Battle North Gold Corporation (TSX: BNAU, OTCQX: BNAUF): Fully Funded to Commercial Production, Owns 2nd Largest Land Package in Red Lake District, Ontario, CA, George Ogilvie, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/3/2021

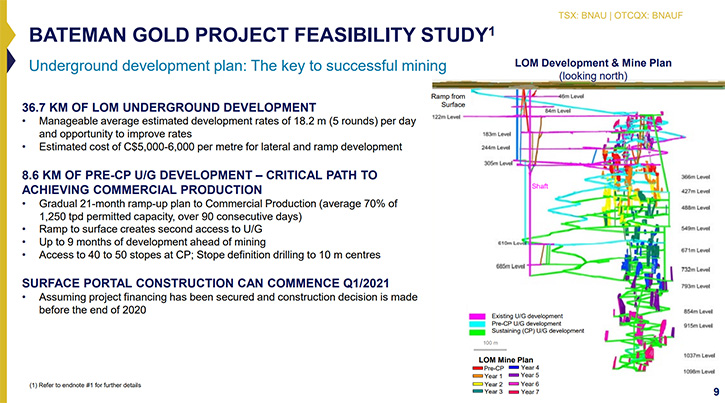

Battle North Gold Corporation (TSX: BNAU, OTCQX: BNAUF) owns the significantly de-risked and shovel-ready Bateman Gold Project, located in the renowned Red Lake gold district in Ontario, Canada and controls the strategic and second largest exploration ground in the district. We learned from George Ogilvie, who is President and CEO of Battle North Gold that the project has a robust maiden feasibility study, completed last October, and it is fully funded through to commercial production towards the end of 2022. The Bateman Gold Project has more than 14,000 m of underground development and extensive infrastructure that includes a 1,800 tonne-per-day mill, a completed tailings management facility, electric power supply and substation, 248-person camp, earth-works and civil-works.

Battle North Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing George Ogilvie, who is President and CEO of Battle North Gold. George, could you give us, our readers/investors an overview of your Company, what differentiates it from others and the highlights during 2020?

George Ogilvie: Absolutely, Allen. Battle North Gold has its primary asset in Red Lake, Northern Ontario, Canada. It's a Tier-One gold mining jurisdiction. For those readers/investors who don't know, Red Lake produced over 30,000,000 ounces of gold, out of the camp, over the last 80 years. It's one of the most prestigious gold mining camps in Canada, if not the world. Our Bateman Gold Project is now fully funded and in the final stages of construction and development. We anticipate that before the end of this calendar year, we will see first gold dore being produced.

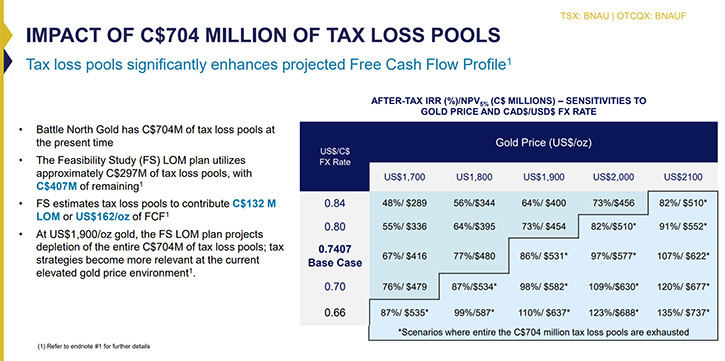

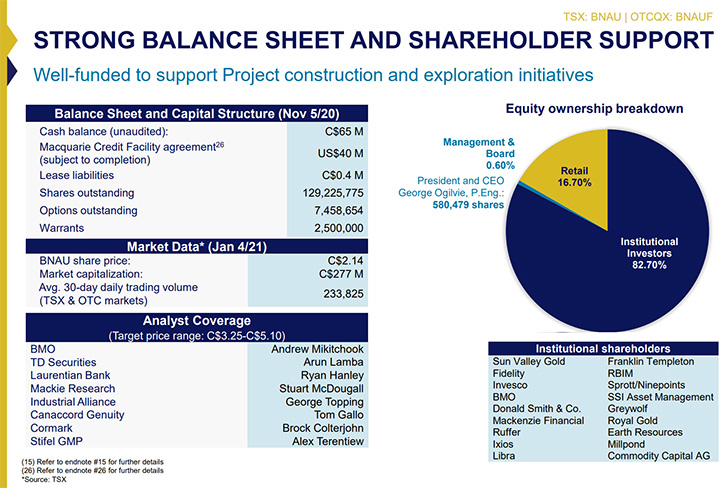

If I had to look at what differentiates us from potentially our peer group, our current market cap is only C$250 million. We have a very tight share and capital structure, with only 129 million shares issued and 137 million shares on a fully diluted basis. There have been over C$770 million of sunk cost put into this project and that in itself has provided us with C$704 million in tax loss pools, meaning that once we start generating profits, we won’t pay any life-of-mine corporate taxes, both provincial and federal tax, which combined would be in excess of 30% today.

