Monarca Minerals, Inc. (TSX-V: MMN): Portfolio of Three 100% Owned Silver Projects, in a Highly Productive Belt in Mexico; Carlos Espinosa, President & CEO and Michael R. Smith, Exec VP of Exploration Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/10/2021

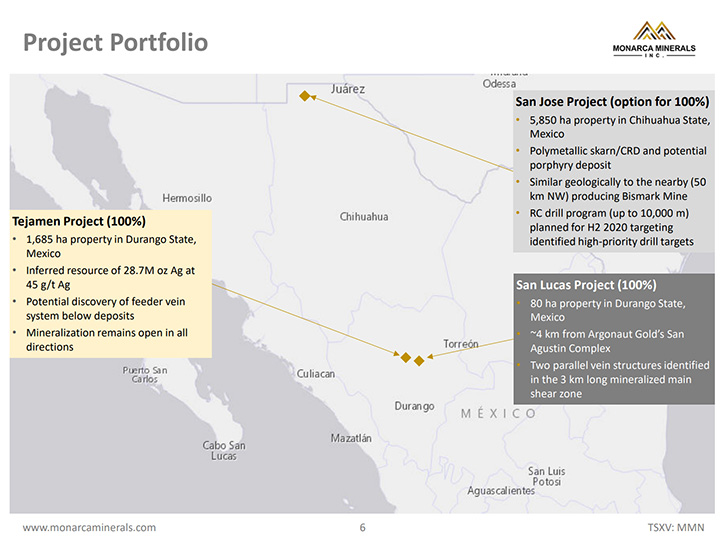

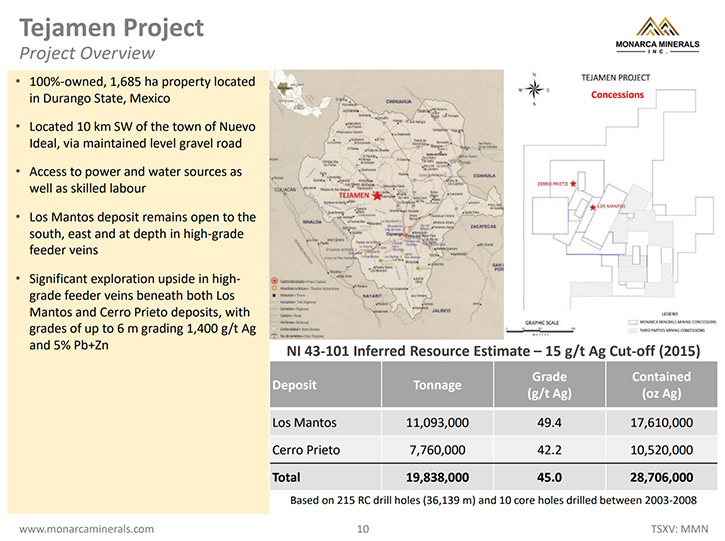

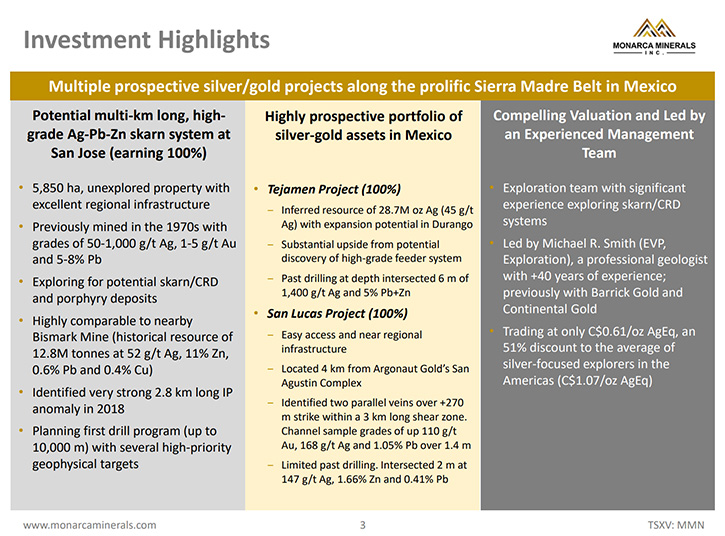

Monarca Minerals, Inc. (TSX-V: MMN) is focused on their portfolio of three 100% owned silver projects, along a highly productive mineralized belt in Mexico, including their Tejamen deposit in the state of Durango, that has an Inferred Mineral Resource of 19.8 million tonnes, at 45.0 g/t Ag (28.7 million ounces of contained silver). The Company's second property is the polymetallic skarn/CRD and potential porphyry, San Jose Property, located in Chihuahua State. The Company's third project is the San Lucas Project, in the State of Durango. We learned from Carlos Espinosa, who is President, CEO & Director of Monarca Minerals, and Michael R. Smith, Executive VP of Exploration, that starting early March of 2021 they will be drilling at the San Jose project, to identify the potential grades of the deposit. Next, upon securing additional financing, Monarca Minerals plans to conduct drilling programs at their two other properties.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Carlos Espinosa, who is President and CEO and Michael R. Smith, Executive VP of Exploration of Monarca Minerals. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Carlos Espinosa: Absolutely, Al. Thank you very much for the opportunity. Monarca Minerals is a junior exploration company, a Canadian company listed on TSX Venture Exchange. We have assets in Mexico. We have three assets, San Jose project, San Lucas and Tejamen. Tejamen and San Lucas are located in the state of Durango and San Jose in the state of Chihuahua. Border States are very, very, friendly to mining and they're very good projects. So we are very excited about them.

