AbraPlata Resource Corp. (TSX-V: ABRA): Very Well-Funded District Scale Silver-Gold Advanced-Stage Exploration Company; Interview with John Miniotis, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/1/2021

Overview

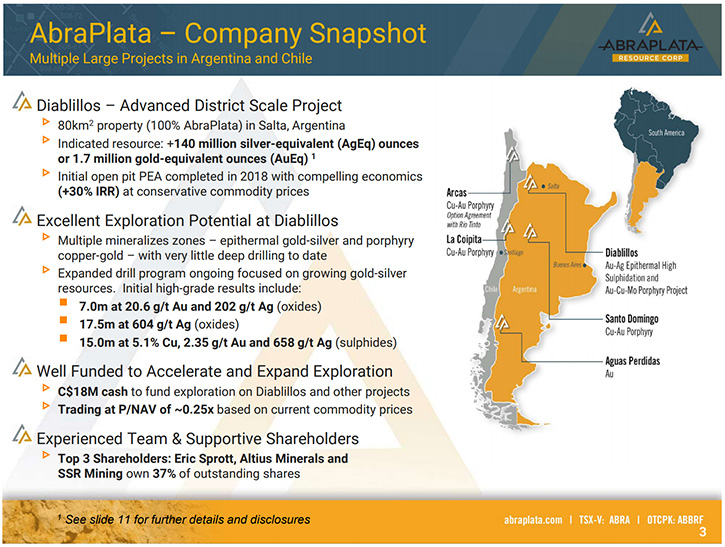

AbraPlata Resource Corp. (TSX-V: ABRA) is a very well-funded silver-gold focused advanced-stage exploration company. We own 100% of the Diablillos project, which is located in a very mining-friendly province in Argentina, called Salta. Diablillos has a large existing resource base, totalling over 140Moz on a silver-equivalent basis, all in the Indicated category. The existing resource base is entirely within oxides, and is located close to surface, so we expect this will be quite a straightforward open pit operation down the road.

Our objective is to continue to grow the size of the project and rapidly advance it towards a construction decision. We’re fortunate to have a very strong exploration team at site, that has been consistently hitting high-grade drill results over the past 12 months now, and so we’re keenly looking forward to announcing an updated resource estimate towards the middle of the year.

AbraPlata Resource Corp.

What differentiates AbraPlata

I believe there are a few key features that truly differentiate the Company from a number of our peers.

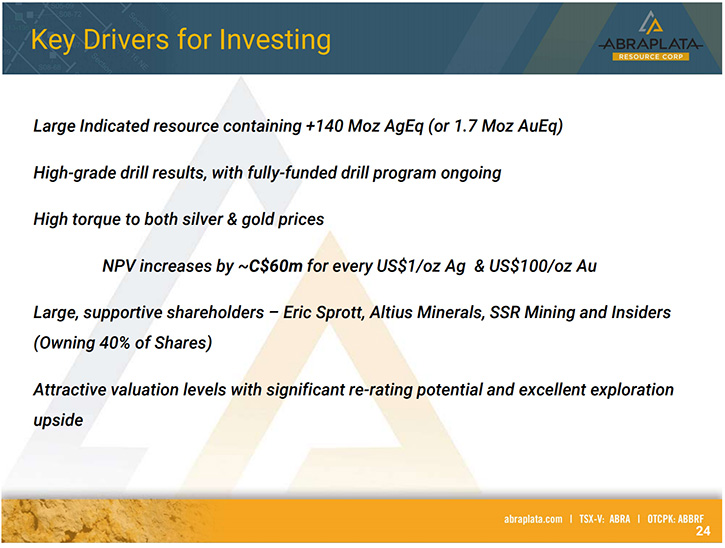

1) This is already a high-margin project, that’s highly economic at current commodity prices. As such, there’s very high scarcity value here, as this is one of only a handful of primary silver projects globally that is economic and can likely be brought into construction within the next two years.

