Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF): One of the Top, Highest Grade Underground Global Gold Mines, Significant Exploration Future, Exciting Times Ahead; Mike Davies Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/2/2021

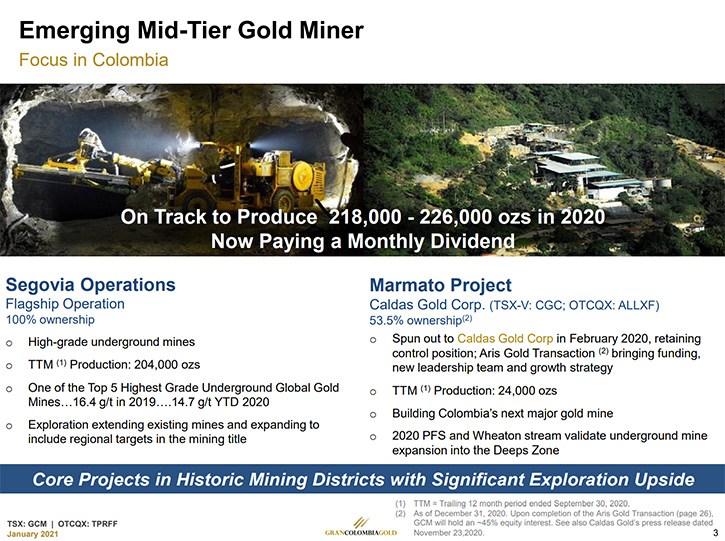

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) is currently the largest underground gold and silver producer in Colombia, with several mines in operation at its high-grade Segovia Operations. Segovia is one of the top five, highest-grade, underground global gold operations, with still a significant exploration future in front of it. Last year they spun off a Company called Caldas Gold Corp. (TSX-V: CGC; OTCQX: ALLXF) to advance Marmato Project. Another spinoff called ESV Resources Ltd. (TSX-V: ESV.H) is aimed to create value through the Zancudo and other projects.

Gran Colombia Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who is CFO of Gran Colombia Gold. Mike, I think Gran Colombia Gold had a great year this past year. Could you give our readers/investors an overview of your Company and what differentiates your Company from others? We have many new viewers and subscribers.

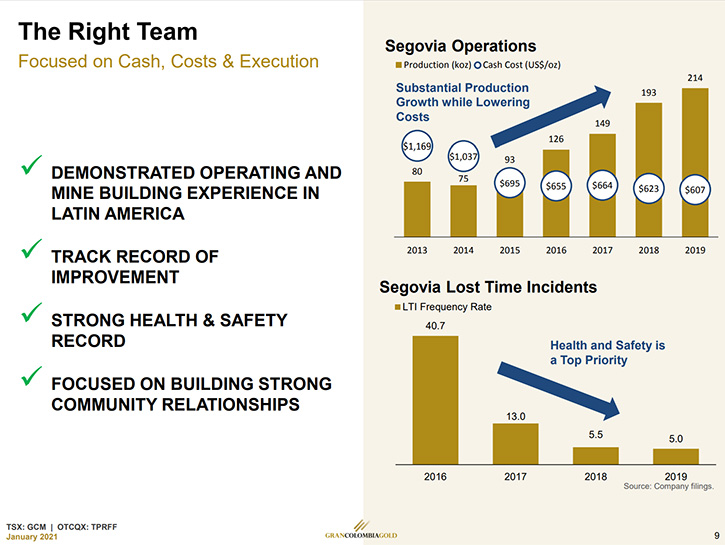

Mike Davies: Happy to. I'm pleased to be able to talk with you again, Allen, and take you through the story of Gran Colombia. We're the largest gold and silver producer in Colombia. In 2020 we celebrated our 10th anniversary since we formed the Company. Over that period of time, we've produced over 1.3 million ounces of gold just from our flagship Segovia operations. It's a high-grade gold and silver title that's been in operation for more than 150 years. Over the 10 years we've had it in operation, our average grade has been about 14 grams per ton, and it is one of the top five highest grade underground global gold operations, with still a significant exploration future in front of it. Exciting times for Gran Colombia to move forward with its strategy this year.

