Giga Metals Corporation (TSX.V: GIGA, FSE: BRR2): Positioned to be Premier Supplier of Nickel and Cobalt, Key Battery Metals for Electric Vehicles; Interview with Mark Jarvis, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/15/2021

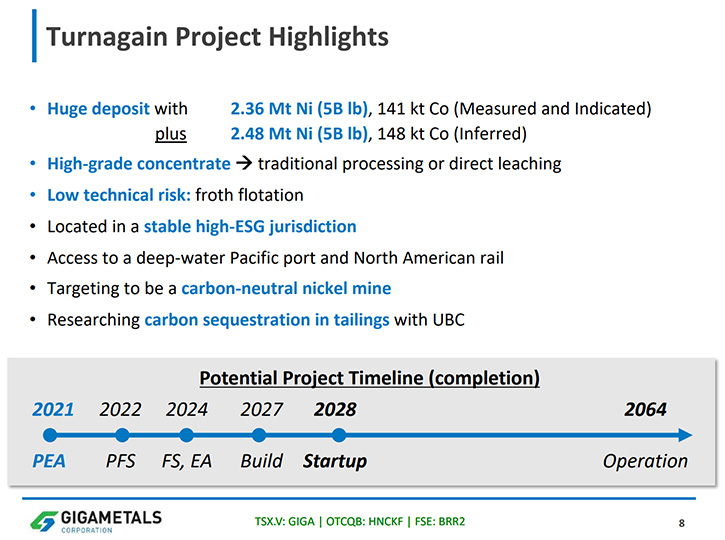

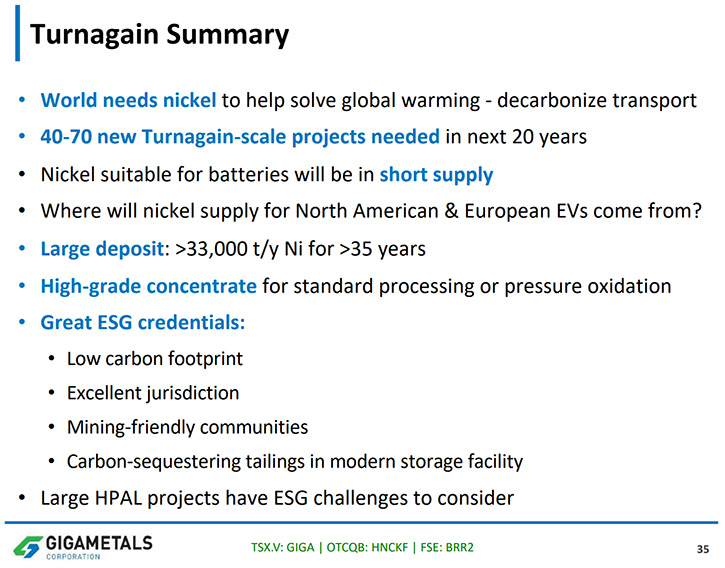

Mark Jarvis, CEO and Director of Giga Metals Corporation (TSX.V: GIGA, FSE: BRR2) aims to be a premier supplier of the key battery metals for electric vehicles: Nickel and Cobalt. They recently released an updated preliminary economic assessment (PEA). The Company's Turnagain Project, located in north central British Columbia, is among the largest undeveloped nickel-cobalt sulfide deposit in the world, in terms of total contained nickel. Production is forecast to average 33,000 tonnes per year of nickel over a 37-year mine life.

