E79 Resources Corp. (CSE: ESNR) : Exploring Two Gold Properties, in the Underexplored and Historically Prolific, Victorian Goldfields, Australia; Interview with Rory Quinn, President, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/23/2021

E79 Resources Corp. (CSE: ESNR) is focused on their two gold properties, in the underexplored and historically prolific, Victorian Goldfields, Australia. The Myrtleford Property represents the consolidation of an entire historic gold camp, with over 70 past producing gold mines on the property. At the Beaufort property, E79 is exploring for a hard rock source, of a major alluvial goldfield, along a structure that is known to host gold in the region. We learned from Rory Quinn, President, CEO and Director of E79 Resources, that they have done a very successful soil sampling grid in the geochemistry program at Beaufort. They are now preparing their first drilling program on the property. According to Mr. Quinn, there is a very target-rich environment at Beaufort, and this year many of the targets will be tested, having the potential to create a lot of value for the Company.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rory Quinn, who is President, CEO and Director of E79 Resources. Rory, could you give our readers/ investors an overview of your Company and what differentiates your Company from others?

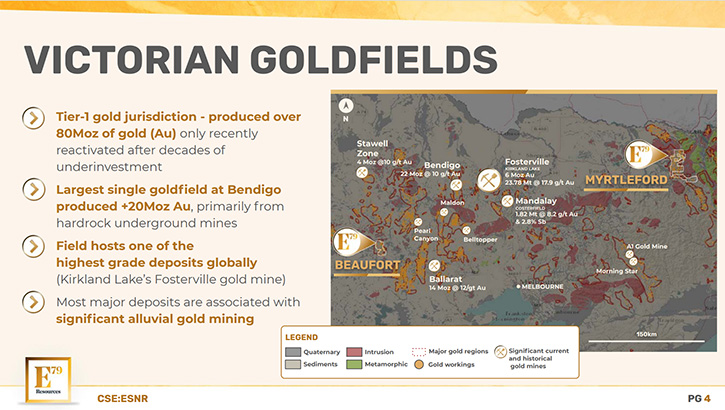

Rory Quinn:E79 Resources is engaged in gold exploration, in the Victorian Goldfields, in Australia, a pretty busy area of the world now for gold exploration. If it's not the hottest gold play area in the world, it's certainly one of them. I think what separates E79 Resources, from a lot of the players in the region, is the nature of the priority ground that we secured. I think we were able to secure some of the best quality ground in the Victorian Goldfields, securing it in mid-2018, so not part of the current land grab that we're seeing. The land was picked up by a gentleman, my partner on the project, who came from the project side. He was on the property with BHP, I think still the largest mining company in the world. They were looking for a large, Sukhoi Log analog, which is a 40-million-ounce gold deposit in Siberia, Russia, before they exited gold. When it became available in 2016, he worked to acquire it again and we are really excited to get involved with it.

Dr. Allen Alper: Oh, that sounds excellent. Could you give our readers/investors an overview of the Victorian Goldfields and, more specifically, the properties that you have acquired and are investigating?

Rory Quinn: The Victorian Goldfields have had a lot of interest, particularly in North America and Canada, since Kirkland Lake proved up Fosterville. Fosterville was a relatively middling, shallow oxide gold mine, being held by Crocodile Gold and I think it might have been Newmarket, but it took Kirkland Lake to really explore the deposit at depths and into the Swan Zone. As they went deeper, the deposit just kept getting richer and richer and richer, to the extent now that their reserve grade is roughly an ounce per tonne. So, it's one of the highest-grade gold mines and one of the more profitable gold mines in the world.

What happens with area plays, and I think why they're exciting and why Victoria Goldfields is exciting, is when Kirkland Lake proved out this reserve and resource, with a reserve grade of about an ounce per tonne, that had people, who were somewhat familiar with the geology in the Victorian Goldfields, re-imagine how they should go about exploring the region.

At our properties, Beaufort in particular, the more advanced of the two properties, there has been over a million ounces of alluvial gold production, at or near surface, but with no hard rock source ever identified. And that's where we see the prize, the high-grade shoots at depth, getting down into the sulfides at between 80 to 120 meters. So, that's a snapshot. I think the Victorian Goldfields has been overlooked internationally, but even within Australia, it's been overlooked because in Western Australia it's much, much easier to put together a meaningful land package to explore.

If you are putting together, let's say 500 square kilometers, in which to explore for gold, you might deal with one or two landowners in Western Australia, where as in Victoria, you might be dealing with 10 to 20. So, folks just went where the lowest hanging fruit was. So, it's relatively untouched, which is surprising, given that Australia is such a good mining jurisdiction, very good, strong mining laws and then, this area in the Victoria Goldfields is remarkably under-explored given how prospective it is for gold exploration.