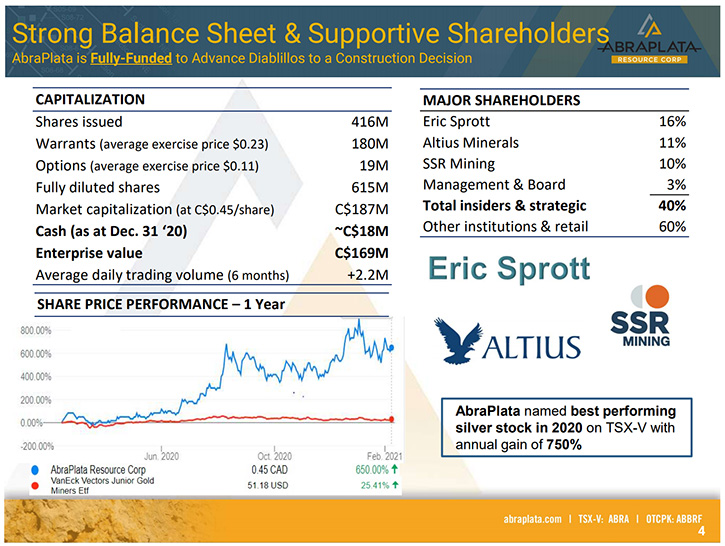

2) We have a very strong supportive shareholder base. Approximately, 40% of the Company’s shares are held by our top 3 shareholders, Eric Sprott, Altius Minerals and SSR Mining. To date, none of these parties have sold a single share in the Company, and so we’re very fortunate to have their support.

3) We have a very strong cash position, and are fully funded to advance Diablillos all the way to a construction decision. At the moment, we have approximately $18 million of cash in the bank, which will enable us to continue to drill the project aggressively and unlock additional value for our shareholders.

Discussions of projects

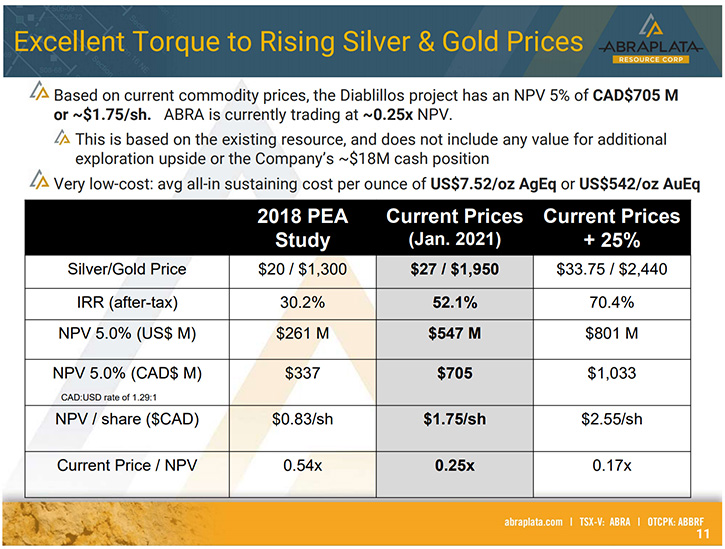

As mentioned, our flagship property is Diablillos. Based on the 2018 PEA study that was completed on the property, and assuming current commodity prices, the net present value of Diablillos is over $700 million, or about $1.75/share.

Currently our share price is trading at a steep discount to the value of this project alone, however we also have a portfolio of other exploration assets that we feel can add significant value down the road.

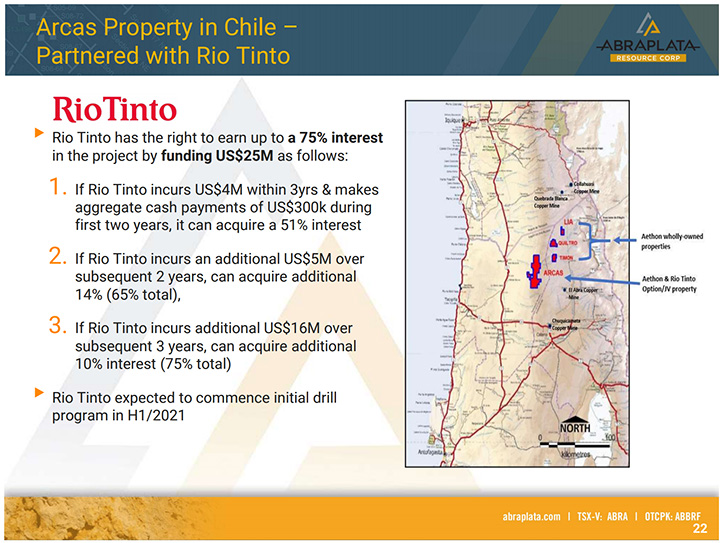

In Chile, we own 100% of the Arcas project, where we have partnered with Rio Tinto, granting Rio an option to earn up to a 75% stake, by spending US$25 million in exploration expenditures. This project is located in the world’s most prospective copper belt in Chile and there are several identified copper-gold porphyry targets, which we expect Rio Tinto to commence drilling shortly.

