S2 Resources (ASX: S2R): Renowned Team of Greenfields Explorers Targeting “Company Making” Precious and Base Metal Discoveries in Australia and Finland; Matthew Keane, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/15/2021

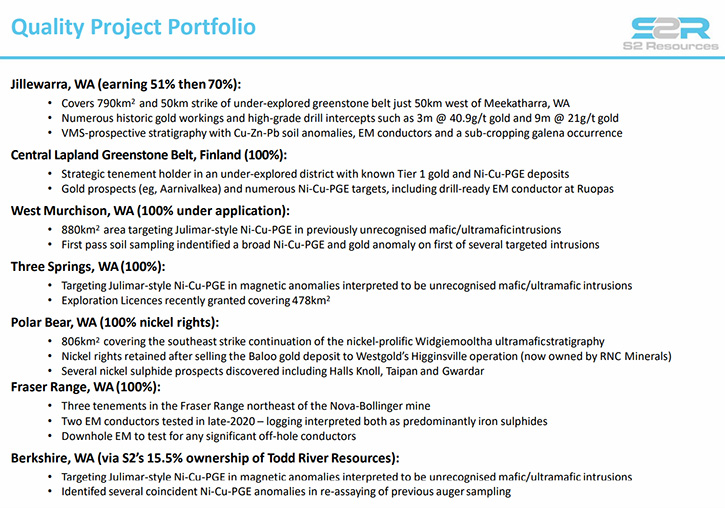

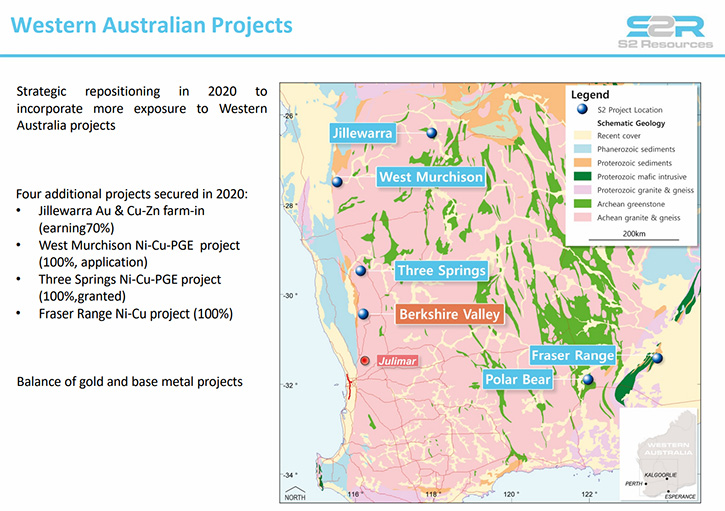

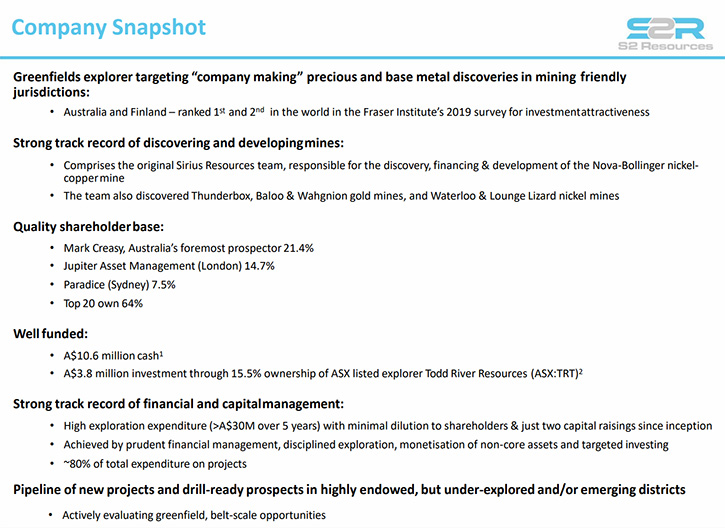

S2 Resources (ASX: S2R) is a greenfields explorer, targeting “company making” precious and base metal discoveries, in mining friendly jurisdictions of Australia and Finland. The Company is building a pipeline of new belt-scale projects and drill-ready prospects, in highly endowed, but under-explored and/or emerging districts. We learned from Matthew Keane, CEO of S2 Resources that in 2020 they expanded their portfolio to incorporate new, highly prospective, Western Australia projects, to complement its strategic position. The plans for 2021 include a large drilling program, in their West Australia Jillewarra gold project, in the Murchison region, as well as at their Aarnivalkea gold project, in Finland, where the Company is on the cusp of a significant new gold discovery.