As I mentioned, Monarca Minerals is an exploration company. We still, are far from production, but we have very, very good assets and we have a great local Team as well in Mexico.

Dr. Allen Alper: Maybe Mike could tell our readers/investors a little bit more about the deposits and the various projects and the resources.

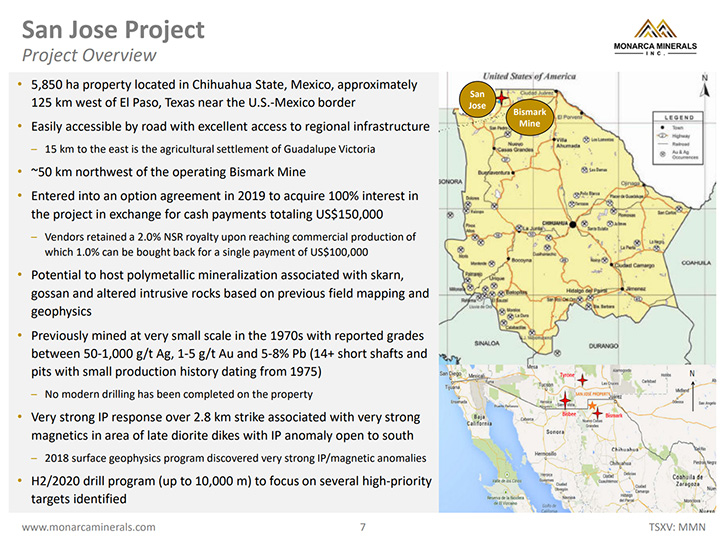

Michael R Smith: We have three projects right now. The principal one that we're most focused on immediately is the San Jose project, which is located just inside the border of Mexico, about 30 kilometers south of the border with New Mexico. It's located about a two-hour drive west of El Paso, Texas, or Juarez, Mexico. It's a project that is a skarn and possibly a porphyry, carbonate replacement style of mineralization. We see a significant area of mineralization at the surface, where, we see mineralization in limestones and causative intrusives.

It's an area that we first looked at about five years ago, Carlos Pacheco, who is a really key person in the Company, and I. Carlos is our Country Manager for Monarca. Excellent guy! We've worked with him for over 10 years. He took me to look at the property. It's a property that other companies had overlooked. It's never been drilled and what we see at the surface is mineralization that is representing leakage from a very large system of skarns and potential carbonate replacement deposits at depth.

We saw lots of impressive grades. At the surface, we saw grades up to, approaching 10 grams per ton, gold, and about 250 grams per ton, silver. That's an area that has half a dozen, or a dozen or so, small mines. The biggest mine is a shaft that's 30 or 40 feet deep. So it's never had any significant historical production. It was only realized that it was there in the early 1970s.

