Equus Mining (ASX: EQE): Maiden Inferred Mineral Resource of 302,000 Gold Equivalent ozs at 2.5 g/t Au EQ in Southern Chile; Interview with Damien Koerber, COO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/1/2021

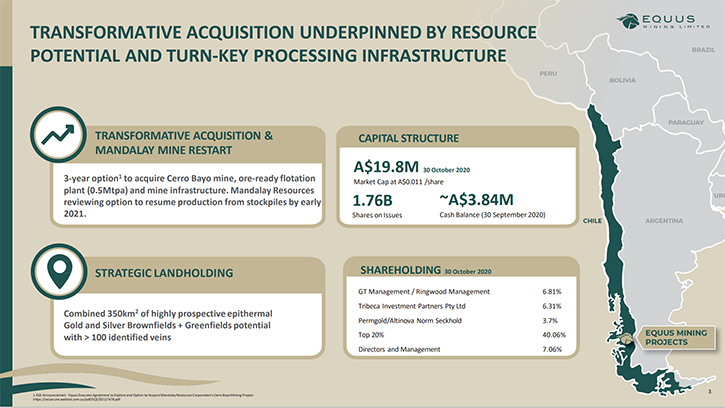

Equus Mining (ASX: EQE) has just announced a maiden, Inferred Mineral Resource of 302,000 gold equivalent ounces at 2.5 g/t Au equivalent, at the historic past producing Taitao Pit, within the Company’s Cerro Bayo Project in Southern Chile. We learned from Damien Koerber, Chief Operating Officer of Equus Mining, that the Company has a 3-year option to acquire Cerro Bayo Project, which includes an ore-ready flotation plant (0.5Mtpa) and mine infrastructure, from Mandalay Resources, with the plan to resume production from stockpiles by early 2021. We learned, from Mr. Koerber, about their two-pronged strategy that combines brownfield resource definition and exploration of areas located near the mine infrastructure, with an aggressive greenfield exploration focus on key targets throughout the 295 square kilometer claim package. Equus Mining is very well positioned to take control of a proven gold and silver mining district, with incredible upside potential.

Equus Mining

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Damien Koerber, who is Chief Operating Officer of Equus Mining, Ltd.

Damien, could you give our readers/investors an overview of your Company, what differentiates your Company, and also what you have discovered in this past year through your drilling and exploration programs?

Damien Koerber: Certainly, Al. Firstly, Equus Mining is an Australian-listed junior exploration and mining company based out of Sydney, but our principal project is the Cerro Bayo Mine project in the 11th region, Southern Chile.

We signed a three-year option to acquire an agreement with Mandalay Resources, which became effective in July of this year. We have roughly two and a half years left of that option agreement, with the idea that we'll be taking on the acquisition of the Cerro Bayo mine plant and about 295 square kilometers of exploration or mining leases, which we believe hold some fantastic untested potential.

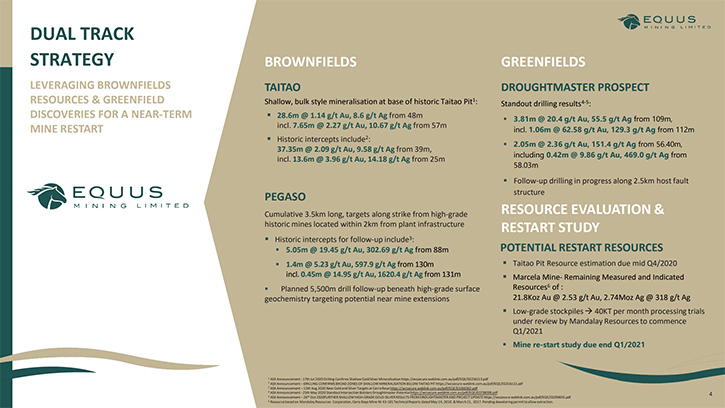

We're applying a two-pronged strategy, where we're defining existing brownfield resources and exploring brownfields targets, which are strategically located within five kilometers of existing plant and in parallel executing greenfield exploration over key new and underexplored targets, throughout the large 295 square kilometer claim package. We believe this duel track strategy will provide a pathway for the definition of a significant resource base to justify a near term mine restart.

