IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF): Intersecting Some of the Best Grades Known in Uranium; Best Performing Uranium Stock in 2020; Interview with Keith Bodnarchuk, Corporate Development Manager

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/19/2021

IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF) is a well-funded uranium exploration and development company, founded and supported by the team of its major shareholder, NexGen Energy Ltd. IsoEnergy recently discovered the high-grade Hurricane Zone of uranium mineralization, on its 100% owned Larocque East property, in the Eastern Athabasca Basin in Saskatchewan, Canada. We learned from Keith Bodnarchuk, who is Corporate Development Manager for IsoEnergy that 2021 will see their fifth ,aggressive exploration drilling campaign on the Hurricane zone, where they have been intersecting some of the best grades known in uranium including 74.0% U3O8 over 3.5m within 38.8% U3O8 over 7.5m during their most recent campaign. We learned from Mr. Bodnarchuk that the widening gap between the demand and supply of uranium had been building for a few years now, and with the number of recent shutdowns, due to COVID-19, the price of uranium started to go up. According to Mr. Bodnarchuk, IsoEnergy is the best performing uranium stock in 2020, and they have about $12 million in the bank.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Keith Bodnarchuk, who is Corporate Development Manager for IsoEnergy Ltd. Keith, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

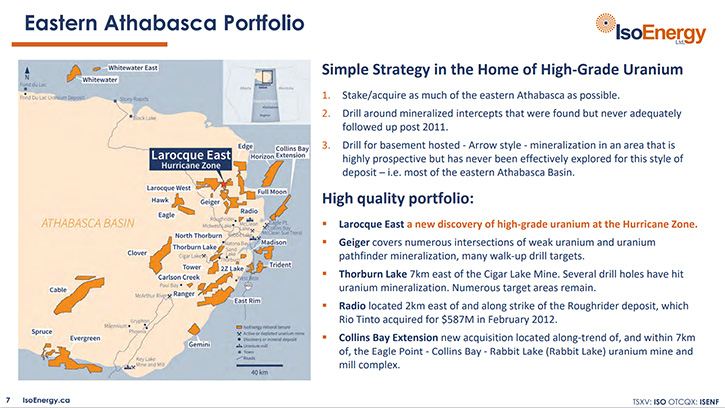

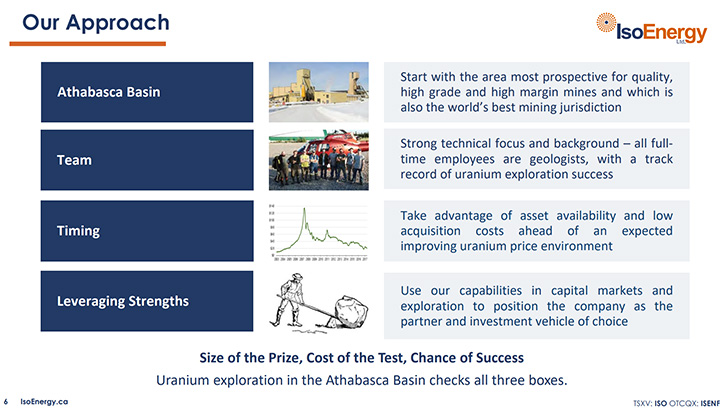

Keith Bodnarchuk:IsoEnergy is a uranium exploration company with projects in the Eastern Athabasca Basin in Northern Saskatchewan, Canada, which is home to the highest-grade deposits of uranium in the world. We are a spinout of NexGen Energy, who is currently developing the great Arrow Deposit in the Athabasca Basin. They remain our major and most supportive shareholder. We are TSX-V (ISO) listed, and also listed on the OTC (ISENF).

We were founded in 2016 as a spinout of NexGen’s assets in the Eastern Athabasca, originally starting with 5 properties. We have since grown that to 27 properties including our flagship Larocque East property that we purchased from Cameco in 2018. Within six weeks of acquiring 100% of the Larocque East property we had a drill onsite and discovered the Hurricane zone, with our very first hole. Since the initial discovery of Hurricane in 2018, we have completed four drill programs growing and expanding what has turned into a large high-grade zone.