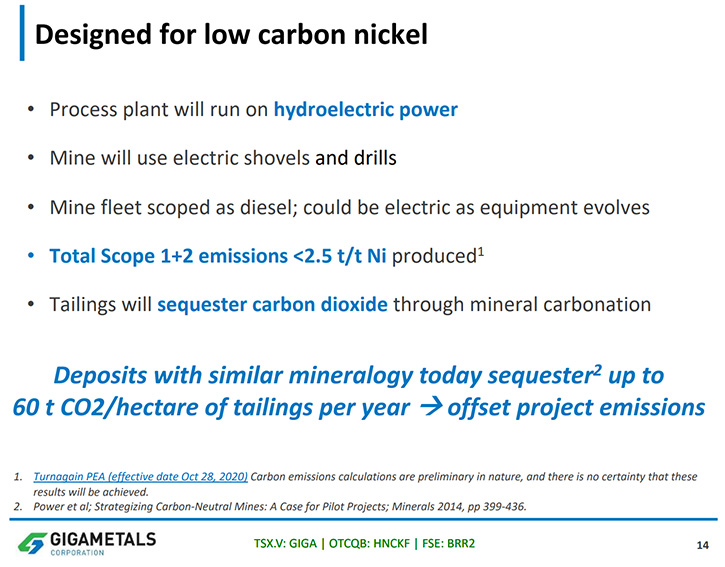

Giga Metals is targeting a carbon neutral nickel mine, with a goal to reduce an already low carbon footprint by sequestering CO2 in the mine tailings. With ethical sourcing of battery materials increasingly important to buyers of electric vehicles, nickel and cobalt from a carbon neutral mine could be very attractive.

Giga Metals Corporation

Dr. Allen Alper: This is Dr. Allen Alper Editor-In-Chief of Metals News, talking with Mark Jarvis, who's CEO and Director of Giga Metals. Mark, I wonder if you could give our readers an overview of Giga Metals and also what differentiates Giga Metals from others.

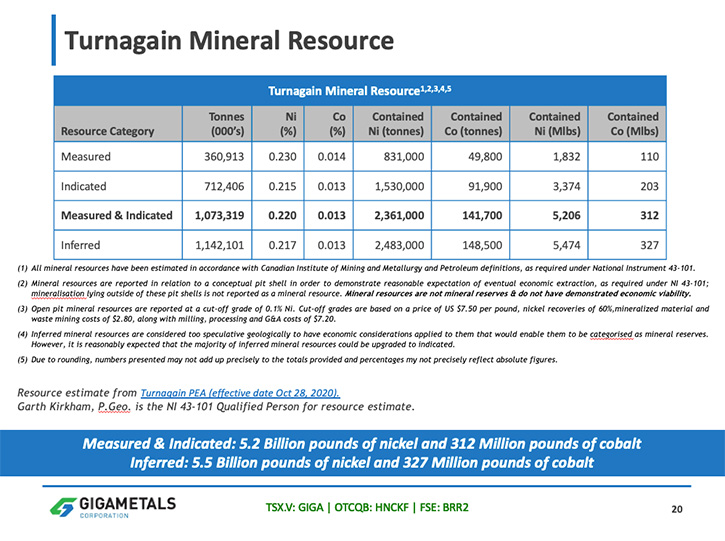

Mark Jarvis:Giga Metals’ core asset is the Turnagain Project. It is an extremely large, low grade, open-pittable sulfide nickel resource, with a very low strip ratio. We've recently come out with a preliminary economic assessment, an updated PEA where we model a project that would be constructed in two phases. When it is in full production, in the early years, it would produce about 37,000 tonnes of nickel per year, but over a 37-year mine life, the average production would be about 33,000 tonnes of nickel per year and that would be in a concentrate grading 18% nickel and 1% cobalt. It is a high-grade, very clean concentrate, with very little in the way of deleterious elements. That high-grade clean concentrate is the key to this whole project.

One of the differentiators from other, similar projects, is that our ultramafic intrusive is so young, only 180 million years old as opposed to more than a billion years old for our peers, which means we have fewer alteration minerals to complicate our metallurgy, so we get higher recoveries than our peers and with a simpler, lower risk processing circuit. We don't need things like magnetic separation and desliming circuits. It's just the plainest, simplest, crush it, grind it, float it type of circuit that is possible. So, for that reason, technical risk is very low. The concentrate we make is a very desirable product. What we modeled in our PEA was that we would sell it to a smelter. The reason we modeled it that way is that's the market that exists today.

