Tarachi Gold Corp. (CSE: TRG, PINK: TRGGF, Frankfurt: 4RZ): High-Grade Gold Exploration, with Near-Term Cash Flow; Interview with Cameron Tymstra, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/12/2021

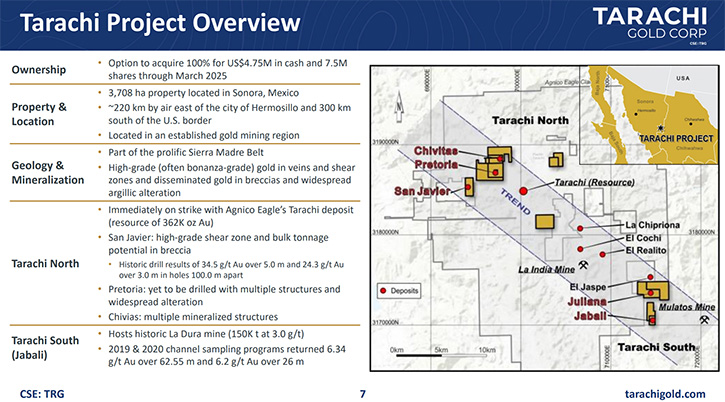

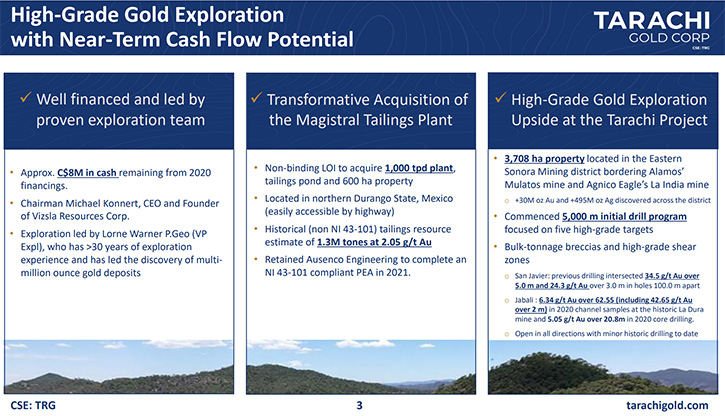

Tarachi Gold Corp. (CSE: TRG, PINK: TRGGF, Frankfurt: 4RZ) is focused on exploring and developing the Tarachi Gold project that covers 3,708 ha of highly prospective mineral concessions, in the Sierra Madre gold belt of Sonora, Mexico, in close proximity to Alamos Gold’s Mulatos mine and Agnico Eagle’s La India mine. Tarachi is also in the process of acquiring the Magistral Mill and tailings project, in Durango, Mexico, that should provide the Company with a near-term pathway to gold production. We learned from Cameron Tymstra, President and CEO of Tarachi Gold that after the PEA and the metallurgical test work at Magistral, they expect to commission a thousand tons a day operation and start generating free cashflow as early as next year.

This cash will fund their exploration and development work.

Mulatos Mine in distance

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Cameron Tymstra, President and CEO of Tarachi Gold Corp. Cameron, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

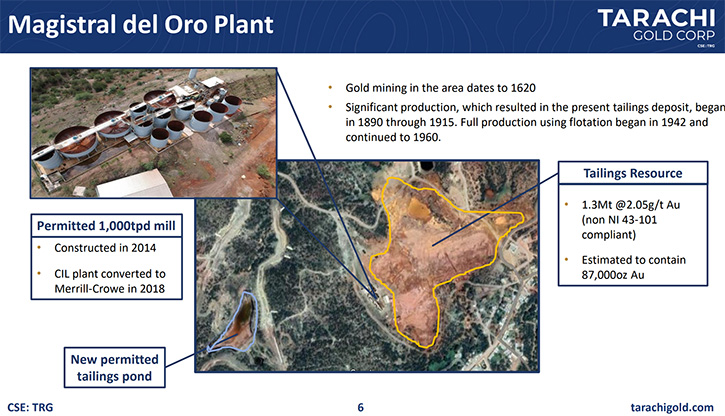

Cameron Tymstra: I'm happy to, Allen. Tarachi Gold is a relatively new Company. It really came together at the beginning of last year, with a name change from a previous company, Kal Minerals, and with the signing of two option agreements for mineral concessions in Mexico totalling a little over 3,700 hectares in the Sonora State. Tarachi is a gold-focused company, a Mexico-focused company. In addition to our Tarachi mineral concessions in Sonora State, we also signed a purchase agreement, a few weeks ago, for what we considered to be a transformational asset for Tarachi, and that was for the Magistral Tailings Reprocessing Operation in Durango State of Mexico. Magistral has a custom- built plant, built for reprocessing gold tailings. In addition to the plant, it comes with access to 1.3 million tons of tailings material that we consider to be high-grade at just over two grams per ton gold.

What we think really separates us from the rest of the industry is that with Magistral, we plan to generate free cashflow as early as next year. Then use that cashflow to deploy at our exploration projects and in the pursuit of other projects in Mexico. Our vision for Tarachi is to expose their shareholders to the upside potential of having really prospective exploration projects in Mexico and as well limit their downside by limiting future shareholder dilution by generating our own cash flow and using that cash flow to fund our exploration efforts.