What differentiates us is we have the most recent discovery of high-grade uranium in the Athabasca Basin, and we're intersecting some of the best grades that you'll see in uranium. An example being from our most recent program, drill hole LE20-76 intersected 74.0% U3O8 over 3.5m (within 38.8% U3O8 over 7.5m). The Hurricane zone has high grade widths and thickness seen at major deposits, is relatively shallow at ~330m, and is well situated amongst existing infrastructures. This includes Orano’s McClean Lake Mill, which is only 40km away, and currently has excess capacity. It is important to note that the extents of Hurricane have yet to be defined, meaning lots of great targets and potential remain. So that is our overview right now. We're looking to get out again in 2021 and start drilling, which would be our fifth aggressive campaign on the Hurricane zone.

Dr. Allen Alper: Well, that sounds excellent. It sounds like a great project. And from what I understand, it is one of the best uranium projects in the world and it is in a great location.

Keith Bodnarchuk: Yeah, absolutely, we are the only company currently defining a high-grade discovery. And I agree Saskatchewan is a fantastic location and was recently voted the #1 jurisdiction in the world for mining investment opportunities

Dr. Allen Alper: Could you tell our readers/investors what is happening in the uranium market?

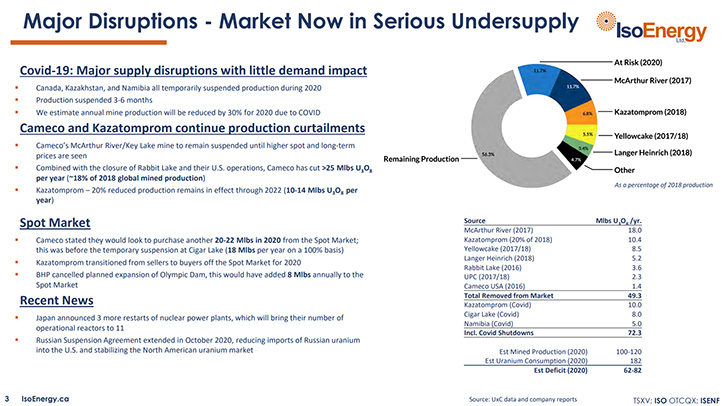

Keith Bodnarchuk: Definitely. 2020 was a year highlighted by Covid-related shutdowns and cutbacks of operating uranium mines in places like Canada, Kazakhstan, and Namibia, which represent a large portion of the world’s uranium supply. This acted as a catalyst to cause the price of uranium to jump up 40% in the first part of 2020 after being relatively flat since 2017.

It is important to note that although these Covid related shutdowns are temporary, even prior to Covid there had been a widening gap between the supply and demand of uranium. New reactors have continued to be built and come online, yet the price of uranium remained so low that McArthur River, one of the largest and best uranium mines in the world was shutdown in 2017 until Cameco sees better uranium prices to justify reopening it. Covid related shutdowns have acted as a catalyst to bring attention to a uranium industry, with underlying fundamentals pointing to the need for a dramatic price increase to close the gap between supply and demand. Expect long-term demand to continue to increase, with public sentiment towards nuclear energy improving and countries focusing on climate change. Nuclear power offers the only reliable source of carbon-free energy.

Dr. Allen Alper: It sounds like an excellent situation and opportunity for investors.

Keith Bodnarchuk: Definitely. Investors have been watching the space for a while because the price of uranium has been stagnant for so long. We have all been waiting for this catalyst that would finally cause the price of uranium to start moving upwards.

Dr. Allen Alper: That's great.

Keith Bodnarchuk: Yeah, and there is still a lot of room for the price to move up. The spot price of uranium remains roughly $30 per pound US right now, and it will likely double to $60 before it incentivizes producers to consider reopening some of those mines, including McArthur River. We are just at the beginning of what looks to be a uranium boom.

Dr. Allen Alper: Could you tell our readers/investors about your capital structure and share structure?

