Star Royalties Ltd.: Growth-Oriented, Precious Metals-Focused Royalty and Streaming Company, Led by an Accomplished and Successful Team; Interview with Alex Pernin, P. Geo, CEO and Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/9/2021

Star Royalties Ltd. is a growth-oriented, precious metals-focused royalty and streaming company. We learned from Alex Pernin, P.Geo., Chief Executive Officer and Director of Star Royalties, that the three points that differentiate his Company are: their strong and capable Team, their differentiated business model of generating wealth creation through accretive royalty and streaming transaction structuring and asset life extension, and their enhanced shareholder alignment. The Company's current portfolio consists of five assets, including a gold stream on the Copperstone gold restart project in Arizona, USA, and royalties on the Keysbrook minerals sand mine in Western Australia, the Lac Seul First Nation Forest carbon offset credit project in Ontario, Canada, the Baavhai Uul lithium project and the Bayan Undur copper-silver project, both in Mongolia. Star Royalties looks to become the trusted financing partner for mining companies throughout the various stages of mine development, and the commodity and capital markets cycles.

Star Royalties Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Alex Pernin, who is CEO and Director of Star Royalties. Alex, I wonder if you could give our readers/investors an overview of your Company and what differentiates your company from others.

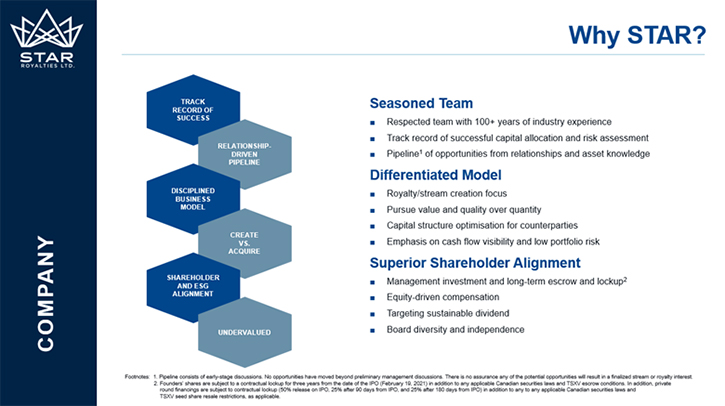

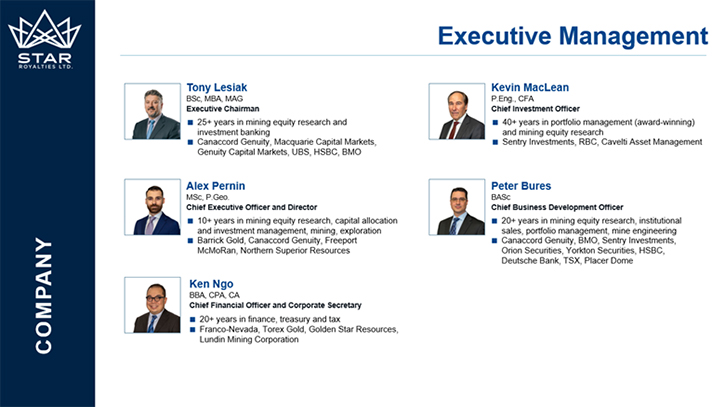

Alex Pernin:Star Royalties is a new royalty and streaming company, based in Toronto, Canada. Management has been working together, in various roles, over the last 20 years. We have a unified vision as to what we want to build, so we rejoined forces to start this Company 18 months ago. We have raised over $40M in the last 12 months, including our recently closed and upsized IPO of $24M, where we listed on the TSXV under symbol “STRR”. Now that Star Royalties is a public company, we will be executing on our already defined pipeline of opportunities. But really, what we are here to do is build a low-risk, low-cost, cash flowing, dividend-paying Company, with a focus on value and quality over quantity. Star Royalties is unique in three ways: our Team, our differentiated model, and our superior alignment.

The Team is very seasoned and respected, with a track record of successful capital allocation and risk assessment. We have over 100 years of mining-specific experience in portfolio management, equity research, corporate development, corporate finance, mining operations and exploration. We have been fortunate enough to have been previously recognized for our risk-adjusted mining returns and mining research, where we have been awarded 13 Lipper and seven Brendan Wood Top Gun awards. With this industry experience, comes deep relationships and asset knowledge and we’re successfully leveraging these to build our exclusive pipeline of opportunities.