Carlos Pacheco and I went and looked at it and I was very impressed. Having years of experience, decades really, of experience in skarn systems, I saw a significant mineralization at the surface. We went in and did a 160 plus sampling program, chip channel samples, across the mineralization, we see at the surface. And we got significant grades over an area of about three kilometers of strike length.

My interpretation was, it indicated something very large at depth. So we did a geophysical program there, and have approaching three kilometers of strike length, very strong IP anomalies, which represents sulfide mineralization. We see high-grades at the surface, which are leaking from something big at depth, which is demonstrated by the IP geophysics as well as the magnetics work that was done there. So we're preparing to drill an initial 5,000 meters, or so, at the surface, targeting the strong IP anomalies. From there, we'll do additional drilling as we have results in the first phase of drilling.

The other two properties that we have are located in, more or less, the central portion of the state of Durango, in central Mexico. They're both easily accessible by paved road. The Tejamen property is a property that's been in the portfolio for a number of years. The San Jose project is something that came into the portfolio in 2019. And so we've put together continued evaluations of the Tejamen project. It has a 43 101 resource of about 29 million ounces of silver. The mineralization that's been drilled so far is very shallow and would be amenable to open pit, heap leach mining, which is very low cost.

But we also have discovered and realized the importance of very high-grade veins, with grades over 1,600 parts per million silver, associated with lead and zinc, and very high-grade veins underneath the mineralization. We see a shallow depth from the surface down to about 200 meters. So we're anxious to get in there and do that drilling to follow up on the very high-grade veins that feed into and form the surficial mineralization.

It's an epithermal silver system, very much like some of the other silver deposits scattered all through Mexico. In many ways it's very similar to Coeur’s Rochester Mine in central Nevada, which is an open pit, heap leach silver operation, operating at an average grade to pad, the leach pads, of about half the grade of what we see at Tejamen. The focus there is going to be working with the community and getting in there and drilling as soon as we can.

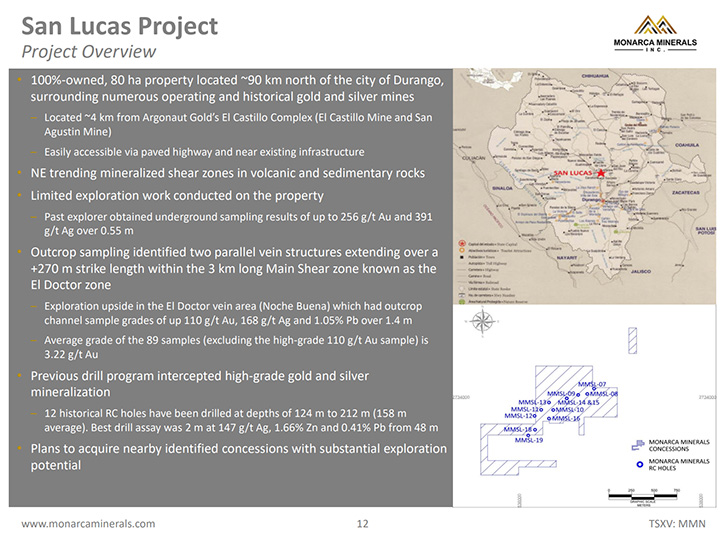

The other property is San Lucas, which is very close to Tejamen. We have significant mineralization at the surface. We took about 60, almost 70, samples from the surface and the mineralization we have, we had one sample that was 110 grams per ton, gold, very, very high grade. Significant silver mineralization, also at the surface, and two parallel shear zones that are mineralized. It's very well-located, it's only about four kilometers away from the San Agustin mine that Argonaut is putting into production, right in that immediate area. So we're in elephant country.

It's an issue there where we have to enhance the claim package, which is pretty limited, about 90 hectares, but we're in discussions with the owner of the surrounding claims, in order to increase our land package from 500 to 1,000 hectares. The mineralization is very strong at surface. It simply needs a deeper drilling. All the drilling that was done there, was down to about 200 meters and we see significant potential and relatively shallow depths below the base of the volcanics and carbonate rocks that may be there.