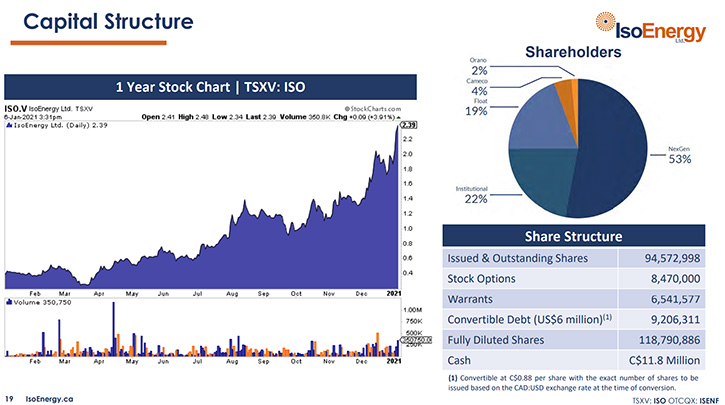

Keith Bodnarchuk: Certainly. We currently have about 94 million shares outstanding and trade in the $2 to $2.50 range, up from $0.38 at the start of 2020. On a fully diluted basis, we have about 119 million shares outstanding. This includes a $6 million USD convertible note, we completed with Queens Road Capital (QRC), in August of 2020. QRC is a publicly traded natural resource fund, led by Warren Gilman, a fantastic and very well-connected person to have supporting your company in the resource industry.

We are a spinout of NexGen Energy and they currently maintain 53% ownership in our Company. They've taken part in all our recent financings, to maintain their majority. They love to have the majority ownership of us. Of the remaining 47% of ISO, approximately 22% is institutional. This consists of the large uranium funds and important institutional shareholders in the uranium space that want to not only keep but increase their shareholdings of ISO. Orano and Cameco, two major uranium producers, own a combined 6%. Orano, is an arm of the French government, and Cameco a Saskatchewan-based uranium giant. Our float is around 19% to 20%. We are very tightly held, which creates a lot of torque when we put out good news.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors about your Management Team, and the Board?

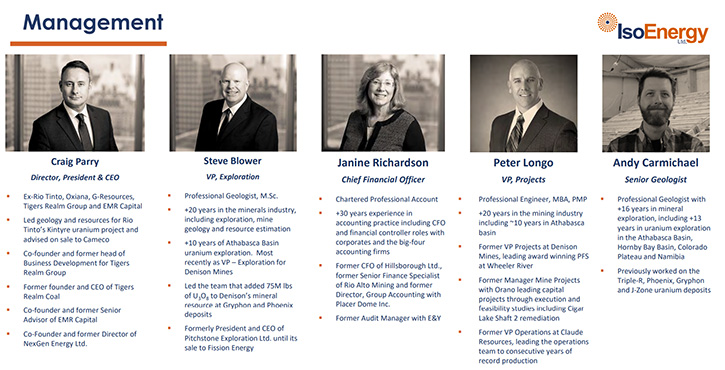

Keith Bodnarchuk: Definitely. Our Management Team is led by Craig Parry, who is an exploration geologist, who got his start with Rio Tinto before going on to form a number of companies including co-founding NexGen Energy. He is currently the Chairman of several gold and silver companies including Vizsla Resources and Skeena Resources. He has an exceptional track record of being able to secure capital throughout all stages of the industry cycle and he has an unparalleled ability to both identify and obtain undervalued projects with exceptional upside.

Our VP Exploration, Steve Blower, is responsible for two of the most recent discoveries in Athabasca Basin. One being our Hurricane zone and the other being the Gryphon zone, when he was the VP of Exploration at Denison Mines. These deposits are very difficult to find, and to have him on our team is just a fantastic asset.

Peter Longo is our VP of Projects. He is a mining engineer, who worked for both Orano and Denison Mines in the past. Peter led the award winning PFS at Denison’s Wheeler River. Adding Peter’s expertise, specifically in mining in the Athabasca Basin, is a massive step toward the continuing advancement of Hurricane.

We also have a fantastic team of geologists led by Andy Carmichael and Justin Rodko, who both have significant uranium experience and very creative exploration minds. It is a Management Team that is built to both explore and advance projects in the Athabasca Basin.

