Roscan Gold Corporation (TSX-V: ROS; FSE: 2OJ; OTC: RCGCF): Well-Financed Canadian Gold Company with 4 major discoveries in 2020 in West Africa; Nana Sangmuah, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/4/2021

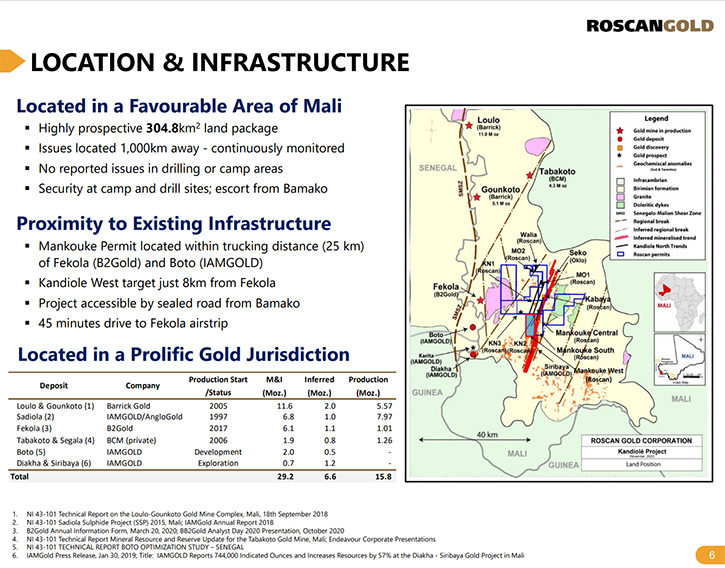

Roscan Gold Corporation (TSX-V: ROS; FSE: 2OJ; OTC: RCGCF) is a well-financed Canadian gold exploration company, focused on the exploration and acquisition of gold properties in West Africa. Roscan has assembled a significant land position of 100%-owned permits around its flagship Kandiolé Project in West Mali, in an area of producing gold mines and major gold deposits.

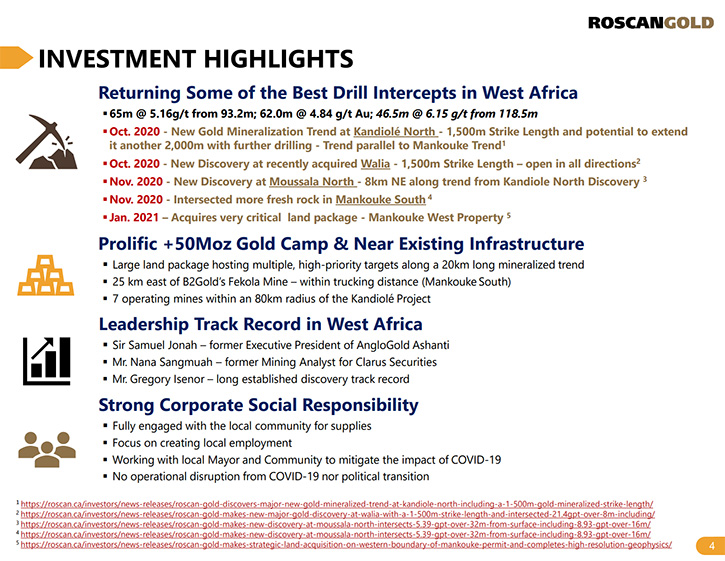

The Kandiolé Project is located east of B2Gold’s Fekola mine and IAMGOLD’s, Boto and Diakha deposits and north of the IAMGOLD Siribaya deposit. We learned from Nana Sangmuah, who is the President CEO. of Roscan Gold, that in 2020 they made four discoveries that drove their stock market value up six-fold. 2021 promises to be a very exciting year of deep drilling to further detail the new discoveries and potentially pick some new ones.