In addition, we will own 45% of Caldas Gold, which was a Company we started last year that was a spinoff of our Marmato project to a new publicly listed Company. We're just completing a transaction with Aris Gold, headed by Neil Woodyer, formerly with Leagold and Endeavour Mining. He's bringing a new Board and Management Team to take over running Caldas Gold, which they'll rename Aris Gold, and they will carry out the execution of the mine expansion into the deep zone at Marmato. Gran Colombia will be a 45% shareholder in that Company, which has a very exciting feature of its own. In addition to that, we own 18% of Gold X, 26% of Western Atlas, and we're in the process, right now, of a spin out of our Zancudo project to a new Company, ESV Resources, that will eventually be part of our portfolio.

Dr. Allen Alper: Oh, that's fantastic. That's great that you have flagship properties and mines, and you are also gathering a portfolio of very high potential gold properties.

Mike Davies: The thing that characterizes Gran Colombia's core is we not only have 100% ownership in the high-grade Segovia project, we are also proud of our turnaround of the Company over the last five years. We just announced in January that in total our production last year was within guidance. We did 220,000 ounces of gold production. 196,000 ounces is coming from Segovia and 24,000 ounces is from the Marmato project that is owned by Caldas. We are also characterized by a high free cash flow yield, one of the best in the industry. Certainly buoyed by not only the high grade and our cost structure, but the rise in gold prices in the latter half of last year.

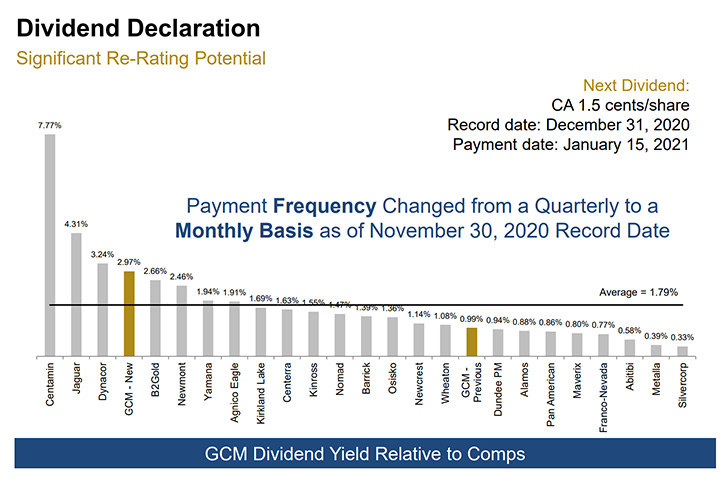

And that allowed us to announce, first in August 2020, that we were going to start paying a dividend of one and a half cents a quarter, and then by November, when we released our third quarter 2020 results, on the strength of continuing strong cash flows and gold prices, we adjusted, and we're now paying a one and a half cent dividend per share on a monthly basis, equivalent to about a 3% yield on our share price and puts us in the top quartile of dividend paying companies. But I think most importantly, it's also paid out on a monthly basis, which relatively few mining companies do these days.

Dr. Allen Alper: That's fantastic. That's really great news. And you'll also have done excellent work with your balance sheet

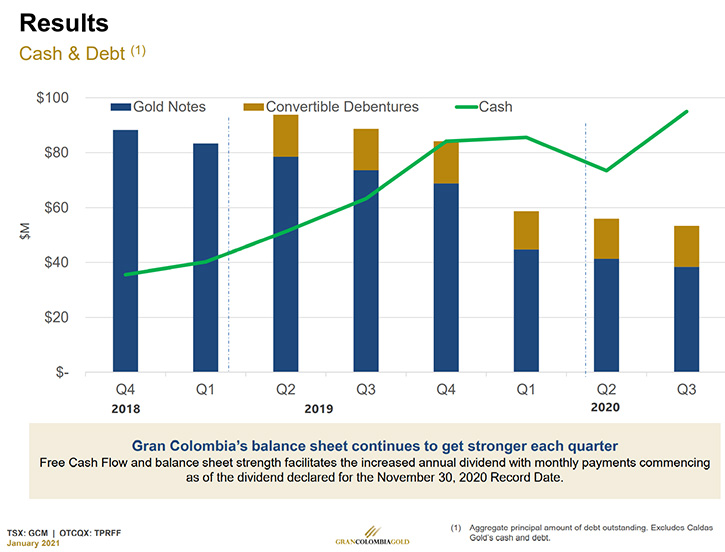

Mike Davies: Yes, we're sitting at the end of December, just in Gran Colombia, excluding Caldas Gold, our balance sheet had US$90 million of cash and US$35.5 million of gold notes. We will repay, at the end of this month, another US$2.9 million of gold notes, so we're down under US$33 million. We also have CA$20 million of convertible debentures on our balance sheet, but with a CA$4.75 exercise price, we expect that those will ultimately be repaid with shares on conversion. So it is a strong balance sheet and we expect that that will continue as we move forward with gold prices still up over $1,800 an ounce. Our free cash flow will remain pretty strong.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors, your primary goals for 2021?

