SPC Nickel: New Canadian Private Corporation, Exploring for Ni-Cu-PGM’s, with an Accomplished Team in the World Class Sudbury Mining Camp; Interview with Grant Mourre, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/13/2021

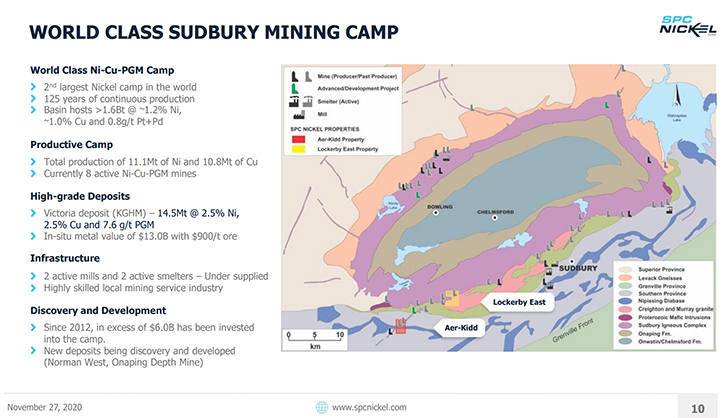

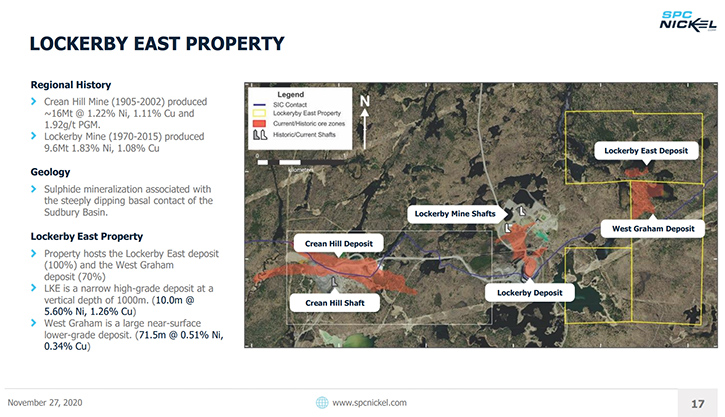

SPC Nickel is a new Canadian private corporation focused on exploring for Ni-Cu-PGM’s, within the world class Sudbury mining camp, in Ontario, Canada. The Company is currently exploring its key 100% owned exploration projects, Aer-Kidd and Lockerby East, both located in the heart of the historic Sudbury Mining Camp and holds an option to acquire 100% interest in the Janes project, located approximately 50 kilometres NE of Sudbury. We learned from Grant Mourre, CEO of SPC Nickel that they just raised $7.8 million and are in the process of taking the Company public in mid Q1 of 2021. According to Mr. Mourre, SPC Nickel's properties are located in one of the worlds’ best nickel camps and well positioned for the bull market for nickel moving forward.

Vale’s Totten Mine situated 1.8 km from the Aer-Kidd Property

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Grant Mourre, who is CEO of SPC Nickel. Grant, could you give our readers/investors an overview of SPC Nickel?

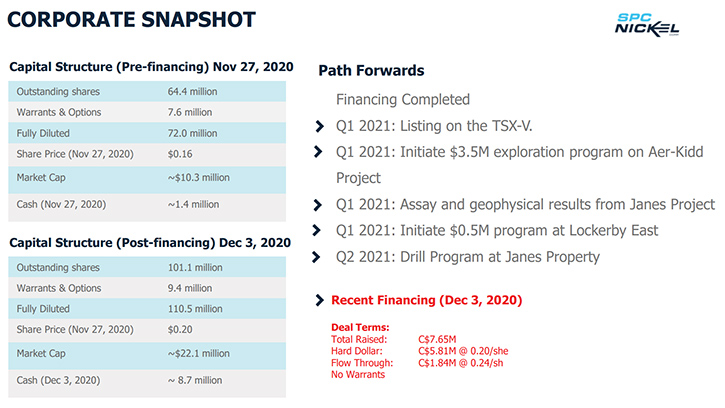

Grant Mourre: Thanks for inviting me Allen. SPC Nickel is currently a private, nickel-focused, exploration company based in Sudbury, Ontario. We are in the process of taking our Company public, which we hope to have completed in Q1 of 2021. We have already completed our financing. Just recently we had a tremendous response and we raised over $7.8 million, as a special warrant financing. These warrants will convert into tradable shares upon listing. So, we have some really good, strong institutions behind us and good financial backers.