S2 Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-In-Chief of Metals News. Talking with Matthew Keane, who is CEO of S2 Resources. Matt, could you give our readers/investors an overview of your Company, and what differentiates your Company from others?

Matthew Keane: Yes, certainly Al. S2 Resources is an exploration Company. However, I prefer to use the term discovery Company. At the moment, I believe we are on the brink of another discovery, this time in Finland, at our Aarnivalkea gold prospect. Our focus is to operate in generally tier-one jurisdictions. Currently, we're in Australia and Finland, ranked one and two on the 2019 Fraser Institute of friendly places to do business for miners. We're generally chasing plain vanilla commodities, precious metals and base metals, primarily nickel and copper.

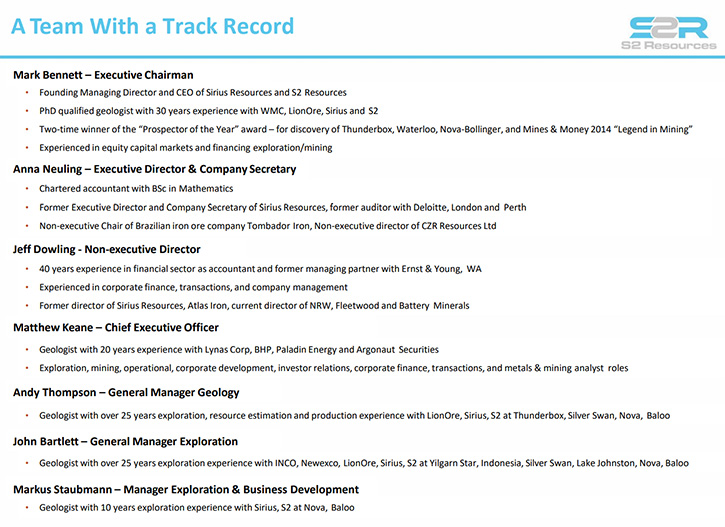

I think the big differentiating point for this Company is the Team and it’s make- up. I'm relatively new, I came on board late last year. But, the primary geological team has been together, not just in S2, but in a string of former companies, including Sirius Resources, from which S2 was spun-out. Sirius Resources was taken over for its Nova-Bollinger asset, a tier-one deposit here in Western Australia, and then spun it, with some assets, into S2. Effectively the Team and the Board came through, with the Company into this new vehicle.

Our core team of geologists, including our Chair Mark Bennett, is very experienced, and has made a number of discoveries, over their journey, through a number of companies. That includes the world class Nova-Bollinger, Base Metal Deposit, Thunderbox gold deposit, now owed by Northern Star, as well as a number of other smaller gold deposits and base metal, including Baloo, which was discovered in Sirius, spun out into S2 and was divested to Westgold, here in Western Australia.

