Dr. Allen Alper Discusses portfolio and plans of the Brazilian Gold Producer, Torio Mining with Co-Founders Hurdle H. “Trip” Lea III, Andre Vienna and Rene Romer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/28/2021

Torio Mining executives, Trip Lea: (Co-Founder, Co-Chairman), Andre Vienna (Co-Founder, COO) and Rene Romer (Capital Markets and Merchant Banking Advisor to Torio), lay out their portfolio and plans. The Company’s mining rights, and operating mine are located in the northern part of the State of Mato Grosso, in Brazil, right in the heart of the Alta Floresta Gold Belt, which is well-known in Brazil. Torio’s portfolio size is approximately 165,000 hectares or almost 400,000 acres. We learned from Mr. Trip Lea:, that SGS-Canada estimated, with a high degree of confidence that the ore body could contain up to 800,000-1.5 million ounces of Gold. Upon completion of the expansion of the proven resources, the Company plans to bring it into full production, with a mining partner.

Dr. Allen Alper: This is Dr. Allen Alper, Editor in Chief of Metals News interviewing Hurdle H. “Trip” Lea III, and Andre Vienna, and also Rene Romer.

Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Trip Lea: Dr. Alper, thank you very much. This is Trip Lea:, and I will provide a brief introduction. And certainly, our COO Andre can expand upon any gaps that I may leave. Torio Mining is organized in Brazil. Our mining rights and operating mine are located in the Northern part of the State of Mato Grosso in Brazil, right in the heart of the Alta Floresta Gold Belt, which is well-known in Brazil. It's approximately 200 kilometers wide by 700 kilometers long. We have a very large portfolio of mining rights, leased from the federal government, approximately 165,000 hectares or almost 400,000 acres, or greater than half the size of the State of Rhode Island in the US, for example.

Dr. Allen Alper: Wow.

Trip Lea: My quick background, I started as a floor trader on the New York Cotton Exchange (“COMEX”), back in the late '70s. The cotton pit was located next to the COMEX pits so I was there for the gold boom and bust in the early '80s and then migrated more towards the direct investment side. I am not a mining professional. I come from a finance background. In the mid-1990s, I was the sole Managing General Partner of PGM Partners or Platinum Group Metals Partners, serving at the behest of a group of well-known investors who are household names, with the three of them leading, we bought almost 80% of the world's above-ground stocks of rhodium and palladium, for roughly a billion dollars. The cost basis for the palladium was $132.45 if I recall correctly all coming out of Russia, overwhelmingly from Norilsk, the world’s largest nickel mine. And the cost basis for the rhodium averaged about $450.

We exited that position early in the 2000s through long-term offtake contracts, with four of the major auto manufacturers, who use PGMs for auto-catalysts and with chemical companies. In the mid-2000s, I was looking at mining leases in Suriname, and while they were very attractive prospects in leases, the public corruption became too challenging for me as an outsider. In 2007, '08, Andre Vienna, who is on the line with us, and Herminio Sotero, called and said, "Trip, we've run across a truly unique situation in the gold mining sector. And given your background and our long-standing relationship stretching back to the 1990s, we'd like for you to join us in pursuing a distressed opportunity, serving as the strategic leader."

It took us approximately four years to complete the due diligence, clean up all the mining licenses, entitlements, rights, and environmental permits and we established a legal entity in 2012 to purchase the pool of distressed assets and expand the development. In 2014, we began working with SGS in Canada. And in 2015, they prepared the initial resource assessment. The body of knowledge that we have on the ore deposits, the initial one that we have targeted, is quite deep. The prior owner, or owners, of these mining rights and mines did an excellent job of preserving the data. Unfortunately, because the Company fell into insolvency and disrepair, those were in no way certifiable or bankable, but it did give us great guidance on where to redrill, for definitional purposes, with SGS leading the assessment.