What makes SPC Nickel an interesting Company, from our point of view is; one, we're at what could be a pretty good bull market for nickel moving forward, and secondly, which is probably the most important, is that we are working and exploring within what is arguably the best nickel camp in the world. In size, Sudbury is probably next to Norilsk, but as far as being in a stable jurisdiction, Sudbury is the top nickel camp, I would say in the world, and it's certainly the largest mining camp in North America, with the infrastructure already in place. So, I feel like that's the one piece that really separates us from a lot of the other junior nickel companies out there.

Dr. Allen Alper: Oh, that's excellent. You're in a great spot, a great time and a great location, with a great product.

Grant Mourre: Yeah.

Dr. Allen Alper: That's excellent! Could you give us more information about your project?

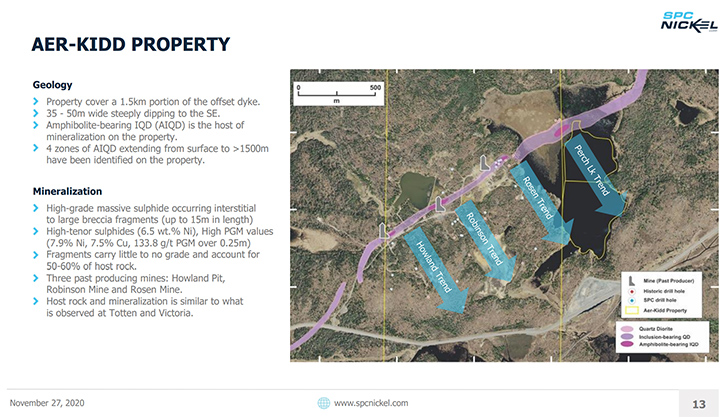

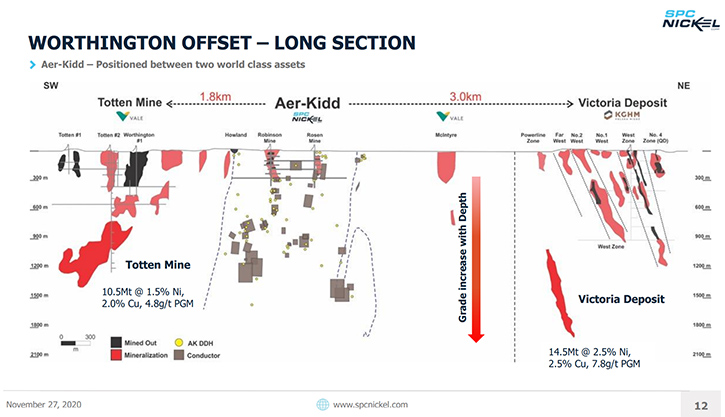

Grant Mourre: We are currently focused on three projects. Two of them are within the Sudbury mining camp, and the third project is just outside of Sudbury. But our flagship property is Aer-Kidd. If you're familiar with the Sudbury basin, it's located down in the southwest corner of the basin. What makes this property so attractive is, not only are we located within the top nickel camp in the world, but we also have world-class assets on either side of us. Our Aer-Kidd property is sandwiched between the most recent mine that's been put into production in February, Vale's Totten Mine only 1.8 km away, and then, on the other side of us is what is arguably the largest, highest-grade deposit in Sudbury that's not in production, but is being developed right now. That's the Victoria deposit, owned by KGHM, 3 km away. These are large high-grade magmatic nickel, copper PGE deposits.