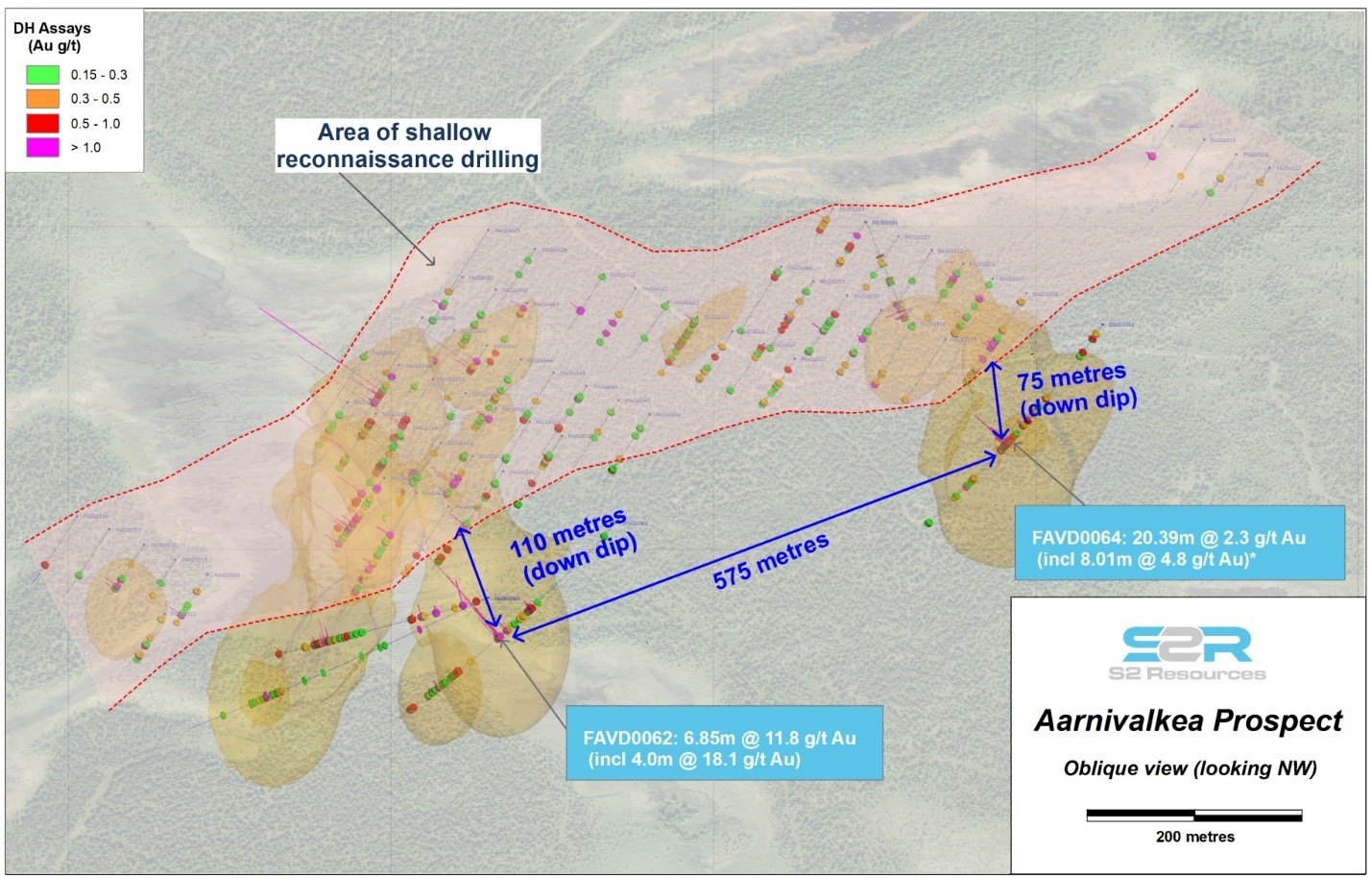

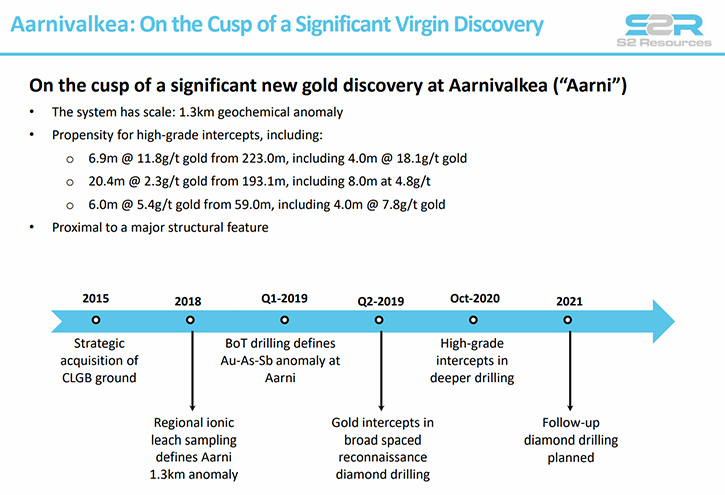

We are a team, with a positive culture and strategies that drive discovery. In Finland’s Central Lapland Greenstone Belt, our Aarnivalkea prospect is at that stage where we have had some nice early-stage, high-grade intercepts, what I would call ore-grade intercepts. It feels like we are on the brink of something quite sizable there, given that there is a 1300m anomalous strike and the only two deep drillholes, 575m apart, both hit strong mineralisation.