However, we think the market is changing and will continue to change. It may be that in the future, we could make more money by selling our concentrate to battery producers or to somebody between us and the battery producers. This type of concentrate lends itself very well to a simple pressure oxidation circuit that could produce nickel and cobalt in sulfate form, or in a hydroxide form or whatever form the battery cathode makers want. The quality and grade of our concentrate gives us a lot of flexibility. And I think that's what differentiates us from our peers.

Dr. Allen Alper: Oh, that's excellent. Could you tell us more about the project and the resource?

Mark Jarvis: The resource in measured and indicated, we have about 5.5 billion pounds of nickel plus in the inferred category, we have another 5.5 billion pounds of nickel, plus cobalt of course. So, it's a very large, low grade resource which we would develop as a high throughput open pit mine. It's a very large project.

In terms of capex, we're looking at $1.4 billion in phase one, plus another half a billion dollars in phase two, to get to full scale production. That includes a lot of offsite infrastructure charges including construction of a power line so that we can access clean hydro energy.

Our CO2 footprint is already very low relative to our peers. What we modeled in our PEA, was using the hydro power grid and then a diesel fleet. In doing that our CO2 footprint for scope one and two emissions would be less than 2.4 tonnes of CO2 equivalent per tonne of nickel produced. If we could switch over to an all-electric fleet, that would be reduced to below one ton of CO2 equivalent per ton of nickel produced.

In addition to that, our tailings will absorb CO2 directly from the atmosphere. We're working with Professor Greg Dipple at the University of British Columbia to test our tailings right now. He has been studying carbon sequestration in silicate tailings for more than 16 years. If we can quantify our rates of sequestration, we could generate carbon credits.

As our tailings absorb CO2 and convert it to carbonate minerals, the CO2 becomes part of the mineral structure and it's locked away for geological time periods, hundreds of millions of years. Carbonates are a very benign material to have as your tailings.

Another interesting effect is that, as you carbonize the silicate minerals, they go through a process of cementation as they absorb the CO2. So, this is going to bolster further the safety and durability of our tailings impoundment facility. What we're hoping is that we can get to a carbon neutral nickel mine, maybe even a carbon sink. We will have to see how it goes. The experimentation is underway.

Dr. Allen Alper: Excellent! It's great to be able to provide metals for electric vehicles and at the same time decrease or minimize the effect of carbon dioxide on the atmosphere.

Mark Jarvis: Yeah. And Al, to compare us to some of the competition for battery metals, the high-pressure, high-temperature acid leach projects. Their carbon footprint is somewhere North of 25 tonnes of CO2 equivalent per tonne of nickel. Some of them are as high as 80 tonnes per tonne. So, if you're looking for a CO2 friendly source of nickel, you really have to talk with us.

Dr. Allen Alper: Oh, that's excellent! That's a great position for you and your Company to be in.

Mark Jarvis: Thank you.

Dr. Allen Alper: Could you tell our readers/investors your key plans for 2021?

Mark Jarvis: Well, we're hoping to get up to the property this year and gather a whole bunch of data through infill drilling, geo-technical drilling and other work, to provide the data to advance our engineering to the pre-feasibility level. Our aim is to continue to de-risk this project by getting into ever more detail with our engineering.