Dr. Allen Alper: Well, that's excellent. That sounds like 2021 is going to be a very exciting time for E79 Resources. Could you tell our readers/investors about two of your main projects and what your plans are in 2021?

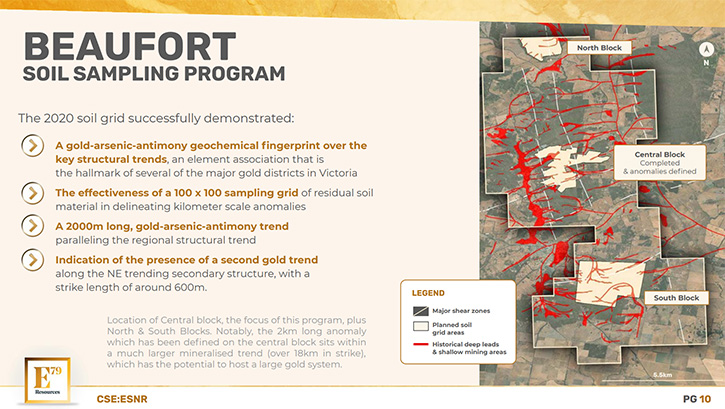

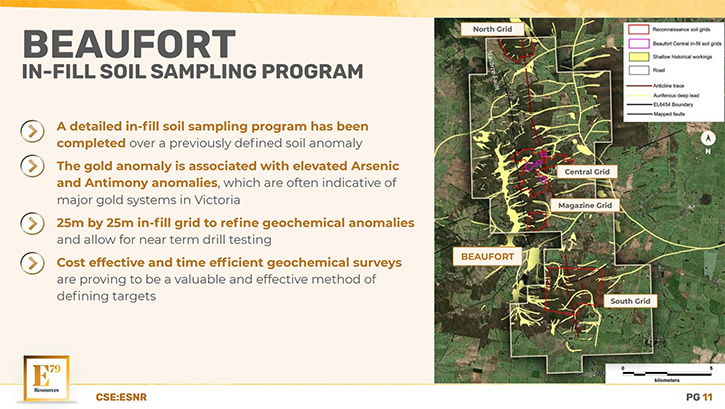

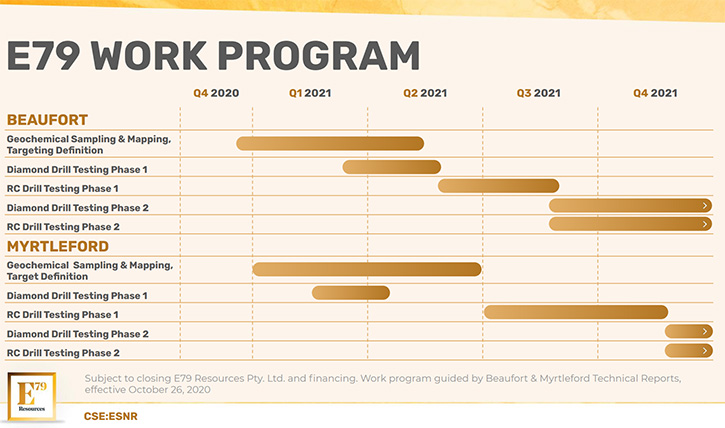

Rory Quinn: We've done a lot of targeting work. We have two properties, one called Beaufort and one Myrtleford, both in the Victorian Goldfields. At Beaufort, we have exactly what we are looking for, which is a 2,000-meter-long gold-arsenic-antimony anomaly. That's the type of Fosterville-type geochemical fingerprint that we're looking for, so we've targeted it. We have done a tight soil sampling grid, within our initial geochemistry program. The property is amenable to geochemistry and soil sampling. Our geochem program is run by a PhD geochemist, who is very good.

He identified this 2,000-meter-long gold-arsenic-antimony anomaly. We have really focused in on that and gone from a 100 by 100-meter grid down to a 25-meter by 25-meter grid. We have received those assays back and we're now in the process of putting all of that information into context and putting together our first drill program. At the same time, we have three other soil sampling grids, we are sampling elsewhere on the property. So, we are very busy, and I think we're going to see a target-rich environment there at Beaufort.