Dr. Allen Alper: It's a very impressive Team, a very outstanding Team, with a great record of accomplishment, so you are well poised to grow Star Royalties and to do the right thing, pick the right companies, pick the right opportunities. It's a very knowledgeable Team. Very impressive!

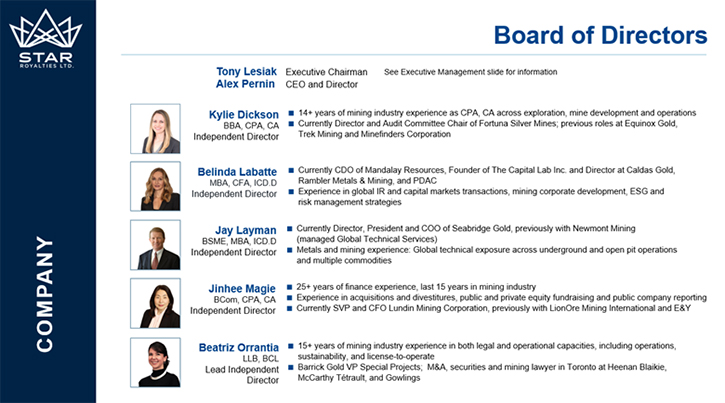

Alex Pernin: Thank you. The reality is, the role of royalty and streaming companies is to allocate capital, in a disciplined and systematic manner. The most valuable asset is the Team, and not one particular royalty or stream. You, as an investor or a potential investor, will want to make sure that you are investing in a group that is capable of successfully allocating that capital. We are also very proud of the talented, diverse and majority independent Board that we’ve put together. The Board is 100% mining savvy, with expertise in mine engineering, finance, law, IR, and ESG. Alignment is also essential. We were all long-term students of the royalty and streaming sector and had an opportunity here to create a Company the right way, with proper alignment to shareholders, proper governance and an equity-driven approach to building this Company. Skin in the game is crucial to drive alignment and we gained our ownership in Star Royalties by directly co-investing alongside our shareholders over the last 18 months, and this is something of which we are very proud.

Dr. Allen Alper: That's a very excellent Team. Could you tell our readers/investors a little bit about your business model, your portfolio and more detail on your current royalty and streaming agreement with Arizona Gold (formerly Kerr Mines)?

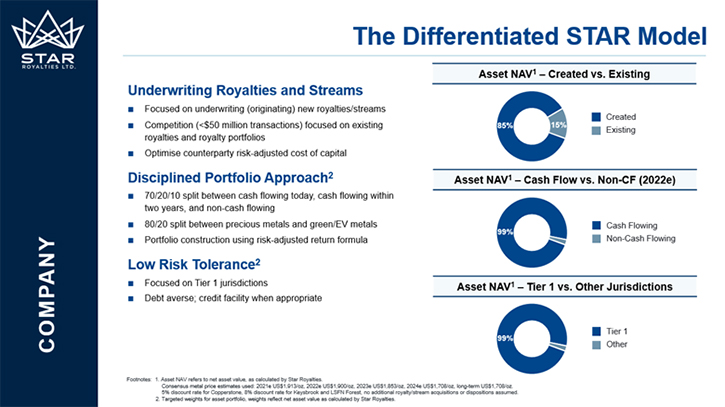

Alex Pernin: Our business model is also unique, given our focus on originating new royalties and streams that best fit our counterparties’ needs. Our rule is to structure mutually beneficial deals. By doing so, we not only directly benefit the counterparty’s financial health, but we also provide capital to a major part of a sector that has been capital starved for nearly a decade. By underwriting these structures, we get much better access for our due diligence, we have access to a much larger pool of opportunities, and we can custom tailor a deal structure and economics, rather than inheriting an existing agreement. The fact that most of our pipeline is exclusive to us is also unique. It’s exclusive because of our focus on origination and our deep relationships.