Dr. Allen Alper: Ah, that sounds excellent. Mike, could you tell our readers/investors your primary goals for 2021?

Michael R Smith: 2021 is focused on getting drilling into the San Jose project. We have an excellent relationship with the community. We're finalizing the contracts to lease the surface from the community. It's something we can get into very quickly and drill. Drilling is very prospective, based on the geophysics that's been done.

It's a geo-physical discovery. We just simply have to demonstrate the tenor of the grades once we do this drilling. Our primary focus this year, is to get drilling started, probably in early March. WE are expecting very good reports of significant mineralization in the drilling. From that point on, we'll look at additional financing to do additional drilling on that property, as well as, hopefully, be able to start doing work, later in the year, in Tejamen and San Lucas.

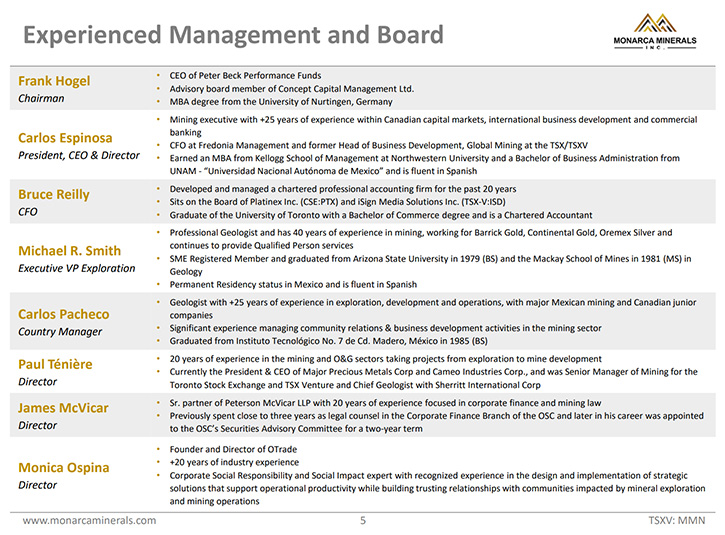

Dr. Allen Alper: That sounds excellent, Carlos, maybe you could tell our readers/investors about your background, and your Management Team and Board. Then Mike could talk about his background.

Carlos Espinosa: Absolutely. I was born and raised in Mexico, moved to Canada over 20 years ago. I'm fully bilingual, English and Spanish. Also, I perfectly understand the business culture in both countries. So these have been very helpful to build the relationship between the local subsidiary in Mexico and the Head Office here in Canada. My background is in business. I have a Bachelor’s Degree in business from Mexico, and then, an MBA from Kellogg School of Management, Northwestern University in Chicago.

I've been involved in mining for almost 15 years. I moved to Canada because I was appointed as a Deputy Trade Commissioner of Mexico to Toronto. My role was to work with Canadian companies investing in Mexico. I worked with Canadian companies in the mining and manufacturing space. In 2011, I was invited to join the TSX and TSXV, and I worked there for five years. I was the Head of Business Development, Global Mining. My role there was to recruit mining companies from all over the world to go public in Toronto.

So that's the time when I became involved heavily in the industry, and learned more about the industry. I also built a very strong network, both in Canada and overseas. So after 2015, I left TSX and I started consulting with mining companies that do business in Latin America. I also worked with some Latin American companies who want to go public in Toronto. I became involved with Monarca, initially, as one of my clients in 2016. Then they invited me to join the Board. One year later, they appointed me President and the following year CEO, having a process of getting involved in the Company and putting all the pieces together.

This is really team work. Mike is our great technical guy. We have our Country Manager, Carlos Pacheco, who is also a geologist, a Mexican fellow who has been doing mining for probably 25 years in Mexico. So, he knows very, very well the industry and the Country, so he has been a great asset to us. Our Board is a mix of office skills. We have a lawyer, James McVicar, who is part of the Board. He's a great advisor on all the legal matters for securities here in Canada.

We have Frank Hogel. Frank is an investor out of Germany. He has been able to bring a lot of investors from Germany to Canada. They've been supporting Monarca, for the last several years.

