Cassiar Gold Corp. (TSX.V: GLDC, OTCQB: CGLCF): Multimillion Ounce Oz Potential, World-Class Team, Great Infrastructure in British Columbia; Interview with Marco Roque, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/21/2021

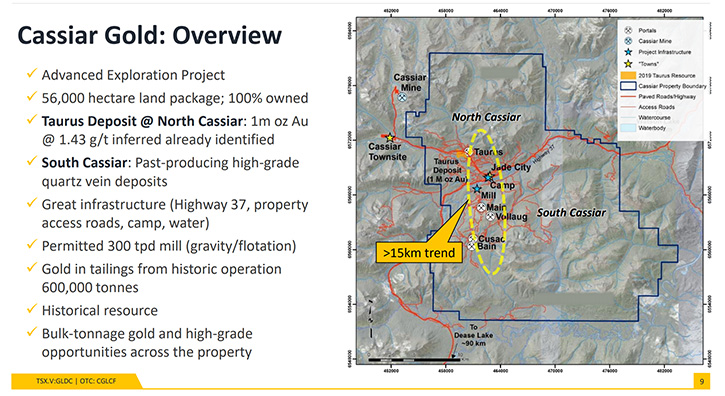

Cassiar Gold Corp. (TSX.V: GLDC, OTCQB: CGLCF) is a Canadian gold exploration company, focused on their 100% owned Cassiar Gold Project in British Columbia. The Cassiar Gold Project is a large, advanced-stage, road-accessible, surrounded by great infrastructure, near-surface gold property, with a two-year old NI 43-101-compliant resource estimate of 1M oz at 1.43 g/t Au at the Taurus bulk-tonnage gold deposit. The Property hosts numerous gold showings, historical workings, and exploration prospects over a >15 km long and up to 10 km wide trend that extends from high-grade past-producing mines at Cassiar South, to the Taurus deposit at Cassiar North. We learned from Marco Roque, who is CEO of Cassiar Gold, that they have mine permits for substantial parts of the property and are currently preparing for the 15,000-meter drilling program, scheduled to start in Q2 of 2021, to update the bulk resource and to prove the high-grade veins.

Cassiar Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, editor-in-chief, of Metals News, interviewing Marco Roque, who is CEO of Cassiar Gold. Marco, could you give our readers an overview of your Company and what differentiates your Company from others?

Marco Roque: Absolutely. Cassiar Gold Corp. is a Canadian explorer. Our flagship asset is located in Northern BC. We already have 1 million ounces identified, 43-101 compliant inferred, and we are working and drilling to prove what we believe to be a multimillion-ounce gold camp potential, at our flagship property.

Dr. Allen Alper: That sounds great. Could you tell us a little bit more about your properties, your resource and what you plan to do in 2021?

Marco Roque: Sure. Our resource is 1 million ounces at 1.43 grams per ton, which is a pretty attractive grade when you consider that this resource is very near surface, so there's almost no overburden to speak of. The overburden, for the most part, is between five and 20 meters. The resource itself is mostly flat lying. So it would be amenable to an open pit. It's also surrounded by infrastructure. You can literally drive to the top of the resource and have Highway 37 bisecting our property. We have a permitted mill and mine permits for substantial parts of our property as well. We also have multiple property access roads that connect some of the old adits that were producing the high-grade in the past. That's the reason we have the benefit of all this infrastructure, as well as tailings and a camp.