Unlike a lot of the other Ni deposits in North America, in the Sudbury basin you find very high-grade, high-value deposits. For example, the Totten mine, is currently in production and is over 10 million tons of 3.5% combined nickel-copper, with about five grams of platinum, palladium and gold. Victoria, which is being developed right now, is even larger, with over 14.5 million tons at 5% nickel-copper and almost eight grams of precious metals. So, Sudbury is not only a nickel camp, but it's also a copper and a precious metals camp. The metals that are forecasted to be in increasing demand, in this EV boom, green energy boom, are things like nickel, copper, platinum, palladium cobalt, and all these commodities, which are found, within these deposits in Sudbury.

Dr. Allen Alper: That's very good.

Grant Mourre: That's our flagship property, the one where we'll be doing the most work. This property did have three past producing mines in the 1950s and 1960s. We've done drilling on the property already. We have really good indications that there are some good, high-grade, massive sulfides, similar to what's on either side of us. Our focus will be to explore this property to find out if there's another Totten or Victoria deposit there.

Dr. Allen Alper: Well, that's excellent! That's great to have those projects that you can move forward. Could you tell our readers/investors your plans for 2021?

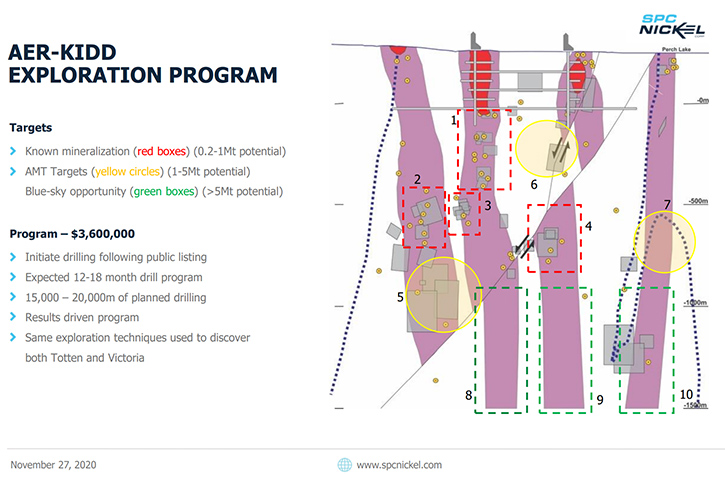

Grant Mourre: Our objective is to get our public listing completed before the end of Q1 . Once that's done, we already have the money in the bank, so we're in a great cash position. We have over $8.5 million in cash in the bank right now. So we're going to have a very aggressive exploration program for the next 12 to 24 months. We're going to focus on our Aer-Kidd property, because we feel that property has the highest ceiling on it. There's the ability to discover one of these world-class deposits on that property. So we'll be tackling that property, with a few drills turning as soon as we’re listed.

We have a 20,000 meter program planned. A lot of this drilling in Q1 is deep, so it does take a long time to drill the holes. It is high-risk, high-cost drilling, but it's very high reward if we are successful.

Our other prospective property is called Lockerby East. That property has a resource on it of 10 million tons. It's lower grade, but it's potentially an open pit, sort of ramp scenario. So we'll be advancing that project, looking more at the economics of it and seeing if we can move that project forward. We also have a third project, which is more of a palladium, platinum, nickel, copper property that's just outside of Sudbury. We've been working on that one throughout this listing process. We should be having some news coming out in the new year, about some channel sampling that has been completed. We completed some geophysics and we'll probably be drilling that property in 2021. We will be really busy, between two and three drills turning all year, with lots of geophysics and other programs going on.

Dr. Allen Alper: Oh, that sounds excellent, Grant. Could you explain to our readers/investors that not all nickel deposits are equal?