And we have Paul Ténière. Paul used to be the geologist for TSX and TSXV. We used to work together there. Paul, with his technical background and regulatory expertise, is very, very useful as well, together with Mike, advising us in terms of how we should present and review the information we provide to the investors. We want to do everything in the right way, so we make a very good team!

The last member who joined the Board, Monica Ospina, is a woman from Colombia, who has been living in Canada, for over 20 years. She's an expert in CSR. She has been working with companies in Mexico, Columbia and Ecuador, especially on relationships with the communities. She joined the Board in the middle of last year, in June 2020. She has been very, very helpful improving our relationships with the work communities.

We have a very, very good balance in expertise. Mike Smith is here so I’ll let him continue.

Dr. Allen Alper: Great.

Michael R Smith: Thank you. I'm from Arizona and currently live in Arizona, so I'm very close to the San Jose project. I'm a geologist with 40 years of operations development and exploration experience. I've worked in various operating mines in Nevada from '83 to '87, generally smaller mines underground and open pit, both, gold and base metals and silver. I went on to be the Chief Geologist at the Goldstrike mine from '87 to '93. I was in charge of ore control and worked with production of long range, short range, mine planning, with the engineering staff.

I ran the Hydrology Department for a while and set up the QA/QC program for the mine, giving me a breadth of experience there in operations. Then I was shipped off by Barrick, to open up operations for Barrick in South America, out of Lima, Peru in 1993. I was there through 1996. I put together, with consultants, the pre-feasibility study for the Cerro Corona project, which Barrick ended up abandoning and now Goldfields has in production. It's a porphyry gold, copper deposit.

In the meantime, while there, I had a chance to look at some mineral properties in Columbia in '95. So I left Barrick in '96, seeing the huge gold opportunities in Columbia. It was a great place to work, because there were only one or two other “gringos” in the entire Country, trying to develop mining properties. And so there was little or no competition in Columbia. I went on to be the Founding CEO and President of Continental Gold, when they were a private company. I left Continental Gold in 2008. Between leaving Barrick and becoming heavily involved in Colombia, I set up a civil engineering business here in Arizona. So I have a lot of hands-on planning experience.

Once I left Continental Gold in 2008, I started doing consulting work in Mexico, which is where I met Carlos Pacheco, and then eventually, Carlos Espinosa. So I’ve had a lot of exploration experience in the last 15 or 20 years in Colombia and Mexico. In Barrick days, I was running everything in Bolivia, Peru and Ecuador. Then I went on to be with Continental Gold, who had great success with the Buriticá deposit, outside northwestern Medellin, Colombia. So that's basically my experience, a broad range of exploration development, project development and operations.

Dr. Allen Alper: Well, that sounds excellent, Mike. Sounds like you and Carlos have a fantastic background. You have a great, diversified team. So that's excellent! Carlos, could you tell our readers/investors about your share and capital structure?

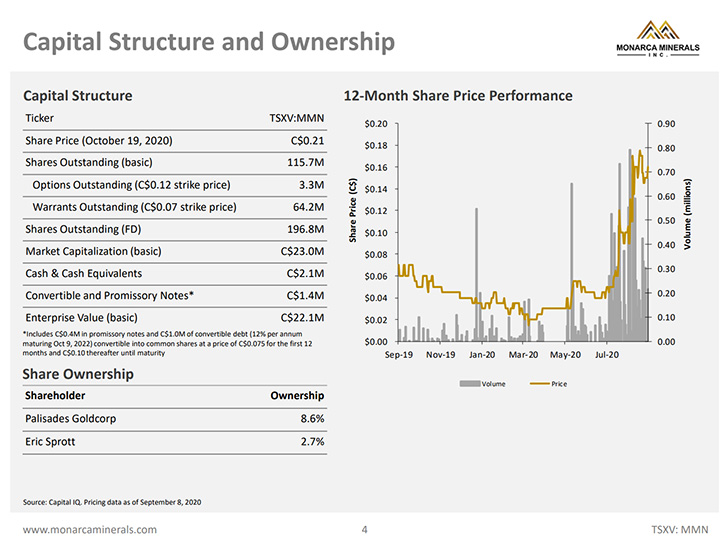

Carlos Espinosa: Absolutely. Absolutely. We finished a private placement last summer. Before the private placement, that share was trading around five cents, because we didn't promote Monarca very much in the past. We were extremely focused on working on the acquisition of San Jose and fixing some of the issues. But after this placement, we raised $3 million and the share price jumped from five cents to 15, 20 cents on average.