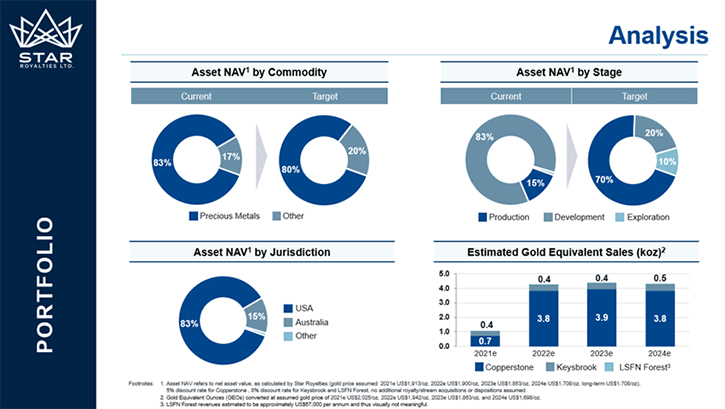

We have a 70/20/10 strategy when deploying capital, meaning 70% of our capital goes to opportunities that are cash flowing now, 20% to cash flow within the next two years, and 10% to well-defined development or exploration projects. We view the 70/20/10 approach as not only a good way to emphasize cash flowing and near-cash flowing opportunities, but also to limit our capital allocation to a non-performing land bank. Lastly, We have an 80% plus portfolio weight in precious metals investments, and up to a 20% weight in green and EV investments.

We currently have five assets, four of which we created. Out of these five assets, one is a gold stream and the other four are royalties. Our portfolio, as it stands now, has an 83% weight in precious metals, a 99% weight in tier-one jurisdictions, which would be Canada, US, and Australia, and a 99% weight in producing and near-producing operations. Our primary asset is a gold stream on Arizona Gold’s Copperstone restart project, this is a US$18 million streaming agreement that we created and announced last November. The investment checked off many boxes for us. Copperstone is located in mining-friendly Arizona. It’s fully permitted, in fact it was a historic operation, having produced a half million ounces, so there’s significant infrastructure already on site. Arizona Gold is a Team of experienced underground mine developers and the timeline to production at Copperstone is short, with a restart expected by the end of this year. We spent over 1,000 hours of due diligence, with our technical consultants, who went to site and reviewed the reserve and resource estimations, mining methods, metallurgy, operating and capital costs. With that work, we’d expect this stream to cash flow to us for at least eight years, but above that, Copperstone has significant further high-grade exploration and expansion upside, so this could be very successful.

I also want to mention that last year we pioneered the first-of-its-kind carbon credit royalty, on the Lac Seul First Nation reserve lands, in northwestern Ontario. In essence, we have a royalty on a forest, and as the forest grows, we will collect a cheque. The way it works is that this particular forest is being transitioned from a logging operation to become a carbon sequestration operation. The trees are no longer cut down, instead, they are allowed to grow, and as they grow, they sequester carbon dioxide from the atmosphere into their biomass, by doing so they generate these carbon offset credits that are then sold to emitters such as American Airlines or ExxonMobil, and the revenue from the monetization of those carbon credits will be distributed to the First Nations, our partner companies, and us as a royalty holder. This one royalty represents the tip of the iceberg in what will be not only a highly scalable business model, but also one, with limited competition and very attractive returns on investment. These types of opportunities also highlight our environmental, social, governance strategy where we’ll be developing more green investments and expanding our First Nations partnerships over the coming years.

Dr. Allen Alper: I think it is great that you not only work for your shareholders and stakeholders, but you also help other companies.

Alex Pernin: You are absolutely right! That's a very good point, with gold prices and global markets being as volatile as they are. We are acutely aware of a counterparty’s debt cost of capital and their equity cost of capital. We want to partner with them, understand what their requirements are, what their priorities are, and then structure a royalty or stream for them that not only fits their needs, but also provides them with a more attractive cost of capital than their alternative sources. In essence, we want to optimize our counterparties’ capital structure.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a little bit about your share and capital structure?