Dr. Allen Alper: Oh, that's excellent. Very few junior exploration companies are in that position to generate cashflow so early to help them explore and develop their properties.

Cameron Tymstra: Yeah. We think very few companies are doing that right now, but the ones that have in the past have been very successful. We are certainly not reinventing the wheel, with our business model. GoGold is a great example, they have been successfully generating cashflow from the Parral Tailings Project in Mexico and using that cash to explore on other properties, like their Los Ricos property. It is certainly a successful business model and one we plan on emulating with Tarachi.

Dr. Allen Alper: Well, that's excellent! Could you tell our readers/investors more details about your project?

Cameron Tymstra: Magistral is in the Durango state of Mexico, it's in the North end of the state. It's highly accessible. It's just a few minutes North of a small town called Santa Maria Del Oro, which has a population of about 5,000 people. The history of this area dates back to the early 1600s, when gold was first discovered there. The tailings resources were generated from mercury amalgamation plants and flotation plants. They have never actually seen the use of cyanide before in these tailings, which is why we believe that we can achieve gold recoveries in the 70% to 75% range.

Our first steps with Magistral, now that we've signed the purchase agreement, will be to initiate a preliminary economic assessment, with Ausenco Engineering. They are going to help us define the final flow sheet for the plant. Although the plant is largely built right now, it was converted from a Carbon-In-Leach system to a Merrill-Crowe system, by the previous operators. We believe there may be some room for some improvements and modifications to improve that flow sheet and improve gold recoveries, as well as reduce costs by reducing the consumption of cyanide. We'll be working with Ausenco, over the next couple of months, to put the PEA together and do the metallurgical test work. That should take about 12 to 14 weeks. We would expect to have that at the end of May or early June. From there, we'll have a more definitive timeline on when we can start commissioning the plant and the capital costs associated with getting us there.

As it stands right now, the plant is a thousand tonne per day operation. Gold grades are just over two grams per ton, and recovery is about 70% to 75%. Once in full production, we expect that facility to be producing somewhere in the ballpark of 1400 ounces of gold per month or 15,000 ounces of gold per year, generating cashflow up to a million dollars a month for Tarachi, at current gold prices. Something we can certainly use to then deploy on our other projects, for example, up in Sonora State, our Tarachi Exploration Projects. These projects are in the Sierra Madre gold belt. They are in the vicinity of Agnico Eagle's La India Mine, as well as Alamos Gold’s Mulatos Mine. We've divided the project into North and South sections. On the Northern concessions, we've had some recent drilling success, which we announced just a few weeks ago.

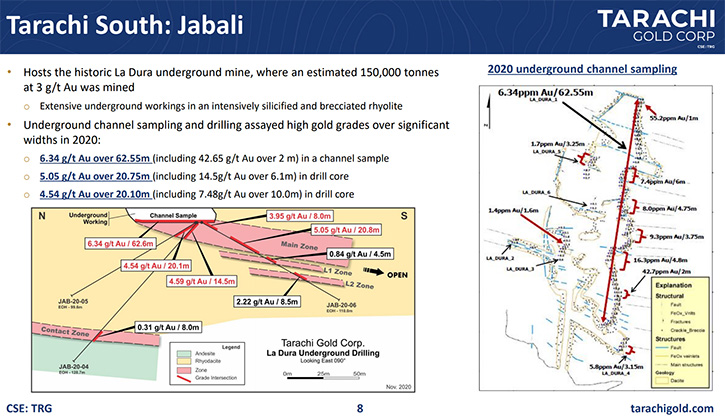

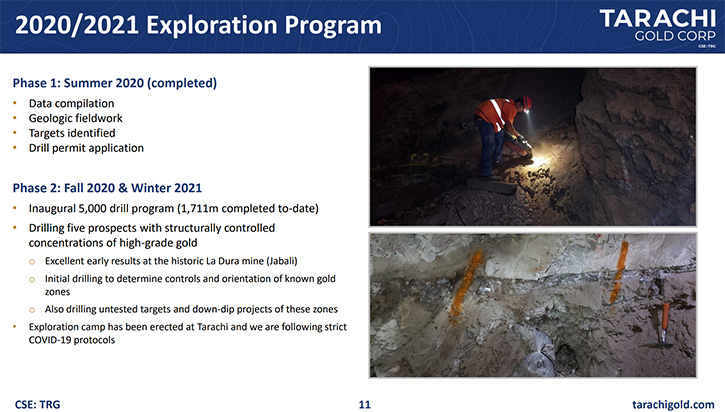

Initially, we were following up on historic drill holes that Agnico had drilled in the area a number of years ago. Some of our first drill holes returned intersections of 11.9 grams per ton over two meters and five and a half grams per ton over five and a half meters. We discovered that the gold seems to be associated with mineralized breccia intrusive bodies, so we'll be following up with another round of drilling in March and April, targeting the deeper extension of those breccia intrusives. On our Tarachi South block of claims, we've been drilling around an area known as the La Dura Mine, which is an old underground mine on the property. We've actually been drilling from the old underground working, following a thick panel of mineralization there that is heavily silicified. Our drilling to date has returned grades of about four and a half to five and a half grams per ton over intervals of about 15 to 20 meters.