Mike Davies: Happy to! I'll start first with 2020. There are couple of key things about 2020, we were able to maintain both mining operations, Segovia and Marmato, in operation throughout 2020, despite the challenges that came with the COVID-19 pandemic. Like every other mining company, it was a function of putting in the protocols and procedures, in order to keep employees safe and keep operations going. We did have some impact during the year, but it was earlier on. The second half of the year things were running at a much more normal pace. In Gran Colombia, in the Segovia Operations, we did have our exploration programs continuing to go, but predominantly at our three existing mining operations, given the COVID limitations, we didn't start the regional program in our Segovia title, looking at the other 24 brownfield opportunities we have in former mines within the title. That kicked off in October 2020 with the first drill focused on an area we call Vera. Those holes are coming along and we should have results soon. But we did release some very good high-grade drill intercepts in December from our Segovia program at our existing mines.

Our focus in 2021 at Segovia will be to continue our drilling. We've only really begun to look at the brownfield targets outside of the four current mines, so we'll follow up with drilling at Cristales starting in February. What's exciting about that is that there is a small contract miner working on the vein at Cristales, and we saw some great results from them in the fourth quarter, as they increased the number of tonnes of material that they were bringing to us. But most importantly, it was averaging about 47 grams a tonne in the fourth quarter, so that correlates well with the previous drilling history and mining history we've seen at Cristales. We're looking at that as another area of potential future development for us to expand production in Segovia, and we have several other targets like that in the regional program in 2021 to follow up on.

Caldas gold was another major effort for us in 2020, spinning the Marmato Project out, getting the initial financing raised to start the deep zone construction, concluding the year with the Aris Gold transaction that will close imminently. In 2021, our focus will largely come back to taking the Segovia Project forward and continuing to look at our other portfolio investments like Gold X, and now this new ESV Resources to assist those companies moving forward with their strategy.

Dr. Allen Alper: That sounds excellent. I'm very, very impressed with what Gran Colombia has done in the past five years and last year. It's really an amazing accomplishment. Very well-managed Company!

Mike Davies: There are a couple of reasons for that. One is our CEO, who came on board in 2014 and has led the operational turnaround. Lombardo Paredes has been very focused on meeting his objectives. We put our 2020 production out recently, our fifth consecutive year of meeting or exceeding our production guidance, so that stability of setting a direction and then following up to meet your goals has been important. I think we've been smart about how we've managed our balance sheet in the last few years, taking our free cash flow and being able to reduce debt, build our cash balance, so we have the money, should we be successful in identifying a development opportunity in Segovia, that we can quickly move forward without unsettling the existing plans and the four current mining operations.

We've just recently started up some mining at a fourth mine in the Segovia area. It's called Carla. It is south of the existing mining operation. We'll be building that one up during 2021 as we continue to expand there. Our Chairman, Serafino Iacono, is always out in front, letting people know that our success in Colombia comes because we not only have the know-how, but we also have the know who, so we've been able to benefit from our knowledge of working in the country. Most of our executive team resides in Colombia. And I think that gives us an advantage in Colombia, being able to work and live in the country.

Dr. Allen Alper: Sounds excellent! Could you tell us more about the Management Team?

Mike Davies: Yes, our founder, Serafino Iacono, is the Executive Chairman of the Company. His business partner, who co-founded the Company, Miguel de la Campa, is the Vice-Chairman. Lombardo Paredes is the CEO, with extensive background building large projects! He has done a tremendous job in the turnaround of our Gran Colombia operations. I am the CFO. I've been working with Serafino for the last 12 years. Alessandro Cecchi, the VP exploration, has done a tremendous job in leading the exploration programs in both Segovia, as well as the discoveries at Marmato, particularly of the deep zone, that is now the heart of the expansion project in Caldas.