Dr. Allen Alper: Could you tell our readers/investors more about your portfolio of projects?

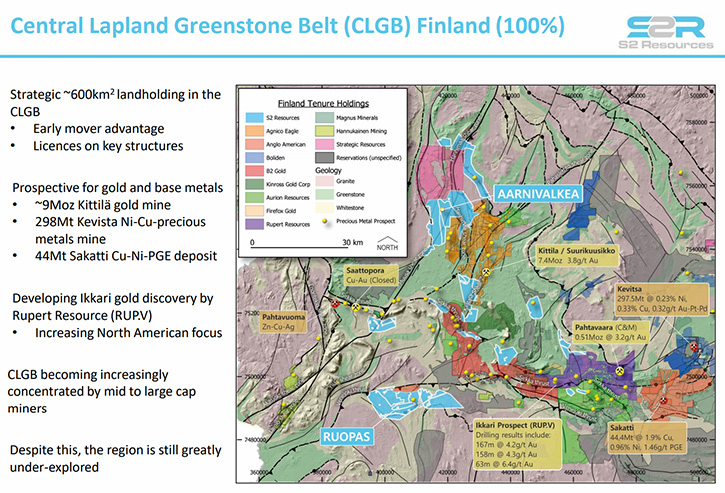

Matthew Keane: Certainly. We are currently active in Western Australia and Finland. Last year, during the COVID period, we made a strategic pivot to increase our position in Western Australia. In Finland, we were early movers at a time when the only major gold mine was Agnico's Kittilä mine. This region is heating up now, with recent success from groups such as Rupert Resources and B2. There are also a number of base metal deposits of size in the region, including Anglo’s Sakatti and Boliden’s Kevista

We pivoted last year to try and expand that portfolio. Finland, whilst very perspective, can be somewhat slow in terms of getting work done on the ground, primarily due to the seasonal effect. Very challenging for a listed junior explorer like ourselves, who needs to provide ongoing news flow.

We picked up some great tenure, just west of a place called Meekatharra, in the Murchison region, here in West Australia. It is a highly respected region, where in excess of 20 million ounces has been discovered. We were very fortunate to pick up 50 kilometers, almost a complete greenstone belt. This is through a joint venture, with a private Company. So, we will be farming in up to 70% in a project called Jillewarra. It is amazing that despite being peppered with historic workings, there is very little drilling deeper than 70 meters.

We also have a number of early-phase projects along the West Coast, proximal to a major structure called the Darling Fault. This is where a Company, called Chalice Mines has had success, with their Julimar project, with the discovery of PGE-nickel-copper sulphides. It was the stand-out discovery, here in West Australia, in the base metal space last year. So, we have tenure along this structure, heading towards the North, in our Three Springs and West Murchison projects. We also have exposure through our 13.9% stake in Todd River Resources, with their Berkshire project.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/ investors a bit about your projects in Finland?

Matthew Keane: In the Central Lapland Belt, we have on the order of about 600 square kilometers, focused along major prospective structures. A number of our licenses sit along the same regional fault line, which hosts Rupert Resources’ Ikkari Discovery, which is unfolding at present, with some really impressive gold results. Our Aarnivalkea prospect sits on a parallel structure to the Kittila gold mine, which has ~9Moz including what has been mined and what remains. To the south we have our Ruopas project, which is prospective for intrusive magmatic style, nickel-copper-PGE deposits.