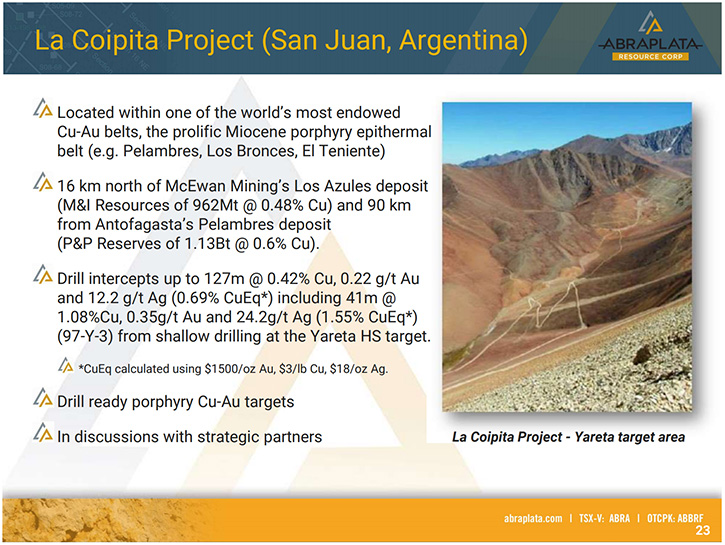

We also have two other earlier stage projects, located in San Juan, Argentina, which is also a very mining-friendly province. These are called La Coipita and Santo Domingo. Both properties are earlier stage, but we truly believe they each have very high exploration upside potential, which again is definitely not being reflected in our share price at the moment. And so, shareholders are currently getting all these other exploration projects for free, while our valuation reflects only a fraction of the value of Diablillos.

Major accomplishments in 2020

2020 was a transformational year for the Company. The current Management Team and I joined the Company back in December 2019, at which stage AbraPlata had less than a $15 million market cap. Our focus was to demonstrate that Diablillos was truly a hidden gem, and that the asset had significant upside exploration potential beyond what was shown in the previous economic study.

As such, we commenced an initial 3,000-meter drill program, which proved to be a great success, and so we quickly expanded that to 13,000-meters, which we’re now currently in the process of completing. Based on our successful drill results, where we have intersected high-grade silver, gold and copper over substantial widths, we’ve now rapidly grown our market cap, and solidified our balance sheet to enable us to advance the project towards a construction decision as quickly as possible.

Plans for 2021

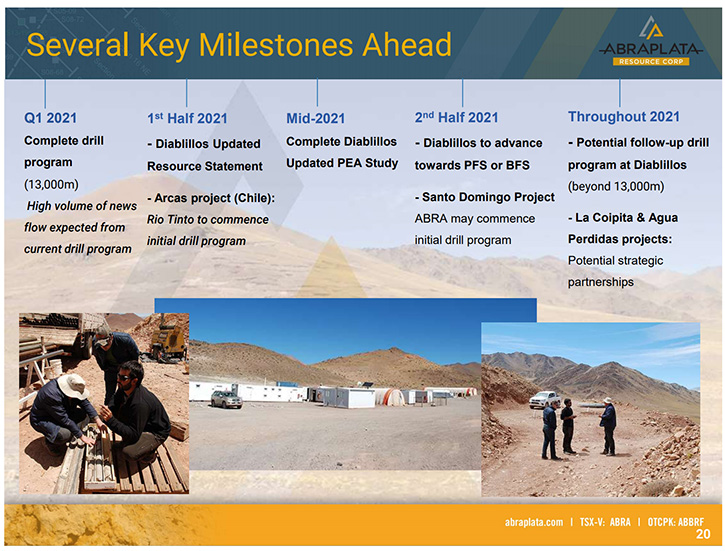

We expect to have another very busy year ahead of us here. We’ll be continuing to drill at Diablillos, and by the middle of the year we expect to publish an updated resource statement, which will be followed by an updated PEA study. The PEA study should be a very significant catalyst for us, as it should demonstrate the extremely robust economics of the project.

