Kenorland Minerals Ltd (TSX.V KLD): Accomplished Team, Large Scale Exploration, Making Completely New Discoveries in Quebec and Alaska; Zach Flood, President, CEO and Founder Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/12/2021

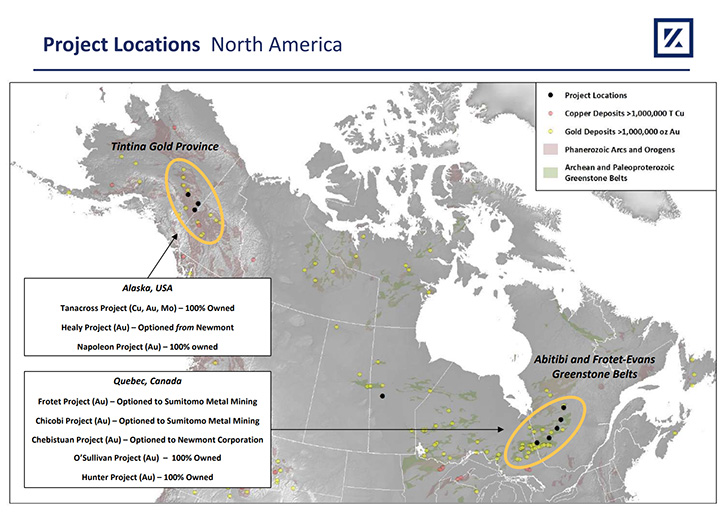

Kenorland Minerals Ltd (TSX.V KLD) currently holds three projects, where work is being completed under an earn-in agreement from third parties. The Frotet and Chicobi Projects, which are both located in Quebec, Canada, are optioned to Sumitomo Metal Mining Canada Ltd. The Chebistuan Project, also located in Quebec, is optioned to Newmont Mining. The Company also owns 100% of the advanced Tanacross porphyry Cu-Au project, as well as an option to earn up to 70% from Newmont Corporation on the Healy Project, both located in Alaska, USA. We learned from Zach Flood, President, CEO and Founder of Kenorland Minerals, that with a large land position, the Company's exploration model is to carry out large scale systematic exploration -, with initial property-wide regional geochemical surveys and then narrowing down targets to make completely new discoveries, like the bona fide high-grade greenfields discovery they made last year in Quebec. According to Mr. Flood, this year Kenorland plans to look for a new discovery in Alaska, where they have found a brand new very large-scale gold anomaly, that had never previously been recognized.

Kenorland Minerals Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Zach Flood, who is President, CEO and Founder of Kenorland Minerals. Zach, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