It is Aarnivalkea which has me excited. Here the only two deep holes we’ve drilled to date, in October last year, both produced high-grade ore with gold intercepts. They were 75 meters to 110 meters, down-dip of previous shallow holes and nearly 600 meters apart, very big step outs. In my opinion, the probability that these are the only higher-grade gold zones, sitting under 1.3 kilometers of “smoke” seems very unlikely. So, we're very keen to get back on the ground and do some follow-up drilling.

Dr. Allen Alper: Could you tell our readers/investors your primary goals for 2021?

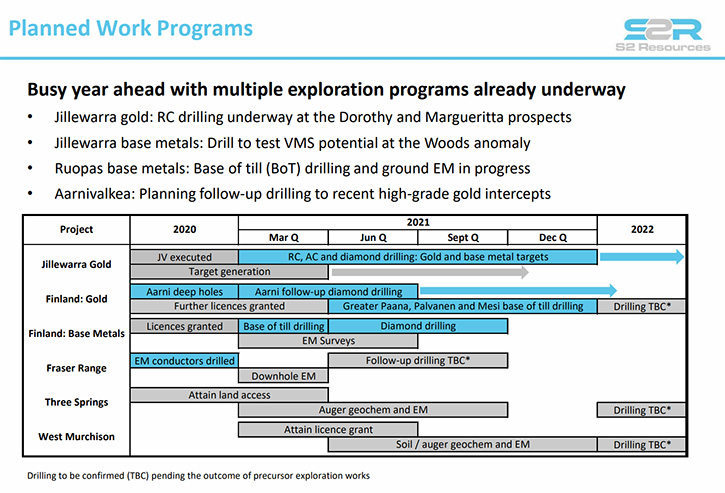

Matthew Keane: Yes, certainly. For 2021, it is quite a busy program. We are on the ground drilling at our West Australian Jillewarra Project, in the Murchison region. We have just completed our first RC program at the Dorothy and Marguerita prospects. Here we were testing below shallow historic drilling, with intercepts such as 9 meters at 21grams per tonne gold and 3 meters at 41 grams per tonne. Another program of aircore, RC and diamond drilling is underway. We'll also do some project generation at Jillewarra, and look to size up more targets, within that large 50-meter strike length of Greenstone. So, that's Jillewarra. In Finland, we've just completed some base of infill drilling and some EM work on the base metals Ruopas project. That will hopefully spawn some more targets to test, when we commence diamond drilling mid-year.

On the gold front in Finland, at Aarnivalkea, we will follow up diamond drilling, testing for more higher-grade hits at depths. Work on our pipeline projects back in Western Australia, will include early stage, proof of concept electromagnetic and soil geochemical studies, trying to see if we have the potential for magmatic, intrusive style, nickel-copper, PGE mineralization.

Dr. Allen Alper: Could you also tell our readers/investors about your team’s successful track record?

Matthew Keane: This team is primarily known for the Nova-Bollinger discovery back in 2012. It was a courageous greenfields discovery, set in a resources market downturn, in a frontier region in Western Australia, in the Fraser Range Mobile Belt. The region had been theorized to host magmatic, intrusive nickel-copper mineralization. This group had the courage and the perseverance to test, to undertake exploration in the region and were almost down to their last dime, when they drilled the discovery hole. A fantastic discovery that ultimately led to the takeover from Independence, now IGO LTD. And, that's history! But that is not the only discovery made by this team. They are also associated, with the discoveries of Thunderbox, Baloo & Wahgnion gold mines, and the Waterloo and Lounge Lizard nickel mines.

Dr. Allen Alper: Can you tell our readers/investors a little bit more about your background, Matt?

Matthew Keane: My background is rather mixed. I am a geologist by trade. Although, my technical career was a mixture of geology and engineering. In my eight years, prior to joining S2, I was a resource analyst, with a local investment and financial advisory group, called Argonaut Securities. Before Argonaut, I worked at Paladin Energy. I was there in a business development role. Before that I was with BHP for 10 years or so. It was quite varied, a mixture of geology, production management, engineering, corporate development, and research. So, hopefully that puts me in stead to compliment the strong technical team already here at S2.

Dr. Allen Alper: Well, you and your Team have an excellent, outstanding background.