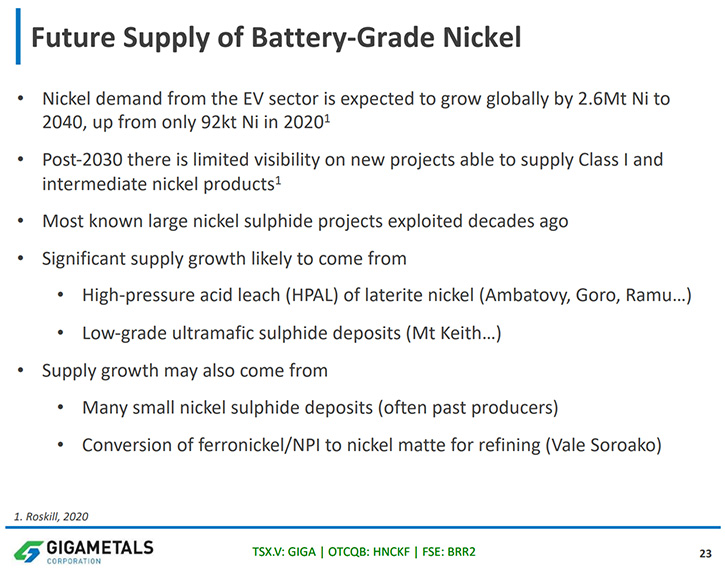

We think there's going to come a time when there's just not enough battery grade nickel around. The way that the electric vehicle market is growing, we think there are going to be shortages and that the price of nickel will likely respond to that. Historically, nickel prices have traded in a very volatile manner and we think that's going to happen again. When that happy day arrives, we want to have as much risk taken from this project as possible, so when people are looking for projects where they can secure a good long-term supply of battery grade nickel, we'll be one of the people they talk to.

It's estimated that by 2040, if the EV revolution continues the way people think it will, you're going to need somewhere between 40 and 70 large new mines the size of Turnagain, each able to produce 35,000 tonnes per year. You're going to need all those new mines to come on stream, just to feed the battery market. It's really quite phenomenal what's happening. It's a fundamental shift in the nickel market, where stainless steel is always going to be an important part of the market, but it will no longer be 70% of the market, I think batteries will become the dominant use of nickel.

Dr. Allen Alper: That sounds like a very bright future for nickel and cobalt too.

Mark Jarvis: Well, exactly. We can reliably produce a concentrate of 18% nickel, 1% cobalt. So, it is a nickel project, but we have a significant cobalt by-product.

Dr. Allen Alper: Well, that's an excellent position to be in. Could you tell our readers/investors about your background and your team’s background?

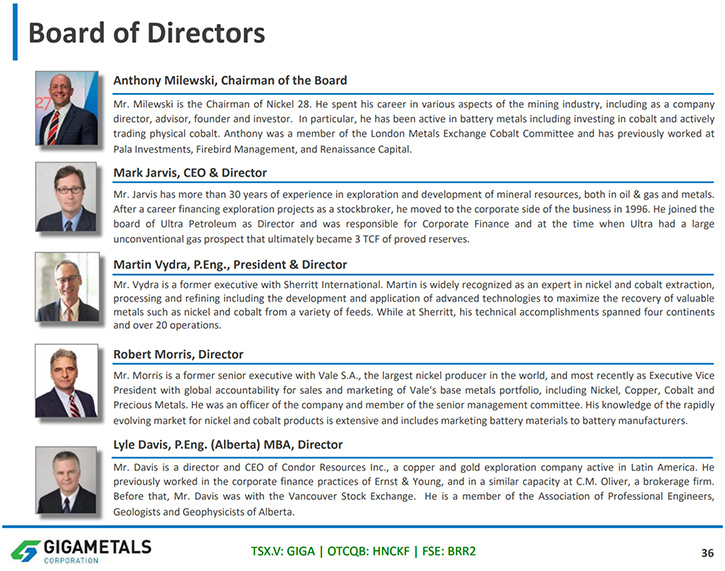

Mark Jarvis: My background is all over the map. I used to be a broker in Vancouver and I would finance mining and oil and gas exploration plays. I crossed the street in '96 and joined the Board of a little company called Ultra Petroleum, which was the first public company to use multi-stage fracks to develop a tight reservoir. It was a tight gas reservoir in Wyoming. That was the first of what they now call resource plays. We went from nothing to proved reserves of three trillion cubic feet of gas, and we got there via the drill bit. I then retired for a while and then I came back and became involved with this Company, in 2004, because I was attracted to the potential size of it.

The team we've put together recently is quite interesting and Anthony has been very helpful with that. He introduced us to Martin Vydra, who's now the President of the Company, I'm still the CEO. Martin had a 31 year career with Sherritt. He's an engineer by training, but he also sold nickel and cobalt to the end-users for Sherritt. So he knows all the end-users. He knows all the battery makers, the trading companies. All the car companies and so forth. We're seeking a strategic partner to become involved with us at the project level and Martin Vydra is leading that search.