Andre Vienna is the Chief Miner, or the Chief Operating Officer and the real genius behind Torio and is exceptionally talented in his field. Torio’s Co-Chairman and CEO, Herminio Sotero, lives in Sao Paolo, who handles the regulatory matters, legal and banking relationships, and business relationships.

In Brazil, as you may be aware, they established a special program for the purchase and sale of raw gold, available only to active miners granted a special Central Bank to those who apply for the license and pass the rigorous due diligence process. This was established in 1994 to bring informal mining activities and informal miners onto the role for two purposes; one, to ensure that best practices, particularly with regards to environmental concerns, the elimination of the use of mercury, et cetera, were being observed and, number two, so that the country could protect both their natural resources and the banking system from bad actors, if you will.

Torio is at the very southern reaches of the Amazon, well outside of the rainforest, in area known for its cattle and agricultural. While the bad actors make headlines, good news doesn't sell quite as well. However, the program has been tremendously successful in making sure that the industry is clean, that the use of mercury is virtually nil, and that they're able to oversee, police and protect the sector.

To put it in perspective, according to US State Department and the Association for Responsible Mining, in Brazil, approximately 10% of the gold recovered each year, is not legal. And not legal includes everything from illegal to informal mining. To put that in perspective, that's about on par with the US, of course, heavily skewed by a couple of western states and Alaska, in particular, where the informal mining sector is significant. By way of comparison, in Colombia, approximately 80% of the gold recovered is illegal. I can share with you the declassified information, if that'd be helpful. In Peru, Ecuador, Bolivia, something in the high 40s to mid-50s. And of course, Venezuela, 110% of whatever's recovered there is illegal, like anything else taking place in Venezuela these days.

This is a rare situation where heavy, heavy regulation is actually a good thing. The Central Bank, the Ministry of Mines, both federal agencies, of course, and then the state environmental agencies do a wonderful job of overseeing the sector. In addition to the 150 employees active on Torio Mining's side, Andre leads an additional 25 people on the ground who are continuing to expand our present 365,000-ounce “operational” resource base. Our cash cost to production is a little over $700 now, it's underground, currently. We have four stopes, three active, but our activities are rather modest because our primary focus is on expanding the ore body, which we call the Red Joe Mine.

We have four adjacent ore bodies identified in the same 15-square-kilometer parcel called the Craton One, Two and Three complexes, and then a fourth called Tamanduá, which is a Portuguese or Brazilian word for anteater. It's entirely possible that these are all part of the same ore body. However, we certainly cannot state that yet.

Once we expand the ore body, which SGS stated, with a surprisingly high degree of confidence, could be expected to be at least 800,000 to 1.5 million ounces and we bring it into full production with a mining partner, we believe our cash cost production will fall by 20%, 25%. So at $700 now, we're in the top quartile in terms of cash cost of production and would be approaching the top decile at something in the low $500 per ounce cost of recovery once we go into full scale production, which speaks to the integrity of the ore body, itself.

In 2017, we created a daughter Company, called Torio Arbitrage. And Torio Arbitrage, under a special Central Bank license, available only to operating miners in good standing, with the environmental and operational licenses in place, allows us to purchase raw gold from artisanal miners overwhelmingly in and around our mining rights at a discount to spot price and smelt it, hallmark it, and export it. The program was created to bring informal miners and unlicensed, not legal mines onto the tax rules.

Arbitrage, which we define as “the simultaneous purchase and sale of a like commodity with no directional price risk”. It is easy to describe however quite challenging to execute in Brazil. Is is the equivalent of a federal royalty, even though I use that as a term of convenience, not a fact and the arbitrage provides the opportunity for very low-risk yet attractive return. Raw gold is taxed as a commodity at a rate of 18% and hallmarked ingots, deliverable on the world’s major exchanges and to the LBMA Good Delivery members, are taxed as financial instruments at 2%. So the arbitrage opportunity, which we pursued, is buying gold at a premium to that federal tax rate, but a substantial discount to spot; we pay about 85 cents on the dollar for contained gold and carry all of the expenses, overhead, et cetera to bring it to 99.5% fine gold for export and pay the 2% tax.