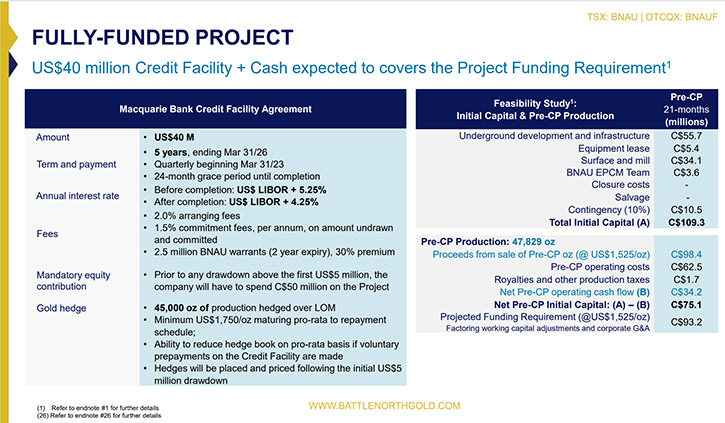

We have significant infrastructure. We're very undervalued considering we are within 12 months of first production. The Company is currently sitting with C$47 million cash in the bank. We've just completed a debt financing agreement with Macquarie Bank, for US$40 million, or approximately C$52 million, over a five-year term. Combined with the C$47 million of cash in the bank, this gives us a fully funded Bateman Gold Project through to commercial production towards the end of 2022.

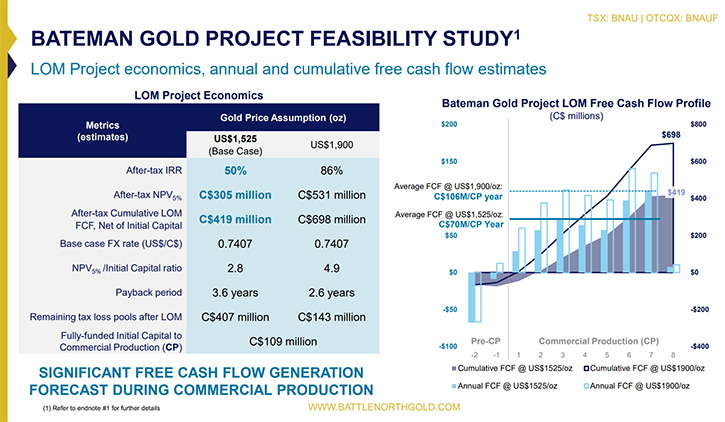

Our main achievement last year was that we completed a robust Feasibility Study on the Bateman Gold Project, with maiden reserves. The reserves were conducted, using a gold price assumption of US$1,375 an ounce and the financial and economic model of the Feasibility Study was completed using a gold price of US$1,525 an ounce. This resulted in a Project with an after-tax NPV (5% discount) of C$305 million and an after-tax IRR slightly north of 50%, and approximately C$420 million in free cash flow over an initial nine year life of mine, of which seven years would be under commercial production. The average annual production of the Bateman Project is approximately 80,000 ounces per year at a C1 cash cost of around US$613 an ounce and an all in sustaining cost of US$865 an ounce. When we layer on the corporate overhead, it gives us about US$1,010 an ounce all-in-cost.

Late last year, we announced the project debt financing agreement with Macquarie Bank, a very well-recognized Commercial Bank and an established lender in the mining space. Our cost of capital was sub-10%. So, pre-completion, we're looking at an interest rate of 5.25% + LIBOR (0.25%), which is about 5.5% money. And then post completion, which is after the declaration of commercial production, the interest rate is 4.25% plus LIBOR, which is about 4.5% money. On top of those fees, we have a 2% commitment fee and 1.5% arrangement fee, which combined is about 3.5%. So, if we add all of that up, we're looking at a 7% cost of capital, which considering our Company size and the fact that we have no producing assets at this juncture in time, I think it's extremely competitive when compared to a lot of other debt financings, which have been announced in the last five years. All in all, Allen, I think it was a very transformational year for Battle North Gold, last year, and we are well set up to have an even more successful year this year.