Currently, we have 118 million shares outstanding. Options for about 3 million, warrants for 64 million in total. And we have institutional investors, such as Palisades Goldcorp or Crescat Capital among others. We have very, very well-performing shares for the last six, seven months. Since we have enough cash for the drilling program that we are in-process of implementing in the San Jose project, we feel very, very confident that the shares are going to continue performing really well.

Dr. Allen Alper: That sounds very good. Carlos or Mike, could you tell our readers/investors, the primary reasons our readers/investors should invest in Monarca Minerals?

Carlos Espinosa: That's a very good question because we are competing with a very large number of companies for the equity from investors. I mentioned some of the reasons to the investors when we had a chat with them. Currently, Monarca is an under- valuated company. If you see Monarca, compared to some of our peers that are exploration companies focused in Latin America, we are trading still very, very low. We are trading around 60 cents per ounce of silver and the average is around $1.26 per ounce of silver. So we still have a lot of room to grow, compared to some of our peers.

We are very happy and confident with the team we have, both in Canada and in Mexico. We haven't talked much about Mexico yet with you, but we have a really good team in Mexico. We have an office in Durango City and we have a couple of houses rented next to San Lucas project. We are working with the local people, local professionals. We are pretty efficient. We are cheap in terms of operation. We don't borrow much cash. We don’t have the fancy offices in downtown Toronto because we are focused on investing the money in the ground and all of the resources, of course, San Jose project, because we feel confident it is going to be a great success.

Overall, we are building a very good portfolio, San Jose, San Luca, Tejamen. We are always looking for new investment opportunities that could add good value to our portfolio. We are, of course, open to discuss with our investors any questions they have. So we are trying to increase communication, with them, as much as we can, to keep the investors informed of our progress in our projects.

Dr. Allen Alper: Oh, that sounds very good, Mike. Do you have anything to add?

Michael R Smith: We have the San Jose project in Mexico and we're always looking for more like it. We got into it very inexpensively, $150,000 for 100% earn in interest agreement. And the owners retain 2% royalty on production, of which we can buy half for a 100,000 dollars. So we got into the property cheap and that's because we're taking advantage of the knowledge that Carlos Pacheco and I have.

We're looking at other assets that are in Mexico. In particular, at this time, I'm looking at one in Nevada also. But in Mexico, what we focus on is looking at properties where they're not really drilled-out resources, because those are going to be very expensive, to get in and acquire a managing interest in a property like that. What we're focused on is our expertise and decades of combined experience, where we look at properties that are unrecognized for what their real potential is, which is what we saw at San Jose.

With our experience, we saw a very large area of mineralization, significant mineral alteration at the surface that indicated something big at depth, lots of small veins and systems above an area of striking three kilometers. We saw that as leakage from something very large at depth. We did the geophysics, we found the IP anomalies, which give us the reason to expect that there are significant minerals at depth. One of the key features here, is relying on our broad experience in the industry, in order to recognize undervalued properties that other people have overlooked, because they just didn't have the right people looking at it, with the right experience.

Dr. Allen Alper: That sounds excellent. Those sound like compelling reasons that Carlos and you, Mike, mentioned for our readers/investors to consider investing in your Company. Is there anything you would like to add?

Carlos Espinosa: Not from my side, Al. Thank you very much for taking the time and giving us the opportunity to give this interview. In closing, I invite your readers to contact us, to look at our website or our presentations. We've been more active doing webinars, trying to inform the market. So I ask them to stay tuned to the news.

Dr. Allen Alper: Well, that sounds very good. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://monarcaminerals.com/

Carlos Espinosa

President, CEO & Director

Monarca Minerals Inc.

E: cespinosa@slgmexico.com

|

|