Historically, this district was a significant producer of gold and silver. From 1995 to 2017, roughly 650,000 ounces of gold and 45 million ounces of silver, at average grades of approximately 2.81 g/t Au and 196 g/t Ag, were produced from 9 historical mines within 15km from the Cerro Bayo plant and we believe that there remains a huge amount of potential on the property. In a relatively short time span, we've spent about a year exploring and defining resources, which has culminated in the announcement of a maiden inferred resource estimate of 302,000 ounces of gold equivalent 2.5 grams per ton gold equivalent beneath the historically producing Taitao Pit. The maiden resource was comprised of 227,000 ounces gold at 1.9 grams per ton gold and 5,844,000 ounces silver at 48 grams per ton silver.

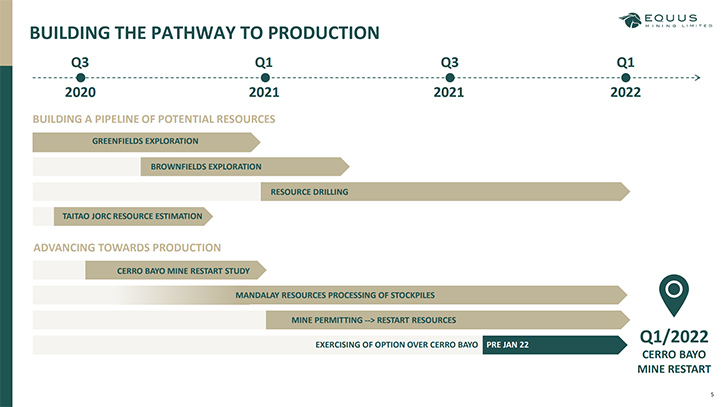

Obviously, we're seeing this as an important milestone for us because the resource estimate forms the basis of a high-level mine restart plan, which is now well underway and we're looking to complete during the first half of 2021. The mine restart study should position us to be able to decide on the execution of the option for the acquisition by the end of 2021.

Along with the Taitao Pit resource, we see a number of other compelling exploration targets to add to that resource base, with even higher grade, mainly underground resources. This includes the Pegaso Targets where drilling is currently underway to test for extensions to high-grade historical drill intercepts, located along host structures that extend individually over approximately 1km strike length, between significant centers of historic production. Some of the more notable historical interceptions, at the Pegas targets, include 5m at 19 grams per ton of gold and 302 grams per ton of silver.

Additionally, our greenfields exploration programs have provided encouraging high-grade results supportive of a significant gold-silver mineralized epithermal vein system at the Droughtmaster Prospect. Some assays are still pending, from the latest round of drilling, but once received, a follow-up drill program will be designed, which provisionally will target further extensions towards the southeast.

As such, we see ourselves in a great position, over the next 12 months, to execute a very aggressive brownfield and greenfield exploration program, enabling us to put together a sufficient resource to justify executing that option agreement with Mandalay Resources.

A great aspect of the option agreement with Mandalay Resource is that it doesn't involve a large cash outlay from Equus. It's basically on execution, we will give 19% of equity in Equus to Mandalay. We will then be liable for a 2.25% royalty paid on production from the mine, and that can be bought out for several million dollars. Also, we will be liable for 50% of the eventual closure costs of the mine, which have been already defined around a total of approximately $14 million.

We think it's a very good deal, especially when you consider the fact that Mandalay Resources is planning to commence processing of low-grade stockpiles by early 2021, which will help provide further insights into the operational capacity of the plant.

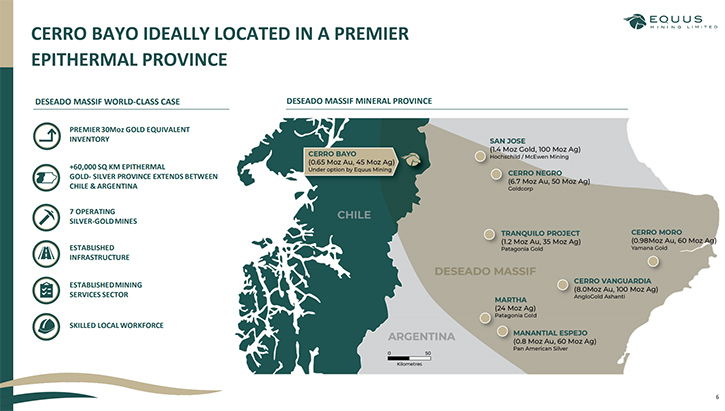

We think we'll be positioned very nicely, by this time next year, having furthered the resource base through continued exploration activity across the project, and that's a compelling story for investors to be exposed to a high-grade silver and gold mine, as a proven producer, in a very favorable geological terrain in South America. It's part of the district called the Deseado Massif, which in sum has about 30 million ounces of gold equivalent resources in past production/remaining resources and throughout which there are currently seven mines operating.