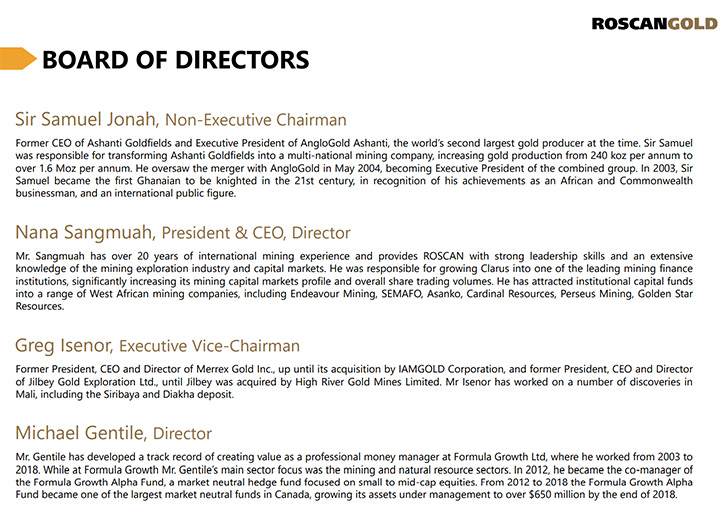

Under the leadership of Sir Samuel Jonah, former CEO of Ashanti Goldfields and Executive President of AngloGold Ashanti, one of the world’s largest gold producers, the Company is well prepared to move their project to full production, and fully unlock its value for shareholders.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nana Sangmuah, who is the President CEO. Could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

Nana B. Sangmuah: We are a junior explorer with an asset in southwestern Mali, right in the middle of a camp that has delineated over 50 million ounces. We have enumerated a number of high priority targets, which we believe could be moved and advanced towards the resource stage. We are in the business of discovery and evaluation. We have a team that can even push the assets towards development to further unlock value.

And what differentiates us from a lot of juniors is, often times you don't have that variety of skillsets in a junior company. They will have to find the resource and oftentimes, pass it on to others to take it the full nine yards. But under the leadership of Seth and Jonah, who operated the second largest gold company, AngloGold Ashanti, as President a few years back and grew a lot of juniors into multi-million market companies. We think we are well-positioned to be able to take the destiny in our hands and move this to full production, if need be, and unlock lots of value for shareholders.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the results you have gotten to date and also what your plans are for 2021?

