Magellan Gold Corporation (OTCQB: MAGE): Exploration and Developing of Precious Metals in North America; Interview with Mike Lavigne, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/20/2021

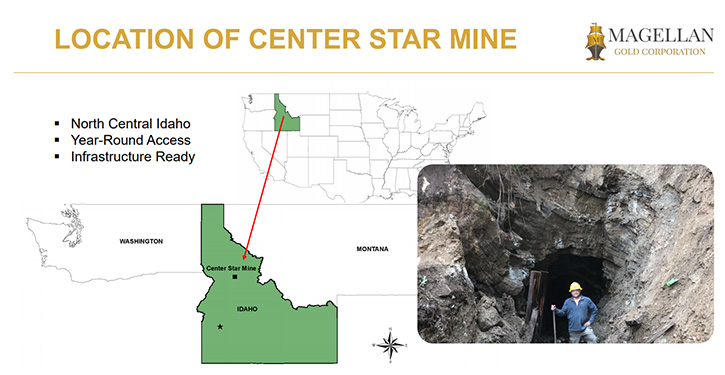

We learned from Mike Lavigne, President and Director of Magellan Gold Corporation (OTCQB: MAGE), that they are looking to acquire properties in the Western United States, with historical high-grade gold production. These would be smaller in scale, near surface, bulk tonnage projects that don't attract the attention of the larger mining companies. The Company's initial focus is on the exploration and development of their flagship project, called the Center Star Gold Mine, in Idaho, one of the world's top jurisdictions for mining and exploration. Near-term plans include sampling and drilling to verify the historical data, mine site clean-up, and possibly some near-term production. In addition, they plan to expand beyond the historic mine site and follow-up on some exciting discoveries, just outside of the existing working areas.

Magellan Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Lavigne, who is President and Director of Magellan Gold Corp.

Mike, could you give our readers/investors an overview of your Company and what differentiates your Company from others, and also tell us a little bit about your strategy?

Mike Lavigne:Magellan's strategy is to acquire properties in the Western United States, with historical high-grade gold production. The properties that we are looking at are generally smaller in scale, so they don't attract the attention of the larger mining companies. In today's environment, they're looking for the near surface, bulk tonnage projects, and we're not going to compete in that space. Our initial targets are in the state of Idaho. One of our other Directors and I are from the state of Idaho, so we know it well. Also, recently, according to the Fraser Institute, the State of Idaho is ranked eighth in the world for mining and exploration. A large part of that is due to its historical gold production and its reputation as a mine-friendly jurisdiction.

In some ways we're significantly different from what you see going on in the exploration and mining industry today, but also fairly similar. We've seen the decline in major gold discoveries over the last 30 years, they've declined dramatically over the last decade and over the last three years. We see a lot of the major companies, focusing back on exploration projects or those near their existing operations. So the exploration dollars are being spent on areas that they know have gold, right next door to where they're mining it today.

There are numerous historical districts, especially in the state of Idaho and other parts of the Western United States that had modest gold production back in the maybe late 1800s, early 1900s and have since been abandoned. Now we're seeing a resurgence of people looking at some of these areas, and that's what we're focused on. We know gold's there. Gold's been produced in the past. Historical information shows that some of these mining districts produced very high-grade gold. But due to various reasons, mining techniques, recovery techniques, accessibility and that sort of thing, these mining districts have been abandoned. And we believe they deserve another look and that's what we're doing.

Dr. Allen Alper: That sounds like a great approach. Could you tell our readers/investors a little bit more about your properties and what you've found to date, and what your plans are for the remainder of 2020 going into 2021?

Mike Lavigne: Yeah, the first property that we acquired is a property near Elk City, Idaho, which has a fairly nice history as far as gold production. It's hard sometimes to get clear indication as to what was really produced in history, so you look at a lot of US geological reports and data that you can come up with on some of these historic mines. But the best we can determine, from looking at this historical information, is there was probably somewhere between two and three million ounces of gold that was taken from the general Elk City area. And we see today that the Elk City area is a truly re-emerging gold district. There's active exploration. Endomines recently just put the Friday Mine there into production, just in the last couple of quarters.

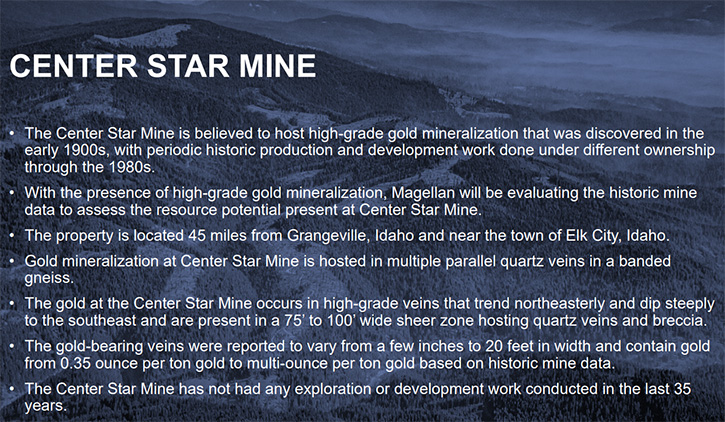

And so the Center Star Mine, which is the property that we acquired, is a small historic producer. It was founded in the early 1900s and has had a significant amount of exploration development work done on it over the years. The most significant production from it came back in the 1940, '41 area, '42. Of course, it was closed down because of the War Act. Since that time, it has had a number of different groups go in there and expand the development of the property, doing extensive exploration. There's been a lot of sampling and a fair amount of drilling. There are about 4,000 feet right now of horizontal workings. We actually know some of the people, who operated the project in the '80s. So we're excited about it.