Dr. Allen Alper: Oh, it sounds great! Sounds like the project is in a great location, with great potential, both near term and longer term development, so that sounds excellent to be in a position to leverage both brownfield and greenfield exploration and development. That's excellent!

Damien Koerber: That's right, Al. We've systematically scanned the world for other assets, previous to doing the deal with Mandalay and there aren't that many large scale, proven, producing districts that are sitting next to idle plants and mine infrastructure. There is a half million ton-per-annum flotation plant onsite, under very good care and maintenance by Mandalay. Historically, it achieved recoveries of about 90% for both gold and silver and has very good operational parameters.

We have a great in-house team, which is backed up by a team based out of both Sydney and Perth. We have consultants in Perth, Cube Consulting, which have completed this mineral resource estimate. We have a qualified person, based in Chile that has previous knowledge and experience in the Cerro Bayo mine district. We have an engineering and processing expert, also based in Santiago, in Chile that is running the restart study. So we've been able to carry on work unhindered by the coronavirus pandemic, which we see as quite an achievement. Obviously, our Team down in Southern Chile executed very strict protocols, which kept them safe during the exploration period this past year and we plan to continue that this year. Were on track to be back drilling again in the third week of January.

Dr. Allen Alper: Oh, that sounds excellent. That's great that you were able to take such excellent precautions and protect your people and continue your exploration studies.

Damien Koerber: That's right, Al. It really is hats off to our in-country team. We have a fantastic Exploration Manager, Guillermo Chacon, who is one of the hardest working discovery-driven exploration geologists, with whom I've worked in my career, which spans nearly 30 years. There's a large difference generally between mining geologists, who are largely focused on sustaining production at mines, and an exploration team, which analyses a much wider range of often more subtle geological information, to unlock new discoveries and define new resources and that's where I see the differentiator between Equus and quite possibly the previous operators of the Cerro Bayo mine. I believe we have some of the most discovery-driven exploration geologists in the business, applying a fresh set of eyes to the Cerro Bayo district and a strong ´boots on the ground´ approach.

A lot of the previous operators had their mine hats on, and they were focused on day-to-day production under very different metal price scenarios. Metals prices back when the majority of the production occurred at Cerro Bayo, over its 20-year-history, were almost a fifth of what the current prices are now. So, we're working under very different metal pricing and operational parameters and scenarios.

I've been involved in several discoveries, both in Australia and in Latin America, and I think I know what the formula is for discovery. That's having that appetite and drive to go out day after day and discover resources.

Dr. Allen Alper: Oh, that's great to be in a position to have such a strong exploration team, yourself and Guillermo.

Could you tell us more about your background, Guillermo’s background and also the Directors?

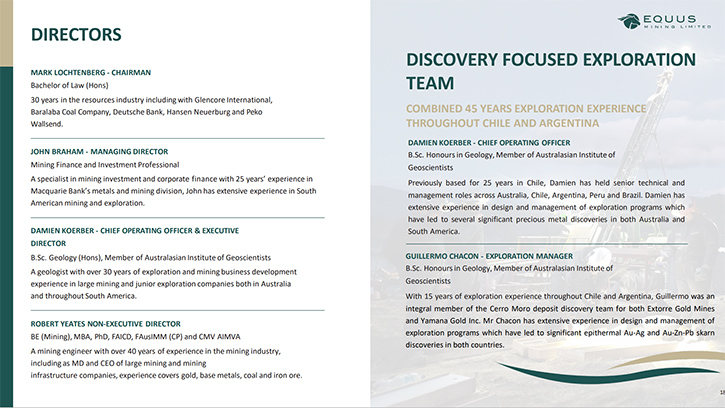

Damien Koerber: I'm a bilingual Australian geologist that worked initially for Billiton Gold in Australia. I was involved in the discovery of the Tanami Mine, Union Reefs, Mount Todd, and also the Cleo-Sunrise Dam gold deposits very early on in my career.