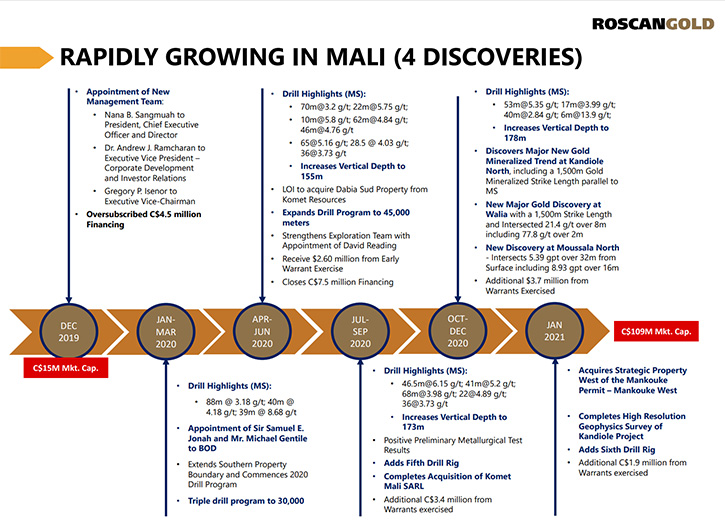

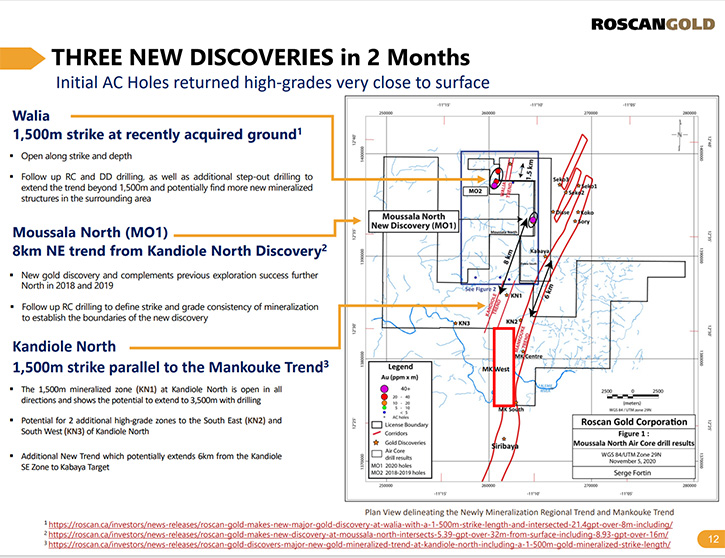

Nana B. Sangmuah: We've reported some of the widest and highest-grade resources over 2020. What was really remarkable for the Company was, in 2020, we made four discoveries. We drilled one aggressively, and this one discovery drove a six-fold increase in market valve. Towards the end of the year, we made three additional discoveries, which we are yet to drill-test in detail. I think that's going to be opening another wave of growth in the story for 2021. But more importantly, we've also completed a geophysics survey, where we have done a very high resolution 100 meter line spacing on all our targets, which has come up with some very exciting revelations. That's going to help us refine our existing targets and discoveries, and potentially pick up some new exciting ones.

It's going to be very newsy in 2021. We just added a sixth rig to our fleet, with potential to drill as deep as 1.4 kilometers, and we think we are dealing with a very deep system here. We should be able to highlight those potentials and show the interconnections of the various targets. But we are clearly in a multimillion camp. We are excited that we should be able to show the value proposition succinctly in 2021.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors about the importance of the region you are in, in Mali?

Nana B. Sangmuah: It's a region that has produced a lot of gold, 50 million ounces delineated and produced. But for the most part, it was done on the main Senegal-Mali share zone, which seemed to be the first order structure that was identified, and areas to the east were very much overlooked. However, what has happened since we started spending exploration dollars here, because all the money was spent on the other main corridor trend. The ground was found by Greg Isenor, who is a founding member of Roscan Gold. We've started revealing that there's another first order structure that is the Siribaya-Mankouke-Kabaya-Seko structure, which seems to be having similar characteristics like the main SMZ zone. However, we are seeing very little allowances because very little exploration dollars have been devoted to it. But now we are spending a lot of money in the ground, we're picking up interesting discoveries. I think we are just in the initial phases of delineating some significant and sizeable ounces.

Dr. Allen Alper: Oh, that sounds very good. Could you highlight and give our readers/investors more information about your background and the team?

Nana B. Sangmuah: Well, I'm a mining engineer by training. I'm originally from Ghana, so I grew up in Africa, live in Canada and have been here for over 20 years. I have been primarily involved in the mining finance business. I was an analyst with Clarus Securities, covering the African mining sector. That brought me a lot of deep understanding and strong connections in this space. That's what I've leveraged to build a very solid reputable team. Our geological team has an average of plus 20 years. They have done work in Western Mali and know the rocks well. They have been quite instrumental in helping us get up to speed and understand the model that we're dealing with very quickly. The Company is really equipped with great talent for what we are doing right now. As we grow, I think because of our success, it's not going to be that challenging to attract the requisite talent that we need for the evolution of the Company.

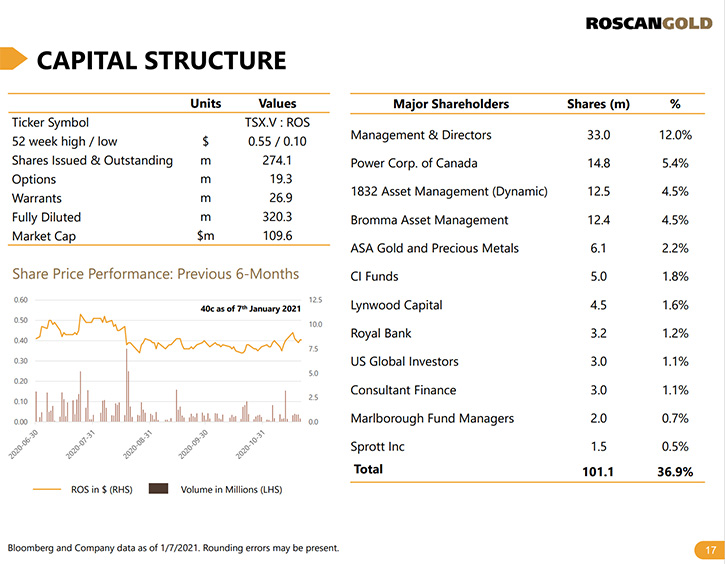

Dr. Allen Alper: That sounds very good. Could you tell us about your Share and Capital Structure?