Matthew Keane: Thank you.

Dr. Allen Alper: Could you tell our readers/ investors about your share and capital structure, and your balance sheet?

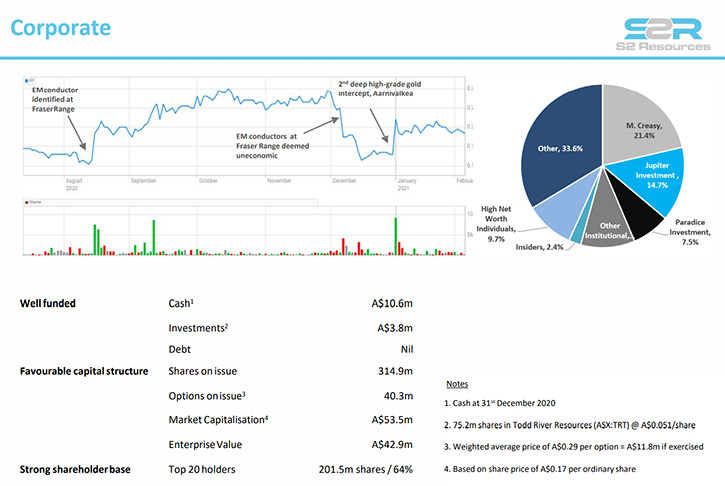

Matthew Keane: Certainly. We have no debt and are relatively well positioned. We have over $10 million Australian, in cash, at present. So, well-funded for our program. We will finish this Australian financial year in a very strong position. We also have an approximate $5 million Australian stake in a small junior, called Todd River Resources. We have shares on issue of roughly 315 million, and about 40 million options outstanding. Since inception, we have only had to raise money twice. We take a very pragmatic and disciplined approach to exploration. Our view is that if a project doesn't cut it, as we found with some of our Swedish and Nevada projects, we are happy to divest or let those go.

If a project looks to be relatively small and not what we'd classify as a company-maker, we divest, which we have done with our Baloo and Polar Bear projects, here in West Australia This has helped us fund further exploration. If we find a big one, we are happy to take it through to development and production, which was certainly the path that Nova was on, before IGO stepped in and acquired the Sirius. So, a strong balance sheet, a very disciplined approach to the way we manage our capital means that we are in good standing to undertake the work we have planned this year.

Dr. Allen Alper: Well, that sounds excellent. And, you have some rather important, key strategic shareholders that make up a core of your shareholders. Could you tell us a little bit about that?

Matthew Keane: Putting my former research hat on, I would have classified S2’s register as rather advanced for our current stage. What I mean is that as a pre-discovery company, we have a number of very high caliber, high-net-worth individuals, as well as institutions on the register.

I believe this register stems from faith and the belief that this team can actually make a Company making discoveries. If I were to draw a pie chart of our market cap, 10 million would be carved out for our cash, and about half for our projects, but there's a very high percentage, which I think is IP and confidence in this team.

Dr. Allen Alper: Well, it shows that the investment community has a great deal of respect for your Team and for your projects. You are in an excellent position to move the Company forward.

Matthew Keane: I like to think so.

Dr. Allen Alper: Matt, could you tell our readers/investors, the primary reasons they should consider investing in S2 Resources?

Matthew Keane: It is an interesting world we live in, where we have had an extraordinary amount of money raised last year in the junior exploration space on the ASX. I suspect also in other markets, including the North American markets. Cash in exploration companies leads to discovery, but it also can lead to some undisciplined spending. With S2, you are getting a Company, which has fantastic assets, is well-funded, but at its core has a team, with the culture, the history and the methodology for discovery. I really think we are on the brink of something in Finland. That is the proposition we put forward.

Dr. Allen Alper: Those are compelling reasons for readers/investors to consider investing in S2 Resources. Matt, is there anything else you would like to add?

Matthew Keane: I think we have covered the key points. I really appreciate your time and interest in S2 Resources. Thanks for reaching out.

Dr. Allen Alper: What you are doing is very interesting. You can be very proud of your Company. We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

http://www.s2resources.com.au

Matthew Keane

CEO

+61 8 6166 0240

|

|