In the past couple of years, we've earned 50%, 60% on our capital base, prior to compensating our investors. Currently, we do about $300 million US in annual turnover or 100, 110 kilos a week, currently. We believe we can easily quadruple that capacity.

We are looking to expand our capital base for the first time since our initial resource assessment, both with arbitrage activities and, more importantly, for the expansion of the mining activities. Under certain circumstances, we may consider bringing in an equity partner, at some point soon, equal to roughly a third of the capitalization of the Company.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your financials and your operations?

Trip Lea: Andre, would you like to take that? I've just covered the history of the Company. And Dr. Alper has asked for an overview of the company's financials, et cetera. Perhaps I can begin and then you can expand upon it.

Andre Vienna: Very good.

Trip Lea: There are three primary sponsors; Andre Vienna, who is with us, myself, and our CEO Herminio Sotero. While we intend to buyout the shares we do not own through a Management buyout, we hold 50% of the ownership interest in the Company and have a small group of passive investors from the US that provided some expansion capital in 2014. The Torio Arbitrage subsidiary has turnover of about $300 million US per year, $1.5 billion reais. And prior to capital cost, we generate returns of roughly 5% a month or 50%, 60% per year. And we've been operating for three full years and that was launched in 2017.

Andre, could you expand upon the mining side of the activities, the recoveries, and the work that the 150 employees at the mine are undertaking?

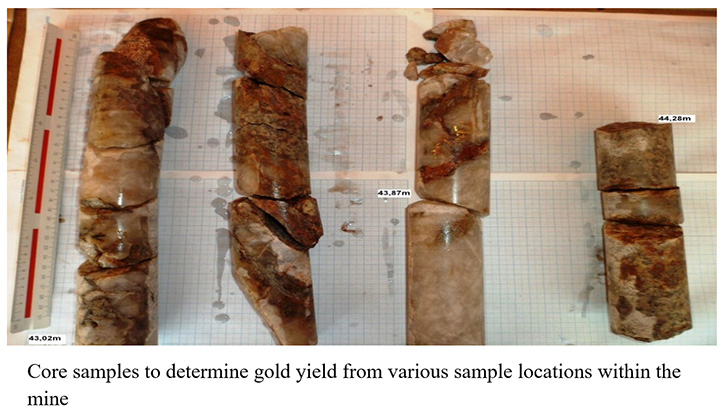

Andre Vienna: Okay. This is Andre Vienna. We are currently doing trail mining on the Red Joe side, exploring the main ore body that's being surveyed, which has reserves proved on 295,000 ounces. We built three shafts and are currently under level minus 130 meters depth and doing the metallurgy on it and the recovery rates. Our survey points out an average grade of gold per ton at 15 grams per ton. And on our metallurgy running site, right now, we are recovering about 12 grams to 13 grams per ton on a total recovery. We also have very large, ore rich tailings on our leases.

This is the main site where we have all these employees working on this mining site and processing site. So we have a processing plant and a leeching plant. And that's where we get all these results from the extraction. On the survey side, which is a parallel activity to expand the total reserves, and since the area is big, really huge, about 200,000 acres that's been surveyed, we have a survey team for drilling and taking all the samples from the artisanal miners that Trip was talking about.

Since the area is very large to cover and because deposits are small, having those artisanal miners active on our lands with our permission, we have been assessing data from what they are producing and then, literally, making all the drilling and trenches. All the data, which is also sent to SGS to get all the total gold results out from all the samples, drilling, and everything. So we have this trial mining with metallurgy. And on the other hand, we have all these people doing the survey to expand that. So roughly, we're talking about getting to a million and a half ounces in one year more of surveying. That's where we stand right now.

Dr. Allen Alper: Now, to expand your resource, what kind of exploration program are you doing? Are you drilling, trenching? What are you doing?