In addition, we expect that Rio Tinto will commence drilling at the Arcas project in Chile shortly, and we’ll also advance our other projects in San Juan as well, either by bringing in a strategic partner or drilling them on our own.

Discussion of the silver market

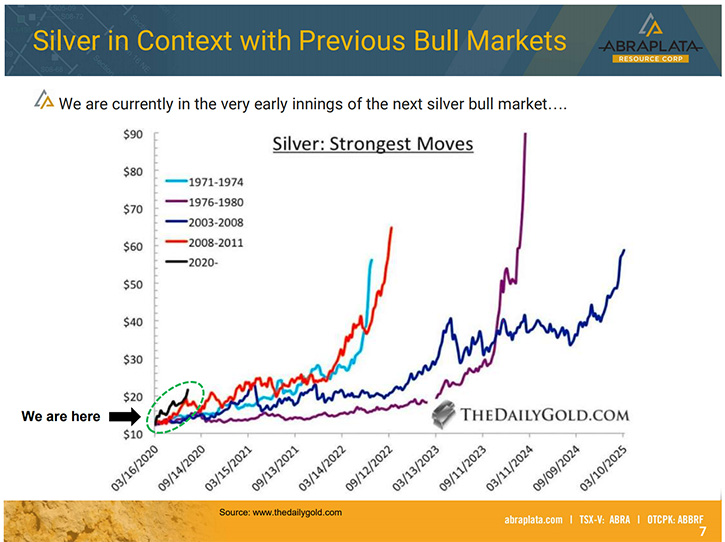

The fundamentals of silver are incredibly strong right now, and I honestly believe we have the perfect set-up in place for quite an extraordinary run on silver prices. Silver’s a unique hybrid metal used on the industrial side, as a conductor of light and energy, and on the investment side as a store of value. And right now, I think it’s safe to say that the demand outlook has never been stronger on both sides of the equation.

Given the global transition to green energy, which requires vast amounts of silver, as well as the strong demand for silver on the investment side, the production deficits in physical silver are very real and I expect will likely intensify over the coming years, which is why we’re focused on advancing Diablillos towards production as quickly as possible.

Discussion about operating in Argentina

It’s very important for investors to recognize that all provinces are highly autonomous in Argentina, and as such largely have their own set of regulations that impact mining activities. I often like to say that Salta is the ‘Nevada of Argentina’, where you clearly have a strong culture of mining and a government that is very supportive towards investment in the industry.

We have seen a number of mining companies invest heavily in Salta over the past several years, and so the province has now established a reputation as being one of the premier investment jurisdictions, not only in Argentina, but across all of Latin America.

This is also reflected in the latest Fraser Institute study, which ranks Chile #1, San Juan #2, and Salta as #4, in terms of being the most attractive mining destinations across all Latin America. We are extremely fortunate to be operating in some of the best jurisdictions on the continent.

Team and Board backgrounds

We have a very lean and efficient Management Team. In terms of my background, I have nearly two decades of experience in the mining industry, focused on Corporate Development and the capital markets side of the business. Throughout that time, I’ve been involved in transactions totaling well over $2 billion dollars and have been both an acquiror and an acquiree. The companies I’ve worked for include: Barrick Gold, Lundin Mining, AuRico Metals and Aethon Minerals, which has now merged with AbraPlata.

On the technical side, we’re very fortunate to have David O’Connor, as our Chief Geologist, running the exploration program at site. Dave has well over 40 years of experience. He has run a number of junior companies and has made a large number of discoveries throughout his career.

We’re also fortunate to have a very strong Board, which provides us with an excellent network of contacts and experience throughout North America and in Argentina.

Capital and Share Structure

We have approximately 416 million shares outstanding, which at the current share price of $0.46, results in a basic market cap of about $190 million. As mentioned, we have about $18 million in cash, and so we are fully funded to advance the project all the way to a construction decision. In terms of our volume, we are frequently among the most actively traded names on the TSX-Venture, with average daily volumes of over 2.2M shares in Canada. And of course, our top three shareholders own approximately 40% of the Company.

Why invest?AbraPlata offers investors a unique asymmetric opportunity, where investors are currently paying for a fraction of the value of our Diablillos project, and getting all the upside for free. So we’re extremely focused on unlocking value here, and we expect 2021 to be another very exciting year ahead for all shareholders.

https://www.abraplata.com/

John Miniotis, President & CEO

john@abraplata.com

Tel: +1 416-306-8334

|

|