Capstone Mining Corp. (TSX:CS): Copper Producer, by 2024, Goal to be a Mid-Tier Miner with about 200,000 Tons of Low-Cost Yearly Copper Production; Jerrold Annett, SVP Strategy and Capital Markets Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/25/2021

Capstone Mining Corp. (TSX:CS) is an innovative copper producer, with two producing copper mines: Pinto Valley in the US and Cozamin in Mexico. Capstone also owns 70% of Santo Domingo, a large scale, fully permitted, copper-iron-gold project in Region III, Chile, as well as a portfolio of exploration properties. We learned from Jerrold Annett, who is a professional Engineer and Senior Vice President of Strategy and Capital Markets for Capstone Mining, that in 2020 they produced 157 million pounds of copper, and this year they expect to produce 183 million pounds. By 2024, Capstone Mining will be a mid-tier company, with around 440 million pounds of low-cost yearly copper production.

Capstone Mining Corp.

Dr. Allen Alper: Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jerrold Annett, who is a professional Engineer and Senior Vice President of Strategy and Capital Markets for Capstone Mining.

Jerrold, could you give our readers/investors, an overview of your Company, what differentiates your Company, and also, some of the great advances you made in 2020?

Jerrold Annett: I would say that we are a very tight knit, very focused entrepreneurial company. We have strong leadership that promotes people to excel and think outside the box. I think there are no big egos, within our organization. Everybody's voice is heard. Management is strongly integrated, with our operations. We are an Americas-focused Company, with two operations, one in Arizona and one in Mexico, and a very large, fully permitted project in Chile that we are targeting to start construction, by the end of this year.

Dr. Allen Alper: That sounds great. Could you tell us a little bit about the copper production and some of your results for last year and going into this year?

Jerrold Annett: 2020 was a transition year for Capstone. Between our two operations, we produced 157 million pounds of copper and our C1 costs were $1.84. This year we expect to produce over 183 million pounds, with lower costs and we are on a trajectory for growth over the next three years with 200 million pounds of production in 2022 and 2023. In 2024, Santo Domingo in Chile will see its first year of production which has the potential to more than double production for Capstone and drive consolidated cash costs to $1.20 per pound. This will be transformational for Capstone.

We will be a mid-tier company, with around 200,000 tonnes of copper production. It is going to cast a bright light on our Company, for its ability to generate a lot of cash flow. If you look at our Company's cash flow growth profile, it is probably the best out there in the sector.

Dr. Allen Alper: Well, that's really excellent. I think even in the past year, you've done a lot to improve your operating costs. Is that correct?

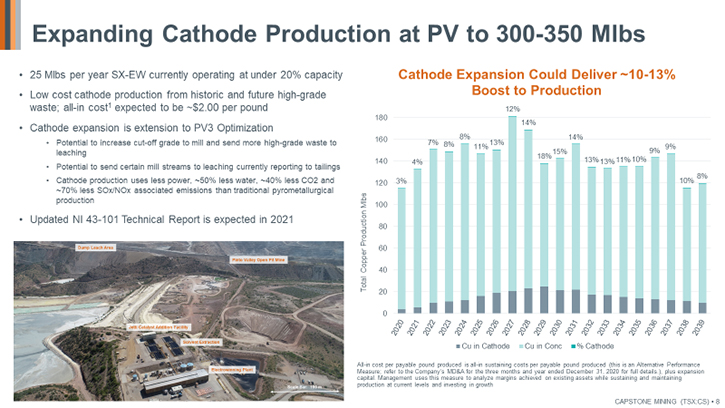

Jerrold Annett: We have, and that comes with higher efficiencies, and more throughput. At Pinto Valley, for example, in 2019, the mill throughput there was 52,000 tonnes per day and we are currently 10% higher, so roughly 57,000 tonnes per day, which is sustainable. The additional 10% throughput comes with lower costs.

At Pinto Valley we invested in key areas to debottleneck the mining and milling operation. One of the biggest gains, I think, we accomplished was blast fragmentation excellence. We worked with a third-party consultant expert that trained us on how to identify different zones in our pit. Using geo-metallurgy, to predict blast performance, allowed us to predict fines generation effectively and optimize for it. Over the course of last year, our fines generation, from the mine, went from 25% minus half-inch run-of-mine to 40% today. That increase has meant improved throughput and less wear and tear, and less maintenance costs. It has had a profound impact on Pinto Valley.