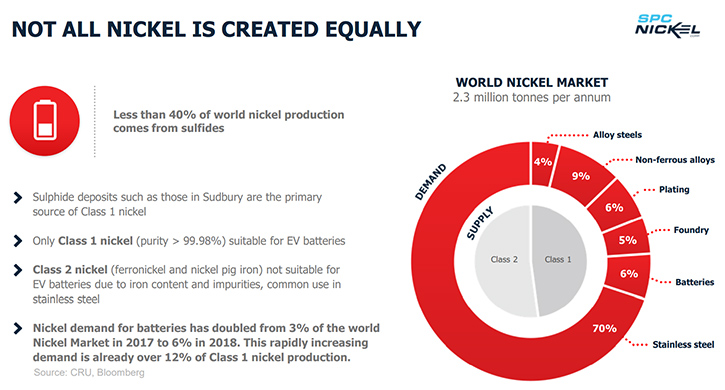

Grant Mourre: Nickel is primarily used in stainless steel. That accounts for about 70% of the consumption right now. Nickel is divided into two groups, called class 1 nickel and class 2 nickel. Class 1 nickel, is a high purity nickel that comes from nickel sulfide deposits. So that's the type that we see in Canada, Australia and parts of Scandinavia. These deposits are typically in the million ton to 10, 20 million tons. This nickel sulfide mineralization comes from some of the big mining camps and is used for the high purity nickel that goes into the EV batteries.

The other type, the class 2 nickel, ferronickel or your nickel pig iron, comes from nickel laterites, primarily in places like Indonesia and the Philippines. It’s used primarily for stainless steel. In certain situations, there is the ability to convert some of that class 2 nickel into class 1 nickel, but that's using these big expensive plants, called the High Pressure Acid Leach plants, or HPAL plants. These things typically have been very expensive to run and usually don't seem to operate quite as well. An EV boom is forecast to be happening over the next 10, 20, 30 years. It is going to need a lot of nickel sulfide, in order to supply the nickel needed for the batteries. So that's where places like Sudbury are going to play a big role.

Dr. Allen Alper: Well, that sounds excellent. I know you have a great background, Scott and you received several awards. Could you tell our readers/investors about your background and your Team?

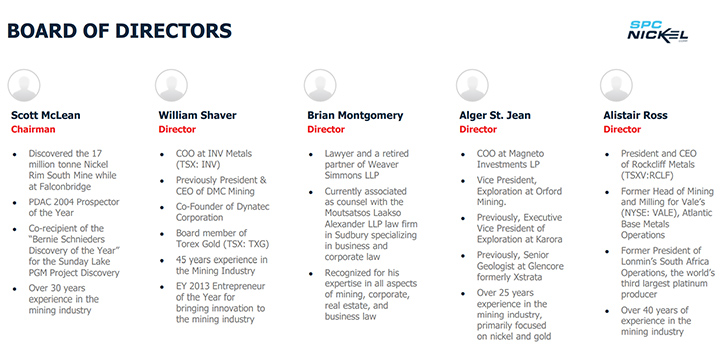

Grant Mourre: Yes, our Team is building the Company right now. I'm the CEO. Scott McLean, who was the previous CEO, is moving into an Executive Director role, and our CFO is a gentleman by the name of Guy Mahaffy. Scott and I have worked together for years at SPC Nickel and previous companies, also at Falconbridge and Xstrata and Glencore in Sudbury. During that time, we've done a lot of exploration for nickel in the Sudbury basin and have been fairly successful in making discoveries. Scott was involved with the Nickel Rim discovery in Sudbury, for which they won the Prospector of the Year award in 2004. And both Scott and I were involved with the Sunday Lake PGM discovery around Thunder Bay, for which we won the Northwestern, Ontario discovery of the year award in 2013.

So we have a good, strong, basic technical team. We're looking to build the rest of the parts right now, adding senior geologists and project geologists. We're working on building up the Team, to have the right people in place, when the drills start turning. We do also have a good strong Board, with a lot of guys that are familiar with the nickel space, but also familiar with building mines and developing mines. We also have some good exposure to the economic market side, with some recently added Directors to the Company. Overall, we're a small group right now, but we're building into a larger, really focused team.