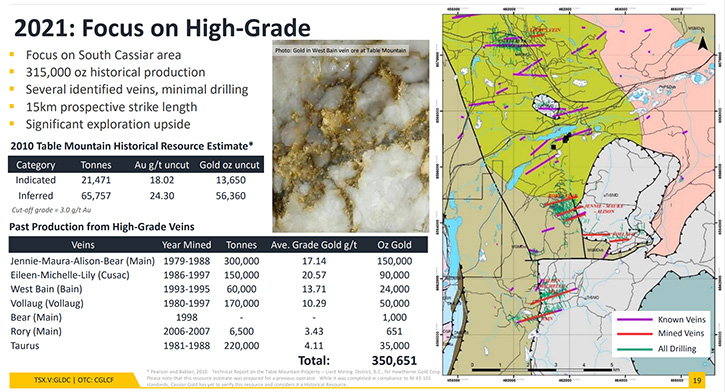

In terms of our plans for 2021, we're currently well advanced in preparation of a 15,000 meters drill program. We will restart drilling our property in Q2, next quarter, as soon as the weather allows. That drilling will be mostly focused on the high-grade part of our property, and that high-grade is actually pretty high- grade. It is 15 to 20 grams per ton high-grade gold, in quartz veins that have seen production in the past in an orogenic gold system. The systems typically tend to be quite large. They're typically stacked and they can go down for hundreds and sometimes even thousands of meters. In the past, this part of the property was under-explored. The old timers only scratched the surface and we are planning to start to properly explore and prove that high-grade potential.

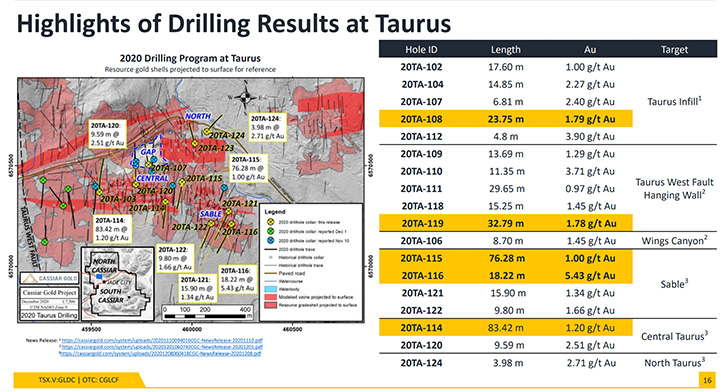

In addition to that, we will also be doing some follow-up drilling around our resource. Our resource is a 2019 resource, 1 million ounces. We already drilled in 2020, in and around the edges of the resource, and were successful in extending the envelope of known mineralization there. And we'll continue to do step out drilling, given the fact that this bulk tonnage resource is still unconstrained.

We have two immediate avenues of growth at Cassiar. The first is to continue to grow our bulk tonnage resource, the 1 million ounces at 1.43 grams-per-ton, which is open in multiple directions. Secondly, we will as start to prove the high-grade veins which have seen production in the past. Proving the high-grade potential in those veins will be transformational for us because then we'll have this bulk tonnage together with a high-grade that changes the development scenarios for our project and its economics and ultimately its valuation. And hopefully we'll be well on our way to prove that multi-million ounce potential that we are very confident we have at our flagship property.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about your background and your Team and your Board’s background. It is a rather impressive group.

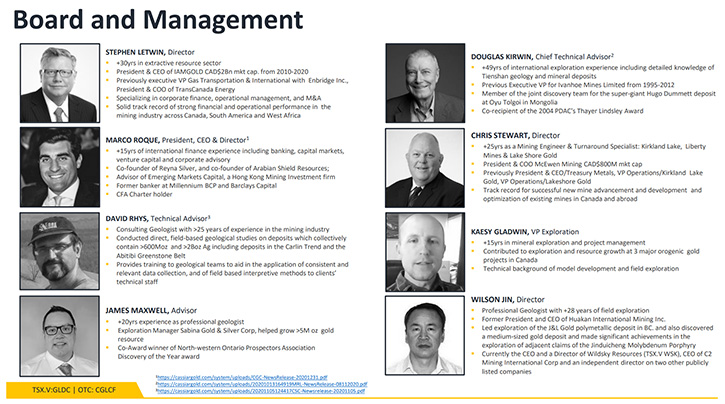

Marco Roque: Yes, absolutely. Myself, I am Portuguese, born and raised. I started my career in private banking, then moved over to capital markets at Barclays Capital, spent roughly six years there. Then I did my MBA between London Business School and Hong Kong UST. More recently, I spent the last, eight years advising and investing in the precious metals space and that's how I also met one of our Board Members, Steve Letwin who is also the largest individual shareholder of the Company. He is the former President and CEO of IAMGOLD. He retired from there in March last year and that's when he joined our Board. He's been a big supporter of the Company over the years, Steve, and he's a real asset to have. It's a real benefit to have someone of his caliber, with his experience, not only supporting but also helping and investing in us, continuing to invest in our Company and help us move forward.