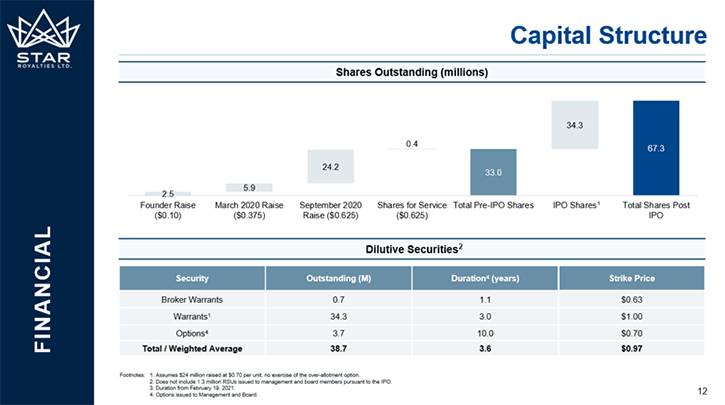

Alex Pernin: Absolutely. We have progressively raised over $40 million in the last 12 months. Following the close of our IPO in mid-February, where we upsized the raise from $20 million to $24 million, the Company now has 67.3 million shares and about 38.7 million dilutive instruments that are not in the money. That said, the capital structure will likely change, in what will be a transformational year for Star Royalties. Something to point out is that we elected to IPO based on shareholder feedback, we received last year, where investors had mentioned that they appreciate the additional transparency of a prospectus offering as well as the lower dilution and lack of shareholder inheritance that would come via an IPO. With that, we pursued an IPO and because of that, there were no shell games, no egregious lifts nor an abundance of cheap stock. We have been running this like an owner-model, where most of the Team has been working for free or below-market rate. Going forward, we would like to maintain this trend and be the lowest G&A royalty company on the street.

Regarding ownership, Management and our Board currently own over 7% of the Company. We achieved this by directly co-investing in each of the three separate private rounds and on the IPO. The point is that we’ve been buying in, this hasn’t been issued to us for free, our hard dollars have gone into the Company to achieve our ownership.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors, the primary reasons for investing in Star Royalties?

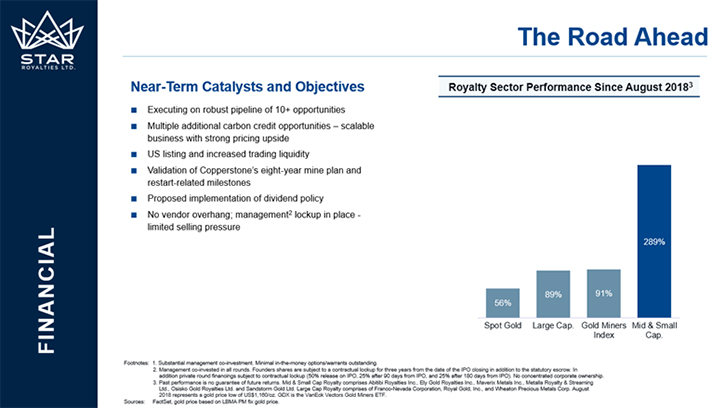

Alex Pernin: We are an experienced and well-connected Team, with a large pipeline of opportunities. We are the least expensive royalty and streaming company on any cash flow metric. Star Royalties is expected to generate nearly $7M in free cash flow next year, meaning we are currently trading at a 30% enterprise value yield, which is more than a 60% discount to our peers. We expect several re-rating catalysts, in the coming months, as we deploy the funds that we raised on our IPO and progressively execute on our precious metals pipeline, where we’re currently reviewing over $125M US of potential acquisitions. The investments vary in size from $10 to $50 million, are for producing or near-producing assets, are primarily in tier-one jurisdictions and are virtually all exclusive to us.

We are focused on increasing our trading liquidity and are progressing a US listing, so that US shareholders can more easily invest. We are also looking to implement a meaningful dividend policy. Our compensation structure is dependent on share price appreciation and dividends. We, as a Team, want to be remunerated and rewarded in the same way as our shareholders.

So, with the signing of accretive deals, increased critical mass and a strong marketing effort, we think we could be trading at a premium to our peers by next year.

Dr. Allen Alper: Well, those sound like very compelling reasons for our readers/investors to consider.

Alex Pernin: Absolutely. With the Team having been vocal critics of the mining industry, be it weak shareholder alignment, poor governance, destruction of capital, or excessive management compensation, we know exactly what we want to build. We are here to build a reputable, disciplined and substantial royalty and streaming company over the coming years.

Dr. Allen Alper: It's good to see you all have skin in the game! I am confident you will make it happen.

Alex Pernin: Thanks, Dr. Alper. Our full focus is to do precisely that.

Dr. Allen Alper: That's great. We will publish your press releases as they come out so our readers/investors can follow your progress.

https://starroyalties.com/

Alex Pernin, P.Geo.

Chief Executive Officer and Director

apernin@starroyalties.com

+1 647 360 4793

|

|