The other thing that we accomplished, and something that we are really proud of, is on the subject of innovation, which is key for companies to embrace as we all strive to improve operational, safety, and environmental performance. There is a company that approached us in 2018. Jetti Resources that have a catalytic leaching technology.

They wanted to work with us to demonstrate its impact. We were a good test case for Jetti because we have an underutilized solvent-extraction-electrowinning plant, that could be a low cost means of recovering more copper. All we needed was something to trigger more leaching. Their catalyst improves the leach kinetics in our historic dumps, by preventing and removing what is called a passivation layer, formed over time on the chalcopyrite mineral surface. This passivation or binding layer prohibited further leaching.

The test ran for a year and over the course of 2019, we saw a doubling of production. Right now, we are doing really well in recovering copper from what would have been deemed waste. This has had a real positive impact and we are excited about expanding its use in the future.

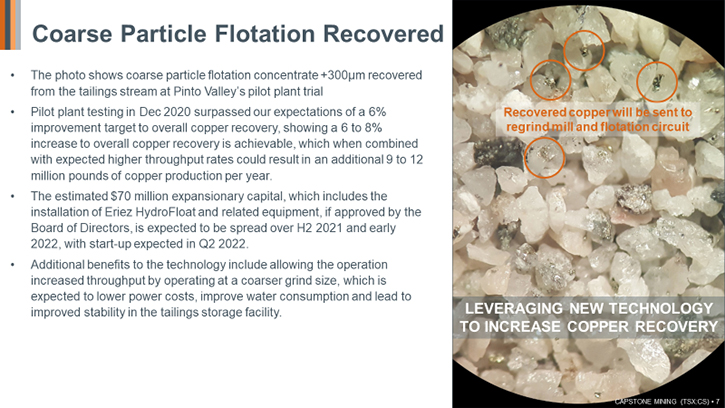

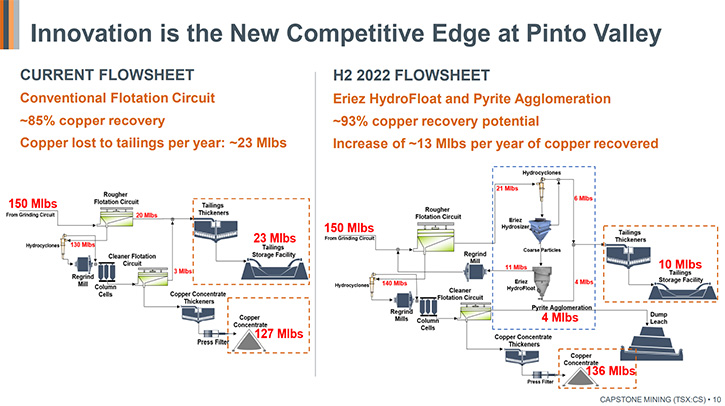

There is one more technology that we are looking to implement, called Eriez HydroFloat. We ran a pilot plant test in December and what we found was, we have an opportunity to increase our recovery by over 6%.

The reason is this equipment specializes in heavy coarse particle flotation, and that is exactly where most of our losses are to tailings. Eriez has said that Pinto Valley was one of the best pilot plant test results they've ever seen. It would be a $70 million capital expenditure, installed by mid-year 2022. With it, we will be able to recover more copper from a stream that would have ended up in tailings, which could lead to nine million pounds of additional copper production per year. The payback on capital is just over two years, so the return on invested capital is really strong with this one.

Dr. Allen Alper: That's excellent.

Jerrold Annett: Yeah.

Dr. Allen Alper: All very impressive operational moves!

Jerrold Annett: Yes.

Dr. Allen Alper: Could you tell our readers/investors, a little bit about your background and the Team?