We also have Chris Stewart on our Board. He's a mining engineer and turnaround specialist. He is the former President and COO of McEwen Mining and was previously President and CEO of Treasury Metals. He was also previously with Kirkland Lake.

Other names that I think we should mention are Doug Kirwin, our Chief Technical Advisor. He has 50 years of international exploration experience. His big claim to fame is the discovery of the super-giant Hugo Dummett Deposits at Oyu Tolgoi in Mongolia for Ivanhoe Mines that was later sold to Rio Tinto. It's probably one of the most significant copper-gold discoveries this century. Doug is an award winner of the Thayer Lindsley Award from PDAC in 2004.

Kaesy Gladwin is our VP of Exploration and James Maxwell, our advisor. They were both quite instrumental at Sabina Gold & Silver. They helped Sabina go from discovery all the way to nearly 10 million ounces in the Arctic Circle. So they have very relevant experience and it's great to have people like these onboard. More recently, we've added David Rhys to the technical team as an advisor. David is a structural geologist and he's one of the foremost orogenic gold experts in the world. Interestingly enough, he also has worked on our flagship property, Cassiar Gold, roughly 10 years ago. He brings a wealth of experience, not only on the structural geology of orogenic systems, but also his practical and hands-on knowledge of our property is invaluable and it's great to have him on the team.

We also have Wilson Jin on our Board. Wilson is a geologist and he's also the CEO of our largest shareholder, Wildsky Resources, and the vendor of the property that we now own 100% of since September last year.

Dr. Allen Alper: Well, that's a very impressive group, you, your Team, your Board and your advisors. It's an excellent, outstanding group.

Marco Roque: Yeah, I agree. I'm really lucky to be surrounded by people of this caliber, no doubt.

Dr. Allen Alper: Well, it shows that you all have faith in the project, and I understand you all are highly invested in your Company. Could you tell our readers/investors more about your capital and share structure?

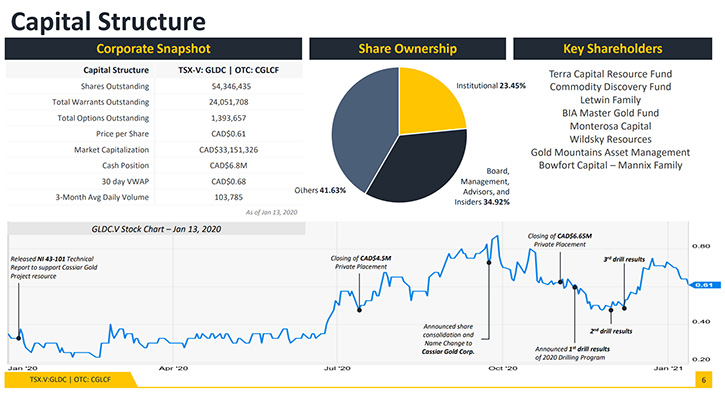

Marco Roque: Absolutely. We have roughly 54 million shares outstanding. Our market cap is, at just under 60 cents, roughly C$30 million, which is a very attractive valuation. Our cash position is $6.8 million. In terms of the capital structure, our Board, Management, Advisors and insiders’ ownership is almost 35%, which is really good to see. In fact, recently insiders of the company purchased more shares on the market. We also have been able to substantially increase our institutional shareholder base over the last few months. It was an effort to attract resource funds that really understand the potential of what we have and could help us in the future to deliver the vision that we have, which is that multimillion ounce camp in Northern BC. Our institutional shareholder base grew from just under 10%, earlier in 2020, to nearing 24% now in January 2021. It's really good to see that we are able to attract that kind of shareholder.