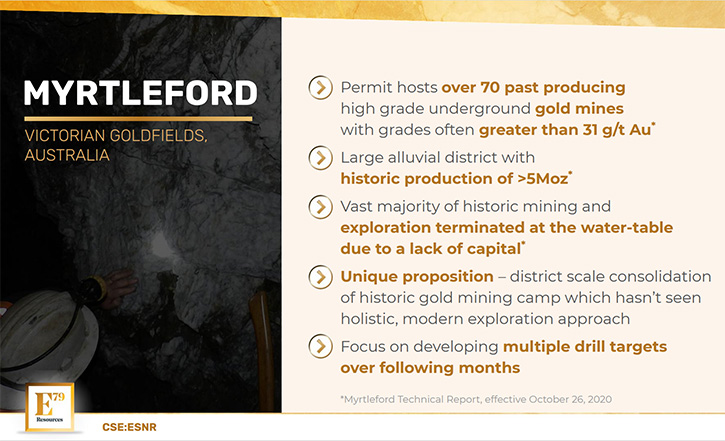

Myrtleford is the consolidation of an entire historic gold mining camp. There has been over 70 historic gold mines on the property and remarkably, only three drill holes in the modern age. We're now focused on the southeast of the property package, where roughly 35,000 ounces was mined at about an ounce per tonne gold, a very high-grade. We are now bringing a drill to bear on that property. We'll drill across where we project three to four reefs (quartz veins) as continuing at depth.

Once we have done that testing, we'll move the drill from Myrtleford, roughly a two to three hours’ drive away, to our property at Beaufort. We'll start drilling on the targeting we're currently doing.

We are starting relatively conservatively, with one drill moving between the two properties. Being such a target-rich environment, we will probably work toward having a diamond drill at Beaufort as well as an RC rig working on larger areas and then having a multi-use rig over at Myrtleford.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like it is going to be one exciting year for you, your geologists and your shareholders.

Rory Quinn: That's right. It's an exciting time. It's an exciting area of the world to be exploring. We're looking for a gold discovery and we feel we're seeing exactly the types of things we want to see. In addition to this gold-arsenic-antimony anomaly we've seen over this structure, that's known to host gold in the region, we're actually finding gold nuggets. We found a gold nugget that was about 1.9 grams and about a centimeter across. Of interest to us, is the relatively sharp texture, pitted and quite rough. It seems to us that this has not traveled very far, that it's a local source. We’ll do more work on the chemistry side. We're looking for the hard rock source of all of this alluvial gold, and the alluvial gold has tended to collect in the gullies around this ridge that runs through the Beaufort property. So, we're really interested to get to work on this ridge and see if that isn't the source of all this alluvial gold.

Dr. Allen Alper: It sounds exciting! Your geologists must be having a lot of fun planning and getting ready to drill. It will be an enjoyable time, as they look at the drill results.

Rory Quinn: Yes. Yes. Absolutely! We're all very excited!

Dr. Allen Alper: Could you tell our readers/investors, Rory, about your background? I know you have a fantastic background in one of the biggest and most successful royalty companies. Tell us about that and also about your whole team.

Rory Quinn: Yes. Thanks for that. I was at Wheaton Precious Metals for about seven years. It was Silver Wheaton before that. Silver Wheaton was more of a retail play when I started working there. It was during a time of relatively high silver prices, in the $30 range. Then it developed into more of an institutional play as we layered in more gold business. I think we did roughly $6 billion worth of streams, while I was with the Company.

I was focused more on the finance and the marketing side. So, we marketed the Company around North America and somewhat in Europe as well. I was also part of the group that looked at hundreds of mining project opportunities and potential opportunities for us to invest in, which put me in good stead for when I was looking for the right opportunity to take my first CEO role. This opportunity really stood out to me, given the type of geology and the similarities to the Fosterville land package, but also the technical team behind it. I bring the finance, marketing and the capital markets focus.

My partner, Martin Pawlitschek, brought in the project. He was with BHP for a very long time. He now works for a mining-focused venture capital group, out of the UK., where he's focused on economic geology. But, his passion is in discovery, like we're working to do in Victoria Goldfields. I should also mention the other folks that have come on. When I was at Wheaton, Steve Butler was my mining analyst at Canaccord and then GMP. I had him on a few different mine tours, during my time at Wheaton. When I told him what I was doing here with E79, he was quite interested. I got him up to speed and introduced him to the whole Team, and he enthusiastically joined our Team. So, I was very glad to be able to add him to the team.

Dr. Allen Alper: That's excellent! Sounds like a very strong team and well-positioned to carry out the exploration, and well-positioned to obtain financing that's needed in exploration. Could you tell our readers/investors a little bit about your share and capital structure?

