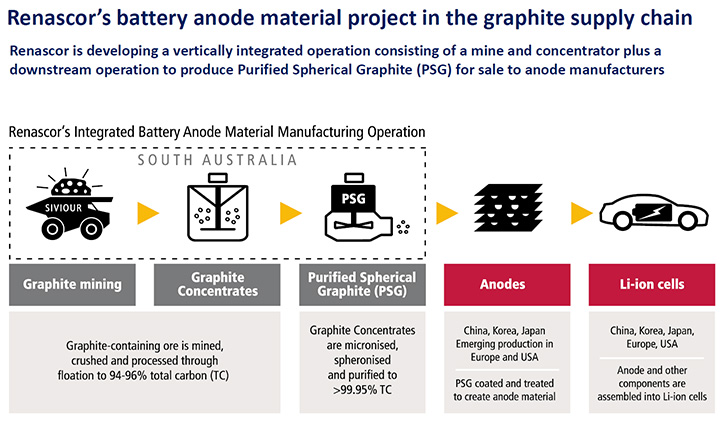

Renascor Resources Limited (ASX: RNU) has an extensive tenement portfolio in South Australia, including their flagship project, the Siviour Battery Anode Material Project, where Renascor is developing a vertically integrated operation, consisting of a mine and concentrator, plus a downstream operation to produce Purified Spherical Graphite (PSG) for sale to anode manufacturers. According to David Christensen, who is Managing Director of Renascor Resources, they have a globally significant, tier one asset, in a very high growth space and highly leveraged towards electric vehicles. The Siviour Battery Anode Material Project is the second largest proven graphite reserve in the world, and the largest reserve outside of Africa. It will be low-cost, with enough resource to support a 40-year mine life. Renascor has already secured offtake partners for up to two-thirds of Siviour’s Stage 1 production of purified spherical graphite. In 2021, Renascor is looking to secure off-take agreements for the remainder of its Stage 1 production, and the Company will make the final investment decision by the first quarter of 2022.

Renascor Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-and-Chief of Metals News, talking with David Christensen, who is Managing Director of Renascor Resources. David, I wonder if you could give our readers/investors an overview of your Company, and what differentiates your Company from others.

David Christensen: Yeah, thanks Al. We are an Australian Company, listed on the Australian stock exchange as RNU, and we're an exploration and development company. Our flagship project is a graphite project, where we have plans for a vertically integrated mine and downstream processing facility to produce battery-grade anode material for sale into the electric vehicle sector. What differentiates us from other companies is first, we are in a very high-growth space and highly leveraged towards electric vehicles. We are firmly a battery minerals-oriented company. And within the EV space, if we focus on our mineral graphite, and where it fits into the supply chain, I think what differentiates us is we have a project that looks to be one of the more interesting undeveloped graphite projects worldwide, in terms of its scale.

It's really a tier one asset, and the other tier one assets are generally located in China or in East Africa. Because of that fact, we think we have a real opportunity to produce, not just a graphite concentrate, but a purified spherical graphite product for sale directly to lithium-ion battery anode companies. As we're pushing this forward, we really believe this project of ours here in South Australia because of its location is an opportunity to be one of, if not the most significant graphite projects globally.

Dr. Allen Alper: That sounds excellent. Could you tell us more about your deposit, it’s size and a little more information on its quality, et cetera?

David Christensen: Absolutely. We're located in South Australia, just off the coast near a major highway. In terms of its scale, it's really a massive ore body. It's the second largest proven graphite reserve in the world, and the largest reserve outside of Africa. It gives us enough to support a 40 year mine life. Scale-wise, it's globally significant, by any measure, in terms of the size of the resource.

Dr. Allen Alper: It sounds excellent! Could you tell us more about it?

David Christensen: There are two attributes that I think make it particularly interesting. One is its scale. It's very large. The second is, it is relatively near surface and it is a flat-lying deposit. Those two factors together translate into a particularly low mining cost. We believe we're going to be able to produce graphite concentrates at amongst the lowest cost of any graphite deposit globally. Moreover, because it's so large, we're able to utilize large scale mining equipment, and selectively mine the deposit in a way that optimizes the production of the higher grade material, and this reduces our unit costs, in producing a high-grade product. In terms of its quality, we're into product quality testing what we can produce.

We've been able to hit the mark consistently for producing a product that's sellable into the EV chain. In particular, we've had our material first stage qualified by two existing anode companies. What that tells us is we know we can produce a product that works for our customer. The question then is, can we do that at a competitive cost? Because it's such a large deposit, our mining cost is low, we're a lowest quartile cost producer. Those two factors together, really give this deposit a particular edge.

Dr. Allen Alper: That sounds very good. Could you tell us what your plans are going forward in 2021?