Andre Vienna: Yes, we started with the grading and taking all the samples from a grading, which is 100 meters between every sample, getting about 60% of the whole 200,000 acres. Then we got back all the results, found out pretty much where all the gold-positive results came from, crossed it with magnetic and chromatography aerial results, and decided to do the trenching and analysis. So after trenching, which is where we are right now, taking back the results from the trenching, we'll drill it with the intercept zones that we're recovering from these results.

Right now, out of this program, we have about 12,000 linear meters of drilling, with diamond drilling, and half of it is recirculating drilling. So, it's a very in-depth survey analysis.

Dr. Allen Alper: That sounds very good. Could tell us what's happening in Brazil in gold mining these days?

Andre Vienna: Nowadays, Brazilian gold, is being mostly developed by what we call the seven big companies that deals with 70% of Brazilian gold's production. And they are producing out of three states; Minas Gerais, which is the oldest state and where the biggest mining Brazilian company, called Vale, started. Then we have the whole Mato Grosso State, where we are, and the Para State, where we have all these big gold deposits from the very beginning of the last century.

Those are the three biggest states where we have gold mining actually being produced. Later, they were doing their mining back in 2008 and most of them went on to become major producers. In 2018, ten years later, there is a heavily funded program by the federal government, with specific credit lines from the social development bank called BNDES. It's specifically for mining. And on the gold mining, all the programs were related to step up on environmental licenses and more integrated with the cultural reality of the Brazilian artisanal miners. Some of them had already a mining size activity but didn't have the proper network to have a drilling assessment and all this, in terms of understanding reserves.

So this is mainly led by a very wide program from the government, which made all this possible in terms of the right environmental activity with the right, proper mining standards. In Brazil, the standards are more in line with the NI-43101 standards. Most of the companies prefer the 43101. And all the surveying, final reports are in accordance with NI-43101 standards, which are used elsewhere around the world.

Dr. Allen Alper: That sounds very good. I wonder if Trip could highlight and summarize the primary reasons our readers, investors should consider investing in Torio Mining.

Trip Lea: Thank you, Al. In short, we spent the past 12 years bootstrapping the Company. We've done it in a very thoughtful, methodical, diligent way. And after receiving the technical assessments from both SGS and the very broad four-year technical financial and regulatory assessment from BNDES, we feel that we're ready for primetime, if you will. We are in the final stages of negotiating a development loan of more than U$100 million from BNDES. We look forward to expanding the capital base, which will be used to expand the resource base to the 1.5 million ounces that we believe are extractable and may well exceed that target. As Andre referenced earlier, we prefer to expand the resource base prior to partnering with, or exiting through, a midsize miner or, perhaps, entering into either a royalty agreement or outright sale in the coming three to five years.

Dr. Allen Alper: Well, that sounds very good. What would you say is the primary opportunity for them? Why should they invest? What do you think the reward will be?

Trip Lea: That's an excellent question. As entrepreneurs in a very closely held Company, we do have a great deal of flexibility. However, we believe the best investment structure would be in the form of a convertible debt instrument, a three-year note, if you will, which would pay a double-digit yield and provide for conversion right at a discount to the current valuation of Torio Mining. Such a structure gives optionality to the investor or lender, giving them exposure, option-oriented exposure to further appreciation in the price of gold, in that they would have the right, but not the obligation to convert their investment into Torio equity. We've structured it at a discount to the current valuation and/or the possibility, the likelihood, that our resource base meets our expectations, which is a 3X to 5X multiple of the current proven reserves.

Dr. Alper, we'll leave the price forecast on gold to others. If we knew where gold was going, we'd be gold speculators instead of mine developers. However, I can tell you that the expansion of our resource base has substantial upside. And the valuation and conversion features for an investor or lender are at a discount to the current value. I think that's the heart of it.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.toriomining.com.br/

Av. Historiador Rubens de Mendonça, 1756

Rooms 1811 / 1812

Bosque da Saúde

Cuiaba, MT 78045-000

Brasil

|

|