Nana B. Sangmuah: We have 274 million shares outstanding right now. We have additional options in banks that made the total fully diluted accounts, about 318. We started last year, with about a hundred billion in warrants. That has been whittled down to about 26 million right now. We've removed the warrant overhang, and going forward, what we expect to see is a better reaction in the share price, with a lot of the growth, coming from exercising warrants to grow the market cap. But we are hopeful that the next leg of growth will be from guys just buying stock. That will be moving upon successful news updates.

Dr. Allen Alper: Well, that sounds like an opportunity. Could you tell our readers/investors, the primary reasons they should consider investing in your Company?

Nana B. Sangmuah: If they follow the space, I think people should be aware of the fact that there is a lot of money being generated at this level of commodity prices. There is lots of free cash flow being had. Unfortunately, what that money is going to be used for, comes with very fewer opportunities in the space. We've seen an M&A frenzy. The truth of the matter is, the M&A has never resolved things. It creates an additional allowance in the industry. I would rather build bigger monsters that would need more reserves and resources to sustain them. The backbone of the industry, if you come back to the roots, is discovery and exploration. I don't recall when we had the last major discovery of 3 million ounces at two grams anywhere of significance.

We are sitting on four targets right now. One discovery, three additional ones, together with advanced results. We have a target that we had our results on, and now we think we will be able to make it bigger, be recognised as a junior success for explorers that are making discoveries. That should be well noticed by both majors trying to replenish their reserves. But more importantly, being in the mine and equity cycle, when you are in the discovery phase, provides the best returns that you have in this business. We are not only sitting on one, we've made three additional ones. Our geophysics that's being completed potentially is going to reveal some more. It's clearly the place you want to be in the cycle. I think management has demonstrated a strong capital market savviness, a strong technical savviness, and good relationships with governments. Once there's delivery and output, I would expect a phenomenal response from the market.

Dr. Allen Alper: Well that sounds very good. Could you tell our readers/investors how it is operating in Mali?

Nana B. Sangmuah: Mali is great. I think in all places, you just have to be respectful of the locals, the stakeholders, and make sure that you did become partners of the business. During COVID, we never shut down operations. It provided a lot of employment for the locals, which a lot of peer companies didn't do.

We drove through the rainy season, continuing some employment for people among contractors and our team, we are up to about almost 150 people for a small company like us. The locals and the governments are seeing the benefits. They see that we are very aggressive. We are putting money into the ground and achieving results, and that's also helped us be able to acquire certain strategic plan packages. Like the one we just announced on Monday, which is a significant extension of a mineralized spring onto our grounds. That adds a lot of volume internally. The relationship has been great. We have very limited experts in the Company. I think out of 140 people, employee contractors, we probably have about 10 people as experts and all the rest are local. That sends a strong message that we are very keen to form partnerships as we advance.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add?

Nana B. Sangmuah: It's been a good year, 2020. We've made the discoveries, we are working to explain and showcase the size potential of the discoveries. I think we will make 2021 a very exciting year for us, as we continue to add value through the drill bit. We are getting very excited about the opportunity here. We firmly believe that it's a new structural corridor, with lots of potential both in surface and at depth. We have the money, the rigs and the people to unlock that value and return a healthy return to shareholders. Existing shareholders stay tuned. People looking for somewhere to get a healthy return, you can look no further. Take a seat and enjoy the ride!

Dr. Allen Alper: That sounds very good. We will publish your press releases as they come out so our readers/investors can follow your progress.

https://roscan.ca/

For further information, please contact:

Dr Andrew J. Ramcharan, P.Eng

Executive Vice President – Corporate Development and Investor Relations

Tel: (902) 832-5555

Email: aramcharan@Roscan.ca

Greg Isenor, P.Geo

Executive Vice-Chairman

Tel: (902) 832-5555

Email: gpisenor@Roscan.ca

|

|