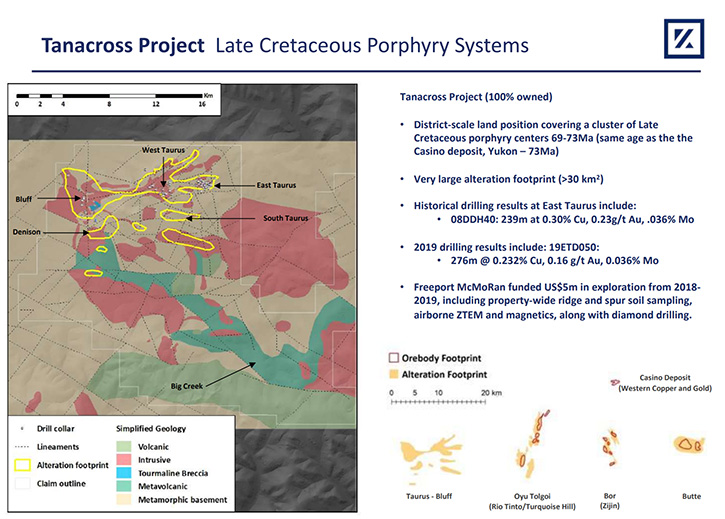

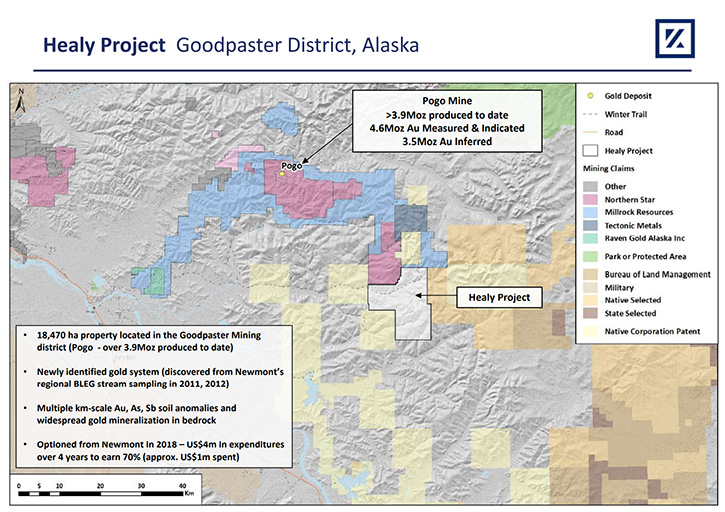

Zach Flood: Absolutely, Allen. And thanks for inviting me to be part of this. Kenorland Minerals is a mineral exploration company, focused mainly on earlier stage exploration in North America, with a commodity focus on gold, but we do have exposure to copper and nickel as well, through a few of our projects. Most of our portfolio is within Quebec. We have four projects in the Abitibi greenstone belt and one in the Frotet-Evans greenstone belt. We have two other flagship projects in Alaska in the Yukon-Tanana Terrane, within the Tintina Gold Province. One of those is a porphyry copper project called Tanacross. The other is the Healy Gold Project, which is in the Goodpaster District.

We started this Company in 2016, really built it from the ground up, organically growing our portfolio and our partnerships along the way. Originally, our business model was project generation, so we went out and staked large land packages and then brought in partners to fund the exploration. We worked with Freeport up in Alaska on our porphyry copper project for two years in 2018 and 2019. And currently we have two active earn-ins with Sumitomo Metal Mining in Quebec and another with Newmont Corporation in Quebec as well, where they're funding exploration and we remain the operator.

I think what really separates Kenorland from the herd is the scale at which we are carrying out our early stage exploration. We have over 400,000 hectares of minerals tenure between these jurisdictions, mostly within Quebec and Alaska, and also nickel targets in the southern Thompson Nickel Belt in Manitoba. With such large land positions, what we're trying to do on these projects is to carry out large-scale systematic exploration. Initially we begin with a property-wide, regional geochemical survey, for example, in order to screen these large areas and hopefully narrowing them down to the most significant anomalies representing new mineral systems, which ideally had never been identified previously. This approach has worked out well for us so far.

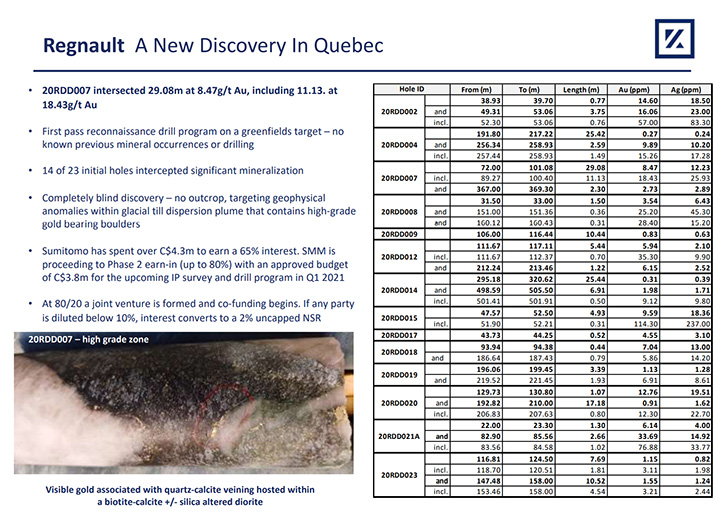

We made a new discovery in Quebec early last year, which is proof of concept that this approach can be effective. In the Frotet-Evans belt, we drilled a completely blind target after two years of systematic exploration and we hit 29 meters at eight and a half grams in a new gold system that was totally concealed under cover. There were no mineral occurrences previously associated with that and no drilling, so it was a bonafide greenfields discovery that we made. We're really excited to advance that.

We have another opportunity that's pretty much in the same setup in the Goodpaster District in Alaska. This is, again, another gold system that had never previously been recognized, there were no known mineral occurrences there either. But now we have a very large-scale gold anomaly in soils, and we've added a lot of detailed geophysics to that last year. This year will be the initial diamond drill campaign on that program. So again, focusing on that greenfields end of the spectrum, making real new discoveries, that's really our approach. And I think when you're playing in that space, you need to cover a lot of ground, doing it as systematically is possible as well.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors your primary goals for 2021?