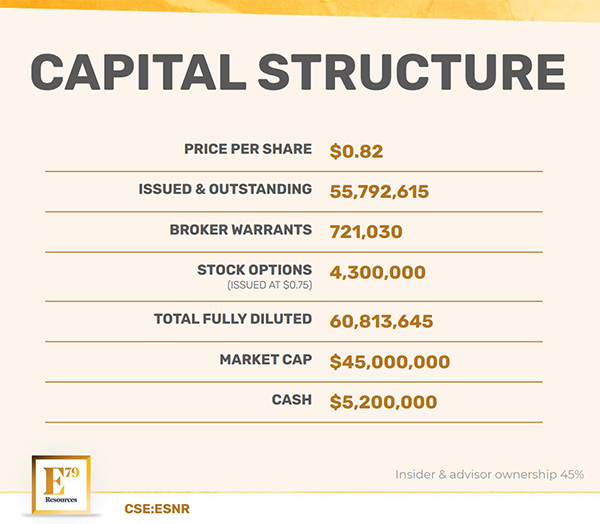

Rory Quinn: Absolutely and so we did! An important point, with regard to the financing, is we have a group that is able to raise capital, to do the work that we want to do. In November, we announced a small financing. We did $6 million at C$0.45, with no warrant. That was done over two and a half days of meetings and $6 million was taken up. We still have just a bit under five and a half million of that left, certainly enough to get going on the drilling and to test our thesis. There’re roughly 55 million shares outstanding. About 20 million shares of that were to the folks that owned the property, so it was to the vendor side. Those shares were all locked up over a year. So, the vendors are wanting to see the Company develop and add shareholder value, moving forward. They and the Management on the capital market side are locked up moving forward, which is good for shareholders.

The float is incredibly small. We only have about a 4 million share float. So the shares have being relatively liquid. We have traded about 900,000 to a million shares around the C$0.80 level. We don't seem to have motivated sellers at that price, but folks are nibbling in and around at that price. So, I think that's where we are. I think as we go forward, we'll get more news into the market and increased liquidity.

So far, this has not been a heavily marketed story. We introduced it to my network and to the networks at the team here, but it has not had a secondary listing. It's just been listed in Canada. I think it still has that opportunity of being taken to a wider audience, a more retail and broker audience, in addition to the initial institutional folks that came into the story.

Dr. Allen Alper: Oh, that sounds like it will be an excellent opportunity for our readers/investors. Rory, could you tell our readers/investors the primary reasons they should consider investing in E79 Resources?

Rory Quinn: I think when you are looking at opportunities like these, you want to look at the area of the world. I think we are in one of the best places to look for gold in the world, a very good jurisdiction and very prospective. I think we have a very good mining team that has shown the ability to be able to raise capital, so we’re good from a financial perspective. Then on the technical side, a very seasoned Team as far as their ability to advance projects, very good folks on the ground in Australia, which is obviously critical at this time with COVID and the inability to travel.

I think we've added a lot of value through this targeting work. I think we're seeing a very target-rich environment at Beaufort in particular, but also at Myrtleford. Now we're just getting into that drilling phase, where we're going to be able to test all of the targets. That's where the value is created. We're just getting started as far as introducing this to the marketplace. The opportunity is, once more people get acquainted with it and understand what we're doing, I think we have an opportunity to see a leg up. And I think, when you look at companies that are working in that area, we tend to see market caps of anywhere from $50 million up to $200 million. I think we're trading in the more mid $40 million range, so I think there's certainly an opportunity to re-rate there.

Dr. Allen Alper: Well, that sounds like it would be an opportunity for our readers/investors to consider investing in E79 Resources. Is there anything else you'd like to add, Rory?

Rory Quinn: Our ticker is ESNR. I would encourage readers/investors to look at our website. We have an up-to-date presentation on the website, at e79resources.com. Also, look for our news. Our drilling at Myrtleford is upcoming here and then our initial drill program at Beaufort as well.

Dr. Allen Alper: Oh, that sounds excellent! Sounds like that's an excellent opportunity. You're in a great area, have an excellent team and a great opportunity to discover gold in your drilling program this year. So, this will be a very exciting time and it's a time that investors may have an opportunity to gain financially.

Rory Quinn: I am certainly a believer in gold. And everything I see out there, I think we can see the gold market consolidating a little bit, but everything I see, with regard to stimulus and government spending, has only increased my faith in gold.

Dr. Allen Alper: With all the money that's being printed, it does seem like a great opportunity for gold and the precious metals. So, Rory, we’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://e79resources.com/

Rory Quinn

President, Chief Executive Officer and Director

E79 Resources Corp.

Email: info@E79resources.com

|

|