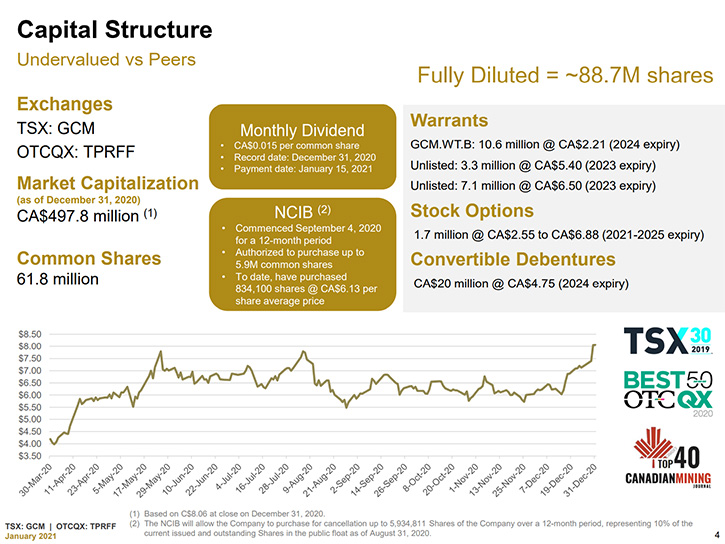

Dr. Allen Alper: Great team, great experience, and great accomplishments! So that's excellent. Could you tell us a little bit about your share and capital structure?

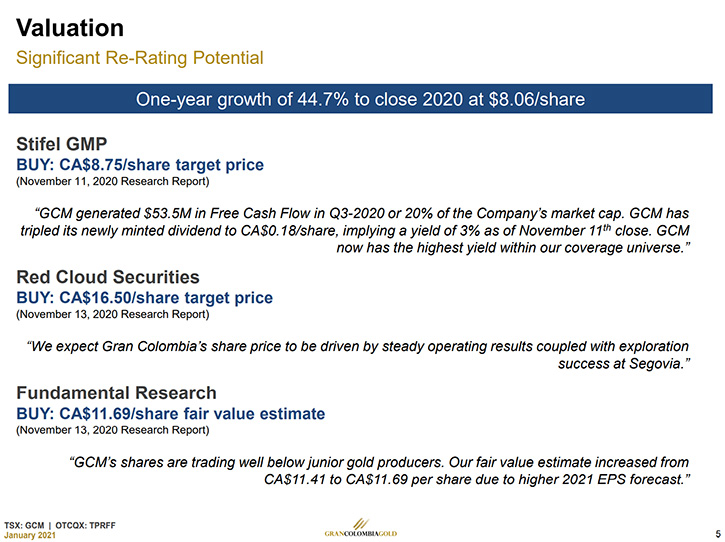

Mike Davies: Yes. We currently have about 62 million shares issued and outstanding, a fully diluted count of about 88 million shares, when they take into account warrants, options, and the convertible debentures. We trade on both the TSX under the symbol GCM and the OTCQX under the symbol of TPRFF. The price of our shares increased by about 45% last year, and I think it's over 200% if you look at the last three year return on our shares. I still feel, based on the analyst estimates, that there is room to go.

Currently Fundamental Research is around CA$11 per share. Stifel GMP, I think we've bumped up against their target, which is about CA$8.75 and Red Cloud has a target of about CA$16. So I think the general consensus is, based on our production, our free cash flows and our metrics, that the current share price, just under CA$8 at the moment, we're certainly still open for a re-rating of our share price.

We are marketing (virtually) a lot more these days and we've seen a lot more interest since we put in the monthly dividend. I think the exploration program results are continuing to get some attention, and we're focusing a lot more on our investor outreach to help support the story. We have a normal course issuer bid also in place. We have bought back, over the last couple of months, about 800,000 shares at an average price of about CA$6 per share. There still is about another eight months to go on that program. It's really at the Company's discretion when and if we buy back shares under that program. But at this point we see our major use of our free cash flow focusing on our investment opportunities, especially in Segovia, as well as funding the dividend and retirement of the rest of our debt.

Dr. Allen Alper: Those are outstanding achievements and compelling reasons for our readers and investors to consider investing in Gran Colombia Gold. Is there anything else you would like to add, Mike?

Mike Davies: No, I think we've covered the key points. It's a pleasure talking to you again and providing that update. At the end of March we'll be releasing the year end results, as well as a new updated reserve and resource for the Segovia project, so look forward to catching up with you and your readers after those announcements come out at the end of March, and between now and then we should have some more updates on the Segovia drilling results to share.

Dr. Allen Alper: Oh, that sounds excellent. I'll be looking forward to updating our readers/ investors in March. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|