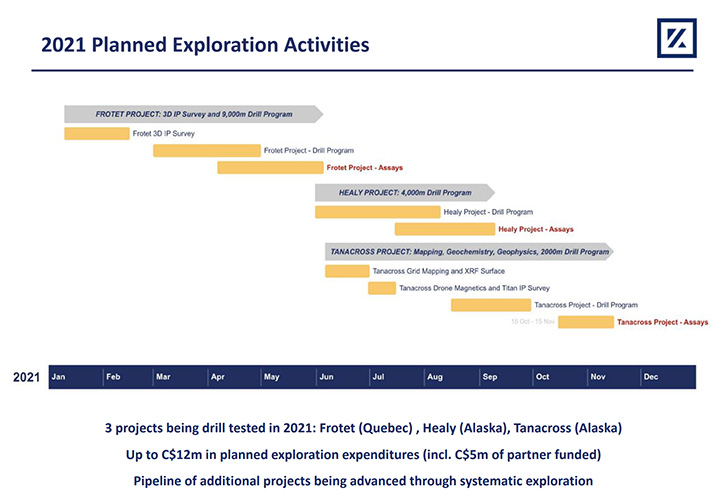

Zach Flood: 2021 is going to be a very exciting year for Kenorland. We are drilling three of our projects, which are all discovery stage. At Frotet, where we made the discovery early last year, we're drilling 9,000 meters starting in March, carrying on through April. So two months of drilling there, with two rigs in Northern Quebec. And then we will be drilling the Healy Project, in Alaska, from June, July into August and that'll be a 4,000 meter diamond drill program. And then the Tanacross Project, which is the porphyry copper project in Eastern Alaska, we'll be putting about 2,000 meters of diamond drilling into that from mid-August into September. So there will be diamond drilling and assays coming from those programs all the way from March into November. It's a very exciting year for the Company and for investors who are involved.

Dr. Allen Alper: Oh, that sounds like it will be very exciting and a lot of news will be flowing for your investors and also your stakeholders, so that's excellent. Could you tell our readers/investors a little bit about your background and your Team and your Board?

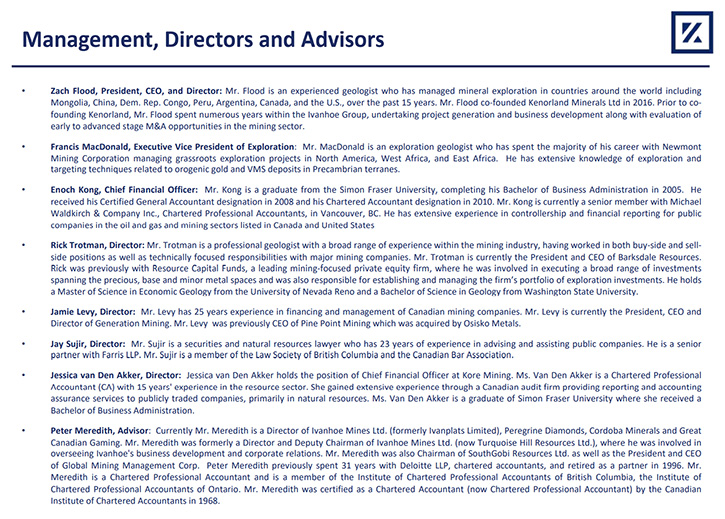

Zach Flood: Certainly. Three of my colleagues and myself, who still work with the Company, co-founded Kenorland in 2016. We're all geologists by trade, so it's quite a strong technical team in that sense. Two of the co-founders are ex-Newmont employees. Francis MacDonald, our Executive Vice President of Exploration was with Newmont, doing regional exploration in East Africa and West Africa with Newmont for the nine years leading up to starting Kenorland. Scott Smits, our Chief Geologist, was involved in a lot of project evaluation for Newmont in North America for the years leading up to creating Kenorland as well. And Dave Stevenson was more recently completing a postdoctoral at the University of Western Australia, at the Center of Exploration, focusing on large-scale structural geophysics. Myself, I had spent a number of years, during the downturn, within the Ivanhoe Group, focused on project evaluation and business development, looking and assessing projects globally, anywhere from the early stage all the way through to development-stage projects.

So we've all had very broad experiences globally, in various stages of exploration and development and different styles of mineral systems. And together, we created a very strong technical team. The other Directors of the Company, aside from myself, include Rick Trotman. He's the President and CEO of Barksdale Resources. Prior to that, he was with Resource Capital Funds. Jamie Levy is CEO and Director of Generation Mining. Jay Sujir has around 25 years, as a securities lawyer, in the natural resource sector in Canada and is very well experienced. Jessica van Den Akker currently is the CFO of Kore Mining, a gold development company with assets in the US.

Peter Meredith is an Advisor to the Company, and Peter was a long-time Director of Kenorland since we started the Company in 2016. He's still involved as an advisor. And Peter has a long history in the Ivanhoe Group. He's the current Director of Ivanhoe Mines and he's been working with Robert Friedland there since the days of IndoChina Goldfields. Peter comes with a wealth of experience and knowledge and is a personal mentor of mine.