Martin then brought in a gentleman named Lyle Trytten, who had a 25 year career was Sherritt. Sherritt hired him right out of university. Martin described him as the most talented engineer he had ever worked with. I've now been working with Lyle for about a year and I have to agree, this is a brilliant engineer. So, he's at the center of our technical effort. We have a small but very good team here.

Dr. Allen Alper: Well, that sounds excellent! It's very impressive! The team you have, the experience and their knowledge! So, I think you are well positioned to move your project forward and to find the proper strategic partner.

Mark Jarvis: Stay tuned Al.

Dr. Allen Alper: Well, that's great! Could you tell our readers/investors about your share and capital structure?

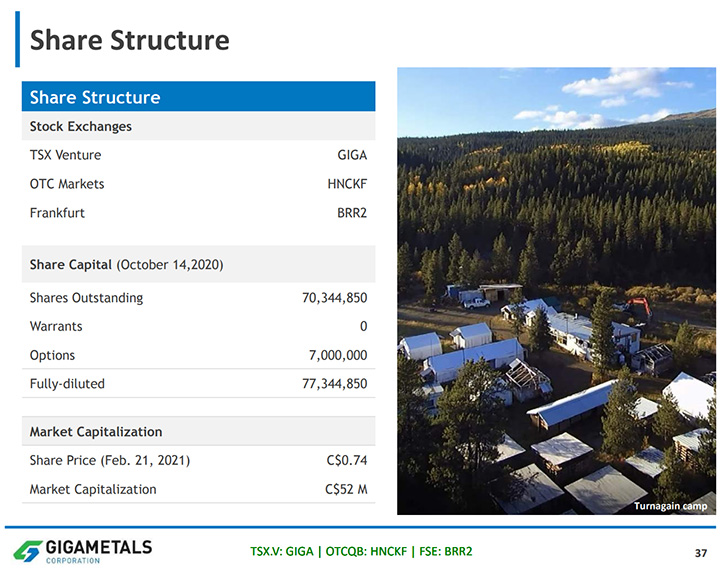

Mark Jarvis: I think we have about 70 million shares outstanding right now, fully diluted worth about 77 million shares. Our price is actually down today. Everything seems to be down today. We're at 65 cents, which is down seven cents from the close yesterday. Our volume ranges anywhere between 300,000 shares to 2 million shares a day.

Dr. Allen Alper: So, very liquid stock, an opportunity for our readers/ investors to increase wealth by investment.

Mark Jarvis: Well there's excellent liquidity, that's for sure. And compared to our peers, I think we're undervalued. So we'll see. Nickel has been doing well. If nickel continues to perform well, the whole investment thesis here is that when you have a really large deposit, that's where the leverage is if the commodity makes a significant move. So, we have excellent optionality to the nickel price.

Dr. Allen Alper: Well, that sounds excellent! Could you highlight and summarize the primary reasons our readers/investors should consider investing in Giga Metals?

Mark Jarvis: Well, we have a very large supply of nickel that is suitable for making cathode material for lithium-ion batteries. We are in Canada, which is an excellent first world jurisdiction. Canada has very stringent environmental regulations, but you can build mines in Canada. So, what that means is, if any end users are looking for an ethical supply of nickel and cobalt, this is someplace they have to look. You really need to be looking in jurisdictions like Canada, Australia, Finland, those sorts of places: first-world jurisdictions that have stringent environmental regulations and you can be happy that you're getting ethically sourced nickel, and in our case, with a very low carbon footprint. I think this is going to become more and more attractive as the electric vehicle revolution continues to take off.

Dr. Allen Alper: Well, that sounds like very strong reasons to consider investing in Giga Metals, particularly those who are interested in being part of the electric vehicle revolution.

Mark Jarvis: I think so Al, yeah!

Dr. Allen Alper: Mark, is there anything else you'd like to add?

Mark Jarvis: No, I think we've covered it pretty well and pretty efficiently. Thank you very much, Al.

Dr. Allen Alper: Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://gigametals.com/

Mark Jarvis

CEO

Tel - 604 681 2300

|

|