I later went to Latin America and worked in Chile for companies like North, MIM, Newcrest Mining, Rio Algom and then several junior companies, mainly in Argentina and Chile. My experience in Latin America spans Brazil, Argentina, Chile and Peru over a 25 year period.

I've more recently been involved in precious metal deposit discoveries in Argentina, namely Cap Oeste, which sits in a similar epithermal province to Cerro Bayo, located on the other side of the border in Argentina.

Guillermo Chacon, our Argentine, bilingual Exploration Manager, carries about 15 years of experience in Argentina and Chile. He performed a key role in the exploration and discovery team of the Cerro Moro deposit in Argentina, which hosts in the order of two and a half million ounces gold equivalent. Again, that sits in the same mineral district as Cerro Bayo, so he has a very good understanding of these epithermal deposits and how to find them.

As far as the Management, we have John Braham, who is the Managing Director. He comes from a mining and finance background at Macquarie Bank, where he headed up the mining division for Macquarie, based out of New York during 2001-2008, and subsequently also performed in consulting roles for the raising of finance for junior and medium-sized companies.

Other Directors come with strong mine and finance experience. Mark Lochtenberg, the Chairman, brings in-depth finance, business development and trading knowledge from senior roles in large trading houses including Glencore. Rob Yeates comes from a strong mining background and brings strong operating, business development and infrastructure experience, throughout large mining operations in Australia.

Dr. Allen Alper: Well, that's a very strong knowledge-pool and successful Team and well-balanced. So that's excellent! That's great! Could you tell our readers/investors about your capital and share structure?

Damien Koerber: As of the 30th of September, we had about 3.8 million Australian dollars in the bank. We're going through that, with the exploration and resource estimates and restart studies in play. We still have enough funding to fund out at least a good part of the first half of 2021, so there is no immediate need to raise further funds.

We currently have about 1.76 billion shares on issue, tightly held by Directors and Management and a couple of key cornerstone investors with roughly 40% of the register contained within the top twenty holders. One of those, Norm Seckold, was involved in Bolnisi Gold in Mexico back in the 2000s which was sold then to Coeur Mining. Also a number of private equity funds have fairly large stakes, such as Tribeca.

Dr. Allen Alper: Sounds excellent, Damien! Tell our readers/investors the primary reasons they should consider investing in the Equus Mining?

Damien Koerber: I think, Al, the primary reasons are that Equus Mining is very well positioned to take control of a proven gold and silver mining project, through our option agreement with Mandalay, in a district that hosts significant kick-off restart resources and compelling potential for discovery of further resources, throughout the large 295 square kilometer package.

The definition of the Taitao and other nearby brownfields resources is forming the base for a restart study that’s progressing well. We believe that we have the capacity to complete this restart study in the first half of next year, and look to execute the option by year’s end and potentially start operating during 2022. The opportunity for Equus to achieve a significant near term production profile places it favorably compared to most junior mining stocks on any metric throughout the global mining industry.

We have a very good team in place, both in Australian and Chile, including several leading in-house consultants, which have equity stakes in Equus. Additionally, there is significant potential to add additional ounces and build a very solid resource base of both high-grade silver and gold in the near future, to justify this option and sustain a significant mine life.

Dr. Allen Alper: Well, those sound like very strong reasons for our readers/investors to consider investing in Equus. Damien, is there anything else you'd like to add?

Damien Koerber: We see the Cerro Bayo Project as being pretty much turnkey, given the existing 500,000 ton per annum flotation plant and infrastructure in place. While we're examining the execution of this option with Mandalay, Mandalay is actually looking at commencing the processing of low-grade ore stockpiles that were mined in the 1990´s and early 2000´s, when metals prices were much lower than what they are now. Mandalay is initially looking at processing at a rate of about 40,000 tons per month, starting March of this year. This is extremely encouraging, given that these low-grade stockpiles are considered by Mandalay to be economic at current prices.

So it goes to show both the effectiveness and the efficiency of the mill, and also the turnkey nature of the mill and the infrastructure.

Dr. Allen Alper: Oh, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.equusmining.com/

John Braham

Managing Director

T: +61 400 852 245

E: jbraham@equusmining.com

|

|