David Christensen: As we move forward through 2021, we're looking at completing the additional technical work we need to do to get to a final investment decision. Also looking to complete our regulatory approvals. At the same time, we're looking to get firm binding offtake agreements for our stage one production of purified spherical graphite. We have two non-binding agreements with anode companies. We'll be looking at changing those from non-binding to binding, and we'll also be looking to move the rest of our stage one production. We have up to two thirds of it tied up, with our existing off-take customers. And we're looking to find firm commitments for the remainder. If we're successful at doing that, we're looking at probably towards the beginning of next year, to reach a final investment decision. At that stage, we'd be looking to start construction of a graphite mine.

Dr. Allen Alper: That sounds excellent. It sounds like you're in a great position. You have a huge property, low cost production, and you are located near shipping. So it sounds like you have everything going for you.

David Christensen: We've known that for a while. The big question was whether the market was ready. Graphite, as a commodity, has traditionally been more industrial. Currently about three quarters of all graphite is used for industrial uses, only about a quarter of it goes into batteries. Graphite isn't yet a battery mineral, but if we project forward to 2023, about 50% of all graphite is going into electric vehicles. By 2028, more like three quarters. So, all the growth is coming from the electric vehicle sector.

To fuel that growth, you need new mines that can do it at scale. Now in the marketplace there's a realization that the electric vehicle revolution is moving forward quite quickly, but there's a supply gap of raw materials to feed it. And that's increasing the investor sentiment for projects that can do that. I think we always knew project-wise, this one looked like one of the more interesting ones. We needed the market to catch up to us, and we're at that stage right now. We're hopeful that 2021 will be a real opportunity for us to transition from what looks like an exciting development to one that's going to be one of the more significant graphite projects globally.

Dr. Allen Alper: Oh, that's really great! Could you tell our readers/investors a little bit about your background and your team?

David Christensen: Yeah, absolutely. I have a finance background. I started in mining, working in uranium for a number of years. I was CEO of a uranium company here in South Australia. I left that company to help found Renascor Resources around 2008. We listed in the stock market in 2010, initially as a uranium explorer, we've since transitioned to multi commodity exploration. Our team includes an exploration group that's been behind some of the more significant exploration discoveries in South Australia, including the Four Mile uranium mine, where I worked together with Geoff McConachy, our Exploration Director. Our team is also made up of some of the more accomplished people outside of China in graphite development, from a mineral processing and engineering point of view. We're a team that's very good at moving from what looked like interesting exploration developments into operating mines, having been behind some of the more significant ones, particularly in our state over the last decade.

Dr. Allen Alper: That sounds excellent. Sounds like you have a great group that really knows what they are doing, well- experienced and an upgrade opportunity to move your product forward.

David Christensen: I think so. I think that's absolutely the case.

Dr. Allen Alper: David, could you tell our readers/investors a little bit about your share and capital structure?

David Christensen: We're listed on the ASX under the ticker symbol RMU. We have about 1.7 billion shares on issue. It's a large number of shares on issue, because we acquired this graphite project through a series of share issuances. Our shareholding is based largely with retail investors, the Board and Management hold less than 10% of the shares. And we're largely a retail investor pool.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/ investors the primary reasons they should consider investing in Renascor Resources?

David Christensen: That's a great question. I think the number one reason is this is a high growth sector, the EV sector. If you look within the EV sector, graphite holds a place where the future supply hasn't been met, the Chinese currently dominate, producing a hundred percent of the product we're looking to produce. And I think we have a competitive edge in being able to meet existing demand because of two factors. The first is in terms of graphite projects, ours looks like a tier one project by any measure, given its scale and a potential low cost of production. Secondly, it's our location, graphite as a commodity isn't too difficult to find, but it's quite difficult to find in large concentrations that can be economically extracted at low costs. If you start looking around the world, most of these deposits, if they're not in China, are in East Africa. We happen to be in a very low sovereign risk jurisdiction.

That's particularly important for graphite, because if you want to capture the extra margins of doing downstream production, you'll generally want to be in a low sovereign risk jurisdiction, with industrial spaces. That's where we are here in Australia. So we can produce not just the graphite concentrate, but then we can upgrade that to a refined product, and then we can sell directly into the EV space. There are two general reasons. One is the EV space is ripe for growth. We're seeing it. Graphite, in particular, needs an answer. We need new supply. And amongst the new supply sources, we look at our deposit and the fact that we're located here in South Australia, in a low sovereign risk jurisdiction. It is giving us an edge to be one of, if not the most competitive producers of battery anode material, directly supplying the EV supply chain, for decades to come.

Dr. Allen Alper: Those sound like very strong reasons for our readers/investors to consider investing in Renascor Resources. David, is there anything else you'd like to add?

David Christensen: I think we've covered it. Graphite is another one of the battery minerals that needs a supply chain solution. If you look at what we have, we have a tier one project, located in a great jurisdiction. We think we have the potential to be one of, if not the most significant graphite development globally. That's why I believe in this project. And I hope your readers/investors will as well.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://renascor.com.au/

David Christensen

Managing Director

+61 8 8363 6989

info@renascor.com.au

|

|