Dr. Allen Alper: Well, that's a very impressive thing.

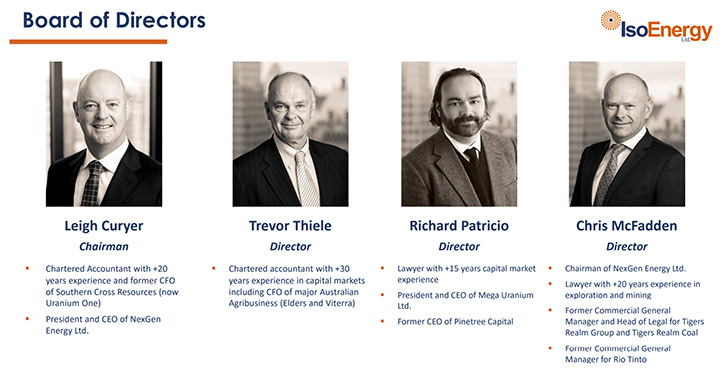

Keith Bodnarchuk: Our Chairman is Leigh Curyer, the current CEO of NexGen. Rounding out the Board we have Chris McFadden, Richard Patricio, and Trevor Thiele. They are all current members of the NexGen Board. All these gentlemen have a great track record in uranium and more importantly Athabasca uranium. Having common Directors provides ISO a lot of good insight into what's happening with the uranium sector and allows us access to the NexGen blueprint for advancing a project through the different stages of the mining cycle.

Dr. Allen Alper: Well, that's a great Team, a very accomplished Team and one that definitely can move your Company forward. That's really excellent! Could you tell our readers/ investors the primary reasons they should consider investing in IsoEnergy?

Keith Bodnarchuk: Number one is the Hurricane zone. It is the only recent discovery of high-grade uranium in the Athabasca Basin. We have intersections of 7.5m of 38.8% uranium, including sections that are 3.5m of 74%. That is the same grade and thickness that you'll see in a lot of the major deposits in the Athabasca Basin. Hurricane has continued to grow each of the past drilling campaigns, and we have yet to determine the extents of it, with numerous targets waiting to be tested.

One thing I haven’t touched on is the excellent exploration potential remaining at our Larocque East property, where ~15km of the same trend that hosts Hurricane remains relatively untested. We also have other high priority properties like Geiger, Radio, and Thorburn Lake, that have drill ready targets offering similar scenarios as the Hurricane discovery hole. Our attention is mostly directed at Hurricane, but we will continue to explore our other high priority target areas.

Finally, we are the best performing uranium stock in the past year. A lot of that was driven by our results at Hurricane in a somewhat stagnate uranium market. Now that fundamentals and investor interest is beginning to pick up in the uranium sector, there will be more attention and an added layer of value to ISO. That puts us in a great position, having a tightly held share structure, so when we do produce good news, our share price responds. Also, we are cashed up with about $12 million in the bank and fully funded for at least this next year.

Dr. Allen Alper: Well, those are excellent reasons for our readers/investors to consider investing in IsoEnergy. Keith, is there anything else you'd like to add?

Keith Bodnarchuk: This is a terrific team to work with. What we've managed to accomplish in such a short time span, from being a spinout in 2016 to already making a significant discovery by 2018, is a direct result of the team that was put together. Our team has taken past discoveries at NexGen and Denison to develop a recipe that leads to repeat success. And we aim to keep applying that recipe for success/discovery in and around Hurricane and our other exploration projects. We still do have a lot of other exploration projects with targets waiting to be tested. So keep an eye out for IsoEnergy, because there is lots of exciting news happening in the future.

Dr. Allen Alper: That sounds excellent! We will publish your press releases as they come out so our readers/investors can follow your progress.

Keith Bodnarchuk: Thanks Al, we appreciate you taking the time to interview IsoEnergy for Metal News.

https://www.isoenergy.ca/

Craig Parry

Chief Executive Officer

IsoEnergy Ltd.

+1 778 379 3211

info@isoenergy.ca

|

|