I joined, as CEO, July 1st, 2020. It's been a really busy six months. I'm very happy with what we have been able to achieve, not only on the technical side, but also from the corporate side, as we attract the right type of investors that will help us achieve our future ambitions.

Dr. Allen Alper: That sounds excellent, really excellent! Could you tell our readers/investors the primary reasons they should consider investing?

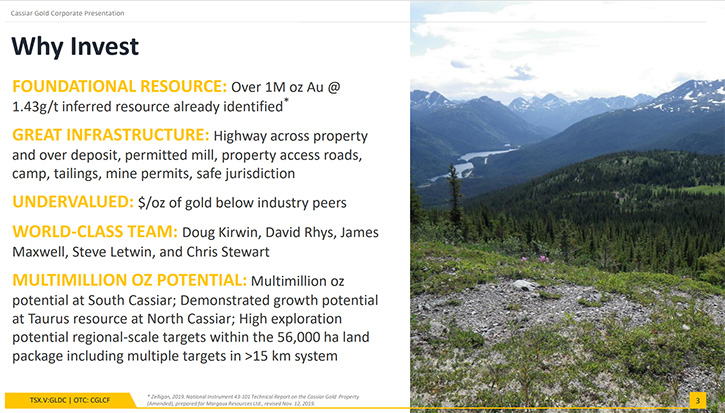

Marco Roque: I named a few, but I think there are five things that people should look at. One is the fact that we already have a foundational resource. There are a lot of Companies out there, a lot of exploration Companies that don't have a resource and we already have a resource. A substantial resource! It's already over a million ounces, at a very nice grade and in a safe jurisdiction.

The second thing is the infrastructure that we benefit from. We are surrounded by infrastructure, which is abnormal for a Company that is basically exploring, or a Company our size as well. And the reason for that is that this is a brownfield project. This property has seen production in the past, mostly in the '80s and '90s and mostly around the high-grade gold in quartz vein, those 15 to 25 grams per ton material. It has a highway bisecting our property and you can actually drive to the top of the resource. There are multiple roads connecting all over the property. We have a permitted mill, 300 ton per day, it last operated in 2007. We have tailings, 600,000 tonnes of tailings. We have mine permits. So this is an unusual level of infrastructure that it's invaluable and allows us to be much further ahead than most of our peers.

The ore is over 95% free-milling, and less than 5% is refractory. And we have a substantial exploration upside. We believe we have a 3 to 5 million ounce potential and we are working and proving that as we speak.

The other thing that is worthwhile mentioning is our valuation. I think we are very attractively valued still. Just look at our resource, look at our market cap, and just on that, we are very attractively valued.

In addition to that, we have truly a world-class team. I already mentioned some of the names. It's really good to have a great asset, attractively valued, surrounded by infrastructure, with the right team to move it forward. A good team can do a good job, with an average asset. A bad team can fail to realize the whole potential of a good asset. We have the benefit of a world-class team and an excellent asset.

Lastly, we truly have that multi-million-ounce potential. The million ounces is just a start, just a foundational resource. We already did step out drilling last year quite successfully. All drill holes came in mineralized. We will continue to grow our resource base and expand that envelope of known mineralization around our foundational resource. Also this year, we will be drilling the high-grade targets start uncovering the potential of that high-grade system. That's what the technical team is mostly excited about. Those are the five things: foundational resource, the infrastructure, our valuation, the team and that multi-million-ounce potential.

Dr. Allen Alper: Those are very compelling reasons for our readers/investors to consider investing in your Company. Great team, great resource, great area and a well-balanced team, both geologically and financially, and a proven record. Very strong reasons for our readers/investors to invest in your Company, Marco.

Marco Roque: Absolutely, I totally agree.

Dr. Allen Alper: Okay, that sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://cassiargold.com/

Marco Roque

CEO and Director

+852 6691 6295

Marco@cassiargold.com

|

|