Dr. Allen Alper: Oh, that sounds excellent. Very, very strong accomplished group and very knowledgeable about nickel in the Sudbury area.

Grant Mourre: Yes. Nickel can be a tough commodity to find. In fact, I've spent my entire 20, 25 year career exploring for nickel and PGEs, and I know they're extremely difficult to find. You do have to have some experience and expertise. Additionally, although Sudbury is a well-established camp, it is challenging to do exploration in Sudbury because of the depth. Not just anyone can do it. So it really does help to have that experience to be as effective as possible.

Dr. Allen Alper: Oh, that sounds excellent. Grant, could you tell our readers/investors about your share and capital structure?

Grant Mourre: Sure. We just completed a financing where we raised a $7.8 million. Primarily it was special warrants for hard dollars at $0.20. We did raise a little bit of flow-through in that at $0.24. We currently have about a 100 million shares, outstanding. Fully diluted, we're around about 110. Based on the financing, our share price is about $0.20. That gives us a pre-listing financing market capital of around $20, $22 million right now, with about $8.5 million in cash.

Dr. Allen Alper: Oh, that sounds excellent. Grant, could you tell our readers/investors the primary reasons they should consider investing in SPC Nickel?

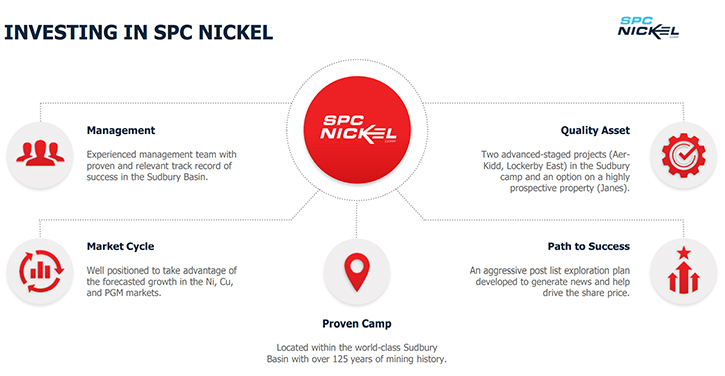

Grant Mourre: Sure. First, we have a good experienced Management Team, with a proven track record of success in the nickel market, and also in the Sudbury basin. We're well-positioned to take advantage of the forecasted growth in the nickel, copper and the PGE markets. So we're right at the beginning of this cycle. In the past, junior companies have gotten into these cycles towards the end and were hurt, when it started to drop off. But we're at the beginning of what could be a long bull run cycle in these metals.

What sets us apart from other companies is the fact that we are exploring within the world-class Sudbury basin. We have two advanced-stage projects in highly perspective areas, within arguably the best nickel camp in the world. Last and most important is that we're well-financed right now and we have a really aggressive drill program, exploration program, planned on our properties. So we're going to have a lot of news coming out and hopefully, with some success in our drilling that we've seen before, we'll be able to make the share price grow substantially, over the short and long-term, and add value back to our shareholders.

Dr. Allen Alper: Sounds like very compelling reasons to consider investing in SPC Nickel. Grant, is there anything else you'd like to add?

Grant Mourre: When we look at some of our comparable peer companies, we feel like we have a significantly lower market capital, compared to a lot of those other companies and I think that's something that makes us attractive. A lot of the nickel companies, out there right now, have been taking advantage of this boom and interest in the nickel cycle. I think we're going to be poised to be another one joining those ranks shortly. Some of our comparable companies have market capitals anywhere from $60 to over a $100 million. And we feel we have comparable projects, we're well-financed, and there's a lot of room for growth for our stock price and our Company.

Dr. Allen Alper: Oh, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.sudburyplatinumcorp.com/

Grant Mourre

Chief Executive Officer

SPC Nickel Corp.

Tel: (705) 669-1777

Email: gmourre@spcnickel.com

|

|