Jerrold Annett: I grew up in Sudbury, Ontario a mining town through and through! My dad worked for INCO and my two, brothers work for the same company now under Vale. After my getting a Mineral Processing Engineering degree, my first job with Cominco took me to some amazing places like the Arctic, south-eastern British Columbia and to Chile. Working at a copper heap leach mine at 4,300m of altitude over 20 years ago, gave me a real passion for copper mining. From 2007 to 2017, I worked on an institutional equities sales desk in Toronto, and I specialized in mining. I was known to be a perma-copper bull, so it is kind of fitting that I found my way back to working for a copper mining company.

We have a strong Management Team with different skillset and experience. Our CEO has created a culture of entrepreneurship, where we embrace new ideas, new technologies, and partnerships that will surface value and improve the sustainability of our business.

Dr. Allen Alper: Well, that sounds great, Jerrold! You have an excellent Team there and a very diversified unusual background, both technical and financial. Could you tell our readers/investors, about the CEO and some of the Board members?

Jerrold Annett: Darren Pylot, our President and CEO founded Capstone 16 years ago. There are not too many founders and CEOs out there anymore Darren purchased Cozamin mine in Mexico back in 2006 for $3 million. Some quick drilling success, by drilling a bit deeper than previous owners, has led to over $500 million of cumulative free cash-flow to date at Cozamin, and we now have a mine plan for the next 10 years that is stronger than it has ever been. The best is yet to come for this crown jewel asset. I talked a lot about our Pinto Valley mine in Arizona and all the excitement around what we are doing there, but none of that would be possible without our Cozamin mine, because it is a tier one, low-cost mine that can produce free-cash flow through the bear market.

Dr. Allen Alper: That's great!

Jerrold Annett: I want to tie this end with Darren, because he is the one that founded Capstone with Cozamin as the engine that could drive future growth, and it is still today, on a go-forward basis, stronger than ever before.

Now we have a debt-free balance sheet. We have a project in Chile that we are on the verge of putting together, to fully finance it and start construction late this year. We have a huge opportunity in front of us in Arizona as well, with our Pinto Valley mine, to optimize and flex that mine for more cash flow, based on innovation. So that has all been made possible by our CEO, who was able to navigate a long period of low copper prices, keeping the Company completely whole, without messing up our corporate structure. He was able to put together a great Team of individuals and create a culture that allows us to perform, with excellence. This is the reason why Capstone can demonstrate so much growth for our investors, perfectly timed with rising copper prices.

Dr. Allen Alper: Well, that is excellent! That is great! That sounds like you have some great things, and it looks like more are coming.

Jerrold Annett: Yeah. We have been called a junior company for pretty much our entire history. Our growth profile, and our ability to deliver on what we say we are going to do, should move us to mid-cap status. Our goal is to ultimately be recognized as a premier growth, mid-cap company of choice, for investors.

Dr. Allen Alper: That sounds excellent. Jerrold, could you tell our readers/investors, the primary reasons they should consider investing in Capstone Mining?

Jerrold Annett: I think it's our growth profile. We're going to double the size of this Company in the next four years. So, by 2024, this Company is going to produce two times more copper than it does today at lower costs, and you are not really paying for that in our share price right now. I am very bullish and think we are in for a nice long run-up for copper prices, and it is driven by the electrification of the world. Many companies do not have projects right now, that are ready to deliver for investors. They are looking, or maybe they are trying to permit them, but by contrast, Capstone’s growth profile is fully permitted. Right now, when I say 400 million pounds of production by 2024, from 183 million pounds this year, we have a nice growth profile, and it is fully permitted. In this copper price environment, of $4 per pound, over the next three years (2021 to 2023), we will deliver $1 billion of after-tax operating cashflow.

Dr. Allen Alper: That's fantastic!

Jerrold Annett: That's huge because that allows us to build Santo Domingo, we are looking to start breaking ground on the mine, starting at the end of this year.

Dr. Allen Alper: Well, that's an excellent position to be in.

Jerrold Annett: Yes!

Dr. Allen Alper: I am very impressed with Capstone. You've done a great job in the past few years, and you're projecting to even do a much better job. So, I think our readers/investors should pay very close attention to your Company and watch your news releases. It's a very exciting Company.

Jerrold Annett: Thank you.

http://capstonemining.com/

Jerrold Annett, SVP, Strategy and Capital Markets

647-273-7351

jannett@capstonemining.com

|

|