Dr. Allen Alper: That sounds excellent. Great accomplishments! Could you tell our readers/investors your plans for Battle North Gold in 2021?

George Ogilvie: Yes. Absolutely. Late last year, when we saw the feasibility study results and we had completed an equity financing, which gave us at that time about C$67 million cash in the bank, we had already started with some of the critical path items, within the feasibility study that will take this mine into commercial production and we've continued those in January of this year. Already, at the mine site, we've prepared the portal on surface and have started the ramp development, into the underground workings. We have workings underground already in place. Some 14,000 meters of development is already within the mine, but there are areas where the ramp is not interconnected.

We're busy putting our own crews together, as we speak, and from February, we should be driving the underground ramp in order to make those connections between the levels and to surface. We're also preparing our camp to accommodate our main underground contractors. They’ll be doing some of that ramp work and driving the ramp from surface. We have a 248-person camp on site. It was put in place five years ago, but wasn’t set up for social distancing given the situation with COVID. So we're currently rearranging the camp. We've changed out the kitchen to make it larger so we can practice good social distancing, when our employees congregate for various meals, throughout the day.

Other critical path items this year we will be; putting in an ammonia reactor to treat the ammonia before we discharge it from the tailings pond to the natural environment.

The last critical path item is raising the tailings dam level to further accommodate additional volume of tailings from mine production. That requires the buttressing of the dams to be reinforced in preparation for a two to three meter lift on the dam. The geo-technical work was completed late last year. We're now doing the engineering design work with Knight Piésold, and that will then allow us to start the construction phase in the second quarter of this year. So, we have significant work going on at site with respect to the project.

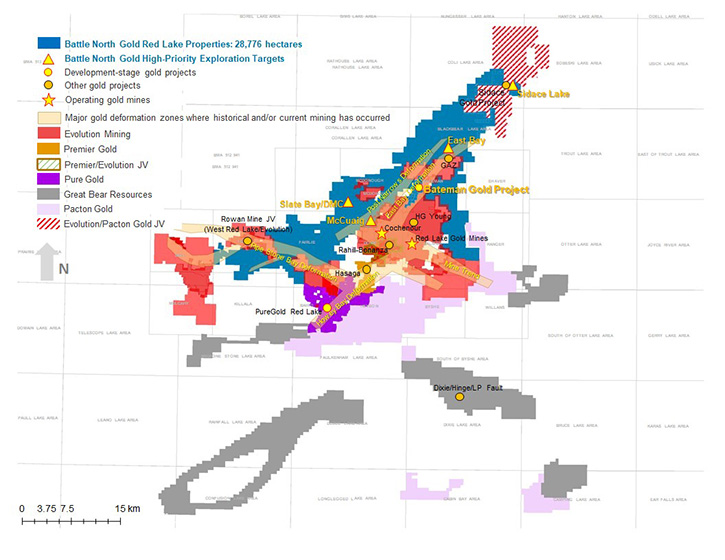

Over and above that, we announced late last year, the hiring of the new Director of Regional Exploration. In addition to the Bateman mine, we control 28,000 hectares of land in Red Lake, which is the second largest land package in the camp, second only to Evolution Mining and that land package has not been explored for over 10 years. So, we've identified our priority targets. We've applied for permits late last year, which have been received and we're now mobilizing our first surface drill to move on to our primary targets in the Red Lake camp, meaning we'll be drilling beginning the first week of February.

We believe that, now that we're entering the construction and development phase of the Bateman Gold Project, this is typically a period of time where share prices of Companies can wane a little bit, as there's limited news flow coming out from the project. We believe that the significant upside opportunity this year from Battle North Gold will come from success with the drill bit from our regional exploration program. We could see our valuation increase significantly, like other peers within the camp, should we see meaningful exploration success.

Dr. Allen Alper: That sounds excellent. Sounds like 2021 will be a very exciting time for Battle North Gold.