It had some significant high-grade gold early on. It's still there and we hope to exploit that. Our first order of business was to open the mine back up. We were able to get the permits to reopen the portals. We've gone underground. We have some structural work to do. There are some areas on the property where, no one's been for almost 35 years now. So we have to go in there now, rebuild the two portals that we opened, go in and clean out a few drifts. And stabilize some areas that need to be stabilized, nothing significant, but just some old timber and things have been there for a long time and need to be repaired.

We have our group of geologists, working now, reviewing the historical reports, where there have been some ore bodies that were discovered in the past that they have delineated. We will go back in and initially do some reef sampling to test and try to verify the historical reports we have. And drill, I'm assuming we'll need to do some drilling to help better define these existing ore blocks, on which we have the historical geological reports.

So that's where we're headed now. It's a little bit of mine cleanup and making it safe for us to go underground. Next we'll go in and start to verify some of these historical reports we have. If we can do that, it's possible we could have some near-term production. We also have some historical reports, on some of our property that lays just outside of the existing working areas, where there have been some very nice discoveries, and some trenching, and some work that was done there. We think we have permits in right now to get some surface drilling and hopefully expand beyond those historical ore blocks that have been delineated in these previous reports.

Dr. Allen Alper: What kind of grades are reported in some of the previous reports?

Mike Lavigne: A lot of the production that was done back in the '40s, runs typically between a half an ounce and slightly higher. So we find a lot of consistency in the neighborhood of three and a half ounces, 0.35 ounces, up to about 0.7 ounces. So I guess I still talk in ounces, not so much in grams. In today's world, high-grade, we have lots of old samplings that have the through-the-roof, multi-ounce assays and some small samplings and that sort of thing. But consistently we have found that we're in that near half an ounce range per ton.

Dr. Allen Alper: Sounds good! Could you tell our readers/investors a little bit about yourself and your team?

Mike Lavigne: I grew up in Wallace, Idaho, which is in the heart of the Silver Valley. Those in the mining industry know that it was, for decades, the most prolific silver mining area in the world, with producers like Sunshine and Hecla. Asarco used to be here, with properties. The Bunker Hill is located here. So I grew up around mining, in a mining community. It gets in your blood a little bit. My first job out of high school, to pay my way through undergraduate school and law school, was working underground for Hecla at the Lucky Friday and Star mines.

I went out and was in investment banking business for a period of time, and moved back to Idaho and decided I wanted to get back involved in mining and have been involved in mostly exploration stage operations in Idaho, Alaska, Montana, Wyoming, Utah and Nevada. I love mining. We want to be a part of it. The recent spike in the price of gold has given us an opportunity to go look at some properties that one of our partners held, Greg Schifrin, who's a Director. Greg and I had been involved in a number of projects over the years, and it was time to see if we could reopen the Center Star. So that's what we're doing with the Center Star.

We've also brought on Dr. Deepak Malhotra. He's a PhD in mining, economics and metallurgy. Many of us in mining consider him a world-class mining guy. He has worked for major mining companies across the globe. And then we have a legacy Director in John Powers, who's been in the mining industry and has been on the Board of a couple of small public mining companies. So that's the core group that is moving forward with Magellan.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit about your share and capital structure?

Mike Lavigne: Yeah. We are, right now, a US listed Company. Not a lot of mining companies list in the US, especially at our stage. In the juniors and exploration stage, it's typically more Canadian juniors. So we're a little bit unique in that regard. We currently only have about six and a half to seven million shares out. A lot of that is held by insiders and people close to the Company. There's not a significant public float out there, probably less than a million shares. And we've been bouncing around between about a dollar and a dollar fifty for the last few weeks here. So we think, from a market cap standpoint, we have value in our Company and we don't have a lot of shares out there today. So we have room to grow and hopefully use our stock to help capitalize the Company as we go forward.

Dr. Allen Alper: Oh, that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Mike Lavigne: Yeah. I think part of it is the value. We really have tried to keep the stock under control right now. So we think from the valuation standpoint, we're a good value. We believe that we have our initial project and we are negotiating on some additional projects that meet a very similar demographic to the Center Star. Our approach is simple. Let's go where we know there is gold, where we know high-grade gold existed in the past and try and operate these things at a much smaller scale than we see at larger companies. We think there is room for a far greater internal rate of returns, when you're dealing with far less cap ex to put these properties into production. So we think we can provide a better return, than the typical things you find in the marketplace today, with the properties that we're looking at.

Dr. Allen Alper: Well, that sounds like a good approach, Mike. Is there anything else you'd like to add?

Mike Lavigne: I think if people have an interest in us and keep an eye on us, we're going to proceed down the path. We want to try and be aggressive about doing things that we say we're going to do. So keep an eye on us. We have the mine opened back up. We have a little work to do, but we'll be on a very aggressive exploration and development stage, very quickly.

Dr. Allen Alper: Oh, that sounds very good. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.magellangoldcorp.com/

Mike Lavigne, President & Director

contact@magellangoldcorp.com

|

|