Dr. Allen Alper: Well, you have a very accomplished and experienced, proven Team and Board, so that's excellent. Could you tell our readers/investors a little bit about your share and capital structure?

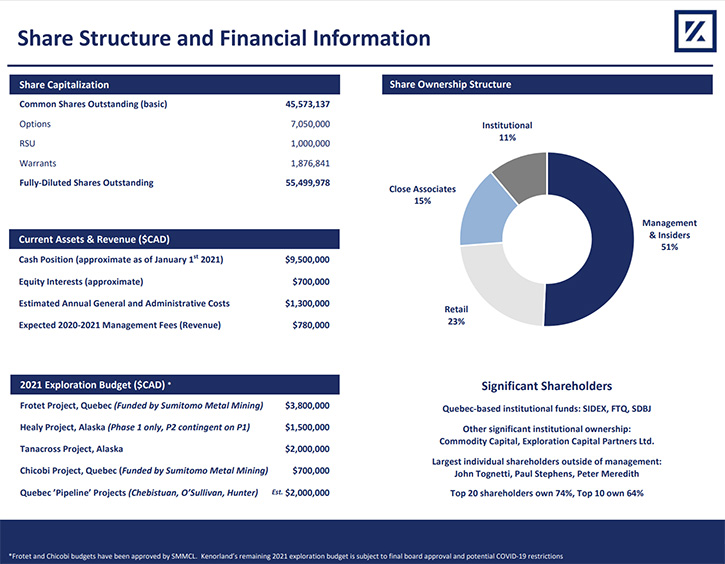

Zach Flood: Certainly. There are around 45.5 million common shares outstanding. There are 55.5 million fully diluted, when you include options, RSUs and warrants. Our current cash position right now is about $9.5 million in the bank. We do hold around $700,000 in equity interest, in other companies. In terms of ownership, Management and insiders own around 51%. This includes our largest individual shareholder, John Tognetti. John is the Chairman of Haywood Securities, a brokerage firm here in Canada. And he's a long-time supporter of Kenorland, all the way through our years as a private company, since 2016. We have, on the institutional side, around 11% interest there. That includes the Quebec-based institutional funds, SIDEX, FTQ and SDBJ. And there are two other funds that have significant positions, Commodity Capital and Exploration Capital Partners Limited. Exploration Capital Partners is a fund under the Sprott umbrella.

Other major individual shareholders include Paul Stephens. Paul is a well-known US generalist investor and a long-term shareholder of a few other project generators. Peter Meredith is in that group as well, close associates that own around 15%. On the retail side, there's about 23% ownership there, so it's fairly tightly held. The top 20 shareholders own 74%. The top 10 own 64%.

Dr. Allen Alper: It sounds like you're very strongly supported and you're very well financially situated, so that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Kenorland?

Zach Flood: Absolutely. In our industry, we firmly believe that the largest value-creation events occurred during the discovery of new mineral deposits. That is where the most value is created in the life cycle of these companies. And we are right at that cusp, where we have an initial discovery made in Quebec, a very high- grade gold discovery there. We'll be drilling that out. We are a minority interest. Sumitomo does own majority there. However, we can maintain our 20% interest in the project and if it becomes a very large project, that's extremely accretive in terms of our value.

Healy is a very similar setup to this, so there's been no diamond drilling on that gold system up in the Goodpaster District, where you have another 10 million ounce deposit in the district at Pogo. So we're in the right rocks. We have great geologic analogs for these targets and they have very big footprints. They seem to be large systems of significance and most importantly, they've never been discovered before. So that's the time you want to get involved as a shareholder, when the drills start testing the targets and hopefully proving up new discoveries.

Dr. Allen Alper: Well, those sound like very strong reasons for our readers/investors to consider investing in your Company. Zach, is there anything else you'd like to add?

Zach Flood: Another reason to get excited is the team behind this Company. We're committed to continually generating new projects and new ideas. These are very high-quality projects themselves, but it is exploration at the end of the day. We know that we need to continue to come up with new ideas and continue testing new targets well into the future. It really is, I think, a solid exploration company and exploration story, and we're here for the long term.

Dr. Allen Alper: Well, that sounds like you have an excellent Company. You're in excellent locations, have a great team and great financial backing, so it sounds like you have everything working for you and you have extensive drilling program plans, all great things.

Zach Flood: Yes, now we just need the rocks to deliver.

Dr. Allen Alper: You have the right people in the right place, so you have a lot going for you.

Zach Flood: Certainly.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://kenorlandminerals.com/

Kenorland Minerals Ltd.

Zach Flood

President and CEO

Tel: +1 604 363 1779

zach@kenorlandminerals.com

|

|