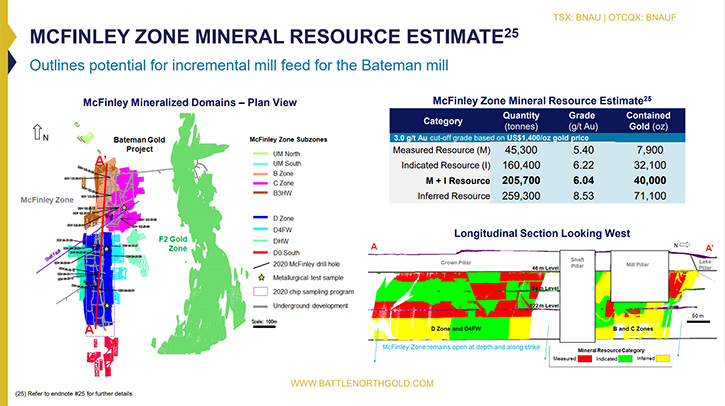

George Ogilvie: Absolutely. We're very excited. If you go back to our previous interviews and you listen to what we said we were going to do and what we've actually delivered on, I think you'll find that in 90% of the case we have absolutely executed on everything we said we were going to do. One of the other additional things that came out late last year was, we delivered an NI 43-101 compliant Mineral Resource estimate on the McFinley deposit, which sits adjacent to the mine site.

We've only drilled it off and have historical results down a couple of hundred meters below surface. The Mineral Resource estimate at McFinley outlines 40,000 ounces of in the measured and indicated category at a gold grade of 6 grams in the ground, and more than 70,000 ounces of inferred material at around 8.5 grams in the ground.

So, we have a least 110,000 ounces of potential incremental ounces that we think we could deliver into the mill, over the next two years, over and above the feasibility study mine plan. The McFinley deposit is currently tied into the underground workings at the Bateman Mine. The main ramp from the Bateman Mine, to which I referred earlier is going to go through the McFinley deposit at the 183 meter level. So, in the next six to nine months, we'll have truck access to enter the McFinley deposit, as well as the Bateman mine. If our stoping plans come together and we can generate some reserves at McFinley, it should give us some incremental tonnes to the mill to further improve the economics from our feasibility study.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors about your accomplished Management Team and yourself?

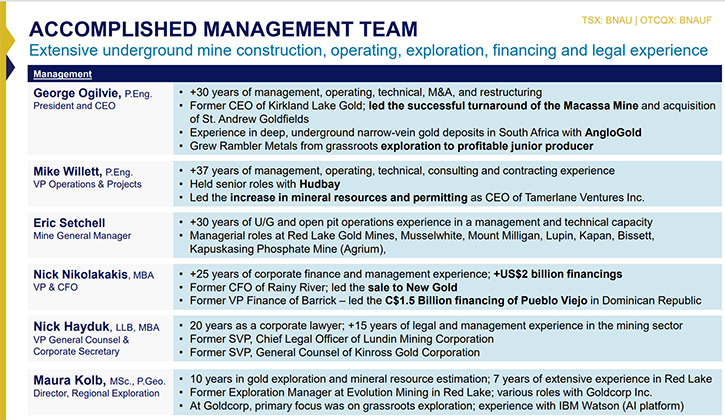

George Ogilvie: I'm a mining engineer originally from Glasgow, Scotland. You might not be able to tell that given the accent, diluted over the years, but I started in 1989 when I graduated from school and went to work for AngloGold in South Africa and spent eight years down there, with ever increasing levels of management positions, cutting my teeth on probably some of the toughest and deepest and most challenging gold mines in the world.

By 1997, I transferred from AngloGold to Anglo Base Metals and ended up with Hudson Bay Mining and Smelting, which was Anglo Base Metals Company at that time. I spent eight years up in Northern Manitoba, both in Flin Flon and Leaf Rapids, managing some of the projects and operations there.

By 2004, I resigned from my position with Anglo and went to work for Dynatec and FNX, in the Sudbury Nickel camp, bringing some of the old Inco mines back into production, such as McCready West, and the sinking of the Podolski shaft under Tony Makuch and Terry McGibbon. Then in 2007, I went to Newfoundland and started up a small grassroots, junior explorer, known as Rambler Metals and Mining, which had an old copper gold mine that had been dormant for over 20 years. Over the course of three years, we got the mine fully permitted. We did all the technical studies, dewatered the mine, raised the monies and put it into commercial production about a year later. During my tenure there, the mine was profitable and generating free cash flow.