The next phase of drilling for Tarachi South will be to bring in a surface RC rig, targeting the Southern potential extension of that mineralization, in between the La Dura Mine and some other underground workings called Zaragoza, which is about 400 meters to the South. We'll be testing this 400-meter gap between these old underground workings to see if the mineralization is continuous in that corridor.

Dr. Allen Alper: That sounds excellent! I'm amazed how much your Company has accomplished in such a short period of time. That's excellent!

Cameron Tymstra: Last year was a foundation building year for the Company, in terms of signing the option agreements for the Tarachi mineral concessions, as well as getting the acquisition completed of Magistral in Durango. And then also putting together a complete team of professionals. I myself am new to the Company, I only came on board at the beginning of December. At the same time, we brought on a new Chairman, Michael Konnert, who's also the President and CEO of Vizsla Resources, which is another Mexican-focused exploration company. Their focus is on silver. Michael brings a lot of experience operating in Mexico, over the last couple of years and exploring in Mexico as well as a lot of marketing and business experience. We also have our Vice President of exploration, Lorne Warner, who has over 30 years of successful international exploration experience, particularly looking for gold and discovering gold deposits. He is currently down in Mexico where he’s been for the last several weeks, working closely with our Mexican geology team and planning the next phase of drilling.

Dr. Allen Alper: Sounds like you have a very strong, experienced and accomplished team. That's excellent!

Cameron Tymstra: Yes. And myself, my background is in mining engineering. In particular, I've worked on a few of these tailings reprocessing operations as well, which is why I was excited to come on board with Tarachi and to work on the Magistral project.

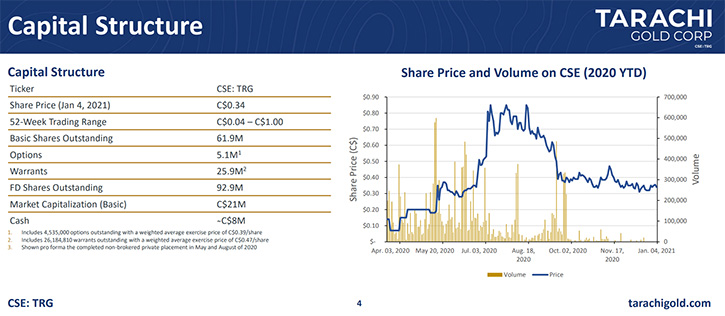

Dr. Allen Alper: Well, that sounds terrific, Cameron! Could you tell our readers/investors a little bit about your share and capital structure?

Cameron Tymstra: Certainly. Presently we have about 62 million shares outstanding. In addition to that, we have about 26 million warrants. Those warrants are split about 50-50 between an exercise price of $0.25 and $0.70, as well as about 5 million options outstanding. Fully diluted, we're about 93 million shares. Over the past week, we've been trading in a range of about $0.38 to $0.40, giving us a market cap today of around $24 million.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors, the primary reasons they should consider investing in Tarachi Gold.

Cameron Tymstra: What really sets Tarachi apart is the potential to have near term cash flow and to be able to use that cashflow to continue exploring on our other properties in Mexico, while at the same time limiting future shareholder dilution. We've seen it all a thousand times over, exploration companies have to constantly go around every six to 12 months to raise money for their next round of drilling or their next exploration program. But once Tarachi is cash flowing next year, we'll be able to limit those future raises and actually pay for our own exploration, using the cashflow from Magistral. We think that sets us apart from the rest of the field and makes Tarachi Gold a very compelling investment for junior exploration investors.

Dr. Allen Alper: Well, those sound like very compelling reasons for our readers/investors to consider investing in Tarachi Gold. Cameron, is there anything else you'd like to add?

Cameron Tymstra: In general, with respect to operating in Mexico and in the COVID environment, our Company has a pretty strict COVID protocol in place. Anybody that flies down to Mexico from outside of the country has to get a COVID test prior to going to any of our project sites. Even any of our domestic employees in Mexico, before going to any of the sites, whether they're drillers, geologists or laborers, need to get a COVID test, wait for their results, and only once they test negative can they actually go into our camps and into our exploration and project areas. That not only protects our own employees and our contractors, but also helps protect the local communities where we work, because most of them are small communities that haven't really seen a lot of COVID yet.

So, we can make sure we're not responsible for bringing COVID into their communities. Working in Mexico has been great. Mexico is such a good mining country. They really have a lot of experienced contractors, consultants and suppliers in the country. We've had a lot of positive experience so far operating in Mexico, and we're quite confident that using our Mexican mining partners and local contractors we'll be able to get Magistral into production and continue successfully exploring for Tarachi.

Dr. Allen Alper: Those sound like very strong, sensible, and safe procedures to protect the community and your own people too. So, that's excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.tarachigold.com/

Cameron Tymstra, CEO

Email: cameron@tarachigold.com

|

|