Then in 2013, I was asked to go over to Kirkland Lake Gold, by the then Chairman Harry Dobson. They were having some significant difficulties at the Macassa mine and my team and I went in there and we turned around that asset. As a result, Kirkland Lake went from C$250 million market cap to C$1.5 billion by the summer of 2016. We acquired the St Andrew Goldfields and took the annual production from 95,000 ounces, when I arrived, to slightly north of 200,000 ounces three years later. Of course, Kirkland Lake has gone from strength to strength over the course of the last four years, since I exited the Company.

My CFO Nick Nikolakakis is very experienced. He started his career with Placer Dome and Barrick and has raised over US$2 billion in the capital markets. He has 25 years’ worth of experience and has done extremely well throughout his career. One of our key guys, who's on the ground, is VP Operations and Projects Mike Willett. He's a professional engineer like myself, with 40 years’ worth of experience. He's been in operations, management, projects, contract work as a consultant and event spent time as a C-suite Executive. He resides in Red Lake and manages our day-to-day operations. All in all Mike is an exceptional all-rounder.

Dr. Allen Alper: Well, you and your Team have a very impressive background and accomplished careers.

George Ogilvie: Thank you.

Dr. Allen Alper: Could you tell our readers/investors about your strong balance sheet and shareholder support.

George Ogilvie: Absolutely. Currently the Company has C$47 million cash in the bank and we recently announced a debt financing agreement with Macquarie bank, to the tune of US$40 million, which is approximately C$52 million. We're busy putting in the definitive documents on the loan agreement as we speak and that is due to close before the end of March of this year.

At that point in time, the Company will probably have access to about C$95 million. When we completed our feasibility study, we showed a funding requirement for the project of approximately C$75 million. Then with exploration drilling expenses and the corporate overhead of C$8 million and first inventory fills out at the mine site. It brought our total funding requirement up to approximately C$93 million. And as I said earlier, we'd been spending monies on this project since the middle of October 2020. By the end of January, we'll have spent C$5 million on the project. That would mean we would have to spend about an additional C$88 million of the C$93 million total funding requirement. Hence, the reason for saying that we have a fully funded project through to commercial production.

Our institutional shareholder registry is what I would classify as blue chip. Our main shareholders consist of Fidelity, Franklin Templeton and Sun Valley. Between those three institutions, they control about 30% of the Company. We also have RBIM, Invesco and a few other quality institutions in there. It's not that common to see institutions of that caliber on the institution registry, for a company of our size and not in production. So, I think your readers/investors should take away from that, that it is obviously due to the strength of the management team and the fundamentals of the project.

Dr. Allen Alper: Well, that's exceptional, to have such a strong institutional backing. So, that's great.

George Ogilvie: Thank you, Allen.

Dr. Allen Alper: George, could you tell us why our readers/investors should consider investing in Battle North Gold?

George Ogilvie: Yeah. Absolutely. Our market cap is only C$250 million. I think we have the ability, with success with the drill bit this year on the regional land package, to ignite a fire under the share price. Also, we should see a re-rate, at the end of this year, as we move into 2022 with first production, assuming we hit all of our construction targets.

If we look at some of our peer groups, who are actually in Red Lake and we look at their valuations. Pure Gold would probably be our immediate peer, approximately six to 12 months ahead of us in the production cycle and their market cap today is an excess of C$900 million.

So, that's obviously a big uplift from our current valuation. On the exploration side, we have a group in town known as Great Bear Resources. They have seen some phenomenal success, within the camp, hitting Bonanza grades at their Dixie project, and had a valuation of almost a billion dollars. I think today it's around C$700 million.

So, you can see, with all the infrastructure that we have, the Bateman Mine under construction and development within 12 months of first production, C$704 million in tax loss pools, a credible Management Team with a proven track record of turning around difficult assets, broken stories and generating significant returns for shareholders. You can see, as we continue to execute on the plan for the Bateman Gold Project, there's a re-rate coming in the next 12 to 18 months. I think we can accelerate that through the region exploration success, given we're in the prestigious Red Lake gold mining camp.

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Battle North Gold.

George Ogilvie: Thank you Allen.

Dr. Allen Alper: Is there anything else you'd like to add, George?

George Ogilvie: No. I think you've covered all the bases there Allen. Thank you so much for your excellent questions. I really appreciate that.

Dr. Allen Alper: I enjoyed talking with you again. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://battlenorthgold.com/

BATTLE NORTH GOLD CORPORATION

George Ogilvie, P.Eng.

President, CEO, and Director

IR@battlenorthgold.com

|

|